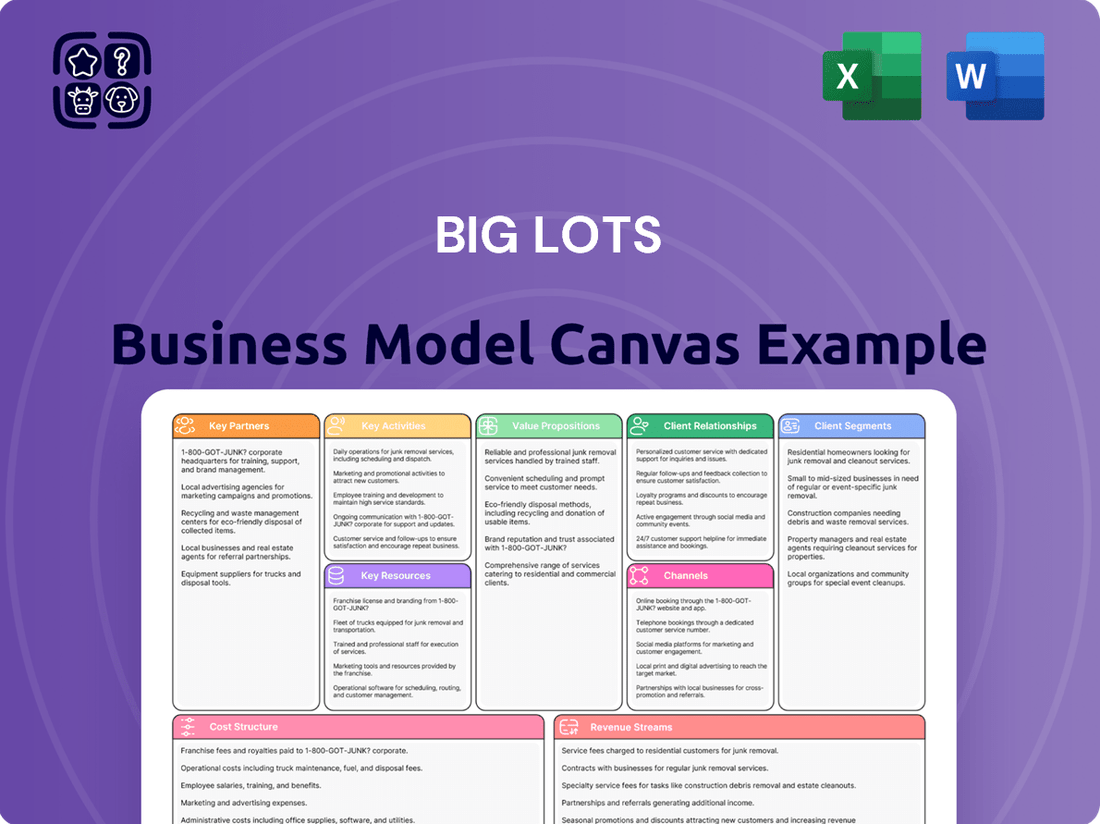

Big Lots Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Big Lots Bundle

Unlock the full strategic blueprint behind Big Lots's business model. This in-depth Business Model Canvas reveals how the company drives value through its discount retail strategy, captures market share with a broad customer base, and stays ahead in a competitive landscape by focusing on value and unique product assortments.

Dive deeper into Big Lots’s real-world strategy with the complete Business Model Canvas. From its unique value propositions targeting budget-conscious shoppers to its cost structure optimized for affordability, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive.

Want to see exactly how Big Lots operates and scales its business by sourcing opportunistic inventory and leveraging strong supplier relationships? Our full Business Model Canvas provides a detailed, section-by-section breakdown, perfect for benchmarking or strategic planning.

Gain exclusive access to the complete Business Model Canvas used to map out Big Lots’s success in connecting with a diverse customer segment. This professional, ready-to-use document is ideal for anyone seeking to learn from proven industry strategies in the off-price retail sector.

See how the pieces fit together in Big Lots’s business model, from its key customer relationships to its revenue streams generated by a wide variety of merchandise. Download the full version to accelerate your own business thinking and gain actionable insights into their operational efficiency.

Partnerships

Big Lots’ key partnerships with closeout and overstock suppliers are fundamental to its sourcing strategy, enabling the acquisition of branded and unbranded merchandise at significant discounts. Maintaining strong, agile relationships with a diverse network of manufacturers and retailers liquidating inventory is crucial. These partnerships allow Big Lots to capitalize on opportunistic buys, which is central to its value proposition. For instance, in fiscal year 2024, Big Lots continued to leverage these relationships to secure unique deals, differentiating its product assortment and driving customer traffic.

