Bidcorp Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bidcorp Group Bundle

Bidcorp Group navigates a dynamic food service distribution landscape where supplier power can be significant due to specialized products, while buyer power is moderate as customers often seek diverse offerings. The threat of new entrants is tempered by capital requirements and established distribution networks, but substitutes pose a constant challenge.

The complete report reveals the real forces shaping Bidcorp Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Bidcorp's bargaining power with suppliers is influenced by how concentrated the supply market is for its key food categories. For instance, if a small number of suppliers dominate the market for fresh produce or specialty meats, these suppliers can demand higher prices from Bidcorp, thus reducing Bidcorp's negotiating leverage.

In 2024, the global food supply chain faced ongoing volatility, with some regions experiencing shortages in specific agricultural products due to climate events. This concentration in certain supply areas can amplify supplier power, potentially increasing input costs for companies like Bidcorp if they heavily rely on those limited sources.

Switching costs for Bidcorp's suppliers are a key factor in determining their bargaining power. If it's expensive or difficult for Bidcorp to switch from one supplier to another, perhaps due to the need to re-establish relationships, reconfigure logistics, or retrain staff, then suppliers gain leverage. For instance, if a particular food ingredient supplier requires extensive testing and certification for their products to meet Bidcorp's stringent quality standards, the cost and time involved in finding and onboarding a new supplier would be substantial, thus increasing the original supplier's power.

Bidcorp's decentralized operational model, which empowers local entities to manage their own procurement, could potentially reduce the impact of supplier switching costs. This flexibility allows individual business units to negotiate terms and explore alternative suppliers more readily, thereby mitigating the supplier's ability to dictate terms based solely on high switching costs. This approach can foster a more competitive supplier landscape across the group.

If suppliers can credibly threaten to move into foodservice distribution themselves, their bargaining power over Bidcorp significantly increases. This could mean Bidcorp faces a situation where its suppliers become direct competitors, potentially diminishing the demand for Bidcorp's own services.

This forward integration threat, while potent in theory, is often tempered by the substantial capital investment and intricate logistics required to establish and manage a distribution network. Many food producers may find these barriers too high to overcome effectively.

Importance of Bidcorp to Supplier's Business

Bidcorp's substantial order volumes significantly influence the bargaining power of its suppliers. If a supplier relies heavily on Bidcorp for a large percentage of its revenue, that supplier is more beholden to Bidcorp's terms, thereby diminishing its own leverage.

Given Bidcorp's expansive global reach, it frequently operates as a major client for numerous suppliers. This scale means that many suppliers are deeply integrated into Bidcorp's supply chain, which can further concentrate their dependence and reduce their individual bargaining power.

- Revenue Dependence: Suppliers whose revenue streams are disproportionately tied to Bidcorp orders face a reduced ability to dictate terms.

- Global Scale Impact: Bidcorp's international presence often positions it as a critical, high-volume customer for its suppliers.

- Market Share: For many suppliers, Bidcorp might represent a significant portion of their total addressable market, amplifying Bidcorp's influence.

Availability of Substitute Inputs

The availability of substitute inputs significantly weakens supplier bargaining power for Bidcorp. If Bidcorp can readily source similar ingredients or components from multiple vendors, or if alternative product specifications exist, the leverage of any single supplier is reduced. This is especially true for commodity food items where numerous producers offer comparable products.

For instance, in the 2024 fiscal year, Bidcorp's diverse sourcing strategies across various food categories, from fresh produce to packaged goods, allowed for flexibility. When faced with potential price increases from one supplier of, say, dairy products, Bidcorp could pivot to alternative suppliers offering comparable quality and specifications, thereby mitigating the impact of any single supplier’s pricing power.

- Reduced Supplier Leverage: The ease of finding alternative suppliers or substitute products directly curtails the power of existing suppliers to dictate terms.

- Commodity Market Dynamics: For commodity food items, Bidcorp benefits from a broad supplier base, making it easier to switch if prices become unfavorable.

- Sourcing Flexibility: Bidcorp's ability to source a wide range of inputs across different geographies and from numerous producers enhances its negotiating position.

