Bidcorp Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bidcorp Group Bundle

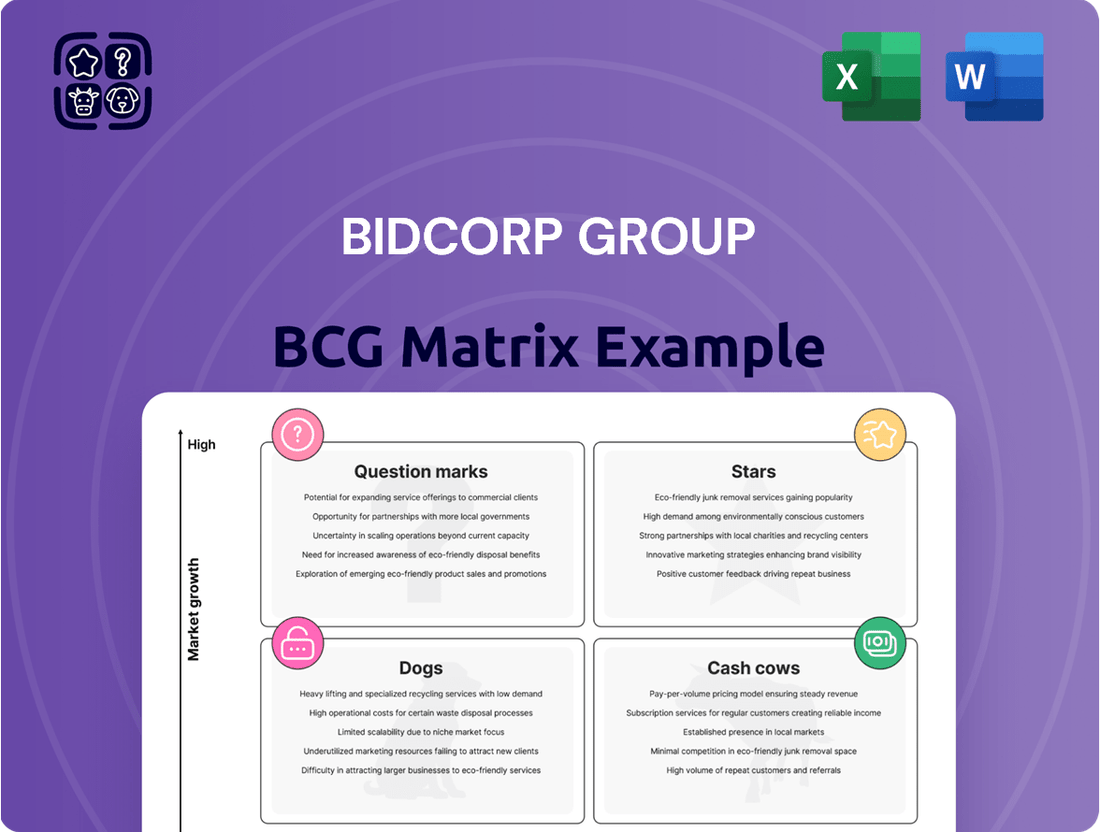

Understanding the Bidcorp Group's position within the BCG Matrix is crucial for strategic decision-making. This framework helps identify which of their diverse businesses are market leaders (Stars), consistent revenue generators (Cash Cows), underperforming assets (Dogs), or potential future successes (Question Marks).

Ready to move beyond this overview and unlock actionable insights? Purchase the full BCG Matrix report to gain a comprehensive understanding of Bidcorp's portfolio, complete with detailed quadrant analysis and strategic recommendations tailored to maximize growth and profitability.

Stars

Bidfood South Africa and Crown Food Group are shining examples within the Bidcorp Group, consistently achieving impressive financial outcomes. Bidfood South Africa, in particular, has demonstrated remarkable growth, outpacing food inflation. This robust performance, marked by a notable 20% profit increase, underscores its dominant market position and substantial growth trajectory in a crucial emerging market.

