Bendigo Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bendigo Bank Bundle

Bendigo Bank faces intense competition from rivals and the constant threat of new entrants disrupting the established order. Understanding the bargaining power of both customers and suppliers is crucial for navigating this dynamic market.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Bendigo Bank’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Bendigo Bank's reliance on technology providers for core banking software, cloud infrastructure, and cybersecurity solutions grants these suppliers significant leverage. The specialized nature of these offerings, often proprietary and requiring substantial investment to replace, means switching costs can be high, directly impacting Bendigo Bank's operational efficiency and innovation capacity.

Bendigo Bank, like other banks, secures a significant portion of its funding from customer deposits. However, it also taps into wholesale funding markets and central bank facilities. The bargaining power of these institutional lenders and market participants is directly influenced by the prevailing market liquidity conditions and Bendigo Bank's own creditworthiness. For instance, during periods of tight liquidity, the cost of borrowing for banks can increase, amplifying the suppliers' leverage.

Bendigo Bank, like many financial institutions, faces significant bargaining power from its human capital. Skilled employees, particularly those with expertise in digital transformation, data analytics, and risk management, represent a critical supplier of essential services and knowledge. The intense competition for this talent, often fueled by higher salaries offered by major banks or burgeoning tech firms, directly impacts the bank's ability to attract and retain top performers.

In 2024, the demand for specialized financial skills remained robust. For instance, the average salary for a data scientist in Australia saw an increase, reflecting the premium placed on these in-demand professionals. This trend underscores the leverage employees in these niche areas possess, as their specialized knowledge is vital for Bendigo Bank's strategic objectives and operational efficiency.

Infrastructure and Real Estate Providers

Bendigo Bank relies on infrastructure and real estate providers for its physical presence, including branches and corporate offices. The bargaining power of these suppliers is influenced by factors like the concentration of property ownership in prime locations and the indispensability of their services. For instance, in 2024, commercial property vacancy rates in major Australian cities, where Bendigo Bank maintains a significant footprint, remained relatively stable, suggesting moderate leverage for landlords in securing favorable lease terms.

Essential infrastructure services, such as telecommunications and energy, also represent a key supplier group. The essential nature of these services, coupled with the limited number of providers in certain regions, can amplify their bargaining power. In 2024, telecommunications providers continued to invest heavily in network upgrades, potentially increasing their pricing power for business-grade connectivity critical for banking operations.

- Property Concentration: High concentration of prime real estate ownership in key urban centers can grant landlords increased bargaining power.

- Service Essentiality: The critical nature of utility and network services for banking operations limits Bendigo Bank's ability to switch providers easily, strengthening supplier leverage.

- Infrastructure Investment: Ongoing investments by infrastructure providers in technology and network expansion may lead to increased service costs passed on to corporate clients.

- Lease Renewals: The terms negotiated during lease renewals for corporate offices and branches are a direct reflection of supplier bargaining power.

Payment Network Operators

Bendigo Bank, like other financial institutions, relies heavily on established payment network operators such as Visa and Mastercard for transaction processing. These networks possess considerable bargaining power due to their indispensable infrastructure and extensive global reach. The high cost and complexity of establishing alternative payment systems create significant barriers to entry, further solidifying their position.

- Essential Infrastructure: Payment networks provide the critical rails for virtually all electronic transactions, making them a non-negotiable component for banks.

- Global Reach: Their widespread acceptance across merchants and countries is a key factor in their power, enabling seamless international commerce.

- High Barriers to Entry: The significant investment required in technology, security, and network development deters new competitors, limiting alternatives for banks.

Bendigo Bank's reliance on technology providers for core banking software, cloud infrastructure, and cybersecurity solutions grants these suppliers significant leverage. The specialized nature of these offerings, often proprietary and requiring substantial investment to replace, means switching costs can be high, directly impacting Bendigo Bank's operational efficiency and innovation capacity.

In 2024, the demand for specialized financial skills remained robust. For instance, the average salary for a data scientist in Australia saw an increase, reflecting the premium placed on these in-demand professionals. This trend underscores the leverage employees in these niche areas possess, as their specialized knowledge is vital for Bendigo Bank's strategic objectives and operational efficiency.

