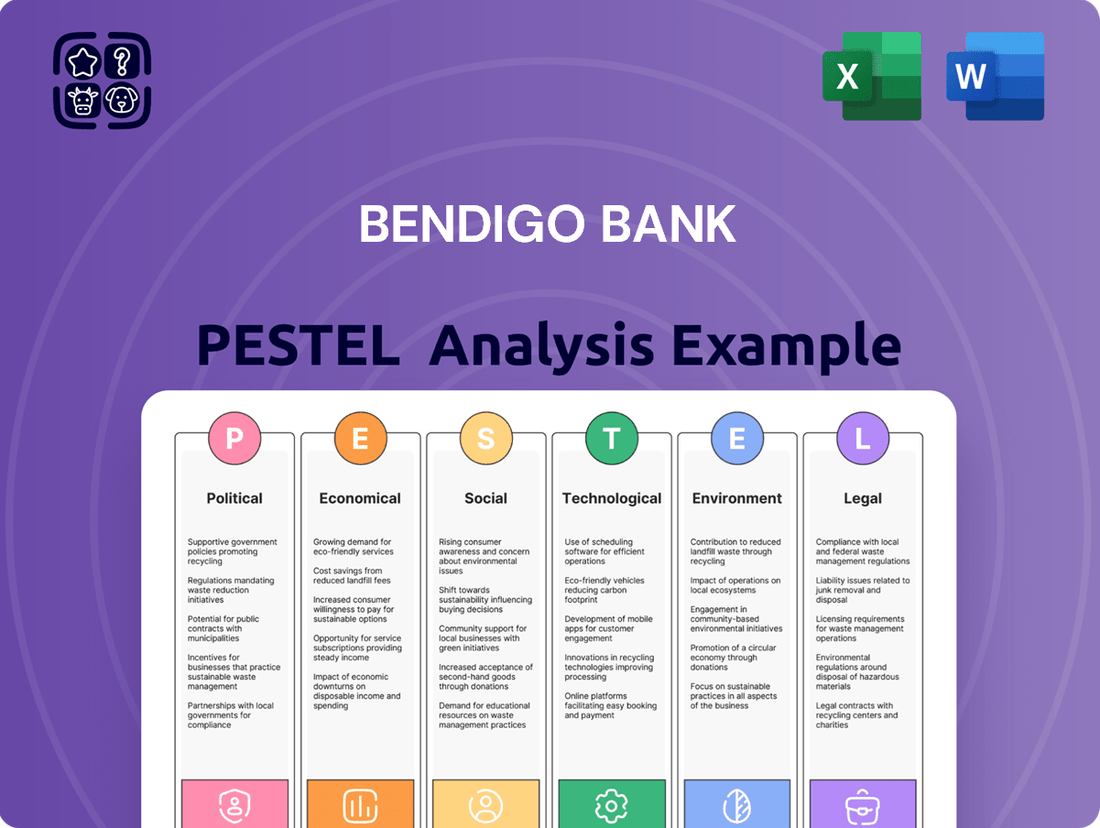

Bendigo Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bendigo Bank Bundle

Bendigo Bank operates within a dynamic external environment, shaped by political shifts, economic fluctuations, and evolving social attitudes. Understanding these forces is crucial for strategic planning and identifying future opportunities and risks. Our comprehensive PESTLE analysis delves into these critical factors, offering actionable insights.

Gain a competitive edge by understanding how technological advancements and environmental regulations impact Bendigo Bank's operations and market position. This detailed PESTLE analysis provides the deep-dive intelligence you need to anticipate market changes and make informed decisions. Download the full version now for immediate strategic clarity.

Political factors

The Australian Prudential Regulation Authority (APRA) has set a clear direction for 2024-25, focusing on reinforcing capital and liquidity requirements for banks. This includes a significant push for enhanced operational and cyber resilience, directly impacting institutions like Bendigo Bank.

Bendigo Bank, along with its peers, must navigate these updated prudential standards. These regulations are fundamental, governing everything from how much capital a bank must hold to how it manages risks and its day-to-day operations. Staying compliant is not just about avoiding fines; it's essential for maintaining the ability to operate as a bank.

The Australian federal government is actively engaging with major banks, including discussions to maintain regional branch operations until at least mid-2027. This initiative reflects a commitment to preserving access to banking services in rural and remote areas, potentially impacting Bendigo Bank's branch network strategy.

In June 2024, the Australian Securities and Investments Commission (ASIC) approved the updated 2025 Banking Code of Practice. This revised code significantly strengthens consumer protections, particularly for small businesses and vulnerable customers, setting new benchmarks for the industry.

