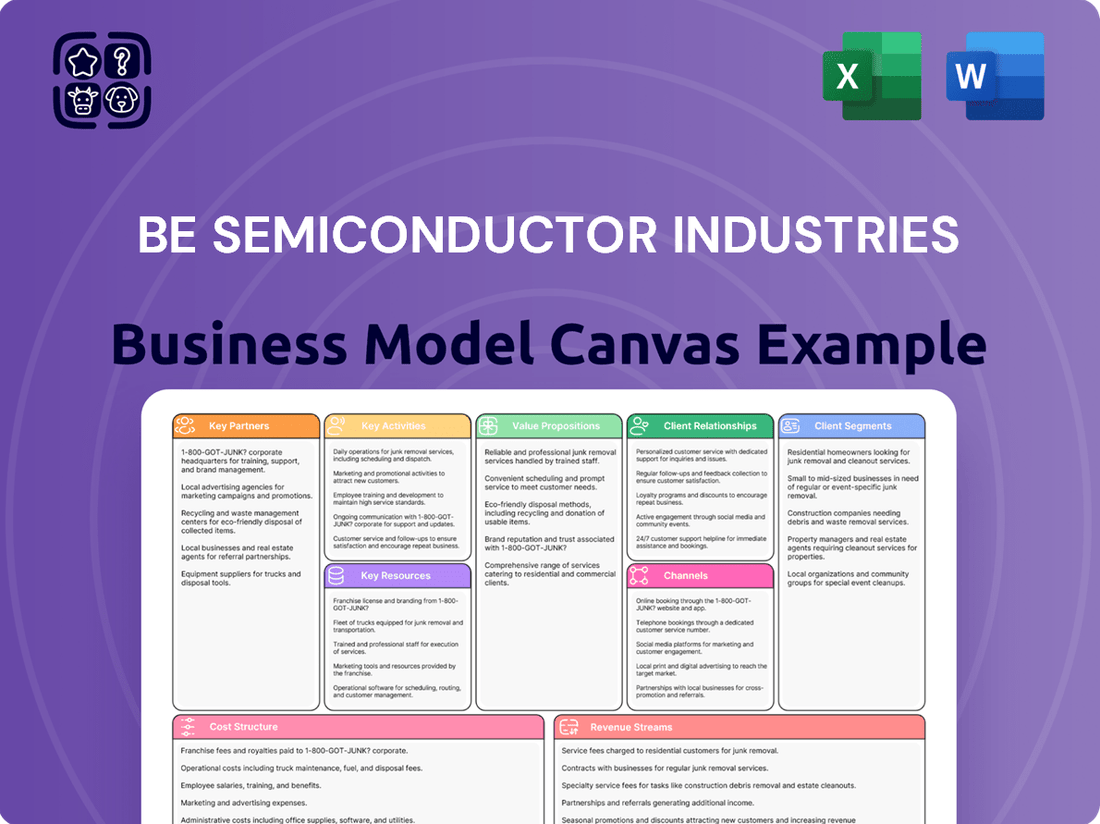

BE Semiconductor Industries Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BE Semiconductor Industries Bundle

Unlock the strategic core of BE Semiconductor Industries with our comprehensive Business Model Canvas. This detailed breakdown illuminates their unique value proposition, key customer segments, and robust revenue streams, offering a clear view of their market dominance. Discover the intricate workings of a leader in semiconductor manufacturing.

Want to dissect the success of BE Semiconductor Industries? Our full Business Model Canvas provides an in-depth look at their customer relationships, cost structure, and key resources, essential for anyone studying or competing in the semiconductor industry. Download it now to gain a competitive edge.

Gain unparalleled insight into BE Semiconductor Industries's operational excellence with our complete Business Model Canvas. This professionally crafted document details their channels, key activities, and competitive advantages, making it an indispensable tool for strategic analysis and learning. Elevate your understanding of their business blueprint.

Partnerships

Besi actively cultivates strategic alliances with prominent technology firms within the semiconductor industry. A prime example is their co-development agreement with Applied Materials, focusing on integrated hybrid bonding solutions. This collaboration is designed to propel innovation in advanced logic and memory chip manufacturing.

This strategic partnership is further solidified by Applied Materials’ acquisition of a 9% stake in Besi in April 2025. Such alliances are fundamental for Besi to enhance its capabilities in intricate chip design processes and scale up high-volume manufacturing, ensuring they remain at the forefront of technological advancements.

Besi's supplier and manufacturing partnerships are crucial. They depend on a diverse network of suppliers providing specialized components and raw materials for their sophisticated semiconductor assembly equipment. For instance, in 2023, the semiconductor equipment industry saw significant investment, with global capital expenditures by chipmakers reaching hundreds of billions of dollars, highlighting the demand for Besi's offerings and the importance of their supply chain.

Furthermore, Besi strategically outsources a portion of its manufacturing to affiliated companies, notably in Malaysia and China. This approach allows them to optimize their global production footprint and capitalize on regional manufacturing strengths and cost efficiencies. This distributed manufacturing model was particularly evident in 2024, as companies sought to diversify their production bases to mitigate geopolitical risks and ensure supply chain resilience.

Besi actively collaborates with leading universities and research institutions to drive innovation in semiconductor manufacturing. These partnerships are crucial for staying ahead in scientific discovery and emerging technologies, such as advanced materials and next-generation packaging. For instance, in 2024, Besi continued its engagement with several European universities focusing on research into novel deposition techniques and advanced metrology, areas critical for future semiconductor advancements.

Industry consortia and standards bodies

Besi's engagement with industry consortia and standards bodies is crucial for shaping the future of semiconductor manufacturing. By actively participating, Besi influences technology roadmaps, ensuring that its equipment and processes align with evolving industry needs and foster interoperability. For instance, in 2024, Besi continued its involvement in key organizations driving advancements in advanced packaging technologies, a sector expected to see significant growth driven by AI and high-performance computing demands.