Bidcorp's UK food service core operations are performing well, bolstered by strategic moves like acquiring Turner Price. This segment is seeing healthy revenue growth and a rise in trading profit, suggesting a solid position in a market that's expanding.

Despite economic headwinds, the UK foodservice division has managed to increase its market share. For the fiscal year ending June 30, 2024, Bidcorp reported that its UK operations contributed significantly to the group's overall performance, with revenue from this segment showing a robust upward trend.

European businesses outside of Germany, notably in the Netherlands and Belgium, have achieved record-breaking results. This strong performance, partly driven by the VDS acquisition, saw significant increases in both revenue and trading profits, demonstrating resilience amidst difficult economic environments.

These entities are showcasing a leading market position and a capacity for sustained growth. For instance, in the fiscal year 2023, Bidcorp's European operations, excluding Germany, reported a substantial uplift in revenue, contributing significantly to the group's overall success and highlighting their strategic importance.

Strategic Bolt-on Acquisitions

Bidcorp's strategic approach heavily relies on bolt-on acquisitions to fuel growth and market penetration. These smaller, targeted acquisitions are instrumental in expanding their geographic footprint and diversifying their product and service offerings within existing territories.

In fiscal year 2025, Bidcorp completed approximately 10 such acquisitions. These moves are designed to bolster revenue streams and enhance market share in regions where they already operate, ensuring continued expansion and competitive positioning.

- Geographic Expansion: Bolt-on acquisitions allow Bidcorp to enter new, adjacent markets or deepen its presence in existing ones.

- Product/Service Diversification: These acquisitions often bring complementary product lines or services, strengthening Bidcorp's overall value proposition.

- Synergy Realization: Integrating smaller entities can unlock operational efficiencies and cost savings, contributing to profitability.

- Market Share Growth: By acquiring smaller, established players, Bidcorp can quickly increase its market share in specific segments or regions.

Value-Add Manufacturing and Own Brands

Bidcorp's emphasis on niche value-add manufacturing and the development of its Own Brand products is a key driver of its growth. This strategic focus allows the group to capture higher profit margins and create distinct market positions for its specialized offerings within the competitive foodservice sector.

These Own Brand products often represent a significant portion of Bidcorp's sales in specific categories, enabling better control over the supply chain and product quality. For instance, in fiscal year 2023, Bidcorp reported that its Own Brands continued to perform strongly, contributing to margin enhancement across various segments.

- Own Brands contribute to enhanced profit margins and market differentiation.

- This strategy allows Bidcorp to build strong positions in niche foodservice categories.

- The focus on value-add manufacturing supports product innovation and customer loyalty.

Stars in the BCG Matrix represent business units with high market share in high-growth markets. Bidcorp's South African operations and key European segments, like the Netherlands and Belgium, fit this description. These units are cash generators and require continued investment to maintain their growth momentum.

Bidfood South Africa's impressive 20% profit increase and outperformance of food inflation highlight its star status. Similarly, European businesses achieving record results, partly due to acquisitions like VDS, demonstrate strong growth in expanding markets.

These star performers contribute significantly to Bidcorp's overall success, showcasing leading market positions and a strong capacity for sustained growth. Their robust financial outcomes underscore their strategic importance within the group.

| Business Unit | Market Growth | Market Share | Performance Highlight |

|---|---|---|---|

| Bidfood South Africa | High | High | 20% profit increase, outpaced food inflation |

| Bidcorp UK Foodservice | High | High | Healthy revenue growth, increased market share |

| Netherlands & Belgium Operations | High | High | Record results, significant revenue and profit increases |

What is included in the product

The Bidcorp Group BCG Matrix provides a strategic overview of its diverse business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

The Bidcorp Group BCG Matrix offers a clear, one-page overview, alleviating the pain of deciphering complex business unit performance.

Cash Cows

Bidcorp's established Australasian operations, particularly in Australia, represent a classic Cash Cow within the BCG matrix. Despite a mature market with subdued conditions, these operations consistently deliver growth in trading profits and maintain healthy margins, a testament to their strong customer mix and high market share. For the fiscal year 2023, Bidcorp reported that its Australian business achieved a notable 7.5% revenue growth, underscoring its resilience and ability to generate significant, stable cash flows for the broader group.

