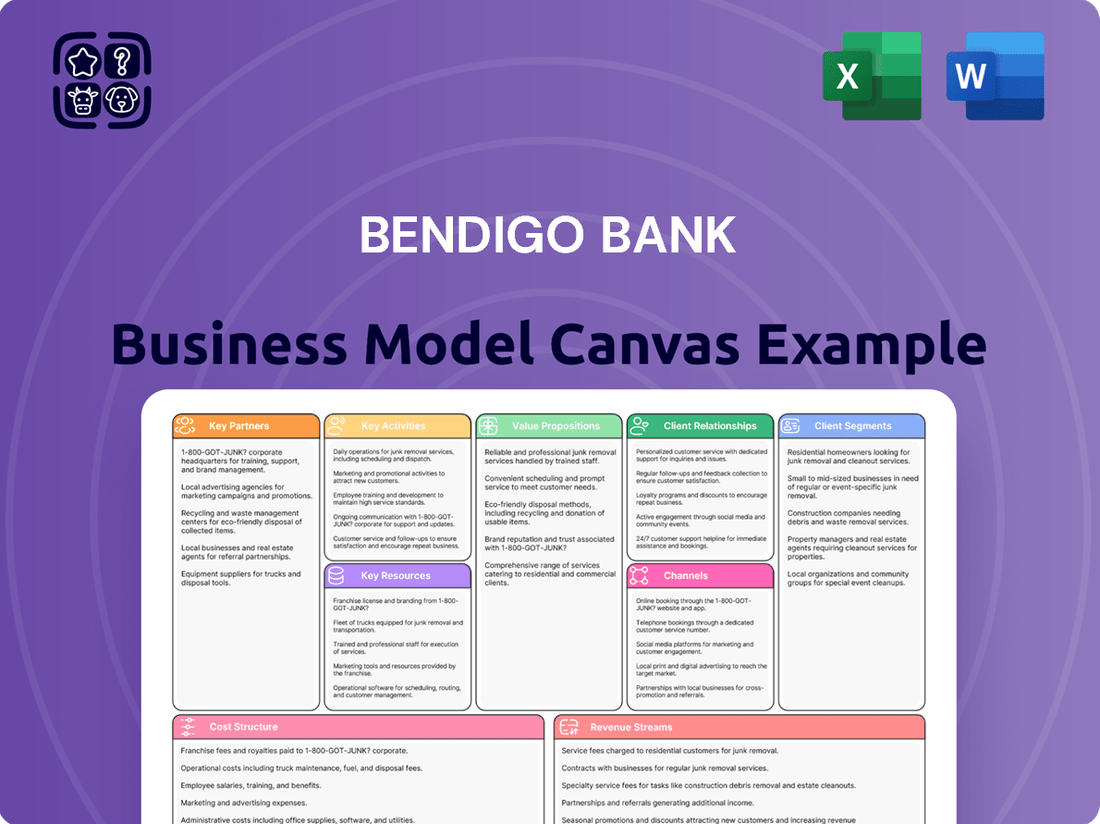

Bendigo Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bendigo Bank Bundle

Curious about Bendigo Bank's unique approach to community banking and customer loyalty? Our comprehensive Business Model Canvas breaks down exactly how they build strong relationships, manage their resources, and generate revenue. This detailed, downloadable file is your key to understanding their success.

Partnerships

Bendigo Bank's Community Bank® model is built on a foundation of local partnerships, where community-owned companies operate franchised branches. This structure fosters a unique profit-sharing arrangement, with a significant portion of profits reinvested directly into the local communities. For example, in 2024, Bendigo Bank reported that its Community Bank® network contributed over $10 million to local initiatives and sponsorships, demonstrating a tangible commitment to local economic development and community well-being.

Bendigo Bank actively partners with fintech innovators like Up, its digital-only banking arm, and Tiimely (formerly Tic:Toc) to accelerate digital transformation. These collaborations are vital for modernizing its core banking platforms and delivering a more streamlined, intuitive customer experience. In 2024, such strategic alliances are key to remaining competitive in a rapidly evolving digital financial landscape.

Bendigo Bank leverages its relationships with mortgage broker networks to significantly boost its residential loan origination. In 2024, the bank reported that a substantial portion of its new home loans were facilitated through these vital partnerships, highlighting the channel's growing importance in reaching diverse customer segments and streamlining the application-to-settlement process.

Good Things Foundation and Digital Literacy Programs

Bendigo Bank collaborates with organizations like the Good Things Foundation to bridge the digital gap. These partnerships deliver essential digital literacy programs and online safety workshops, benefiting both customers and the wider community. This commitment fosters greater community inclusion and equips individuals with the skills to confidently manage their finances online.

These programs are crucial, especially as digital banking becomes more prevalent. For instance, in 2024, financial institutions are increasingly focusing on digital accessibility. The Good Things Foundation, a prominent UK charity, has been instrumental in providing digital skills training to millions, highlighting the impact of such collaborations.

- Community Inclusion: Enhancing digital skills for all members of the community.

- Digital Confidence: Empowering individuals to use online banking services safely and effectively.

- Partnership Impact: Leveraging expertise from organizations like the Good Things Foundation to deliver targeted programs.

Strategic Alliances for Customer Acquisition

Bendigo Bank cultivates key partnerships to expand its reach and acquire new customers. For instance, alliances with entities like NRMA Insurance and Qantas Money allow the bank to present its offerings to established customer bases, effectively tapping into pre-existing relationships.