Collaborating with both peers and competitors within these groups allows Besi to drive the adoption of new assembly processes and establish industry best practices. This collective effort helps accelerate innovation and address common challenges, such as yield improvement and cost reduction in complex manufacturing environments. Such partnerships are vital for maintaining a competitive edge and ensuring that Besi's solutions remain at the forefront of technological development.

These collaborations also provide a platform for tackling broader industry opportunities and challenges. For example, discussions within these bodies in 2024 focused on supply chain resilience and sustainability initiatives, areas where unified action can yield significant benefits for the entire semiconductor ecosystem.

- Influence Technology Roadmaps: Besi's participation in groups like SEMI (Semiconductor Equipment and Materials International) directly impacts the direction of future semiconductor manufacturing technologies, ensuring alignment with market trends.

- Promote Interoperability: By contributing to standards development, Besi helps guarantee that its equipment can seamlessly integrate with other systems in the semiconductor supply chain.

- Accelerate Process Adoption: Collaborative efforts within consortia facilitate the faster acceptance and implementation of novel assembly techniques, benefiting the entire industry.

- Address Industry Challenges: Working with other stakeholders allows for the pooling of resources and knowledge to overcome common hurdles, such as increasing manufacturing efficiency and reducing waste.

Customer co-development initiatives

Besi actively partners with its top-tier customers, such as major integrated device manufacturers and foundries, to create customized assembly solutions. This direct engagement ensures their equipment is precisely engineered for the evolving demands of advanced packaging, including sophisticated 2.5D and 3D structures.

These co-development efforts are crucial for aligning Besi's technological advancements with specific customer requirements, directly impacting their ability to serve cutting-edge semiconductor applications. For instance, in 2024, Besi reported that a significant portion of its new product revenue was directly attributable to solutions developed in collaboration with key clients, highlighting the financial impact of these partnerships.

- Customer co-development initiatives foster innovation by directly addressing specific, advanced packaging needs.

- This collaboration ensures Besi's equipment aligns with the evolving technological roadmaps of leading semiconductor manufacturers.

- Such partnerships are vital for maintaining market leadership and driving revenue growth, with a notable percentage of new product sales in 2024 stemming from these joint efforts.

Besi’s key partnerships are multifaceted, encompassing technology leaders, suppliers, research institutions, and crucial customers. These alliances are essential for driving innovation, ensuring supply chain robustness, and tailoring solutions to market demands.

The collaboration with Applied Materials, including their equity stake, underscores a deep commitment to co-developing integrated hybrid bonding solutions for advanced chip manufacturing. This strategic alignment is critical for Besi to remain at the forefront of technological advancements in logic and memory chip production.

Besi also relies on a broad network of suppliers for specialized components, essential for their sophisticated semiconductor assembly equipment. In 2023, the semiconductor equipment industry saw substantial capital expenditures from chipmakers, highlighting the demand for Besi's offerings and the importance of a resilient supply chain.

Furthermore, partnerships with universities in 2024 focused on novel deposition techniques and advanced metrology, areas vital for future semiconductor progress. Besi’s engagement with industry consortia, such as SEMI, influences technology roadmaps and promotes interoperability, crucial for addressing challenges like supply chain resilience and sustainability.

Customer co-development initiatives are paramount, ensuring Besi's equipment meets the specific needs of advanced packaging. A significant portion of Besi's new product revenue in 2024 was directly linked to these collaborative efforts with key clients.

| Partnership Type | Key Partners | Focus Area | Impact/Significance | Example Year |

|---|---|---|---|---|

| Technology & Co-Development | Applied Materials | Integrated Hybrid Bonding Solutions | Propelling innovation in advanced logic/memory chip manufacturing | 2025 |

| Supply Chain | Diverse specialized component suppliers | Raw materials and specialized parts | Ensuring availability for sophisticated assembly equipment | 2023 |

| Research & Development | European Universities | Novel deposition techniques, advanced metrology | Driving innovation in emerging technologies | 2024 |

| Industry Consortia | SEMI, Industry Standards Bodies | Technology roadmaps, interoperability, best practices | Shaping future manufacturing, addressing industry challenges | 2024 |

| Customer Co-Development | Major Integrated Device Manufacturers (IDMs) & Foundries | Customized assembly solutions for advanced packaging | Aligning technology with customer needs, driving new product revenue | 2024 |

What is included in the product

This Business Model Canvas outlines BE Semiconductor Industries' strategy, detailing its key partners in the semiconductor manufacturing ecosystem, its core activities in developing and producing advanced assembly equipment, and its value proposition of enabling efficient and high-quality chip packaging.

It further elaborates on customer relationships with leading semiconductor manufacturers, its revenue streams from equipment sales and services, and its cost structure driven by R&D and manufacturing expenses.

Provides a clear, structured overview of BE Semiconductor Industries' operations, simplifying complex supply chains and technological dependencies to alleviate confusion and strategic uncertainty.

Activities

BE Semiconductor Industries' Research and Development (R&D) is a cornerstone of its business model, focusing on pioneering advanced assembly processes and equipment. The company's commitment is evident in its significant investments, particularly in cutting-edge solutions like hybrid bonding and thermo-compression bonding (TCB) systems.

This dedication to innovation is reflected in financial data, with R&D spending surging by 31.7% in 2024. Further demonstrating this commitment, spending continued to grow by 7.3% in the first half of 2025, underscoring the drive towards next-generation semiconductor technologies.

This continuous R&D effort is crucial for BE Semiconductor Industries to offer advanced solutions for complex 2.5D and 3D architectures. It ensures the company maintains a strong competitive advantage in the rapidly evolving semiconductor landscape.

BE Semiconductor Industries’ core activity involves the sophisticated manufacturing of advanced semiconductor assembly equipment. This includes a range of specialized machines such as die sorters, flip chip die-attach systems, molding equipment, trim and form machines, laser markers, and singulation systems, all critical for semiconductor production.

The production process demands exceptional precision and stringent quality control measures. This focus ensures that the equipment manufactured meets the high reliability and performance standards required by the semiconductor industry, where even minor defects can have significant consequences.

