BE Semiconductor Industries PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BE Semiconductor Industries Bundle

Uncover the intricate web of external factors shaping BE Semiconductor Industries's trajectory. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental forces that present both opportunities and challenges for this key player in the semiconductor assembly equipment market. Gain a critical understanding of the landscape to inform your strategic decisions.

Ready to anticipate market shifts and capitalize on emerging trends? Our comprehensive PESTLE analysis of BE Semiconductor Industries provides the actionable intelligence you need. Equip yourself with foresight into regulatory changes, economic volatility, and technological advancements. Purchase the full report now and unlock a deeper understanding of their competitive environment.

Political factors

Global trade tensions, especially between the United States and China, continue to cast a long shadow over the semiconductor sector. These ongoing disputes can directly impact BE Semiconductor Industries by disrupting supply chains and limiting market access. For instance, in 2023, the US expanded export controls on advanced semiconductor technology to China, affecting the sales of certain equipment and software.

Such export controls and restrictions on sales to specific nations can significantly alter BE Semiconductor Industries' market reach and its customer base. The company must navigate these complex regulations, which can influence where it can sell its advanced equipment. This dynamic environment necessitates agile strategies to adapt to evolving geopolitical landscapes.

Furthermore, government initiatives focused on reshoring or regionalizing semiconductor manufacturing, such as the US CHIPS and Science Act or similar programs in Europe, are reshaping investment and supply chain strategies. These policies aim to bolster domestic production, potentially creating new opportunities but also requiring companies like BE Semiconductor Industries to re-evaluate their global footprint and operational strategies to align with these national objectives.

Governments globally are actively promoting domestic semiconductor manufacturing through significant financial support. For instance, the US CHIPS and Science Act, signed in August 2022, allocates over $52 billion for domestic chip production and research, while the EU Chips Act aims to mobilize €43 billion in public and private investment by 2030. These substantial incentives, including grants and tax credits, directly benefit equipment manufacturers like BE Semiconductor Industries (Besi) by encouraging customers to invest in new or expanded fabrication facilities.

The stability of international relations is a critical factor for BE Semiconductor Industries (Besi). New alliances or trade blocs can significantly alter global supply chains and market dynamics, impacting Besi's operations and customer access. For instance, the ongoing shifts in global trade policies and the potential for increased protectionism in various regions present a complex landscape for a company with a worldwide customer base like Besi.

Besi's reliance on open trade and predictable political environments means that shifting geopolitical landscapes introduce uncertainties. These uncertainties can affect market access for their advanced semiconductor equipment and potentially impact the operational stability of their manufacturing and service centers located across different continents. For example, trade disputes between major economic powers could lead to tariffs or restrictions that hinder the free flow of goods and technology, directly affecting Besi's business.

Intellectual Property Protection Policies

Intellectual property (IP) protection policies are a significant political factor for BE Semiconductor Industries (Besi). Given Besi's substantial investment in research and development, robust IP laws are essential to safeguard its innovations. Strong patent and trade secret enforcement globally is vital for maintaining Besi's competitive edge.

Weak IP protection in key markets presents a considerable risk. For instance, if countries with developing economies do not adequately enforce IP rights, Besi could face unauthorized replication of its advanced semiconductor equipment, leading to diluted market share and reduced revenue. The World Intellectual Property Organization (WIPO) reported in 2024 that global patent filings continued to rise, indicating an increasing emphasis on IP, but enforcement remains a patchwork across jurisdictions.

- Global IP Enforcement: Besi relies on the effectiveness of patent and trade secret laws in countries where it operates and sells its equipment.

- Risk of Infringement: In regions with lax IP enforcement, there's a higher probability of competitors copying Besi's proprietary technologies.

- Market Share Impact: Unauthorized replication can erode Besi's market position and profitability, as seen in past industry cases where IP theft led to significant financial losses for innovators.

- Regulatory Compliance: Besi must navigate varying IP regulations and ensure its own IP is protected while respecting the IP rights of others.

Regulatory Frameworks and Compliance

Political decisions significantly shape the landscape for companies like BE Semiconductor Industries by introducing new regulatory frameworks. These regulations often target manufacturing processes, labor practices, and environmental standards, directly influencing operational costs and strategic planning. For instance, stricter emissions standards or new worker safety mandates can require substantial investment in updated equipment and training.

Besi operates within a complex international environment, necessitating navigation of a multifaceted web of national and supranational regulations. This includes varying compliance requirements across key markets such as the United States, China, and European Union member states. In 2024, for example, ongoing trade policy shifts and potential tariffs between major economic blocs could necessitate adjustments in supply chain management and market access strategies.

Adherence to these evolving regulatory frameworks is not merely a matter of avoiding fines; it is crucial for maintaining operational licenses and BESI's reputation. Non-compliance can lead to significant penalties, operational disruptions, and damage to brand trust, impacting future sales and partnerships. For example, failing to meet data privacy regulations in certain jurisdictions could result in substantial fines and a loss of customer confidence.

Key regulatory areas impacting BESI include:

- Export Controls: Regulations governing the export of advanced semiconductor manufacturing equipment, particularly concerning national security interests, can impact market access and sales to specific countries.

- Environmental Standards: Compliance with evolving environmental regulations, such as those related to hazardous materials handling, waste disposal, and energy efficiency, is critical for sustainable operations.

