BE Semiconductor Industries Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BE Semiconductor Industries Bundle

Unlock the strategic potential of BE Semiconductor Industries with a comprehensive look at their BCG Matrix. Discover which of their innovative products are poised to be market leaders (Stars), which are generating consistent revenue (Cash Cows), and which require careful evaluation (Question Marks and Dogs). This preview is just the beginning; purchase the full report for detailed quadrant placements and actionable insights to optimize your investment strategy.

Stars

BE Semiconductor Industries' hybrid bonding equipment is a clear Star in their BCG matrix. This segment experienced impressive growth in 2024, with revenues roughly tripling and orders more than doubling, underscoring its market dominance.

Besi is a leader in hybrid bonding, a key technology for advanced chip packaging, essential for high-performance applications like AI and high-bandwidth memory (HBM). This direct chip-to-chip bonding capability is vital for the next generation of computing power.

Looking ahead, the demand for hybrid bonding tools is expected to surge in the latter half of 2025. This anticipated increase is driven by customer advancements in technology roadmaps for cutting-edge logic devices and HBM4 products.

Advanced die placement solutions are a significant growth engine for BE Semiconductor Industries. AI applications alone accounted for roughly 50% of the company's total orders in 2024, underscoring the immense demand in this sector.

Besi is experiencing robust momentum with these critical technologies, which are essential for enabling the high-performance computing required by AI systems and data centers. This strategic focus positions Besi to effectively leverage the substantial and ongoing investments being made in AI infrastructure globally.

As traditional chip scaling hits its limits, 2.5D and 3D packaging are crucial for boosting data speeds and power efficiency. BE Semiconductor Industries (Besi) is seeing substantial demand for its equipment supporting these advanced architectures, particularly for AI computing. This segment is expected to grow robustly due to the increasing need for denser integration and better performance.

Thermocompression Bonding (TCB) Systems for Advanced Applications

Thermocompression Bonding (TCB) Systems are pivotal for advanced semiconductor packaging, especially with the advent of next-generation AI applications. This technology is crucial for enabling the latest iterations of High Bandwidth Memory, such as HBM3E and the upcoming HBM4. Besi, a key player, has seen substantial new orders for its TCB Next systems, a clear signal of robust market demand and significant growth prospects in this specialized segment.

Besi's TCB Next systems are designed for the intricate demands of modern chip manufacturing. They facilitate extremely precise placement and bonding of semiconductor components, a capability that is non-negotiable for complex, high-performance devices. This precision is what allows for the dense integration and high speeds required by AI accelerators and advanced memory modules.

- Market Growth: The advanced packaging market, particularly for AI-driven applications, is experiencing rapid expansion.

- Besi's Position: Besi's strong order intake for TCB Next systems highlights its leading role in supplying critical equipment for this growth.

- Technological Edge: TCB technology offers superior precision and reliability, essential for HBM3E/HBM4 and future memory standards.

- Investment Potential: Companies investing in TCB technology are well-positioned to capitalize on the increasing demand for high-performance computing solutions.

Overall Advanced Packaging Solutions

Overall Advanced Packaging Solutions represent a significant portion of BE Semiconductor Industries' (Besi) business, accounting for roughly 75% of its systems. This focus places Besi squarely in a high-growth market segment. The demand for advanced packaging is fueled by the increasing complexity and performance requirements of semiconductors, particularly in areas like artificial intelligence (AI) and high-performance computing (HPC). Analysts project continued strong expansion in this sector through 2025 and into the foreseeable future.

Besi's leadership within the advanced packaging space, coupled with the market's upward trend, solidifies its position as a Star in the BCG Matrix. This category is broad, encompassing several rapidly evolving technologies where Besi has consistently demonstrated a competitive advantage. For instance, in 2024, the global semiconductor packaging market was valued at approximately $60 billion and is expected to grow at a compound annual growth rate (CAGR) of over 6% through 2030, with advanced packaging technologies being the primary driver.

- Market Dominance: Besi's commitment to advanced packaging, representing 75% of its offerings, highlights its strategic focus.

- Growth Drivers: AI and high-performance computing are key catalysts propelling the advanced packaging market forward.

