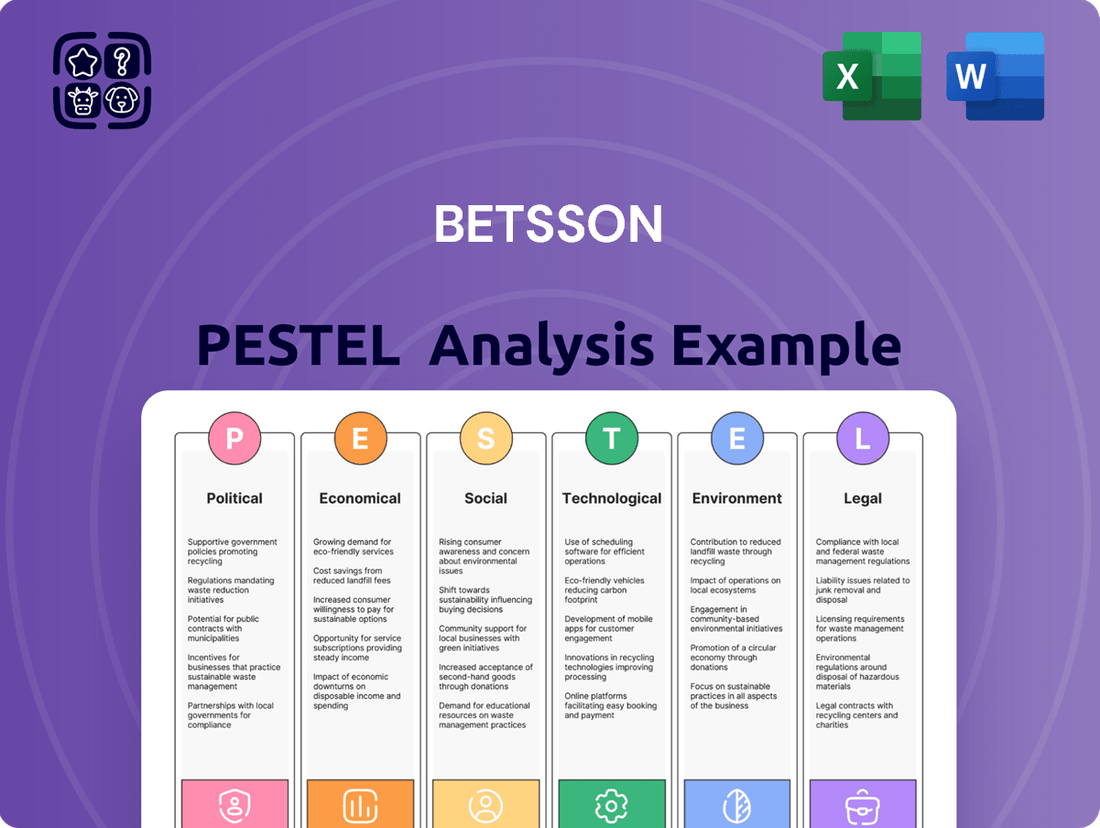

Betsson PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Betsson Bundle

Navigate the complex external environment influencing Betsson's success. Our PESTLE analysis meticulously breaks down the political, economic, social, technological, legal, and environmental factors at play. Understand how evolving regulations, economic shifts, and consumer trends impact the online gaming giant's strategy. Gain a competitive advantage by anticipating these forces. Download the full PESTLE analysis now for actionable intelligence to inform your decisions.

Political factors

Governments globally are actively revising their online gambling regulations. For instance, as of early 2024, several European nations are either implementing or considering stricter advertising rules for betting companies, which could impact Betsson's marketing spend and reach. These shifts often introduce new licensing fees or alter existing tax structures, directly influencing operational costs and revenue streams for operators like Betsson.

The political stability in countries where Betsson operates, such as Sweden and Spain, is a critical factor. For instance, in 2024, Sweden's government has been navigating a complex political landscape, which could impact regulatory frameworks for the gambling industry. Similarly, Spain’s regional political dynamics can influence licensing and operational conditions.

Unstable political environments introduce significant risks, potentially leading to abrupt regulatory shifts or increased operational costs for Betsson. For example, a sudden change in gambling tax laws in a key market could directly affect profitability. Betsson's continuous assessment of political risk is therefore essential for maintaining business continuity and safeguarding revenue streams.

Governments worldwide exhibit a spectrum of attitudes toward online gaming, from outright bans to active promotion. This political stance significantly shapes Betsson's market opportunities and strategic approach. For instance, while some nations like Australia have implemented stringent regulations, others, such as parts of Europe, are moving towards liberalization.

A supportive regulatory environment, seen in countries like Sweden where online gaming is licensed and taxed, allows for greater market penetration and investment. In 2023, the Swedish Gambling Authority reported a total gambling market value of SEK 27.1 billion, with a significant portion from online offerings, highlighting the economic potential in well-regulated markets. Conversely, a restrictive political climate can deter investment and limit operational scope.

Betsson must continuously monitor and adapt to evolving government policies. The company's 2024 strategy, for example, likely factors in the potential impact of anticipated regulatory changes in key European markets, aiming to capitalize on favorable shifts while mitigating risks associated with stricter controls elsewhere.

