Betsson Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Betsson Bundle

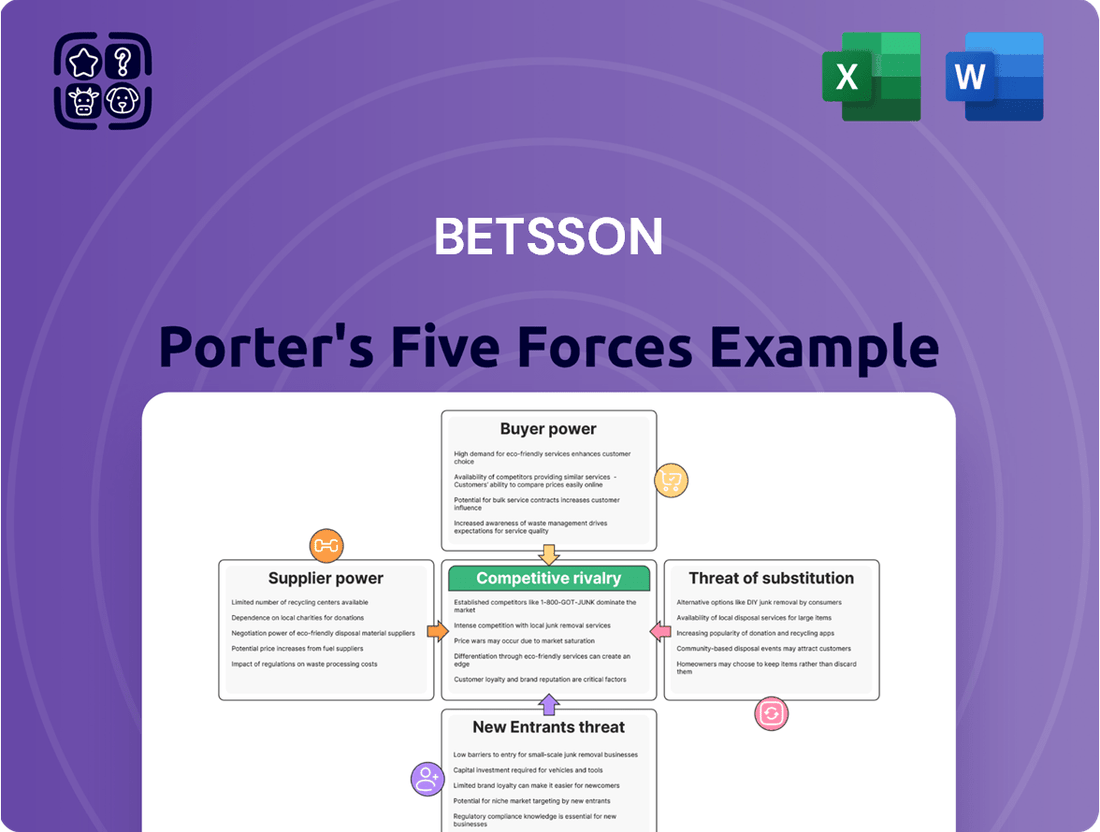

Betsson navigates a dynamic online gaming landscape, where understanding competitive forces is paramount. Our analysis reveals how buyer power and the threat of new entrants significantly shape Betsson's strategic options.

We've also delved into the intensity of rivalry and the bargaining power of suppliers within the iGaming sector, highlighting critical pressures Betsson faces.

Furthermore, the threat of substitute products and services presents a unique challenge, influencing customer loyalty and market share.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Betsson’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Software and game developers, such as Evolution Gaming and Playtech, wield considerable influence over companies like Betsson. Their specialized, high-quality gaming content is essential for attracting and retaining a broad customer base.

Betsson's need for a diverse and engaging game library means these developers are critical partners. The exclusivity of popular game titles and the substantial costs associated with migrating to alternative software providers further bolster the bargaining power of these suppliers.

Payment solution providers like Trustly, Skrill, and Paysafe hold significant bargaining power over online gaming companies such as Betsson. This power is derived from their ability to offer secure, efficient, and globally accessible transaction gateways, which are absolutely essential for customer satisfaction and trust in the online gaming sector. The need for seamless and reliable payment processing, coupled with the complex regulatory landscape, makes these providers indispensable partners.