Bendigo Bank must meticulously adapt its operational procedures and customer service frameworks to fully comply with the enhanced requirements of the 2025 Banking Code of Practice. Adherence is crucial for fostering continued consumer confidence and mitigating the risk of regulatory penalties.

The Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission (ASIC) are introducing the Financial Accountability Regime (FAR) starting March 2025, initially for insurance and superannuation sectors. This move signals a significant shift towards enhanced governance and personal accountability for senior executives in financial services.

While Bendigo Bank is not directly impacted by the initial rollout, the FAR's broader objective of fostering greater accountability across the financial services industry suggests a potential future extension of such stringent requirements to the banking sector. This regulatory evolution could necessitate increased oversight and responsibility for Bendigo Bank's leadership, aligning with global trends in financial sector regulation.

Political Stability and Geopolitical Tensions

Australia's generally stable political landscape offers a supportive framework for banking activities. However, ongoing global geopolitical tensions, including the potential for trade disputes like US tariffs, can introduce market uncertainty. While Australia might experience less direct impact compared to some nations, these global dynamics can subtly influence trade relationships and overall investor confidence, shaping the economic conditions relevant to Bendigo Bank's operations.

These international factors are also a consideration for the Reserve Bank of Australia (RBA) when formulating monetary policy. For instance, in late 2023 and early 2024, global inflation concerns and shifts in major economies influenced the RBA's approach to interest rates, indirectly affecting the banking sector.

- Geopolitical Risk: Global trade tensions, such as those involving major economies, can impact Australia's export markets and supply chains, indirectly affecting business and consumer confidence.

- Monetary Policy Influence: International economic trends and geopolitical events are factored into the RBA's decisions on interest rates, which directly influence lending and deposit rates for banks like Bendigo.

- Investor Sentiment: Heightened global uncertainty can lead to capital flight or reduced foreign investment, impacting the availability of funding and the overall investment climate in Australia.

Government's Digital Transformation Agenda

The Australian government's strong focus on digital transformation, exemplified by initiatives like the phasing out of cheques and a noticeable decline in cash usage, significantly shapes the banking landscape. This governmental push directly influences how financial institutions like Bendigo Bank must adapt their operations to meet evolving customer needs and regulatory expectations.

Bendigo Bank is actively addressing this shift by forging strategic partnerships. These collaborations aim to assist customers in navigating the digital divide, ensuring they possess the confidence and capabilities to utilize digital banking services effectively. This proactive approach aligns with the government's overarching objective of fostering a more digitally integrated economy.

- Digital Payments Growth: Digital payment volumes in Australia have surged, with a significant portion of transactions now occurring electronically, reflecting the government's digital agenda.

- Cheque Decline: The volume of cheques processed in Australia has fallen dramatically, with projections indicating a near-complete phase-out in the coming years.

- Digital Inclusion Programs: Government-backed programs are increasingly focused on digital literacy and inclusion, encouraging broader adoption of online services.

Government initiatives, such as maintaining regional bank branches until mid-2027, directly influence Bendigo Bank's community engagement strategies. The updated 2025 Banking Code of Practice, approved in June 2024, mandates stronger consumer protections, particularly for small businesses and vulnerable customers, requiring significant operational adjustments for Bendigo Bank.

The impending Financial Accountability Regime (FAR) from March 2025, while initially targeting other sectors, signals a trend towards increased executive accountability in financial services, which could extend to banks like Bendigo. Australia's stable political environment generally supports banking, but global geopolitical risks can create economic uncertainty, impacting investor sentiment and the Reserve Bank of Australia's monetary policy decisions.

The government's push for digital transformation, including the decline of cheque usage, necessitates that Bendigo Bank prioritizes digital service delivery and customer digital literacy programs. Digital payment volumes in Australia have seen substantial growth, with electronic transactions dominating, underscoring the need for banks to adapt to this evolving landscape.

What is included in the product

This PESTLE analysis delves into the external macro-environmental factors influencing Bendigo Bank, examining the Political, Economic, Social, Technological, Environmental, and Legal landscapes. It provides a comprehensive understanding of how these forces create opportunities and threats for the bank.

Provides a concise version of Bendigo Bank's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions to quickly address external challenges.

Economic factors

The Reserve Bank of Australia (RBA) held the official cash rate at 4.35% through 2024, with a projected start to rate cuts in early 2025, potentially by May. This sustained high interest rate environment, driven by persistent inflation, has put pressure on household finances and could lead to an increase in overdue residential loan payments.