- Labor Laws: Adherence to diverse international labor laws regarding working conditions, wages, and employee rights is essential for managing a global workforce.

- Trade Agreements and Tariffs: Changes in international trade policies, including the imposition of tariffs or trade barriers, can directly affect the cost of components and the competitiveness of BESI's products in various markets.

Government incentives, like the US CHIPS Act and the EU Chips Act, are driving significant investment in domestic semiconductor manufacturing. These policies, totaling billions in funding by 2030, directly benefit equipment suppliers like BE Semiconductor Industries (Besi) by encouraging customer expansion. Geopolitical tensions, particularly US-China trade disputes, continue to influence supply chains and market access for Besi's advanced equipment.

Intellectual property protection remains a critical political factor, with Besi relying on robust global enforcement to safeguard its innovations. Weak IP laws in certain markets pose a risk of unauthorized replication, potentially impacting Besi's market share and profitability. Navigating diverse international regulations, from export controls to environmental standards, is essential for Besi's operational integrity and market presence.

What is included in the product

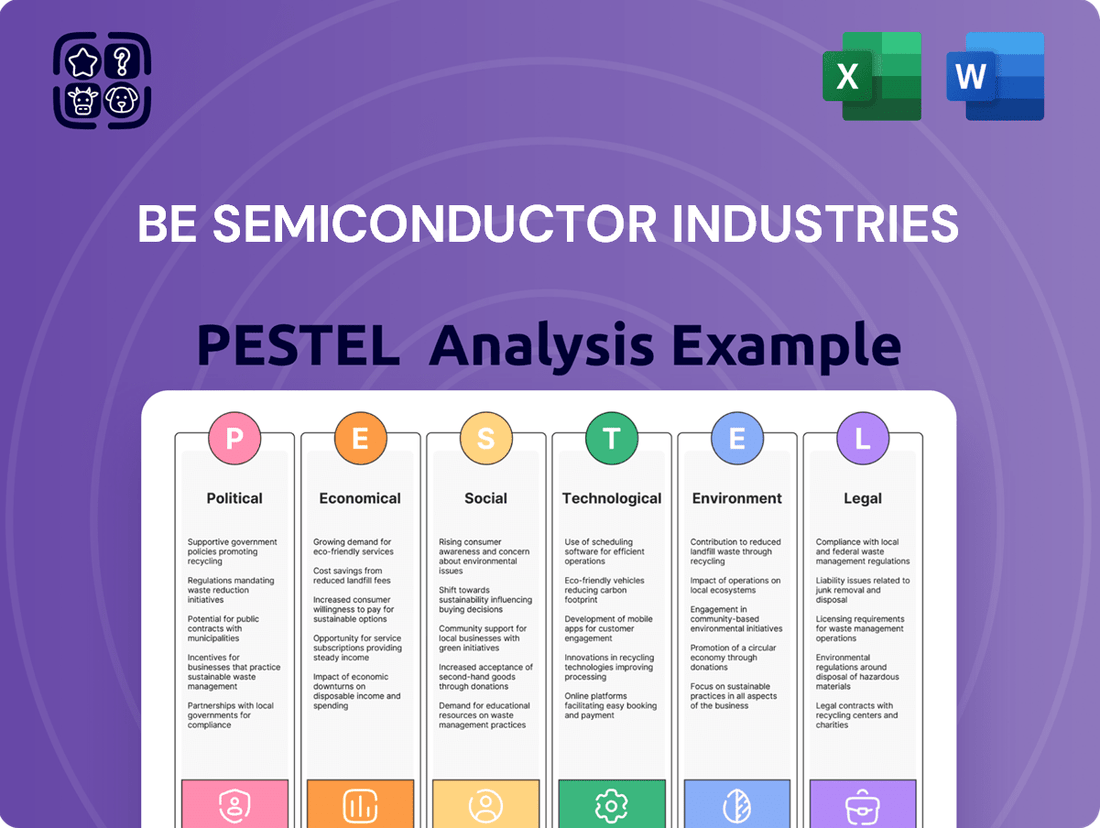

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors influencing BE Semiconductor Industries, detailing how Political, Economic, Social, Technological, Environmental, and Legal forces present both challenges and strategic advantages.

It provides actionable insights and forward-looking perspectives, empowering stakeholders to navigate the dynamic landscape and make informed strategic decisions for sustainable growth.

A PESTLE analysis for BE Semiconductor Industries offers a structured framework to identify and mitigate external threats and opportunities, thereby relieving the pain point of navigating complex and unpredictable market dynamics.

Economic factors

Global economic growth is a critical driver for the electronics industry, directly impacting consumer and business spending on devices. For BE Semiconductor Industries (Besi), this translates into demand for their advanced semiconductor assembly and testing equipment. A robust global economy in 2024 and projected into 2025, with forecasts suggesting continued, albeit potentially moderating, growth, bodes well for increased capital expenditure by chip manufacturers and, consequently, for Besi's equipment sales.

Conversely, economic slowdowns or recessions pose a significant risk. During such periods, both consumers and businesses tend to cut back on discretionary spending, including new electronics. This reduction in demand for end products can lead semiconductor companies to postpone or reduce their own investments in new manufacturing capacity and advanced equipment, directly affecting Besi's order pipeline. For instance, if global GDP growth falters significantly in late 2024 or early 2025, Besi could see a slowdown in demand for its specialized equipment.