Bidcorp's bargaining power with suppliers is significantly influenced by the availability of substitute products and the ease of switching suppliers. In 2024, Bidcorp’s extensive global sourcing network, particularly for commodity items like grains and basic dairy products, meant that if one supplier attempted to raise prices, Bidcorp could readily shift to alternatives, thereby limiting individual supplier leverage.

The company’s sheer purchasing volume also plays a crucial role. For many food producers, Bidcorp represents a substantial portion of their sales. This dependence means suppliers are often more amenable to Bidcorp's pricing and terms, as losing such a significant client could severely impact their business. For example, a supplier of frozen vegetables might rely on Bidcorp for over 20% of its annual revenue, making them less likely to push for unfavorable contract terms.

Conversely, suppliers with unique or highly specialized products, or those operating in concentrated markets with few competitors, can wield more power. If Bidcorp requires a specific, niche ingredient that only a handful of producers can supply, those suppliers gain leverage. The cost and time associated with finding and qualifying new suppliers for such specialized items can be prohibitive, strengthening the original supplier's negotiating position.

| Factor | Impact on Bidcorp's Supplier Bargaining Power | 2024 Context/Example |

|---|---|---|

| Availability of Substitutes | Weakens supplier power | High availability of commodity produce allowed Bidcorp to switch suppliers easily when prices rose. |

| Supplier Revenue Dependence | Weakens supplier power | Suppliers relying heavily on Bidcorp for sales are more accommodating to terms. |

| Switching Costs | Weakens supplier power if low; Strengthens if high | Low switching costs for standard items; High for specialized, certified ingredients. |

| Concentration of Supply Market | Strengthens supplier power if concentrated | A few dominant suppliers for specialty meats can command higher prices. |

| Threat of Forward Integration | Strengthens supplier power | Suppliers could theoretically enter foodservice distribution, competing with Bidcorp. |

What is included in the product

This analysis unpacks the competitive forces shaping Bidcorp Group's operating environment, evaluating buyer and supplier power, the threat of new entrants and substitutes, and the intensity of rivalry within the food service distribution sector.

A clear, one-sheet summary of Bidcorp's competitive landscape—perfect for quick strategic decision-making.

Instantly understand competitive pressures with a powerful spider/radar chart, highlighting areas of strategic focus for Bidcorp.

Customers Bargaining Power

The bargaining power of Bidcorp's customers is notably shaped by customer concentration and the sheer volume of their purchases. When a significant portion of Bidcorp's revenue comes from a few large clients, these customers gain considerable leverage, allowing them to negotiate more favorable terms, pricing, and service agreements. This concentration can put pressure on Bidcorp's profit margins.

For instance, major hotel chains or large healthcare providers, due to their substantial and consistent order volumes, often wield significant influence. Their ability to switch suppliers, though potentially costly, is a credible threat that can be used to extract better deals. In 2023, Bidcorp reported that its top 10 customers represented approximately 15% of its total revenue, highlighting the importance of managing these relationships effectively.

Bidcorp actively works to mitigate the impact of customer concentration by fostering a broad and diversified customer base across numerous sectors and geographies. This strategy reduces the risk of over-reliance on any single large customer, thereby diffusing some of the inherent bargaining power that concentrated clients might otherwise possess. The company's presence in over 30 countries, serving a multitude of businesses from independent restaurants to large catering operations, is a testament to this diversification effort.

The ease with which Bidcorp's customers can switch to alternative foodservice distributors significantly impacts their bargaining power. If switching costs are low, customers can more readily move to competitors for better pricing or service. For instance, a small restaurant owner might find it simple to change suppliers if the ordering process and product range are similar across distributors.

Bidcorp actively works to increase these switching costs for its diverse clientele. By offering tailored local product assortments and cultivating strong, long-term relationships, Bidcorp aims to make it less appealing or more difficult for customers to transition to another distributor. This strategy is crucial in maintaining customer loyalty and mitigating the downward pressure on prices that low switching costs can create.

