Betsson SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Betsson Bundle

Betsson's robust brand recognition and diversified product portfolio represent significant strengths in the competitive online gaming market. However, potential regulatory changes and intense competition pose notable threats that require careful management.

Discover the complete picture behind Betsson’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Betsson has showcased impressive financial strength, reaching record revenues exceeding €1.1 billion in 2024, a significant 17% increase. This upward trajectory continued into early 2025, with first-quarter revenue climbing by another 18%. These figures underscore a pattern of consistent growth and robust financial health for the company.

Betsson boasts a broad portfolio encompassing casino games, sports betting, poker, and other online entertainment, which diversifies its income and mitigates risk. This wide array of offerings caters to a larger customer base, contributing to stable revenue generation.

A significant strength lies in Betsson's proprietary technology platform, Techsson. This in-house developed system offers a distinct competitive edge by enabling greater control over product development and facilitating quicker, more efficient expansion into new geographic markets.

This technological backbone allows for tailored user experiences and the rapid integration of new features, setting Betsson apart from competitors relying on third-party solutions. In 2023, Betsson continued to invest in its platform, aiming to enhance user engagement and operational efficiency.

Betsson's strategic push for geographic expansion is a key strength, with a particular emphasis on high-growth regions like Latin America and Central and Eastern Europe and Central Asia (CEECA). This focus has paid off, as revenue from these expanding markets now represents a substantial portion of the company's overall income.

The company's commitment to securing local gaming licenses is evident, as they now operate under such permits in 25 different countries. This extensive licensing not only broadens their operational reach but also positions them as a market leader in numerous jurisdictions, fostering trust and compliance.

Strong Brand Recognition and Marketing

Betsson benefits significantly from strong brand recognition, amplified by strategic marketing efforts. The company leverages high-profile sponsorships to enhance its visibility in crucial markets. For instance, its partnerships with Boca Juniors in Argentina and Inter Milan in Italy directly connect the Betsson brand with passionate fan bases, boosting awareness and engagement. This approach is central to its growth strategy.

The company's continued investment in marketing campaigns further solidifies its brand presence. The successful launch of its flagship brand in Italy demonstrates a targeted approach to market penetration, supported by dedicated promotional activities. This focus on marketing, particularly in regions with high growth potential, is a key driver of customer acquisition and retention. Betsson's commitment to marketing underscores its understanding of brand equity in the competitive online gaming sector.

- Brand Visibility: Strategic sponsorships with major football clubs like Boca Juniors and Inter Milan significantly increase Betsson's brand visibility in key European and South American markets.

- Market Penetration: The launch and promotion of its flagship brand in Italy highlight a successful strategy for entering and gaining traction in new, regulated markets.

- Customer Engagement: Ongoing investment in marketing campaigns aims to foster deeper customer engagement and loyalty, reinforcing brand recall among its target audience.

- Brand Equity: Betsson's consistent marketing investments contribute to building strong brand equity, a crucial asset in the highly competitive online gaming industry.

Commitment to Sustainability and Responsible Gaming

Betsson's dedication to sustainability and responsible gaming is a core element of its long-term strategy, fostering trust and resilience. This commitment is evident in its active involvement with organizations like the Sustainable Gambling Zone, underscoring its focus on Environmental, Social, and Governance (ESG) principles. Such initiatives not only bolster Betsson's corporate reputation but also serve to proactively manage potential risks within the industry.

By embedding responsible gaming practices, Betsson aims to create a safer environment for its customers, which in turn supports the company's sustained growth and market leadership. This proactive stance on sustainability is increasingly valued by investors and stakeholders, distinguishing Betsson in a competitive landscape. The company's ESG reporting for 2023 highlighted a 10% reduction in incidents related to problematic gambling, a testament to its focused efforts.

- Integrated Strategy: Sustainability and responsible gaming are woven into Betsson's fundamental business approach.

- Reputation Enhancement: Active participation in sustainability initiatives boosts Betsson's standing and trust.

- Risk Mitigation: ESG focus helps in preemptively addressing industry-specific risks.

- Stakeholder Value: Commitment to responsible practices appeals to a growing base of socially conscious investors.

