Bendigo Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bendigo Bank Bundle

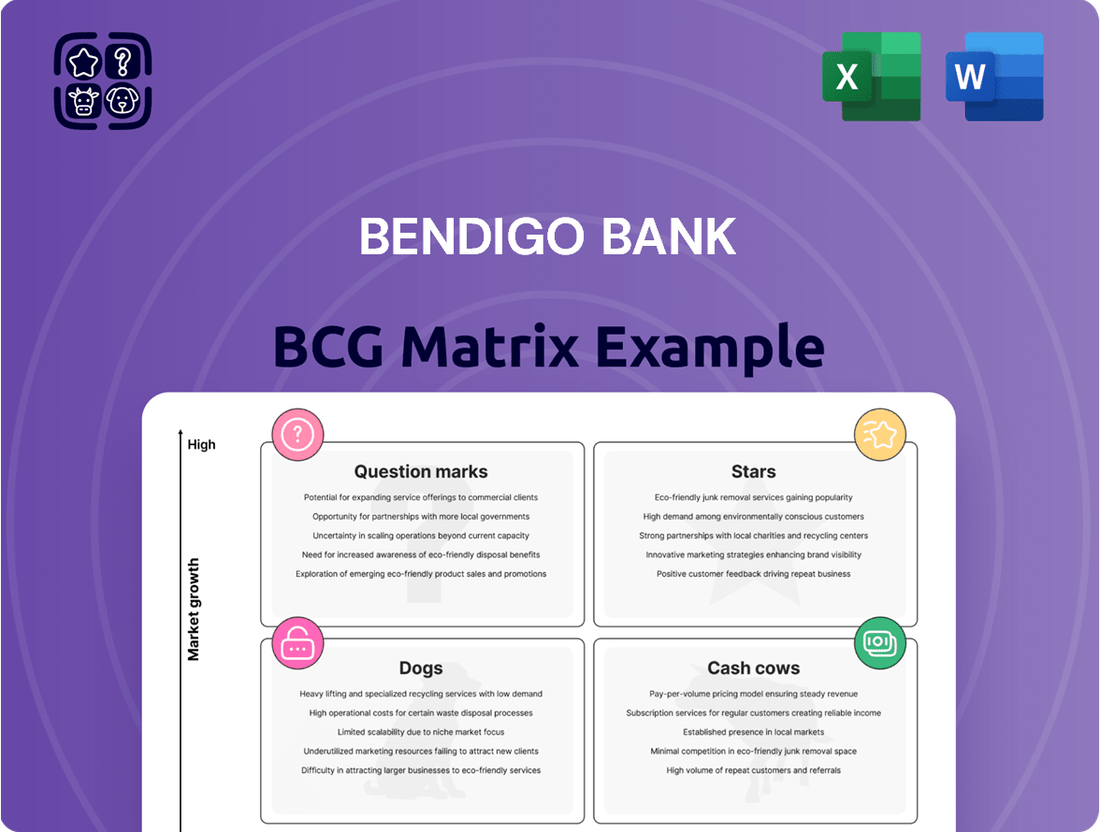

Curious about Bendigo Bank's strategic positioning? Our BCG Matrix analysis reveals how their products stack up as Stars, Cash Cows, Dogs, or Question Marks. This snapshot is just the beginning of understanding their market dynamics.

Unlock the full potential of this analysis by purchasing the complete Bendigo Bank BCG Matrix. Gain detailed quadrant placements, data-backed recommendations, and a clear roadmap for optimizing their product portfolio and investment strategies.

Don't miss out on the crucial insights that will drive smarter decision-making. Invest in the full BCG Matrix today for a comprehensive understanding of Bendigo Bank's competitive edge and future growth opportunities.

Stars

Up Digital Bank, Bendigo Bank's innovative digital offering, is experiencing robust expansion. In FY24, its customer base grew by an impressive 29%, and this momentum continued into the first half of FY25 with a 13.2% increase, surpassing the 1 million customer mark.

This substantial growth is largely fueled by customer referrals, a clear indicator of Up's strong value proposition and high customer satisfaction, particularly among younger demographics.

Up's performance highlights Bendigo Bank's successful strategy in digital innovation and its ability to attract and retain customers in a competitive digital banking landscape.

Digital mortgages represent a significant growth driver for Bendigo Bank, capturing 19.3% of residential lending in the latter half of fiscal year 2024. This upward trend continued into the first half of fiscal year 2025, with digital settlements making up 19% of all settled mortgages.