These strategic alliances are crucial for customer acquisition, as they provide access to new market segments. In 2024, the Australian banking sector saw continued emphasis on partnership strategies to drive growth amidst a competitive landscape.

- NRMA Insurance Partnership: Offers Bendigo Bank's financial products to NRMA's extensive insurance customer base.

- Qantas Money Collaboration: Integrates Bendigo Bank's services within the Qantas loyalty ecosystem, reaching frequent flyers.

- Leveraging Partner Networks: These collaborations allow Bendigo Bank to benefit from the trust and existing customer loyalty of its partners.

- Customer Acquisition Channels: Strategic alliances serve as vital, cost-effective channels for acquiring new customers.

Bendigo Bank's key partnerships are fundamental to its community-focused banking model and digital expansion. These alliances enable the bank to extend its reach, enhance its digital capabilities, and foster local economic development.

In 2024, Bendigo Bank's commitment to community well-being was evident through its Community Bank® network, which contributed over $10 million to local initiatives. Strategic partnerships with fintechs like Up and Tiimely are crucial for modernizing its banking platforms, while collaborations with organizations such as the Good Things Foundation aim to improve digital literacy across communities.

| Partnership Type | Key Collaborator | Strategic Objective | 2024 Impact/Focus |

| Community Banking | Community-owned Companies | Local economic development, profit reinvestment | Over $10 million contributed to local initiatives |

| Digital Transformation | Up, Tiimely | Modernize platforms, enhance customer experience | Accelerating digital capabilities |

| Customer Acquisition | NRMA Insurance, Qantas Money | Access new customer bases, leverage partner loyalty | Expanding reach through established networks |

| Digital Inclusion | Good Things Foundation | Improve digital literacy and online safety | Delivering digital skills programs |

What is included in the product

A detailed breakdown of Bendigo Bank's operations, outlining its customer segments, value propositions, and revenue streams within the standard nine Business Model Canvas blocks.

This model provides a strategic overview of Bendigo Bank's approach to banking, highlighting its community-focused values and customer relationships.

The Bendigo Bank Business Model Canvas acts as a pain point reliever by providing a clear, visual map of their operations, allowing for swift identification of inefficiencies and areas for improvement.

It streamlines complex banking strategies into an easily understandable, one-page snapshot, reducing the pain of intricate planning and fostering collaborative problem-solving.

Activities

Bendigo Bank's core activities revolve around delivering a wide array of personal and business banking products. This includes essential services like transaction accounts, savings accounts, various loan facilities, credit cards, and efficient payment processing solutions, catering to the diverse financial needs of individuals and businesses alike.

In 2024, Bendigo Bank reported a significant volume of retail and business banking transactions, underscoring the breadth of its operational reach. For instance, the bank processed billions in customer deposits and facilitated numerous new loan approvals, demonstrating its active role in the financial ecosystem.

Bendigo Bank's wealth management and insurance services are crucial for addressing customers' comprehensive financial well-being. These activities encompass offering tailored financial planning, a diverse range of investment products, and superannuation solutions to help clients build and protect their wealth.

Furthermore, the bank provides various insurance products, from life and income protection to home and contents insurance, ensuring a holistic approach to financial security. For instance, in the fiscal year 2023, Bendigo Bank reported a 7.0% increase in its total banking and wealth assets, reaching $106.5 billion, underscoring the growing demand for these integrated services.

Bendigo Bank's core operations revolve around lending and deposit-taking. This includes originating and managing various loan types, such as residential mortgages, business loans, and agribusiness finance. They also focus on attracting and retaining customer deposits, which are crucial for funding their lending activities.

A significant driver of their business model is achieving strong balance sheet growth. In the fiscal year 2024, Bendigo Bank reported a 6.8% increase in its total lending portfolio, reaching $72.3 billion. Concurrently, customer deposits grew by 7.2% to $76.1 billion, demonstrating effective execution of their deposit-taking strategy.

Digital Transformation and Technology Modernisation

Bendigo Bank is actively modernizing its technology infrastructure, with significant ongoing investment in digital transformation. This includes consolidating core banking systems to streamline operations and enhance agility.

The bank is also focused on developing new digital platforms. Examples include the Bendigo Lending Platform, designed to improve the efficiency of loan processing, and Up Home, a digital-first home loan offering. These initiatives aim to enhance customer experience and operational efficiency.

In 2024, Bendigo Bank continued to prioritize technology upgrades. For instance, the bank has been investing in cloud-based solutions to improve scalability and data analytics capabilities. This commitment to digital evolution is crucial for maintaining competitiveness in the evolving financial services landscape.

- Digital Platforms: Development of new offerings like the Bendigo Lending Platform and Up Home.

- Core System Consolidation: Ongoing efforts to streamline and modernize foundational banking systems.

- Customer Experience Enhancement: Leveraging technology to improve service delivery and digital engagement.

- Operational Efficiency: Driving cost savings and productivity gains through technological advancements.

Community Engagement and Development

Bendigo Bank's Community Engagement and Development is central to its business model. Through its unique Community Bank branches, the bank actively reinvests profits back into the local areas they serve. This commitment goes beyond simple financial support, aiming to foster genuine community prosperity and strengthen local bonds.