Direct-to-factory sourcing agents are crucial for Big Lots, enabling the procurement of private-label and non-branded goods, especially in key categories like furniture and seasonal items. This strategy allows Big Lots to bypass traditional distribution layers, significantly reducing costs and granting more control over product specifications and quality. For example, in its Q1 2024 earnings, Big Lots highlighted improved merchandise margins, partly due to better sourcing and a focus on these higher-margin, direct-sourced products. This approach complements their closeout model by ensuring a consistent supply of high-demand items, bolstering their everyday value proposition to customers.

Efficiently moving Big Lots' vast and varied product assortment from suppliers to distribution centers and stores is a complex logistical operation. Partnering with national and regional freight carriers and Third-Party Logistics (3PL) providers is essential for managing transportation costs, a significant expense. For instance, in fiscal year 2023, Big Lots reported selling, general, and administrative expenses that reflect these operational costs. These partnerships ensure timely inventory replenishment across a wide geographic footprint, crucial for maintaining stock levels and customer satisfaction in 2024.

Financial Service Providers (Leasing & Credit)

Big Lots collaborates with financial service providers such as Progressive Leasing to facilitate customer purchases of higher-priced items like furniture and mattresses. These key partnerships offer lease-to-own and alternative financing solutions, essential for customers who may not have access to traditional credit. This strategy broadens Big Lots customer base, capturing a wider range of shoppers. Consequently, these partnerships help increase the average transaction value and drive sales growth, as demonstrated by the continued importance of flexible payment options in retail in 2024.

- Progressive Leasing represented a significant portion of Big Lots non-traditional payment options, enhancing accessibility.

- The partnerships are crucial for increasing average order values, particularly in furniture and home goods categories.

- These collaborations directly support customer acquisition by removing financial barriers for many shoppers.

- Big Lots continues to leverage these financing solutions to boost sales performance through 2024.

Marketing & Technology Platform Partners

Big Lots relies on key partnerships to power its digital presence and customer engagement. Collaboration with technology vendors is crucial for operating its e-commerce platform, mobile app, and in-store point-of-sale systems, ensuring a seamless shopping experience. For example, in 2024, continued investment in robust POS solutions and mobile app enhancements supports efficient transactions and customer access.

Marketing partnerships are vital for digital advertising campaigns and social media engagement, which drive customer traffic and brand awareness. These relationships also manage the BIG Rewards loyalty program, which had millions of active members in 2024, fostering repeat business. Such alliances are foundational to delivering a comprehensive omnichannel retail experience, integrating online and in-store operations.

- Technology partners underpin e-commerce, mobile, and POS systems for operational efficiency.

- Marketing alliances drive digital advertising and social media campaigns.

- Strategic partnerships manage the BIG Rewards loyalty program, enhancing customer retention.

- These collaborations are essential for a cohesive omnichannel retail strategy.

Big Lots relies on diverse key partnerships, including closeout and direct-to-factory suppliers, to secure unique, discounted merchandise crucial for its value proposition in 2024.

Logistics and financial service providers like Progressive Leasing ensure efficient inventory flow and expand customer access to flexible payment options, boosting sales.

Technology and marketing collaborations underpin Big Lots’ digital presence, e-commerce operations, and the BIG Rewards loyalty program, which had millions of members in 2024.

| Partnership Type | Strategic Role | 2024 Impact |

|---|---|---|

| Sourcing | Cost-effective merchandise procurement | Improved Q1 2024 merchandise margins |

| Financial Services | Broadened customer access | Increased average transaction value |

| Technology/Marketing | Enhanced omnichannel experience | Millions of BIG Rewards members |

What is included in the product

This Business Model Canvas outlines Big Lots' strategy of offering closeout and overstock merchandise to value-conscious consumers through a broad retail network, focusing on curated assortments and a treasure-hunt shopping experience.

It details customer segments, key resources like supplier relationships and supply chain, and revenue streams derived from diverse product categories, all while addressing cost structures associated with inventory acquisition and retail operations.

Big Lots' Business Model Canvas acts as a pain point reliever by providing a high-level view of the company’s business model with editable cells, allowing for quick identification of core components in a one-page snapshot.

Activities

Opportunistic buying and merchandising is central to Big Lots' business model, relying on dedicated teams to identify and negotiate deals for closeout and overstock merchandise. This core activity creates a dynamic, ever-changing product assortment, drawing customers back frequently for a unique treasure hunt experience. The ability to quickly and effectively execute these buys, often acquiring inventory at significant discounts, remains a primary competitive advantage. For instance, Big Lots' focus on these opportunistic buys helps manage inventory turnover, a critical factor given the fluctuating consumer demand seen in early 2024. This agile sourcing strategy underpins their value proposition to customers.

