Bidcorp Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bidcorp Group Bundle

Navigate the complex external forces impacting Bidcorp Group with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and evolving social trends are shaping its operational landscape. Gain a critical advantage by identifying potential risks and opportunities. Download the full analysis now to unlock actionable intelligence for your strategic planning.

Political factors

Bidcorp's extensive global footprint means its operations are highly susceptible to geopolitical tensions and evolving trade policies. For instance, ongoing conflicts in regions like Eastern Europe and the Red Sea have demonstrably disrupted global supply chains, escalating shipping expenses and affecting the procurement of essential resources, thereby raising Bidcorp's operational costs.

Shifts in tariff regimes or the renegotiation of trade pacts in crucial markets directly impact import and export expenditures and alter the competitive dynamics for Bidcorp. The International Monetary Fund (IMF) projected in late 2024 that global trade growth would likely remain subdued in 2025, a trend influenced by these geopolitical and trade policy uncertainties, potentially affecting Bidcorp's international sales volumes and cost structures.

Bidcorp navigates a complex web of regulations globally, impacting everything from food safety standards to labor laws and foreign ownership rules. For instance, in 2024, the European Union continued to strengthen its food safety regulations, requiring extensive documentation and traceability for all food suppliers, a significant operational consideration for Bidcorp's European operations.

The growing emphasis on Environmental, Social, and Governance (ESG) reporting presents a substantial compliance challenge. By 2025, many jurisdictions are expected to mandate more rigorous non-financial disclosures. Bidcorp’s investment in robust reporting systems and updated governance frameworks is crucial to meet these evolving demands and maintain stakeholder trust.

Bidcorp's performance in markets with significant public sector foodservice, such as the UK's National Health Service (NHS) or Australian schools, is directly tied to government spending. In 2024, the UK government announced plans to increase healthcare spending by 3% annually, a move that could boost contract opportunities for foodservice providers like Bidcorp. Conversely, budget austerity measures in education sectors elsewhere could limit contract growth.

Political Stability in Operating Regions

Bidcorp's operational success is significantly tied to the political stability of the regions where it functions. Unforeseen political shifts or instability can disrupt supply chains and impact consumer spending, especially in its key markets. For instance, while South Africa, a significant market for Bidcorp, has shown some signs of political stabilization in the lead-up to the 2024 general elections, ongoing policy debates and potential shifts in governance create an element of uncertainty for businesses.

The company's exposure to diverse political landscapes means that localized instability can have ripple effects. In Europe, while generally stable, specific countries might face political transitions that could influence regulatory environments or economic sentiment. Bidcorp's strategy often involves navigating these varying political climates, with a focus on markets offering greater predictability.

Factors influencing political stability relevant to Bidcorp's operations include:

- Government Effectiveness: The capacity of governments to formulate and implement sound policies and regulations affecting the food service and distribution sectors.

- Regulatory Environment: Stability and predictability in food safety standards, import/export regulations, and labor laws across operating countries.

- Geopolitical Risk: Exposure to regions with potential for conflict or significant diplomatic tensions that could impact trade and economic activity.

- Policy Continuity: The likelihood that existing business-friendly policies will remain in place or evolve predictably, fostering a secure investment climate.

Food Security and National Policies

National governments increasingly prioritize food security, implementing policies that can directly impact food distributors like Bidcorp. These agendas often involve supporting local agricultural sectors through subsidies or preferential procurement, as seen in various European Union agricultural policies. Conversely, some nations may impose import restrictions or tariffs to protect domestic markets, potentially affecting Bidcorp's ability to source and distribute a wide range of products efficiently. For example, in 2024, several African nations continued to explore measures to boost local food production and reduce reliance on imports, which could influence Bidcorp's supply chain dynamics in those regions.

These national food security policies aim to ensure stable and accessible food supplies for citizens, but they can introduce significant operational complexities for global players. Bidcorp must navigate a patchwork of regulations concerning local content requirements, import quotas, and phytosanitary standards that vary by country. For instance, while the EU promotes free movement of goods within its bloc, individual member states may still have specific national regulations tied to food safety and origin labeling that add layers of compliance. These measures can influence Bidcorp’s sourcing strategies, pushing for more localized procurement or requiring adjustments to product portfolios to meet specific national demands.

The evolving landscape of food security policies presents both challenges and opportunities for Bidcorp:

- Support for Local Producers: Government initiatives to bolster domestic agriculture can create opportunities for Bidcorp to partner with local suppliers, enhancing its product offering in specific markets.

- Import Restrictions: Tariffs or quotas on imported food items may necessitate a re-evaluation of Bidcorp's sourcing strategies and could lead to increased operational costs or reduced product availability in certain regions.

- Regulatory Compliance: Navigating diverse national food safety and origin regulations requires robust compliance frameworks and can influence Bidcorp's logistical and operational planning.

- Market Adaptation: Bidcorp's ability to adapt its product mix and supply chain to align with national food security agendas will be crucial for maintaining market access and competitive advantage.