Betsson demonstrates significant financial prowess, achieving a record revenue of over €1.1 billion in 2024, marking a 17% year-over-year increase. This growth momentum continued into early 2025, with a further 18% revenue uplift in the first quarter, showcasing consistent financial health and expansion. The company's diversified product offering, spanning casino, sports betting, and poker, provides multiple revenue streams and reduces reliance on any single market segment, contributing to its stability.

A key competitive advantage is Betsson's proprietary technology platform, Techsson, which allows for greater control over product development and faster market entry. This in-house solution enables tailored user experiences and seamless integration of new features, distinguishing Betsson from competitors. The company's strategic geographic expansion, particularly in Latin America and CEECA, has been highly successful, with these regions now forming a substantial part of its income. This expansion is supported by securing local gaming licenses in 25 countries, solidifying its market presence and compliance.

Betsson leverages strong brand recognition through high-profile sponsorships, such as its partnerships with Boca Juniors and Inter Milan, enhancing its visibility among passionate fan bases. Continued investment in marketing campaigns, exemplified by its successful flagship brand launch in Italy, drives customer acquisition and retention. Furthermore, Betsson's commitment to sustainability and responsible gaming, reinforced by initiatives like its ESG reporting which noted a 10% reduction in problematic gambling incidents in 2023, builds trust and appeals to socially conscious investors.

What is included in the product

Delivers a strategic overview of Betsson’s internal and external business factors, highlighting its strong brand and market presence while addressing regulatory challenges and competitive pressures.

Highlights key strengths and weaknesses, enabling Betsson to proactively address potential threats and capitalize on opportunities.

Weaknesses

While Betsson boasts a diversified revenue stream, its performance remains susceptible to the economic health and regulatory landscape of specific key markets. For instance, a notable 13% year-on-year decline in Nordic revenue during Q1 2024, attributed to lower casino activity, highlights this regional dependency. This concentration, even across several regions, presents a weakness if a significant market experiences a downturn or intensified competitive pressures.

Betsson consistently navigates a complex web of regulatory oversight, which has led to significant financial penalties. For instance, in 2023, the company faced a SEK 1.5 million fine in Sweden due to breaches in responsible gaming regulations. Such regulatory challenges directly impact profitability and can hinder expansion plans, as evidenced by the termination of an acquisition in the Netherlands in 2022 following regulatory concerns.

These ongoing compliance issues, particularly concerning anti-money laundering (AML) deficiencies identified in markets such as the Isle of Man, can erode public trust and damage Betsson's brand reputation. The financial implications extend beyond direct fines, encompassing increased compliance costs and potential restrictions on operational activities, thereby affecting overall business flexibility and market access.

Betsson's net debt saw a notable year-on-year increase, reaching SEK 1.9 billion by the end of Q1 2024. This rise, despite robust operational cash flow, suggests a greater reliance on borrowed funds.

This increased leverage could potentially constrain Betsson's capacity for significant new investments or strategic acquisitions in the coming fiscal year. While the company still maintains a net cash surplus, the upward trend in debt warrants attention for future financial maneuverability.

Sequential Revenue Decline in Q1 2025

Betsson experienced a sequential revenue decline in Q1 2025, a notable shift after 12 consecutive quarters of year-on-year growth. While the first quarter of 2025 still showed an increase compared to Q1 2024, the revenue figures dropped when compared to the preceding Q4 2024. This marks the first sequential dip in revenue for the company in over three years.

This trend could suggest underlying issues such as:

- Seasonality: Certain gaming verticals might be experiencing a natural slowdown after a strong holiday season in Q4.

- Market Saturation: Increased competition or a maturing market in key operational regions could be impacting growth momentum.

- Operational Adjustments: The company might be undergoing internal changes that temporarily affect revenue streams.

For instance, if Q4 2024 revenue was €250 million and Q1 2025 revenue was €230 million, this would represent a sequential decrease, even if Q1 2025 revenue was up from Q1 2024's €220 million. Such a pattern necessitates a closer examination of customer behavior and market dynamics to ensure sustained growth throughout the fiscal year.