This strong performance is a direct result of shifting customer preferences towards streamlined, online loan application processes. Bendigo Bank's strategic investments in its digital lending infrastructure have clearly paid off, enabling it to effectively meet this demand and enhance customer experience.

The bank is strategically positioned to capitalize on this expanding market segment. By continuing to refine its digital offerings, Bendigo Bank aims to further increase its market share in the digital mortgage space, solidifying its competitive advantage.

The Bendigo Lending Platform is a key driver in Bendigo Bank's strategy, contributing to impressive home lending growth. In the first half of FY25, it helped the bank achieve double the system-wide growth rate, a testament to its effectiveness.

Initially targeting the broker channel, the platform's reach is expanding to mobile lenders and branches. This broader rollout underscores its critical role in enhancing future lending operations and streamlining processes.

This initiative signifies a significant investment in upgrading Bendigo Bank's lending technology. The platform's success positions it as a strategic asset for sustained growth and operational excellence in the competitive banking landscape.

Residential Lending Growth

Bendigo Bank's residential lending has shown impressive momentum. The bank's residential lending book expanded by 3.1% in the 2024 financial year, reaching $60.4 billion. This growth accelerated to 5.3% in the first half of 2025, representing its most robust performance in recent years.

This upward trend is attributed to strategic initiatives. Key factors include the implementation of improved risk-based pricing strategies and a dedicated focus on enhancing digital channels for customer engagement.

- Residential Lending Growth (FY24): 3.1% to $60.4 billion

- Residential Lending Growth (1H25): 5.3%

- Key Drivers: Improved risk-based pricing, digital channel focus

Strategic Investment in Digital Capabilities

Bendigo Bank is strategically boosting its digital infrastructure, earmarking an additional $30 million to $40 million for investment across fiscal years 2025 and 2026.

This significant capital allocation is directed towards modernizing its technology stack, focusing on simplifying existing infrastructure, migrating to cloud-based services, and integrating artificial intelligence. These initiatives are foundational for the continued expansion of its digital product offerings and for ensuring the bank remains competitive.

- Digital Investment: $30 million - $40 million planned for FY25-FY26.

- Key Focus Areas: Infrastructure simplification, cloud migration, AI integration.

- Strategic Goals: Enhance customer experience, streamline operations, sustain digital product growth.

- Market Position: Crucial for maintaining competitiveness in a rapidly evolving banking sector.

Up Digital Bank, Bendigo Bank's digital arm, is a clear Star in the BCG matrix. Its customer base surged by 29% in FY24 and continued its strong growth with a 13.2% increase in the first half of FY25, surpassing one million customers. This rapid expansion, driven by customer referrals, indicates high market share in a growing digital banking sector.

Bendigo Bank's digital mortgages are also performing exceptionally well, capturing 19.3% of residential lending in the latter half of FY24 and maintaining a 19% share in 1H25. This segment is experiencing significant growth due to customer preference for online processes.

The Bendigo Lending Platform is another Star, achieving double the system-wide growth rate in home lending in 1H25. Its expansion into mobile lenders and branches further solidifies its position in a growing market.

Bendigo Bank's overall residential lending experienced robust growth, accelerating from 3.1% in FY24 to 5.3% in 1H25. This performance, driven by improved pricing and digital channels, places it in a high-growth market.

| Business Unit | Market Growth | Market Share | BCG Classification |

|---|---|---|---|

| Up Digital Bank | High | High | Star |

| Digital Mortgages | High | High | Star |

| Bendigo Lending Platform | High | High | Star |

| Residential Lending | High | High | Star |

What is included in the product

Bendigo Bank's BCG Matrix provides strategic insights into its business units, guiding investment decisions.

The Bendigo Bank BCG Matrix offers a clear, visual overview of their business units, relieving the pain of strategic uncertainty.

This simplified matrix provides actionable insights, easing the burden of complex portfolio management.

Cash Cows

Bendigo Bank's Community Bank model is a true cash cow, showcasing remarkable stability and growth. In FY24, deposits from these community-focused branches expanded by a healthy 8.3%, demonstrating their enduring appeal and financial strength.

This innovative model has a profound impact, having channeled over $366 million back into local communities since its launch. It also provides a substantial and cost-effective funding base for the bank, contributing a net $12 billion in diversified and cheaper funding.

