Bidcorp Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bidcorp Group Bundle

Bidcorp Group's diverse product portfolio and strong global presence are significant strengths, but they also face intense competition and potential supply chain disruptions. Understanding these dynamics is crucial for any stakeholder looking to navigate the food service distribution landscape.

Want the full story behind Bidcorp's market position, competitive advantages, and potential challenges? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Bidcorp stands as a titan in the global foodservice sector, recognized as the largest player outside the United States. Its operations span numerous countries, showcasing a remarkably diversified footprint that mitigates risks associated with any single market. This extensive reach is a cornerstone of its competitive strength.

The company consistently secures a top-three market share position in most of its operating regions, a testament to its operational excellence and market penetration. For instance, in the fiscal year 2023, Bidcorp reported revenue growth of 12.6%, highlighting its continued ability to expand its leading positions amidst varied economic conditions.

Bidcorp's decentralized operating model is a significant strength, allowing its diverse businesses worldwide to independently adapt product offerings and services to local market needs. This agility is crucial in the food service distribution sector, where consumer tastes and regulatory environments vary greatly by region. For instance, in 2024, Bidcorp's European operations, like those in the UK and Germany, can leverage this autonomy to focus on specific dietary trends or sustainability initiatives that resonate locally, distinct from their African or Asian counterparts.

Bidcorp's financial performance remains exceptionally strong, with consistent revenue growth and a notable increase in headline earnings per share observed through FY2024 and into H1 FY2025. This robust financial health is underpinned by the group's impressive cash generation capabilities.

The company's operational efficiency translates into significant cash flow, allowing Bidcorp to maintain low gearing levels and a solid balance sheet. This financial discipline provides substantial strategic flexibility for future growth.

This strong financial position empowers Bidcorp to pursue strategic investments, fund organic growth initiatives, and explore potential acquisition opportunities, further solidifying its market leadership.

Acquisitive Growth Strategy & Balance Sheet Capacity

Bidcorp has a well-established strategy of enhancing its organic growth through targeted bolt-on acquisitions, a method that has consistently delivered results, evidenced by numerous successful transactions in recent years.

The company's robust balance sheet, characterized by conservative gearing, offers significant financial flexibility to capitalize on consolidation opportunities within fragmented markets. This financial strength is crucial for executing its growth ambitions.

This acquisitive approach enables Bidcorp to broaden its geographical footprint, diversify its product offerings, and position itself for potentially larger, transformative acquisitions that could reshape its market presence.

For instance, in the fiscal year ending June 30, 2024, Bidcorp's net debt to EBITDA ratio remained comfortably low, providing substantial headroom for further M&A activities. This financial discipline underpins its aggressive growth strategy.

- Proven Acquisition Track Record: Bidcorp has a history of successfully integrating acquired businesses, demonstrating operational expertise in expanding its market share.

- Financial Flexibility: Strong balance sheet and conservative leverage ratios (e.g., net debt to EBITDA below 1.5x as of FY2024) allow for significant M&A capacity.

- Market Consolidation: The strategy targets fragmented food service distribution markets, offering economies of scale and operational efficiencies through acquisitions.

- Diversification Benefits: Acquisitions contribute to geographic diversification and the expansion of product and service portfolios, reducing reliance on single markets or offerings.

Robust Supply Chain & Digital Innovation

Bidcorp's robust supply chain is a significant strength, amplified by substantial investments in digital innovation. The company is actively deploying advanced e-commerce platforms and logistics optimization technologies. This focus on technology is designed to boost operational efficiency and foster better real-time connections with customers and suppliers, thereby sharpening its competitive position.

These digital initiatives are not just about streamlining operations; they also extend to crucial areas like renewable energy adoption and enhancing overall environmental efficiency. For instance, in the 2023 financial year, Bidcorp reported a 12.5% increase in revenue to R214.9 billion, showcasing the positive impact of its operational strategies, including its digital transformation efforts.

- Sophisticated Supply Chain: Bidcorp benefits from a well-established and efficient global supply chain network.

- Digital Transformation: Significant investment in e-commerce and logistics technologies is a key driver of operational improvement.

- Enhanced Engagement: Digital tools facilitate real-time interaction with customers and suppliers, improving service and responsiveness.

- Sustainability Focus: Technology investments also support environmental goals, including renewable energy integration.