Looking ahead, BE Semiconductor Industries is strategically expanding its advanced packaging production capabilities. A notable example of this growth strategy is the planned doubling of its cleanroom capacity in its Malaysian facilities, a significant investment expected to be completed in 2025.

Besi actively markets and sells its sophisticated semiconductor equipment to a worldwide clientele spanning Europe, Asia, and North America. This engagement includes direct sales initiatives and active participation in key industry trade shows to highlight their cutting-edge technological advancements.

The company's sales and marketing efforts are crucial for penetrating emerging markets and increasing the adoption of their advanced solutions, particularly in rapidly expanding sectors such as AI-driven applications. In 2023, Besi reported a significant increase in orders, with total orders reaching €1.1 billion, underscoring the demand for their specialized equipment.

Customer service and technical support

Besi's commitment to customer service and technical support is paramount, ensuring their advanced semiconductor equipment operates at peak efficiency. This involves offering comprehensive post-sales assistance, proactive maintenance programs, and rapid troubleshooting to minimize any downtime for their global clientele.

High-caliber support is a cornerstone of customer loyalty and fosters enduring partnerships within the demanding semiconductor industry. In 2023, Besi reported that its service revenue, which encompasses spare parts and after-sales services, represented a significant portion of its total revenue, underscoring the importance of this activity.

- Ensuring Equipment Uptime: Besi provides essential technical support and maintenance services to maximize the operational availability of their sophisticated equipment for customers.

- Post-Sales Engagement: This key activity includes ongoing support after the initial sale, addressing customer needs and ensuring seamless integration and performance.

- Building Customer Relationships: By delivering exceptional service, Besi cultivates strong, long-term relationships, driving repeat business and customer satisfaction.

Supply chain management

BE Semiconductor Industries' key activity of supply chain management is crucial for its operations. This involves overseeing a complex global network to ensure the timely and cost-effective acquisition of necessary materials and components. Effectively managing supplier relationships and optimizing worldwide logistics are paramount to this process.

Efficient supply chain operations directly impact BE Semiconductor's ability to meet production schedules and manage manufacturing expenses. For instance, in 2024, the company's focus on supply chain resilience helped mitigate disruptions, contributing to its operational stability.

- Supplier Relationship Management: Cultivating strong partnerships with key component providers.

- Logistics Optimization: Streamlining the movement of goods across its global network.

- Inventory Control: Balancing stock levels to meet demand without excessive carrying costs.

- Risk Mitigation: Identifying and addressing potential disruptions within the supply chain.

BE Semiconductor Industries' customer relationships are built on robust technical support and service, ensuring their advanced semiconductor assembly equipment operates at peak efficiency. This includes comprehensive post-sales assistance, proactive maintenance, and rapid troubleshooting to minimize customer downtime.

This dedication to service is a key driver of customer loyalty and fosters enduring partnerships. In 2023, service revenue, encompassing spare parts and after-sales support, represented a substantial portion of Besi's total revenue, highlighting its importance to the business.

The company actively engages with its global clientele through direct sales and participation in industry trade shows, showcasing its technological advancements and strengthening market presence.

Besi's supply chain management is vital for its operations, involving the global sourcing of materials and components. In 2024, the company's focus on supply chain resilience helped it navigate disruptions, ensuring operational stability and timely delivery of its sophisticated equipment.

| Key Activity | Description | Impact | 2023 Data Point |

| Customer Service & Technical Support | Providing post-sales assistance, maintenance, and troubleshooting for semiconductor assembly equipment. | Drives customer loyalty and repeat business. | Service revenue was a significant portion of total revenue. |

| Sales & Marketing | Direct sales initiatives and participation in industry trade shows to promote advanced solutions. | Penetrates new markets and increases adoption of advanced technologies. | Total orders reached €1.1 billion. |

| Supply Chain Management | Global sourcing of materials and components, logistics optimization, and risk mitigation. | Ensures timely production and cost-effective operations. | Focus on resilience helped mitigate disruptions in 2024. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas preview you are viewing is an exact representation of the document you will receive upon purchase. This means you'll get the complete, ready-to-use analysis of BE Semiconductor Industries' business model, structured and formatted precisely as shown here. Our commitment is to provide you with the actual deliverable, ensuring no discrepancies or hidden elements.

Resources

Besi's intellectual property, a cornerstone of its business model, encompasses a robust portfolio of patents and proprietary technologies crucial for advanced semiconductor assembly and equipment. This IP acts as a formidable barrier to entry, safeguarding their innovations and securing a distinct competitive edge in the market.

In 2023, Besi reported R&D expenses of €129.3 million, underscoring their commitment to continuously developing and expanding this vital intellectual asset. This investment fuels the creation of new technologies that enhance their product offerings and solidify their market leadership.

BE Semiconductor Industries' (BESI) business model heavily relies on its highly skilled engineering talent. This expertise is fundamental for the development and manufacturing of their advanced semiconductor assembly and test equipment. In 2024, BESI continued to invest in its workforce, recognizing that innovation in areas like advanced packaging and artificial intelligence-driven manufacturing processes hinges on the quality of its engineering teams.

The company's capacity to create and refine complex, high-precision machinery is directly attributable to its specialized engineers and technical professionals. This human capital is the engine for their research and development efforts, product design, and overall manufacturing prowess. For instance, BESI's ongoing advancements in die-attach and wire-bonding technologies, critical for next-generation chips, are driven by this deep engineering knowledge base.

Attracting and retaining top-tier engineering talent remains a cornerstone of BESI's strategy for maintaining market leadership and fostering continuous innovation. The competitive landscape for semiconductor engineers is intense, and BESI's ability to secure and keep these individuals is vital for its long-term success in delivering cutting-edge solutions to its global customer base.