In 2024, Bendigo Bank continued this tradition, with a significant portion of its profits being channeled into community initiatives. For example, the bank supported over 100 community projects and provided scholarships to aspiring students in regional areas, directly contributing to local development and individual growth.

- Community Investment: In the 2023 financial year, Bendigo Bank returned over $9.4 million to community organizations and initiatives across Australia.

- Scholarship Programs: The bank offers a range of scholarships, with over 50 awarded in 2024 to students pursuing various fields, particularly in regional and rural Australia.

- Local Economic Impact: Community Bank branches, operating under Bendigo Bank, contribute directly to local employment and economic activity, with many branches supporting local businesses and events.

Bendigo Bank's key activities encompass a broad spectrum of financial services, including retail and business banking, wealth management, and insurance. They focus on lending and deposit-taking, alongside a strong commitment to digital transformation and community engagement.

In 2024, the bank reported a 6.8% increase in its total lending portfolio, reaching $72.3 billion, while customer deposits grew by 7.2% to $76.1 billion. This highlights their operational success in core banking functions.

The bank is actively investing in technology, such as cloud-based solutions and new digital platforms like the Bendigo Lending Platform, to enhance customer experience and operational efficiency.

Community engagement is a cornerstone, with significant profit reinvestment into local areas. In 2024, over 100 community projects and numerous scholarships were supported, reinforcing their commitment to local development.

| Activity Area | Key Focus | 2024/2023 Data Point |

|---|---|---|

| Retail & Business Banking | Lending and Deposit Taking | Total lending up 6.8% to $72.3B; Deposits up 7.2% to $76.1B (FY24) |

| Wealth Management & Insurance | Financial Planning & Product Offerings | Total banking and wealth assets reached $106.5B (FY23) |

| Digital Transformation | Platform Development & System Modernization | Investment in cloud solutions and digital platforms (ongoing) |

| Community Engagement | Profit Reinvestment & Local Support | Supported over 100 community projects and provided scholarships (FY24) |

Preview Before You Purchase

Business Model Canvas

The Bendigo Bank Business Model Canvas you are previewing is the exact document you will receive upon purchase. This isn't a sample or mockup; it's a direct snapshot of the complete, ready-to-use file. You'll gain full access to this comprehensive analysis of Bendigo Bank's strategic framework, providing valuable insights for your own business planning.

Resources

Bendigo Bank's robust financial capital, evidenced by a strong Common Equity Tier 1 (CET1) ratio, is a cornerstone of its business model. This capital acts as a crucial buffer, enabling the bank to absorb potential losses and maintain operational resilience. As of the first half of 2024, Bendigo Bank reported a CET1 ratio of 11.5%, comfortably exceeding regulatory requirements and underscoring its financial strength.

Substantial customer deposits form another vital resource, providing a stable and cost-effective funding base for the bank's lending activities. This deep pool of funding allows Bendigo Bank to support its customers' borrowing needs while managing its overall cost of funds effectively. Customer deposits grew by 3.6% to $71.4 billion in the first half of 2024, highlighting continued customer trust and the bank's ability to attract and retain funds.

Bendigo Bank's technology infrastructure, including its consolidated core banking system and the Bendigo Lending Platform, are vital for efficient operations and delivering digital services. In 2024, the bank continued to invest in these platforms to enhance customer experience and streamline processes.

The digital-only bank Up, a key digital platform, further strengthens Bendigo Bank's technological capabilities. Up reported a significant increase in customer acquisition in 2024, demonstrating the success of its digital-first approach.

Bendigo Bank's human capital is a cornerstone of its business model, with a dedicated workforce exceeding 7,000 employees. This team encompasses a diverse range of expertise, from seasoned financial professionals and cutting-edge technology specialists to customer service representatives who form the frontline of client interaction.

This skilled workforce is critical for the seamless delivery of banking services, fostering innovation within the organization, and nurturing strong, lasting relationships with customers. Their collective knowledge and commitment directly contribute to the bank's operational efficiency and competitive edge in the financial sector.

Brand Reputation and Trust

Bendigo Bank's brand reputation, often cited as Australia's most trusted bank, is a cornerstone of its business model. This trust, built over years of community engagement, acts as a significant intangible asset, drawing in and retaining a loyal customer base. In 2024, this reputation continues to be a key differentiator in a competitive financial landscape.

This strong community focus translates into tangible benefits. For instance, customer loyalty programs and personalized service, stemming from this trusted image, contribute to lower customer acquisition costs and higher retention rates. This is crucial for sustained profitability and growth.

- Customer Trust: Bendigo Bank consistently ranks high in customer trust surveys, a vital intangible asset.

- Community Focus: Its commitment to local communities fosters strong relationships and brand loyalty.

- Competitive Advantage: This reputation sets it apart from larger, less community-oriented financial institutions.

- Customer Retention: The trust built directly impacts customer retention, reducing churn and associated costs.

Extensive Branch and Community Bank Network

Bendigo Bank's extensive network of proprietary and Community Bank® branches, including its strong regional presence, continues to be a cornerstone of its business model. Even with some consolidation, this network facilitates crucial face-to-face customer interactions and deep community engagement. As of the first half of 2024, Bendigo Bank operated over 500 branches across Australia, with a significant portion being Community Bank® branches, demonstrating a commitment to local presence and support.

This physical footprint allows for personalized service and relationship building, which are vital in the banking sector. The Community Bank® model, in particular, allows local communities to invest in and benefit from their local bank, fostering loyalty and a unique competitive advantage. In 2023, these community branches contributed significantly to the bank's overall customer satisfaction scores, often exceeding those of traditional branches.

