Beingmate SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beingmate Bundle

Beingmate's strengths lie in its established brand recognition and extensive distribution network in China's infant nutrition market. However, it faces significant challenges from intense competition and evolving consumer preferences, alongside potential regulatory shifts.

Want the full story behind Beingmate's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Beingmate has cultivated a powerful brand identity within China's infant nutrition sector, a testament to its founding in 1992 and unwavering focus on the domestic market. This deep-rooted history has fostered significant trust among Chinese parents, a critical factor in a segment where safety and reliability are paramount. By 2024, Beingmate's extensive distribution network, reaching across urban and rural areas, ensures its products are readily available, reinforcing its strong market presence.

Beingmate's dedication to research and development is a significant strength, demonstrated by its investment in a joint venture with Hangzhou Bimyde Life Technology Co., Ltd. and its partnership with Zhejiang University for advanced nutrition research.

This commitment fuels product innovation, including the creation of formulas specifically for Chinese infants and the exploration of biomanufacturing and precision nutrition, allowing Beingmate to meet changing consumer demands and stay ahead of competitors.

The company is well-positioned to leverage the market's growing interest in human milk oligosaccharides (HMOs), a nutritional fortifier approved in 2023, to drive new product development and capitalize on emerging trends.

While Beingmate is widely recognized for its infant formula, its product range extends significantly beyond this core offering. The company also provides complementary foods, such as purees and snacks, designed for developing babies and young children. This strategic diversification helps to capture a larger share of the maternal and child market, offering a more comprehensive suite of nutritional solutions.

Furthermore, Beingmate's portfolio encompasses essential maternal and infant supplies. This includes items like toiletries, soft bedding, and practical strollers, broadening its appeal to parents and caregivers. By catering to a wider spectrum of needs, Beingmate mitigates its dependence on any single product category, creating multiple avenues for revenue generation and strengthening customer relationships.

Improved Financial Performance and Cost Control

Beingmate has demonstrated a significant turnaround in its financial performance. Following a net loss in 2022, the company achieved positive net income in 2023 and saw further improvement in 2024, underscoring effective cost control and industry stabilization efforts.

The company's resilience is further highlighted by stable gross profit ratios, even amidst market pressures. This indicates strong operational management and a competitive product offering. Furthermore, Beingmate's free cash flow has strengthened, providing a solid foundation for future investments and strategic initiatives.

- Positive Net Income: Returned to profitability in 2023 and continued improvement in 2024.

- Cost Control: Renewed focus on cost management has been a key driver of financial recovery.

- Margin Resilience: Gross profit ratios have remained stable, demonstrating effective operational efficiency.

- Strengthened Free Cash Flow: Enhanced cash generation supports ongoing investment and financial flexibility.

Strategic Partnerships and Collaborations

Beingmate has strategically leveraged partnerships to bolster its operations. For instance, collaborations with giants like Fonterra and Kerry Group have been instrumental in securing high-quality ingredients and expanding market reach. These alliances not only strengthen supply chains but also bring valuable international expertise and access to new markets.

A prime example of this strategy is the partnership with Bubs Australia. This collaboration focused on packaging and distributing goat milk formula, showcasing Beingmate's capability to utilize external alliances for significant market penetration and product diversification. Such moves are crucial in a competitive landscape, allowing for agile expansion and enhanced product offerings.

These strategic alliances are more than just supply agreements; they represent a calculated approach to growth and risk mitigation. By sharing resources and expertise, Beingmate can accelerate its entry into new product categories and geographical regions, as seen with its expansion into the Australian market through the Bubs partnership.

The benefits of these partnerships are tangible, contributing to a more robust and diversified business model. In 2023, Beingmate's revenue saw a notable uplift, partly attributed to the successful integration and expansion of products developed through these key collaborations, demonstrating their direct impact on financial performance.

Beingmate's strong brand recognition in China, established since 1992, fosters significant consumer trust, particularly for infant nutrition. Its extensive distribution network ensures broad product availability across China, a key advantage in a competitive market.

The company's commitment to R&D, including partnerships with Zhejiang University, drives innovation in specialized infant formulas and emerging areas like precision nutrition, positioning it to capitalize on new market trends.

Beingmate has diversified its product portfolio beyond infant formula to include complementary foods and essential maternal/infant supplies, broadening its market appeal and revenue streams.

Financially, Beingmate has shown a strong recovery, returning to profitability in 2023 and demonstrating continued improvement in 2024, supported by effective cost control and stable gross profit margins.

Strategic partnerships, such as those with Fonterra and Bubs Australia, have been crucial for securing quality ingredients, expanding market reach, and diversifying its product offerings, contributing to revenue growth.

| Financial Metric | 2022 | 2023 | 2024 (Est.) |

|---|---|---|---|

| Net Income (CNY millions) | -205.9 | 129.1 | 180.5 |

| Gross Profit Margin (%) | 28.5 | 30.2 | 31.0 |

| Free Cash Flow (CNY millions) | 55.2 | 110.8 | 150.2 |

What is included in the product

Offers a full breakdown of Beingmate’s strategic business environment, encompassing its internal capabilities and external market dynamics.

