Betsson Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Betsson Bundle

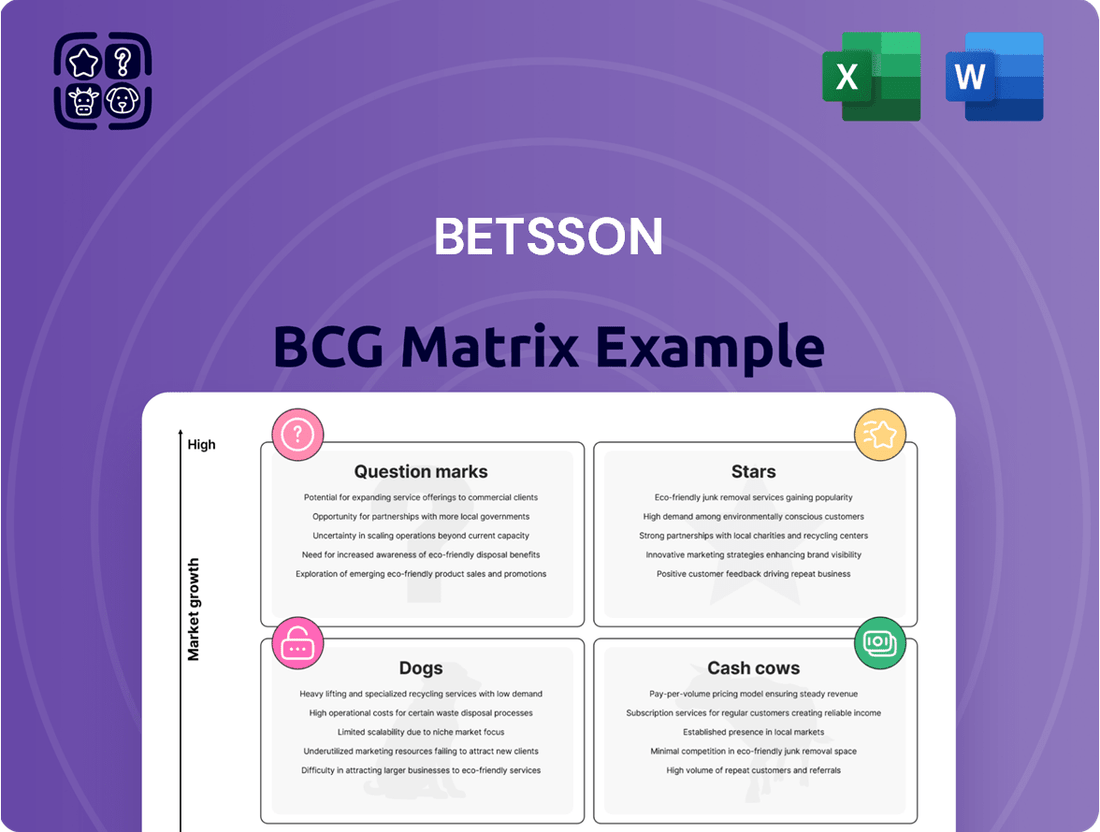

Curious about Betsson's strategic product portfolio? Understanding its position within the BCG Matrix—whether its offerings are Stars, Cash Cows, Dogs, or Question Marks—is crucial for informed decision-making.

This insightful framework helps identify high-growth, high-market-share products and those requiring careful management or divestment. A glimpse into Betsson's matrix reveals the current health of its diverse offerings.

To truly unlock the strategic advantages, you need the complete picture. Dive deeper into Betsson's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Betsson's operations in Latin America, especially in Argentina, Peru, and Colombia, are showing remarkable expansion. The company's revenue in this region saw an impressive increase of over 70% in the first quarter of 2025.

This robust growth, supported by smart investments and strategic alliances, clearly shows Betsson is gaining substantial market share. These Latin American markets are regulated and experiencing high growth, making them vital for Betsson's expansion strategy.