Bendigo Bank, like other financial institutions, relies heavily on established payment network operators such as Visa and Mastercard for transaction processing. These networks possess considerable bargaining power due to their indispensable infrastructure and extensive global reach. The high cost and complexity of establishing alternative payment systems create significant barriers to entry, further solidifying their position.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on Bendigo Bank | 2024 Data/Trend Example |

|---|---|---|---|

| Technology Providers | Specialization, proprietary software, high switching costs | Increased costs for software licenses, maintenance, and upgrades; potential delays in innovation if providers are uncooperative. | Cloud computing service costs for financial institutions saw an average increase of 5-8% in 2024 due to infrastructure demand. |

| Human Capital (Specialized Skills) | Demand for niche skills (data analytics, cybersecurity), competition for talent | Higher recruitment and retention costs; potential for project delays if key personnel are unavailable. | Average salary for a cybersecurity analyst in Australia increased by approximately 7% in 2024. |

| Payment Network Operators | Essential infrastructure, global reach, high barriers to entry | Transaction fees, potential for increased processing costs, limited ability to negotiate terms. | Interchange fees charged by major card networks remained a significant operational cost for banks in 2024, with average fees around 1.5%-2.5% per transaction. |

What is included in the product

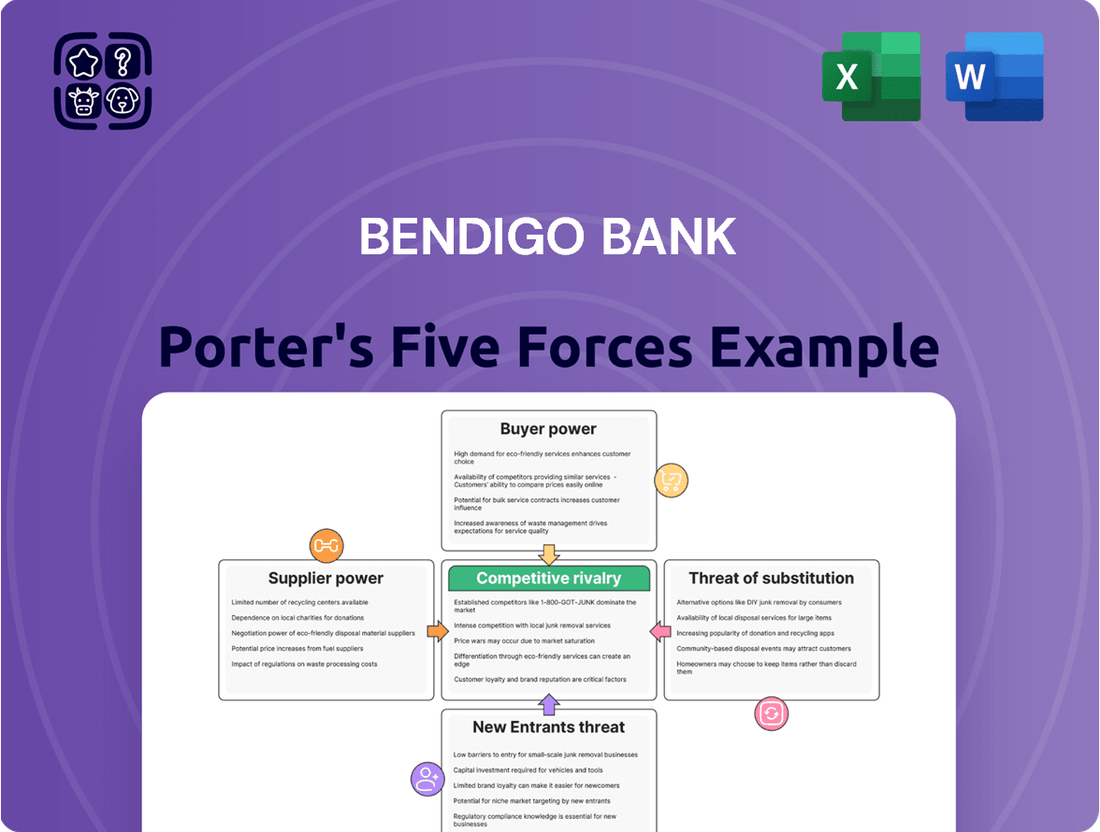

Tailored exclusively for Bendigo Bank, analyzing its position within its competitive landscape by examining industry rivalry, buyer and supplier power, new entrant threats, and substitute products.