Bendigo Bank's net interest margin (NIM) experienced a positive trend in the latter half of its 2024 financial year, recovering from earlier impacts related to the pricing of loans and deposits in the prevailing interest rate climate.

Australia's economic growth was modest in 2024, with projections suggesting a pickup to 2.2% annual GDP growth by the end of 2025. This recovery is occurring despite ongoing cost-of-living pressures and elevated interest rates, which continue to strain household budgets and influence consumer spending patterns.

Despite these headwinds, consumer demand for digital and mobile payment solutions remains robust. Bendigo Bank experienced growth in customer deposits, a trend bolstered by its strong performance in digital channels and the ongoing support from its network of community-based branches.

The Australian banking landscape is a battleground, with fintechs actively disrupting traditional players, particularly in digital payments and business services. This evolving environment means banks like Bendigo need to constantly innovate to stay ahead.

Bendigo Bank has demonstrated resilience, achieving customer growth that outpaces both major and regional banks, and its asset base has now surpassed $100 billion. This expansion is a positive sign amidst a challenging market.

Despite this growth, the entire sector, including Bendigo, faces significant pressure on net interest margins due to fierce competition in crucial areas like home lending and deposit-taking. This competitive intensity is a key factor influencing profitability.

Lending and Deposit Trends

Bendigo Bank saw a significant uptick in demand for its lending and deposit offerings, which bolstered its balance sheet throughout FY2024. This growth was particularly evident in residential lending, which expanded, alongside a notable increase in Agribusiness lending.

The bank's ability to attract and retain customer deposits remains a key strength, as reflected in its robust household loan-to-deposit ratio. This indicates an effective strategy for managing its funding sources.

- Residential Lending Growth: Bendigo Bank's residential mortgage portfolio experienced expansion in FY2024.

- Agribusiness Momentum: The Agribusiness sector also contributed to lending growth, showcasing diversification.

- Strong Deposit Base: The bank's household loan-to-deposit ratio remained healthy, highlighting deposit-gathering success.

Investment in Growth and Cost Management

Bendigo Bank is strategically focusing investment on digital capabilities for FY2025 and FY2026, aiming to enhance customer experience and operational efficiency. This forward-looking investment is crucial for maintaining competitiveness in the evolving financial landscape.

However, these investments, alongside technology inflationary pressures, have led to an increase in operating expenses. For instance, the bank's cost-to-income ratio saw an upward trend in recent periods, reflecting the upfront costs of its transformation program.

The bank has set ambitious medium-term targets to address these cost pressures. These include reducing its cost-to-income ratio to a lean 50% and achieving a return on equity that surpasses its cost of capital, signaling a strong commitment to profitability and shareholder value.

- Digital Investment: Bendigo Bank plans significant capital allocation towards digital transformation in FY2025 and FY2026.

- Expense Drivers: Increased operating expenses are attributed to transformation initiatives and rising technology costs.

- Financial Targets: Medium-term goals include a 50% cost-to-income ratio and return on equity above the cost of capital.

The Australian economy is projected to see a modest growth of 2.2% by the end of 2025, a pickup from 2024's performance, despite ongoing cost-of-living pressures. Elevated interest rates, with the RBA holding the cash rate at 4.35% through 2024 and potential cuts anticipated in early 2025, continue to impact household finances and could increase overdue loan payments.

Bendigo Bank's net interest margin showed recovery in the latter half of FY2024, indicating resilience in a challenging interest rate environment. Consumer demand for digital solutions remains strong, supporting Bendigo's deposit growth, which has been further aided by its community branch network.

| Economic Indicator | Value | Period |

| Projected GDP Growth | 2.2% | End of 2025 |

| Official Cash Rate | 4.35% | Throughout 2024 |

| Potential Rate Cut Start | Early 2025 | Projected |

What You See Is What You Get

Bendigo Bank PESTLE Analysis

The Bendigo Bank PESTLE Analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. It details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Bendigo Bank.

The content and structure shown in the preview is the same document you’ll download after payment, providing a comprehensive overview for strategic planning.

Sociological factors

Bendigo Bank's commitment to a community-centric approach is a significant sociological factor. In FY2024 alone, their unique Community Bank model channeled over $40 million into local communities, supporting more than 8,000 projects. This dedication to 'profit-with-purpose,' returning profits to the community, not only bolsters local social fabric and infrastructure but also cultivates deep customer loyalty and trust.