Customer price sensitivity significantly influences their bargaining power within the food distribution sector. When customers, such as restaurants or retailers, face tight profit margins or operate in highly competitive markets, they become more inclined to seek the lowest prices, directly impacting distributors like Bidcorp. For instance, a study in early 2024 indicated that over 60% of small to medium-sized food service businesses reported increased price sensitivity among their end consumers, forcing them to negotiate harder with their suppliers.

Availability of Alternative Distributors

The number and strength of alternative foodservice distributors available to Bidcorp's customers significantly influence their bargaining power. In regions where numerous competitors offer similar products and services, customers can more readily switch, giving them leverage to negotiate better pricing and terms. This is particularly relevant for larger clients who represent a substantial portion of a distributor's revenue.

Bidcorp's extensive global footprint means the competitive intensity and availability of alternatives vary greatly by market. For instance, in highly saturated European markets, customers may have a wider array of choices compared to some emerging markets where Bidcorp might be one of the few established players. This regional disparity directly impacts the bargaining power customers wield.

- Customer Choice: A greater number of comparable foodservice distributors in a market increases customer bargaining power.

- Regional Variation: Bidcorp faces differing levels of customer bargaining power across its diverse geographic segments due to varying competitive landscapes.

- Market Saturation: Highly saturated markets, such as parts of Europe, tend to offer customers more alternatives, thereby strengthening their negotiating position.

Threat of Backward Integration by Customers

Customers, particularly large restaurant chains or institutional buyers, can significantly increase their bargaining power if they possess a credible threat of backward integration. This means they could potentially take over their own food sourcing and distribution, bypassing intermediaries like Bidcorp.

While this is a less common strategy for smaller businesses, for major players, it becomes a viable consideration if the cost or inefficiency of relying on external distributors becomes substantial. For instance, if a large hotel group finds its current food supply chain significantly more expensive than managing it internally, they might explore this avenue.

Bidcorp's extensive network and integrated service model are designed to mitigate this threat. By offering a broad range of products, efficient logistics, and value-added services, Bidcorp aims to make backward integration by its customers economically unappealing and operationally challenging.

- Customer Bargaining Power: Increased if customers can credibly threaten backward integration.

- Backward Integration Likelihood: Higher for large chains and institutional clients when external costs rise.

- Bidcorp's Strategy: Comprehensive service offering to reduce the attractiveness of customer self-sourcing.

The bargaining power of Bidcorp's customers is influenced by their ability to switch suppliers, the concentration of its customer base, and their price sensitivity. In 2023, Bidcorp's top 10 customers accounted for approximately 15% of its revenue, underscoring the influence these large clients can exert. The company mitigates this by diversifying its customer base across over 30 countries, serving a wide array of businesses from small restaurants to large catering operations.

Low switching costs empower customers to seek better deals, a factor Bidcorp counters by offering tailored product assortments and building strong relationships to increase customer loyalty. Furthermore, heightened price sensitivity among food service businesses, with over 60% reporting increased end-consumer price sensitivity in early 2024, compels them to negotiate harder with suppliers like Bidcorp.

| Factor | Impact on Bidcorp | Mitigation Strategy |

| Customer Concentration | High leverage for large clients, potentially pressuring margins. | Diversified customer base across sectors and geographies. |

| Switching Costs | Customers can easily move to competitors if costs are low. | Tailored assortments and strong relationship building to increase loyalty. |

| Price Sensitivity | Customers seek lower prices, especially in competitive markets. | Efficient operations and value-added services to justify pricing. |