Bidcorp's market leadership is a significant strength, underscored by its consistent top-three positioning across most operating regions. This dominance is further bolstered by a decentralized operating model that allows for agile adaptation to diverse local market needs, a crucial advantage in the fragmented foodservice sector. The company's financial robustness, demonstrated by strong revenue growth of 12.6% in FY2023 and continued earnings per share increases into H1 FY2025, provides the foundation for its expansion strategies.

Bidcorp's proven track record in executing bolt-on acquisitions, coupled with a strong balance sheet and conservative leverage (net debt to EBITDA below 1.5x in FY2024), fuels its market consolidation strategy. This financial flexibility enables the group to capitalize on growth opportunities and expand its geographic and product diversification. Furthermore, substantial investments in digital transformation, including advanced e-commerce and logistics technologies, are enhancing supply chain efficiency and customer engagement, while also supporting sustainability initiatives.

What is included in the product

Delivers a strategic overview of Bidcorp Group’s internal and external business factors, highlighting its strengths in diverse markets and operational efficiency, while also addressing potential weaknesses in integration and threats from economic volatility and competition.

Offers a clear roadmap for Bidcorp to navigate market challenges and capitalize on opportunities, relieving strategic uncertainty.

Weaknesses

Bidcorp's global reach, while a strength, also exposes it to regional economic sensitivities. For instance, challenging economic climates and consumer spending pressures in Australasia have historically impacted performance in that segment.

Similarly, subdued activity in Greater China presents another area where localized economic headwinds can affect Bidcorp's overall financial results. This unevenness across markets means that downturns in specific regions can indeed dampen group-wide outcomes.

Bidcorp's extensive international presence, with over 90% of its operations outside South Africa, exposes it to significant currency volatility. This means that when results are reported in South African Rand (ZAR), fluctuations in exchange rates can distort the true picture of operational performance. For instance, a strengthening ZAR against other currencies could make overseas earnings appear lower, even if the underlying businesses performed well in their local markets.

This constant exposure to foreign exchange markets presents a persistent challenge for Bidcorp's management. The company must actively manage these currency risks to mitigate potential negative impacts on reported revenue and profitability. The need to translate diverse global earnings into a single reporting currency means that currency movements are an unavoidable factor in assessing Bidcorp's financial health.

Bidcorp is facing escalating operating expenses, with a significant portion attributed to increased labor costs. Persistent wage pressures across its global operations are a key driver of this trend, impacting profitability.

Labor expenses represent a substantial component of Bidcorp's overall cost structure. The company is also grappling with challenges related to labor availability, which further exacerbates wage pressures and contributes to rising operational costs.

Even as food inflation begins to stabilize, the ongoing inflation in labor costs presents a considerable threat to Bidcorp's ability to maintain its profit margins. This is a critical area that requires careful management and strategic planning to mitigate the impact on financial performance.

Price Sensitivity and Increased Competition

Economic headwinds in key markets are making customers more sensitive to price, and this is fueling fiercer competition in the foodservice sector. This environment can force Bidcorp to lower prices to keep sales steady and hold onto market share, even if it means thinner profit margins.

Maintaining a delicate balance between offering competitive prices to win and keep customers, while simultaneously safeguarding profitability, presents a continuous strategic hurdle for the group.

- Price Pressure: Increased customer price sensitivity directly impacts Bidcorp's ability to maintain its pricing power.

- Margin Erosion: To combat competitive pressures and retain sales volume, Bidcorp may need to accept lower profit margins.

- Strategic Balancing Act: The ongoing challenge lies in finding the optimal pricing strategy that supports both market share and profitability.

Short-Term Impact of Capital Investments

Bidcorp's substantial capital investments in new distribution centers and infrastructure upgrades, while crucial for long-term expansion, can temporarily depress short-term earnings. These large-scale projects demand significant initial outlays and require a period to reach full operational capacity and profitability. For instance, the company's ongoing investments in its European logistics network, a key part of its 2024-2025 strategy, will likely see a near-term impact on divisional profitability metrics.

This drag on immediate financial performance is a common challenge for companies undertaking ambitious growth initiatives. The capital expenditure, coupled with the ramp-up period for new facilities, can lead to:

- Increased operating costs during the initial phases of new facility operation.