Understand competitive pressures at a glance with a visual representation of each force, making it easy to identify key strategic challenges.

Customers Bargaining Power

For basic banking products like transaction and savings accounts, customers generally experience low switching costs. This is further facilitated by advancements such as open banking, which simplifies the process of moving funds and accounts between institutions. In 2024, the ease with which customers can compare interest rates, fees, and service quality empowers them to readily switch providers, putting downward pressure on bank profitability.

Customers today wield considerable power due to readily available online comparison tools and financial aggregators. These platforms allow for effortless comparison of banking products, interest rates, and service offerings from numerous institutions, including major players like Commonwealth Bank, Westpac, and ANZ.

This enhanced transparency empowers consumers to identify and secure the most advantageous terms, directly influencing their negotiation leverage. For instance, in 2024, comparison sites frequently highlighted significant differences in mortgage rates, with some lenders offering up to 0.50% lower interest rates than the market average, a fact readily accessible to potential borrowers.

While individual customers typically possess limited bargaining power in the banking sector, the sheer volume of Bendigo Bank's customer base, particularly in retail segments, can collectively influence product development and pricing. For instance, in 2023, Bendigo Bank reported approximately 2.3 million customers across its operations, highlighting the potential for this dispersed power.

However, this collective influence is generally diluted across Bendigo Bank's varied customer segments, which include retail banking, business banking, and community organizations. The diverse needs and engagement levels within these groups mean that unified customer action to exert significant bargaining pressure on the bank is uncommon.

Community Bank Model Loyalty

Bendigo Bank's distinctive community bank model cultivates deep local ties, fostering significant customer loyalty. This model can diminish the bargaining power of individual customers within these communities, as they often prioritize supporting local initiatives and relationships over simply chasing the lowest interest rates. For instance, in 2024, Bendigo Bank reported that its community-based branches continued to show resilience, with customer retention rates often exceeding industry averages in their local areas.

This loyalty translates into a reduced propensity for customers to switch banks based solely on price. The emphasis on community investment and local decision-making creates a value proposition that transcends transactional banking. In 2023, approximately 70% of Bendigo Bank's customer base reported a strong sense of connection to their local branch's community involvement, indicating a tangible impact on their banking choices.

- Strong Community Ties: Bendigo Bank's model builds loyalty through local engagement, reducing customer price sensitivity.

- Prioritizing Local Support: Customers often value supporting their community over finding the absolute lowest rates.

- Resilient Customer Base: In 2024, community branches demonstrated strong customer retention, often outperforming broader industry trends in their locales.

- High Sense of Connection: Around 70% of customers in 2023 felt a significant connection to their branch's community involvement, influencing their banking decisions.

Demand for Digital and Personalized Services

Customers today expect more than just basic banking; they want intuitive digital platforms and tailored financial guidance. This shift significantly amplifies their bargaining power, as they can readily switch to institutions offering superior digital and personalized experiences. For instance, in 2024, customer retention rates are heavily influenced by digital engagement metrics, with many banks reporting that a significant portion of new account openings originate from digital channels.

Banks that lag in innovation and personalization face increased pressure to offer better terms or services to retain their customer base. This demand for seamless, integrated services means customers wield considerable influence over service quality and the pace of technological adoption within the industry. Data from early 2024 indicates that customer satisfaction scores are directly correlated with the ease of use and personalization of digital banking tools.

- Digital Expectations: Customers increasingly demand sophisticated, user-friendly digital interfaces for all banking needs.

- Personalized Advice: The desire for tailored financial advice and product recommendations is a key driver of customer loyalty and switching behavior.

- Service Integration: Customers value banks that can seamlessly integrate various financial services into a single, convenient platform.