International Regulatory Cooperation

International regulatory cooperation is increasingly shaping the online gambling landscape, directly impacting companies like Betsson. Nations are intensifying their efforts to align on regulations, especially for cross-border transactions and combating financial crime. This collaboration aims to create a more unified approach to licensing, player protection, and responsible gaming.

The degree to which international standards are harmonized or diverge significantly affects Betsson's ability to operate smoothly across multiple jurisdictions. Harmonization can simplify compliance, reducing the burden of adhering to vastly different rules. Conversely, divergence necessitates highly adaptable and robust internal policies to navigate complex and often conflicting legal frameworks. For instance, the European Union's ongoing discussions on digital services and market regulation, which could impact online platforms operating within member states, highlight the need for Betsson to stay attuned to these evolving international trends to maintain global compliance.

- Harmonization Efforts: Increased focus on common standards for anti-money laundering (AML) and Know Your Customer (KYC) procedures across different countries.

- Divergence Challenges: Betsson must manage varying data privacy laws (e.g., GDPR versus other national regulations) and differing advertising restrictions in markets like Sweden and the UK.

- Cross-Border Operations: International cooperation is crucial for addressing issues like payment processing and preventing fraud in a globalized online gaming environment.

- Monitoring Trends: Betsson's compliance teams actively monitor developments from international bodies and individual country regulatory changes to ensure adherence.

Taxation Policies on Gambling Revenue

Changes in government taxation policies on gambling revenue significantly impact Betsson's financial results and how it prices its offerings. For instance, in Sweden, where Betsson operates extensively, the gaming tax rate on net sales from licensed gambling activities was 18% in 2024. An increase in such rates, as has been discussed in various European markets, could squeeze profit margins, potentially forcing Betsson to raise prices for customers or scale back marketing investments.

Monitoring and anticipating these fiscal policy adjustments are crucial for Betsson's financial planning and maintaining positive investor relations. Fluctuations in tax liabilities directly affect earnings per share and overall profitability. For example, a 5% increase in the effective tax rate on a company like Betsson, with reported net gaming revenue of €800 million in 2024, could translate to a substantial impact on its bottom line.

- Impact on Profitability: Higher gambling taxes directly reduce net profit margins for operators like Betsson.

- Pricing Strategy Adjustments: Increased tax burdens may necessitate price hikes for consumers or a reduction in promotional offers.

- Competitive Landscape: Disparate tax rates across different jurisdictions can alter Betsson's competitive positioning.

- Financial Forecasting: Accurate prediction of tax policy changes is vital for realistic financial planning and investor communication.

Governments globally are refining online gambling regulations, impacting companies like Betsson. For example, stricter advertising rules were considered in several European nations in early 2024, potentially affecting Betsson's marketing expenses and reach. New licensing fees and altered tax structures are also becoming common, directly influencing operational costs and revenue.

Political stability in key markets such as Sweden and Spain is crucial. In 2024, Sweden's government navigated a complex political environment that could influence gambling regulations. Similarly, Spain's regional political shifts can affect licensing and operational conditions for Betsson.

Betsson must remain agile in response to evolving government policies. For instance, the company's 2024 strategy likely incorporates potential regulatory changes in major European markets, aiming to leverage favorable shifts while mitigating risks from stricter controls.

Changes in gambling taxation policies directly affect Betsson's financial performance. In Sweden, the gaming tax rate on net sales for licensed gambling activities stood at 18% in 2024. An increase in such rates, a possibility in various European markets, could reduce profit margins, potentially leading to price adjustments for consumers or scaled-back marketing efforts.

| Factor | Impact on Betsson | 2024/2025 Data/Trend |

| Regulatory Revisions | Affects marketing spend, operational costs, and revenue streams. | Ongoing revisions in European advertising rules; potential for new licensing fees and tax structures. |

| Political Stability | Influences licensing and operational conditions; risk of abrupt regulatory shifts. | Monitoring political landscapes in Sweden and Spain; regional dynamics impact operations. |

| Taxation Policies | Impacts profitability and pricing strategies. | Swedish gaming tax at 18% in 2024; potential for increases in other European markets. |

| International Cooperation | Simplifies compliance through harmonization or necessitates adaptable policies due to divergence. | Focus on common AML/KYC standards; varying data privacy laws (e.g., GDPR) and advertising restrictions require navigation. |

What is included in the product

This Betsson PESTLE Analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces shaping the company's operating landscape, offering a comprehensive view of external influences.

It provides actionable insights for strategic decision-making, identifying potential threats and opportunities within the dynamic online gaming sector.

Provides a concise overview of Betsson's external environment, highlighting key opportunities and threats to inform strategic decision-making and alleviate concerns about market uncertainty.

Economic factors

The trajectory of global economic growth significantly influences Betsson's revenue, as online gaming is a discretionary purchase. A robust global economy, projected by the IMF to grow by 3.2% in 2024 and a similar rate in 2025, generally translates to higher disposable incomes and increased consumer spending on leisure activities like online betting.

Conversely, economic slowdowns or recessions can dampen consumer confidence and reduce discretionary spending, directly impacting Betsson's customer engagement and overall revenue. For instance, periods of high inflation or rising unemployment can lead consumers to cut back on non-essential expenditures, potentially affecting Betsson's user base and average revenue per user (ARPU).