Political stability and government policies significantly shape Bidcorp's operating environment. Fluctuations in trade agreements and tariffs, as seen with the IMF's subdued global trade growth forecast for 2025, directly impact Bidcorp's international costs and sales. Increased government spending on public services, such as the UK's 3% healthcare spending increase for 2024, can create contract opportunities, while austerity measures may limit them.

National food security agendas, including subsidies for local agriculture or import restrictions, necessitate Bidcorp's adaptation in sourcing and product offerings. For instance, African nations' focus on boosting local production in 2024 affects supply chain dynamics. Bidcorp must navigate varying national regulations on food safety and origin, such as specific EU member state requirements.

| Political Factor | Impact on Bidcorp | 2024/2025 Data/Trend |

|---|---|---|

| Trade Policy & Tariffs | Affects import/export costs and competitiveness. | IMF projects subdued global trade growth for 2025 due to policy uncertainties. |

| Government Spending (Public Sector) | Influences contract opportunities in healthcare, education, etc. | UK plans 3% annual healthcare spending increase (2024). |

| Food Security Policies | Drives sourcing strategies and product mix. | African nations exploring measures to boost local food production (2024). |

| Regulatory Environment (Food Safety) | Requires robust compliance frameworks. | EU continues to strengthen food safety regulations (2024). |

What is included in the product

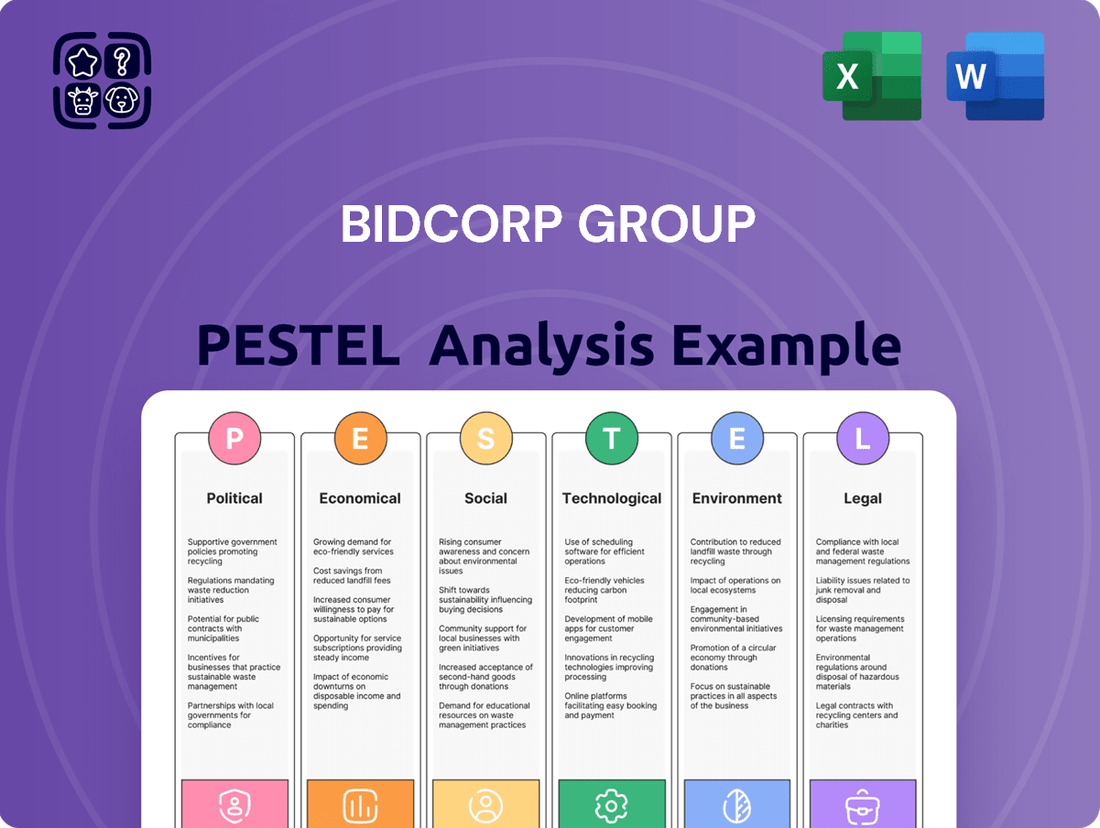

This PESTLE analysis of the Bidcorp Group examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations, providing a comprehensive overview of the external landscape.

A concise PESTLE analysis for Bidcorp Group, offering a clear overview of external factors to proactively address market challenges and inform strategic decision-making.

This PESTLE analysis serves as a pain point reliever by providing a structured framework to identify and mitigate potential risks and capitalize on opportunities within Bidcorp Group's operating environment.

Economic factors

Bidcorp is navigating persistent inflationary headwinds, with core inflation proving particularly stubborn and labor costs escalating at a pace that can exceed food price increases. This dynamic directly impacts their operational expenses.