- Lower revenue generation until new distribution networks achieve optimal throughput.

- Potential for reduced profit margins as new operations scale up.

Bidcorp's significant international footprint exposes it to currency fluctuations, with over 90% of its operations outside South Africa. For example, during the first half of fiscal year 2024, while reported revenue in Rand increased, the underlying performance in local currencies faced headwinds from a stronger Rand, impacting the translation of foreign earnings.

Escalating operating expenses, particularly rising labor costs, are a persistent challenge. In 2024, Bidcorp noted ongoing wage pressures across its global operations, contributing to increased operational expenditure and potentially impacting profit margins, even as food inflation showed signs of stabilization.

Intensified competition and customer price sensitivity in key markets are forcing Bidcorp to navigate a delicate balance. To maintain market share in a challenging economic environment, the company may need to accept lower profit margins, as seen in certain European markets where price competition has been particularly fierce.

Substantial capital investments in infrastructure, such as new distribution centers in Europe as part of its 2024-2025 strategy, can temporarily depress short-term earnings due to initial outlays and ramp-up periods before reaching full operational efficiency.

| Weakness | Impact | Example/Data Point |

|---|---|---|

| Currency Volatility | Distorts reported earnings due to translation effects from over 90% of operations outside South Africa. | A stronger Rand in H1 FY24 reduced the reported value of foreign earnings despite solid local performance. |

| Rising Labor Costs | Increases operating expenses and can erode profit margins. | Ongoing wage pressures globally were a key factor in rising operational costs during 2024. |

| Price Sensitivity & Competition | Forces pricing adjustments, potentially leading to lower profit margins. | Increased price competition in some European markets in 2024 necessitated careful pricing strategies to retain market share. |

| Capital Expenditure | Temporarily depresses short-term earnings due to investment in new facilities. | Investments in new distribution networks in Europe during 2024-2025 are expected to impact near-term divisional profitability. |