Betsson's financial performance is intrinsically linked to these macroeconomic cycles and the prevailing consumer sentiment. In regions experiencing strong economic expansion and high consumer confidence, Betsson is likely to see increased demand for its gaming products and services, leading to higher revenues.

The company's reliance on discretionary spending means it's particularly sensitive to shifts in consumer purchasing power. As global economic conditions evolve, Betsson must remain agile, adapting its strategies to capitalize on growth periods and mitigate risks during downturns.

Currency exchange rate fluctuations present a notable economic factor for Betsson, given its extensive international operations. When Betsson converts earnings from foreign markets back into its reporting currency, Swedish Krona (SEK), volatility in exchange rates can directly impact its reported revenues and expenses. For instance, a stronger SEK against currencies where Betsson generates significant revenue would reduce the SEK value of those earnings.

Significant swings in exchange rates can materially affect Betsson's overall profitability. If the SEK strengthens considerably, the cost of operating in foreign markets might appear higher when translated, potentially squeezing profit margins. Conversely, a weaker SEK could boost reported profits from overseas operations. For example, during 2023, the Euro's performance against the SEK played a role in the reported financial results from Betsson's substantial European operations.

To manage this economic exposure, Betsson employs strategies such as hedging, which involves using financial instruments to lock in exchange rates for future transactions. Geographical diversification across various currency zones also serves as a natural hedge, as losses in one currency might be offset by gains in another. This multi-market presence helps to smooth out the impact of any single currency's movement on the company's consolidated financial performance.

Rising inflation presents a significant challenge for Betsson, directly impacting its operating costs. Increases in the cost of technology infrastructure, essential for its online platforms, and higher marketing expenditures to maintain brand visibility can erode profitability. Furthermore, wage inflation necessitates adjustments to personnel salaries, adding to the company's expense base.

Managing these escalating costs is paramount for Betsson to sustain its profit margins. For instance, as of early 2024, many European economies experienced inflation rates fluctuating between 2% and 6%, directly translating to higher input costs for businesses like Betsson. The company's ability to effectively control its cost base, perhaps through renegotiating supplier contracts or optimizing digital marketing spend, will be crucial in counteracting these pressures without sacrificing service quality or its competitive edge.

Interest Rate Environment

Changes in interest rates directly impact Betsson's financial flexibility. Higher rates increase the cost of borrowing, making it more expensive for Betsson to fund new ventures or acquisitions, potentially impacting its expansion strategies. For instance, if Betsson were to take on significant debt in a period of rising rates, its interest expenses would climb, eating into profitability.

Conversely, a lower interest rate environment makes capital more accessible and cheaper. This can encourage investment in new technologies, market penetration, or even potential mergers and acquisitions, thereby fueling growth. The European Central Bank (ECB) has been adjusting its key interest rates, with the main refinancing operations rate standing at 4.50% as of June 2024, reflecting a policy stance that influences borrowing costs across the Eurozone.

Monitoring central bank policies, such as those enacted by the ECB or the Bank of England, is crucial for Betsson's financial planning. These policy shifts signal future economic conditions and directly affect the cost of capital. For example, anticipated rate cuts could lower future borrowing costs, while unexpected hikes might necessitate a reassessment of investment projects and their expected returns.

- Borrowing Costs: Rising interest rates increase the expense of debt financing for Betsson's investments and expansion.

- Investment Returns: Higher capital costs can reduce the attractiveness of new projects and potentially lower overall investment returns.

- Central Bank Influence: Policies from institutions like the ECB, which set rates such as 4.50% for main refinancing operations (as of June 2024), are critical for financial strategy.

- Growth Capital: The prevailing interest rate environment dictates the cost and availability of capital for Betsson's growth initiatives.

Competition and Market Saturation

Competition in the online gaming sector remains fierce, directly influencing Betsson's operational strategies. In 2024, the global online gambling market was valued at approximately $70 billion and is projected to grow significantly. This intense landscape means Betsson often faces elevated customer acquisition costs as it competes for player attention through marketing and bonuses.

Market saturation in key regions presents another challenge. For instance, many European markets are highly developed, leading to intense price competition and reduced pricing power for operators like Betsson. This necessitates a constant drive for innovation to maintain a competitive edge.

To counter these pressures, Betsson is focusing on differentiating its product portfolio through proprietary technology and unique gaming experiences. This strategic focus is crucial for standing out in a crowded marketplace. The company's ability to adapt and innovate will be key to navigating these competitive dynamics and achieving sustained profitability.

- The global online gambling market was valued at around $70 billion in 2024.

- Intense competition drives up customer acquisition costs for companies like Betsson.

- Market saturation in developed regions limits pricing power.

- Continuous innovation is essential for differentiation and profitability.

Economic growth directly correlates with Betsson's revenue potential, as online gaming is a discretionary spend. The IMF forecasts global growth at 3.2% for both 2024 and 2025, suggesting a stable environment for increased consumer spending on leisure. However, economic downturns, marked by rising inflation and unemployment, can reduce disposable income and negatively impact Betsson's user engagement and revenue per user.

Currency fluctuations are a significant economic factor for Betsson, given its international operations. For example, the Euro's performance against the Swedish Krona in 2023 impacted reported earnings from European markets. Betsson mitigates this risk through hedging and geographical diversification to smooth out the impact of currency movements on its consolidated financial results.