Managing these rising costs, which encompass wages, fuel, and investments in new capacity, is critical for Bidcorp to sustain its profitability and its ability to offer competitive pricing to its customers. For instance, in the fiscal year ending June 2024, Bidcorp reported that wage inflation in certain markets was a significant factor contributing to increased operating costs.

Consumer spending habits and disposable income are crucial for Bidcorp, as they directly impact demand in the foodservice industry. When consumers have more disposable income, they tend to spend more on dining out and discretionary purchases, benefiting Bidcorp's diverse customer base.

However, economic headwinds can shift these patterns. For instance, in Australasia, persistent cost-of-living pressures and waning consumer confidence in 2024 have led to a noticeable reduction in dining out frequency. This trend forces consumers to become more price-sensitive, potentially impacting Bidcorp's sales volumes and requiring a strategic focus on value offerings.

Currency volatility poses a significant challenge for Bidcorp, a global food service group with over 90% of its operations outside South Africa. Fluctuations in exchange rates directly impact its reported financial results, affecting everything from revenue and profit figures to the cost of essential imported goods. For instance, if the South African Rand weakens against major currencies like the Euro or Pound Sterling, Bidcorp's reported earnings in Rand terms can appear stronger, even if the underlying business performance in local currencies remains steady.

This impact is particularly relevant when considering Bidcorp's substantial presence in markets like Europe and the UK. As of its latest reporting periods in 2024, the group consistently highlights the influence of currency movements on its reported profit. A strong Euro, for example, would translate to lower Rand-denominated profits for its European operations, even if sales volumes and margins in Euros are healthy. This necessitates careful hedging strategies and a nuanced understanding of the group's performance beyond simple headline figures.

Interest Rate Environment

The prevailing interest rate environment significantly influences Bidcorp's operational landscape. High interest rates across its key markets, such as the UK and Europe, directly increase Bidcorp's borrowing costs, potentially impacting its profitability and ability to finance new ventures. For instance, as of early 2024, central banks in several major economies maintained or cautiously lowered rates, but the overall cost of capital remained elevated compared to previous years, affecting companies like Bidcorp with substantial debt financing.

Furthermore, elevated interest rates can dampen capital expenditure by Bidcorp's customers, particularly within the hospitality and food service sectors. When financing becomes more expensive, businesses are more likely to postpone or scale back investments in new equipment or expansions, thereby reducing demand for Bidcorp's products and services. This trend was observable in late 2023 and early 2024, where reports indicated a slowdown in business investment due to economic uncertainty and higher borrowing costs.

The impact extends to consumer spending as well. Higher interest rates often translate to increased costs for mortgages and other loans, squeezing household disposable income. This reduction in discretionary spending can lead to lower demand for dining out and other hospitality services, directly affecting Bidcorp's customer base and, consequently, its sales volumes. For example, consumer confidence indices in many European countries showed sensitivity to inflation and interest rate hikes throughout 2023, signaling potential headwinds for the food service industry.

- Increased Financing Costs: Bidcorp faces higher interest expenses on its debt, impacting net profit margins.

- Reduced Customer Investment: Customers may delay or reduce capital expenditures, leading to lower sales for Bidcorp.

- Pressure on Consumer Spending: Higher rates can decrease disposable income, negatively affecting demand in the hospitality sector.

- Impact on Bidcorp's 2024/2025 Outlook: Continued elevated rates in key markets like the UK and Eurozone pose ongoing challenges for revenue growth and investment strategies.

Economic Growth and Market Conditions

Bidcorp operates within a global economic landscape marked by diverse growth trajectories. While some markets demonstrate robust expansion, others face headwinds, impacting overall demand for food services and related products. For instance, while developed economies might show moderate growth, emerging markets could present higher potential but also greater volatility.

Market conditions are directly shaped by these economic variances. Regions experiencing strong GDP growth typically see increased consumer spending, benefiting Bidcorp’s operations through higher sales volumes. Conversely, areas with stagnant or declining economies can lead to reduced purchasing power and heightened price sensitivity among customers.

Recent data highlights these disparities. In 2024, global GDP growth was projected around 2.6% by the IMF, with significant regional differences. For example, Sub-Saharan Africa, a key market for Bidcorp, was expected to grow at a faster pace than many European nations. This unevenness necessitates a flexible strategy to capitalize on growth pockets while mitigating risks in slower markets.

- Global GDP Growth: IMF projected global GDP growth of 2.6% in 2024.

- Regional Disparities: Sub-Saharan Africa projected to outpace growth in many European economies.

- Impact on Demand: Strong economic growth fuels consumer spending and demand for Bidcorp’s offerings.

- Competitive Intensity: Economic slowdowns can intensify competition as businesses vie for a smaller pool of consumer spending.

Persistent inflation, particularly in labor costs, continues to challenge Bidcorp's operational expenses, with wage inflation in some markets exceeding food price increases in 2024. This necessitates careful cost management to maintain competitive pricing and profitability.