Rising inflation directly impacts BE Semiconductor Industries (Besi) by increasing the cost of essential inputs like raw materials, components, and labor. For instance, the US Consumer Price Index (CPI) saw a significant increase in 2023, averaging around 4.1%, which translates to higher operational expenses for Besi. This necessitates careful adjustments to pricing strategies to maintain profitability in a fluctuating cost environment.

Higher interest rates, such as the Federal Reserve's benchmark rate which hovered around 5.25%-5.50% in late 2023 and early 2024, present a dual challenge. Besi faces increased borrowing costs for its own capital expenditures, potentially impacting investment in new manufacturing capabilities. Simultaneously, customers, often semiconductor manufacturers themselves, may face higher financing costs for their own equipment purchases, potentially slowing demand for Besi's advanced systems.

These economic shifts collectively influence market liquidity and investor sentiment. When interest rates are elevated, the attractiveness of fixed-income investments rises, potentially drawing capital away from growth-oriented sectors like semiconductor manufacturing equipment. This can lead to a more cautious investment climate, affecting Besi's ability to secure funding and influencing overall market demand for its products.

Global supply chain disruptions, exemplified by the semiconductor shortages of 2020-2022, directly affect BE Semiconductor Industries (Besi) by hindering component sourcing and product delivery timelines. These events underscore the critical need for robust supply chain management.

Fluctuations in raw material costs present a significant economic challenge. For instance, the price of copper, a key component in electronics, saw considerable volatility in 2023, impacting manufacturing expenses for companies like Besi. Similarly, the cost of specialized chemicals used in semiconductor manufacturing can experience sharp increases.

Ensuring supply chain resilience and effectively managing these input costs are paramount for Besi's economic viability. In 2024, continued geopolitical tensions and shifts in global trade policies are expected to maintain pressure on raw material prices and supply chain stability, requiring proactive strategies from Besi.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant challenge for BE Semiconductor Industries (Besi), a Dutch company with extensive global operations. As Besi conducts business and generates revenue in numerous currencies, fluctuations in exchange rates directly affect its reported financial performance when these earnings are translated back into its reporting currency, the euro. For instance, a strengthening euro against currencies where Besi has substantial sales can reduce its reported revenue and profit margins.

The impact of these currency shifts is not merely theoretical. In 2023, while Besi reported robust revenue growth, the specific impact of currency translation on its earnings would have been a key consideration for investors. Companies like Besi often employ sophisticated hedging strategies to mitigate the financial risks associated with these currency movements. These strategies can involve forward contracts or options to lock in exchange rates for future transactions, thereby providing greater predictability in financial results.

Effective currency risk management is therefore crucial for Besi's financial stability and profitability. The company's ability to navigate these fluctuations can significantly influence its bottom line. For example, if the US dollar weakens considerably against the euro, Besi's dollar-denominated profits would translate into fewer euros, potentially impacting its reported earnings per share. Conversely, a weaker euro could boost its euro-denominated profits from sales in dollar markets.

- Revenue Impact: Fluctuations in exchange rates can alter the euro value of Besi's foreign currency revenues, affecting reported sales figures.

- Cost Management: Similarly, costs incurred in foreign currencies are subject to translation risk, impacting Besi's cost of goods sold and operating expenses.

- Profitability: Significant currency swings can compress or expand Besi's profit margins, making consistent financial forecasting more challenging.

- Hedging Importance: Besi's reliance on currency hedging strategies is vital for stabilizing financial outcomes and protecting against adverse currency movements.

Semiconductor Market Cycles

The semiconductor industry is inherently cyclical, experiencing booms and busts driven by a complex interplay of factors. These cycles are often exacerbated by inventory build-ups and subsequent corrections, as well as the rapid pace of technological innovation that can render existing products obsolete. Macroeconomic shifts, such as changes in consumer spending or global trade policies, also play a significant role in demand fluctuations.

Besi's financial performance is directly tied to these semiconductor market cycles. For instance, during periods of high demand, such as the surge in chip manufacturing seen in 2021 which contributed to record revenues for many players, Besi's order books and sales tend to be robust. Conversely, during downturns, like the anticipated slowdown in certain segments of the memory market in late 2023 and early 2024, Besi's growth can be tempered.

- Inventory Adjustments: Overstocking by chip manufacturers leads to reduced orders for equipment, impacting Besi's sales.

- Technological Transitions: Shifts to new process nodes or chip architectures can create demand spikes for specialized equipment.

- Macroeconomic Conditions: Global economic health influences demand for end products like smartphones and vehicles, which in turn affects chip demand.

- Industry Growth Forecasts: While the semiconductor market is projected to grow, with some analysts forecasting a compound annual growth rate (CAGR) of over 6% through 2030, the cyclical nature means this growth will not be linear.

Global economic growth directly impacts demand for BE Semiconductor Industries' (Besi) advanced semiconductor assembly and testing equipment. Forecasts for 2024 and 2025 suggest continued, albeit potentially moderating, global GDP growth, which should support increased capital expenditure by chip manufacturers, benefiting Besi. However, any significant economic slowdown in late 2024 or early 2025 could lead to postponed investments by Besi's customers, impacting its order pipeline.