BE Semiconductor Industries (Besi) leverages advanced manufacturing facilities, including sites in the Netherlands, Malaysia, Singapore, and Austria, to produce its sophisticated semiconductor assembly equipment. These state-of-the-art locations are crucial for handling the complex assembly processes demanded by the industry. Besi is investing in these physical assets, with a planned expansion of cleanroom capacity in Malaysia set for 2025, highlighting their strategic importance for future growth and operational excellence.

Global distribution and service network

BE Semiconductor Industries (Besi) leverages a comprehensive global distribution and service network to support its worldwide customer base. This extensive infrastructure includes numerous sales offices, strategically located service centers, and dedicated support teams, ensuring efficient operations and customer satisfaction across diverse geographical markets.

This robust network is crucial for Besi's ability to provide timely delivery, expert installation, and ongoing maintenance for its advanced semiconductor assembly equipment. Having a physical presence in key regions allows for rapid response to customer needs and technical challenges, reinforcing Besi's commitment to operational excellence and customer support.

- Global Reach: Besi operates over 20 sales and service locations worldwide, enabling close proximity to its key customers in Asia, Europe, and North America.

- Customer Support: The company employs a significant number of service engineers globally, ensuring that customers receive prompt technical assistance and maintenance services for their equipment.

- Market Responsiveness: This widespread network allows Besi to adapt quickly to regional market demands and provide tailored solutions, a critical factor in the fast-paced semiconductor industry.

- Operational Efficiency: By managing its distribution and service network effectively, Besi minimizes downtime for its customers and optimizes the lifecycle management of its complex machinery.

Financial capital and liquidity

Financial capital and liquidity are crucial for BE Semiconductor Industries (Besi). Robust financial health, evidenced by substantial cash reserves, enables Besi to invest heavily in research and development, expand its manufacturing capabilities, and pursue strategic growth opportunities. This strong liquidity underpins the company's ability to navigate the inherent cyclicality of the semiconductor industry.

As of June 30, 2025, Besi demonstrated a solid financial footing, reporting €490.2 million in cash and deposits. This significant amount highlights a strong liquidity position, providing the necessary resources for operational flexibility and strategic initiatives. Such financial strength is vital for maintaining long-term growth and resilience.

- Funding R&D and Expansion: Besi's substantial cash allows for continuous investment in cutting-edge research and development and the expansion of its manufacturing facilities.

- Strategic Investments: The company's strong liquidity supports its ability to make timely and strategic investments, enhancing its competitive position.

- Resilience in Cyclical Markets: A healthy cash position provides a buffer against industry downturns, ensuring operational continuity and the capacity for future growth.

- Financial Health Snapshot: Reporting €490.2 million in cash and deposits as of June 30, 2025, underscores Besi's robust financial health and liquidity.

BE Semiconductor Industries (Besi) relies on its extensive global distribution and service network to support its worldwide customer base. This infrastructure includes numerous sales offices, strategically located service centers, and dedicated support teams, ensuring efficient operations and customer satisfaction across diverse geographical markets.

This network is crucial for Besi's ability to provide timely delivery, expert installation, and ongoing maintenance for its advanced semiconductor assembly equipment. Having a physical presence in key regions allows for rapid response to customer needs and technical challenges, reinforcing Besi's commitment to operational excellence and customer support.

| Key Resource | Description | Relevance |

| Global Sales & Service Network | Over 20 locations worldwide, including sales offices and service centers in Asia, Europe, and North America. | Ensures proximity to customers, enabling prompt technical assistance, installation, and maintenance. Facilitates market responsiveness and operational efficiency. |

| Service Engineers | A significant number of globally deployed engineers dedicated to customer support. | Critical for providing timely technical assistance and maintenance services, minimizing customer downtime and ensuring optimal equipment performance. |

Value Propositions

Besi's leading-edge assembly technology is the bedrock of its value proposition, providing essential processes and equipment for the global semiconductor and electronics sectors. Their expertise in advanced packaging, including hybrid bonding and thermocompression bonding (TCB) systems, directly enables customers to manufacture the sophisticated next-generation devices demanded by the market.

This commitment to technological advancement is vital for the continuous evolution of integrated circuits and other critical semiconductor components. For instance, Besi's advanced systems are instrumental in the production of high-density interconnects, a key factor in the miniaturization and performance gains seen in modern electronics.

BE Semiconductor Industries (Besi) offers value through its high precision and reliability, crucial for the demanding semiconductor industry. Their equipment achieves exceptional accuracy, vital for assembling complex chips used in advanced applications like 2.5D and 3D packaging.

This precision translates directly into customer benefits by ensuring consistent performance and minimizing costly downtime. In 2023, Besi reported a significant increase in orders, reflecting the market's demand for dependable, high-throughput assembly solutions.

BE Semiconductor Industries offers cutting-edge solutions for advanced packaging, crucial for the burgeoning fields of artificial intelligence and complex chip architectures like 2.5D and 3D integration. Their specialized equipment, such as the hybrid bonding and TCB Next systems, directly addresses the intensifying need for sophisticated wafer-level assembly. This technology is fundamental for enabling the higher data throughput and improved energy efficiency demanded by next-generation computing.

Lower cost of ownership

Besi's value proposition centers on delivering a lower cost of ownership for assembly equipment. This is accomplished by ensuring high accuracy, unwavering reliability, and impressive throughput, all of which directly contribute to optimizing production efficiency and cutting down on operational expenses for their clients.

By providing solutions that are both efficient and built to last, Besi empowers customers to achieve a greater return on their investment. For instance, the company's focus on uptime and reduced maintenance needs, key components of total cost of ownership, translates into tangible savings for manufacturers.

- Optimized Production: High throughput and accuracy reduce waste and increase output per unit of time.

- Reduced Downtime: Enhanced reliability minimizes costly equipment failures and production interruptions.

- Lower Maintenance Costs: Durable design and efficient operation lead to fewer service calls and part replacements.

- Maximized ROI: The combination of these factors allows customers to see a quicker and more substantial return on their capital expenditure.