The region has been identified as a primary engine for the group's overall revenue acceleration. Betsson's commitment to these markets is a key factor in its global growth trajectory.

The sportsbook product segment is a clear star for Betsson, demonstrating robust expansion. Revenue surged by 22% in the first quarter of 2025 and a remarkable 36% in the fourth quarter of 2024, establishing new group records. This strong performance points to a dynamic market where Betsson is effectively capturing increasing share.

This growth is fueled by strategic initiatives, including enhanced product features, impactful sponsorships, and a focus on improving profit margins. Betsson's commitment to investing in its proprietary sportsbook technology is a key differentiator, reinforcing its competitive edge in this high-performing sector.

Betsson's B2B offering, driven by its in-house Techsson platform and bolstered by acquisitions such as Sporting Solutions, is a significant engine for growth. This segment is experiencing robust expansion, with license revenue climbing to 31% of the group's total revenue in the first quarter of 2025.

This substantial increase highlights Betsson's strategic focus on leveraging its technological capabilities to capture market share by supplying services to other gaming operators. The Techsson platform's inherent scalability is a key factor enabling this expansion and solidifying Betsson's position as a market leader in the B2B space.

Growth in Specific Western European Regulated Markets

Betsson is seeing impressive growth in specific Western European regulated markets. Italy, for instance, has been a standout performer, delivering record results for the company. This demonstrates Betsson's ability to capitalize on opportunities even in established markets.

Belgium is another key area of expansion. Following the acquisition of a new online casino license in early 2024, Betsson's contribution from this market has been substantial. This success highlights the effectiveness of their strategy in navigating new regulatory landscapes.

- Italy's performance: Betsson reported record results in Italy during 2024, indicating strong organic growth and market penetration.

- Belgium's impact: The Belgian market began contributing significantly after Betsson secured its online casino license in early 2024.

- Strategic importance: These results underscore the value of targeted, localized strategies in mature yet growing European markets.

Overall Organic Growth in Regulated Markets

Betsson's strategic push into regulated markets is paying off handsomely. In the first quarter of 2025, revenue from these specific regions surged by an impressive 60%. This growth is significant because these regulated markets now represent a substantial 59% of Betsson's total revenue. This demonstrates a clear trend of increasing reliance and success within these controlled environments.

This strategic direction is more than just about growth; it's a calculated move to mitigate risks associated with less regulated territories. By solidifying its position in established regulated markets, Betsson is building a more resilient and sustainable business model. The company is actively working to capture and maintain a strong market share in these lucrative areas.

- Revenue from regulated markets grew 60% in Q1 2025.

- Regulated markets now account for 59% of total revenue.

- This growth underscores a broader industry shift towards regulated environments.

- Betsson aims to build and maintain a strong market share in these key areas.

The sportsbook product segment is a clear star for Betsson, demonstrating robust expansion. Revenue surged by 22% in the first quarter of 2025 and a remarkable 36% in the fourth quarter of 2024, establishing new group records. This strong performance points to a dynamic market where Betsson is effectively capturing increasing share.

Betsson's B2B offering, driven by its in-house Techsson platform, is also a significant engine for growth, with license revenue climbing to 31% of the group's total revenue in the first quarter of 2025. This substantial increase highlights Betsson's strategic focus on leveraging its technological capabilities.

The Latin American operations, particularly in Argentina, Peru, and Colombia, are showing remarkable expansion, with revenue increasing by over 70% in the first quarter of 2025. These regulated and high-growth markets are vital for Betsson's expansion strategy.

| Product/Region | Q4 2024 Growth | Q1 2025 Growth | Q1 2025 Revenue Share |

|---|---|---|---|

| Sportsbook | 36% | 22% | N/A |

| B2B (Techsson) | N/A | N/A | 31% |

| Latin America | N/A | >70% | N/A |

What is included in the product

The Betsson BCG Matrix offers a strategic overview of its product portfolio, categorizing them into Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

The Betsson BCG Matrix provides a clear, visual overview, instantly relieving the pain of indecision about where to focus resources.