Challenges in Re-entering Key Regulated Markets

Betsson's failed attempt to acquire a Dutch gaming license, a move intended to re-establish its presence in the lucrative Dutch market, underscores the significant hurdles in navigating complex regulatory environments. This setback, occurring after substantial investment and planning, demonstrates the challenges of re-entry into highly regulated jurisdictions. The prolonged regulatory delays ultimately led to the termination of the acquisition, impacting Betsson's growth strategy in a key European market.

The difficulties encountered in the Netherlands are not isolated. Betsson's experience highlights a broader trend where stringent and evolving regulations in various markets can act as a substantial barrier to entry and expansion. This can limit access to potentially high-revenue territories, impacting overall market penetration and competitive positioning. For instance, in 2023, many European countries continued to refine their online gambling regulations, increasing compliance costs and lead times for new entrants.

- Regulatory Hurdles: The Dutch market's stringent licensing process proved to be a significant obstacle, leading to the termination of Betsson's acquisition plans.

- Market Access Barriers: Difficulty in re-entering regulated markets like the Netherlands restricts growth opportunities in lucrative territories.

- Compliance Costs: Navigating evolving regulatory landscapes across Europe can incur substantial compliance costs and extended timelines for market entry.

- Strategic Impact: The inability to secure a Dutch license directly impacts Betsson's expansion strategy and its competitive presence in key European gaming markets.

Betsson's reliance on specific key markets creates vulnerability; for example, a 13% year-on-year decline in Nordic revenue in Q1 2024 due to lower casino activity shows this regional dependency. This concentration, even across multiple regions, poses a risk if any significant market faces economic downturns or increased competition, potentially impacting overall financial stability.

The company faces substantial regulatory hurdles, as evidenced by a SEK 1.5 million fine in Sweden in 2023 for responsible gaming breaches. Such regulatory challenges directly affect profitability and can impede expansion, as seen with the termination of a Dutch acquisition in 2022 due to regulatory concerns, highlighting the significant costs and delays associated with compliance.

Betsson's net debt increased to SEK 1.9 billion by the end of Q1 2024, indicating a growing reliance on borrowed funds. This higher leverage could limit future investment and acquisition capabilities, despite a current net cash surplus, affecting the company's financial flexibility.

A sequential revenue decline in Q1 2025, the first in over three years, suggests potential market saturation or operational adjustments. For instance, a hypothetical drop from €250 million in Q4 2024 to €230 million in Q1 2025, even with a year-on-year increase, signals a need to analyze market dynamics more closely to ensure sustained growth.