Rising inflation increases Betsson's operational costs, affecting technology infrastructure, marketing, and salaries. With European inflation rates hovering between 2% and 6% in early 2024, managing these escalating expenses is crucial for maintaining profit margins. Betsson's ability to control its cost base will be key to counteracting these pressures.

Interest rates influence Betsson's financial flexibility and growth capital. The European Central Bank's main refinancing operations rate at 4.50% as of June 2024 indicates current borrowing costs. Higher rates increase debt financing expenses, while lower rates can encourage investment in expansion and technology, impacting the cost and availability of capital for growth initiatives.

Same Document Delivered

Betsson PESTLE Analysis

The Betsson PESTLE Analysis preview you're viewing is the exact document you'll receive after purchase. This comprehensive report delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Betsson's operations. You'll gain valuable insights into market dynamics and strategic considerations.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. It meticulously details the external forces shaping Betsson's industry.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a robust framework for understanding Betsson's strategic landscape.

What you’re previewing here is the actual file—fully formatted and professionally structured. You can immediately begin leveraging this PESTLE Analysis for your business intelligence needs.

Sociological factors

Societal attitudes towards gambling are shifting, with a growing emphasis on responsible gaming and potential harms. For instance, in the UK, a 2023 report by the Gambling Commission indicated that 1.5% of adults are problem gamblers, a figure that drives public concern and calls for tighter controls. Betsson must remain attuned to these evolving perceptions, as increased public acceptance could expand its market, while heightened awareness of risks may lead to more stringent regulations and a more cautious player base.

Societal expectations around responsible gaming are intensifying, pushing companies like Betsson to invest heavily in player protection. This growing emphasis means that robust tools and proactive initiatives to prevent problem gambling are no longer optional but essential for market credibility.

Betsson's dedication to responsible gaming, demonstrated through features like self-exclusion programs, customizable deposit limits, and readily available support services, directly addresses these societal demands. Such commitments are vital for fostering player trust and ensuring the company aligns with public welfare concerns.

Beyond player welfare, these responsible gaming practices are intrinsically linked to regulatory compliance and the overall brand reputation. For instance, in 2023, the UK Gambling Commission reported that 2.8% of adults were experiencing some form of gambling harm, highlighting the critical need for operators to implement effective safeguards.

Demographic shifts significantly impact Betsson's customer base. For instance, an aging population in some European markets might prefer different gaming formats or channels than younger, digitally native generations who are accustomed to mobile-first experiences. By 2025, it's projected that over 60% of global internet users will be mobile-only, a trend Betsson must cater to.

Understanding these evolving demographics is crucial for Betsson to adapt its product portfolio and marketing. This includes developing intuitive mobile applications and potentially offering content that appeals to a wider age range, ensuring continued relevance in a dynamic market. In 2024, the 18-34 age group continued to be the largest demographic engaging with online gaming platforms.

Impact of Social Media and Influencers

Social media and online influencers significantly sway consumer behavior and brand perception in the gaming sector. Betsson can capitalize on these channels for marketing campaigns and fostering player communities. For instance, by mid-2024, influencer marketing spend in the gaming industry was projected to reach over $2.6 billion globally, highlighting its economic importance. However, the company must also navigate the potential for reputational damage from negative online sentiment or the spread of false information.

Effective management of Betsson's digital footprint and proactive engagement with online communities are therefore crucial for brand health and growth. This includes monitoring social media conversations and responding to customer feedback. The rapid growth of platforms like TikTok and Twitch, with millions of active users daily in 2024, presents both opportunities for targeted outreach and challenges in controlling brand narrative.

- Influencer Marketing Growth: Global influencer marketing spend in gaming is expected to exceed $2.6 billion by mid-2024.

- Platform Reach: Platforms like TikTok and Twitch boast millions of daily active users, offering significant audience engagement potential.

- Reputational Risk: Negative publicity or misinformation on social media can quickly impact brand perception and customer trust.

- Community Engagement: Active participation in digital communities builds brand loyalty and provides valuable customer insights.

Cultural Nuances in Gaming Preferences

Gaming preferences are deeply rooted in cultural norms, influencing everything from the types of games people enjoy to their betting habits. For instance, while slots might dominate in some European markets, skill-based games or sports betting could be more popular in others.

Betsson's strategic approach necessitates a granular understanding of these cultural differences to tailor its product portfolio effectively. This means not just translating content but also adapting game mechanics, bonus structures, and marketing messages to resonate with local tastes and expectations.

In 2024, emerging markets in Asia and Latin America, for example, show a growing appetite for mobile-first gaming experiences and localized payment solutions, presenting both opportunities and challenges for global operators like Betsson. Adapting to these evolving regional demands is crucial for sustained growth.

- Language Localization: Providing interfaces and customer support in over 15 languages, including Swedish, English, and Spanish, caters to Betsson's diverse customer base.

- Payment Method Integration: Offering a wide array of local payment options, such as Trustly in Sweden and Boleto Bancário in Brazil, is vital for seamless transactions.

- Game Content Adaptation: Featuring popular local casino games or adapting themes to align with cultural preferences can significantly boost engagement.

- Regional Betting Behaviors: Understanding preferences for sports betting versus casino games, and the specific sports that are most popular in a region, informs product development and marketing.