The reliance of Betsson on these providers for smooth financial operations, especially for catering to a diverse international customer base, amplifies their influence. In 2024, the online gambling market continued its robust growth, with transaction volumes for digital payments reaching trillions globally, underscoring the critical infrastructure payment providers offer.

Affiliate marketing networks wield considerable power over online gaming companies like Betsson. These networks act as crucial conduits, funneling a substantial amount of traffic and new customers. Their influence stems from their extensive reach and their capability to attract large volumes of precisely targeted players, making them indispensable for customer acquisition.

Betsson's marketing approach is deeply reliant on these affiliate channels. For instance, in 2024, affiliate marketing continued to be a primary driver of new player sign-ups across the iGaming industry, with some operators reporting over 60% of their new customer acquisition originating from affiliate partnerships. This reliance means that maintaining robust relationships with major affiliate networks is paramount for Betsson's ongoing growth and market presence.

Data Center and Cloud Service Providers

The bargaining power of suppliers in the data center and cloud service provider segment significantly impacts Betsson. Reliable and scalable IT infrastructure is the backbone of Betsson's online gaming operations, encompassing everything from platform hosting and cybersecurity to managing massive data volumes. Providers of these critical services hold substantial power because switching them can be incredibly costly and technically complex, involving significant data migration and system reconfigurations. The continuous and secure operation of Betsson's platforms is directly tied to the quality and reliability of these infrastructure providers.

The reliance on a few major cloud providers, such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, concentrates power in their hands. For instance, in 2023, AWS held an estimated 31% of the global cloud infrastructure market share, with Azure close behind at 24%. This market concentration means Betsson has limited alternatives if a primary provider increases prices or alters service terms. The specialized nature of cloud infrastructure and the deep integration required often make it difficult and time-consuming for companies like Betsson to change providers, further strengthening supplier leverage.

- High Switching Costs: Migrating vast amounts of data and reconfiguring complex IT systems involves substantial financial investment and operational disruption for Betsson.

- Market Concentration: A few dominant cloud providers control a significant portion of the market, limiting Betsson's negotiation leverage and alternative options.

- Critical Infrastructure: The essential nature of cloud services for Betsson's platform uptime, security, and data management means any disruption or unfavorable change from a supplier can have severe consequences.

- Vendor Lock-in: Deep integration with proprietary technologies and services from a specific provider can create a de facto lock-in, making it challenging to move to a competitor.

Regulatory Compliance and Legal Services

The bargaining power of suppliers in the online gaming sector, particularly for legal and compliance services, is substantial due to the industry's stringent regulatory environment. Specialized legal expertise is critical for navigating licensing, responsible gaming mandates, and diverse market-specific rules. For instance, Betsson's operations across the EU and Latin America require constant adaptation to evolving legal frameworks, from GDPR compliance in Europe to specific gambling laws in countries like Brazil or Mexico.

This reliance on niche legal knowledge grants these service providers considerable leverage. Firms offering these specialized services can command higher fees and dictate terms, as finding alternative providers with equivalent expertise is challenging and time-consuming. The cost and complexity of ensuring compliance across multiple jurisdictions means that companies like Betsson are often locked into relationships with their existing legal counsel.

Key areas where suppliers exert power include:

- Licensing and Permitting: Expertise in obtaining and maintaining gaming licenses in regions like Malta (MGA), the UK (UKGC), or various US states is a significant differentiator.

- Regulatory Interpretation: Understanding and advising on nuanced regulations, such as those pertaining to advertising, player protection, and anti-money laundering (AML), is crucial.

- Compliance Software and Auditing: Providers of specialized compliance software or independent auditors who verify adherence to regulations also hold sway.

- Data Privacy and Security: Legal experts specializing in data protection laws relevant to player information are in high demand.

Software and game developers, such as Evolution Gaming and Playtech, wield considerable influence over companies like Betsson. Their specialized, high-quality gaming content is essential for attracting and retaining a broad customer base. Betsson's need for a diverse and engaging game library means these developers are critical partners. The exclusivity of popular game titles and the substantial costs associated with migrating to alternative software providers further bolster the bargaining power of these suppliers.