Rising interest rates, with the US Federal Reserve's benchmark rate around 5.25%-5.50% in early 2024, increase borrowing costs for both Besi and its customers, potentially dampening demand for new equipment. Currency exchange rate volatility also poses a risk, as fluctuations can affect the euro value of Besi's foreign revenues and profitability. For instance, a stronger euro against the US dollar would reduce the euro-equivalent of dollar-denominated profits.

The semiconductor industry's inherent cyclicality, driven by inventory adjustments and technological shifts, directly influences Besi's performance. While the industry is projected for growth, this expansion will not be linear, meaning Besi will experience periods of strong demand and potential slowdowns. For example, the memory market experienced a downturn in late 2023 and early 2024, which would have tempered demand for certain types of assembly equipment.

| Economic Factor | Impact on Besi | Data Point/Trend (2023-2025) |

| Global GDP Growth | Drives demand for semiconductor equipment | Projected moderate growth in 2024-2025, but potential slowdown risk |

| Interest Rates | Increases borrowing costs for Besi and customers | US Fed rate ~5.25%-5.50% (late 2023-early 2024) |

| Currency Exchange Rates | Affects reported revenue and profitability | Volatile, e.g., EUR/USD fluctuations |

| Semiconductor Industry Cycle | Influences order volumes and growth | Cyclicality persists, with some segments (memory) experiencing downturns in late 2023/early 2024 |

What You See Is What You Get

BE Semiconductor Industries PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of BE Semiconductor Industries.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting BE Semiconductor Industries.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the strategic landscape for BE Semiconductor Industries.

Sociological factors

The semiconductor sector, including companies like BE Semiconductor Industries (Besi), relies heavily on a highly specialized workforce, encompassing engineers, scientists, and technicians. A significant global shortage of qualified talent, especially in advanced areas like chip packaging and automation, presents a considerable hurdle for Besi's ability to recruit and retain essential personnel.

Demographic trends, such as an aging workforce in key manufacturing regions, further intensify this talent scarcity. For instance, in 2024, reports indicated a growing demand for semiconductor engineers, with projections suggesting a deficit of tens of thousands of workers globally by 2030.

Societal trends are a powerful engine for the semiconductor industry, with consumers increasingly embracing smart devices, artificial intelligence, electric vehicles, and the Internet of Things (IoT). This growing reliance on connected technologies directly fuels the demand for the sophisticated semiconductor devices that power them.

For BE Semiconductor Industries (BESI), this translates into a critical need to align product development and market strategy with these evolving consumer preferences. For instance, the global smart home market, a significant driver of IoT adoption, was projected to reach over $150 billion in 2024, underscoring the vast opportunity for semiconductor equipment manufacturers like BESI.

Societal expectations for corporate social responsibility are significantly shaping how companies like BE Semiconductor Industries (Besi) operate and are viewed. There's a growing demand for businesses to go beyond just profits and actively contribute to societal well-being.

Besi is increasingly expected to showcase ethical labor practices throughout its supply chain, ensure responsible sourcing of materials, and demonstrate a clear commitment to environmental sustainability. This includes areas like reducing carbon emissions and waste management, aligning with global sustainability goals.

For instance, in 2023, the global ESG (Environmental, Social, and Governance) investing market was valued in the trillions, indicating a strong investor preference for companies with robust CSR initiatives. By adhering to strong CSR principles, Besi can enhance its brand reputation, making it more attractive to socially conscious investors and top talent, a crucial factor in the competitive semiconductor industry.

Changing Work Patterns and Automation Impact

Societal trends are increasingly favoring flexible work arrangements, with remote and hybrid models becoming more prevalent. This shift impacts how manufacturing companies, including those in the semiconductor equipment sector like BE Semiconductor Industries (Besi), attract and retain talent. For instance, a 2024 survey indicated that over 60% of employees prefer hybrid work, influencing recruitment strategies for even factory-based roles where possible.

Automation, a core component of Besi's business, is profoundly reshaping manufacturing. While driving efficiency, it necessitates a workforce equipped with new skills, particularly in areas like data analytics and advanced machinery operation. By 2025, the World Economic Forum projects that automation will create 97 million new jobs globally, but also displace 85 million, highlighting the critical need for reskilling and upskilling within the manufacturing sector.

Adapting to these evolving work patterns is paramount for Besi's operational success and talent acquisition. Companies that embrace flexible approaches and invest in training for the automated future are better positioned to secure the skilled workforce needed to operate sophisticated semiconductor manufacturing equipment.

- Flexible Work Demand: Over 60% of employees expressed a preference for hybrid work models in 2024 surveys, impacting talent attraction.

- Automation's Dual Impact: While driving efficiency, automation demands new skill sets in manufacturing, with 97 million new jobs projected by 2025, alongside 85 million displacements.

- Talent Retention Strategy: Companies adapting to flexible work and investing in reskilling initiatives are more likely to attract and retain essential talent in the evolving industrial landscape.

Education and Innovation Ecosystems

The quality and focus of education systems in key regions directly impact the availability of future talent for the semiconductor industry. Regions with robust academic and research ecosystems are more likely to foster innovation and supply a steady stream of skilled professionals. BE Semiconductor Industries, or Besi, thrives in and actively supports environments that emphasize science, technology, engineering, and mathematics (STEM) education.