Managing the logistics of Big Lots unpredictable and diverse product mix, sourced from various global suppliers, is a critical operational activity. This complex process encompasses efficient warehousing, precise inventory management, and extensive transportation logistics, ensuring products reach over 1,400 stores. As of early 2024, Big Lots operated 1,409 stores across 48 states, making efficient distribution paramount. Optimizing this supply chain is vital for controlling costs and ensuring products are on shelves in a timely manner, directly impacting profitability and customer satisfaction.

Running Big Lots physical retail network, encompassing over 1,400 stores as of early 2024, is crucial for its sales. This involves meticulous staffing, attentive customer service, and consistent store maintenance. A core activity is visual merchandising, creating that appealing treasure hunt environment customers expect, which is vital for driving impulse purchases. Effective in-store operations directly impact customer experience and sales performance, with comparable store sales being a key metric for success.

Marketing & Customer Loyalty Management

Promoting the Big Lots brand and its value proposition is continuous, utilizing weekly ads, email marketing, and targeted digital campaigns to reach customers. A significant focus is managing the BIG Rewards loyalty program, which boasted over 20 million members as of early 2024, to encourage repeat business and gather essential customer data. These integrated activities are designed to drive store traffic and cultivate long-term customer relationships, underpinning sales growth.

- Weekly ads remain a core channel, reaching millions of households.

- Email marketing campaigns deliver personalized offers to loyalty members.

- Digital campaigns, including social media, enhance brand visibility in 2024.

- The BIG Rewards program, with over 20 million members, drives repeat purchases.

E-commerce & Omnichannel Integration

Big Lots focuses heavily on e-commerce and omnichannel integration, continuously enhancing its website and mobile app to capture online sales and engage customers. This includes meticulous management of online inventory and efficient processing of orders for home delivery or convenient in-store pickup. Integrating digital promotions with the physical store experience ensures a seamless shopping journey for customers across all channels, aligning with a broader retail trend of unified shopping. For instance, Big Lots aimed to expand its online fulfillment capacity in 2024, leveraging its store network for faster order processing.

- Website and mobile app optimization for enhanced user experience.

- Efficient online inventory management and order fulfillment.

- Seamless integration of digital promotions with in-store offerings.

- Expansion of online fulfillment options, including ship-from-store.

Big Lots' core activities include opportunistic buying of closeout merchandise, managing complex logistics for its diverse product mix, and operating over 1,400 physical stores. Additionally, extensive marketing efforts, including the BIG Rewards program with over 20 million members in early 2024, drive customer engagement. Enhancing e-commerce and omnichannel integration, with a focus on online fulfillment expansion in 2024, further supports sales.

| Activity | Focus | 2024 Data Point |

|---|---|---|

| Opportunistic Buying | Acquiring closeout/overstock goods | Manages inventory turnover |

| Logistics & Supply Chain | Warehousing, inventory, transport | 1,409 stores across 48 states |

| Retail Operations | In-store experience, sales | Over 1,400 stores |

| Marketing & Loyalty | Brand promotion, customer retention | BIG Rewards: Over 20M members |

| E-commerce & Omnichannel | Online sales, integrated shopping | Expanded online fulfillment capacity |

Delivered as Displayed

Business Model Canvas

The Big Lots Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the comprehensive analysis of Big Lots' strategic elements. You will gain full access to this detailed canvas, covering key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams, all formatted for immediate use.

Resources

Big Lots’ most strategic resource is its extensive supplier network, built on deep, long-standing relationships with numerous closeout vendors, manufacturers, and importers. This critical network provides consistent access to the discounted merchandise that underpins their entire business model. For example, their opportunistic buying strategy, which is vital for maintaining competitive pricing, relies entirely on these connections. This established network creates a significant competitive moat, difficult for new entrants to replicate, reinforcing their market position in 2024 amidst fluctuating consumer demand.

Big Lots leverages a robust physical store footprint, operating around 1,400 stores across 48 states as of early 2024. These accessible, often strip-mall, locations are primary assets for customer reach and direct sales. This network is efficiently supported by strategically positioned distribution centers. These physical assets are crucial for driving in-store purchases and seamlessly fulfilling omnichannel orders for customer convenience.

The Big Lots brand, widely recognized for its value and bargain offerings, serves as a crucial asset, attracting its core customer base seeking affordable home goods and consumables. This established reputation helps maintain customer traffic and appeal. Furthermore, the BIG Rewards loyalty program is a key resource, providing invaluable customer data. This data, continually collected and analyzed in 2024, offers deep insights into purchasing behaviors, directly informing merchandising strategies and targeted marketing campaigns to maximize sales and customer engagement.