Consumer spending, a vital driver for Bidcorp, is being impacted by cost-of-living pressures and waning confidence in regions like Australasia, leading to more price-sensitive consumers and potentially lower sales volumes.

Currency volatility remains a significant factor, with fluctuations in exchange rates, especially for the Euro and Pound Sterling against the Rand, directly influencing Bidcorp's reported financial results and necessitating robust hedging strategies.

Elevated interest rates in key markets like the UK and Europe increase Bidcorp's borrowing costs and can dampen customer investment, impacting both profitability and sales demand.

Global economic growth presents a mixed picture, with projected IMF global GDP growth around 2.6% for 2024, but with significant regional disparities, such as faster growth anticipated in Sub-Saharan Africa compared to many European nations.

| Economic Factor | Impact on Bidcorp | 2024/2025 Data/Trend |

|---|---|---|

| Inflation (Core & Labor) | Increased operating costs, pressure on margins | Stubborn core inflation; labor costs escalating, sometimes exceeding food price increases. |

| Consumer Spending & Confidence | Directly impacts demand for foodservice; price sensitivity rising | Reduced dining out frequency in Australasia due to cost-of-living pressures. |

| Currency Volatility | Affects reported financial results (revenue, profit) | Significant impact on Rand-denominated earnings from operations in Europe and UK. |

| Interest Rates | Higher borrowing costs; reduced customer capital expenditure; lower consumer disposable income | Elevated rates in UK/Europe increasing cost of capital; consumer spending sensitive to rate hikes. |

| Global GDP Growth | Influences overall demand and market conditions | IMF projected 2.6% global GDP growth for 2024, with regional variations (e.g., Sub-Saharan Africa vs. Europe). |

Same Document Delivered

Bidcorp Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Bidcorp Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Understand the strategic landscape and potential challenges and opportunities facing this global food service business.

Sociological factors

Consumer dining habits are in constant flux, with notable shifts including more frequent mid-week meals and a growing preference for both solo and group dining experiences. This evolution also encompasses a significant surge in demand for experiential dining, where the overall atmosphere and unique offerings are as important as the food itself.

Bidcorp must remain attuned to these changing patterns in when and how consumers opt to dine out. For instance, data from 2024 indicates a continued rise in casual dining occasions during weekdays, suggesting opportunities for more accessible and convenient meal solutions. Adapting to these trends is crucial for Bidcorp to effectively cater to its broad spectrum of customers, from individual diners to large groups seeking memorable outings.

Consumers increasingly favor healthier, sustainable, and ethically produced food. This trend is evident in the rise of plant-based diets, a demand for ingredient transparency, and a focus on food security. For instance, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to reach $162.5 billion by 2030, highlighting a significant shift in consumer preferences.

Bidcorp must adapt its product portfolio and supply chain to meet these evolving demands. This involves offering more whole food and plant-based options, ensuring clear labeling, and demonstrating commitment to sustainable sourcing and food security initiatives. Companies that align with these values often see increased customer loyalty and market share, as seen in the growing success of brands prioritizing these aspects.

Millennials and Gen Z are increasingly shaping the foodservice landscape, with a significant impact on dining habits and technology adoption. These demographics prioritize convenience and experience, leading to higher dining frequency and a strong preference for digital ordering platforms. In 2024, it's estimated that over 70% of Gen Z and Millennials in developed markets utilize mobile apps for food orders, a trend Bidcorp's decentralized structure can effectively leverage by allowing local operations to cater to these digital-first consumers.

Changing Lifestyles and Convenience Demands

Modern life is incredibly fast-paced, and people are looking for ways to save time, especially when it comes to meals. This trend strongly supports the demand for convenience foods, like pre-packaged meals and ready-to-eat options. It also boosts the need for catering services, even for smaller, more informal events, as people juggle work and personal commitments.

Bidcorp, as a major player in foodservice distribution, is right in the middle of this. They need to keep offering products that are quick, simple to prepare, and adaptable for various needs. This means their product selection and how they deliver these solutions must constantly evolve to meet these changing consumer habits.

For instance, the global market for ready-to-eat meals was valued at approximately $176.8 billion in 2023 and is projected to grow significantly. This growth underscores the direct impact of busy lifestyles on Bidcorp's business, highlighting the necessity for agile product development and efficient distribution networks to cater to the demand for convenient culinary solutions.

Key impacts include:

- Increased demand for ready-to-eat and convenience food options.

- Growth in catering services for smaller, informal gatherings.

- Necessity for Bidcorp to adapt product ranges and delivery models.

- Focus on solutions that offer speed, ease of preparation, and versatility.

Cultural and Regional Food Preferences

Bidcorp's decentralized structure is a significant advantage in navigating diverse cultural and regional food preferences worldwide. This model allows local operating companies to deeply understand and cater to the unique tastes and demands of their specific markets, ensuring a relevant product mix. For instance, in 2024, Bidcorp's operations in Asia saw increased demand for a wider array of authentic Asian ingredients, a trend they effectively met by sourcing locally and expanding their ethnic product lines. This agility is crucial for maintaining market share and customer loyalty in a globalized yet highly localized food industry.