What You See Is What You Get

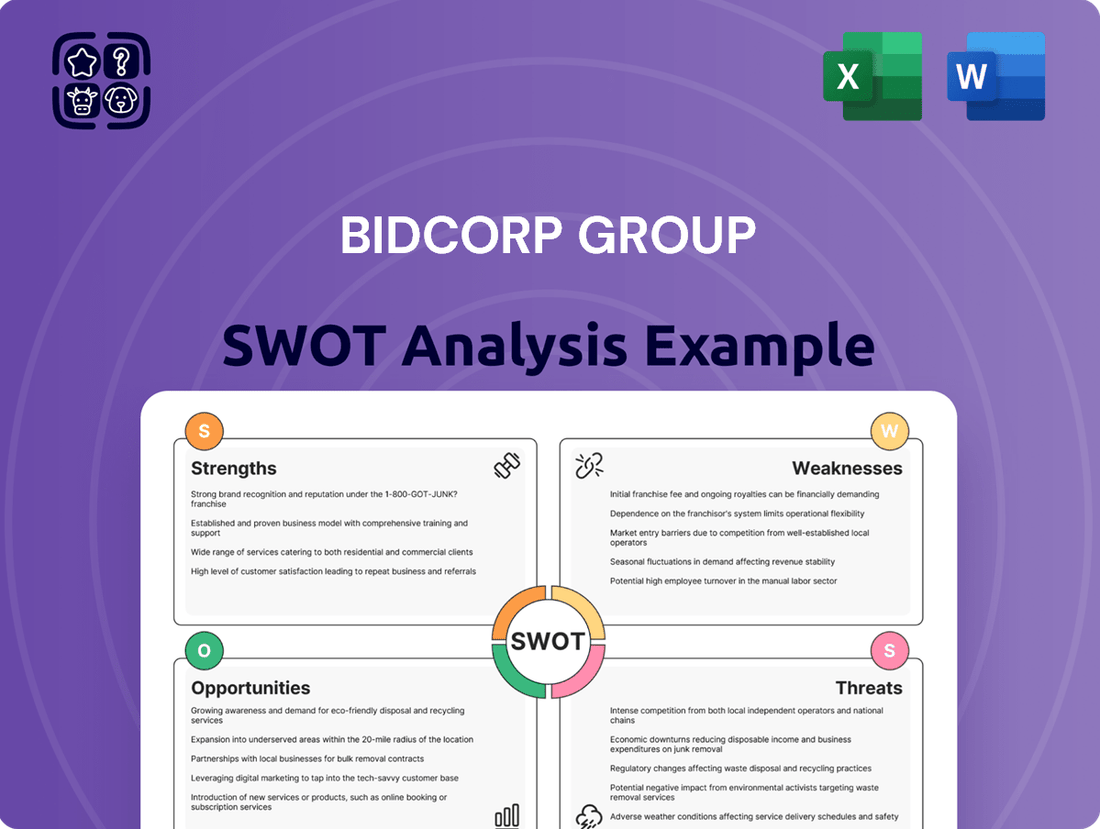

Bidcorp Group SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing Bidcorp Group's Strengths, Weaknesses, Opportunities, and Threats.

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Bidcorp's strategic position.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, offering actionable insights for Bidcorp Group.

Opportunities

Bidcorp's robust financial position, demonstrated by its strong balance sheet, provides significant capacity for further strategic acquisitions. The group has a clear strategy focused on consolidating fragmented markets, often through bolt-on acquisitions that enhance existing operations.

The company is not limited to smaller, in-country expansions; larger, transformative acquisitions are also a key opportunity. These could unlock entry into new geographic territories or substantially bolster current operational strengths, driving sustained growth.

For example, in the fiscal year 2023, Bidcorp completed acquisitions contributing approximately R1.5 billion to its revenue, highlighting the tangible impact of its M&A strategy on growth. This acquisitive pipeline remains a critical driver for future performance.

Bidcorp can boost profitability by strategically targeting higher-margin independent businesses within its customer base, a move that typically yields better returns than focusing solely on larger, potentially lower-margin accounts.

Expanding its private label or own-brand product lines presents a significant opportunity for Bidcorp to increase value capture. For instance, in the fiscal year 2024, food service distributors globally saw their own-brand sales grow by an average of 7% year-over-year, often outperforming national brands in terms of margin. Bidcorp can capitalize on this trend.

Further investment in niche value-add manufacturing capabilities allows Bidcorp to differentiate its product offerings and secure more margin throughout the supply chain, moving beyond simple distribution to more specialized food preparation and processing.

Bidcorp can leverage ongoing investments in advanced digital commerce systems and AI tools to streamline operations and enhance customer and supplier interactions. For instance, the company's commitment to digital transformation, evidenced by its ongoing rollout of advanced ERP systems across its divisions, is expected to yield significant efficiency gains.

Adopting new technologies for renewable energy and overall energy efficiency offers a dual benefit: reducing operational costs and minimizing environmental impact. This strategic move aligns with global sustainability trends and can lead to substantial savings, as seen in similar industry initiatives where energy efficiency improvements have lowered operating expenses by up to 15%.

Embracing these technological advancements serves as a crucial competitive differentiator in the food service distribution sector. Companies that effectively integrate AI for demand forecasting and optimize logistics through smart technologies are better positioned to respond to market changes and deliver superior service, a trend clearly visible in Bidcorp's 2024 strategic priorities.

Growth in Emerging Markets

Bidcorp's diversified portfolio across emerging markets, including South Africa, Malaysia, and Türkiye, presents significant growth opportunities. Despite current macroeconomic headwinds in some regions, these markets are experiencing expanding middle classes and increasing disposable incomes, driving demand in the foodservice sector.

For instance, Bidcorp's operations in Malaysia have benefited from a growing urban population and a rising trend in out-of-home dining. Similarly, while Türkiye faces economic volatility, its large, young population represents a long-term potential for increased food consumption outside the home. Bidcorp's established presence and distribution networks in these areas position it to capture this future expansion.

- South Africa: Bidcorp holds a substantial market share in South Africa's foodservice distribution, benefiting from a large consumer base and increasing demand for convenience foods.

- Malaysia: The company's operations in Malaysia are poised to grow with the nation's economic development and the increasing adoption of modern retail and foodservice formats.

- Türkiye: Despite economic challenges, Türkiye's demographic profile, with a significant youth population, offers long-term potential for foodservice sector expansion.