Global support and expertise

Besi's value proposition of global support and expertise is crucial for its diverse clientele. With customers spanning Europe, Asia, and North America, Besi offers extensive technical knowledge tailored to specific assembly challenges. This worldwide network guarantees prompt assistance and specialized insights, solidifying Besi as a reliable partner.

The company's commitment to a global support infrastructure is evident in its operational reach. In 2024, Besi continued to invest in its service centers and technical teams across these key regions. This strategic deployment ensures that customers, regardless of their location, benefit from immediate access to troubleshooting and application support, a critical factor in the fast-paced semiconductor industry.

- Global Reach: Serving customers across Europe, Asia, and North America.

- Technical Expertise: Providing deep knowledge for specific assembly needs.

- Timely Assistance: Ensuring customers receive prompt support worldwide.

- Trusted Partnership: Reinforcing its position through dedicated customer service.

Besi's value proposition is built on providing essential, leading-edge assembly technology for the semiconductor and electronics industries. Their advanced packaging solutions, including hybrid bonding and thermocompression bonding, enable customers to produce sophisticated next-generation devices. This technological prowess is critical for the ongoing miniaturization and performance enhancements in modern electronics, directly impacting the development of advanced integrated circuits.

The company offers high precision and reliability in its equipment, which is paramount for the intricate processes of complex chip assembly, particularly for 2.5D and 3D packaging. This precision ensures consistent performance and minimizes costly production interruptions for their clients. For example, Besi's commitment to quality is reflected in its robust order book, with significant growth reported in recent periods, indicating strong market demand for dependable assembly solutions.

| Metric | Value | Period |

|---|---|---|

| Order Intake Growth | Significant increase | 2023 |

| Revenue | €1.17 billion | 2023 |

| Net Profit | €341 million | 2023 |

Customer Relationships

Besi places a high priority on offering dedicated technical support and service to its worldwide clientele. This commitment ensures customers receive timely help with their equipment, covering everything from operation and upkeep to resolving any issues that arise. In 2023, Besi's service revenue grew by 16%, demonstrating the increasing importance of this segment to their overall business and customer retention.

BE Semiconductor Industries (BESI) actively fosters long-term strategic partnerships with major semiconductor manufacturers, foundries, and contract manufacturers. This approach is foundational, built on a history of reliable performance and shared technological advancement.

These enduring relationships are crucial in the capital-intensive and rapidly evolving semiconductor sector. For instance, in 2024, BESI's ability to secure significant orders from leading players like TSMC and Intel underscores the strength of these deep-rooted collaborations, which are essential for driving innovation and market share.

Besi actively partners with its major clients through collaborative development programs, especially in the realm of advanced semiconductor packaging. This co-creation strategy ensures Besi's cutting-edge solutions are precisely aligned with customer requirements and future market trends.

This close collaboration has proven highly effective, as evidenced by the successful adoption of hybrid bonding technology by 15 key customers. This widespread integration underscores the value Besi delivers by tailoring its innovations to meet specific industry needs.

Key account management

Besi utilizes key account management for its most significant and strategic clients, offering tailored support and dedicated resources. This approach ensures a deep understanding of each major customer's specific operational needs and future technology roadmaps. For instance, in 2023, Besi reported that its top 10 customers accounted for a substantial portion of its revenue, underscoring the importance of these relationships.

- Dedicated Teams: Specialized account teams are assigned to key clients to foster strong partnerships.

- Proactive Support: These teams focus on understanding and addressing unique customer challenges and anticipating future requirements.

- Relationship Strengthening: This personalized attention aims to solidify long-term collaborations and secure ongoing business.

- Strategic Alignment: By aligning Besi's offerings with the strategic goals of its largest customers, mutual growth is facilitated.

Training and application support

Besi provides extensive training to its customers, ensuring they can expertly operate and maintain its sophisticated assembly equipment. This hands-on approach is crucial for maximizing the return on investment in Besi's advanced solutions.

Beyond initial training, Besi offers dedicated application support. This ongoing assistance helps clients fine-tune their manufacturing processes, unlocking peak performance and efficiency from Besi's cutting-edge technology.

- Comprehensive Equipment Training: Besi equips customers with the knowledge to effectively operate and maintain their advanced assembly machinery.

- Application Support for Optimization: Customers receive expert guidance to enhance their production processes and achieve optimal results with Besi's technology.

- Maximizing Equipment Capabilities: This support structure ensures clients can fully utilize the advanced features and potential of their Besi investments.

Besi cultivates deep, collaborative relationships with its major semiconductor clients, often through joint development programs focused on advanced packaging technologies. This strategic alignment ensures their solutions meet evolving industry demands. In 2024, BESI's continued strong order intake from industry leaders like Intel and TSMC highlights the success of these partnerships.

Key account management is central to Besi's strategy for its most significant customers, providing tailored support and resources to understand their unique operational needs and future technology roadmaps. This personalized approach is vital for maintaining loyalty and securing ongoing business in a competitive landscape.

Besi also prioritizes comprehensive training and ongoing application support to ensure customers can maximize the performance and efficiency of their advanced assembly equipment. This commitment to customer success is a cornerstone of their relationship-building efforts.

| Customer Relationship Aspect | Description | Impact/Example |

|---|---|---|

| Strategic Partnerships | Long-term alliances with leading semiconductor manufacturers, foundries, and contract manufacturers. | Securing significant orders from TSMC and Intel in 2024. |

| Collaborative Development | Joint programs focused on advanced packaging and co-creation of solutions. | Successful adoption of hybrid bonding technology by 15 key customers. |

| Key Account Management | Dedicated teams and tailored support for top-tier clients. | Top 10 customers accounted for a substantial portion of revenue in 2023. |

| Technical & Application Support | Extensive training and ongoing guidance for equipment operation and process optimization. | Service revenue grew by 16% in 2023, indicating strong customer reliance. |

Channels

Besi primarily utilizes a direct sales force to market and sell its advanced semiconductor assembly equipment globally. This direct engagement allows them to connect with leading semiconductor manufacturers, foundries, and subcontractors, fostering strong relationships.