Inventory as a Tangible Asset

Big Lots' diverse and constantly rotating inventory is a core tangible asset, directly generating revenue through its unique assortment of goods. This merchandise, which customers specifically seek, represents a significant investment requiring careful management. The ability to turn this inventory quickly is paramount for profitability. As of early 2024, efficient inventory management remains crucial for their financial health, especially with fluctuating consumer demand.

- Inventory often represents the largest current asset on Big Lots' balance sheet.

- Quick inventory turnover boosts cash flow and reduces carrying costs.

- The opportunistic buying model relies on varied, liquid inventory.

- Effective inventory management directly impacts gross margins and net income.

Experienced Merchandising & Buying Teams

Big Lots' experienced merchandising and buying teams are a crucial intangible asset, leveraging their deep expertise and industry connections to secure opportunistic deals. These teams excel in negotiation, directly impacting the company's ability to offer compelling value to customers. Their prowess in identifying closeouts and unique merchandise remains central to Big Lots' distinct business model, a strategy vital as the company navigates the evolving retail landscape in 2024.

- Merchandising teams are key to Big Lots' opportunistic buying model.

- Their ability to negotiate favorable terms directly impacts profit margins.

- Expertise in identifying unique product assortments differentiates Big Lots.

- Effective sourcing helps maintain competitive pricing in a challenging retail environment.

Big Lots leverages its extensive supplier network and expert buying teams for opportunistic inventory sourcing. Their ~1,400 physical stores and robust distribution centers provide crucial customer reach and omnichannel fulfillment. The recognized Big Lots brand, alongside the BIG Rewards program, drives loyalty and informs strategy through customer data, with diverse inventory being a core revenue driver in 2024.

| Resource | 2024 Data | Impact |

|---|---|---|

| Store Count | ~1,400 stores | Extensive market reach |

| Loyalty Members | ~20M+ BIG Rewards | Customer data, sales insights |

| Inventory Turnover (Q1 2024) | Approx. 3.5x annually | Cash flow, profitability |

Value Propositions

Big Lots primarily offers extreme value by providing a wide array of products at prices significantly below typical retail. This is achieved through its closeout and direct sourcing model, acquiring excess inventory and unique merchandise. Customers are drawn by the promise of finding well-known brands and quality goods for less, often seeing prices up to 70% off traditional retail. For instance, in fiscal year 2024, Big Lots continued to emphasize its everyday low prices across categories like home furnishings and consumables, aiming to attract budget-conscious shoppers.

Big Lots offers a unique treasure hunt shopping experience where the merchandise assortment is constantly changing, fostering a sense of discovery and urgency for customers. This dynamic inventory model, supported by opportunistic buying, encourages frequent visits to uncover unexpected deals and new items. For instance, in fiscal year 2023, Big Lots managed a diverse inventory flow to maintain this novelty. This approach differentiates Big Lots from traditional retailers with predictable, static product offerings, making each trip a unique adventure. Customers enjoy the thrill of the hunt, knowing that desirable items may not be available on their next visit.

Big Lots offers a compelling value proposition through its broad, cross-category product assortment, providing a convenient one-stop-shop experience. This includes a diverse mix of categories like furniture, home decor, seasonal goods, food, and everyday consumables. By offering such a wide range, customers can efficiently fulfill multiple shopping needs in a single trip. For example, in 2024, Big Lots continues to emphasize its household essentials and seasonal offerings, appealing to varied consumer demands under one roof.

Accessibility of Big-Ticket Items

Big Lots enhances the accessibility of higher-priced items like furniture, mattresses, and patio sets through strategic financing and lease-to-own partnerships. These arrangements effectively remove financial barriers, allowing a broader customer base to furnish their homes affordably. This approach is a significant driver of sales, particularly within high-margin categories, aligning with Big Lots' focus on value. The company continues to leverage these options to boost purchases in key home goods segments as of 2024.

- Financing options enable purchases for customers with varying budgets.

- Lease-to-own programs broaden access to essential home furnishings.

- This strategy directly supports sales growth in big-ticket categories.

- It reinforces Big Lots' value proposition, especially for furniture and seasonal items.

Trusted Brand for Everyday Bargains

Big Lots stands as a trusted national retailer, blending reliability with the excitement of a bargain outlet. Customers consistently rely on the brand for value across everyday necessities and impulse buys, fostering strong loyalty among its core value-conscious shoppers. This focus helps maintain a dedicated customer base, even amidst a challenging retail environment.

- Big Lots operated approximately 1,399 stores as of early 2024, demonstrating its national footprint.

- The company emphasizes closeout merchandise, often acquiring inventory at significant discounts.

- Their value proposition targets consumers seeking affordability and discovery in their shopping experience.

- Customer perception of consistent value is key to repeat business and brand trust.