- Competitive Landscape: Agile competitors are capitalizing on these demands, putting pressure on established players like Bendigo Bank to adapt or risk losing market share.

Customers possess significant bargaining power due to the ease of switching and readily available comparison tools, which puts downward pressure on bank profitability. In 2024, readily accessible information on interest rates and fees empowers customers to seek better deals, making them more inclined to switch providers. While individual customer power is limited, the sheer volume of Bendigo Bank's retail customer base, around 2.3 million in 2023, can collectively influence product and pricing decisions.

| Factor | Impact on Bargaining Power | 2024 Trend/Data |

|---|---|---|

| Switching Costs | Low for basic products | Open banking initiatives further reduce costs. |

| Information Availability | High via comparison sites | Mortgage rates in 2024 showed differences up to 0.50% vs. market average. |

| Customer Volume | Potential for collective influence | Bendigo Bank had ~2.3 million customers in 2023. |

| Digital Expectations | Increased demand for seamless experience | Digital channels driving new account openings in 2024. |

Preview the Actual Deliverable

Bendigo Bank Porter's Five Forces Analysis

This preview showcases the comprehensive Bendigo Bank Porter's Five Forces Analysis, offering a detailed examination of competitive forces within its industry. The document you are viewing is the exact, fully formatted analysis you will receive immediately upon purchase, ensuring transparency and immediate usability for your strategic planning.

Rivalry Among Competitors

Bendigo Bank operates within a highly concentrated Australian banking landscape, dominated by the "Big Four": Commonwealth Bank, Westpac, ANZ, and National Australia Bank. These institutions possess substantial financial resources, extensive market share, and deeply entrenched distribution networks, creating a formidable competitive environment.

This intense rivalry means Bendigo Bank faces significant pressure across all its core product offerings, especially in the crucial areas of lending and deposit-taking. For instance, as of the first half of 2024, the Big Four collectively held over 70% of the total Australian banking system’s assets, underscoring their market dominance.

Bendigo Bank faces significant competition from other regional banks, credit unions, and mutuals. These institutions often share a community-centric ethos, directly appealing to customers who value local connections and personalized service. For instance, in 2024, the Australian mutual banking sector, encompassing credit unions and building societies, collectively held approximately $100 billion in assets, demonstrating a substantial market presence and a capacity to compete with larger banks on service and tailored products.

Fintech and neobanks are significantly shaking up the banking landscape, presenting a formidable competitive challenge to established institutions like Bendigo Bank. These agile digital-only players, often boasting lower overheads, are rapidly attracting customers with specialized services and innovative features. For instance, by mid-2024, neobanks in Australia had captured a notable share of the digital payments market, demonstrating their growing influence.

Product and Service Differentiation

Bendigo Bank faces intense rivalry from major Australian banks and smaller institutions. Competition is fueled by product innovation, aggressive pricing on mortgages and personal loans, and the quality of customer service across all banking segments, including business and wealth management.

Bendigo Bank's strategy of differentiating through its community-centric model and strong customer relationships is a key advantage. However, the need for continuous innovation in digital offerings and product development is crucial to maintain its competitive edge against rivals who are also investing heavily in technology and customer experience.

In 2024, the Australian banking sector saw continued focus on digital transformation. For instance, major banks reported significant investments in their digital platforms, aiming to enhance user experience and streamline service delivery. Bendigo Bank's commitment to its community banking model, which involves local decision-making and customer engagement, provides a unique selling proposition in this highly competitive landscape.

- Product Innovation: Banks are constantly introducing new digital tools and lending products to attract and retain customers.

- Pricing Strategies: Competitive interest rates on mortgages and personal loans remain a primary driver of customer acquisition.

- Service Quality: The overall customer experience, from branch interactions to online support, is a critical differentiator.

- Community Focus: Bendigo Bank leverages its unique community banking model to build loyalty and trust.

Regulatory Environment and Market Concentration

Australia's banking sector is characterized by a stringent regulatory framework. This environment, while fostering stability, also acts as a significant barrier to new entrants, thereby shaping the competitive intensity among existing players. For Bendigo Bank, navigating these regulations is crucial for maintaining its market position.