Societal attitudes are increasingly focused on responsible gambling, with a notable 2.8% of UK adults experiencing some form of gambling harm in 2023, according to the Gambling Commission. This trend necessitates Betsson's investment in player protection measures to maintain credibility and align with public welfare concerns.

Demographic shifts are critical, as the 18-34 age group continues to dominate online gaming engagement in 2024. With over 60% of global internet users projected to be mobile-only by 2025, Betsson must prioritize mobile-first experiences to capture younger, digitally savvy audiences.

Social media and influencers wield significant power, with global influencer marketing spend in gaming projected to surpass $2.6 billion by mid-2024. Betsson must strategically leverage platforms like TikTok and Twitch, which have millions of daily active users in 2024, while actively managing its digital reputation to mitigate risks from negative sentiment.

Cultural norms shape gaming preferences; for instance, mobile-first experiences and localized payment solutions are in demand in emerging Asian and Latin American markets in 2024. Betsson's success hinges on adapting game content and marketing to resonate with these diverse regional tastes and behaviors.

| Sociological Factor | Impact on Betsson | Supporting Data (2023-2025) |

| Responsible Gambling Emphasis | Increased investment in player protection tools and adherence to stricter regulations. | 1.5% of UK adults identified as problem gamblers (2023); 2.8% experienced gambling harm (2023). |

| Demographic Shifts | Need to cater to a mobile-first, younger demographic while considering older player preferences. | 18-34 age group largest engaging with online gaming (2024); >60% global internet users projected mobile-only by 2025. |

| Social Media & Influencers | Opportunity for targeted marketing and community building, but also reputational risk. | Gaming influencer marketing spend >$2.6 billion (mid-2024); TikTok & Twitch have millions of daily active users (2024). |

| Cultural Preferences | Requirement for localized product offerings, payment methods, and marketing strategies. | Growing demand for mobile-first and local payment solutions in Asian and Latin American markets (2024). |

Technological factors

The relentless march of mobile technology, especially the rollout of 5G networks, is a game-changer for Betsson. These faster speeds and lower latency mean smoother, more immersive gaming experiences on smartphones and tablets. We're seeing an increasing number of players opting for mobile, with projections suggesting mobile gaming will continue to dominate the market share in the coming years, likely exceeding 60% of the global gaming revenue by 2025.

Betsson's commitment to a mobile-first approach is directly supported by these advancements. Developing intuitive and high-performing apps is no longer optional; it's crucial for attracting and retaining the growing segment of users who exclusively game on their mobile devices. This technological shift fuels innovation in how games are designed and delivered, pushing for more engaging and accessible mobile platforms.

Cybersecurity is absolutely critical for Betsson. As an online gaming company, they handle a lot of sensitive customer data and financial transactions, so keeping all that safe is a top priority. The risk of cyberattacks is always there, meaning Betsson needs to keep investing in the latest security technology, like strong encryption and systems to catch fraud, to protect its customers and keep their trust.

Failing to protect data can have serious consequences. Data breaches not only damage a company's reputation, making customers wary, but they can also lead to hefty fines. For instance, in 2023, the European Union saw a significant increase in reported data breaches, with regulatory bodies imposing substantial penalties. Betsson must stay ahead of these evolving threats to avoid such costly impacts.

Betsson leverages big data and AI to understand player habits, customize games, and refine marketing. For instance, in 2024, the iGaming industry saw a significant increase in AI adoption for personalized recommendations, with studies indicating a potential 15-20% uplift in player engagement. This allows Betsson to offer tailored experiences, boosting customer retention and lifetime value.

AI also plays a crucial role in fortifying security and player welfare. By analyzing vast datasets, AI algorithms can identify and flag suspicious activities, enhancing fraud detection capabilities. Furthermore, AI-powered tools are being developed to promote responsible gaming by recognizing patterns indicative of problematic behavior, a key area of focus for operators like Betsson as regulations tighten.

The integration of these advanced technologies offers Betsson a distinct competitive advantage. In 2023, companies heavily investing in AI reported a notable improvement in operational efficiency, with some seeing cost reductions of up to 10% in areas like customer service through AI-driven chatbots. This technological investment directly translates to better resource allocation and improved profitability.

Payment Processing Innovations

The evolution of payment processing presents significant technological shifts for Betsson. Innovations like digital wallets, cryptocurrencies, and instant banking solutions are reshaping how customers transact, demanding adaptability for seamless integration. Betsson's ability to offer these secure and convenient options directly influences customer acquisition and retention across its global operations.

Reliability and transaction speed are paramount in this evolving landscape. For instance, by the end of 2024, global e-commerce payment processing times are expected to continue their trend towards near-instantaneous settlement for many methods. Betsson must ensure its infrastructure supports these expedited processes to meet customer expectations.

- Digital Wallets: Growing adoption, with global usage projected to reach over 2.5 billion users by 2025, offering a streamlined checkout.

- Cryptocurrency Adoption: While still nascent in mainstream gaming, the potential for faster, lower-fee transactions is being explored by some operators.

- Instant Banking: Solutions like Open Banking are gaining traction, enabling direct, real-time transfers from customer bank accounts.

- Biometric Security: Increasing use of fingerprint and facial recognition for enhanced transaction security and user experience.