The ability to adapt product offerings to regional palates is central to Bidcorp's strategy. This includes stocking a broader range of specialty items and ethnic ingredients that resonate with local communities. For example, Bidcorp's European divisions have reported a 5% year-on-year increase in sales of plant-based and allergen-free products in 2024, reflecting evolving consumer health consciousness and dietary trends across the continent. This granular approach to product selection, driven by local market insights, allows Bidcorp to remain competitive.

- Cultural Adaptation: Bidcorp’s decentralized model enables local units to tailor product assortments to specific regional tastes and culinary traditions.

- Ethnic Ingredient Demand: In 2024, Bidcorp observed a notable rise in the demand for ethnic ingredients across various global markets, particularly in Asia.

- Specialty Product Focus: Local businesses within the Bidcorp group actively expand their offerings of specialty and niche food products to meet diverse consumer preferences.

- Health and Dietary Trends: Bidcorp’s European operations, for example, experienced a 5% growth in plant-based and allergen-free product sales in 2024, highlighting responsiveness to evolving dietary patterns.

Sociological factors significantly influence consumer behavior in the foodservice industry, driving demand for convenience, health, and experiential dining. Bidcorp's success hinges on its ability to adapt to these evolving consumer preferences, particularly those of younger demographics like Millennials and Gen Z who prioritize digital engagement and unique dining experiences.

The increasing demand for healthier, sustainable, and ethically sourced food products is a key sociological trend. Bidcorp must continue to integrate plant-based options and ensure transparency in its supply chain to align with these values. For instance, the global plant-based food market's projected growth to $162.5 billion by 2030 underscores this significant shift.

Bidcorp's decentralized structure allows for agile responses to diverse cultural and regional food preferences, a critical advantage in the global market. In 2024, the company noted increased demand for authentic Asian ingredients in its Asian operations, which were met through local sourcing and expanded ethnic product lines, demonstrating effective adaptation to localized tastes.

| Trend | Impact on Bidcorp | Supporting Data (2023-2024) |

|---|---|---|

| Demand for Convenience | Increased need for ready-to-eat and easy-to-prepare food solutions. | Global ready-to-eat meal market valued at ~$176.8 billion in 2023. |

| Health & Sustainability | Growth in plant-based and ethically sourced product offerings. | Plant-based food market projected to reach $162.5 billion by 2030. |

| Demographic Shifts (Millennials/Gen Z) | Emphasis on digital ordering, convenience, and experiential dining. | Over 70% of Gen Z/Millennials in developed markets use mobile apps for food orders (2024 est.). |

| Cultural Preferences | Need for localized product assortments and ethnic ingredients. | Bidcorp observed increased demand for Asian ingredients in Asia (2024). |

Technological factors

Bidcorp's embrace of digital solutions, including e-commerce platforms and AI, is pivotal for operational efficiency and market influence. For instance, in 2024, the company continued to invest in digital transformation initiatives aimed at streamlining inventory management and enhancing customer engagement across its diverse business units.

Leveraging AI for predictive analytics in demand forecasting and route optimization is key to Bidcorp's strategy. This allows for proactive supply chain management, reducing waste and improving delivery times, which is critical in the competitive food service distribution landscape.

Technological advancements are crucial for Bidcorp Group in maintaining food safety and quality. Innovations like blockchain technology are increasingly being adopted for enhanced traceability, allowing for real-time tracking of products from source to consumer. This is vital as global food traceability regulations continue to tighten, with many markets demanding more transparency.

Bidcorp leverages sophisticated data loggers and advanced temperature monitoring systems to ensure product integrity throughout its complex distribution networks. For instance, the adoption of IoT sensors in refrigerated transport can provide continuous data streams, alerting managers to any deviations from optimal temperature ranges, a critical factor in preventing spoilage and ensuring compliance with food safety standards, which are a growing concern for consumers and regulators alike.

The foodservice sector is increasingly turning to automation and smart kitchen technologies to combat persistent staffing shortages and escalating labor expenses. These advancements, including IoT-enabled appliances and AI-driven kitchen management systems, are crucial for boosting operational efficiency and minimizing reliance on human labor. For instance, in 2024, the global smart kitchen market was valued at approximately $20 billion, with a projected compound annual growth rate (CAGR) of over 15% through 2030, indicating strong adoption trends.

Smart kitchen integration allows for more consistent food preparation and service, directly addressing quality control issues often exacerbated by labor gaps. Bidcorp's focus on these technologies in 2024 and 2025 will likely improve throughput and reduce waste, as automated systems can precisely manage cooking times and inventory. The ability to remotely monitor and control kitchen equipment also offers significant advantages in managing dispersed operations, a key aspect for a group like Bidcorp.

Data Analytics and Business Intelligence

Bidcorp's strategic advantage hinges on its ability to leverage advanced data analytics and business intelligence. This allows for a deep understanding of customer preferences and emerging market trends, crucial for optimizing its vast product and service portfolio.