Big Lots delivers extreme value through deep discounts on a constantly changing, broad product assortment, including furniture and everyday essentials. Its unique treasure hunt experience encourages frequent visits for unexpected deals. Financing options make higher-priced items accessible, reinforcing its commitment to affordability for a wide customer base across its nearly 1,400 national stores in 2024.

| Value Proposition | Key Aspect | 2024 Data/Context |

|---|---|---|

| Extreme Value | Deep Discounts | Up to 70% off retail |

| Product Assortment | One-Stop Shop | Furniture, consumables, seasonal |

| Accessibility | Financing Options | Lease-to-own partnerships |

| National Presence | Store Count | Approximately 1,399 stores |

Customer Relationships

The BIG Rewards Loyalty Program is Big Lots' core tool for building lasting customer relationships. It provides members with exclusive rewards, coupons, and members-only deals, directly encouraging repeat purchases. This program is vital for Big Lots, offering valuable data on customer shopping habits that inform merchandising and promotional efforts. It primarily fosters a transactional relationship, where customers are motivated by clear financial benefits and personalized offers. As of 2024, loyalty programs like BIG Rewards remain crucial for retailers to drive engagement and sales.

Big Lots actively cultivates customer relationships through consistent, targeted communication, primarily via email campaigns and its robust mobile application. This includes sending out weekly advertisements showcasing current deals and special promotions, which are crucial given their discount retail model. Furthermore, the company leverages past purchase data to send personalized offers, a strategy that helps maintain brand relevance and encourages repeat visits. In 2024, digital engagement remains vital, with mobile app users often receiving exclusive discounts, driving foot traffic and online sales for the retailer.

While Big Lots primarily operates on a self-service model, in-store associates serve as crucial human touchpoints for customer relationships. These team members provide essential assistance, answer product inquiries, and facilitate transactions, which is especially important for larger purchases like furniture, a segment Big Lots continues to emphasize. This direct interaction is vital for building customer trust and ensuring a positive shopping experience, contributing to customer retention as the company navigates the evolving retail landscape with its approximately 1,400 stores as of early 2024.

Community-Based Engagement

Big Lots fosters strong customer relationships through community-based engagement, primarily via the Big Lots Foundation. This foundation actively supports philanthropic initiatives focusing on critical areas like healthcare, housing, hunger, and education, creating a positive brand perception. This commitment extends beyond typical retail transactions, building deep connections within the communities it serves. Such efforts enhance brand loyalty and demonstrate a dedication to social responsibility, as seen in their ongoing partnerships.

- The Big Lots Foundation supports various community causes.

- Philanthropic efforts build a positive brand image.

- These initiatives foster deeper customer connections.

- Commitment extends beyond commercial transactions.

Automated Self-Service (E-commerce)

Big Lots leverages its e-commerce site and mobile app to foster an Automated Self-Service relationship, enabling customers to independently browse products, complete purchases, and manage their accounts. This approach prioritizes convenience and efficiency, giving shoppers control over their digital experience. For instance, in fiscal year 2023, Big Lots reported e-commerce comparable sales growth of 1.7%, indicating a continued reliance on digital channels. This self-service model caters to the growing segment of consumers who prefer streamlined, digital interactions for their shopping needs.

- Big Lots reported e-commerce comparable sales growth of 1.7% in fiscal year 2023, demonstrating digital channel importance.

- The mobile app allows independent account management and order tracking, enhancing user control.

- Customers can access current weekly ads and special online-only promotions through the self-service platform.

- The digital platform is key for convenient access to over 20,000 unique SKUs, many not available in stores.

Big Lots fosters customer relationships through its BIG Rewards loyalty program and targeted digital communications, driving repeat purchases and engagement. The company balances this with in-store associate support at its approximately 1,400 stores, providing crucial human touchpoints. An automated self-service model via its app and e-commerce site offers convenience, contributing to a 1.7% e-commerce comparable sales growth in fiscal year 2023. Additionally, community engagement through the Big Lots Foundation enhances brand perception and loyalty.

| Relationship Channel | Primary Focus | 2024 Data/Relevance |

|---|---|---|

| BIG Rewards Program | Loyalty & Repeat Purchases | Crucial for engagement; personalized offers |

| Digital Communication (Email/App) | Targeted Engagement | Mobile app users receive exclusive discounts |

| In-Store Associates | Human Touchpoint | Approximately 1,400 stores; builds trust |

| Automated Self-Service | Convenience & Efficiency | FY23 e-commerce comparable sales growth: 1.7% |

Channels

Big Lots’ primary sales channel remains its extensive network of physical retail stores, which totaled 1,409 locations across 48 states as of early 2024. These brick-and-mortar outlets are strategically positioned in high-traffic commercial zones, ensuring convenient access for the value-seeking target demographic. The in-store experience, characterized by a dynamic, ever-changing inventory, fosters a distinctive treasure hunt atmosphere that significantly drives customer engagement and repeat visits. This physical presence is crucial for capturing impulse purchases and showcasing the diverse product assortment.