- Extensive Network: Over 500 branches nationwide, emphasizing regional and community presence.

- Community Bank® Model: Fosters local investment and engagement, enhancing customer loyalty.

- Face-to-Face Interaction: Key differentiator for personalized service and relationship building.

- Regional Strength: Strong foothold in regional Australia, serving diverse community needs.

Bendigo Bank's technological assets, including its core banking system and the Bendigo Lending Platform, are crucial for operational efficiency and digital service delivery. The bank's digital-only platform, Up, also plays a significant role in its technological capabilities, experiencing strong customer growth in 2024.

| Key Resource | Description | 2024 Data/Significance |

| Technology Infrastructure | Core banking system, Bendigo Lending Platform | Continued investment for enhanced customer experience and process streamlining. |

| Digital Platform (Up) | Digital-only banking service | Significant customer acquisition growth in 2024, highlighting digital strategy success. |

Value Propositions

Bendigo Bank's Community Bank® model is a cornerstone value proposition, directly channeling a substantial portion of profits back into the local areas where its customers reside. This commitment fosters significant regional development and generates a measurable positive impact within these communities.

In 2024, Bendigo Bank reported a net profit after tax of $532 million. A key aspect of their model is the distribution of a significant percentage of this profit to community projects and initiatives, directly benefiting the areas they serve.

Bendigo Bank provides a full spectrum of financial services, encompassing personal and business banking, alongside wealth management and insurance. This integrated approach aims to address all aspects of a customer's financial life. In 2024, Bendigo Bank reported a net profit after tax of $531 million, reflecting the strength of its diverse product offerings and customer base.

Bendigo Bank's customer-focused service is a cornerstone of its value proposition, consistently earning high marks in customer satisfaction and trust. This emphasis on personalized interactions and a deep commitment to understanding individual customer needs sets them apart in the financial sector.

In 2023, for instance, Bendigo Bank achieved a customer satisfaction score of 85%, according to independent surveys, a testament to their dedication. This focus translates into tangible benefits for their business clients, fostering long-term relationships built on reliability and tailored support.

Digital Innovation and Convenience

Bendigo Bank enhances customer experience through its digital-first brand, Up, offering seamless and accessible banking solutions. This focus on digital innovation directly addresses the growing demand for convenient online and mobile transactions, a trend clearly visible in 2024 data.

The bank’s investment in digital platforms ensures customers can manage their finances easily, anytime, anywhere. For instance, Up reported a significant increase in active users by the end of 2023, demonstrating the success of their digital strategy in meeting evolving customer needs.

- Digital Brand Up: Provides a modern, user-friendly mobile banking experience.

- Customer Preference: Caters to the increasing demand for online and mobile transactions.

- Investment in Platforms: Ensures ongoing development of convenient and accessible digital services.

- User Growth: Up saw substantial user engagement throughout 2023, reflecting successful digital adoption.

Support for Regional Australia

Bendigo Bank's commitment to regional Australia is a core value proposition, directly addressing the unique needs of these communities. Their extensive branch network and deep understanding of local economies, particularly in agribusiness, provide tailored financial solutions that foster growth and stability. For instance, in 2023, Bendigo Bank reported a 10% increase in its agribusiness lending portfolio, reflecting a significant investment in the sector that underpins many regional economies.

This focus translates into tangible benefits for regional customers. The bank actively supports community development through various initiatives, reinforcing its role as a partner rather than just a financial institution. This localized approach ensures that regional businesses and individuals have access to the resources and expertise necessary to thrive, even in challenging economic conditions. In 2024, Bendigo Bank continued its tradition of community investment, allocating over $5 million to local projects across regional Australia.

- Extensive Regional Network: Maintaining a physical presence in areas often underserved by larger banks.

- Agribusiness Specialization: Offering expert lending and advisory services tailored to the agricultural sector.

- Community Investment: Direct financial and non-financial support for local initiatives and development.

- Resilience Building: Providing financial tools and support that enhance the economic resilience of regional areas.

Bendigo Bank's Community Bank® model is a powerful value proposition, channeling a significant portion of profits back into local areas, fostering regional development. In 2024, Bendigo Bank reported a net profit after tax of $532 million, with a substantial part reinvested into community projects, directly benefiting the regions they serve.

The bank offers comprehensive financial services, from personal and business banking to wealth management and insurance, aiming to be a one-stop shop for customers' financial needs. This integrated approach supported a net profit after tax of $531 million in 2024, highlighting the strength of their diverse offerings.

Bendigo Bank prioritizes customer-centric service, consistently achieving high customer satisfaction ratings, such as an 85% score in 2023. This focus on personalized interactions and understanding individual needs builds strong, long-term relationships.

Through its digital-first brand, Up, Bendigo Bank enhances customer experience with seamless mobile banking solutions, catering to the growing demand for digital transactions. Up saw significant user growth throughout 2023, demonstrating the success of their digital strategy.

| Value Proposition | Description | Key Data Point |

|---|---|---|

| Community Focus | Profits reinvested into local communities. | Over $5 million allocated to regional projects in 2024. |

| Full-Service Banking | Comprehensive financial products and services. | Net profit after tax of $531 million in 2024. |

| Customer Centricity | Personalized service and high customer satisfaction. | 85% customer satisfaction score in 2023. |

| Digital Innovation | User-friendly mobile banking via Up. | Significant user engagement growth for Up in 2023. |

Customer Relationships

Bendigo Bank's Community Bank® model fosters strong customer relationships by embedding local staff and boards directly within the communities they serve. This deep integration allows for genuine, long-term connections built on trust and direct engagement. For instance, in the 2023 financial year, Bendigo Bank reported a net profit after tax of $501 million, with a significant portion of profits reinvested into local communities through sponsorships and grants, reinforcing this community-centric approach.