For instance, in 2024, countries like South Korea, Taiwan, and the Netherlands, where Besi has significant operations or customer bases, continue to invest heavily in STEM education. South Korea's Ministry of Science and ICT announced plans in early 2024 to increase the number of university graduates in AI and semiconductor fields by 15% by 2027, aiming to address critical talent shortages. Similarly, Taiwan's National Science and Technology Council reported a 10% rise in semiconductor-related research publications between 2022 and 2023, highlighting a strong link between academic output and industry needs.

- Talent Pipeline: Educational focus on STEM fields directly shapes the pool of qualified engineers and researchers available to Besi and its clients.

- Innovation Hubs: Strong university-industry collaborations, often fueled by government research grants, create fertile ground for new technologies and process improvements.

- Regional Strengths: Countries with established semiconductor research institutions and specialized university programs offer a competitive advantage in talent acquisition.

- Future Investment: Ongoing government and private sector investments in educational infrastructure and curriculum development are crucial for sustained industry growth.

Societal expectations for corporate social responsibility are increasingly influencing BE Semiconductor Industries (Besi). There's a growing demand for ethical labor practices, responsible sourcing, and a tangible commitment to environmental sustainability, including carbon emission reduction and waste management. By 2023, the global ESG investing market was valued in the trillions, highlighting investor preference for companies with strong CSR initiatives, which can boost Besi's brand reputation and appeal to both investors and top talent.

The growing consumer embrace of smart devices, AI, EVs, and IoT directly fuels demand for the sophisticated semiconductors Besi's equipment produces. The global smart home market, a key IoT driver, was projected to exceed $150 billion in 2024, presenting a significant opportunity for semiconductor equipment manufacturers like Besi to align product development with these evolving preferences.

Societal trends favor flexible work arrangements, impacting talent attraction for companies like Besi. In 2024, over 60% of employees preferred hybrid models, a factor Besi must consider in its recruitment strategies, even for roles that may require some on-site presence.

Automation, central to Besi's offerings, is transforming manufacturing by demanding new skills in areas like data analytics and advanced machinery operation. The World Economic Forum projected in 2025 that automation would create 97 million new jobs globally while displacing 85 million, emphasizing the critical need for reskilling within the sector.

Technological factors

The relentless pursuit of smaller, more potent, and energy-saving electronics is a major technological driver, directly impacting the semiconductor industry. This trend fuels the demand for sophisticated semiconductor packaging solutions, an area where BE Semiconductor Industries (BESI) excels.

BESI's expertise lies in providing advanced assembly equipment crucial for achieving miniaturization and heterogeneous integration. For instance, the company's die-attach equipment supports the growing demand for complex chiplets, a key aspect of heterogeneous integration. This focus positions technological advancements in packaging as central to BESI's business model and future expansion.

The increasing integration of Artificial Intelligence (AI) and Machine Learning (ML) into semiconductor manufacturing is a significant technological driver for BE Semiconductor Industries. These advanced technologies are revolutionizing processes by boosting efficiency, improving product yield, and enabling sophisticated predictive maintenance for manufacturing equipment. For instance, AI can analyze vast datasets from production lines to identify subtle anomalies that might lead to defects, allowing for proactive adjustments and reducing waste.

Besi's equipment is well-positioned to capitalize on this trend. By embedding AI capabilities, their tools can offer customers more intelligent and autonomous solutions, optimizing operational parameters in real-time for enhanced performance. This means machines can learn from their own operations and adapt to changing conditions, leading to more consistent output and reduced downtime. This technological advancement directly fuels the demand for more advanced and automated semiconductor assembly equipment.

The semiconductor industry is heavily influenced by automation and robotics, driving significant gains in efficiency and precision on assembly lines. This trend is crucial for manufacturers aiming to boost throughput and lower operational expenses. Besi's advanced automated solutions are designed to meet these demands, offering enhanced manufacturing consistency for their clients worldwide.

Development of New Materials and Processes

Innovation in semiconductor technology is fundamentally driven by the creation and implementation of novel materials and sophisticated manufacturing processes. Besi's competitive edge hinges on its ability to evolve its equipment to effectively manage these new materials and facilitate emerging fabrication methods, thereby maintaining alignment with the forefront of chip manufacturing.

The relentless pursuit of smaller, faster, and more energy-efficient chips necessitates breakthroughs in materials science, such as advanced compound semiconductors and novel deposition techniques. For instance, the increasing adoption of gallium nitride (GaN) and silicon carbide (SiC) for power electronics, which offer superior performance characteristics, requires specialized handling and processing capabilities from equipment manufacturers like Besi. By 2024, the global market for GaN power devices was projected to reach over $2 billion, highlighting the growing demand for technologies that can support these advanced materials.

- Advancements in materials science, like the use of 2D materials, are pushing the boundaries of semiconductor performance.

- Besi's equipment must adapt to handle new materials such as GaN and SiC, crucial for next-generation power electronics.

- The semiconductor industry's investment in R&D for new processes, including advanced lithography and packaging, directly impacts equipment requirements.

Rise of High-Performance Computing and Data Centers

The relentless surge in data generation and the escalating need for robust high-performance computing (HPC) power are fundamentally reshaping the semiconductor landscape. This trend directly fuels the expansion of cloud infrastructure and data centers globally, creating a substantial demand for advanced semiconductor solutions.