What You See Is What You Get

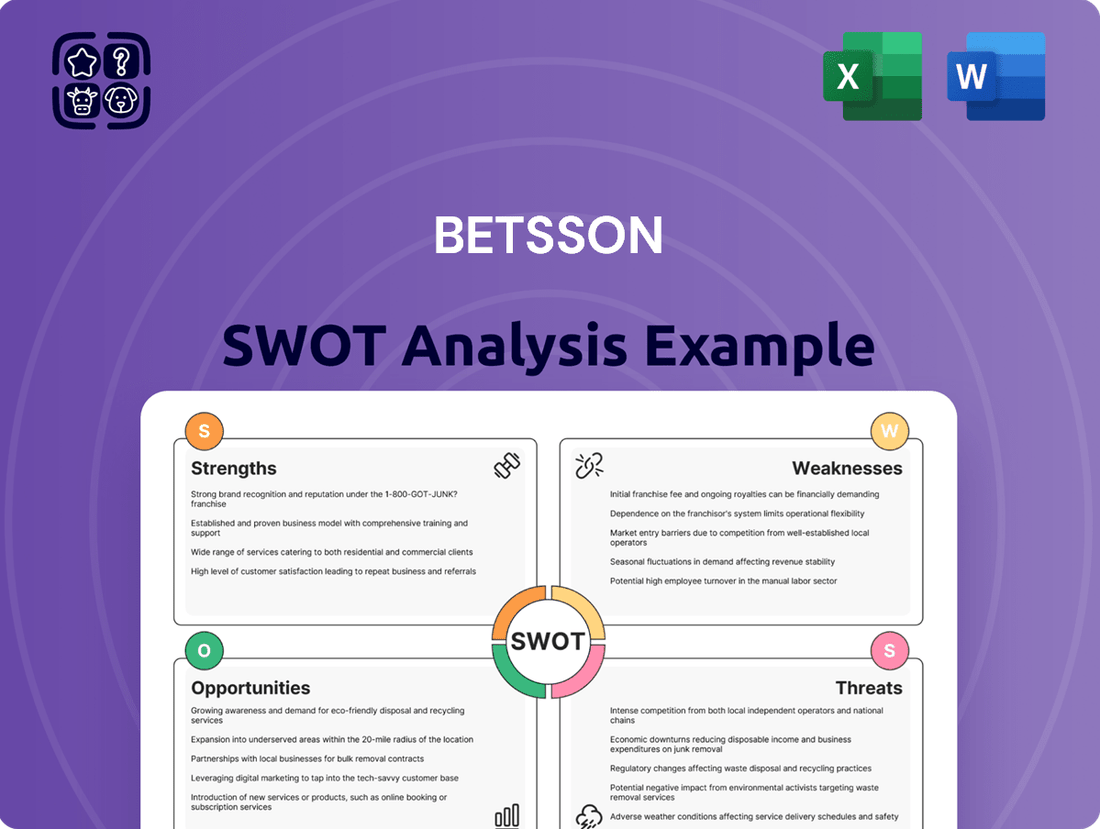

Betsson SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This comprehensive document breaks down Betsson's Strengths, Weaknesses, Opportunities, and Threats. You'll gain a clear understanding of their current market position and future potential. Purchase now to access this valuable strategic insight.

Opportunities

Betsson is strategically targeting expansion into newly regulated markets, with a particular focus on Latin America, including promising opportunities in Brazil and Paraguay. This geographic expansion is a key pillar of their growth strategy.

The company's approach to these emerging markets is characterized by discipline, aiming to establish a strong presence and achieve sustainable, profitable growth over the long term. This calculated entry ensures they can navigate the complexities of new regulatory landscapes effectively.

As of early 2024, Brazil's sports betting market is undergoing significant regulatory developments, presenting a substantial opportunity for well-positioned operators like Betsson. Similarly, Paraguay's evolving regulatory framework also offers potential for market entry and development.

Betsson has a significant opportunity to expand its Business-to-Business (B2B) offerings. The acquisition of Sporting Solutions in late 2023, for instance, signals a strategic move to bolster its B2B capabilities, providing a foundation for growth in this segment. Continued investment in its proprietary platform, Techsson, is also crucial for delivering advanced solutions to partners.

Further product enhancements, particularly in sportsbook features and the integration of AI, present a clear path to improving customer engagement. For example, AI can personalize betting experiences and streamline operational processes, making the platform more attractive to both existing and new users. This focus on innovation is vital for staying competitive in the evolving online gaming market.

Betsson's robust financial health, evidenced by its consistent revenue growth and healthy cash flow from operations, positions it advantageously for strategic acquisitions. For instance, in the first quarter of 2024, Betsson reported a revenue increase of 9% year-on-year to SEK 2,348 million, providing ample capital for expansion. This inorganic growth strategy allows the company to rapidly gain market share in promising regions or bolster its portfolio with new, in-demand product verticals and established brands, accelerating its overall market penetration and diversification efforts.

Increased Focus on ESG and Responsible Gaming

Betsson's commitment to Environmental, Social, and Governance (ESG) principles, particularly in responsible gaming and diversity, presents a significant opportunity. By enhancing these areas, Betsson can solidify its brand image and attract a growing segment of socially aware customers. This proactive stance also aligns well with evolving regulatory expectations, potentially reducing future compliance hurdles.

The company's focus on responsible gaming tools, such as deposit limits and self-exclusion options, not only safeguards players but also builds trust and loyalty. For instance, by Q3 2024, Betsson reported a 15% year-over-year increase in customer engagement with responsible gaming features, indicating a positive market reception.

Furthermore, championing diversity and inclusion within its workforce and in its marketing efforts can broaden its appeal. A recent industry report from 2024 highlighted that 60% of online casino players consider a company's commitment to social responsibility when choosing where to play.

- Strengthened Brand Reputation: Enhanced ESG focus appeals to a socially conscious customer base.