Preview Before You Purchase

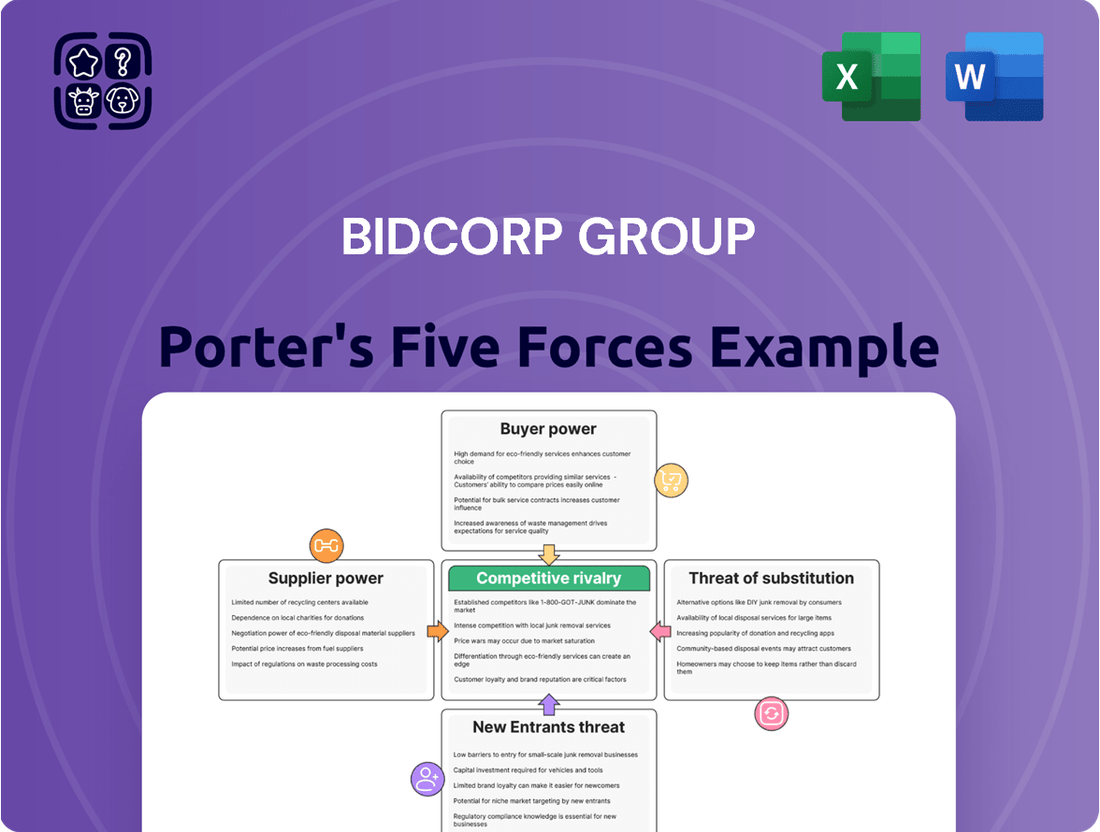

Bidcorp Group Porter's Five Forces Analysis

This preview showcases the Bidcorp Group Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the foodservice distribution industry. You're looking at the actual document; once purchased, you’ll get instant access to this exact, comprehensive analysis, ready for immediate use.

Rivalry Among Competitors

The foodservice distribution landscape is a crowded one, featuring a blend of global giants, established national companies, and a multitude of smaller, regional players. This sheer volume and variety of competitors directly fuels intense rivalry, with each entity striving to capture a larger piece of the market.

For instance, in 2024, the global foodservice distribution market was valued at approximately $410 billion, showcasing the significant scale and the number of businesses operating within it. This diverse competitive environment means that companies must constantly innovate and differentiate to stand out.

Bidcorp's strategic advantage lies in its decentralized operational structure. This allows the group to remain agile and responsive, effectively tailoring its offerings to meet specific local market demands. This adaptability enables Bidcorp to compete effectively against both the broad reach of large multinational corporations and the niche focus of smaller, specialized distributors.

The foodservice industry's growth rate significantly influences competitive rivalry. In 2024, the global foodservice market is projected to grow at a compound annual growth rate (CAGR) of approximately 8.1%, reaching an estimated value of over $3.7 trillion. This robust growth generally tempers intense competition as companies can expand by capturing new market opportunities rather than solely by aggressively targeting competitors' existing customer bases.

Bidcorp's competitive rivalry is influenced by how well its distributors can make their offerings stand out. By providing a wide selection of both food and non-food items, along with extra services and adapting to local needs, Bidcorp aims to move away from just competing on price. This strategy helps build loyalty and reduces direct price wars.