By analyzing sales data, Bidcorp can make informed decisions about adjusting its product range, refining delivery schedules, and developing new value-added services. For instance, in 2024, the food service industry saw a significant shift towards plant-based options, a trend Bidcorp could identify and capitalize on through robust data analysis.

- Customer Segmentation: Utilizing data analytics to segment customers based on purchasing behavior, dietary preferences, and operational needs allows for tailored offerings and marketing campaigns.

- Market Trend Identification: Real-time analysis of sales data and external market indicators helps Bidcorp anticipate shifts in demand, such as the growing demand for sustainable and locally sourced ingredients.

- Operational Efficiency: Data-driven insights can optimize logistics, inventory management, and supply chain operations, reducing costs and improving delivery times.

- New Product Development: Analyzing consumption patterns and customer feedback informs the development of new products and services that meet evolving market demands.

Renewable Energy and Energy Efficiency Technologies

Bidcorp is strategically investing in new renewable energy technologies, like solar installations, to reduce its environmental footprint and operational costs. This aligns with global trends towards sustainability in the food service and distribution sectors.

Improvements in refrigeration and logistics optimization are also key technological focuses for Bidcorp. These advancements are crucial for maintaining product quality and minimizing waste throughout their extensive supply chain.

For instance, in 2024, Bidcorp continued to explore and implement energy-efficient solutions across its operations. While specific figures for 2025 are not yet fully available, the group's commitment to reducing its carbon intensity remains a priority, with ongoing projects focused on reducing energy consumption in its cold chain logistics.

- Solar Installations: Exploring and implementing solar power generation at various sites to offset grid electricity consumption.

- Refrigeration Efficiency: Upgrading to more energy-efficient refrigeration units and systems to reduce energy usage and refrigerant leakage.

- Logistics Optimization: Utilizing advanced route planning and fleet management software to minimize fuel consumption and emissions.

- Waste Reduction Technologies: Implementing technologies that help monitor and reduce food waste throughout the supply chain.

Bidcorp's technological strategy in 2024 and 2025 centers on enhancing operational efficiency and customer experience through digital integration. The company is actively investing in e-commerce platforms and artificial intelligence to refine inventory management and deepen customer engagement across its global operations.

AI plays a crucial role in Bidcorp's predictive analytics for demand forecasting and optimizing delivery routes, thereby improving supply chain resilience and reducing waste. Furthermore, advancements like blockchain technology are being explored for enhanced food traceability, a critical factor given increasing global regulatory demands for transparency in the food supply chain.

Bidcorp is also focusing on smart kitchen technologies and automation to address labor challenges and improve efficiency, with the global smart kitchen market projected for significant growth. Data analytics is key to understanding customer behavior and market trends, enabling Bidcorp to tailor offerings and identify opportunities, such as the rising demand for plant-based products observed in 2024.

| Technology Focus | 2024/2025 Impact | Key Initiatives |

|---|---|---|

| Digital Platforms & AI | Streamlined operations, enhanced customer engagement | E-commerce development, AI for demand forecasting |

| Food Traceability | Improved food safety, regulatory compliance | Blockchain exploration, IoT sensor integration |

| Automation & Smart Kitchens | Increased efficiency, reduced labor dependency | Adoption of IoT-enabled appliances, AI kitchen management |

| Data Analytics | Informed decision-making, market trend identification | Customer segmentation, sales data analysis |

Legal factors

Bidcorp operates within a dynamic global food safety regulatory environment. For instance, in 2024, the European Union continued to refine its approach to novel foods and food contact materials, impacting ingredient sourcing and product development. Companies like Bidcorp must stay abreast of these changes to ensure compliance and maintain consumer confidence.

Labeling requirements are also a significant legal consideration. Updated allergen declarations, such as clearer guidance on gluten and dairy content, are becoming standard. Furthermore, evolving definitions of 'healthy' for food products, as seen in some markets by 2025, necessitate careful product reformulation and transparent communication to avoid misrepresentation and meet consumer expectations.

Enhanced food traceability is another critical legal factor. Regulations increasingly demand robust record-keeping systems to track ingredients from source to sale, a crucial element for rapid recall management and ensuring product safety. Bidcorp’s adherence to these stringent traceability mandates, often supported by digital solutions, is paramount for operational integrity and legal standing.

Bidcorp operates across diverse global markets, making compliance with varying labor laws and wage regulations a critical operational factor. Increases in statutory minimum wages, such as the recent adjustments seen in countries like the UK and South Africa throughout 2024, directly influence Bidcorp's staffing expenses. These regulatory shifts necessitate continuous monitoring and adaptation of compensation structures to ensure adherence, potentially impacting overall labor costs and profit margins across its extensive network.

New legal mandates like the Corporate Transparency Act (CTA) in the US are increasing the compliance workload for businesses, requiring the filing of Beneficial Ownership Information (BOI) reports. This legislation, which went into effect on January 1, 2024, impacts millions of companies by demanding disclosure of their ultimate beneficial owners.