Enhanced Sustainability and ESG Initiatives

Bidcorp can significantly bolster its brand and market standing by intensifying its focus on Environmental, Social, and Governance (ESG) principles, embedding sustainability more deeply into its operational framework. For instance, by continuing to report progress on its science-based targets, such as those aimed at reducing Scope 1 and 2 emissions, Bidcorp can attract a growing pool of ESG-focused investors. In 2023, Bidcorp reported a 5.4% reduction in its Scope 1 and 2 greenhouse gas emissions intensity, demonstrating tangible progress in this area.

Deepening its commitment to ESG can translate into enhanced reputation among consumers and investors who increasingly prioritize ethical and sustainable business practices. This proactive stance not only mitigates risks but also opens doors to new market segments and encourages innovation within its supply chain. The group's continued investment in responsible sourcing, for example, can lead to more resilient and efficient operations.

- Strengthened Brand Reputation: Aligning with investor and consumer demand for sustainability.

- Attracting ESG Investment: Demonstrating commitment to carbon reduction targets, like the 5.4% Scope 1 & 2 emissions intensity reduction reported in 2023.

- New Business Opportunities: Unlocking markets and partnerships focused on sustainable practices.

- Supply Chain Resilience: Fostering innovation through responsible sourcing initiatives.

Bidcorp's strategic acquisition strategy remains a significant opportunity, with R1.5 billion in revenue generated from acquisitions in FY2023 alone, showcasing its effectiveness. The company can further enhance profitability by targeting higher-margin independent businesses and expanding its own-brand product lines, which saw global foodservice distributors' own-brand sales grow by an average of 7% in 2024.

Investing in niche manufacturing capabilities and leveraging digital commerce and AI tools are key to differentiation and efficiency, with ongoing ERP system rollouts expected to yield substantial gains. Furthermore, Bidcorp's presence in diverse emerging markets like Malaysia and Türkiye offers long-term growth potential driven by expanding middle classes and increasing disposable incomes.

A strengthened focus on ESG principles, including a 5.4% reduction in Scope 1 and 2 greenhouse gas emissions intensity in 2023, can attract ESG-focused investors and create new business opportunities. This commitment to sustainability also bolsters brand reputation and supply chain resilience.

Threats

Persistent weak economic growth and elevated inflation continue to put pressure on consumers globally. In 2024, many developed economies experienced inflation rates above central bank targets, impacting disposable incomes and leading to reduced discretionary spending, including on eating out. For instance, the IMF projected global growth to be around 3.2% in 2024, a slight slowdown from previous years, signaling ongoing economic headwinds.

This subdued demand in the eating-out-of-home market directly challenges Bidcorp's revenue growth and profitability. As consumers become more price-sensitive, they may opt for cheaper alternatives or reduce the frequency of dining out, directly affecting the volumes and margins Bidcorp can achieve across its diverse markets.

The ongoing cost-of-living pressures mean that even in markets with moderate economic growth, consumer behavior shifts towards value and necessity, making it harder for food service businesses to maintain pricing power. This broader macroeconomic environment remains a critical factor influencing Bidcorp's performance and necessitates careful management of costs and product offerings.

The foodservice distribution sector is notoriously competitive, and as rivals vie for market share, Bidcorp faces pressure to lower prices. This can directly impact their ability to maintain healthy profit margins, especially with food inflation showing signs of moderating in 2024 and into 2025, making it harder to offset costs through price increases.

For instance, in the fiscal year ending June 30, 2023, Bidcorp reported a gross profit margin of 21.6%. While strong, sustained competitive intensity could erode this figure. Companies like Sysco and US Foods are also actively competing, pushing for efficiency and cost savings that translate to price advantages for their customers.

This environment necessitates continuous strategic adjustments to protect profitability. Bidcorp must focus on operational efficiencies, supply chain optimization, and value-added services to differentiate itself beyond just price, ensuring it can navigate the ongoing margin pressures effectively.

While food inflation has seen some moderation, non-food cost inflation continues to be a significant hurdle for Bidcorp. This is largely driven by ongoing wage pressures and persistent labor shortages across its global operations. For instance, the UK, a key market for Bidcorp, has experienced significant wage growth in the logistics sector, with average weekly earnings for transport and storage workers rising by approximately 7.5% year-on-year in early 2025, according to ONS data.