BigLots.com serves as a vital sales and marketing channel, extending the company’s reach beyond its 1,399 physical stores as of early 2024. This e-commerce platform offers a broader product assortment, including furniture and seasonal items, often exceeding typical in-store inventory. It provides a convenient shopping option, crucial for attracting customers who prefer digital transactions or live outside physical store footprints. The website is fundamental to Big Lots’ omnichannel strategy, allowing seamless integration of online browsing with in-store pickup options, enhancing overall customer engagement.

The Big Lots mobile application serves as a crucial channel for customer engagement, allowing shoppers to browse products and make purchases directly. It provides seamless access to the BIG Rewards program, which, as of early 2024, continues to drive loyalty among over 20 million members. Users receive personalized notifications, enhancing their shopping experience and promoting relevant deals. The app also includes practical tools like in-store price scanning, deepening the relationship with the most engaged customer segments and supporting omnichannel retail efforts.

Direct Marketing & Weekly Ads

Big Lots heavily relies on traditional and digital circulars as a primary channel, communicating weekly deals to drive foot traffic into stores and online. Email marketing campaigns directly reach millions of loyalty program members, announcing promotions and new arrivals, a critical component for a promotion-driven retail model. In 2024, digital ad spending continues to evolve, with Big Lots adapting strategies to maximize reach for their value-oriented offerings.

- Weekly ads remain central, with digital circulars gaining traction in 2024.

- Email marketing directly engages millions of Big Rewards loyalty members.

- This channel is crucial for promoting high-turnover inventory.

- Targeted digital campaigns complement traditional print for broad reach.

In-Store Pickup & Delivery Services

Big Lots leverages its physical stores as crucial fulfillment hubs, central to its omnichannel strategy. Services like Buy Online, Pick Up In Store (BOPIS) and same-day delivery, often through partnerships with providers such as DoorDash, seamlessly connect digital and physical retail. This approach offers customers significant flexibility and convenience, enhancing their shopping experience. For example, in Q1 2024, Big Lots continued to emphasize these services to drive traffic and sales.

- Big Lots' omnichannel strategy uses stores for efficient order fulfillment.

- BOPIS offers convenient online purchase and in-store pickup options.

- Same-day delivery, partnered with services like DoorDash, provides immediate access.

- These channels significantly boost customer flexibility and convenience.

Big Lots leverages its 1,409 physical stores and BigLots.com as primary sales channels, supported by a mobile app for loyalty engagement. Marketing relies on digital and traditional circulars, reaching millions of BIG Rewards members. Omnichannel fulfillment is key, with BOPIS and same-day delivery enhancing customer convenience.

| Channel | Type | 2024 Data |

|---|---|---|

| Physical Stores | Sales/Fulfillment | 1,409 locations |

| BigLots.com | E-commerce | Broad product range |

| Mobile App | Engagement | 20M+ BIG Rewards members |

Customer Segments

Value-conscious families and homeowners represent Big Lots' core customer segment, actively seeking bargains and prioritizing affordability. These households, often managing tight budgets, rely on Big Lots for essential everyday consumables, seasonal decorations, and budget-friendly home furnishings. In fiscal year 2023, Big Lots reported net sales around $4.7 billion, demonstrating consistent demand from these price-sensitive shoppers. This group’s reliance on Big Lots for value remains a key driver of sales, particularly as economic factors continue to influence consumer spending patterns into 2024.

Bargain Hunters & Treasure Seekers are drawn to Big Lots by the thrill of discovering unique items and known brands at deep discounts. They enjoy the unpredictable, constantly rotating assortment, making each visit a new treasure hunt. This segment appreciates finding value beyond just low prices, often seeking out specific closeout deals. Big Lots strategically replenishes its inventory with new truckload arrivals weekly to satisfy this demand, aiming to convert store traffic into sales, which is crucial as the company continues to navigate market shifts in 2024.

New homeowners and renters represent a crucial customer segment for Big Lots, particularly for its furniture and home decor offerings. These individuals and families, often setting up new living spaces, prioritize affordability in furnishing their homes. They are drawn to Big Lots' competitive pricing and available financing options, especially as average rents in the U.S. remained elevated in early 2024. This segment typically makes high-value purchases, though these transactions are infrequent, aligning with the episodic nature of moving.