- Projected Expansion: The market is anticipated to see robust growth continuing well past 2025.

- Competitive Edge: Besi's established leadership in this dynamic segment underpins its Star status.

BE Semiconductor Industries' advanced packaging solutions, including hybrid bonding and thermocompression bonding (TCB), are definitively Stars in their BCG matrix. These segments are experiencing significant demand, particularly from the AI sector, which accounted for about 50% of Besi's orders in 2024. The company's hybrid bonding revenue roughly tripled in 2024, and orders more than doubled, showcasing exceptional market penetration and growth. Besi's TCB Next systems are also seeing substantial new orders, indicating strong market adoption for next-generation AI applications and HBM. This strategic focus on high-growth areas positions Besi for continued success.

| Segment | BCG Status | Key Drivers | 2024 Performance Indicator |

| Hybrid Bonding | Star | AI, HBM, advanced chip packaging | Revenue ~3x, Orders >2x |

| Thermocompression Bonding (TCB) | Star | AI accelerators, HBM3E/HBM4 | Substantial new orders for TCB Next |

| Advanced Packaging Solutions (Overall) | Star | AI, HPC, denser integration | 75% of Besi's systems revenue |

What is included in the product

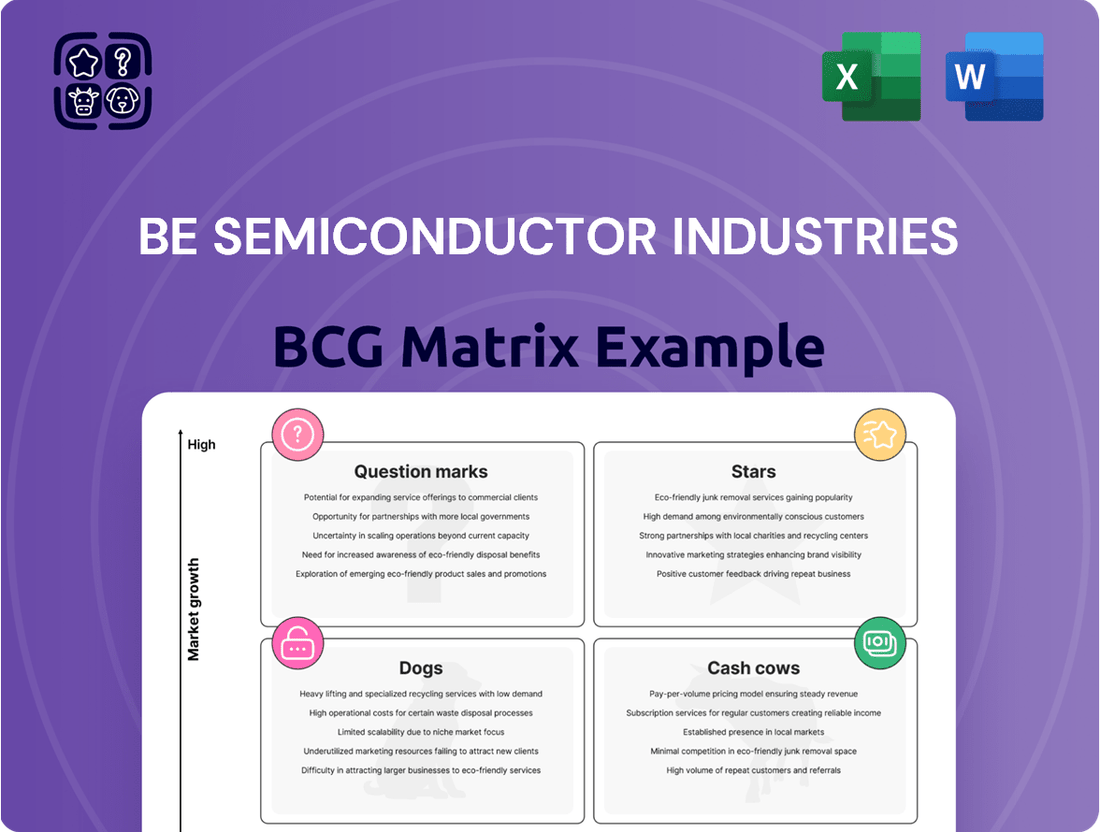

This BCG Matrix analysis highlights BE Semiconductor Industries' product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic insights on investment, holding, or divestment for each category, guiding future business decisions.