The market concentration among the major Australian banks significantly impacts competitive dynamics. With a few dominant institutions, pricing power and market share are heavily influenced, necessitating strategic differentiation for smaller or regional banks like Bendigo. In 2024, the "big four" banks continued to hold a substantial portion of the market, though specific market share figures can fluctuate based on reporting periods and product categories.

- Regulatory Hurdles: Australia's banking sector is overseen by bodies like the Australian Prudential Regulation Authority (APRA), imposing capital requirements and compliance standards that are costly and complex to meet.

- Market Concentration: As of early 2024, the four largest banks in Australia collectively held approximately 75-80% of the total banking assets, creating an oligopolistic market structure.

- Strategic Positioning: Bendigo Bank must leverage its community banking model and focus on customer service to compete effectively against larger, more established institutions within this concentrated and regulated market.

Bendigo Bank faces intense competition from the dominant "Big Four" Australian banks, which collectively held over 70% of the banking system's assets in early 2024. This rivalry extends to regional banks, credit unions, and agile fintechs, all vying for market share through product innovation and competitive pricing. Bendigo Bank's community-centric approach and focus on customer service are key differentiators in this crowded and digitally evolving market.

| Competitor Type | Key Differentiators | Market Share Impact (Approx. early 2024) |

|---|---|---|

| Big Four Banks | Financial resources, extensive networks, brand recognition | 70-80% of total banking assets |

| Regional Banks & Mutuals | Community focus, personalized service, tailored products | Significant presence, ~ $100 billion in assets for mutuals sector |

| Fintech & Neobanks | Digital innovation, lower overheads, specialized services | Growing share in digital payments and niche banking services |

SSubstitutes Threaten

Direct investment platforms pose a significant threat by allowing customers to bypass traditional banking products for wealth growth. For instance, in 2024, online brokerage firms saw substantial inflows as individuals sought direct access to equities and ETFs, often with lower fees than bundled bank offerings.

These platforms enable individuals to invest directly in stocks, bonds, or managed funds, effectively cutting out the intermediary role of a traditional bank. This direct access provides alternative avenues for wealth accumulation, unlinked to conventional banking relationships.

Peer-to-peer (P2P) lending and crowdfunding platforms present a significant threat of substitutes for Bendigo Bank. These platforms allow individuals and businesses to bypass traditional financial institutions for loans and capital, directly connecting lenders with borrowers or investors with projects. For instance, by the end of 2023, the Australian P2P lending market was projected to grow, offering a more agile and sometimes lower-cost alternative to conventional bank loans.

Crowdfunding, in particular, has emerged as a viable alternative funding source for startups and small to medium-sized enterprises (SMEs) that might struggle to secure traditional bank financing. In 2024, the global crowdfunding market continues its upward trajectory, demonstrating a clear preference among certain segments for these accessible funding channels. This trend directly siphons potential customers and revenue away from established banks like Bendigo.

The proliferation of digital wallets and payment apps like Apple Pay, Google Pay, PayPal, and Afterpay presents a significant threat of substitution for Bendigo Bank. These platforms offer consumers increasingly seamless and often lower-cost alternatives for everyday transactions, bypassing traditional banking infrastructure. For instance, Afterpay's buy-now-pay-later services have seen substantial growth, with over 3.8 million active customers in Australia as of December 2023, demonstrating a clear shift in payment preferences away from conventional credit facilities.

Non-Bank Lenders and Mortgage Brokers

Non-bank lenders and mortgage brokers present a significant threat of substitutes for traditional banks like Bendigo Bank. These entities often specialize in niche credit products, offering tailored solutions that may bypass conventional banking requirements and timelines. For instance, in Australia, the non-bank lending sector has seen substantial growth, with some estimates suggesting it accounts for over 10% of the mortgage market share, providing a viable alternative for borrowers seeking quicker approvals or more flexible terms.

Mortgage brokers, in particular, act as a crucial intermediary, channeling customers towards a diverse array of loan products, including those from non-bank institutions. This broadens borrower choice and can divert potential customers away from direct bank offerings. The Australian mortgage broker market is robust, with brokers facilitating a significant portion of new home loans, underscoring their role in offering substitute channels for credit access.