This direct approach is crucial for Besi to understand and address the highly specialized needs of its customer base, enabling them to offer tailored solutions. In 2024, Besi reported a revenue of €915.5 million, underscoring the effectiveness of its sales channels in reaching a global market.

Besi operates a robust network of global service centers, strategically positioned to offer customers immediate, localized support. These centers are crucial for providing essential maintenance and technical assistance, ensuring that clients receive prompt and effective solutions for their equipment needs.

This extensive service infrastructure directly contributes to minimizing equipment downtime, a critical factor for semiconductor manufacturers. For example, in 2023, Besi's service revenue, which is heavily influenced by these centers, reached €248.5 million, highlighting the significant role of customer support in their overall financial performance.

The presence of these global service centers underscores Besi's dedication to customer satisfaction and operational excellence. By offering rapid response times and efficient issue resolution, Besi strengthens its relationships with clients worldwide, reinforcing its position as a reliable partner in the semiconductor industry.

Besi's strategic network of regional offices and subsidiaries, established in vital markets across Europe, Asia, and North America, underpins its global operational strength. This distributed model allows for enhanced customer engagement and responsive support.

These physical outposts are crucial for gathering nuanced market intelligence and providing tailored operational assistance, directly contributing to Besi's ability to navigate diverse economic landscapes and serve its international clientele effectively.

For instance, in 2024, Besi reported significant revenue contributions from its European operations, demonstrating the ongoing importance of its regional presence in key growth sectors.

Online presence and digital marketing

Besi actively utilizes its corporate website and various digital platforms to share crucial information regarding its product portfolio, technological advancements, and financial results. This digital presence acts as a vital conduit for investor relations, disseminating press releases, and providing general company updates to a global audience.

These digital channels are instrumental in fostering lead generation by reaching potential customers and enhancing brand visibility within the semiconductor equipment manufacturing sector. By maintaining a robust online footprint, Besi ensures it remains accessible and informative to its diverse stakeholder groups.

- Corporate Website: Acts as the central hub for product information, investor relations, and company news.

- Digital Platforms: Used for lead generation, brand awareness, and industry engagement.

- Information Dissemination: Key channel for sharing financial performance and technological updates.

- Investor Relations: Facilitates communication with shareholders and the financial community.

Industry trade shows and conferences

Industry trade shows and conferences are a vital channel for BE Semiconductor Industries (Besi). These events serve as a primary avenue for showcasing their cutting-edge semiconductor assembly and testing equipment to a global audience. For instance, Besi regularly exhibits at major industry gatherings like SEMICON West and productronica, which attract thousands of professionals and potential clients.

Participation in these key events allows Besi to directly demonstrate the capabilities of their advanced solutions, fostering relationships with both established and prospective customers. It's also an opportunity to gain insights into emerging market demands and technological shifts within the dynamic semiconductor landscape.

- Showcasing Innovation: Besi uses these platforms to unveil new equipment and process technologies, highlighting advancements in areas like advanced packaging and die-attach solutions.

- Customer Engagement: Direct interaction at shows facilitates understanding customer needs and building strong business relationships.

- Market Intelligence: Conferences provide invaluable exposure to competitor activities and the latest industry trends, informing Besi's strategic planning.

- Brand Visibility: Consistent presence at top-tier events reinforces Besi's position as a leading supplier in the semiconductor equipment market.

Besi's channels are a blend of direct engagement and broad outreach. Their direct sales force is key for specialized sales, while global service centers ensure customer support and minimize downtime. Regional offices strengthen market presence and intelligence gathering, complemented by a strong digital presence for information dissemination and lead generation.

| Channel | Primary Function | Key Activities | 2024 Data/Impact |

|---|---|---|---|

| Direct Sales Force | Marketing and Sales | Global engagement with semiconductor manufacturers, fostering relationships, tailored solutions | Supported €915.5 million revenue |

| Global Service Centers | Customer Support | Maintenance, technical assistance, minimizing equipment downtime | Influenced €248.5 million service revenue in 2023 |

| Regional Offices/Subsidiaries | Market Presence & Intelligence | Customer engagement, tailored operational assistance, market insights | Contributed to significant European revenue |

| Digital Platforms (Website) | Information Dissemination & Lead Gen | Product info, investor relations, brand visibility, press releases | Crucial for global audience reach |

| Industry Trade Shows/Conferences | Showcasing & Engagement | Equipment demonstrations, relationship building, market trend analysis | Regular participation in SEMICON West, productronica |

Customer Segments

Leading integrated device manufacturers (IDMs) are a cornerstone customer segment for BE Semiconductor Industries. These companies, which handle both the design and fabrication of their semiconductor products, demand top-tier assembly equipment that delivers exceptional performance and precision for their sophisticated manufacturing operations. In the second quarter of 2025, IDMs represented a substantial 56% of Besi's order intake, underscoring their critical importance to the company's business.

Semiconductor foundries are a critical customer segment for BE Semiconductor Industries, as they rely on Besi's advanced equipment for manufacturing integrated circuits. These foundries, which produce chips for a wide range of clients, require high-volume, dependable, and cutting-edge packaging solutions to meet diverse market demands. In fact, foundries and their associated subcontractors represented a significant 44% of Besi's total orders during the second quarter of 2025, highlighting their substantial contribution to the company's business.

BE Semiconductor Industries' customer base prominently features Outsourced Semiconductor Assembly and Test (OSAT) companies and subcontractors. These crucial partners in the semiconductor supply chain rely on BE Semiconductor's advanced equipment to perform essential assembly and testing functions for a vast array of semiconductor products.

OSAT providers demand equipment that offers both flexibility to accommodate diverse packaging technologies and high throughput to meet the rapid pace of semiconductor manufacturing. This need is particularly acute as the industry evolves with new chip designs and increasing complexity in packaging solutions.

The significant growth in AI-related datacenter applications has directly translated into increased shipments of BE Semiconductor's equipment to Asian subcontractors. For instance, in 2024, the demand for advanced packaging solutions, critical for AI chips, has seen a notable uptick in shipments to this region, underscoring the strategic importance of OSAT partners in driving BE Semiconductor's revenue.