The BE Semiconductor Industries BCG Matrix provides a clear, one-page overview of each business unit's market position, alleviating the pain of strategic uncertainty.

Cash Cows

BE Semiconductor Industries' established die attach equipment segment acts as a classic Cash Cow. This market, expected to see a 4.3% compound annual growth rate from 2025 to 2035, provides a reliable source of income. Besi's strong leadership in this mature area translates into consistent revenue streams, essential for funding other business ventures.

BE Semiconductor Industries, often referred to as Besi, leverages its significant installed base to generate substantial, high-margin recurring revenue. This income stream primarily comes from service contracts, spare parts sales, and ongoing technical support for their semiconductor manufacturing equipment. In 2024, the company continued to see robust demand for these services, which are essential for keeping complex machinery operational and reliable.

These service-related revenues provide a stable and predictable cash flow for Besi, acting as a strong foundation for its financial performance. The critical nature of maintaining uptime in semiconductor fabrication means customers are consistently willing to invest in these support services. This segment typically demands minimal new capital investment to sustain its returns, making it a highly efficient generator of profits within the company's portfolio.

Besi's mature flip-chip bonding equipment likely serves as a Cash Cow. This technology is fundamental to the advanced packaging market, which is projected to capture a substantial market share by 2029.

Despite the rapid growth of newer techniques like fan-out WLP, Besi's established flip-chip offerings in mature sectors are well-positioned to generate steady cash flow. This is due to their commanding market share and strong, long-standing relationships with customers in these established segments.

Standard Substrate Assembly Solutions

Standard substrate assembly solutions represent a mature segment within BE Semiconductor Industries' (Besi) portfolio. These offerings are crucial for fundamental semiconductor manufacturing steps, catering to less intricate assembly processes. While the market for these standard solutions experiences moderate growth, Besi's established position and high market share allow these products to function as reliable cash cows. Their consistent performance is underpinned by mature production methodologies and strong, long-standing customer ties.

These standard substrate assembly solutions are characterized by their dependable contribution to Besi's overall revenue. In 2024, Besi reported a significant portion of its revenue derived from its assembly solutions, reflecting the ongoing demand for these foundational technologies. The company's ability to maintain a dominant market share in this segment, despite moderate market growth, highlights the efficiency and cost-effectiveness of its offerings.

- Mature Market Position: Standard substrate assembly operates in a segment with moderate market growth, allowing for stable revenue generation.

- High Market Share: Besi's strong presence in this area ensures consistent demand and cash flow.

- Established Processes: Benefit from optimized production and deep customer relationships, reducing operational risks.

- Cash Flow Generation: These solutions are key contributors to Besi's financial stability, funding investments in other business areas.

Mainstream Die Bonding for General Computing Applications

Besi's mainstream die bonding for general computing applications represents a classic Cash Cow within its product portfolio. While AI-driven advancements capture significant attention as a Star, these established solutions continue to be a reliable revenue generator, underpinning the company's financial stability.

Despite some recent softness in the broader mainstream assembly markets, the fundamental demand for components in general computing remains robust. This sustained necessity translates into a consistent, albeit slower-growing, revenue stream for Besi's high-market-share die bonding equipment in this segment.

- Revenue Generation: These products consistently contribute to Besi's top line, leveraging their established market position.

- Market Share: Besi holds a significant share in the mainstream die bonding market, ensuring continued demand.

- Steady Demand: The underlying need for general computing components provides a stable, predictable revenue base.

- Profitability: Mature products in this category typically benefit from optimized production and lower R&D costs, leading to healthy profit margins.

BE Semiconductor Industries' (Besi) established die attach equipment, particularly for mature applications, functions as a strong Cash Cow. This segment benefits from a stable market, projected to grow at a 4.3% CAGR between 2025 and 2035, providing a consistent and reliable income stream essential for funding growth initiatives.