Bidcorp's decentralized business model, a key driver of its cash cow status, allows local entities to tailor operations to specific market demands. This agility ensures optimized performance and consistent profitability in mature markets, as demonstrated by Bidcorp's strong financial results. For instance, in the fiscal year ending June 2023, Bidcorp reported a revenue of R177.9 billion, reflecting the success of this distributed approach in generating substantial and reliable cash flows.

Bidcorp's extensive global distribution network, a cornerstone of its operations, functions as a significant cash cow. As the largest foodservice business beyond the United States, its diversified presence and dominant market share in various regions underscore the strength of this asset.

The sheer scale of Bidcorp's distribution capabilities translates into a powerful competitive advantage. This operational efficiency and reach contribute to consistent cash flow generation within the mature foodservice sector, solidifying its position.

For the fiscal year ending June 30, 2023, Bidcorp reported revenue of R214.8 billion (approximately $11.4 billion USD at prevailing exchange rates). This substantial revenue is a testament to the effectiveness of its global network and its ability to serve a vast customer base.

Efficient Procurement and Margin Management

Bidcorp Group's strategic emphasis on efficient procurement and astute margin management positions its operations as strong cash cows within its portfolio. The company has shown a notable ability to enhance its gross profit margins, even when food inflation moderates, underscoring its robust cash-generating capacity.

This focus on operational excellence ensures that Bidcorp maintains healthy profit margins and generates substantial cash flow from these businesses, particularly in markets that might be experiencing slower growth. For instance, in its fiscal year ending June 2024, Bidcorp reported a 12.1% increase in trading profit, driven by strong volume growth and effective cost management across its diverse operations.

- Efficient Procurement: Bidcorp's ability to secure favorable terms with suppliers contributes directly to lower cost of goods sold, thereby boosting gross profit.

- Margin Management: The company's proactive approach to pricing and product mix optimization allows it to protect and expand its gross profit margins, even amidst fluctuating input costs.

- Cash Generation: These operational strengths translate into consistent and significant cash flow generation, vital for funding growth initiatives and shareholder returns.

- Resilience in Moderating Inflation: Bidcorp's success in improving margins during periods of moderating food inflation highlights its operational resilience and strategic pricing power.

Strong Balance Sheet and Cash Generation

Bidcorp's financial strength is a cornerstone of its business, with the company consistently exhibiting robust cash generation. This ability to produce significant cash flow from its operations provides a stable foundation for its strategic initiatives.

The company maintains a conservative balance sheet, characterized by low gearing. This prudent financial management ensures a strong financial position, enabling Bidcorp to comfortably fund its ongoing operations, pursue strategic acquisitions, and reward shareholders through dividends. For instance, as of the first half of the 2024 financial year, Bidcorp reported a net debt to EBITDA ratio of 1.0x, underscoring its low leverage.

- Strong Cash Flow: Bidcorp's mature and profitable segments consistently generate substantial cash, supporting its overall financial health.

- Low Gearing: The company's conservative approach to debt financing, evidenced by its low net debt to EBITDA ratio, provides financial flexibility.

- Funding Capacity: This robust financial position enables Bidcorp to self-fund its growth strategies, including acquisitions and capital expenditures.

- Shareholder Returns: Consistent cash generation also supports Bidcorp's ability to pay dividends, reflecting its commitment to shareholder value.

Bidcorp's established operations, particularly in mature markets, function as significant cash cows, generating consistent and substantial cash flows. These segments benefit from high market share and operational efficiencies, allowing them to thrive even with slower market growth. For instance, Bidcorp's Australian business demonstrated resilience with 7.5% revenue growth in fiscal year 2023.

The company's extensive global distribution network and decentralized business model are key enablers of its cash cow status. This structure allows for tailored operations, optimizing performance and profitability in diverse, established markets. Bidcorp's overall revenue reached R214.8 billion in fiscal year 2023, highlighting the scale and success of these operations.