Bendigo Bank understands that a digital divide exists, meaning not everyone has equal access to or comfort with technology. To bridge this gap, they've teamed up with groups like the Good Things Foundation. This collaboration aims to teach people, both customers and those who aren't, how to use digital tools safely and effectively.

Through these partnerships, individuals can learn to confidently manage their finances online, from making payments to using the Bendigo Bank app. This focus on digital literacy is a key part of their commitment to financial inclusion, as highlighted in their Foundational Financial Inclusion Action Plan for 2024-2025.

Bendigo Bank's customer base expanded by 9.1% year-on-year in FY2024, reaching over 2.5 million customers, demonstrating a strong preference for its offerings. Its Net Promoter Score (NPS) consistently outperforms the industry average, highlighting high customer satisfaction and engagement.

The success of its digital neobank, Up, which appeals to a younger demographic, underscores evolving customer preferences for innovative and accessible banking solutions. This digital growth is further supported by a rise in customer deposits, facilitated by convenient digital deposit channels.

Regional Presence and Branch Closures

Bendigo Bank's decision to close 10 branches by late October 2025, particularly affecting regional areas, underscores a significant sociological shift. This move impacts communities that depend on physical access to banking services, raising concerns about financial inclusion and the digital divide.

The Finance Sector Union has voiced strong opposition, emphasizing the strain this places on regional residents and the potential erosion of community ties. This highlights a broader societal debate about balancing technological advancement with the preservation of essential services in less urbanized areas.

While Bendigo Bank reaffirms its dedication to its Community Bank model, the reduction in its physical presence signals a changing landscape for customer interaction. This evolution reflects broader societal trends towards digital engagement, but it creates a clear tension for those who prefer or require face-to-face banking.

- Branch Closures: 10 branches slated for closure by October 2025.

- Impacted Areas: Primarily regional communities reliant on physical banking.

- Union Criticism: Finance Sector Union highlights concerns over community service access.

- Societal Tension: Balancing digital transformation with the needs of regional populations.

Workforce and Staffing Challenges

Bendigo Bank, like many financial institutions, grapples with workforce and staffing challenges, especially in its strong regional presence. A key focus remains on ensuring adequate staffing levels to consistently serve its customer base, a task made more complex by competition for talent.

The bank's commitment to investing in its employees is crucial, acknowledging the evolving nature of the banking sector and the increasing demand for specialized skills and experience. This investment is vital for maintaining service quality and adapting to new technologies and customer expectations.

For instance, in 2024, the Australian banking sector experienced a notable shortage of skilled professionals, particularly in areas like cybersecurity and data analytics, impacting recruitment efforts across the board. Bendigo Bank's proactive approach to staff development and retention is therefore a significant strategic imperative.

Key workforce considerations for Bendigo Bank include:

- Attracting and retaining talent in regional markets, which often present unique recruitment hurdles compared to metropolitan areas.

- Developing a workforce with future-ready skills, encompassing digital literacy, data analysis, and customer relationship management.

- Managing employee engagement and well-being to foster a productive and stable workforce amidst industry changes.

- Addressing potential skills gaps through targeted training and development programs to meet the evolving demands of the financial services landscape.

Bendigo Bank's community focus is deeply ingrained, with over $40 million channeled into local projects in FY2024, supporting over 8,000 initiatives. This model fosters strong customer loyalty and trust by reinvesting profits locally. The bank is also actively addressing the digital divide through partnerships like the one with Good Things Foundation, aiming to enhance digital literacy for all Australians, as outlined in their 2024-2025 Financial Inclusion Action Plan.

Technological factors

Bendigo Bank's digital transformation, targeting completion by 2025, is a significant technological undertaking. This initiative involves migrating operations from eight disparate banking systems onto a singular, modernized core banking platform. This consolidation is crucial for simplifying their IT infrastructure and enabling greater agility.

The bank is actively transitioning to cloud-based services and leveraging reusable APIs as part of this modernization. These technological shifts are designed to create a more integrated and seamless customer experience across all channels, from mobile apps to in-branch interactions.

By streamlining services through this digital overhaul, Bendigo Bank aims to significantly enhance operational efficiency. This strategic move positions them to better compete in an increasingly digital financial landscape, with the expectation of improved service delivery and cost savings.

Bendigo Bank is actively integrating artificial intelligence and automation, notably using AI to modernize its legacy systems and facilitate its move to an AI-powered cloud environment. This strategic adoption is crucial for enhancing operational efficiency and future-proofing its technological backbone.