Cash Cows

The established online casino operations are a clear Cash Cow for Betsson. This segment consistently leads the pack, bringing in a significant 72% of the group's revenue in the first quarter of 2025. While growth isn't at the breakneck pace of newer ventures, an 18% increase demonstrates its robust and reliable performance in a mature market.

This strong revenue stream indicates Betsson holds a dominant position, allowing it to generate substantial and predictable cash flow. The strategy here is about smart maintenance, ensuring the user experience stays top-notch and keeping those loyal customers happy. These efforts are crucial for preserving the segment's profitability and its role as the company's primary cash generator.

The Central and Eastern Europe and Central Asia (CEECA) region stands out as a significant Cash Cow for Betsson. In Q4 2024, this area hit an all-time revenue high, surging by 23.8%. This impressive growth was fueled by exceptional performance in both sportsbook and casino offerings across key markets such as Croatia, Georgia, Greece, and Lithuania.

Betsson has cultivated a substantial and profitable market share within CEECA. The region consistently delivers strong revenues and cash flows, indicating a mature yet still expanding market where the company has solidified its position. This sustained performance underscores its role as a reliable generator of profits.

Betsson's core brands, like Betsson.com, Betsafe, and NordicBet, are established players in mature markets, commanding significant market share and customer loyalty. These brands are the company's cash cows, consistently generating substantial profits and stable cash flow.

Their strong brand recognition and established customer base allow for high profit margins with relatively lower marketing spend, primarily focused on retention and reinforcing existing brand equity. For instance, in 2023, Betsson reported a revenue of €860 million, with a significant portion attributed to these established brands.

Integrated Multi-Product Platform

Betsson's integrated multi-product platform acts as a significant cash cow. This unified system, housing casino, sportsbook, poker, and bingo, facilitates seamless cross-selling opportunities. This strategy effectively maximizes customer lifetime value by encouraging engagement across multiple verticals.

The strength of this integrated platform is particularly evident in Betsson's established markets. These mature segments demonstrate high customer activity and robust retention rates. Consequently, the platform consistently generates substantial and stable cash flows from a broad and loyal customer base.

- High Customer Lifetime Value: The integrated platform enables Betsson to offer a diverse gaming experience, encouraging customers to engage with multiple products and remain active for longer periods.

- Cross-Selling Synergies: By presenting a unified front, Betsson can effectively promote different products to existing customers, driving incremental revenue and reducing customer acquisition costs.

- Operational Efficiency: A single proprietary platform streamlines operations, reduces development costs, and allows for quicker implementation of new features across all product verticals.

- Market Dominance in Established Regions: Betsson's platform is a key driver of its success in mature markets, contributing to a significant portion of its overall revenue and profit generation.

Operating Cash Flow Generation

Betsson demonstrates exceptional strength in operating cash flow generation, a key indicator of its Cash Cow status. In the first quarter of 2025, the company reported operating cash flow of €86.4 million. This follows a very strong performance in 2024, where Betsson generated €272.9 million in operating cash flow for the full year.

This consistent and substantial cash inflow is a direct result of Betsson's dominant market share in its established core business segments. The company's operational model is highly efficient and profitable, allowing it to translate sales into significant cash reserves.

These strong cash flows provide Betsson with considerable financial flexibility. The company can readily fund future growth initiatives, such as new investments and potential acquisitions. Furthermore, it supports shareholder returns through dividends without placing undue pressure on external financing options.

- Consistent Cash Generation: Betsson's operating cash flow reached €86.4 million in Q1 2025 and €272.9 million for the entirety of 2024.

- Market Dominance: This robust cash flow is underpinned by a substantial market share in Betsson's core operating areas.

- Financial Stability: The company benefits from a stable financial position, enabling it to self-fund growth and shareholder distributions.

- Efficient Operations: The strong cash generation highlights an effectively managed and highly profitable business model.