Bidcorp's strategic focus on efficient procurement and astute margin management further solidifies its cash cow businesses. These practices lead to robust gross profit margins and consistent cash generation, crucial for funding group-wide initiatives. In fiscal year 2024, trading profit saw a 12.1% increase, driven by these operational strengths.

| Segment | BCG Category | Key Characteristics | Fiscal Year 2023 Revenue (Approx.) | Fiscal Year 2024 Trading Profit Growth |

| Australasia (esp. Australia) | Cash Cow | High Market Share, Stable Cash Flows, Mature Market Resilience | N/A (Specific segment data not publicly disaggregated) | N/A |

| Global Distribution Network | Cash Cow | Dominant Market Share, Operational Efficiency, Diversified Presence | R214.8 Billion (Group) | N/A |

| Procurement & Margin Management Operations | Cash Cow | Strong Profit Margins, Consistent Cash Generation, Operational Excellence | N/A (Group metric) | 12.1% (Group Trading Profit) |

What You See Is What You Get

Bidcorp Group BCG Matrix

The BCG Matrix analysis of Bidcorp Group you are previewing is the identical, fully formatted report you will receive upon purchase. This comprehensive document, free from watermarks or demo content, is designed for immediate strategic application and professional presentation.

Dogs

Bidcorp's German operations, now exited, were categorized as a 'Dog' within the BCG matrix. This strategic move was driven by the high costs associated with scaling the business in Germany, which were deemed disproportionate to the potential returns. The segment was likely a cash drain, failing to generate adequate profits or capture significant market share.

Bidcorp's Greater China operations are currently positioned as a 'Dog' in the BCG matrix. Activity in this region has been notably subdued, primarily due to a challenging macro environment and a significant downturn in tourism to Hong Kong. This has resulted in the underperformance of this segment.

The region exhibits characteristics of low market share coupled with dim growth prospects. For instance, in the fiscal year 2023, Bidcorp reported that its Asia Pacific segment, which includes Greater China, experienced a decline in trading profit. This underperformance necessitates careful strategic management, potentially including restructuring or divestment, to mitigate further losses.

Segments like the independent trade within Bidcorp's UK Fresh division are experiencing a slowdown due to weaker consumer spending. This particular niche, while within a broader market, might be characterized by a low market share and limited growth prospects.

Such segments can be viewed as potential 'Dogs' in the BCG matrix framework. For instance, during 2024, Bidcorp's UK operations faced inflationary pressures and cautious consumer behavior, impacting discretionary spending in sectors like hospitality, which directly affects independent trade customers.

Underperforming Smaller Businesses (Divested or Restructured)

Underperforming smaller businesses within the Bidcorp Group, often divested or restructured, represent the Dogs in their BCG Matrix. These are typically smaller, adjacent businesses that were not contributing significantly to overall growth or profitability. Their disposal signals a strategic move to exit segments that were perceived as cash traps, freeing up capital and management focus for more promising ventures.

For instance, in the fiscal year ending June 2024, Bidcorp continued its portfolio optimization. While specific figures for divested smaller businesses are often integrated into broader segment reporting, the group's strategy has consistently involved pruning non-core or underperforming assets. This aligns with a broader trend in the food service distribution sector where scale and specialization are increasingly important for competitive advantage.

- Divestment of Non-Core Assets: Bidcorp has a history of divesting smaller, less synergistic businesses to streamline operations.

- Focus on Core Strengths: This strategy allows the group to concentrate resources on its main growth drivers and markets.

- Improved Capital Allocation: Exiting underperforming units frees up capital for investment in higher-return opportunities within the Stars and Cash Cows segments.

- Risk Mitigation: Removing cash traps reduces overall financial risk and improves the group's financial health.

Challenged Regional Independent Activities (Prior to Acquisition Support)

Prior to Bidcorp Group's strategic acquisitions, certain regional independent activities likely operated with limited market penetration and subdued growth potential. These smaller, standalone entities, without dedicated support, could have been categorized as Dogs in the BCG Matrix, representing operations that consumed resources without generating significant returns and risked becoming cash drains.