Cloud Computing Infrastructure

The adoption of scalable cloud computing infrastructure is crucial for Betsson to manage its dynamic player base and ensure consistent service delivery. This allows for rapid deployment of new features, enhancing the player experience and competitive edge. In 2024, the global cloud computing market was projected to reach over $600 billion, showcasing the significant investment and reliance on these services across industries. Betsson leverages this to maintain high availability, a critical factor in the online gaming sector where downtime directly translates to lost revenue and customer dissatisfaction.

Cloud services provide Betsson with essential flexibility and cost efficiency, mitigating the need for substantial upfront capital expenditure on physical hardware. This approach is particularly beneficial for supporting global operations and facilitating future expansion into new markets. For instance, infrastructure-as-a-service (IaaS) and platform-as-a-service (PaaS) models allow for pay-as-you-go pricing, aligning costs with actual usage. Betsson's reliance on cloud for disaster recovery further strengthens its operational resilience, ensuring business continuity even in unforeseen circumstances. By mid-2025, it is expected that over 90% of enterprises will be using cloud services, underscoring the industry standard Betsson adheres to.

- Scalability: Cloud infrastructure allows Betsson to seamlessly handle peak loads during major sporting events or popular game releases, ensuring all players have a smooth experience.

- Cost Efficiency: By utilizing cloud services, Betsson can optimize IT spending, converting capital expenditures into more predictable operational expenses.

- Agility: The ability to quickly deploy and test new features and services in the cloud accelerates innovation and time-to-market.

- Resilience: Enhanced disaster recovery and backup capabilities provided by cloud providers ensure Betsson's platforms remain operational and secure.

Advancements in mobile technology, particularly the widespread adoption of 5G, are significantly enhancing Betsson's player experience. Faster speeds enable more fluid gameplay, directly supporting the growing trend of mobile-first gambling, which is projected to account for over 60% of global gaming revenue by 2025.

Betsson's strategic focus on mobile gaming is amplified by these technological shifts, necessitating the development of high-performance applications. This technological evolution also drives innovation in game design, pushing for more engaging and accessible mobile platforms to capture the increasing mobile user base.

The integration of AI and big data analytics allows Betsson to personalize player experiences and optimize marketing efforts. In 2024, AI adoption in iGaming saw an estimated 15-20% increase in player engagement through personalized recommendations, a trend Betsson actively leverages for customer retention.

Furthermore, AI is instrumental in bolstering security and promoting responsible gaming. By analyzing player data, AI can detect suspicious activities, enhancing fraud prevention, and identify patterns of problematic behavior, aligning with stricter regulatory requirements.

| Technology Area | Impact on Betsson | 2024/2025 Data/Projections |

|---|---|---|

| Mobile & 5G | Enhanced gaming experience, increased mobile play | Mobile gaming revenue projected to exceed 60% of global market by 2025. |

| AI & Big Data | Personalization, improved marketing, enhanced security | AI adoption in iGaming potentially boosting engagement by 15-20% in 2024. |

| Cloud Computing | Scalability, cost efficiency, operational resilience | Global cloud market projected to exceed $600 billion in 2024; over 90% of enterprises to use cloud by mid-2025. |

Legal factors

Betsson's global operations are intrinsically tied to obtaining and maintaining specific gambling licenses in each market it enters. These licenses are not merely permissions to operate but come with a complex web of compliance obligations that vary significantly by jurisdiction. For instance, in 2024, the company continues to navigate the evolving regulatory landscapes in Europe, such as the updated regulations in Germany and the Netherlands, which impose stricter advertising and player protection measures.

Adherence to these diverse licensing frameworks is non-negotiable and forms the bedrock of Betsson's operational legitimacy and market access. This includes undergoing rigorous regular audits, submitting detailed financial and operational reports, and ensuring robust anti-money laundering (AML) and know-your-customer (KYC) procedures are in place. These ongoing compliance efforts are crucial for maintaining the trust of regulators and customers alike.

The financial and reputational consequences of non-compliance are severe. Betsson, like other operators, faces the risk of substantial fines, license revocation which would immediately halt operations in a specific market, and significant reputational damage that can erode customer confidence and investor sentiment. For example, in 2023, several operators faced significant penalties in the UK for breaches in player protection, highlighting the sharp penalties for regulatory failures.

Data privacy regulations, like the General Data Protection Regulation (GDPR) and its global counterparts, impose stringent rules on Betsson for handling customer information. These laws mandate transparency in data collection, require explicit consent, and demand robust data security measures, impacting how Betsson manages data across its operations. Non-compliance can lead to substantial fines; for instance, GDPR penalties can reach up to 4% of global annual turnover or €20 million, whichever is higher, underscoring the financial risk.

Betsson operates under strict Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations designed to thwart illegal financial activities on its platforms. These rules are critical for maintaining legal standing and fighting financial crime, requiring thorough customer identification and continuous transaction monitoring.

Failure to adhere to these stringent AML/KYC requirements can result in substantial legal penalties and significant financial sanctions. For instance, in 2023, the UK's Gambling Commission fined a major operator £1 million for AML failings, highlighting the serious consequences of non-compliance.

Betsson's commitment to robust verification procedures, including identity checks and source of funds inquiries, is paramount. Transaction monitoring systems are also vital to detect and report any suspicious behavior, ensuring compliance with evolving global financial crime prevention standards.