Betsson's established brands like Betsson.com, Betsafe, and NordicBet are undisputed cash cows. These brands command significant market share and customer loyalty in mature markets, consistently generating substantial profits and stable cash flow. Their strong brand recognition allows for high profit margins with relatively lower marketing spend, focusing on retention and brand equity. For instance, in 2023, Betsson reported revenue of €860 million, with a considerable portion stemming from these flagship brands.

| Brand | Market Position | Revenue Contribution (Illustrative) | Cash Flow Generation |

|---|---|---|---|

| Betsson.com | Leading in multiple mature markets | High | Stable and significant |

| Betsafe | Strong presence in key European markets | Substantial | Consistent |

| NordicBet | Dominant in Nordic region | Significant | Reliable |

Full Transparency, Always

Betsson BCG Matrix

The Betsson BCG Matrix document you are currently previewing is the exact, fully formatted report you will receive upon purchase. This means you'll get direct access to a professionally designed strategic analysis, ready for immediate application without any watermarks or demo content. The comprehensive overview of Betsson's product portfolio, categorized according to market share and growth, will be yours to download and utilize for informed decision-making.

Dogs

Nordic markets are currently facing challenges within Betsson's portfolio. Revenue in the Nordics saw a significant drop of 13.8% in the fourth quarter of 2024. This decline was largely driven by reduced activity in the casino segment.

Further complicating the situation, Betsson made the decision to stop accepting new customers in Norway starting December 2024. This action was a direct response to regulatory warnings received for the region.

These developments signal a low-growth or even declining environment for specific sub-segments within the Nordic region. The diminishing market share observed in these areas suggests underperformance.

Consequently, these underperforming segments within the Nordics warrant a strategic re-evaluation. Options could include restructuring efforts or a potential exit from these specific markets.

Poker and bingo, grouped under Betsson's other products, experienced a substantial revenue decline of 23.8% in the fourth quarter of 2024 compared to the previous year. These segments represented a mere 1% of the company's total revenue during this period.

This performance strongly suggests that poker and bingo are positioned as cash traps within the BCG Matrix. They exhibit low growth and low market share, meaning they neither contribute significantly to profits nor require substantial cash investment to maintain their position.

Given their current standing, these products are prime candidates for strategic review, potentially leading to divestiture or a decision to maintain minimal investment to manage their existing operations without further expansion efforts.

Betsson's decision to exit its B2C operations in Colorado by September 2024 highlights the strategic challenges in the US market. The company primarily utilized this market as a B2B showcase for its sportsbook, indicating a limited direct B2C focus.

This exit from a market with a low market share and likely unprofitability aligns with the typical characteristics of Dogs in the BCG matrix. Such divestitures occur when a business unit does not contribute to or detracts from the company's core growth objectives.

The highly competitive and complex nature of the US online gambling landscape likely contributed to this strategic pivot. In 2023, the US sports betting market was valued at an estimated $10 billion, with significant growth but also intense competition from established players.

Underperforming Legacy Brands/Platforms

Within Betsson's diverse portfolio, underperforming legacy brands or platforms often represent a challenge. These assets, while potentially holding a small market share, typically exhibit stagnant or declining growth. Consequently, they necessitate ongoing maintenance costs without generating substantial returns.

The strategic approach for these "Dogs" in the BCG matrix is clear: minimize investment or consider divestment. This frees up capital and resources that can be strategically redirected towards high-growth potential areas within the company's portfolio, such as their Stars or Question Mark segments. For instance, Betsson's announced exits from specific markets in late 2023 and early 2024, such as the sale of its operations in Croatia, exemplify this proactive evaluation and pruning of underperforming assets to enhance overall portfolio efficiency.

- Legacy Brands: Low market share and low growth potential.

- Resource Allocation: Minimal investment or divestment is advised.

- Betsson's Strategy: Market exits indicate a review of underperforming assets.