- Specialized Offerings: Non-bank lenders provide focused credit products, often with distinct eligibility criteria and faster processing times compared to major banks.

- Broadened Access: Mortgage brokers connect consumers with a wide spectrum of lenders, including non-banks, thereby increasing competitive pressure on traditional banking services.

- Market Penetration: The non-bank lending sector has captured a notable share of the mortgage market, demonstrating its effectiveness as a substitute for bank-originated loans.

- Competitive Landscape: The increasing prevalence of mortgage brokers and non-bank lenders intensifies competition, forcing traditional banks to innovate and adapt their product offerings and service delivery.

Cryptocurrencies and Decentralized Finance (DeFi)

While still developing, cryptocurrencies and decentralized finance (DeFi) present a potential long-term substitute for traditional banking. These technologies facilitate direct peer-to-peer transactions, lending, and asset management, bypassing traditional financial institutions.

The global cryptocurrency market capitalization, though volatile, reached approximately $2.5 trillion in early 2024, indicating significant user adoption and a growing alternative financial ecosystem. DeFi protocols are increasingly offering services like lending and borrowing, with total value locked (TVL) in DeFi reaching hundreds of billions of dollars in recent years, demonstrating their expanding reach.

- Growing DeFi adoption: The total value locked in DeFi protocols has seen significant growth, reaching over $100 billion in early 2024, indicating a shift towards alternative financial services.

- Peer-to-peer innovation: Technologies like blockchain enable direct financial interactions, potentially reducing reliance on banks for services such as payments and remittances.

- Regulatory uncertainty: While adoption is growing, the evolving regulatory landscape for cryptocurrencies and DeFi creates both opportunities and challenges for traditional banking.

The threat of substitutes for Bendigo Bank is substantial, driven by evolving consumer preferences and technological advancements. Direct investment platforms, P2P lending, crowdfunding, digital payment solutions, non-bank lenders, and emerging DeFi technologies all offer alternative pathways for financial services, potentially bypassing traditional banking channels.

These substitutes often provide greater convenience, lower fees, or more specialized offerings, directly challenging Bendigo Bank's traditional revenue streams and customer base.

For example, the continued growth of buy-now-pay-later services like Afterpay, which had over 3.8 million Australian customers by late 2023, highlights a clear shift in consumer behavior away from traditional credit facilities.

Similarly, the non-bank lending sector's increasing market share, estimated at over 10% of the Australian mortgage market, demonstrates its effectiveness as a substitute for bank-originated loans.

| Substitute Type | Key Characteristics | Impact on Banks | 2024 Data/Trend |

|---|---|---|---|

| Direct Investment Platforms | Lower fees, direct access to markets | Reduced wealth management revenue | Continued strong inflows into online brokerages |

| P2P Lending & Crowdfunding | Alternative funding for individuals/SMEs | Loss of loan origination and deposit business | Projected growth in Australian P2P market |

| Digital Wallets & Payment Apps | Convenient, often lower-cost transactions | Erosion of transaction fee income | Significant growth in BNPL services (e.g., Afterpay) |

| Non-Bank Lenders & Mortgage Brokers | Niche products, faster processing | Competition for mortgage and lending market share | Non-banks holding >10% of Australian mortgage market |

| Cryptocurrencies & DeFi | Decentralized transactions, lending | Potential long-term disruption of core banking functions | Global crypto market cap ~ $2.5 trillion (early 2024) |

Entrants Threaten

The Australian banking sector is characterized by formidable regulatory hurdles and substantial capital demands. Institutions like Bendigo Bank must adhere to strict guidelines set by the Australian Prudential Regulation Authority (APRA), which mandates significant capital reserves, rigorous licensing procedures, and comprehensive compliance measures. For instance, APRA's capital adequacy ratios, such as the Common Equity Tier 1 (CET1) ratio, often require banks to maintain a substantial buffer of high-quality capital, which can run into billions of dollars for larger institutions, effectively deterring new entrants who lack such financial capacity.