Bendigo Bank prioritises personalised interactions, offering tailored financial advice and support. This is evident in their strong branch network and specialized teams like the Mortgage Help Centre, designed to provide direct, individualized assistance. In 2024, the bank continued to invest in digital tools that complement these personal connections, aiming to enhance customer experience and build lasting relationships.

Bendigo Bank fosters digital self-service for its tech-comfortable clientele through user-friendly mobile and online banking portals. These platforms are enhanced by digital literacy initiatives and online safety workshops, ensuring customers can confidently navigate their financial lives online.

Proactive Customer Support

Bendigo Bank proactively supports its business customers, especially during challenging economic periods or digital transformations. This commitment is evident through tailored assistance programs and educational resources designed to help clients navigate financial difficulties and adopt new technologies.

For instance, in 2024, Bendigo Bank continued to offer a range of support services. These included dedicated relationship managers who provided personalized guidance, particularly for small businesses facing economic headwinds. The bank also focused on digital literacy programs, ensuring customers could effectively utilize online banking platforms and digital tools.

- Dedicated Relationship Managers: Providing personalized support and advice, especially for small and medium-sized enterprises.

- Financial Hardship Assistance: Offering tailored solutions and guidance for customers experiencing financial difficulties.

- Digital Adoption Programs: Educating and assisting customers in transitioning to and utilizing digital banking services.

- Small Business Support Initiatives: Implementing programs aimed at fostering growth and resilience within the small business sector.

Broker Relationship Management

Bendigo Bank prioritizes a dedicated relationship management approach with its mortgage broker network. This strategy is designed to foster a seamless experience for brokers, ensuring efficient communication and robust support for their clients. By investing in these partnerships, the bank strengthens a crucial indirect channel for customer acquisition and service delivery.

This focus on broker relationships is vital for expanding market reach. In 2024, mortgage brokers played a significant role in the Australian home loan market, facilitating a substantial portion of new lending. Bendigo Bank's commitment to this channel reflects an understanding of its importance in reaching a diverse customer base.

- Dedicated Support: Providing specialized relationship managers to assist mortgage brokers with inquiries, application processes, and client needs.

- Streamlined Operations: Implementing efficient systems and clear communication protocols to ensure quick turnaround times and a positive experience for brokers and their clients.

- Partnership Growth: Actively engaging with brokers through training, product updates, and feedback mechanisms to foster long-term, mutually beneficial relationships.

- Client Focus: Ultimately, ensuring that the broker relationship management directly translates into better outcomes and experiences for the end customers seeking home finance.

Bendigo Bank cultivates deep customer loyalty through its unique Community Bank model, emphasizing personal connections and local engagement. This approach is reinforced by dedicated relationship managers for both individual and business clients, ensuring tailored support and advice. The bank also actively supports its mortgage broker network, recognizing their crucial role in reaching a wider customer base.

| Relationship Type | Key Engagement Strategy | 2024 Focus/Data Point |

|---|---|---|

| Community Members | Local integration, personalized advice, financial hardship assistance | Continued investment in digital tools to complement personal service. |

| Business Clients | Dedicated relationship managers, tailored support, digital literacy programs | Assistance programs for small businesses navigating economic challenges. |

| Mortgage Brokers | Specialized relationship managers, streamlined operations, partnership growth | Facilitating a substantial portion of new lending in the Australian home loan market. |

Channels

Bendigo Bank's physical branch network, a blend of proprietary and Community Bank® branches, continues to be a cornerstone for customer engagement, offering personalized service and fostering local connections. While some consolidation has occurred, these branches remain vital for face-to-face interactions and community building.

As of the first half of 2024, Bendigo Bank operated 535 branches across Australia. This extensive network, including its unique Community Bank® model where branches are locally owned and operated, underscores a commitment to accessible banking and local economic development.

Bendigo Bank offers robust digital banking through its online platform and mobile app, allowing customers to manage accounts, make payments, and access a wide range of services conveniently. This digital suite extends to its digital-only brand, Up, which caters to a growing segment of digitally-savvy consumers. In 2023, digital transactions across the banking sector saw continued growth, with mobile banking apps becoming increasingly central to customer engagement.

The mortgage broker channel is a significant and expanding avenue for Bendigo Bank's residential lending. This channel allows customers to connect with Bendigo Bank's home loan offerings via independent, third-party mortgage brokers.

In 2024, mortgage brokers played a crucial role in the Australian home loan market, facilitating a substantial portion of new lending. Data from the Mortgage & Finance Association of Australia (MFAA) indicated that brokers settled over $100 billion in home loans in the first half of 2024 alone, highlighting the channel's growing influence and reach.

ATM Network

Bendigo Bank's ATM network serves as a crucial physical touchpoint, offering customers convenient access to cash and essential banking services. This network underpins the bank's commitment to accessibility, particularly for those in regional and rural areas where physical branches might be less prevalent. In 2024, Bendigo Bank operated a significant number of ATMs across Australia, facilitating millions of transactions annually.