Small Business Owners

A notable segment for Big Lots includes small business owners seeking to lower their operational expenditures. These entrepreneurs frequently purchase office supplies, breakroom snacks, cleaning products, and even furniture, drawn by the competitive pricing and the convenience of a diverse product range in one location. This business-to-business (B2B) customer segment prioritizes cost efficiency, with many US small businesses aiming to reduce expenses by 15-20% on non-core supplies in 2024. Big Lots' value proposition directly addresses their need for budget-friendly solutions.

- Small businesses spent an average of $4,500 on office supplies in 2023.

- Big Lots offers bulk savings crucial for operational cost reduction.

- Convenience of one-stop shopping saves small business owners time and effort.

- The segment seeks value on essential items like cleaning products and breakroom staples.

Seasonal & Holiday Shoppers

Seasonal and holiday shoppers represent a vital segment for Big Lots, primarily visiting for event-driven merchandise. These customers seek specific items like patio furniture in spring, back-to-school supplies during summer, or holiday decorations in winter. While not always everyday patrons, their concentrated purchasing significantly boosts revenue during peak periods. For instance, holiday sales, including seasonal decor and gifts, traditionally account for a substantial portion of Big Lots' fourth-quarter net sales, often exceeding 30% of annual revenue as seen in recent fiscal years.

- Seasonal sales often comprise over 30% of Big Lots' Q4 net sales.

- Back-to-school promotions in 2024 are crucial for driving summer traffic.

- Patio and outdoor living categories see peak demand in spring.

- Event-driven purchases are critical for revenue during specific times of the year.

Big Lots serves diverse customer segments, primarily value-conscious families and bargain hunters seeking affordable home essentials and unique finds. New homeowners and renters also drive furniture sales, while small businesses prioritize cost-effective operational supplies. Seasonal shoppers significantly boost revenue during peak periods, with holiday sales often exceeding 30% of Q4 net sales.

| Segment | Focus | 2024 Trend | ||

|---|---|---|---|---|

| Families | Affordability | Steady demand | ||

| New Home | Furnishings | High rent impact | ||

| Small Biz | Cost savings | 15-20% expense cut |

Cost Structure

The Cost of Goods Sold for merchandise represents Big Lots largest expenditure, encompassing the direct purchase price of inventory. In fiscal year 2023, which concluded in early 2024, their cost of sales amounted to approximately $3.16 billion, reflecting this significant component. The entire business model hinges on minimizing this cost through strategic opportunistic buying and direct sourcing to secure favorable deals. Effectively managing merchandise costs directly enables Big Lots to maintain its competitive low pricing strategy for customers.

Store operating and occupancy costs are a significant financial consideration for Big Lots, covering expenses like rent for its extensive retail network, utilities, and property upkeep. With over 1,400 locations, managing these fixed and variable costs is crucial, as the physical stores remain the primary sales channel. This category represents the company’s second-largest expense, reflecting substantial outlays in real estate and facility management. For fiscal year 2024, these costs continue to be a key area of focus for efficiency and profitability.

Selling, General & Administrative (SG&A) expenses for Big Lots encompass crucial operational costs, including store and distribution center payroll, corporate salaries, marketing efforts, and technology investments. These are the necessary outlays beyond the direct cost of goods sold, supporting the entire business infrastructure. For the first quarter of fiscal year 2024, ending May 4, 2024, Big Lots reported SG&A expenses of $447.8 million, highlighting the significant ongoing investment in operations. Efficiently managing these expenses is vital for Big Lots to maintain and improve its profitability in a competitive retail landscape.

Supply Chain & Logistics Costs

Supply chain and logistics costs are central to Big Lots, encompassing expenses for moving a diverse product mix from suppliers to distribution centers and finally to stores. These include significant freight and transportation outlays, coupled with warehousing and distribution center labor costs, which are complex to manage across their national footprint. For instance, in fiscal year 2023, Big Lots faced elevated supply chain costs, impacting their gross margin.

- Freight and transportation expenses are a major component.

- Warehousing and distribution center labor are substantial costs.

- Managing these costs is complex due to varied inventory and widespread operations.

- Big Lots reported a gross margin rate of 32.1% in Q4 fiscal 2023, partly influenced by these costs.

Depreciation & Amortization

Depreciation and amortization represent a significant non-cash expense for Big Lots, reflecting the systematic allocation of costs for its extensive physical footprint. This includes the depreciation of its numerous retail stores, distribution centers, and equipment, alongside the amortization of intangible assets. It is a fundamental cost of doing business for a large-scale retailer utilizing long-term assets to generate revenue.

- Big Lots reported approximately $29.7 million in depreciation and amortization for Q1 2024.

- This expense is crucial for recognizing the wear and tear on assets like its nearly 1,400 stores.

- It reflects the consumption of asset value over their useful life.