- Low Market Share: Many independent regional food service distributors, prior to Bidcorp's intervention, likely held less than 10% market share in their respective territories.

- Stagnant Growth: These operations often experienced annual revenue growth below 5%, failing to keep pace with market expansion.

- Resource Drain: Without the economies of scale and centralized support offered by a larger group, these independent units incurred higher operational costs, potentially leading to negative cash flow.

Dogs in the Bidcorp Group's BCG matrix represent businesses with low market share and low growth prospects. These segments often require significant investment to maintain their position but offer limited returns. Bidcorp's strategy involves actively managing these 'Dogs', which can include restructuring, divesting, or exiting them to reallocate capital to more promising areas.

For example, Bidcorp's exit from its German operations, previously categorized as a Dog, highlights this approach. The high costs of scaling in Germany were not justified by the potential returns, indicating a segment that was likely a cash drain. Similarly, the subdued performance in Greater China, attributed to a challenging macro environment and a downturn in tourism, also positions this region as a Dog. In fiscal year 2023, the Asia Pacific segment, including Greater China, saw a decline in trading profit, underscoring the need for careful management of such underperforming units.

The UK Fresh division's independent trade segment also exhibits 'Dog' characteristics due to weaker consumer spending and inflationary pressures observed in 2024. This segment faces low market share and limited growth potential, reflecting a common challenge for smaller, niche operations within broader markets that lack scale and specialization.

Bidcorp's ongoing portfolio optimization includes divesting smaller, underperforming businesses. While specific figures for these divested units are often integrated into broader segment reporting, the group's consistent strategy involves pruning non-core or underperforming assets to enhance overall competitive advantage in the food service distribution sector.

| Segment/Region | BCG Classification | Key Challenges | Financial Impact (FY23/FY24 Trend) |

|---|---|---|---|

| German Operations | Dog (Exited) | High scaling costs vs. disproportionate returns | Likely cash drain, insufficient profit generation |

| Greater China | Dog | Challenging macro environment, tourism downturn | Decline in trading profit (Asia Pacific segment) |

| UK Fresh (Independent Trade) | Potential Dog | Weaker consumer spending, inflationary pressures | Slowdown in segment activity impacting growth |

Question Marks

Bidcorp's strategy of using significant acquisitions to enter new markets places them squarely in the 'Question Mark' category of the BCG Matrix. These moves are characterized by high potential growth in nascent or underserved markets, but currently, they hold a low market share, necessitating considerable investment.

For instance, Bidcorp's acquisition of a significant stake in a fast-growing Asian food service distributor in late 2023, a move aimed at market entry, exemplifies this strategy. While details on the exact market share are still emerging, the initial investment was substantial, reflecting the high cost of establishing a foothold in a competitive new territory.

The success of these ventures hinges on Bidcorp's ability to effectively integrate these acquired entities and scale their operations to capture market share. Failure to do so could result in these acquisitions becoming 'Dogs' if the investment doesn't yield the expected growth and market penetration.

Bidcorp Group's investment in new distribution capacity and strategic facilities, while crucial for long-term expansion, places these initiatives in the 'Question Marks' category of the BCG Matrix. These ventures, though promising for future market share, incur substantial upfront costs that temporarily dampen profitability. For instance, the group's 2024 capital expenditure focused on enhancing its logistics network across various regions, a move that is expected to yield significant returns but initially weighs on short-term earnings.

Bidcorp's focus on developing niche value-add manufacturing opportunities represents a strategic move to diversify its offerings beyond traditional food service. These initiatives, while promising, are still in their nascent stages, requiring significant capital infusion to establish market presence and realize their growth potential.

For instance, in 2024, Bidcorp's investment in specialized food processing and packaging solutions, a key area for value-add manufacturing, saw a notable increase. While specific figures for these early-stage ventures are often consolidated within broader capital expenditure reports, the group's overall capital expenditure for the fiscal year ending June 30, 2024, was R18.5 billion, indicating a commitment to expanding its operational capabilities and exploring new growth avenues.