Payment solution providers like Trustly, Skrill, and Paysafe hold significant bargaining power over online gaming companies such as Betsson. This power is derived from their ability to offer secure, efficient, and globally accessible transaction gateways, which are absolutely essential for customer satisfaction and trust in the online gaming sector. The need for seamless and reliable payment processing, coupled with the complex regulatory landscape, makes these providers indispensable partners. In 2024, the online gambling market continued its robust growth, with transaction volumes for digital payments reaching trillions globally, underscoring the critical infrastructure payment providers offer.

The bargaining power of suppliers in the data center and cloud service provider segment significantly impacts Betsson. Reliable and scalable IT infrastructure is the backbone of Betsson's online gaming operations. Providers of these critical services hold substantial power because switching them can be incredibly costly and technically complex. For instance, in 2023, AWS held an estimated 31% of the global cloud infrastructure market share, with Azure close behind at 24%, concentrating power.

The bargaining power of suppliers in the online gaming sector, particularly for legal and compliance services, is substantial due to the industry's stringent regulatory environment. Specialized legal expertise is critical for navigating licensing and responsible gaming mandates. Betsson's operations across the EU and Latin America require constant adaptation to evolving legal frameworks. This reliance on niche legal knowledge grants these service providers considerable leverage, as finding alternative providers with equivalent expertise is challenging.

What is included in the product

This Porter's Five Forces analysis for Betsson evaluates the intensity of rivalry among existing competitors, the bargaining power of buyers and suppliers, the threat of new entrants, and the potential for substitute products or services within the online gambling industry.

Quickly identify and address competitive threats with a visually intuitive breakdown of Betsson's market pressures.

Customers Bargaining Power

Individual players, especially in the highly competitive online gaming landscape, demonstrate significant price sensitivity. This means they readily switch between platforms if they find better bonus offers, more attractive odds, or a wider selection of games elsewhere. For Betsson, this necessitates a constant effort to provide compelling promotions and an engaging user experience to keep customers loyal.

The proliferation of online gaming sites, easily accessible with just a few clicks, amplifies this customer power. Players can effortlessly compare offerings and migrate to competitors, forcing companies like Betsson to remain highly competitive in their pricing and value propositions. In 2024, the online gambling market continued its robust growth, with many new entrants vying for market share, further intensifying price competition.

While direct financial costs for players to switch between online gaming platforms like Betsson might be minimal, the psychological switching costs can be a significant barrier. Familiarity with a platform's user interface, the appeal of ongoing loyalty programs offering tangible rewards, and the value of accumulated balances or progress within a game all contribute to a player's reluctance to migrate. Betsson actively works to cultivate strong brand loyalty and deliver an exceptional user experience to counter this customer power, recognizing that personalized interactions and intuitive navigation are key to retaining players.

For Betsson's B2B partners, particularly significant white-label clients, substantial bargaining power exists. These large clients can leverage their volume of business to negotiate customized solutions, more favorable terms, and potentially lower fees. Their influence is directly tied to the revenue they generate for Betsson and the competitive landscape of B2B gaming providers.

Betsson's continued success in its B2B operations hinges on cultivating and maintaining robust relationships with these key partners. Offering compelling and competitive services is crucial to mitigating this customer bargaining power. The company must continually assess its B2B partner portfolio and adapt its offerings to retain these valuable clients.

Information Availability and Transparency

Customers today have an unprecedented amount of information at their fingertips, thanks to the internet. For a company like Betsson, this means players can easily compare odds, bonus offers, and user reviews across numerous online gambling platforms. This readily available data significantly enhances their bargaining power.

The transparency fostered by comparison websites and online forums compels Betsson to remain highly competitive. They must offer attractive pricing, ensure fair gaming practices, and provide top-notch customer service to retain players. The digital nature of the iGaming industry intensifies this dynamic, making information access instantaneous and universal.

- Increased Information Access: Comparison sites and player forums provide detailed insights into competitor offerings, helping customers make informed choices.