The company's significant installed base in die attach technology generates substantial, high-margin recurring revenue through service contracts and spare parts. In 2024, Besi observed continued strong demand for these services, which are critical for maintaining the operational efficiency of semiconductor manufacturing equipment.

Besi's flip-chip bonding equipment also represents a Cash Cow, especially within established sectors of the advanced packaging market. Despite the rise of newer techniques, Besi's leading market share and deep customer relationships in these mature areas ensure a steady generation of profits.

Standard substrate assembly solutions are another key Cash Cow for Besi. These foundational technologies, while in a moderately growing market, contribute dependably to the company's revenue due to Besi's dominant market share and optimized production processes.

| Product Segment | BCG Category | Market Growth (Est. 2025-2035) | Besi's Market Share | Revenue Contribution (2024 Est.) |

|---|---|---|---|---|

| Die Attach Equipment (Mature) | Cash Cow | 4.3% CAGR | High | Significant & Stable |

| Flip-Chip Bonding (Mature) | Cash Cow | Moderate | Leading | Consistent |

| Standard Substrate Assembly | Cash Cow | Moderate | Dominant | Dependable |

Full Transparency, Always

BE Semiconductor Industries BCG Matrix

The BE Semiconductor Industries BCG Matrix you are currently previewing is the identical, fully-formatted report you will receive upon purchase. This means no watermarks, no demo content, and no hidden surprises—just a professionally crafted analysis ready for your strategic planning.

Rest assured, the preview you see is the exact BE Semiconductor Industries BCG Matrix document that will be delivered to you after your purchase. This comprehensive report is designed for immediate use, offering clear insights into the company's product portfolio and market positions without any need for further editing or revision.

Dogs

Older generation assembly equipment for mainstream automotive applications is likely positioned as a Dog in BE Semiconductor Industries' BCG Matrix. The automotive sector has seen a significant slump, with reduced demand impacting Besi's revenue, as evidenced by a projected revenue decline in Q4 2024 and Q2 2025 due to these market conditions.

This segment of older equipment, specifically catering to the traditional automotive market, faces a challenging environment characterized by low market share and minimal growth prospects. Consequently, these product lines are prime candidates for divestiture or a strategic decision to minimize their presence within the company's portfolio.

The automotive industry's current overcapacity means manufacturers are actively pushing back orders for this type of equipment. This directly translates to a weakened market position for Besi's older automotive assembly lines, further solidifying their Dog status.

Older generation assembly equipment for traditional smartphone applications falls into the Dogs category for BE Semiconductor Industries. The market for these devices has been experiencing persistent weakness, directly impacting Besi's revenue and profitability.

Products like legacy assembly equipment for these segments are characterized by declining demand and existing overcapacity. This means they are low-growth offerings, and Besi might even see its market share diminish over time.

These older machines are essentially cash traps. They tie up valuable investment capital but offer very limited potential for returns, making them a drain on resources rather than a contributor to growth.

Legacy wire bonding equipment, while still relevant for some traditional integrated circuit packages, faces increasing competition from advanced techniques like flip-chip and fan-out wafer-level packaging. Besi's older wire bonding machines, particularly those with a diminishing market share in this segment, would likely be classified as Dogs in their BCG Matrix. This is often due to sub-optimal utilization rates and the significant investment required for revitalization efforts that may not yield substantial returns.

Commoditized Standard Assembly Tools

In the highly commoditized segments of the semiconductor assembly market, BE Semiconductor Industries' standard assembly tools face significant challenges. Intense competition and minimal product differentiation limit their ability to capture or retain substantial market share.

These products operate within low-growth environments, leading to limited returns. Consequently, they are less appealing for sustained investment, often performing at a break-even point with minimal cash generation or consumption.

- Market Saturation: The market for standard assembly tools is highly saturated, with numerous players offering similar functionalities.

- Price Sensitivity: Customers in this segment are highly price-sensitive, squeezing profit margins for manufacturers like Besi.

- Low Growth Potential: The demand for these tools is not expected to grow significantly in the coming years, limiting revenue expansion opportunities.