Furthermore, the growing emphasis on non-financial disclosures, exemplified by the EU's Corporate Sustainability Reporting Directive (CSRD), demands sophisticated internal systems for gathering and reporting data. The CSRD, applicable from the 2024 fiscal year for some companies, broadens the scope of reporting to include environmental, social, and governance (ESG) factors, requiring more detailed and standardized information than ever before.

Competition Law and Anti-Trust Regulations

Bidcorp, as a major player in global foodservice distribution, must navigate a complex web of competition laws and anti-trust regulations across its operating regions. These rules are designed to ensure fair play and prevent monopolies, directly impacting how Bidcorp can grow and price its products. For instance, in 2024, regulatory bodies worldwide continued to scrutinize large mergers and acquisitions, potentially affecting Bidcorp's expansion plans.

These regulations can significantly shape Bidcorp's strategies. For example, efforts to increase market share through acquisitions or organic growth are often subject to review to ensure they do not stifle competition. Similarly, pricing strategies must remain compliant, avoiding any practices that could be deemed anti-competitive, such as price-fixing or predatory pricing. The ongoing enforcement of these laws means Bidcorp must remain vigilant in its compliance efforts to avoid penalties and maintain its market position.

- Regulatory Scrutiny: Competition authorities globally, including the European Commission and the US Federal Trade Commission, actively monitor market concentration in the food distribution sector.

- Merger Control: Bidcorp's proposed acquisitions are evaluated based on their potential impact on market competition, with thresholds often set for revenue and market share.

- Pricing Compliance: Anti-trust laws prohibit practices that could lead to artificially high prices for consumers or unfair advantages for Bidcorp over smaller competitors.

- Market Share Limits: In certain jurisdictions, dominant market positions may be subject to specific regulations or oversight to prevent abuse.

Import/Export Regulations and Trade Compliance

Bidcorp's extensive global operations necessitate strict adherence to diverse import and export regulations, customs duties, and trade compliance laws across numerous jurisdictions. For instance, in 2024, the World Trade Organization (WTO) continued to monitor and address trade barriers, impacting the cost and efficiency of international food distribution. Fluctuations in these regulations, such as potential tariff adjustments or new non-tariff barriers, can significantly disrupt Bidcorp's supply chain, potentially increasing operational costs and necessitating agile adjustments to its sourcing and distribution strategies.

The complexities of international trade compliance are a constant consideration for Bidcorp. For example, changes in food safety standards or labeling requirements in key markets like the European Union or the United States can necessitate costly product reformulation or packaging redesign. In 2025, ongoing geopolitical shifts and trade disputes continue to create an unpredictable regulatory landscape, requiring Bidcorp to maintain robust compliance frameworks and proactive risk management to navigate these challenges effectively.

- Global Trade Agreements: Monitoring and adapting to changes in trade agreements, such as those impacting the movement of goods between major economic blocs, is crucial for cost management.

- Customs Duties and Tariffs: Understanding and forecasting the impact of varying customs duties and tariffs on imported raw materials and finished goods directly influences Bidcorp's pricing and profitability.

- Sanctions and Embargoes: Compliance with international sanctions and embargoes is paramount to avoid legal penalties and reputational damage when sourcing or selling in certain regions.

- Food Safety and Quality Standards: Adhering to the specific food safety regulations and quality standards of each country is essential for market access and consumer trust.

Bidcorp must navigate a complex landscape of competition laws and anti-trust regulations globally, impacting growth and pricing strategies. In 2024, regulatory bodies intensified scrutiny on market concentration within the food distribution sector, directly influencing merger controls and potentially limiting market share expansion.

Pricing practices are under constant review to prevent anti-competitive behavior, such as price-fixing, ensuring fair market competition. Bidcorp's adherence to these regulations is vital to avoid penalties and maintain its market standing, as demonstrated by ongoing enforcement actions worldwide.

The company's global operations are significantly affected by varying labor laws and wage regulations, with statutory minimum wage increases in 2024 impacting staffing expenses in key markets like the UK and South Africa. This necessitates continuous adaptation of compensation structures to ensure compliance and manage labor costs effectively.

Bidcorp is also increasingly subject to non-financial disclosure mandates, such as the EU's Corporate Sustainability Reporting Directive (CSRD), which expanded reporting to ESG factors from the 2024 fiscal year. This requires robust systems for data gathering and transparent reporting to meet evolving legal expectations.

Environmental factors

Bidcorp is actively addressing climate change by aiming for Net Zero by 2050. A key milestone is their commitment to a 25% reduction in Scope 1 and 2 carbon emissions by 2034, using their 2024 performance as a benchmark.

To achieve these ambitious targets, Bidcorp is making tangible investments in sustainable practices. This includes the implementation of renewable energy solutions, such as solar panel installations across its operations, directly contributing to a lower carbon footprint.

Bidcorp faces growing pressure to ensure its vast global supply chain prioritizes sustainable and ethical sourcing. This means scrutinizing suppliers to confirm they actively minimize their environmental footprint, from agricultural practices to transportation.