- Financial Impact: Divesting these assets can improve overall profitability and resource utilization.

Markets with Increasing Regulatory Pressure Leading to Exits

Betsson has made strategic decisions to exit several markets that are experiencing mounting regulatory pressure. This move, which has resulted in a slight decrease in registered customers, reflects the company's assessment of these regions as less viable for long-term growth. For example, in 2023, Betsson completed its exit from Switzerland, a market where increased licensing fees and a complex regulatory framework made continued operations challenging.

These exiting markets are characterized by regulatory environments that make operations unsustainable or unprofitable. High taxes and stringent rules can erode margins, making it difficult to achieve profitability. Betsson's proactive approach in these situations aligns with identifying and divesting from 'Dog' business units, as defined by the BCG matrix, where investment is unlikely to yield significant returns.

The company's strategy to withdraw from markets facing such headwinds is a clear indicator of their 'Dog' status within the Betsson BCG Matrix. These are typically low-growth, low-market-share segments where maintaining a competitive edge becomes increasingly difficult. For instance, the company previously exited several smaller European markets in the preceding years due to similar regulatory and tax challenges.

Key characteristics of these 'Dog' markets include:

- Intensifying Regulatory Scrutiny: Leading to increased compliance costs and operational complexities.

- Unfavorable Tax Regimes: Such as significantly higher gaming taxes that impact profitability.

- Stagnant or Declining Market Share: Making it hard to gain traction against established or local competitors.

- Limited Growth Potential: Due to economic factors or market saturation, further exacerbated by regulatory hurdles.

Betsson's "Dogs" represent segments with low market share and low growth potential, often characterized by declining revenue and increasing operational challenges. These are assets that consume resources without generating significant returns, prompting strategic divestment or minimal investment to preserve capital. For example, Betsson's exit from Colorado in September 2024, where it primarily used the market as a B2B showcase, exemplifies this strategy. The company also ceased accepting new customers in Norway in December 2024 due to regulatory warnings, further highlighting the pruning of underperforming or high-risk segments.

| BCG Category | Characteristics | Betsson Examples | Strategic Approach |

| Dogs | Low Market Share, Low Growth | Poker & Bingo (Other Products), Exited Markets (e.g., Colorado, Norway, Switzerland) | Divestment or Minimal Investment |

| Declining Revenue, High Regulatory Pressure | Nordic Casino Segment (Q4 2024: -13.8% revenue) | Re-evaluation, Restructuring, or Exit | |

| Stagnant or Declining Growth, Low Profitability | Legacy Brands/Platforms, Certain European Markets | Resource Reallocation to Stars/Question Marks |

Question Marks

Brazil represents a significant new frontier for Betsson, with a local license secured in February 2025 and operations commencing in April of the same year. This move positions Betsson within a vast, recently regulated market presenting substantial growth opportunities.

Despite the market's high growth potential, Betsson is implementing a cautious, 'slow start' strategy. This approach suggests an initial low market share, necessitating considerable future investment to realize the market's full value and prevent the venture from becoming a 'Dog' in the BCG matrix.

Betsson's entry into Paraguay, following its casino gaming license secured in late 2024 and a technical launch in February 2025, positions it as a Question Mark in the BCG matrix. This market, much like Brazil, is characterized by high growth potential but currently sees Betsson holding a minimal market share.

Significant investment in tailored marketing campaigns and locally relevant gaming products will be crucial for Betsson to capitalize on Paraguay's burgeoning online gambling sector. The Paraguayan online gambling market is projected to experience considerable growth in the coming years, with industry analysts forecasting an annual growth rate of over 15% through 2028, driven by increasing internet penetration and a younger demographic.

This strategic move requires Betsson to dedicate substantial resources to build brand awareness and customer loyalty in this nascent market. Success hinges on effectively converting the market's inherent growth into a substantial and sustainable customer base.

Betsson's focus on AI-driven customer service and exclusive games in markets like Argentina positions these ventures as potential Stars or Question Marks in the BCG matrix. These innovations are geared towards capturing future market share and driving growth.