- Limited Innovation: There is little room for technological advancement or unique selling propositions in this commoditized space.

Products Heavily Impacted by Persistent Overcapacity in Traditional Assembly Markets

BE Semiconductor Industries' products facing persistent overcapacity in traditional assembly markets, such as back-end semiconductor assembly for mainstream logic and memory chips, would likely fall into the Dogs category of the BCG Matrix. These segments have experienced significant post-pandemic excess capacity, leading to order pushbacks and reduced demand from manufacturers. For instance, the global semiconductor equipment market saw a contraction in 2023, with some assembly equipment segments feeling the pinch of oversupply.

Products heavily reliant on these oversupplied traditional markets, where BE Semiconductor Industries' competitive edge might be less pronounced compared to more advanced or niche segments, would exhibit low growth and low market share. This situation ties up valuable capital within the company without generating substantial returns, mirroring the characteristics of a Dog in the BCG framework. The ongoing efforts to rebalance inventory in the consumer electronics sector, a major end-market for these traditional chips, further exacerbates this overcapacity.

- Low Market Growth: Traditional assembly segments are experiencing subdued growth due to market saturation and reduced demand.

- Low Market Share: BE Semiconductor Industries may hold a smaller share in these commoditized, highly competitive traditional assembly areas.

- Capital Intensive: Products serving these markets require significant investment in manufacturing and R&D, tying up capital.

- Limited Profitability: The intense competition and oversupply in traditional assembly markets generally lead to lower profit margins.

BE Semiconductor Industries' older generation assembly equipment for mainstream automotive applications is likely positioned as a Dog. The automotive sector has experienced reduced demand, impacting Besi's revenue, with a projected revenue decline in Q4 2024. This segment faces low market share and minimal growth, making divestiture a strategic consideration.

Legacy assembly equipment for traditional smartphone applications also falls into the Dogs category due to persistent market weakness. These products are characterized by declining demand and overcapacity, acting as cash traps that tie up capital with limited return potential.

Standard assembly tools in commoditized semiconductor assembly markets are also Dogs. Intense competition and low differentiation limit market share, operating in low-growth environments with limited returns.

Products serving traditional assembly markets like back-end semiconductor assembly for logic and memory chips, facing persistent overcapacity, are classified as Dogs. These segments exhibit low growth and low market share, tying up capital without substantial returns.

| Product Segment | BCG Category | Key Characteristics | Financial Implication |

| Older Automotive Assembly Equipment | Dog | Low market share, minimal growth, overcapacity in sector | Revenue decline, divestiture potential |

| Legacy Smartphone Assembly Equipment | Dog | Declining demand, overcapacity, cash trap | Limited profitability, capital drain |

| Standard Assembly Tools (Commoditized) | Dog | High competition, low differentiation, low growth | Break-even performance, minimal cash generation |

| Traditional Back-End Assembly (Logic/Memory) | Dog | Persistent overcapacity, low growth, low market share | Tied-up capital, low returns |

Question Marks

Besi's new hybrid bonding tool, boasting 50nm accuracy and slated for a late 2025 launch, is positioned for the demanding next-generation logic semiconductor market, aiming for sub-2nm design geometries. This advanced capability targets a high-growth segment within the semiconductor manufacturing industry.

Despite the promising market for hybrid bonding, this specific tool is in its early phase, meaning it currently holds a minimal market share as it works towards broader industry acceptance and integration. Its success hinges on gaining traction and demonstrating its value proposition to key players.

Significant capital investment will be crucial for Besi to establish this new tool as a market leader. Without substantial development and aggressive market penetration strategies, the tool risks being categorized as a Dog in the BCG matrix, characterized by low market share and potentially low growth if adoption falters.

Memory manufacturers such as Samsung and SK hynix are aggressively pushing research and development for hybrid bonding and advanced Through-Silicon Via (TSV) Copper Bonding (TCB) technologies, specifically targeting future High Bandwidth Memory (HBM) generations like HBM4 and HBM4E. This advancement is anticipated to see market adoption as early as next year, signaling a significant shift in memory architecture.