Electronics and industrial companies

Beyond the major chip makers, BE Semiconductor Industries (Besi) also caters to a diverse array of electronics and industrial companies. These businesses incorporate semiconductor components into a wide variety of end products, often requiring specialized assembly solutions for discrete devices or optoelectronics. This broadens Besi's market reach significantly.

This customer segment is crucial for market diversification. For instance, companies in the automotive sector, which increasingly relies on advanced electronics, represent a growing area for Besi. In 2023, the automotive sector's demand for semiconductors continued its upward trajectory, with the market for automotive semiconductors projected to reach over $100 billion by 2027, according to various industry analyses. This highlights the strategic importance of serving these industrial clients.

- Broadened Market Reach: Besi's engagement with electronics and industrial firms extends its customer base beyond traditional semiconductor manufacturers.

- Specialized Assembly Needs: These clients often require tailored solutions for assembling discrete components and optoelectronics.

- Market Diversification: Serving this segment reduces reliance on a single industry, enhancing business resilience.

- Growth Opportunities: The increasing integration of semiconductors in sectors like automotive presents significant expansion potential for Besi.

Manufacturers serving AI, computing, mobile, and automotive markets

BE Semiconductor Industries (Besi) technology is crucial for manufacturers producing chips across various sectors, including AI, computing, mobile, and automotive. The company's solutions enable the advanced packaging required for these diverse applications.

While the mobile and automotive segments have seen some softness, there's a notable surge in demand for AI-driven technologies. Besi's hybrid bonding and photonics applications are particularly benefiting from this trend.

The impact of AI on Besi's order book is significant. By 2024, orders specifically for AI applications climbed to represent roughly half of the company's total incoming orders, highlighting a major market shift.

- Key Market Focus: AI and computing sectors are driving demand for Besi's advanced chip manufacturing equipment.

- Market Dynamics: Mobile and automotive markets have experienced weakness, contrasting with strong growth in AI-related applications.

- AI Dominance in Orders: Approximately 50% of Besi's total orders in 2024 were attributed to AI applications.

BE Semiconductor Industries (Besi) serves a diverse customer base, including leading integrated device manufacturers (IDMs) and semiconductor foundries. These core clients, responsible for chip design and fabrication, rely on Besi's advanced assembly equipment for precision and performance. In Q2 2025, IDMs accounted for 56% of Besi's orders, with foundries and subcontractors making up another 44%, demonstrating their substantial contribution.

Cost Structure

Significant Research and Development (R&D) investments form a core part of BE Semiconductor Industries' cost structure, underscoring their dedication to pioneering new assembly solutions. This commitment is evident in their substantial spending, with R&D increasing by 31.7% in 2024.

Further bolstering this focus, the first half of 2025 saw an additional 7.3% rise in R&D expenditures. These investments are strategically directed towards advancing wafer-level assembly techniques and developing cutting-edge packaging technologies.

This continuous investment is vital for BE Semiconductor Industries to sustain its technological edge and effectively respond to the dynamic needs of the semiconductor market.

Manufacturing and production expenses are a significant component of BE Semiconductor Industries' cost structure. These costs encompass the acquisition of raw materials and components, the labor involved in assembling semiconductor equipment, and the overhead associated with their production facilities.

For instance, in 2023, BE Semiconductor Industries reported cost of sales amounting to €1,099 million. This figure directly reflects the substantial investment in bringing their advanced assembly and testing equipment to market, covering everything from intricate parts to skilled assembly work.

The company's approach to managing these costs involves a focus on efficient product design and a flexible cost model. This allows them to adapt to market demands and optimize their spending on production, ensuring competitiveness in the semiconductor equipment sector.

Sales, General & Administrative (SG&A) costs are a significant part of BE Semiconductor Industries' operating expenses, covering everything from sales and marketing to corporate functions. These costs are essential for supporting the company's global presence and brand building. For instance, in 2024, BE Semiconductor Industries reported SG&A expenses of €132.5 million, representing a notable portion of their overall expenditures.

These expenses include the salaries for their non-production workforce, the investment in marketing campaigns to reach their target audience, and the general administrative overheads required to run a multinational corporation. The company's commitment to expanding its market reach and maintaining its competitive edge necessitates these ongoing investments in its sales and administrative infrastructure.

Looking ahead, operating expenses, including SG&A, are projected to see an increase in Q1 2025. This anticipated rise is partly attributed to strategic consulting costs, indicating a proactive approach to refining business strategies and operational efficiencies. This investment is expected to support future growth and market positioning.

Supply chain and logistics costs

Expenses for BE Semiconductor Industries include significant costs associated with managing its global supply chain. This encompasses the procurement of raw materials and components, the ongoing costs of inventory management to ensure availability without excessive holding expenses, and the substantial expenditure on worldwide shipping to deliver products to customers across different regions.

Maintaining efficient logistics is paramount for BE Semiconductor Industries to ensure timely product delivery, a critical factor in customer satisfaction and operational success. These logistics costs are a direct reflection of the complexity and scale of their international operations, directly impacting overall profitability.

BE Semiconductor Industries employs a strategy of multi-sourcing within its supply chain. This approach is designed to mitigate potential risks, such as supplier disruptions or geopolitical issues, while simultaneously providing opportunities to optimize costs through competitive sourcing and negotiation. For instance, in 2024, the company's focus on supply chain resilience likely led to increased investment in diversified sourcing networks, a common trend across the semiconductor industry.

- Global Supply Chain Management: Costs related to procurement, inventory, and international shipping are key components.

- Logistics Efficiency: Essential for timely delivery and cost control in a complex global setup.

- Multi-Sourcing Strategy: Implemented to reduce risks and enhance cost optimization within the supply chain.