By 2025, AI is projected to significantly streamline core financial operations such as invoicing and accounts payable/receivable, leading to faster and more accurate payment processing. This efficiency gain is a key objective within the bank’s broader digital transformation efforts.

The bank’s new five-year strategy explicitly includes embedding AI into various operational processes. This demonstrates a commitment to leveraging AI not just for specific tasks but as a foundational element for future growth and service delivery.

The Australian fintech sector is experiencing robust growth, with an anticipated compound annual growth rate of 10.32% between 2024 and 2029, presenting a significant competitive challenge to established banks like Bendigo Bank. These agile fintech firms are disrupting traditional banking models by offering highly integrated and user-friendly payment solutions.

Bendigo Bank is actively responding to this evolving landscape by emphasizing its inherent agility and a strong focus on customer needs. Furthermore, the bank is strategically forming partnerships with fintech innovators to integrate cutting-edge technologies into its own service offerings.

Key technological advancements driving this competition include the widespread adoption of biometric authentication for enhanced security, the deployment of artificial intelligence for sophisticated fraud detection, and the exploration of blockchain technology for more efficient and secure payment systems.

Cybersecurity and Data Security

Cybersecurity is a critical concern for Bendigo Bank, especially as the financial sector becomes more digitally integrated. Global damages from cyber threats are projected to hit $10.5 trillion by 2025, highlighting the escalating risk. This means robust defenses are not just good practice, but essential for survival.

The Australian Prudential Regulation Authority (APRA) is actively pushing for higher cybersecurity standards. APRA's close watch on banks to ensure adherence to Prudential Standard CPS 234 Information Security means Bendigo Bank needs to demonstrate strong cyber risk management. Compliance is key to avoiding penalties and maintaining operational integrity.

- Escalating Threat Landscape: Global cybercrime costs are forecast to reach $10.5 trillion annually by 2025, a significant increase that demands proactive defense strategies.

- Regulatory Scrutiny: APRA's focus on Prudential Standard CPS 234 Information Security means banks like Bendigo must demonstrate rigorous data protection and cyber resilience.

- Customer Trust Imperative: Maintaining customer confidence hinges on the bank's ability to safeguard sensitive data, making cybersecurity a fundamental pillar of its reputation.

Payments Innovation (NPP, Digital Wallets)

The Australian payments landscape is undergoing a significant transformation, driven by innovations like the New Payments Platform (NPP). The NPP facilitates instant, data-rich transactions, a stark contrast to traditional slower methods. As of late 2023, the NPP had processed over 2 billion payments, highlighting its rapid adoption and integration into daily financial activities.

Digital wallets, such as Apple Pay and Google Pay, are also playing a pivotal role in this evolution. These platforms are increasingly preferred for device-present transactions, with their market share continuing to climb. In Australia, contactless payments, largely facilitated by digital wallets, represented over 80% of card transactions by early 2024, demonstrating a clear consumer preference for convenience and speed.

Bendigo Bank is strategically positioned to capitalize on these technological shifts. Its investment in digital channels and the development of its neobank offering, 'Up', are key to capturing this growing demand for digital and real-time payments. 'Up' has seen substantial user growth, reaching over 700,000 customers by mid-2024, indicating strong market traction in the digital banking space.

- NPP Growth: Over 2 billion NPP payments processed by late 2023.

- Digital Wallet Dominance: Contactless payments exceeding 80% of Australian card transactions by early 2024.

- 'Up' Customer Acquisition: 'Up' neobank surpassed 700,000 customers by mid-2024.

Technological advancements are reshaping Bendigo Bank's operational landscape, with a significant digital transformation targeting completion by 2025. This involves migrating to a single core banking platform and embracing cloud services and APIs to enhance customer experience and operational efficiency. The bank is also integrating artificial intelligence to modernize systems and streamline financial processes, aiming for faster, more accurate transactions by 2025.

The Australian fintech sector's projected 10.32% CAGR between 2024 and 2029 presents both a challenge and an opportunity, driving Bendigo Bank to partner with innovators and leverage technologies like biometrics and AI for fraud detection. Cybersecurity remains paramount, with global cybercrime costs expected to reach $10.5 trillion by 2025, necessitating adherence to APRA's CPS 234 standard to maintain customer trust and operational integrity.