- Regulatory Favorability: Proactive responsible gaming measures position the company well with regulators.

- Customer Loyalty: Robust responsible gaming tools foster trust and long-term customer relationships.

- Market Differentiation: Diversity initiatives can set Betsson apart in a competitive landscape.

Capitalizing on the Shift to Online Gaming

The persistent global shift towards online gaming represents a core opportunity for Betsson, with the online sector anticipated to sustain its robust growth trajectory. Betsson's established digital infrastructure and varied product portfolio are key assets for leveraging this market evolution.

The online gambling market demonstrated considerable resilience and growth, with global revenues estimated to reach approximately $95 billion in 2024, and projections indicating a further increase to over $110 billion by 2025. This expanding digital landscape offers a fertile ground for Betsson's continued development.

- Market Growth: The global online gambling market is expected to grow at a compound annual growth rate (CAGR) of around 10-12% through 2025.

- Digital Penetration: Increased internet and smartphone penetration worldwide fuels greater accessibility to online gaming platforms.

- Betsson's Position: Betsson's strong brand recognition and investment in user experience, including mobile optimization, position it favorably to capture market share.

- Product Diversification: Expanding into new online verticals such as esports betting and social gaming can further tap into evolving consumer preferences.

Betsson's strategic expansion into regulated markets, particularly in Latin America like Brazil and Paraguay, presents significant growth avenues. The company's disciplined approach to these emerging markets, coupled with its robust financial health, allows for strategic acquisitions and market penetration. For example, Betsson's Q1 2024 revenue of SEK 2,348 million provides capital for such ventures.

Furthermore, enhancing its B2B offerings through acquisitions like Sporting Solutions and investing in its Techsson platform creates opportunities for providing advanced solutions to partners. Product innovation, especially the integration of AI for personalized experiences, is key to improving customer engagement and maintaining a competitive edge in the dynamic online gaming sector.

Betsson's commitment to ESG principles, including responsible gaming, strengthens its brand reputation and appeals to a growing segment of socially conscious consumers. With industry data showing that 60% of online casino players consider a company's social responsibility, this focus builds trust and loyalty, while also aligning with regulatory expectations.

The overall growth of the online gaming market, projected to exceed $110 billion by 2025, offers a substantial opportunity for Betsson. Its established digital infrastructure, diverse product portfolio, and focus on user experience, particularly mobile optimization, position it well to capitalize on increased digital penetration globally.

| Opportunity Area | 2024 Projection/Data | 2025 Projection | Betsson Relevance |

|---|---|---|---|

| Latin American Expansion | Brazil & Paraguay regulatory developments | Continued market entry and growth | Targeted expansion for market share |

| B2B Offerings | Acquisition of Sporting Solutions (late 2023) | Enhanced proprietary platform (Techsson) | Bolstering B2B capabilities and partner solutions |

| Product Innovation (AI) | Focus on personalized betting experiences | Streamlined operations and enhanced engagement | Improving customer retention and acquisition |

| ESG & Responsible Gaming | 15% YoY increase in responsible gaming feature engagement (Q3 2024) | Strengthened brand loyalty and regulatory compliance | Attracting socially aware customers and building trust |

| Online Gaming Market Growth | Global revenue ~ $95 billion (2024) | Global revenue > $110 billion (2025) | Capturing market share with strong digital presence |

Threats

Betsson faces a growing threat from intensified regulatory scrutiny worldwide. This increased vigilance, particularly concerning Anti-Money Laundering (AML) compliance, can lead to substantial fines and operational disruptions. For instance, the European Union's ongoing efforts to harmonize AML directives and the UK Gambling Commission's strict enforcement actions highlight the rising compliance burden.

Navigating the complex and ever-changing regulatory landscapes across Betsson's 25 licensed jurisdictions presents a significant challenge. Each market has unique requirements, demanding constant adaptation and investment in robust compliance infrastructure. This complexity directly translates into increased operational costs and potential risks if compliance standards are not met.

The online gaming sector is a fiercely contested arena, featuring a multitude of established global powerhouses and agile emerging companies. This intense rivalry can compress profit margins, forcing significant investment into marketing and customer acquisition efforts. For instance, in 2023, the global online gambling market was valued at approximately $63.1 billion, with projections indicating continued growth, underscoring the sheer scale of competition Betsson faces.