BE Semiconductor Industries (Besi) plays a critical role in this ecosystem. Their sophisticated assembly solutions are indispensable for manufacturing the cutting-edge processors and memory chips that underpin these data-intensive applications. This ensures Besi's continued relevance and growth as these sectors expand.

The global data center market size was valued at approximately $240.5 billion in 2023 and is projected to reach $582.3 billion by 2030, exhibiting a compound annual growth rate of 13.5%. This expansion necessitates a proportional increase in semiconductor production capacity.

- Data Growth: Global data creation is expected to exceed 295 zettabytes by 2025, a significant increase from previous years.

- HPC Demand: The HPC market is anticipated to grow at a CAGR of over 7% through 2027, driven by AI, scientific research, and big data analytics.

- Cloud Infrastructure: Spending on cloud infrastructure services reached $233.5 billion in 2023, highlighting the critical need for the underlying semiconductor components.

- Besi's Role: Besi's advanced packaging technologies are crucial for enabling the higher density and performance required by chips used in these high-demand environments.

The increasing sophistication of semiconductor manufacturing processes, such as advanced lithography and heterogeneous integration, directly influences the equipment BESI provides. The industry's commitment to research and development in these areas necessitates continuous innovation in assembly solutions to accommodate new chip architectures and functionalities.

The adoption of novel materials like Gallium Nitride (GaN) and Silicon Carbide (SiC) for power electronics is a key technological trend, requiring specialized handling and processing capabilities from equipment manufacturers. For instance, the global market for GaN power devices was projected to exceed $2 billion in 2024, underscoring the demand for technologies supporting these advanced materials.

Advancements in AI and machine learning are being integrated into semiconductor manufacturing to boost efficiency and yield. BESI's equipment is evolving to incorporate these AI capabilities, offering customers more intelligent and autonomous solutions for optimized operational parameters.

The relentless pursuit of smaller, faster, and more energy-efficient chips drives innovation in materials science and manufacturing processes. BESI's competitive edge relies on adapting its equipment to effectively manage new materials and emerging fabrication methods, ensuring alignment with the forefront of chip manufacturing.

| Technological Factor | Impact on Semiconductor Industry | Besi's Role/Opportunity |

| Miniaturization & Heterogeneous Integration | Demand for smaller, more powerful, and energy-efficient electronics. | BESI's die-attach equipment supports complex chiplets for heterogeneous integration. |

| AI & Machine Learning in Manufacturing | Increased efficiency, improved yield, and predictive maintenance. | Besi's equipment can embed AI for intelligent, autonomous solutions. |

| Advanced Materials (GaN, SiC) | Need for specialized handling and processing for power electronics. | Besi must adapt equipment to manage GaN and SiC, supporting a market projected over $2 billion in 2024. |

Legal factors

BE Semiconductor Industries' global operations mean it's deeply affected by international trade laws and tariffs. For instance, the World Trade Organization (WTO) reported that global trade growth slowed to just 0.6% in 2023, down from 5.3% in 2022, highlighting increased protectionism. Changes in these regulations, such as new import duties or export controls, can significantly impact the cost and accessibility of BE Semiconductor's equipment in key markets.

Navigating these complex legal landscapes is crucial for BE Semiconductor to maintain smooth cross-border operations. Failure to comply with varying customs regulations or trade agreements could lead to substantial fines, shipping delays, or even outright market access restrictions. For example, the US-China trade tensions have led to increased scrutiny and tariffs on technology goods, directly impacting supply chains and market strategies for companies like BE Semiconductor.

Environmental regulations are becoming more demanding, affecting how BE Semiconductor Industries designs and manufactures its products. Laws like RoHS and REACH, which restrict hazardous substances, and WEEE, which governs waste electrical and electronic equipment, are key examples.

Compliance with these regulations isn't just about staying legal; it's also a way for Besi to show it's committed to being environmentally responsible. For instance, in 2024, the European Union continued to strengthen its Green Deal initiatives, pushing for greater circularity and reduced chemical footprints across manufacturing sectors.

Besi, as a global player, navigates a complex web of labor laws across its operating regions, including Europe, Asia, and North America. These regulations dictate everything from standard working hours and minimum wage requirements to stringent workplace safety protocols and comprehensive employee rights, encompassing non-discrimination policies.

Failure to adhere to these diverse legal frameworks can lead to significant financial penalties, protracted legal battles, and severe damage to Besi's corporate reputation. For instance, in 2024, the European Union continued to emphasize stricter enforcement of worker protections, with countries like Germany imposing fines for non-compliance with working time directives.

Intellectual Property Rights and Patent Law

Intellectual property rights are crucial for BE Semiconductor Industries (Besi) to maintain its edge in advanced semiconductor assembly and testing equipment. Protecting its innovations through patents, trade secrets, and copyrights across its global operations is essential for preserving its competitive advantage. Besi's reliance on proprietary technology means that robust legal frameworks for intellectual property enforcement are vital to deter infringement and safeguard the exclusivity of its technological advancements.

The evolving landscape of intellectual property law directly impacts Besi's ability to innovate and market its solutions. For instance, in 2023, the global semiconductor industry saw significant investment in R&D, with major players allocating billions to develop next-generation technologies, underscoring the importance of IP protection. Navigating varying patentability standards and enforcement mechanisms across jurisdictions, such as the US, Europe, and Asia, requires diligent legal strategy.