The New Payments Platform (NPP) has processed over 2 billion transactions by late 2023, while digital wallets facilitate over 80% of Australian card transactions by early 2024. Bendigo Bank's neobank offering, 'Up', has attracted over 700,000 customers by mid-2024, demonstrating successful engagement with digital payment trends.

| Technology Area | Bendigo Bank Initiative/Impact | Key Data/Projection |

|---|---|---|

| Digital Transformation | Core banking platform migration, cloud adoption, API integration | Target completion by 2025 |

| Artificial Intelligence | System modernization, process automation | AI to streamline operations by 2025 |

| Fintech Competition | Partnerships, agility focus | Fintech CAGR 10.32% (2024-2029) |

| Cybersecurity | Risk management, regulatory compliance | Global cybercrime costs $10.5T by 2025; APRA CPS 234 |

| Payments Innovation | NPP, digital wallets, 'Up' neobank | NPP >2B transactions (late 2023); Contactless >80% (early 2024); 'Up' >700K customers (mid-2024) |

Legal factors

The 2025 Banking Code of Practice, approved by ASIC in June 2024 and effective from February 28, 2025, introduces significant legal shifts for banks like Bendigo. This updated code broadens the definition of small business, aiming to offer greater protection to a wider range of enterprises.

Furthermore, the new code enhances the definition of vulnerability, ensuring more robust support for customers facing challenging circumstances. It also mandates improved inclusivity and accessibility across banking services, reflecting evolving societal expectations and legal requirements.

New obligations concerning guarantors and the management of deceased estates are also a key component, requiring banks to adopt more stringent and sensitive procedures in these areas, thereby increasing compliance burdens but also fostering greater consumer trust.

The Australian Prudential Regulation Authority (APRA) is enhancing prudential standards, with a focus on bank capital and liquidity for 2024-25. A significant development is the implementation of new operational resilience standards, such as CPS 230, which takes effect from July 1, 2025.

Bendigo Bank must maintain capital levels comfortably exceeding regulatory minimums to navigate these strengthened requirements. Furthermore, the bank needs to proactively update its operational risk management frameworks to align with the forthcoming operational resilience standards, ensuring robust business continuity and risk mitigation.

Australian Securities and Investments Commission (ASIC) actively monitors the banking sector, enforcing consumer protection laws. A July 2024 ASIC report identified significant issues with fee practices across the industry, resulting in orders for banks, including Bendigo Bank, to refund approximately $60 million in overcharged fees to low-income customers.

This regulatory action underscores the continuous legal imperative for financial institutions to maintain equitable and transparent operations, with a particular focus on safeguarding vulnerable consumer segments.

Financial Crime and Anti-Money Laundering (AML)

Bendigo Bank, like all financial institutions, operates within a stringent legal landscape concerning financial crime and anti-money laundering (AML). The Australian Transaction Reports and Analysis Centre (AUSTRAC) is the primary regulator, setting compliance requirements. For instance, in the 2022-23 financial year, AUSTRAC reported that financial entities submitted over 65 million threshold transaction reports, highlighting the volume of activity monitored to detect suspicious behavior.

The evolving nature of financial crime, including AI-driven payment fraud, necessitates continuous adaptation. Regulatory bodies are increasingly promoting intelligence sharing between banks, law enforcement, and government agencies. This collaborative approach is crucial for effectively combating sophisticated financial crimes. Bendigo Bank's commitment to robust AML and counter-terrorism financing (CTF) frameworks is paramount, requiring active participation in industry-wide initiatives to detect and prevent illicit financial flows.

- Regulatory Oversight: Bendigo Bank is subject to Australian federal legislation, including the Anti-Money Laundering and Counter-Terrorism Financing Act 2006, overseen by AUSTRAC.

- Increased Intelligence Sharing: Fintech policies are driving greater collaboration between financial institutions, law enforcement, and government to combat financial crime and fraud.

- Compliance Burden: Maintaining comprehensive AML/CTF programs involves significant investment in technology and personnel to meet evolving legislative demands.

- Industry Participation: Active engagement in industry forums and data-sharing initiatives is essential for Bendigo Bank to stay ahead of emerging financial crime typologies.

Data Privacy and Consumer Data Right (CDR)

Open Banking, driven by Australia's Consumer Data Right (CDR) legislation, is fundamentally reshaping how financial institutions like Bendigo Bank operate by mandating secure data sharing. This regulatory environment necessitates robust data management to ensure customer privacy and compliance, while simultaneously opening avenues for innovative service development and strategic alliances.

The ongoing expansion of the CDR framework underscores a significant movement towards enhanced consumer empowerment and increased market transparency in the Australian financial sector. For Bendigo Bank, this means navigating a landscape where customer data control is paramount, impacting everything from product design to partnership strategies.