A key aspect involves reducing food miles by supporting local producers, which not only cuts emissions but also fosters community economic development. For instance, in 2023, Bidcorp's commitment to sustainability saw initiatives focused on reducing waste and improving energy efficiency across its operations, with specific targets set for 2025.

Bidcorp acknowledges that waste, especially from packaging and food, presents a significant environmental challenge. The group is actively working to address this through various programs. For instance, in the 2023 financial year, Bidcorp reported a 6% reduction in food waste across its operations, a testament to their ongoing efforts.

Key to their strategy is promoting recycling initiatives across their diverse business units. They also focus on minimizing food waste by partnering with charitable food banks, which not only reduces environmental impact but also supports community development. These partnerships saw over 1,500 tonnes of surplus food redistributed in the 2023 fiscal year.

Water Management and Resource Scarcity

Bidcorp recognizes that even if its direct water usage is minimal, the agricultural and food production sectors it relies on are heavily dependent on water availability. This dependency is particularly acute in regions experiencing water scarcity, a growing global concern. For instance, by 2025, it's projected that over two-thirds of the world's population could face water shortages, directly impacting food supply chains.

This reality means Bidcorp must actively engage in water management strategies across its entire value chain, not just within its own facilities. The company's commitment extends to ensuring its suppliers adopt responsible water practices, especially those operating in water-stressed geographies. This proactive approach mitigates risks associated with water scarcity, safeguarding the continuity of supply for its diverse product offerings.

The implications for Bidcorp are clear: fostering resilience in its supply base by promoting efficient water use is paramount. This includes:

- Encouraging water-efficient farming techniques among suppliers.

- Supporting initiatives for improved water infrastructure in key sourcing regions.

- Monitoring water-related risks within its supplier network.

- Prioritizing suppliers with demonstrable water stewardship programs.

Environmental Reporting and Disclosure Requirements

The increasing expectation for transparency regarding sustainability, driven by both consumers and investors, places a greater emphasis on Bidcorp's environmental reporting. This trend is amplified by evolving regulations, such as the European Union's Corporate Sustainability Reporting Directive (CSRD), which mandates more comprehensive disclosures. Bidcorp is proactively addressing this by expanding the environmental metrics it reports, aiming to offer a clearer understanding of its worldwide carbon footprint.

For instance, as of their latest reporting cycle, Bidcorp is enhancing its data collection to include Scope 3 emissions more robustly, a critical step in accurately portraying its total environmental impact. This commitment to detailed reporting aligns with global efforts to standardize sustainability disclosures, ensuring stakeholders have access to comparable and reliable environmental performance data.

- Expanded Scope 3 Emissions Tracking: Bidcorp is increasing its focus on reporting Scope 3 emissions, which include indirect emissions from its value chain, such as purchased goods and services and transportation.

- Regulatory Compliance: The company is adapting its reporting frameworks to meet new mandates like the CSRD, which requires detailed information on environmental impacts and risks.

- Investor Demand for ESG Data: There's a significant rise in investor interest in Environmental, Social, and Governance (ESG) performance, pushing companies like Bidcorp to provide more granular sustainability data.

- Global Carbon Footprint Visualization: By broadening its reported metrics, Bidcorp aims to provide a more holistic and accurate representation of its global environmental performance.

Bidcorp is actively working towards a Net Zero by 2050 goal, with a specific target of reducing Scope 1 and 2 carbon emissions by 25% by 2034, using 2024 as a baseline.

The company is investing in renewable energy, such as solar panels, and is focused on reducing food waste, reporting a 6% reduction in the 2023 financial year, with over 1,500 tonnes of surplus food redistributed to food banks in the same period.

Bidcorp recognizes the critical importance of water availability in its supply chain, especially in water-scarce regions, and is encouraging responsible water practices among its suppliers.

Increased demand for transparency in sustainability reporting, driven by regulations like the EU's CSRD and investor interest in ESG data, is leading Bidcorp to enhance its reporting, including a greater focus on Scope 3 emissions.

| Environmental Focus | Target/Action | 2023/2024 Data |

|---|---|---|

| Carbon Emissions | Net Zero by 2050; 25% Scope 1 & 2 reduction by 2034 (vs. 2024) | N/A (2024 baseline) |

| Renewable Energy | Solar panel installation | Ongoing investment |

| Food Waste | Reduce waste; redistribute surplus | 6% reduction (FY23); 1,500+ tonnes redistributed (FY23) |

| Water Management | Promote efficient water use in supply chain | Focus on suppliers in water-stressed regions |

| Reporting | Enhance ESG & Scope 3 reporting | Expanding metrics for global carbon footprint |

PESTLE Analysis Data Sources

Our Bidcorp Group PESTLE Analysis is informed by a comprehensive review of data from international financial institutions, government publications, and reputable market research firms. This ensures a robust understanding of political, economic, social, technological, legal, and environmental factors impacting the food service and distribution industry.