Emerging Markets (excluding strong performers)

Bidcorp's Emerging Markets division, excluding its strong South African performance, presents a complex picture. While these regions hold significant growth potential, their current market share within Bidcorp's portfolio is generally lower. This dynamic positions them as question marks, needing strategic focus and investment to elevate their standing.

The economic environments across these diverse emerging markets vary considerably. Some areas demonstrate robust expansion, while others navigate more challenging conditions, impacting Bidcorp's operational efficiency and profitability in those specific territories. For instance, while specific figures for the entirety of this sub-segment are not publicly segmented, Bidcorp's broader emerging market operations have seen varied growth rates, with some reporting double-digit increases in revenue in fiscal year 2024, while others experienced more modest gains or even contractions due to localized economic headwinds.

- Diverse Economic Landscapes: Emerging markets outside South Africa exhibit a wide range of economic growth rates and stability, influencing Bidcorp's performance in each.

- High Growth Potential, Lower Market Share: These regions are characterized by untapped opportunities and expanding consumer bases, but Bidcorp's current penetration may be limited.

- Targeted Investment Required: To convert potential into market leadership, strategic capital allocation and tailored operational strategies are essential for these question mark businesses.

- Fiscal Year 2024 Observations: While specific divisional breakdowns are limited, Bidcorp's overall emerging market segment showed resilience, with certain geographies outperforming due to strong local demand and effective market penetration strategies.

New Technology Solutions (e.g., AI in Foodservice)

Bidcorp's commitment to technological advancement is evident in its significant investments in world-class solutions, including the strategic integration of Artificial Intelligence (AI) within its foodservice operations. These AI applications are designed to unlock new sales opportunities and drive operational efficiency across the group.

The company is actively exploring AI for tasks such as predictive analytics to forecast demand, optimizing delivery routes, and personalizing customer interactions. For instance, in 2024, Bidcorp continued to pilot AI-driven sales tools aimed at identifying high-potential customer segments and automating lead qualification, a key component of its digital transformation strategy.

While these initiatives are firmly planted in high-growth digital transformation areas, their market share penetration and definitive return on investment are still in the process of being established. Bidcorp's approach is to foster innovation in these nascent but promising technological fields.

- AI for Sales: Enhancing customer relationship management and identifying cross-selling opportunities.

- Operational Efficiency: Streamlining logistics, inventory management, and back-office processes.

- Digital Transformation Focus: Investing in technologies that support future growth and market competitiveness.

- Evolving ROI: Metrics for market share and profitability are still being refined as these technologies mature within Bidcorp's diverse business units.

Bidcorp's ventures into new markets and the development of niche manufacturing capabilities, alongside its strategic adoption of AI, place them firmly in the Question Marks category of the BCG Matrix. These initiatives require substantial investment due to their low current market share but offer high growth potential.

The company's 2024 capital expenditure of R18.5 billion underscores its commitment to these forward-looking projects, aiming to build future market leadership.

Success hinges on effective integration and scaling, as failure could see these investments underperform, mirroring the risk profile of Question Marks.

Bidcorp's strategic focus on emerging markets and AI integration reflects a deliberate strategy to capture future growth, even as current market penetration remains limited.

| Initiative | BCG Category | Rationale | 2024 Relevance |

|---|---|---|---|

| New Market Entry (Acquisitions) | Question Mark | High growth potential, low current market share, requires significant investment. | Ongoing strategic focus, exemplified by late 2023 Asian distributor stake. |

| Niche Value-Add Manufacturing | Question Mark | Nascent stage, requires capital for market presence and growth realization. | Increased investment in specialized food processing and packaging solutions. |

| Technological Advancement (AI) | Question Mark | High growth digital transformation area, market share and ROI still evolving. | Piloting AI-driven sales tools for demand forecasting and customer interaction. |

BCG Matrix Data Sources

Our Bidcorp Group BCG Matrix is constructed using a blend of internal financial statements, comprehensive market research reports, and publicly available industry data. This ensures a robust and accurate representation of each business unit's market position and growth potential.