- Patent Protection: Besi's core business relies on patented technologies in areas like wafer handling, die attach, and packaging.

- Trade Secret Management: Safeguarding proprietary manufacturing processes and design blueprints is critical for maintaining a technological lead.

- Copyright Enforcement: Protecting the intellectual property embedded in its software and control systems is equally important.

- Global IP Strategy: Besi must continuously adapt its legal approach to comply with and leverage intellectual property laws in over 30 countries where it operates.

Data Privacy Regulations

Besi's global footprint necessitates strict adherence to diverse data privacy regulations, including the GDPR in Europe and similar frameworks like the California Consumer Privacy Act (CCPA) in the United States. Failure to comply can result in significant fines, with GDPR penalties reaching up to 4% of annual global turnover or €20 million, whichever is higher. This legal imperative demands robust data security protocols and transparent privacy policies to safeguard sensitive customer and employee information.

Key considerations for Besi regarding data privacy:

- GDPR Compliance: Ensuring all data processing activities within the EU meet GDPR standards, including consent mechanisms and data subject rights.

- Global Data Transfer: Navigating complex rules for transferring personal data across international borders, often requiring specific contractual clauses or certifications.

- Cybersecurity Investments: Allocating resources to advanced cybersecurity measures to prevent data breaches and unauthorized access, a critical legal and reputational concern.

BE Semiconductor Industries (Besi) operates within a dynamic legal framework that significantly shapes its global business strategy and operational costs. International trade laws and tariffs, for instance, directly influence the pricing and market access of its advanced semiconductor equipment, with global trade growth slowing to 0.6% in 2023, signaling increased protectionism.

Compliance with varying customs regulations and trade agreements is paramount to avoid substantial fines, shipping disruptions, and market access limitations, as exemplified by the impact of US-China trade tensions on technology goods supply chains.

Environmental regulations, such as RoHS, REACH, and WEEE, are increasingly stringent, compelling Besi to adapt its product design and manufacturing processes to minimize hazardous substances and promote circularity, a trend reinforced by the EU's continued focus on its Green Deal initiatives in 2024.

The company's global workforce is subject to diverse labor laws, covering working hours, wages, safety, and employee rights, with non-compliance risking significant financial penalties and reputational damage, as seen in stricter enforcement of worker protections in the EU during 2024.

Intellectual property protection is critical for Besi's technological leadership, necessitating robust legal strategies to safeguard patents and trade secrets amidst a competitive landscape where R&D investment reached billions in 2023, underscoring the value of IP.

Data privacy regulations like GDPR and CCPA impose strict requirements on handling sensitive information, with GDPR penalties potentially reaching 4% of annual global turnover, making cybersecurity investments and transparent policies a legal and reputational necessity for Besi.

| Legal Factor | Impact on BE Semiconductor Industries | Relevant Data/Trend (2023-2025) |

| International Trade Laws & Tariffs | Affects cost, market access, and supply chain stability. | Global trade growth slowed to 0.6% in 2023; increased protectionism. |

| Environmental Regulations (RoHS, REACH, WEEE) | Drives product design and manufacturing process adaptation. | EU Green Deal initiatives pushing for greater circularity (2024). |

| Labor Laws | Dictates working conditions, safety, and employee rights; non-compliance leads to penalties. | Stricter enforcement of worker protections in the EU (2024). |

| Intellectual Property Rights | Crucial for competitive advantage and safeguarding innovation. | Semiconductor R&D investment reached billions in 2023. |

| Data Privacy Regulations (GDPR, CCPA) | Requires robust data security and transparent policies; significant penalties for breaches. | GDPR fines up to 4% of annual global turnover. |

Environmental factors

Semiconductor manufacturing, including assembly, is notoriously energy-intensive. BE Semiconductor Industries (Besi) plays a role in this as its equipment is utilized by its customers, directly contributing to their overall energy consumption.

The global push towards sustainability and net-zero emissions is intensifying. This pressure is a significant driver for the semiconductor industry, creating a strong demand for more energy-efficient equipment and the adoption of sustainable manufacturing practices throughout the entire supply chain.

For instance, the European Union's Green Deal aims for climate neutrality by 2050, impacting manufacturing sectors like semiconductors. Companies are increasingly evaluating the energy efficiency of their production lines, making it a key factor in equipment purchasing decisions.

BE Semiconductor Industries, like all semiconductor manufacturers, navigates a complex landscape of waste management and hazardous materials. The assembly process inherently uses and generates substances that require careful handling to meet stringent environmental regulations. For instance, in 2024, the global semiconductor manufacturing industry faced increasing scrutiny over its environmental footprint, with a particular focus on chemical waste and water usage, highlighting the need for robust compliance strategies.

Besi's commitment extends beyond its own operational waste, encompassing the design of equipment that aids its customers in managing their waste streams more effectively. This focus on supporting customer sustainability efforts aligns with the growing adoption of circular economy principles within the tech sector. Data from 2025 indicates a significant push by major electronics manufacturers towards closed-loop systems, aiming to minimize raw material consumption and waste generation throughout the product lifecycle.

Water is absolutely essential for semiconductor manufacturing, especially during the intricate fabrication processes where it's used for cleaning and cooling. While BE Semiconductor Industries (Besi) itself might not have the same direct water usage as a chip fabrication plant, the semiconductor industry as a whole is under increasing pressure to manage its water consumption responsibly.