- Price Sensitivity: Easy access to competitor pricing and bonus structures forces Betsson to maintain competitive offers.

- Demand for Transparency: Players expect clear terms and conditions, fair payout rates, and responsive customer support.

- Impact on Loyalty: A lack of transparency or uncompetitive offers can quickly lead customers to switch to rival platforms.

Regulatory Protections for Consumers

Increasing regulatory scrutiny across various markets significantly bolsters the bargaining power of customers. Regulations focusing on consumer protection, responsible gaming, and fair advertising empower players by setting clearer expectations and providing recourse for unfair practices. For instance, in 2024, the UK Gambling Commission intensified its focus on player protection, leading to stricter rules for operators like Betsson regarding advertising and bonus terms.

These enhanced protections can indirectly increase customer bargaining power by forcing operators to be more transparent and customer-centric. Stricter compliance requirements can also influence operational practices and potentially increase costs for companies, making customer satisfaction a more critical factor for profitability. The trend of increased regulatory oversight, evident in new directives anticipated for 2025 across several European jurisdictions, further reinforces this shift.

- Increased Transparency: Regulations mandate clearer terms and conditions for games and bonuses, allowing customers to make more informed choices.

- Responsible Gaming Measures: Requirements for self-exclusion tools and deposit limits empower players to control their spending, reducing potential harm and increasing their sense of control.

- Fair Play Enforcement: Regulatory bodies actively monitor for unfair practices, giving customers confidence that they will be treated equitably.

- Advertising Standards: Stricter rules on advertising prevent misleading promotions, ensuring customers are not lured by false promises.

The online gaming market's intense competition means customers have significant power. Easy access to information through comparison sites and forums allows players to readily switch between Betsson and its rivals based on better odds or bonuses. This necessitates Betsson's focus on competitive offers and a superior user experience to foster loyalty.

Regulatory trends, particularly in 2024 and looking towards 2025, are further empowering customers. Increased focus on consumer protection and responsible gaming, as seen with the UK Gambling Commission's actions, mandates greater transparency from operators like Betsson. This means clearer terms, fairer practices, and robust player support, all of which enhance the customer's position.

| Factor | Impact on Betsson | Customer Power Level |

|---|---|---|

| Information Access | Requires competitive pricing & strong UX to retain players. | High |

| Price Sensitivity | Drives need for attractive bonuses and promotions. | High |

| Regulatory Scrutiny | Mandates transparency & fair practices, increasing customer leverage. | Increasingly High |

Same Document Delivered

Betsson Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of Betsson, providing an in-depth examination of the competitive landscape that you will receive immediately after purchase. The document displayed here is the exact, fully formatted report, offering no placeholders or generic content. You're looking at the actual, professionally written analysis, ensuring you get precisely what you need for your strategic planning. Once your purchase is complete, you'll gain instant access to this detailed breakdown, ready for immediate application and insightful decision-making regarding Betsson's market position.

Rivalry Among Competitors

The online gaming landscape is incredibly crowded, featuring a vast array of global giants and niche local operators. Major companies like Flutter Entertainment, which reported revenues of over €10 billion in 2023, and Entain, with its significant presence across various brands, are direct rivals to Betsson.

Betsson contends with this fierce competition not just on a global scale but also within each specific region it operates in and across its various product offerings, such as casino, sports betting, and poker.

The sheer volume of competitors means Betsson must constantly innovate and differentiate itself to capture and retain market share, as players have numerous choices available to them.

This high degree of fragmentation and the presence of well-established, financially robust competitors create a challenging environment where price wars and aggressive marketing are common tactics.

The online gambling industry is a dynamic space, marked by robust expansion despite the presence of numerous competitors. This underlying growth trend is crucial, as it offers avenues for companies like Betsson to increase their market share and potentially soften the intensity of competitive rivalry by creating more opportunities for everyone.

Evidence of this market vitality is seen in Betsson's performance; the company reported an 18% revenue increase in the first quarter of 2025. Such growth suggests that the market is not a zero-sum game, allowing even established players to prosper as the overall pie expands, thus providing some buffer against aggressive competitive tactics.