BE Semiconductor Industries (Besi) is developing specialized TCB systems designed for these cutting-edge HBM applications. While this positions Besi in a rapidly expanding market, their market share for these particular advanced TCB systems is likely modest currently, given that these products are still in the prototype or initial commercialization stages. This phase typically involves substantial investment in research and development and early-stage deployment costs.

New advanced packaging solutions targeting nascent niche markets, like those for quantum computing or advanced bio-sensors, represent BE Semiconductor Industries' potential "Question Marks" in the BCG matrix. While Besi's commitment to R&D fuels these innovations, their current market share in these emerging areas is naturally low due to the markets themselves being in their infancy. These products demand significant investment to foster adoption and secure future market leadership.

Strategic Investments in New Process Technologies with Unproven Market Adoption

Besi's commitment to innovation is evident in its consistent R&D increases, aiming to pioneer next-generation technologies and broaden its market reach. New process technologies with nascent commercialization and unproven market adoption, despite their high growth potential, are strategically placed here. These represent significant investments with inherently uncertain near-term returns.

These ventures, while carrying substantial risk, are crucial for Besi's long-term competitive advantage and market leadership. For instance, in 2023, Besi's R&D expenditure represented approximately 11.5% of its net sales, highlighting a significant allocation towards future growth engines. The company's focus on advanced packaging solutions, such as hybrid bonding, exemplifies this strategy, where early adoption challenges are weighed against the transformative potential in semiconductor manufacturing.

- High R&D Investment: Besi dedicates substantial resources to developing cutting-edge technologies, often exceeding 10% of net sales annually.

- Unproven Market Adoption: Investments are made in technologies where market acceptance is still being established, carrying inherent risks.

- Long-Term Growth Potential: These strategic bets are aimed at capturing future market share in emerging semiconductor sectors.

- Resource Intensive: Early-stage technology development requires significant capital and expertise with no guarantee of immediate commercial success.

Expansion into Specific Emerging Geographic Markets for Advanced Packaging

Expansion into specific emerging geographic markets for advanced packaging, particularly in regions experiencing rapid semiconductor growth but where BE Semiconductor Industries (Besi) has lower brand recognition or market share for certain advanced packaging solutions, would fall under the Stars category in a BCG Matrix analysis. This signifies a high-growth market where Besi is investing to build its position.

These strategic market entries require substantial marketing and sales investments to rapidly capture market share. For instance, Besi's focus on expanding its footprint in Southeast Asia, a region projected for significant semiconductor manufacturing expansion, aligns with this strategy. By 2024, countries like Vietnam and Malaysia are anticipated to see a substantial increase in semiconductor assembly and testing operations, creating a fertile ground for Besi's advanced packaging equipment.

- High-Growth Market Entry: Targeting emerging geographic markets with strong semiconductor growth potential for advanced packaging solutions.

- Investment Required: Significant marketing and sales expenditure is necessary to establish brand presence and gain market share.

- Strategic Importance: Building a strong foothold in these new regions is crucial for future revenue streams and competitive positioning.

- Example: Expanding into Southeast Asia, where semiconductor manufacturing is rapidly growing, to offer advanced packaging equipment.

BE Semiconductor Industries' ventures into new, unproven semiconductor markets, such as those for quantum computing or advanced bio-sensors, represent their Question Marks. These areas, while holding significant future potential, are in their nascent stages, meaning Besi currently commands a minimal market share.

The company's substantial investment in research and development, which was approximately 11.5% of net sales in 2023, fuels these innovative but uncertain product lines. This strategy aims to establish leadership in future high-growth segments, though near-term returns are not guaranteed.

These investments are resource-intensive, requiring considerable capital and expertise without immediate commercial success. The success of these Question Marks hinges on fostering market adoption and demonstrating their value proposition to key players in these emerging fields.

Besi's strategic allocation of resources towards these early-stage technologies underscores a commitment to long-term competitive advantage, even with the inherent risks associated with unproven market acceptance.

BCG Matrix Data Sources

Our BE Semiconductor Industries BCG Matrix is built on a foundation of financial disclosures, market growth data, and industry expert analysis to provide a clear strategic overview.