The consistent profitability of each Community Bank company is a testament to the model's success. This reliable profit generation solidifies Bendigo Bank's robust funding position, making the deposit franchise a cornerstone of its financial strategy.

Bendigo Bank’s established customer deposit base is a significant Cash Cow. In FY24, this base grew by 3.4% to $68.3 billion, and further expanded by 5.4% in the first half of FY25. This consistent growth, particularly in EasySaver accounts (up 12.4%) and offset accounts (up 14%), highlights the bank's strong customer loyalty and its ability to attract and retain funds.

Bendigo Bank's traditional personal banking products, encompassing transaction accounts, savings accounts, and credit cards, form its Cash Cows. These offerings represent a mature and stable revenue stream, catering to a substantial and loyal customer base. In 2024, the Australian personal banking sector continued to be dominated by these core products, with major banks reporting consistent growth in deposit volumes and transaction account usage.

Existing Residential Home Loan Portfolio

Bendigo Bank's existing residential home loan portfolio is a clear Cash Cow. With a substantial lending book of $60.4 billion in FY24, this segment consistently delivers strong net interest income, forming the bedrock of the bank's profitability.

The stability of this Cash Cow is further reinforced by a significant portion of customers being ahead on their loan repayments. This indicates a high-quality, low-risk asset base, ensuring predictable earnings with minimal need for aggressive growth strategies or substantial reinvestment.

- $60.4 billion residential lending book in FY24.

- Generates significant and reliable net interest income.

- High-quality and stable asset base due to customers ahead on repayments.

- Provides predictable earnings with lower associated growth costs.

Wealth Management and Insurance Services

Bendigo Bank's wealth management and insurance services are considered Cash Cows within its BCG Matrix. These established offerings, like their superannuation products and general insurance, are known for their consistent revenue generation. In 2023, Bendigo Bank reported that its wealth management segment contributed significantly to its fee and commission income, highlighting its role as a stable profit driver.

These mature product lines benefit from Bendigo Bank's extensive existing customer base, allowing for effective cross-selling opportunities. The bank leverages its strong retail presence to promote these services, enhancing profitability without the need for substantial investment in market share expansion. This stability is crucial for supporting other business units within the bank.

- Stable Fee-Based Income: Wealth management and insurance services consistently generate predictable revenue streams for Bendigo Bank.

- Cross-Selling Potential: The bank effectively leverages its existing customer relationships to expand the adoption of these services.

- Profitability Contribution: These mature offerings are key contributors to Bendigo Bank's overall financial health and profitability.

- Low Investment Needs: They require minimal capital expenditure due to their established market position and customer loyalty.

Bendigo Bank's Community Bank model is a prime example of a Cash Cow, demonstrating consistent profitability and stability. In FY24, deposits from these branches grew by 8.3%, underscoring their dependable financial contribution. This model has a proven track record of returning funds to local areas, having channeled over $366 million back since its inception, while also providing a cost-effective funding base of $12 billion.

| Business Unit | BCG Category | FY24 Performance Indicator | Significance |

|---|---|---|---|

| Community Bank Model | Cash Cow | 8.3% deposit growth | Stable, cost-effective funding source |

| Established Customer Deposits | Cash Cow | $68.3 billion total deposits (FY24) | Loyal customer base, reliable funding |

| Residential Home Loans | Cash Cow | $60.4 billion loan book (FY24) | Generates consistent net interest income |

| Wealth Management & Insurance | Cash Cow | Significant fee and commission income (2023) | Stable revenue, cross-selling opportunities |

Delivered as Shown

Bendigo Bank BCG Matrix

The Bendigo Bank BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive immediately after purchase. This comprehensive report, designed for strategic insight, contains no watermarks or placeholder content, ensuring you get a professional and ready-to-use analysis of Bendigo Bank's business units.

Dogs

Bendigo Bank is phasing out its agency model by October 2025, a strategic decision driven by a significant decline in customer engagement with this service. This move acknowledges the diminishing relevance of third-party locations offering limited banking services as customer preferences shift towards more direct and digital channels.

The agency model, which once served as a supplementary distribution channel, has become unsustainable due to decreasing demand and evolving customer expectations for convenience and comprehensive service offerings. This strategic pivot away from the agency model underscores Bendigo Bank's focus on optimizing its distribution network and investing in channels that align with current market realities and future growth potential.