Competitors in the online gaming sector actively differentiate through unique game portfolios, cutting-edge features like AI-powered personalization and immersive live streaming, and a superior user experience. Brand reputation also plays a crucial role in attracting and retaining customers.

Betsson distinguishes itself by providing a diverse array of casino, sportsbook, and poker products under various brands, catering to a broad customer base. This multi-brand strategy aims to capture different market segments and preferences.

The company's commitment to continuous product development is evident in its ongoing investment in innovation, ensuring its offerings remain competitive and appealing. This focus on R&D is vital for staying ahead in a rapidly evolving market.

High Exit Barriers

High exit barriers in the online gaming sector, driven by substantial fixed costs in technology, licensing, and marketing, often trap companies in the market. These considerable investments, along with navigating complex regulatory landscapes, make it economically challenging for operators to leave, even if they are not performing well. This situation can prolong competitive intensity, as the cost of exiting outweighs the potential losses from continued operation.

Betsson, for example, has invested heavily in its technological infrastructure, brand development, and securing numerous gaming licenses across different jurisdictions. These substantial sunk costs mean that simply shutting down operations would result in a significant financial loss, compelling the company to continue competing rather than exiting.

The implications of these high exit barriers for competitive rivalry are significant:

- Sustained Competition: Companies are less likely to exit, leading to a more crowded and competitive market for longer periods.

- Price Wars: To maintain market share or cover fixed costs, companies may engage in aggressive pricing strategies, impacting overall profitability.

- Focus on Differentiation: Operators often focus on product innovation and customer loyalty to retain their position, rather than simply competing on price.

Marketing and Promotional Intensity

The online gaming industry, where Betsson operates, is marked by fierce competition, with companies frequently engaging in aggressive marketing and promotional activities to capture market share. This often translates into substantial spending on advertising, attractive bonus offers for new and existing customers, and high-profile sponsorship agreements. For instance, in 2024, many leading online betting operators continued to allocate significant portions of their revenue to marketing, with some reporting marketing expenses exceeding 20% of their gross gaming revenue.

Betsson itself is a participant in this intense promotional environment, investing heavily in marketing to bolster its brand presence and connect with a global player base. These investments are crucial for customer acquisition and retention in a crowded marketplace. However, this high level of promotional spending can put pressure on profit margins if not executed with precision and efficiency.

- Aggressive Marketing Campaigns: Companies frequently employ extensive advertising across various channels, including digital, social media, and traditional media.

- Bonus Offers and Promotions: Customer acquisition and loyalty are driven by welcome bonuses, free bets, deposit matches, and loyalty programs.

- Sponsorship Deals: Major sports teams, leagues, and events are often sponsored to enhance brand visibility and engagement.

- Impact on Profitability: While necessary for growth, intense marketing can significantly impact profit margins if not carefully managed and optimized.

The competitive rivalry in the online gaming sector is intense, characterized by numerous global and regional players vying for market share. Betsson faces formidable competition from giants like Flutter Entertainment and Entain, both reporting substantial revenues. This crowded market necessitates continuous innovation and differentiation, as players have abundant choices.

Companies actively differentiate through unique game offerings, advanced features, and superior user experiences, with brand reputation being a key differentiator. Betsson employs a multi-brand strategy and invests in product development to maintain its competitive edge.

The industry's high exit barriers, stemming from significant investments in technology, licensing, and marketing, contribute to sustained competition. Companies are compelled to remain active, often leading to aggressive pricing and marketing tactics to cover fixed costs and maintain presence.

In 2024, marketing expenses remained a significant factor, with many operators allocating over 20% of their gross gaming revenue to advertising, bonuses, and sponsorships. Betsson also invests heavily in marketing to acquire and retain customers, though this can pressure profit margins.

| Competitor | Reported Revenue (Approx.) | Key Differentiators |

|---|---|---|

| Flutter Entertainment | > €10 billion (2023) | Diverse brand portfolio, strong market presence, innovation. |

| Entain | Significant (specific 2023 figure not publicly emphasized as a single number) | Multi-brand strategy, extensive product offerings, global reach. |

| Betsson | 18% revenue increase (Q1 2025) | Multi-brand catering, continuous product development, focus on R&D. |

SSubstitutes Threaten

Land-based casinos and betting shops represent significant substitutes for Betsson's online offerings. These physical establishments provide a distinct social atmosphere and a tangible betting experience that online platforms cannot fully replicate, appealing to a specific customer segment. For instance, while the global online gambling market is projected to reach over $150 billion by 2024, brick-and-mortar casinos in major markets like Las Vegas still generate billions in revenue annually, indicating a persistent demand for the traditional venue.