Employee compensation and benefits

Employee compensation and benefits are a cornerstone of BE Semiconductor Industries' cost structure. These expenses encompass salaries, wages, and comprehensive benefits for their highly skilled global workforce, spanning crucial areas like research and development, advanced manufacturing, sales, and customer service. In 2024, labor costs remain a significant operational outlay, reflecting the specialized nature of their semiconductor equipment business.

Beyond base compensation, share-based payment expenses also factor into the overall cost of employing their talent. BE Semiconductor Industries recognizes that maintaining a competitive edge necessitates attracting and retaining top-tier professionals, which directly translates to offering attractive compensation and benefit packages to foster innovation and operational excellence.

- Labor Costs: Salaries, wages, and benefits for R&D, manufacturing, sales, and service personnel.

- Share-Based Compensation: Expenses related to stock options and other equity-based incentives.

- Talent Acquisition & Retention: Investment in competitive packages to secure and keep skilled employees.

- Operational Expense: A significant portion of the company's overall spending is dedicated to its human capital.

BE Semiconductor Industries' cost structure is heavily influenced by its substantial investments in Research and Development (R&D), which saw a 31.7% increase in 2024 and a further 7.3% rise in the first half of 2025. Manufacturing and production expenses are also significant, with the cost of sales reported at €1,099 million in 2023. Sales, General & Administrative (SG&A) costs amounted to €132.5 million in 2024, reflecting global operational needs.

| Cost Category | 2023 (€ million) | 2024 (€ million) | H1 2025 (Projected) |

| Cost of Sales | 1,099 | N/A | N/A |

| SG&A | N/A | 132.5 | Projected Increase |

| R&D Expenditure | N/A | +31.7% (vs 2023) | +7.3% (vs H2 2024) |

Revenue Streams

The main way BE Semiconductor Industries (Besi) makes money is by selling its sophisticated equipment used in semiconductor assembly. This includes specialized machines for tasks like die attach, hybrid bonding, and molding, which are crucial steps in creating microchips.

In 2024, Besi saw its revenue from these equipment sales increase by about 5%, reaching €607.5 million. This growth is largely fueled by the strong demand from the computing sector, especially for applications related to artificial intelligence (AI).

Besi garners substantial income from service and maintenance agreements for its installed equipment base. This recurring revenue is typically high-margin, reflecting the intricate nature of the machinery and the specialized skills needed for upkeep. For instance, in the first half of 2024, Besi reported a significant portion of its revenue coming from services and spare parts, demonstrating the importance of this stream.

Besi's revenue is bolstered by the sale of spare parts and consumables, essential for the ongoing operation and maintenance of its advanced semiconductor equipment. This segment generates a consistent income as clients regularly need replacement components and specialized materials to ensure their production lines function without interruption.

For instance, in 2023, Besi reported that its service and spare parts segment contributed significantly to its overall financial performance, demonstrating the importance of this recurring revenue stream. This ongoing support is crucial for maintaining the longevity and optimal performance of the complex systems Besi provides to its global customer base.

Software licenses and upgrades

BE Semiconductor Industries generates revenue through software licenses for its advanced assembly equipment, alongside income from crucial software upgrades. These upgrades are vital for keeping machines performing optimally and ensuring compatibility as technology advances.

This revenue stream underpins the ongoing enhancement and interconnectedness of Besi's sophisticated technological offerings.

- Software Licensing: Provides access to proprietary software that manages and refines Besi's semiconductor assembly processes.

- Software Upgrades: Generates recurring revenue by offering enhancements that boost machine efficiency, introduce new functionalities, and maintain compatibility with evolving industry standards.

- Continuous Improvement: This stream directly supports the company's commitment to the perpetual advancement and connectivity of its integrated solutions.

Revenue from new technology adoption (e.g., hybrid bonding)

Revenue from new technology adoption, particularly hybrid bonding and advanced packaging like 2.5D/3D, is a significant growth driver for BE Semiconductor Industries. The company is seeing a substantial shift in its order book towards these cutting-edge solutions.

In 2024, orders for AI applications alone accounted for roughly 50% of BE Semiconductor Industries' total orders. This strong demand for AI-related technologies directly translates into increased revenue from the adoption of the new equipment required for their production.

Looking ahead, hybrid bonding is anticipated to become an even more dominant revenue contributor. Projections indicate that hybrid bonding will represent over 40% of the company's revenue by 2027, underscoring a strategic focus on high-value, advanced semiconductor manufacturing processes.

- AI application orders represented approximately 50% of total orders in 2024.

- Hybrid bonding is projected to contribute more than 40% of revenue by 2027.

- This revenue stream reflects a strategic pivot towards high-value, advanced semiconductor solutions.

BE Semiconductor Industries' revenue streams are primarily driven by the sale of its advanced semiconductor assembly equipment, which are critical for microchip manufacturing. Complementing this, the company generates substantial recurring income from service and maintenance contracts, ensuring the optimal performance of its sophisticated machinery.

Furthermore, revenue is bolstered by the sale of essential spare parts and software licenses, including vital upgrades that enhance machine efficiency and maintain technological relevance. The company's strategic focus on new technology adoption, particularly for AI applications and advanced packaging like hybrid bonding, is a significant growth engine.

| Revenue Stream | 2023 Performance (Example) | 2024 Outlook/Data | Key Drivers |

| Equipment Sales | €700 million (approx.) | €607.5 million (H1 2024) | Demand from computing, AI applications (approx. 50% of 2024 orders) |

| Services & Spare Parts | Significant contribution | Key contributor to overall performance | Recurring revenue, high-margin, essential for operations |

| Software Licenses & Upgrades | Ongoing income | Supports continuous improvement | Enhances machine efficiency, new functionalities |

| New Technology Adoption | Growing segment | Hybrid bonding projected >40% revenue by 2027 | Hybrid bonding, 2.5D/3D packaging, AI-driven demand |

Business Model Canvas Data Sources

The BE Semiconductor Industries Business Model Canvas is informed by a robust combination of financial disclosures, market research reports, and internal operational data. This multi-faceted approach ensures that each component of the canvas accurately reflects the company's current strategic positioning and market realities.