- Network Reach: Bendigo Bank maintained a substantial ATM footprint, ensuring widespread availability for its customer base.

- Transaction Volume: The ATMs processed a high volume of daily transactions, highlighting their importance in customer banking habits.

- Customer Convenience: This channel directly addresses customer needs for immediate cash access and basic self-service banking.

- Cost Efficiency: While a physical asset, ATMs offer a more cost-effective delivery channel for routine transactions compared to in-branch services.

Bank@Post and Australia Post Outlets

Bendigo Bank leverages its partnership with Australia Post, offering customers access to banking services at over 3,500 Bank@Post locations. This significantly expands the bank's physical touchpoints, particularly benefiting those in regional and rural Australia where traditional bank branches are less common. In 2024, this network facilitated millions of transactions, demonstrating its crucial role in customer accessibility and financial inclusion.

The Bank@Post service allows customers to perform a range of everyday banking activities, such as deposits, withdrawals, and balance inquiries, directly at post office counters. This convenience is a key component of Bendigo Bank's strategy to reach a broader customer base and enhance customer satisfaction by meeting them where they are. The sheer volume of these transactions underscores the trust placed in this distributed service model.

- Extended Reach: Over 3,500 Australia Post outlets act as banking access points.

- Regional Focus: Crucial for providing financial services in underserved areas.

- Transaction Volume: Millions of transactions processed in 2024 highlight service utility.

Bendigo Bank utilizes a multi-channel approach to reach its customers, blending traditional and digital methods. This includes its physical branch network, a strong digital offering with its online platform and mobile app, and partnerships like the one with Australia Post. The mortgage broker channel is also a significant contributor to its lending business.

| Channel | Description | Key Data/Impact (as of H1 2024 or relevant period) |

|---|---|---|

| Physical Branches | Proprietary and Community Bank® branches for personalized service and local engagement. | 535 branches operated across Australia in H1 2024. |

| Digital Channels | Online platform and mobile app for convenient banking, including the digital-only brand Up. | Continued growth in digital transactions sector-wide; mobile banking apps central to customer engagement. |

| Mortgage Brokers | Third-party brokers facilitating home loan access. | Brokers settled over $100 billion in home loans in H1 2024 in the Australian market. |

| ATM Network | Physical touchpoints for cash access and essential banking services. | Significant ATM footprint across Australia, facilitating millions of transactions annually. |

| Australia Post (Bank@Post) | Partnership providing banking services at over 3,500 locations. | Millions of transactions processed in 2024, significantly extending reach, especially in regional areas. |

Customer Segments

Individual customers, or retail banking clients, represent the bedrock of Bendigo Bank's customer base. This segment encompasses a wide array of everyday Australians looking for essential financial services. These include day-to-day transaction accounts, tools to grow their savings, and financing options like personal loans, credit cards, and crucially, home loans.

In 2024, Bendigo Bank continued to serve millions of these individual customers, reflecting the ongoing demand for accessible and reliable banking products. For instance, home lending remains a significant area, with the bank actively supporting Australians in achieving homeownership.

Small and Medium-Sized Enterprises (SMEs) represent a crucial customer segment for Bendigo Bank, encompassing businesses that require a comprehensive suite of banking services. This includes essential offerings like business loans for expansion or working capital, everyday transaction accounts, and merchant facilities to process customer payments.

The bank places a particular emphasis on supporting microbusinesses within this segment, recognizing their vital role in the economy. As of June 2024, SMEs accounted for approximately 99.8% of all businesses in Australia, highlighting their widespread importance and the significant market opportunity for financial institutions like Bendigo Bank.

Bendigo Bank's Agribusiness customers are primarily farmers and agricultural businesses, a vital sector for the Australian economy. This segment benefits from specialized lending products and services delivered through Bendigo Bank Agribusiness, formerly known as Rural Bank. In 2024, the agricultural sector continued to be a significant contributor to Australia's GDP, with agribusiness lending remaining a core focus for the bank.

Community Organisations

Bendigo Bank actively partners with local community groups, non-profits, and social enterprises. These organizations represent a vital customer segment, often seeking financial support and banking services to advance their local initiatives and community projects.

These community organizations leverage Community Banks not just for standard banking, but also for access to funding and strategic support. This symbiotic relationship helps fuel local development and social impact.

- Community Bank Partnerships: In 2023, Bendigo Bank reported supporting over 300 community-based initiatives through its Community Bank model, demonstrating a tangible commitment to these segments.

- Social Enterprise Engagement: The bank has also focused on increasing its engagement with social enterprises, recognizing their role in addressing social and environmental challenges.

- Funding Access: Community organizations often utilize Bendigo Bank's tailored lending products and grant programs to fund projects ranging from local sports clubs to environmental conservation efforts.

Digitally-Savvy Customers (Up Users)

Digitally-Savvy Customers, often referred to as Up users, represent a rapidly expanding segment, particularly within the 18 to 35-year-old demographic. This group actively seeks and embraces digital-only banking solutions, valuing the intuitive and feature-rich experience offered by platforms like the Up banking app.

These users are characterized by their comfort and preference for managing their finances entirely through mobile applications, often engaging with innovative tools for budgeting, saving, and spending tracking. By the end of 2023, Up reported over 700,000 customers, showcasing the significant adoption of this digital-first approach.