Betsson must therefore continually emphasize the superior convenience, wider game selection, and often better odds available on its digital platforms. The challenge lies in converting players who value the in-person interaction and traditional casino ambiance. The continued growth of the online sector, with a CAGR of around 10% expected in the coming years, suggests a shift, but the presence of these substitutes remains a key consideration for Betsson's competitive strategy.

Other forms of digital entertainment, like video games and streaming services, are a significant threat to Betsson. In 2024, the global video game market was projected to reach over $200 billion, showcasing the vast amount of leisure spending available. These alternatives directly compete for consumers' attention and disposable income, offering immersive experiences that can pull users away from traditional online betting.

Unregulated or 'black market' gambling presents a substantial threat to licensed operators like Betsson. These illicit platforms can attract customers by offering seemingly more attractive terms, such as higher odds or more generous bonuses, and by sidestepping the rigorous Know Your Customer (KYC) verification processes that regulated entities must enforce. This creates a competitive pressure, as they operate outside the established compliance frameworks.

For consumers, the allure of these unregulated sites comes with significant risks, including potential fraud and lack of recourse in case of disputes. Betsson and similar regulated companies must therefore continually highlight and reinforce their commitment to safety, security, and responsible gaming practices as key differentiators. This focus on player protection is crucial for maintaining trust and customer loyalty in a market segment where illegal alternatives exist.

Lotteries and Scratch Cards

State-run lotteries and physical scratch cards present a notable threat of substitution for Betsson, primarily due to their widespread accessibility and low entry barriers. These traditional forms of gambling cater to a vast demographic seeking a chance at financial windfalls, fulfilling a similar entertainment need as online offerings. In 2024, lotteries continue to be a significant revenue generator for governments, with national lottery sales in many countries remaining robust, indicating sustained consumer interest in this predictable, albeit low-probability, form of entertainment.

Betsson actively counters this threat by integrating its own lottery and scratch card products into its online platform. This allows the company to directly capture demand from players who might otherwise opt for physical alternatives. The convenience of online play, coupled with potentially wider prize pools and more frequent draws, offers a competitive advantage. For instance, the global lottery market size was estimated to be over USD 300 billion in 2023, with online lottery sales showing steady growth, demonstrating the potential for digital platforms to siphon market share from traditional channels.

- Accessibility: Physical lotteries and scratch cards are readily available in convenience stores and retail outlets, requiring no internet access.

- Simplicity: The rules and gameplay are universally understood, making them appealing to casual consumers.

- Low Entry Cost: Tickets are typically inexpensive, allowing for participation with minimal financial commitment.

- Broad Appeal: These products target a wide demographic, from young adults to seniors, seeking entertainment and the dream of winning big.

Social Gaming and Fantasy Sports

Free-to-play social casino games and fantasy sports platforms represent a significant threat of substitutes for Betsson. These platforms offer entertainment and competitive engagement, often without the direct financial risk associated with real-money wagering. This can divert player attention and spending power that might otherwise be directed towards Betsson's offerings.

The appeal of social gaming lies in its accessibility and low barrier to entry. For instance, the global social casino market was valued at approximately $8.6 billion in 2023 and is projected to grow. Similarly, fantasy sports, particularly in North America, saw substantial engagement, with estimates suggesting over 70 million participants in 2023. These numbers highlight a large audience that can be drawn to alternative forms of digital entertainment and competition.

Betsson's presence in both B2C and B2B markets provides a unique opportunity. By understanding the engagement mechanics and player behaviors within these adjacent, often less regulated, substitute markets, Betsson can potentially adapt its strategies. This could involve developing hybrid products or enhancing the entertainment value of its core real-money offerings to better compete for consumer time and discretionary spending.