Advertising and Marketing Regulations

Advertising and marketing regulations in the online gaming sector are notably strict and differ significantly across various countries. These rules often emphasize promoting responsible gambling and ensuring marketing messages do not target or appeal to individuals who might be considered vulnerable. For Betsson, navigating this complex landscape is crucial; non-compliance can lead to substantial fines, legal disputes, and reputational harm. For example, in 2023, the UK’s Advertising Standards Authority (ASA) issued several rulings against gambling operators for marketing that potentially breached these regulations, highlighting the ongoing scrutiny.

These regulations directly influence Betsson’s creative strategies and where its advertisements can be placed. The company must ensure all campaigns align with local advertising standards, which can include restrictions on certain imagery, slogans, and the timing or channels of advertisements.

- Responsible Messaging: Adherence to guidelines requiring clear messaging about the risks of gambling and the availability of support.

- Target Audience Restrictions: Prohibitions on marketing that could be perceived as appealing to minors or other vulnerable populations.

- Jurisdictional Variation: The need to tailor marketing efforts to comply with specific legal frameworks in each operating market, such as Sweden's recent tightening of advertising rules in 2023.

- Sanctions for Non-Compliance: The potential for significant financial penalties and license reviews for breaches of advertising codes.

Consumer Protection Laws and Dispute Resolution

Consumer protection laws are a significant legal factor for Betsson, ensuring fair play and player safety. These regulations mandate transparent terms and conditions, clear game rules, and robust dispute resolution processes, all of which are crucial for maintaining customer trust and a positive brand image. For instance, the European Union's strong consumer protection framework, including directives on unfair commercial practices, directly impacts how Betsson markets its services and handles customer interactions.

Betsson's commitment to adhering to these laws is paramount. This includes providing easily accessible channels for players to raise complaints and ensuring these issues are resolved efficiently and fairly. Failure to comply can lead to substantial fines and reputational damage. The company must continually monitor and adapt its operations to meet evolving consumer protection standards across its various operating markets, which can range from strict enforcement in the UK Gambling Commission regulated markets to other national variations.

- Consumer Safeguards: Laws protect players regarding fair odds, secure transactions, and responsible gambling features, crucial for Betsson's license renewals.

- Dispute Resolution: Betsson must offer clear, accessible mechanisms for addressing player grievances, often mandated by regulatory bodies like the Malta Gaming Authority.

- Transparency Requirements: Regulations demand clear communication of game rules, bonus terms, and potential risks, impacting Betsson's marketing and website content.

- Regulatory Compliance: Adherence to consumer protection laws, such as those enforced by the Swedish Gambling Authority (Spelinspektionen), helps prevent legal challenges and builds player confidence.

Betsson must navigate a complex web of gambling licenses and varying regulatory requirements across its operating markets, with compliance being a critical factor for market access and legitimacy. For instance, in 2024, the company continues to adapt to stricter advertising and player protection measures in Germany and the Netherlands.

Adherence to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations is paramount, with significant penalties for non-compliance. In 2023, a UK operator was fined £1 million for AML failings, illustrating the severe financial repercussions.

Strict advertising and consumer protection laws directly impact Betsson's marketing strategies and operational transparency. Non-compliance can lead to substantial fines, as seen with ASA rulings against gambling operators in the UK in 2023, and requires ongoing adaptation to evolving global standards.

| Regulation Area | Key Compliance Aspect | Potential Consequence of Non-Compliance | Example/Data Point |

|---|---|---|---|

| Licensing | Obtaining and maintaining gambling licenses | License revocation, operational halt | Ongoing navigation of evolving German and Dutch regulations (2024) |

| AML/KYC | Customer identification, transaction monitoring | Substantial fines, financial sanctions | UK operator fined £1 million for AML failings (2023) |

| Advertising | Responsible messaging, target audience restrictions | Significant fines, reputational damage | ASA rulings against UK operators for marketing breaches (2023) |

| Consumer Protection | Fair play, transparent terms, dispute resolution | Fines, reputational damage | GDPR fines can reach up to 4% of global annual turnover |

Environmental factors

Stakeholder and regulatory demands are intensifying, compelling companies like Betsson to showcase their dedication to environmental responsibility and broader Corporate Social Responsibility (CSR). This translates into a need for clear reporting on their environmental impact, including energy usage, particularly for data centers, and waste reduction strategies. For instance, Betsson's 2023 Sustainability Report highlighted a 5% reduction in energy consumption across their operations compared to the previous year.

The gaming industry, with its significant digital infrastructure, faces scrutiny regarding energy consumption. Betsson, in its 2024 outlook, plans to invest further in energy-efficient data center technologies, aiming for a further 7% decrease in energy intensity by the end of 2025. Strong CSR performance not only bolsters brand image but also attracts investors, with studies showing companies with robust ESG (Environmental, Social, and Governance) scores often outperforming their peers in the long term.

Betsson's operations, while online, depend significantly on energy-intensive data centers and IT infrastructure. The global data center industry, for instance, consumed an estimated 1% of the world's electricity in 2023, a figure projected to rise. This heavy reliance means the company's environmental footprint is directly tied to energy consumption and its associated carbon emissions, an area facing growing regulatory and public scrutiny.

To mitigate this, Betsson must prioritize energy efficiency within its technological framework. This could involve adopting more power-efficient hardware and optimizing software for reduced processing demands. Furthermore, exploring the procurement of renewable energy sources, such as solar or wind power, for its data centers and offices presents a clear pathway to reducing its environmental impact.