In 2024, Bidcorp's extensive product portfolio, which includes over 15,000 SKUs across its various brands, allows for significant cross-selling opportunities. This breadth of offering, combined with specialized product lines like their own-brand premium ingredients, acts as a key differentiator against competitors who may offer a narrower range.

Exit Barriers

Bidcorp, like many in the foodservice distribution sector, faces significant exit barriers. These are the costs and difficulties a company encounters when trying to leave an industry. For Bidcorp, these include substantial investments in fixed assets like extensive warehouse networks and a large, specialized fleet of delivery vehicles. For instance, the capital expenditure for a modern distribution center can run into tens of millions of dollars, and maintaining a fleet of refrigerated trucks requires ongoing, significant investment.

These high exit barriers mean that even if a particular segment of the foodservice distribution market becomes unprofitable, companies like Bidcorp may be compelled to remain operational due to the difficulty and cost of divesting these assets. This can lead to prolonged periods of intense competition and potential overcapacity as struggling firms continue to operate, often leading to price wars that impact overall industry profitability. The capital-intensive nature of this business inherently creates these moderate to high exit barriers.

The implications for competitive rivalry are clear:

- High fixed asset commitment: The need for specialized infrastructure like temperature-controlled warehouses and a dedicated logistics fleet makes exiting the market costly.

- Specialized labor and contracts: The industry relies on skilled labor for operations and often engages in long-term contracts with suppliers and customers, further complicating an exit.

- Sustained price competition: When firms cannot easily leave, they may resort to aggressive pricing to maintain market share, even in the face of declining profitability.

Price Competition

The intensity of price competition is a critical determinant of profitability within the food service distribution sector. When products are perceived as commodities, aggressive pricing can quickly diminish profit margins. Bidcorp strategically differentiates itself by offering a diverse product portfolio and tailored local services, aiming to move the competitive focus from mere price to overall value and customer loyalty.

Despite these efforts, price remains a significant consideration for many customers when making purchasing decisions. For instance, in the competitive UK food service market, while quality and service are valued, price sensitivity can be particularly acute, especially among smaller independent businesses. Bidcorp's ability to manage its cost base effectively, as demonstrated by its consistent revenue growth, is crucial in navigating this price-sensitive environment.

- Price Sensitivity: Customers in the food service sector often weigh price heavily, especially for standardized products.

- Value Proposition: Bidcorp's strategy focuses on value-added services and product breadth to mitigate pure price competition.

- Margin Erosion: Intense price wars can significantly reduce profitability for all players in the market.

- Cost Management: Efficient supply chain and operational management are key to maintaining competitive pricing while preserving margins.

The foodservice distribution industry is highly competitive, characterized by numerous players ranging from global entities to smaller regional firms. Bidcorp navigates this landscape by emphasizing a broad product offering and value-added services, aiming to reduce reliance on pure price competition.

In 2024, the global foodservice distribution market's substantial size, estimated at $410 billion, underscores the intense rivalry. Bidcorp's strategy of offering over 15,000 SKUs and specialized products helps it differentiate, moving beyond price as the sole competitive factor.

The industry's growth, projected at an 8.1% CAGR in 2024, offers opportunities for expansion, which can somewhat temper outright price wars as companies pursue new market segments.

Bidcorp's competitive rivalry is also shaped by high exit barriers, such as significant investments in infrastructure like warehouses and delivery fleets, which can keep even struggling firms in the market, potentially intensifying price competition.

| Aspect | Description | Impact on Bidcorp |

|---|---|---|

| Number of Competitors | Vast, from global to local players | Requires differentiation beyond price |

| Market Value (2024) | ~$410 billion | Indicates significant scale and competition |

| Bidcorp's Differentiation | Broad product range (15,000+ SKUs), value-added services | Reduces direct price wars, builds loyalty |

| Industry Growth (2024 CAGR) | ~8.1% | Can mitigate intense rivalry by offering expansion opportunities |

| Exit Barriers | High (fixed assets, logistics) | Can lead to sustained price competition if firms struggle to exit |

SSubstitutes Threaten

The threat of customers bypassing distributors like Bidcorp and sourcing directly from manufacturers is a significant substitute. Large entities, such as major hotel chains or restaurant groups, might consider establishing their own procurement and logistics arms if they perceive it as more cost-effective or a way to gain tighter control over their supply chains. For instance, a large hospitality group in 2024 could evaluate the cost savings of negotiating directly with food producers versus the bundled services and efficiencies offered by a distributor like Bidcorp.