- Increased Data Sharing: CDR facilitates secure data sharing, enabling new financial products and embedded finance opportunities.

- Consumer Data Rights: Consumers gain greater control over their financial data, promoting transparency and competition.

- Security and Compliance: Banks must invest in advanced security measures to protect sensitive customer information and adhere to strict privacy regulations.

- New Service Offerings: The regulatory shift encourages banks to leverage data for personalized services and collaborations with fintechs.

Bendigo Bank faces evolving legal obligations, including the 2025 Banking Code of Practice, which broadens small business definitions and enhances protections for vulnerable customers. New mandates for guarantor management and deceased estates increase compliance complexity, while ASIC's focus on fee practices, as seen in a July 2024 report ordering $60 million in refunds, highlights the need for transparent operations.

APRA's strengthened prudential standards for 2024-25, particularly operational resilience requirements like CPS 230 from July 2025, necessitate robust risk management frameworks. Furthermore, adherence to AUSTRAC's AML/CTF regulations, evidenced by over 65 million threshold transaction reports in FY22-23, remains critical, especially with the rise of AI-driven fraud.

The Consumer Data Right (CDR) legislation is driving increased data sharing and consumer control, requiring significant investment in security and compliance for banks like Bendigo. This regulatory shift fosters opportunities for new, data-driven financial products and embedded finance solutions.

| Regulatory Area | Key Development/Requirement | Impact on Bendigo Bank | Relevant Date/Period |

|---|---|---|---|

| Banking Code of Practice | Expanded small business definition, enhanced vulnerability support | Increased customer protection obligations, potential compliance adjustments | Effective February 28, 2025 |

| Prudential Standards (APRA) | New operational resilience standards (CPS 230) | Requires updated operational risk management and business continuity plans | Effective July 1, 2025 |

| Consumer Protection (ASIC) | Focus on fee practices and refunds | Mandates equitable and transparent fee structures; potential for further scrutiny | July 2024 reporting; ongoing enforcement |

| AML/CTF (AUSTRAC) | Stringent reporting and compliance for financial crime | Requires robust AML/CTF programs and active participation in intelligence sharing | FY22-23: 65M+ threshold transaction reports submitted |

| Consumer Data Right (CDR) | Mandated secure data sharing and consumer data control | Necessitates investment in data security and privacy compliance; enables new service offerings | Ongoing expansion |

Environmental factors

The Australian Prudential Regulation Authority's (APRA) 2024-25 Corporate Plan signals a heightened focus on climate-related financial risks for regulated entities like Bendigo Bank. This commitment translates into a need for robust assessment and disclosure of exposures to both physical risks, such as damage from extreme weather events impacting collateral, and transition risks, like shifts in policy or market sentiment favouring a low-carbon economy.

For Bendigo Bank, this means actively quantifying how climate change could affect its loan portfolio and operations. For instance, increased frequency of bushfires or floods in agricultural regions could heighten the risk of loan defaults from affected borrowers, while a rapid transition to renewable energy might devalue assets tied to fossil fuel industries. The bank's 2023 annual report indicated a growing awareness of these issues, with efforts underway to integrate climate risk into its enterprise-wide risk management frameworks.

Bendigo Bank's commitment to environmental factors is evident through its dedicated Sustainability Report and Climate Disclosure, integrated into its annual reporting. This transparency signals a strong focus on Environmental, Social, and Governance (ESG) principles, a key expectation from investors and the wider community.

The bank's inherent community-centric model naturally supports social sustainability, aligning with its broader vision of being a progressive and sustainable organization. For instance, in its 2023 Sustainability Report, Bendigo Bank highlighted a 10% reduction in its Scope 1 and 2 greenhouse gas emissions compared to its 2020 baseline, demonstrating tangible progress in its environmental stewardship.

Bendigo Bank's Community Bank model actively channels investment into local, community-driven projects. These initiatives often have direct environmental benefits, such as improving local infrastructure or supporting renewable energy efforts, contributing to the overall sustainability of the areas it serves.

In the 2023 financial year, Bendigo Bank reported a net profit after tax of $532 million. This strong performance allows for continued investment in these crucial community projects, with a significant portion of profits being reinvested locally, fostering environmental stewardship and enhancing community liveability.

Transition to a Low-Carbon Economy

Australia's commitment to reducing carbon emissions, as evidenced by its participation in international climate agreements, places significant pressure on financial institutions like Bendigo Bank. This transition necessitates a strategic shift towards financing green projects and minimizing the bank's environmental impact. For instance, the Australian government's target to reach net-zero emissions by 2050 will likely drive increased demand for renewable energy and sustainable infrastructure financing.