While Betsson's core business is digital, its office operations still produce waste, including paper, plastics, and electronic equipment. For example, many companies aim to reduce paper consumption by 20% by 2025 through digital document management. Effective waste management, such as implementing robust recycling programs for paper, plastics, and e-waste, is crucial for minimizing environmental impact. This approach demonstrates a commitment to sustainability beyond just the primary business activities.

Supply Chain Environmental Standards

Betsson's environmental footprint is significantly influenced by its supply chain, encompassing everything from the IT hardware and software powering its operations to the marketing materials it utilizes. By actively assessing and encouraging environmental standards among its vendors, Betsson can foster a more responsible approach to its operations. This involves promoting practices like sustainable sourcing and ethical manufacturing throughout its network of third-party providers.

Due diligence on these external partners is crucial for ensuring alignment with Betsson's environmental goals. For instance, in 2024, many companies in the technology sector are facing increased scrutiny regarding the lifecycle management of electronic waste, with regulations like the EU's Ecodesign directive influencing hardware design and repairability. Betsson's suppliers will need to demonstrate compliance with such evolving standards.

Key areas for Betsson's supply chain environmental focus include:

- Sustainable Sourcing of IT Hardware: Encouraging suppliers to use recycled materials and minimize the environmental impact of raw material extraction. For example, the global IT hardware market, valued at over $1 trillion annually, presents a substantial opportunity for sustainability improvements.

- Energy Efficiency in Software Development and Hosting: Partnering with cloud providers and software developers committed to renewable energy sources and efficient data center operations. Data centers are significant energy consumers, and by 2025, many are targeting 100% renewable energy use.

- Eco-Friendly Marketing Materials: Prioritizing suppliers who offer recycled paper options, vegetable-based inks, and carbon-neutral printing processes for promotional items. The global printing market, while evolving, still represents a significant material usage area for marketing.

- Ethical Manufacturing and Labor Practices: Ensuring suppliers adhere to fair labor standards and safe working conditions, which often go hand-in-hand with environmental responsibility. Investigations in 2024 continue to highlight the importance of supply chain transparency in these areas.

Climate Change Adaptation and Risk Management

Climate change presents indirect risks to Betsson through potential disruptions to its digital infrastructure. Extreme weather events, such as severe storms or floods, could impact the reliability of data centers or the energy grids supplying them, affecting service availability. For example, the increased frequency of extreme weather events globally, as noted by organizations like the IPCC, highlights the growing vulnerability of digital services to physical environmental changes.

Betsson must consider climate resilience in its infrastructure planning and operational continuity strategies. This includes assessing the potential impact of climate-related disruptions on its data processing capabilities and ensuring robust backup and recovery systems are in place. The company's reliance on a stable digital environment means that broader climate impacts on energy and telecommunications infrastructure are a key consideration.

Assessing these indirect risks and building resilience is becoming increasingly important for digital-first companies like Betsson. This involves understanding how global climate trends might translate into localized operational challenges, even if the company itself does not directly emit significant greenhouse gases. Proactive measures can mitigate potential downtime and safeguard customer experience.

- Indirect Impact: Extreme weather events can disrupt data center operations and energy supply chains, affecting Betsson's service availability.

- Infrastructure Resilience: Planning for climate resilience in data center locations and energy sourcing is crucial for operational continuity.

- Risk Assessment: Evaluating the indirect effects of climate change on digital infrastructure is a growing concern for online businesses.

- Operational Continuity: Ensuring robust backup and recovery systems mitigates potential downtime caused by climate-related disruptions.

Betsson faces increasing pressure to demonstrate environmental responsibility, with stakeholders and regulators demanding transparency in energy consumption and waste reduction. The company's 2023 Sustainability Report showed a 5% decrease in energy usage, and by 2025, Betsson aims for an additional 7% reduction in energy intensity in its data centers. This focus on sustainability not only enhances brand image but also attracts investors, as companies with strong ESG scores often show better long-term performance.

Given the energy demands of its digital infrastructure, Betsson is investing in energy-efficient data center technologies. The global data center industry consumed approximately 1% of the world's electricity in 2023, a figure expected to grow, underscoring the importance of Betsson's efforts. By optimizing hardware and exploring renewable energy sources, Betsson can significantly reduce its environmental footprint.

Betsson's supply chain also presents environmental considerations, from IT hardware sourcing to marketing materials. By promoting sustainable practices among vendors, such as using recycled materials and eco-friendly printing, Betsson can extend its environmental commitment. For example, the tech sector is increasingly scrutinized for e-waste management, with regulations like the EU's Ecodesign directive influencing hardware design and repairability by 2024.

Climate change poses indirect risks, with extreme weather events potentially disrupting data centers and energy supplies, impacting service availability. Betsson must integrate climate resilience into its infrastructure planning, ensuring robust backup systems to mitigate downtime and maintain operational continuity amidst growing environmental vulnerabilities.

PESTLE Analysis Data Sources

Our Betsson PESTLE Analysis is meticulously constructed using a combination of publicly available data from reputable financial news outlets, regulatory body websites, and industry-specific market research reports. We also incorporate insights from global economic indicators and technological trend analyses to provide a comprehensive view.