- Growing Demographic: The 18-35 age group is increasingly adopting digital banking, with Up's user base reflecting this trend.

- Digital-First Preference: This segment prioritizes mobile app functionality and a seamless digital banking experience over traditional branch interactions.

- Feature Adoption: Up users actively utilize innovative app features for enhanced financial management and control.

- Market Penetration: With over 700,000 customers by the close of 2023, Up demonstrates strong traction within this digitally-oriented market.

Bendigo Bank serves a diverse range of customer segments, from individual retail clients seeking everyday banking and home loans to small and medium-sized enterprises (SMEs) requiring business finance and transaction services. The bank also has a specialized focus on agribusiness and actively supports community groups and social enterprises through its unique Community Bank model.

Furthermore, the bank caters to digitally-native customers through its Up banking app, a segment that prioritizes mobile-first financial management. This multi-faceted approach allows Bendigo Bank to address the varied financial needs across the Australian economic landscape.

| Customer Segment | Key Offerings | 2023/2024 Data Points |

|---|---|---|

| Individual Customers | Transaction accounts, savings, personal loans, home loans, credit cards | Millions of retail clients served; strong focus on home lending |

| SMEs | Business loans, transaction accounts, merchant facilities | SMEs represent ~99.8% of Australian businesses (June 2024) |

| Agribusiness | Specialized lending and banking services | Agribusiness lending remains a core focus; vital sector for Australia's GDP |

| Community Groups & Social Enterprises | Banking services, funding, strategic support via Community Banks | Over 300 community initiatives supported in 2023 |

| Digitally-Savvy (Up users) | Digital-only banking, mobile app features | Up reported over 700,000 customers by end of 2023; strong adoption in 18-35 demographic |

Cost Structure

Bendigo Bank's cost structure heavily features operating expenses, particularly those related to its workforce and technological infrastructure. Significant costs are incurred for staff wages, employee benefits, and continuous training programs designed to enhance skills and customer service. For instance, in the fiscal year 2023, Bendigo Bank reported employee-related expenses exceeding AUD 1.1 billion, reflecting the substantial investment in its human capital.

Ongoing investment in technology is another major cost driver for Bendigo Bank. This includes substantial capital allocated to digital transformation initiatives, the consolidation of legacy systems, and the development of new digital assets to improve customer experience and operational efficiency. As of its 2023 annual report, the bank highlighted a commitment to technology spending, with digital transformation programs being a key focus area, aiming to streamline processes and offer more competitive digital banking solutions.

Bendigo Bank's funding costs, encompassing customer deposits and wholesale market borrowings, are a critical component of its financial health. In 2024, the bank actively managed these expenses to maintain a competitive net interest margin. For instance, a significant portion of their funding comes from retail deposits, which are typically less volatile and cheaper than wholesale options.

The cost of attracting and retaining these deposits, through competitive interest rates and customer service, directly influences profitability. Simultaneously, accessing wholesale funding, such as through term funding facilities or debt issuance, involves market-driven interest rates and fees. These costs are carefully balanced to ensure a stable and cost-effective funding profile for the bank's lending activities.

Bendigo Bank's extensive branch network, a cornerstone of its community banking model, incurs significant operational expenses. These include costs for rent, utilities, staffing, and security across its numerous physical locations. In 2024, while the bank continues to invest in its digital offerings, it also navigates the ongoing trend of branch rationalization to optimize these fixed costs, balancing physical presence with evolving customer preferences.

Marketing and Brand Development

Bendigo Bank incurs significant expenses in its marketing and brand development efforts. These costs are crucial for customer acquisition and maintaining brand loyalty across its diverse portfolio, including its digital banking brand, Up. In 2024, the Australian banking sector saw increased marketing spend, with digital channels becoming paramount for reaching new customers.

Key cost drivers within this category include:

- Digital Marketing Investments: Expenses for online advertising, search engine optimization, social media campaigns, and content creation, particularly for brands like Up, which relies heavily on digital engagement.

- Brand Building Initiatives: Costs associated with sponsorships, public relations, community engagement programs, and traditional advertising to strengthen the Bendigo Bank and Up brand identities.

- Customer Acquisition Costs: Outlays for promotional offers, referral programs, and sales team efforts aimed at attracting new retail and business customers.

- Market Research and Analytics: Spending on understanding customer behavior, market trends, and campaign effectiveness to optimize marketing strategies and ensure efficient resource allocation.

Regulatory and Compliance Costs

Bendigo Bank, like all financial institutions, faces substantial regulatory and compliance costs. These are essential for maintaining trust and operating within the legal framework of the Australian financial services sector. Meeting these requirements involves significant investment in systems, personnel, and ongoing processes.

These costs encompass a range of activities, including the development and maintenance of robust risk management frameworks, the generation of detailed regulatory reports, and the implementation of policies to address issues such as excessive fees. For instance, the Australian Prudential Regulation Authority (APRA) imposes strict capital adequacy and reporting requirements on banks, directly contributing to these expenses.

- Reporting Obligations: Costs associated with data collection, aggregation, and submission to regulatory bodies like APRA and ASIC.

- Risk Management: Investment in systems and expertise for credit risk, market risk, operational risk, and compliance risk management.

- Compliance Programs: Development and execution of policies and procedures to adhere to financial services laws, anti-money laundering (AML), and counter-terrorism financing (CTF) regulations.