The scarcity of essential talent, particularly for critical roles such as warehouse staff and delivery drivers, directly contributes to increased operating expenses. This talent gap can lead to higher recruitment costs and the necessity of offering more competitive compensation packages. In Australia, for example, the logistics industry faced a shortage of over 50,000 workers in late 2024, pushing up labor costs for companies like Bidcorp.

If these rising labor costs are not effectively managed through operational efficiencies, automation, or strategic workforce planning, they pose a direct threat to Bidcorp's profit margins. The cumulative effect of these non-food cost increases can significantly impact the group's overall financial performance, especially in a competitive market where price pass-through may be limited.

Supply Chain Disruptions & Geopolitical Risks

Global supply chain dislocations, such as those experienced in the Red Sea during early 2024, continue to create significant logistical challenges and drive up operational costs for companies like Bidcorp. These disruptions directly impact product availability and can lead to increased shipping expenses, affecting Bidcorp's cost structure and potentially its profit margins.

Ongoing geopolitical instability and trade tensions in key operating regions present a persistent threat. For instance, evolving trade policies or regional conflicts could restrict market access or disrupt the continuity of operations in certain territories where Bidcorp has a significant presence. This uncertainty makes long-term business planning more challenging.

- Supply Chain Vulnerability: Events like the 2024 Red Sea shipping crisis highlighted the fragility of global logistics, leading to extended transit times and increased freight costs, impacting Bidcorp’s ability to source and distribute goods efficiently.

- Geopolitical Impact: Trade disputes and regional conflicts can lead to tariffs, sanctions, or operational shutdowns, directly affecting Bidcorp's market access and the predictability of its international business activities.

- Cost Inflation: Both supply chain issues and geopolitical risks contribute to inflationary pressures, increasing the cost of raw materials, energy, and transportation, which Bidcorp must manage to maintain competitive pricing.

Regulatory Burden & Food Safety Risks

Bidcorp navigates an escalating wave of non-financial reporting and compliance mandates, with sustainability and ESG disclosures demanding significant attention. For instance, the EU's Corporate Sustainability Reporting Directive (CSRD), fully applicable from 2024 for many companies, significantly expands reporting obligations. This increasing regulatory complexity adds to operational costs and requires robust data management systems.

The food industry inherently carries substantial risks, including the potential for food contamination and large-scale product recalls, which demand rigorous quality assurance protocols. A 2024 report highlighted a 10% increase in food recall incidents across major markets compared to the previous year, underscoring the persistent nature of these threats. Effective risk mitigation and adherence to evolving food safety standards are paramount to prevent substantial reputational and financial repercussions.

- Increased Compliance Costs: Growing ESG and sustainability reporting requirements, exemplified by the CSRD, necessitate investment in new systems and expertise.

- Food Safety Incidents: The risk of contamination and recalls remains a constant threat, with a noted rise in recall frequency in 2024 impacting operational continuity and consumer trust.

- Reputational and Financial Damage: Failure to manage regulatory burdens or food safety risks can lead to severe financial penalties, loss of market share, and diminished brand value.

Bidcorp faces significant threats from persistent global economic headwinds, including slow growth and elevated inflation, which dampen consumer spending on dining out. This directly impacts sales volumes and pricing power, as seen with the IMF projecting a modest 3.2% global growth for 2024.

Intense competition within the foodservice distribution sector pressures Bidcorp's margins, especially as food inflation moderates, limiting its ability to pass on costs. For instance, while Bidcorp's FY23 gross margin was 21.6%, rivals like Sysco are aggressively pursuing cost efficiencies.

Rising non-food costs, particularly labor shortages and wage pressures in key markets like the UK (where transport worker wages rose ~7.5% YoY in early 2025), increase operating expenses. Australia's logistics sector alone faced a deficit of over 50,000 workers in late 2024, exacerbating this issue.

Supply chain disruptions, such as the 2024 Red Sea crisis, and geopolitical instability continue to drive up logistics costs and create operational uncertainties. Furthermore, increasing regulatory burdens, like the EU's CSRD, and the constant risk of food safety incidents pose significant compliance and reputational threats.

SWOT Analysis Data Sources

This Bidcorp Group SWOT analysis is built upon a foundation of verified financial statements, comprehensive market intelligence reports, and expert industry commentary. These sources are carefully selected to ensure a robust and accurate assessment of the company's strategic position.