Bendigo Bank's decision to close 10 physical branches across Victoria, Queensland, and Tasmania from August 2025 places these outlets firmly in the Dogs category of the BCG Matrix. This strategic move acknowledges a significant decline in in-person transactions, a trend mirrored across the broader banking sector as customers increasingly adopt digital banking solutions. For instance, many banks have reported double-digit percentage decreases in branch visits over the past few years.

The financial rationale behind such closures is clear: maintaining underutilized physical branches represents a substantial operational cost with a correspondingly low and diminishing return on investment. In 2024, the cost of operating a single bank branch can range from hundreds of thousands to over a million dollars annually, depending on location and services offered. These closures are a necessary step to reallocate resources towards more profitable and customer-centric digital initiatives, aligning with market realities.

Bendigo Bank's legacy core banking systems are firmly in the Dogs quadrant of the BCG Matrix. The bank is actively working to consolidate its eight core banking systems into a single proprietary platform, a process expected to be completed by FY2026. This strategic move aims to shed the burden of these outdated, complex, and costly systems.

These legacy systems represent significant operational inefficiencies and a drain on resources. Their continued maintenance incurs substantial costs, estimated to be in the millions annually, hindering the bank's ability to innovate and respond quickly to market changes. Decommissioning them is a crucial step towards streamlining operations and enhancing overall efficiency.

Certain Non-Performing or High-Arrears Loans

Certain non-performing or high-arrears loans, while a small fraction of Bendigo Bank's total portfolio, represent a segment that requires careful consideration within its Business Growth Opportunities (BCG) Matrix. In FY24, the bank observed a slight uptick in residential lending arrears exceeding 90 days. This indicates potential stress in specific loan segments, even as overall asset quality is robust.

These underperforming loans, though not a significant drag on overall performance, are akin to cash traps. They tie up valuable capital that could otherwise be deployed in more productive areas of the business. Furthermore, they necessitate increased management resources and attention to mitigate further deterioration.

- FY24 Arrears: Residential lending saw a marginal increase in 90-day plus arrears in FY24.

- Small Percentage, High Impact: These loans, while representing a small percentage of gross loans, are areas of underperformance.

- Capital Tie-up: Such loans immobilize capital and demand heightened management focus.

Underperforming Niche Business Lending Segments

Bendigo Bank's Business and Agribusiness lending saw a 3% contraction in the first half of FY25. This was largely influenced by the natural seasonal decrease in its Agribusiness portfolio.

While the bank has set growth objectives for Agribusiness, certain specialized areas within general business lending might be facing challenges. These niche segments could be characterized by a low market share and limited growth potential.

It's crucial to conduct a thorough assessment of these underperforming niche business lending segments. The aim is to identify and address any areas that could potentially become cash traps, draining resources without yielding adequate returns.

- Niche Business Lending Contraction: Business and Agribusiness lending decreased by 3% in H1 FY25.

- Agribusiness Seasonal Impact: The contraction was primarily driven by seasonal run-off in the Agribusiness sector.

- Potential Niche Weaknesses: Certain niche segments within general business lending may exhibit low market share and growth.

- Risk of Cash Traps: These underperforming areas require careful review to prevent them from becoming inefficient cash drains.

Bendigo Bank's decision to close 10 branches from August 2025 positions these outlets as Dogs in the BCG Matrix due to declining in-person transactions. This strategic move reflects a broader industry trend where digital channels are increasingly preferred by customers. For example, many banks have reported substantial drops in branch footfall in recent years, making the upkeep of underperforming branches financially inefficient.

The legacy core banking systems are also classified as Dogs. Bendigo Bank is consolidating its eight core systems into one platform by FY2026, aiming to eliminate the inefficiencies and high maintenance costs associated with these outdated systems. These legacy platforms represent millions in annual upkeep, hindering innovation and agility.

Certain non-performing loans, while a small part of the portfolio, are also considered Dogs. In FY24, Bendigo Bank noted a slight increase in residential lending arrears over 90 days. These loans tie up capital and require significant management attention, representing a drain on resources that could be better allocated.

The contraction in Business and Agribusiness lending by 3% in H1 FY25, particularly due to seasonal factors in Agribusiness, highlights potential Dogs within niche business lending segments. These areas may suffer from low market share and limited growth, posing a risk of becoming cash traps if not actively managed.