Smaller establishments like independent cafes or local restaurants may opt to bypass traditional foodservice distributors. They can source supplies directly from retail supermarkets, cash-and-carry outlets, or even online consumer marketplaces. This offers greater flexibility for smaller or immediate needs, even if it's less cost-effective for bulk buying.

For instance, in 2024, the convenience retail sector saw continued growth, with many supermarkets expanding their own-brand professional catering ranges, directly appealing to smaller businesses seeking accessible alternatives. This trend highlights the need for distributors like Bidcorp to emphasize their value proposition beyond just product availability.

The threat of substitutes in the food service distribution industry, particularly concerning in-house food preparation, presents a notable challenge. Some institutions, especially larger ones with the necessary infrastructure and skilled labor, can opt to increase their preparation of food from raw ingredients. This directly lessens their reliance on pre-prepared or semi-prepared items that distributors like Bidcorp supply. For instance, a large catering company might decide to source bulk raw meats, vegetables, and grains, preparing meals entirely from scratch to control costs and customize offerings.

Bidcorp, recognizing this dynamic, strategically offers a comprehensive portfolio that includes a wide array of raw ingredients alongside its processed and semi-prepared lines. This allows them to serve customers who prefer to do more in-house preparation. By providing high-quality raw materials, Bidcorp can still capture a significant portion of these customers' spending, even if they are not purchasing fully prepared components. In 2024, the global food service market continued to see a trend towards customization and cost control, with some segments of institutional catering showing increased interest in from-scratch preparation.

Changes in Consumer Preferences and Dietary Trends

Shifts in consumer preferences toward plant-based or health-focused diets can reduce demand for traditional food products. For instance, the global plant-based food market was valued at approximately USD 30 billion in 2023 and is projected to grow significantly, indicating a potential substitution threat for conventional food distributors. Bidcorp's ability to adapt its product offerings to these evolving trends is crucial for mitigating this risk.

The rise of direct-to-consumer models and meal kit services also presents a substitute threat by bypassing traditional distribution channels. In 2024, the meal kit delivery market continued its expansion, with many consumers opting for convenience and curated culinary experiences at home. Bidcorp's broad network and diverse portfolio position it to potentially integrate or compete within these emerging substitute channels.

- Growing demand for plant-based alternatives: Consumer interest in flexitarian, vegetarian, and vegan diets continues to rise globally.

- Health and wellness trends: Increased focus on functional foods, organic products, and specific dietary needs (e.g., gluten-free, low-carb) creates demand for specialized offerings.

- Direct-to-consumer (DTC) and online food delivery: These channels offer consumers alternatives to traditional retail and foodservice, potentially impacting distributor volumes.

- Convenience food and meal kits: The popularity of pre-prepared meals and meal kits provides consumers with convenient substitutes for restaurant dining or home cooking, affecting traditional food service demand.

Alternative Food Service Models

The emergence of alternative food service models, like cloud kitchens and direct-to-consumer meal kits, presents a potential threat of substitution. These models can bypass traditional distribution channels and cater to evolving consumer preferences for convenience and specialized offerings. For instance, the global cloud kitchen market was projected to reach over $100 billion by 2027, indicating a significant shift in how food is prepared and delivered.

These new models may cultivate their own supply chains or partner with niche providers, potentially diverting demand from established food service distributors. Bidcorp's broad customer base and adaptable supply chain are crucial for navigating this evolving landscape, allowing them to serve these emerging segments. In 2024, Bidcorp reported a revenue of approximately R210 billion, showcasing its scale and capacity to adapt to market shifts.

- Cloud Kitchen Market Growth: Projected to exceed $100 billion by 2027, indicating a significant shift in food preparation and delivery.