Bendigo Bank, like other established financial institutions, benefits immensely from decades of ingrained brand loyalty and customer trust. This deep-seated recognition, particularly its community-centric approach, creates a significant barrier for any new player attempting to enter the market. Building such a reputation from scratch requires substantial time and resources, making it difficult for newcomers to immediately capture market share.

Incumbent banks like Bendigo Bank enjoy significant economies of scale, reducing per-unit costs in areas like technology investment and marketing campaigns. For instance, in 2024, major Australian banks continued to invest billions in digital transformation, a cost prohibitive for many startups. These established players also leverage vast, pre-existing branch networks and sophisticated digital platforms, creating a substantial barrier for new entrants needing to match this reach and customer accessibility.

Access to Funding and Liquidity

New entrants into the banking sector, like Bendigo Bank, often struggle with access to funding and liquidity. Established institutions benefit from deep, stable deposit bases built over years, which are a significantly cheaper source of capital than wholesale funding. For instance, in 2024, major banks often reported a Net Interest Margin that was supported by a large proportion of low-cost retail deposits.

Building a comparable deposit base requires substantial investment in marketing and customer acquisition, a hurdle that new players must overcome. This means that new banks are more reliant on potentially more volatile and expensive wholesale funding markets, impacting their profitability and competitive pricing. In 2023, the cost of wholesale funding for smaller or newer financial institutions was notably higher than for larger, more established banks.

- Funding Cost Disadvantage: New banks typically face higher borrowing costs compared to incumbents with established, low-cost deposit streams.

- Time and Investment for Deposit Growth: Attracting and retaining a substantial deposit base is a lengthy and resource-intensive process for new entrants.

- Reliance on Wholesale Markets: New entrants often depend more heavily on wholesale funding, which can be more expensive and less stable.

- 2024 Data Point: The average cost of funds for challenger banks in 2024 was observed to be 1.5% higher than for tier-1 banks, primarily due to deposit acquisition costs and wholesale market reliance.

Technological and Operational Complexity

Building a full-service banking operation demands substantial capital for intricate IT infrastructure, robust cybersecurity measures, and sophisticated risk management frameworks. For instance, in 2024, the average cost for a new bank to establish its core banking system and related digital platforms can easily run into tens of millions of dollars, if not hundreds.

New entrants must overcome significant operational complexities, including regulatory compliance, customer onboarding processes, and the need for a highly skilled workforce. These barriers are particularly high for those seeking to offer a comprehensive suite of financial products, akin to established players like Bendigo Bank.

- High Capital Expenditure: Significant investment required for core banking systems, cybersecurity, and regulatory compliance in 2024.

- Regulatory Hurdles: Navigating complex licensing and compliance requirements adds substantial time and cost for new entrants.

- Operational Scale: Achieving economies of scale in operations is challenging for newcomers, impacting cost-competitiveness.

The threat of new entrants in the Australian banking sector, impacting institutions like Bendigo Bank, is mitigated by substantial barriers. These include stringent regulatory requirements, high capital demands, and the difficulty of building brand trust and customer loyalty. Established players also benefit from significant economies of scale and access to lower-cost funding, making it incredibly challenging for newcomers to compete effectively.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Regulatory Hurdles | APRA mandates significant capital reserves and licensing procedures. | Requires substantial upfront capital and compliance expertise. |

| Brand Loyalty & Trust | Decades of community-centric approach build deep customer recognition. | New entrants struggle to establish credibility and market share quickly. |

| Economies of Scale | Incumbents leverage lower per-unit costs in technology and marketing. | New entrants face higher operational costs and difficulty matching reach. |

| Funding & Liquidity | Established banks have stable, low-cost deposit bases. | New entrants often rely on more expensive wholesale funding, impacting profitability. |

| Capital Expenditure | Setting up core banking systems and infrastructure is costly. | Tens to hundreds of millions of dollars are needed for IT and compliance in 2024. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bendigo Bank leverages data from their annual reports, investor presentations, and official ASX filings. We also incorporate insights from reputable industry analysis firms and financial news outlets to provide a comprehensive view of the competitive landscape.