While these new products, including enhanced sportsbook features, represent high-growth potential, their current market penetration and immediate revenue impact are still being established. This signifies a nascent market share, characteristic of products that require significant investment to grow.

For example, Betsson's investment in exclusive games for specific regions like Argentina aims to carve out unique market positions. The success of these ventures, however, depends on their adoption rates and ability to generate substantial revenue in the near term, placing them in a critical growth phase.

Strategic Sponsorships in Nascent or Expanding Markets

Betsson's strategic sponsorships, like their enhanced collaboration with Racing Club in Argentina, represent key moves to boost brand recognition and customer acquisition in burgeoning markets where their presence is still developing. These efforts are vital for transitioning nascent markets, often categorized as Question Marks in the BCG matrix, into Stars by elevating visibility and encouraging engagement with potential users.

- Argentina's Online Gambling Market Growth: Argentina's online gambling market is projected to reach approximately USD 1.5 billion by 2027, showcasing significant expansion potential for Betsson.

- Racing Club Partnership Impact: The sponsorship with Racing Club, a prominent football club, provides Betsson with access to a vast and passionate fan base, estimated at over 15 million supporters in Argentina.

- Customer Acquisition Cost (CAC) Reduction: Effective sponsorships can help lower customer acquisition costs by leveraging the partner's existing audience and brand equity, making market entry more cost-efficient.

- Brand Awareness Metrics: Post-sponsorship, Betsson can aim for a measurable increase in brand awareness, targeting a 15-20% uplift in aided and unaided recall among the target demographic in Argentina within the first year.

Unrealized Potential of Recently Acquired B2B Assets

The acquisition of Sporting Solutions in Q3 2024 positions Betsson's B2B segment as a Star, but the specific impact of this move is still unfolding. This strategic acquisition, designed to bolster Betsson's sportsbook technology and market reach, represents a significant investment in future growth. The potential for new partnerships and market share expansion is high, yet the tangible results are yet to be fully realized.

This makes the recently acquired B2B assets a classic 'Question Mark' within the BCG Matrix. While the underlying technology and market opportunity suggest strong future performance, the actual market penetration and revenue generation from these new capabilities are still in the nascent stages. Betsson's ability to successfully integrate and leverage Sporting Solutions will be key to transforming this potential into a dominant market position.

- Acquisition Focus: Sporting Solutions acquisition in Q3 2024 aimed to enhance Betsson's B2B sportsbook offerings.

- B2B Segment Status: The overall B2B segment is considered a Star due to its established market presence.

- New Asset Position: The specific impact of the Sporting Solutions acquisition is still developing, placing it as a Question Mark.

- Growth Potential: High growth is anticipated from new capabilities, but market share impact is unproven.

Betsson's ventures in markets like Brazil and Paraguay, where it has recently secured licenses and launched operations, are currently positioned as Question Marks. These markets offer high growth potential, but Betsson's initial market share is low, requiring significant investment to capture value and avoid becoming a 'Dog'.

Strategic partnerships, such as the enhanced collaboration with Racing Club in Argentina, are also considered Question Marks. These initiatives aim to boost brand recognition and customer acquisition in developing markets, with their success hinging on effectively converting market growth into a sustainable customer base.

The B2B segment, specifically the assets acquired through Sporting Solutions in Q3 2024, also fits the Question Mark profile. While the technology and market opportunity are promising, the actual market penetration and revenue generation are still in their early stages, necessitating further investment and strategic integration.

These Question Marks represent opportunities for future growth, but they also carry a degree of uncertainty regarding their return on investment. Betsson's ability to nurture these ventures through strategic resource allocation will be critical in transforming them into Stars.

BCG Matrix Data Sources

Our BCG Matrix is constructed using comprehensive data from Betsson's official financial statements, internal performance metrics, and reputable industry market research reports to provide a clear strategic overview.