Question Marks

Agribusiness lending at Bendigo Bank saw a 3% contraction in the first half of fiscal year 2025. This dip follows a robust 7.4% growth for the entirety of fiscal year 2024. The bank is actively transforming its Business & Agribusiness division, a process that includes integrating Rural Bank customers.

The strategic focus is on achieving renewed growth in the agribusiness sector by fiscal year 2026. While this segment holds significant potential in key Australian states, its performance has been uneven, necessitating ongoing strategic investment to establish market leadership.

Bendigo Bank's new Micro and SME Business Direct team is a strategic move to better serve its smallest business clients. This team is designed to boost capabilities and streamline processes within the highly competitive micro and SME sector, aiming to improve the overall customer experience.

While this initiative represents a key area for future growth, its precise impact on Bendigo Bank's overall market share and profitability is still in the early stages of development and measurement. For instance, as of the first half of 2024, the bank reported a 6.6% increase in its SME lending portfolio, suggesting a positive trend in this segment.

Bendigo Bank is strategically integrating Artificial Intelligence across its operations, notably within the broker channel, as a cornerstone of its five-year plan. This forward-looking initiative signifies a substantial commitment to a burgeoning technological frontier.

While the full ramifications of this AI adoption on market share, operational efficiency, and customer acquisition remain to be seen, it positions Bendigo Bank for potentially significant gains in a competitive landscape. For instance, the Australian banking sector saw a 15% increase in AI adoption for customer service in 2023, highlighting the trend.

New Digital Offerings/Features from Transformation

Bendigo Bank's transformation program is nearing completion, bringing a wave of new digital offerings designed to enhance customer experience and digital capabilities. While the Bendigo Lending Platform is recognized as a Star within the BCG matrix, other recent digital rollouts are still in their nascent stages of market adoption.

These emerging digital features, while promising, have yet to demonstrate significant market share growth or widespread customer acceptance. Their true impact and position within the BCG matrix will become clearer as adoption rates increase and their competitive advantages solidify.

- New Digital Features: Specific new digital assets are being launched as the six-year transformation program concludes.

- Early Adoption Phase: Many of these offerings are currently in early adoption phases, meaning their long-term success is not yet guaranteed.

- Market Acceptance Uncertainty: The ability of these new digital features to capture significant market share remains to be fully proven.

- Strategic Importance: These digital advancements are crucial for Bendigo Bank's future competitiveness and customer engagement strategy.

Expansion of International Payments and Travel Products

Bendigo Bank's international payments and travel products, while standard in personal banking, represent a segment with potential for growth but likely low current market share. These services, which include international money transfers and foreign currency accounts, operate in a highly competitive global landscape. For instance, in 2024, the global cross-border payments market was valued at over $150 trillion, with significant growth driven by e-commerce and remittances.

To elevate these offerings from their current position, Bendigo Bank would need to undertake significant strategic investment. This would involve enhancing digital platforms, potentially partnering with fintechs for more competitive exchange rates and faster transaction times, and increasing marketing efforts to build brand awareness in these specialized areas. Without such dedicated investment, these products may remain in a position requiring substantial resources to gain meaningful traction.

- Low Market Share: International payments and travel products often face intense competition from established global players and agile fintech companies.

- High Investment Needs: To capture a larger share of the global payments market, significant capital expenditure on technology and marketing is typically required.

- Potential for Growth: Despite the challenges, the increasing volume of global trade and personal travel presents an opportunity for expansion if strategic investments are made.

- Competitive Landscape: The market is characterized by players offering a wide range of services, from simple remittances to complex foreign exchange solutions, making differentiation crucial.

Question Marks within Bendigo Bank's portfolio likely represent its newer digital initiatives and potentially its micro and SME lending efforts. These segments require significant investment to grow and capture market share. The bank is actively transforming its business and agribusiness division, integrating Rural Bank customers, and has launched a new Micro and SME Business Direct team. While the SME lending portfolio saw a 6.6% increase in the first half of 2024, these areas are still developing their market position.

| BCG Matrix Category | Bendigo Bank Business Segment Example | Market Share | Market Growth Rate | Strategic Recommendation |

|---|---|---|---|---|

| Question Marks | New Digital Features / Micro & SME Lending | Low | High | Invest selectively to gain market share or divest if growth potential is not realized. |

BCG Matrix Data Sources

Our BCG Matrix leverages robust financial statements, comprehensive market research, and industry growth forecasts to accurately position Bendigo Bank's business units.