- Direct-to-Consumer Meal Kits: Gaining traction by offering convenience and specialized culinary experiences.

- Supply Chain Diversification: New models may develop independent or specialized supply chains, impacting traditional distributors.

- Bidcorp's Revenue (2024): Approximately R210 billion, demonstrating its scale and ability to serve diverse and evolving market segments.

Customers can bypass distributors like Bidcorp by sourcing directly from manufacturers, especially larger entities seeking cost savings or supply chain control. Smaller businesses might also opt for retail supermarkets or online marketplaces for flexibility, as seen with the expansion of supermarket catering ranges in 2024.

Institutions with the capacity for in-house preparation can reduce reliance on semi-prepared items, a trend supported by the global push for cost control and customization in 2024. Bidcorp mitigates this by offering a wide range of raw ingredients alongside processed options.

Shifting consumer preferences towards plant-based and health-focused diets, with the plant-based market valued at around $30 billion in 2023, also pose a substitution threat. Similarly, the growth of direct-to-consumer meal kits in 2024 offers an alternative to traditional channels.

Emerging models like cloud kitchens and direct-to-consumer meal kits, with the cloud kitchen market projected to exceed $100 billion by 2027, bypass traditional distribution. Bidcorp's substantial 2024 revenue of approximately R210 billion demonstrates its capacity to adapt to these evolving market dynamics.

| Threat of Substitutes | Description | Impact on Bidcorp | 2024 Data/Trends |

| Direct Sourcing by Large Customers | Major clients bypassing distributors for direct manufacturer deals. | Reduced volume for Bidcorp. | Large hospitality groups evaluating in-house procurement. |

| Small Business Retail Sourcing | Smaller businesses using supermarkets or online platforms. | Loss of smaller account revenue. | Supermarkets expanding professional catering ranges. |

| In-House Food Preparation | Customers preparing more food from scratch. | Lower demand for processed/semi-prepared items. | Global trend towards customization and cost control. |

| Dietary Shifts & Health Trends | Consumer move to plant-based, organic, or specialized diets. | Reduced demand for conventional products. | Plant-based market ~$30 billion (2023); growth projected. |

| DTC & Meal Kits | Consumers opting for direct delivery or meal kits. | Bypassing traditional distribution channels. | Meal kit market expansion in 2024. |

| Cloud Kitchens | Alternative food service models operating without traditional storefronts. | Potential for alternative supply chain development. | Cloud kitchen market projected >$100 billion by 2027. |

Entrants Threaten

The foodservice distribution sector demands significant upfront capital. Companies need to invest heavily in warehouses, refrigerated trucks, and sophisticated inventory technology. For instance, establishing a new distribution center can easily cost tens of millions of dollars, encompassing land acquisition, construction, and specialized equipment.

These considerable capital requirements create a substantial barrier for new players looking to enter the market. Bidcorp's existing, well-established network of facilities and vehicles, built over years, represents a formidable advantage that new entrants would struggle to replicate quickly or affordably.

Established players like Bidcorp leverage significant economies of scale in purchasing, logistics, and operations, enabling them to offer competitive pricing and a broader product selection. For instance, Bidcorp's substantial purchasing volume across its diverse markets in 2024 likely secured favorable terms with suppliers, a feat difficult for newcomers to replicate rapidly.

New entrants face a considerable hurdle in achieving similar operational efficiencies and cost advantages quickly, placing them at a distinct disadvantage from the outset. Bidcorp's extensive global network and established supply chains further amplify this barrier to entry, as replicating such infrastructure requires substantial capital and time investment.

Bidcorp's success hinges on deeply ingrained brand loyalty and extensive customer relationships built over years with diverse clients like restaurants, hotels, and healthcare facilities. This trust is a significant barrier for newcomers.

New entrants face a steep challenge in replicating Bidcorp's established reputation and service track record, which are crucial for attracting and retaining customers in the food service distribution sector. For instance, in 2024, Bidcorp reported a revenue of €16.1 billion, underscoring the scale and market penetration achieved through these enduring relationships.