The threat is amplified as these substitute platforms often leverage sophisticated gamification techniques and community features to retain users. This creates a compelling user experience that can be difficult for traditional real-money gambling operators to replicate directly, especially given the differing regulatory landscapes and operational models.

The threat of substitutes for Betsson is significant, encompassing both traditional and digital alternatives. Land-based casinos and betting shops offer a social experience, while unregulated online platforms can lure customers with promises of better odds or fewer checks. Furthermore, other digital entertainment options like video games and streaming services compete directly for leisure time and disposable income.

Betsson must highlight its convenience, game variety, and competitive odds to retain customers. The company also actively counters threats from state-run lotteries and scratch cards by integrating similar products into its online platform, offering greater accessibility and potentially larger prize pools.

| Substitute Category | Key Characteristics | Market Size/Engagement (2023/2024 Estimates) | Betsson's Counter-Strategy |

|---|---|---|---|

| Land-Based Casinos | Social atmosphere, tangible experience | Billions in revenue (e.g., Las Vegas) | Emphasize convenience, wider selection, better odds |

| Unregulated Online Gambling | Potentially higher odds, fewer checks | Significant market presence | Focus on safety, security, responsible gaming |

| Other Digital Entertainment (Video Games, Streaming) | Immersive experiences, competition for attention | Video game market > $200 billion (2024) | Enhance entertainment value, gamification |

| State Lotteries & Scratch Cards | Accessibility, low entry cost, broad appeal | Lottery market > $300 billion (2023) | Integrate similar products online |

| Social Casino & Fantasy Sports | Low financial risk, gamification | Social casino market ~$8.6 billion (2023) | Adapt engagement mechanics, hybrid products |

Entrants Threaten

The online gaming sector is characterized by stringent regulatory requirements, demanding substantial investments in licenses for each market entered. New competitors must grapple with intricate legal landscapes, the arduous process of license acquisition, and ongoing compliance obligations, creating a formidable entry barrier. For instance, in 2024, obtaining a license in a key European market could cost upwards of €1 million, excluding ongoing fees and legal counsel.

Establishing a successful online gaming operation demands considerable capital. This includes significant investment in developing robust and secure gaming platforms, implementing aggressive marketing campaigns to build brand awareness, and funding customer acquisition strategies. Furthermore, securing licenses across various jurisdictions, each with its own fees and compliance requirements, adds another layer of substantial expense.

These considerable financial hurdles act as a strong deterrent for many aspiring new entrants. The sheer scale of investment needed to compete effectively in the online gaming market is a major barrier to entry. For instance, companies often spend hundreds of millions of dollars annually on marketing and technology to maintain a competitive edge.

Betsson's long-standing global presence and its diverse portfolio of gaming products are a testament to years of continuous and substantial capital deployment. This deep financial commitment has allowed Betsson to build a strong brand, acquire a loyal customer base, and navigate the complex regulatory landscape effectively.

Established companies like Betsson enjoy a significant advantage due to strong brand recognition and loyal customer bases cultivated over many years. This makes it challenging for newcomers to gain traction. For instance, Betsson operates popular platforms such as Betsafe and NordicBet, which have built substantial trust and repeat business.

New entrants face the arduous task of building credibility and attracting customers in a market already dominated by established brands. This often necessitates substantial investment in marketing and promotional activities just to get noticed. In 2024, the online gambling industry continued to see significant marketing expenditures, with major players investing heavily to maintain their market share and attract new users.

Betsson's portfolio of well-recognized brands acts as a powerful barrier to entry. These established names already have a significant portion of the market’s attention and customer loyalty, meaning a new competitor would need to offer something truly disruptive or invest heavily to even begin competing for market share.

Technological Complexity and Infrastructure

The technological complexity and infrastructure requirements present a significant barrier to new entrants in the online gaming sector. Developing and maintaining a robust, secure, and scalable platform, complete with advanced back-end systems, seamless payment integrations, and stringent cybersecurity measures, demands substantial investment and specialized expertise. New players often face the choice of making massive upfront technology investments or relying on potentially costly third-party solutions, both of which can hinder their ability to compete effectively from the outset.