Besi's role could be indirect. By developing and supplying more efficient manufacturing equipment, they can help their customers reduce their overall water footprint. Furthermore, as a key player in the supply chain, Besi is part of an ecosystem that must proactively address growing concerns around water scarcity in many manufacturing regions.

Climate Change Impacts on Supply Chains

Climate change is increasingly disrupting global supply chains, a significant concern for companies like BE Semiconductor Industries (Besi). The rising frequency and intensity of extreme weather events, such as floods, droughts, and storms, directly impact Besi's ability to procure essential components and deliver finished products to its customers. For instance, the World Meteorological Organization reported that 2023 was the warmest year on record, with numerous extreme weather events causing widespread infrastructure damage and transportation delays worldwide.

Adapting to these physical risks and proactively building supply chain resilience are no longer optional but critical for long-term business continuity. Besi must consider how to mitigate the impact of climate-related disruptions on its operations and its suppliers. This involves diversifying sourcing locations, investing in more robust logistics, and potentially exploring alternative materials or manufacturing processes that are less vulnerable to environmental shocks.

- Supply Chain Vulnerability: Extreme weather events directly threaten the flow of goods and materials, impacting production schedules and delivery times for semiconductor equipment manufacturers like Besi.

- Increased Operational Costs: Disruptions can lead to higher transportation costs, expedited shipping fees, and the need for emergency inventory management, all of which affect profitability.

- Resilience Investment: Companies are increasingly investing in supply chain mapping, risk assessment tools, and backup logistics to counter climate-related vulnerabilities, with a growing focus on sustainability reporting in 2024 and beyond.

Sustainable Manufacturing Practices and Certifications

Growing environmental consciousness among stakeholders is a significant driver for companies like BE Semiconductor Industries (Besi) to adopt sustainable manufacturing practices. This heightened awareness translates into increased demand for products and services that minimize environmental impact. For instance, in 2024, the global market for sustainable manufacturing technologies was projected to reach over $30 billion, indicating a strong and growing trend.

Besi faces pressure to integrate eco-friendly designs, utilize sustainable materials in its production processes, and actively pursue recognized environmental certifications for both its operations and its advanced semiconductor equipment. This commitment is not just about compliance; it's increasingly becoming a competitive advantage. Companies demonstrating robust sustainability initiatives often see improved brand reputation and stronger customer loyalty.

- Demand for Sustainability: Stakeholder pressure is pushing for greener manufacturing, influencing purchasing decisions.

- Eco-Friendly Design & Materials: Besi is encouraged to incorporate environmentally sound principles in product development and material sourcing.

- Environmental Certifications: Pursuing certifications like ISO 14001 can validate Besi's environmental management systems.

- Market Appeal & Regulation: Sustainability efforts enhance market appeal and ensure adherence to evolving environmental regulations, potentially avoiding penalties and opening new market opportunities.

The semiconductor industry's energy intensity presents a direct environmental consideration for BE Semiconductor Industries (Besi), as its equipment contributes to customer energy consumption. Global sustainability mandates, like the EU's Green Deal targeting climate neutrality by 2050, are increasing demand for energy-efficient solutions, making this a key factor in purchasing decisions for 2024 and beyond.

Waste management and the use of hazardous materials are critical environmental challenges for Besi and the broader semiconductor sector. In 2024, the industry faced heightened scrutiny over chemical waste and water usage, necessitating robust compliance strategies and a focus on circular economy principles, with major manufacturers pushing for closed-loop systems by 2025.

Climate change poses significant supply chain risks for Besi, with extreme weather events impacting logistics and procurement. The World Meteorological Organization reported 2023 as the warmest year on record, underscoring the need for resilience investments, supply chain mapping, and risk assessment tools to mitigate climate-related disruptions.

Growing stakeholder environmental consciousness is driving demand for sustainable practices, pushing Besi towards eco-friendly designs and materials. The global market for sustainable manufacturing technologies was projected to exceed $30 billion in 2024, highlighting the competitive advantage of strong environmental, social, and governance (ESG) initiatives.

| Environmental Factor | Impact on Besi | Industry Trend (2024-2025) | Besi's Response/Opportunity |

|---|---|---|---|

| Energy Consumption | Equipment contributes to customer energy use. | Increasing demand for energy-efficient equipment. | Develop and market more energy-saving solutions. |

| Waste & Hazardous Materials | Assembly processes involve and generate regulated substances. | Heightened scrutiny on chemical waste; push for circular economy. | Design equipment to aid customer waste management; adopt sustainable materials. |

| Climate Change & Extreme Weather | Disrupts supply chains, procurement, and delivery. | Growing investment in supply chain resilience and risk assessment. | Diversify sourcing, enhance logistics, build operational robustness. |

| Stakeholder Environmental Consciousness | Drives demand for sustainable products and practices. | Market for sustainable manufacturing tech projected over $30 billion (2024). | Integrate eco-friendly design, pursue environmental certifications, enhance brand reputation. |

PESTLE Analysis Data Sources

Our BE Semiconductor Industries PESTLE Analysis is built on a robust foundation of data from leading economic institutions, government policy databases, and reputable industry research firms. We incorporate insights from global trade reports, technological advancement forecasts, and environmental impact assessments to ensure comprehensive coverage.