- Remediation and Issue Resolution: Costs incurred when addressing regulatory breaches or customer remediation programs, such as those related to past fee-charging practices.

Bendigo Bank's cost structure is significantly influenced by its commitment to its community banking model and digital expansion. Key expenses include those related to its extensive branch network, staff, and technology investments. For fiscal year 2024, the bank continued to balance these operational costs with strategic investments in digital platforms like Up, aiming for efficiency and customer reach.

Funding costs, primarily from customer deposits and wholesale borrowings, are a critical expense category. Bendigo Bank actively manages these to maintain profitability, with retail deposits forming a substantial and cost-effective funding base. The bank's investment in attracting and retaining these deposits, alongside managing wholesale funding costs, directly impacts its net interest margin.

Regulatory and compliance costs are substantial, reflecting the stringent requirements of the Australian financial services landscape. These expenses cover risk management frameworks, reporting obligations to bodies like APRA, and adherence to AML/CTF regulations. In 2024, the bank's focus on robust compliance systems remained a significant cost driver.

| Cost Category | FY2023 (AUD Billion) | FY2024 Focus Areas |

|---|---|---|

| Employee Expenses | > 1.1 | Staff training, digital skills development |

| Technology & Digital Transformation | Significant Investment | Platform upgrades, cybersecurity, Up brand development |

| Branch Network Operations | Ongoing | Rent, utilities, staffing, optimization initiatives |

| Marketing & Brand Development | Increased Spend | Digital marketing, customer acquisition (Up), brand loyalty |

| Regulatory & Compliance | Substantial | Risk management, reporting, AML/CTF adherence |

Revenue Streams

Net Interest Income is Bendigo Bank's core revenue engine, stemming from the spread between interest earned on its loan portfolio and interest paid on customer deposits. This fundamental banking activity is directly shaped by the prevailing interest rate environment and the volume of lending and deposit-taking activities. For the financial year 2024, Bendigo and Adelaide Bank reported a Net Interest Income of $3.25 billion, reflecting a 7% increase from the previous year, underscoring its importance.

Bendigo Bank generates revenue through a variety of fees and commissions tied to its banking services. This includes income from everyday account keeping and transaction charges, as well as fees associated with lending products like mortgages and business loans.

Furthermore, the bank earns commissions from offering wealth management services and various insurance products to its customers. For instance, in the first half of the 2024 financial year, Bendigo Bank reported a statutory profit after tax of $505 million, demonstrating the overall health of its revenue streams.

Bendigo Bank generates significant revenue from its lending products, encompassing residential mortgages, business loans, and agribusiness financing. This income stream is primarily derived from the interest charged on these loans, as well as associated fees.

In the first half of fiscal year 2024, Bendigo Bank reported a 10.3% increase in its total lending portfolio, reaching $72.4 billion. This growth, particularly in the business and agribusiness segments, directly fuels the bank's revenue through interest income and fees.

Digital Banking Services and Innovation

Bendigo Bank's revenue growth is significantly influenced by its expanding digital banking services and ongoing innovation. Customer acquisition, particularly through its digital-first banking app Up, is a key driver, alongside efficiencies gained from digital mortgage settlements. This highlights a strategic pivot towards revenue generation via increasingly digital channels.

The bank reported a 10.6% increase in its digital customer base in the first half of fiscal year 2024, demonstrating the success of its digital strategy. This digital engagement translates directly into fee income and net interest margin expansion as more transactions and services are managed online.

- Digital Customer Acquisition: Growth in users of the Up app and other digital platforms.

- Digital Mortgage Settlements: Increased efficiency and reduced costs in mortgage processing, contributing to profitability.

- Digital Product Adoption: Revenue generated from customers utilizing digital savings accounts, transaction services, and lending products.

Wealth Management and Insurance Premiums

Bendigo Bank generates revenue through its wealth management services, offering advice and managing investment products for clients. This includes fees for financial planning, investment management, and administration of superannuation and other investment vehicles.

Another significant revenue stream comes from insurance premiums. The bank underwrites and distributes a range of insurance products, such as home, contents, car, and life insurance, earning income from the premiums paid by policyholders.

- Wealth Management Fees: Revenue from financial advice, investment management, and administration services.

- Insurance Premiums: Income derived from underwriting and distributing various insurance policies.

- Commissions: Earnings from selling third-party financial products and insurance.

Bendigo Bank's revenue streams are diverse, encompassing net interest income, fees and commissions, and income from wealth management and insurance. The bank's strategic focus on digital growth, particularly through its Up app, is a key driver for increasing customer acquisition and transaction volumes. This digital push directly enhances fee income and net interest margin expansion.

| Revenue Stream | Description | FY24 H1 Contribution (Illustrative) |

|---|---|---|

| Net Interest Income | Interest earned on loans minus interest paid on deposits. | $1.66 billion (Net Interest Margin of 1.90%) |

| Fees and Commissions | Charges for banking services, lending, and wealth products. | Included within total income, driven by transaction volumes and product uptake. |

| Wealth Management & Insurance | Income from financial advice, investment management, and insurance premiums. | Commissions and fees from these services contribute to overall profitability. |

Business Model Canvas Data Sources

The Bendigo Bank Business Model Canvas is informed by a blend of internal financial data, customer feedback, and extensive market research. This comprehensive approach ensures each component accurately reflects the bank's operational realities and strategic direction.