Betsson, for instance, has demonstrably invested in cutting-edge technology to power its diverse product portfolio, which includes everything from sports betting to casino games and poker. This deep technological integration allows Betsson to offer a superior user experience and maintain operational efficiency. For example, in 2024, the company continued to enhance its proprietary platform, focusing on AI-driven personalization and more efficient data processing to improve customer engagement and operational costs.

- High Development Costs: Building a proprietary gaming platform can cost tens of millions of dollars, including software development, licensing, and initial infrastructure setup.

- Cybersecurity Demands: The industry faces constant threats, requiring continuous investment in cybersecurity to protect user data and financial transactions, with global spending on cybersecurity expected to exceed $200 billion in 2024.

- Scalability Challenges: Platforms must handle millions of concurrent users and transactions, necessitating sophisticated cloud infrastructure and real-time performance optimization.

- Third-Party Reliance: New entrants may opt for white-label solutions, which can offer quicker market entry but often come with higher revenue-sharing agreements and less control over the core technology.

Access to Distribution Channels and Affiliates

New companies entering the online gaming sector face significant hurdles in securing access to vital distribution channels and established affiliate networks. These channels are the lifeblood of customer acquisition, and incumbents like Betsson have cultivated deep, long-standing relationships that grant them preferential terms and greater reach. For a newcomer, building these partnerships from scratch is a time-consuming and costly endeavor, often resulting in less favorable commission structures and limited exposure.

Betsson's robust affiliate program, a cornerstone of its marketing strategy, represents a substantial barrier to entry. In 2024, the online gambling industry continued to see a significant portion of its new customer acquisition driven by affiliate marketing, with some estimates suggesting it accounts for over 30% of all new players in mature markets. Betsson's established affiliate base means they can leverage this channel more effectively and efficiently than a new entrant who must first build trust and demonstrate value to potential partners. This existing network is a critical competitive advantage, making it difficult for new entrants to compete on acquisition cost and volume.

- Affiliate Marketing Dominance: Affiliate marketing remains a primary driver of customer acquisition in the online gaming industry, with its importance underscored by its significant contribution to new player sign-ups.

- Incumbent Advantage: Established operators like Betsson benefit from long-standing relationships with affiliates, leading to preferred terms and wider reach, which new entrants struggle to replicate.

- Cost of Acquisition: New entrants face higher customer acquisition costs due to the need to build affiliate relationships and potentially offer higher commissions to gain visibility.

- Network Effects: Betsson's extensive affiliate network creates a network effect, where more affiliates lead to more players, further strengthening Betsson's market position and making it harder for new companies to gain traction.

The threat of new entrants in the online gaming sector is significantly mitigated by high capital requirements for licensing, platform development, and marketing, alongside the need to build brand recognition. Established players like Betsson benefit from strong existing customer bases and long-standing affiliate relationships, making it costly and time-consuming for newcomers to gain market traction.

The substantial upfront investment required for regulatory compliance, technology infrastructure, and securing market presence acts as a major deterrent. For instance, in 2024, the cost of obtaining gaming licenses in major European markets could exceed €1 million, with ongoing compliance and marketing expenses adding to this financial burden.

| Barrier Category | Description | Estimated Cost/Impact (2024 Data) |

|---|---|---|

| Licensing & Regulation | Acquiring licenses in multiple jurisdictions | €1M+ per key market; ongoing compliance costs |

| Capital Investment | Platform development, marketing, customer acquisition | Hundreds of millions USD annually for established players |

| Brand & Customer Loyalty | Building trust and repeat business | Requires sustained marketing and excellent user experience |

| Technological Infrastructure | Developing secure, scalable gaming platforms | Tens of millions USD for proprietary platforms; significant cybersecurity investment |

| Distribution & Partnerships | Establishing affiliate networks and marketing channels | Significant portion of new customer acquisition via affiliates; costly to build new relationships |

Porter's Five Forces Analysis Data Sources

Our Betsson Porter's Five Forces analysis is built upon a robust foundation of publicly available information, including Betsson's annual financial reports, industry-specific market research from reputable firms, and regulatory filings from relevant gaming authorities.