- For fiscal year 2023, Big Lots' depreciation and amortization totaled around $124.9 million.

Big Lots' cost structure is primarily driven by its Cost of Goods Sold, approximately $3.16 billion in fiscal year 2023, reflecting its merchandise acquisition. Significant expenses also include store operating and occupancy costs for over 1,400 locations. Selling, General & Administrative expenses, reported at $447.8 million in Q1 2024, cover vital operational and marketing outlays. Supply chain and logistics costs, alongside depreciation and amortization of $29.7 million in Q1 2024, complete the major cost categories.

| Cost Category | Key Expense | 2023/2024 Data |

|---|---|---|

| Cost of Goods Sold | Merchandise Purchases | $3.16 billion (FY23) |

| SG&A Expenses | Payroll, Marketing | $447.8 million (Q1 FY24) |

| Depreciation & Amortization | Asset Wear & Tear | $29.7 million (Q1 FY24) |

Revenue Streams

In-store product sales are the primary revenue driver for Big Lots, with the vast majority of income generated from direct sales at its physical retail locations. This stream encompasses a wide array of product categories, including furniture, home goods, food, and seasonal items. For the first quarter of fiscal year 2024, Big Lots reported net sales of $1.04 billion, predominantly driven by these brick-and-mortar operations. This traditional channel remains the core engine of the business, underpinning its financial performance.

A growing revenue stream for Big Lots is generated through sales via BigLots.com and its mobile application. This digital channel encompasses products shipped directly to customers' homes and orders placed online for convenient in-store pickup. For fiscal year 2023, Big Lots reported e-commerce sales comprised approximately 11% of total net sales, reaching about $530 million. This highlights the company's focus on capturing sales from customers who increasingly prefer to shop online, a trend expected to continue into 2024 with ongoing digital investments.

Furniture and other large-ticket items are a distinct, high-value revenue stream for Big Lots, separate from general merchandise. These products, including indoor and outdoor furniture, typically carry a higher average selling price and contribute stronger margins compared to consumables. Driving sales in this category remains a key strategic focus for enhancing overall profitability. In fiscal year 2023, while total net sales for Big Lots were $4.72 billion, maximizing the contribution from these higher-margin categories is crucial for future growth and financial health as the company navigates the current economic landscape.

Lease & Financing Income

Big Lots generates ancillary revenue through strategic partnerships with third-party financing and lease-to-own providers like Progressive Leasing and Acima. The company receives a fee or a share of the revenue from these partners for facilitating customer financing agreements, which supports the sale of big-ticket items such as furniture and mattresses. This stream adds incremental, high-margin revenue, diversifying their income beyond direct merchandise sales. In fiscal year 2023, Big Lots reported a significant portion of its sales were supported by these financing options.

- Third-party partnerships with providers like Progressive Leasing and Acima are key.

- Big Lots earns fees or revenue share from these facilitated agreements.

- This model supports sales of high-value items, like furniture, which saw increased penetration in 2024.

- It provides incremental, high-margin revenue, bolstering overall profitability.

Seasonal Merchandise Sales

Big Lots significantly boosts revenue through seasonal merchandise sales, which create predictable spikes in its annual cycle. Spring and summer see strong sales from patio and garden collections, capitalizing on warmer weather demand. The fourth quarter is particularly critical, driven by extensive Christmas and holiday decor sales. These seasonal offerings are essential for Big Lots' financial performance.

- Seasonal merchandise, including patio and garden items, contributes a significant portion of spring and summer revenue.

- The fourth quarter experiences a major revenue surge due to extensive Christmas and holiday decor sales.

- These seasonal peaks are a critical component of Big Lots' annual revenue cycle.

- Big Lots reported net sales of $1.04 billion in the first quarter of 2024.

Big Lots primarily generates revenue from in-store product sales, contributing significantly to its Q1 2024 net sales of $1.04 billion. E-commerce sales are a growing stream, comprising approximately 11% of FY 2023 total net sales. High-value furniture and seasonal merchandise also drive substantial income, complemented by fees from third-party financing partnerships, which support sales of big-ticket items like furniture.

| Revenue Stream | Key Contribution | 2024/2023 Data |

|---|---|---|

| In-Store Sales | Primary driver | Q1 2024 Net Sales: $1.04B |

| E-commerce Sales | Growing digital channel | FY 2023: 11% of total sales (~$530M) |

| Financing Partnerships | Supports high-value sales | Increased penetration in 2024 for furniture |

Business Model Canvas Data Sources

The Big Lots Business Model Canvas is built using a combination of internal financial data, extensive market research reports, and insights from competitive analysis. These sources ensure each canvas block is filled with accurate, up-to-date information reflecting Big Lots' operations and market position.