Bidcorp’s decentralized operational model further strengthens local ties and customer loyalty, making it exceptionally difficult for new competitors to gain significant traction quickly.

Access to Distribution Channels and Supplier Networks

New businesses entering the food service distribution market often struggle to build the robust distribution networks and secure the supplier relationships that established players like Bidcorp possess. Bidcorp's long-standing presence, spanning decades, has allowed it to cultivate deep ties with a vast array of food and non-food suppliers globally, ensuring consistent supply and favorable pricing. This established infrastructure acts as a significant barrier, making it difficult for newcomers to compete on scale and reliability.

The intricate nature of supply chain management further deters potential entrants. Bidcorp manages complex logistics, including warehousing, transportation, and inventory management, across diverse geographic regions. For instance, in 2023, Bidcorp reported a significant portion of its revenue derived from its extensive distribution network, highlighting the critical role these channels play in its competitive advantage. New entrants would need substantial capital investment and operational expertise to replicate this level of efficiency and reach.

- Established Distribution Networks: Bidcorp's global reach provides unparalleled access to customers, a hurdle for new entrants.

- Supplier Relationships: Decades of experience have fostered strong, preferential agreements with a wide range of suppliers.

- Supply Chain Complexity: The sophisticated logistics and inventory management Bidcorp employs are costly and time-consuming for new players to develop.

Regulatory Hurdles and Food Safety Standards

The foodservice sector faces significant regulatory hurdles, including strict health, safety, and food quality standards that differ across geographies. These regulations necessitate substantial investments in infrastructure, operational processes, and obtaining necessary certifications, thereby increasing the barrier to entry for newcomers.

Navigating this intricate web of compliance requirements adds considerable difficulty and financial burden for potential entrants. For instance, in 2024, the European Union continued to enforce its rigorous food safety legislation, requiring extensive documentation and adherence to standards like HACCP (Hazard Analysis and Critical Control Points) for all food businesses.

- Regulatory Complexity: Foodservice operations must comply with a patchwork of local, national, and international food safety laws.

- Investment Costs: Meeting these standards often requires significant capital expenditure on facilities, equipment, and quality control systems.

- Certification Requirements: Obtaining and maintaining certifications, such as ISO 22000, adds another layer of cost and operational complexity.

- Bidcorp's Advantage: Bidcorp's established global presence and experience allow it to efficiently manage compliance across diverse regulatory environments.

The threat of new entrants for Bidcorp Group is relatively low, primarily due to the substantial capital investment required to establish a competitive foodservice distribution operation. Building the necessary infrastructure, including warehouses and a refrigerated fleet, along with securing supplier agreements and navigating complex regulations, presents significant financial and operational hurdles.

Bidcorp’s established global distribution network and strong supplier relationships, cultivated over decades, provide a formidable competitive advantage. For example, in 2024, Bidcorp's extensive operational footprint across numerous countries allowed it to achieve economies of scale that new entrants would find extremely difficult and costly to replicate in the short to medium term.

Furthermore, the brand loyalty and customer relationships Bidcorp has built are critical barriers. Newcomers must overcome Bidcorp's reputation for reliability and service, which is often reinforced by substantial revenue figures, such as Bidcorp's reported €16.1 billion in revenue for 2024, indicating deep market penetration.

| Barrier Type | Description | Impact on New Entrants | Bidcorp's Position |

| Capital Requirements | High costs for warehouses, fleet, technology. | Significant financial barrier. | Established infrastructure and scale. |

| Economies of Scale | Lower per-unit costs due to high volume. | Difficulty competing on price. | Leveraged through global operations. |

| Brand Loyalty & Relationships | Customer trust and repeat business. | Challenge in customer acquisition. | Decades of service and reliability. |

| Regulatory Compliance | Adherence to food safety and quality standards. | Increased operational complexity and cost. | Expertise in managing diverse regulations. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bidcorp Group is built upon a foundation of comprehensive data, including Bidcorp's annual reports, investor presentations, and financial statements. We also leverage industry-specific research from reputable market analysis firms and trade publications to understand the competitive landscape.