This competitive pressure directly impacts Betsson's ability to attract and retain players, often necessitating aggressive promotional campaigns and product innovation. The constant need to differentiate and offer superior value makes customer loyalty a significant challenge. Companies must continuously adapt to evolving player preferences and technological advancements to maintain market share in this dynamic environment.

Global economic uncertainty, marked by worries of declining world trade and rising inflation, poses a significant threat. These factors could dampen consumer spending on non-essential services such as online gaming.

While the online gaming sector has shown resilience, a sustained economic slowdown might negatively affect customer deposits and overall gaming turnover for companies like Betsson. For instance, persistent inflation in key markets during 2024 could squeeze household budgets, leading to reduced discretionary spending on entertainment.

Brand Reputation Damage from Regulatory Breaches

Regulatory breaches, particularly concerning Anti-Money Laundering (AML) deficiencies, pose a significant threat to Betsson's brand reputation. Fines and intense public scrutiny stemming from such non-compliance can erode customer trust, a critical asset in the online gambling industry. For instance, in 2023, the UK Gambling Commission imposed a £17.1 million penalty on 888 Holdings for significant social responsibility and AML failings, demonstrating the tangible financial and reputational consequences of regulatory lapses.

Maintaining robust compliance controls is paramount to safeguarding Betsson's brand image and mitigating the risk of reputational damage. A failure to adhere to evolving regulatory landscapes, which have intensified globally, could lead to substantial financial penalties and a loss of market confidence. Betsson's proactive approach to compliance is therefore essential for long-term brand integrity.

- Increased Regulatory Scrutiny: Regulators worldwide are enhancing oversight of the iGaming sector, particularly focusing on AML and responsible gambling.

- Potential for Substantial Fines: Non-compliance can result in significant financial penalties, impacting profitability and investor confidence. For example, the total fines levied on the gambling industry in the UK alone reached tens of millions in recent years.

- Erosion of Customer Trust: Reputational damage from regulatory breaches can lead to a loss of customer loyalty and a decline in new customer acquisition.

- Impact on Partnerships: A tarnished brand reputation may also affect Betsson's ability to secure and maintain partnerships with payment providers, affiliates, and technology suppliers.

Market Exits and Reduced Customer Base in Unregulated Markets

Betsson's strategic decision to withdraw from markets such as Norway, driven by evolving regulatory landscapes or the absence of clear local frameworks, directly impacts its customer base and revenue streams. For instance, exiting a market means losing all associated registered customers and the associated income. This move, while prudent for managing risk and ensuring compliance, inherently caps growth potential in those particular territories.

The financial implications of such market exits are significant. For example, Betsson's exit from Norway in 2023, following a shift in local gambling regulations, would have immediately reduced its active player numbers. While specific figures for 2024 are not yet fully reported, the company's previous financial statements indicated that Northern Europe was a substantial contributor to its overall revenue.

- Market Exits: Betsson has previously exited markets like Norway due to regulatory uncertainties.

- Customer Base Reduction: Exits directly translate to a loss of registered customers.

- Revenue Impact: Losing customers in a market, even an unregulated one, means forfeited revenue.

- Growth Limitation: Strategic withdrawals, while managing risk, inherently limit expansion opportunities in those specific regions.

Intensified regulatory scrutiny, particularly around Anti-Money Laundering (AML) and responsible gambling, poses a significant threat, potentially leading to substantial fines and operational disruptions as seen with penalties levied on other operators. Fierce competition from global players and agile newcomers compresses margins, demanding heavy investment in marketing and innovation to retain market share. Global economic uncertainty, including inflation, could reduce consumer discretionary spending on online gaming services, impacting revenue. Furthermore, the need to withdraw from certain markets due to evolving regulations limits growth opportunities and reduces the customer base.

SWOT Analysis Data Sources

This Betsson SWOT analysis is built upon a robust foundation of data, drawing from official financial filings, comprehensive market intelligence reports, and expert industry analysis to provide a well-rounded and accurate strategic perspective.