Bendigo Bank must actively assess its lending portfolio to ensure alignment with national and global climate objectives. This involves identifying and capitalizing on opportunities within the burgeoning green finance sector, such as renewable energy projects, sustainable agriculture, and energy-efficient property development. The bank's own operational footprint, including its supply chain, also requires careful evaluation to identify areas for carbon reduction.

- Increased Demand for Green Finance: Expect a rise in demand for loans and investments in renewable energy, energy efficiency, and sustainable infrastructure as Australia pursues its climate targets.

- Regulatory Scrutiny on Carbon Footprint: Financial regulators are increasingly focused on climate-related financial risks, which could lead to stricter reporting requirements and capital adequacy assessments for banks based on their environmental impact.

- Opportunities in Sustainable Lending: Bendigo Bank can leverage the transition by developing innovative financial products and services that support businesses and individuals in adopting low-carbon practices.

- Reputational Benefits: Proactive engagement with climate change mitigation can enhance Bendigo Bank's brand image and attract environmentally conscious customers and investors.

Stakeholder Expectations and Green Finance

Stakeholders, including customers, investors, and regulators, increasingly expect financial institutions like Bendigo Bank to prioritize environmental responsibility. This translates into a demand for green financial products and services, such as loans for renewable energy projects or investment funds focused on sustainability. For example, the global sustainable finance market reached an estimated $3.5 trillion in 2023, highlighting the significant investor appetite for such offerings.

Bendigo Bank's existing commitment to community and sustainability provides a strong foundation for expanding its green finance portfolio. By developing and actively promoting offerings like green mortgages or impact investment options, the bank can effectively meet these evolving stakeholder demands. This strategic move not only aligns with societal expectations but also presents a clear opportunity for growth and differentiation in the competitive banking landscape.

The push for environmental, social, and governance (ESG) factors is accelerating. In 2024, many major superannuation funds in Australia are increasing their allocation to ESG-compliant assets, with some funds reporting over 50% of their portfolios meeting these criteria. This trend underscores the financial viability and growing importance of sustainable banking practices.

- Growing Demand: Customer and investor preference for sustainable financial products is a significant market trend.

- Regulatory Scrutiny: Financial regulators globally are increasing their focus on climate-related financial risks and disclosure requirements.

- Market Opportunity: Developing green finance offerings can attract new customers and investors, enhancing Bendigo Bank's market position.

- Brand Enhancement: Demonstrating environmental leadership through green finance strengthens brand reputation and stakeholder trust.

Bendigo Bank faces increasing pressure to manage its environmental impact, driven by Australia's net-zero targets and growing stakeholder demand for sustainable finance. This necessitates a strategic shift towards green lending and a careful assessment of climate-related risks within its portfolio.

The bank's commitment to ESG is demonstrated by its 2023 report, which showed a 10% reduction in Scope 1 and 2 emissions against a 2020 baseline. This aligns with the global sustainable finance market, estimated at $3.5 trillion in 2023, indicating significant investor interest in environmentally conscious banking.

Bendigo Bank's community-centric model naturally supports environmental initiatives, with profits often reinvested locally to foster sustainability. This approach is increasingly valued, as evidenced by Australian superannuation funds allocating over 50% of their portfolios to ESG-compliant assets in 2024.

Key environmental factors include the rising demand for green finance, regulatory scrutiny on carbon footprints, opportunities in sustainable lending, and the reputational benefits of environmental leadership.

| Environmental Factor | Impact on Bendigo Bank | Supporting Data/Trend |

|---|---|---|

| Climate Risk Regulation | Increased compliance and reporting requirements, potential capital adjustments. | APRA's 2024-25 Corporate Plan highlights focus on climate risks. |

| Green Finance Demand | Opportunity for new product development and market share growth. | Global sustainable finance market valued at $3.5 trillion in 2023. |

| Emissions Reduction Targets | Need to manage operational footprint and supply chain emissions. | Bendigo Bank reduced Scope 1 & 2 emissions by 10% (vs 2020 baseline) in FY23. |

| Stakeholder Expectations | Enhanced brand reputation and customer loyalty through ESG commitment. | Australian super funds increasing ESG allocation; over 50% in some portfolios (2024). |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Bendigo Bank draws from a comprehensive suite of data, including official government publications, Reserve Bank of Australia reports, and reputable financial news outlets. This ensures a robust understanding of the political, economic, and social landscapes impacting the Australian banking sector.