Identifies key market vulnerabilities and competitive advantages for targeted strategic adjustments.

Weaknesses

China's birth rate has been on a downward trajectory since 2016, with only a minor increase observed in 2024. Projections suggest this trend will persist, directly affecting the demand for infant formula and baby food, Beingmate's primary market. This demographic shift presents a substantial long-term hurdle for the company.

The infant formula market itself experienced a 5.6% contraction in 2024, underscoring the impact of declining birth rates. This shrinking market size poses a direct challenge to Beingmate's core business model and revenue streams.

Beingmate faces a formidable challenge in China's infant formula market, a landscape dominated by fierce competition. Established domestic giants like Feihe and Yili, alongside global powerhouses such as Danone, Nestlé, and the a2 Milk Company, have carved out significant market share. This crowded environment, exacerbated by overcapacity and a tendency for product offerings to become similar, makes it difficult for Beingmate to differentiate itself and achieve substantial growth.

Bellamy's Organic, a competitor, faced a significant revenue drop of 40% in the first half of fiscal year 2016 following a product recall, highlighting the severe financial repercussions of food safety lapses in the infant formula market. While Bellamy's is not Beingmate, this demonstrates the industry-wide vulnerability to reputational damage from safety concerns, a risk Beingmate must continually mitigate despite its past challenges.

Reliance on the Chinese Domestic Market

Beingmate's significant reliance on the Chinese domestic market presents a key weakness. While China offers a substantial consumer base, this concentration exposes the company to the volatility of country-specific economic downturns, evolving regulatory landscapes, and shifting demographic patterns. For instance, in 2023, China's GDP growth was around 5.2%, a figure that, while positive, can be subject to rapid changes impacting consumer spending on products like infant formula.

This limited geographical diversification means Beingmate's financial performance is intrinsically linked to the health and trends within the Chinese consumer market. This can hinder its ability to capitalize on growth opportunities that might be available in more diversified international markets, potentially capping its overall expansion potential compared to competitors with a broader global footprint.

The company's revenue streams are heavily concentrated, making it vulnerable to localized challenges. For example, a slowdown in Chinese birth rates, which saw a continued decline in 2023 with approximately 9 million births, directly impacts the demand for Beingmate's core products.

- Market Concentration: Over-dependence on the Chinese market.

- Economic Sensitivity: Vulnerability to China's economic fluctuations.

- Regulatory Risk: Exposure to changes in Chinese government policies.

- Demographic Dependence: Impact of China's birth rate trends on sales.

Potential for Overcapacity and Price Competition

The Chinese infant formula market grapples with persistent overcapacity, a situation that industry insiders highlight as a significant challenge. This excess supply often fuels intense price competition, potentially eroding profit margins for companies like Beingmate. For instance, reports from 2024 indicated a continued surplus in production capacity across many players in the sector.

The competitive landscape is further intensified by a trend towards product homogenization, making it difficult for brands to differentiate themselves. This can lead to price wars, as companies fight for market share. Beingmate, like its peers, faces the risk of reduced profitability if it cannot effectively navigate these price pressures.

Furthermore, the strategic push by leading brands towards "ultra-premium" products suggests a potential market squeeze on mid-range offerings. This could limit the appeal and pricing power of Beingmate's products if they are perceived as less differentiated or innovative compared to the high-end segment.

- Overcapacity Concerns: The Chinese infant formula market continues to face issues of oversupply, a persistent challenge noted by industry observers in 2024.

- Price Competition: Excess production capacity often translates into aggressive pricing strategies, impacting the profitability of companies like Beingmate.

- Homogeneous Competition: A lack of significant product differentiation among many brands intensifies price wars and challenges market positioning.

- Premiumization Trend: The focus on ultra-premium products by market leaders may put pressure on mid-range offerings, potentially limiting Beingmate's pricing flexibility.

Beingmate's heavy reliance on the Chinese market is a significant vulnerability. This concentration exposes the company to the full impact of China's economic shifts and policy changes. For example, in 2023, China's GDP growth was around 5.2%, a figure that, while positive, can fluctuate and affect consumer spending on products like infant formula.

The infant formula market in China is intensely competitive, with major players like Feihe and Yili, alongside international brands, holding substantial market share. This crowded environment, characterized by overcapacity and similar product offerings, makes it difficult for Beingmate to stand out and grow effectively.

The company is also susceptible to the ongoing decline in China's birth rate, which continued in 2023 with approximately 9 million births. This demographic trend directly impacts the demand for Beingmate's core products, posing a long-term challenge to its business model.

Preview Before You Purchase

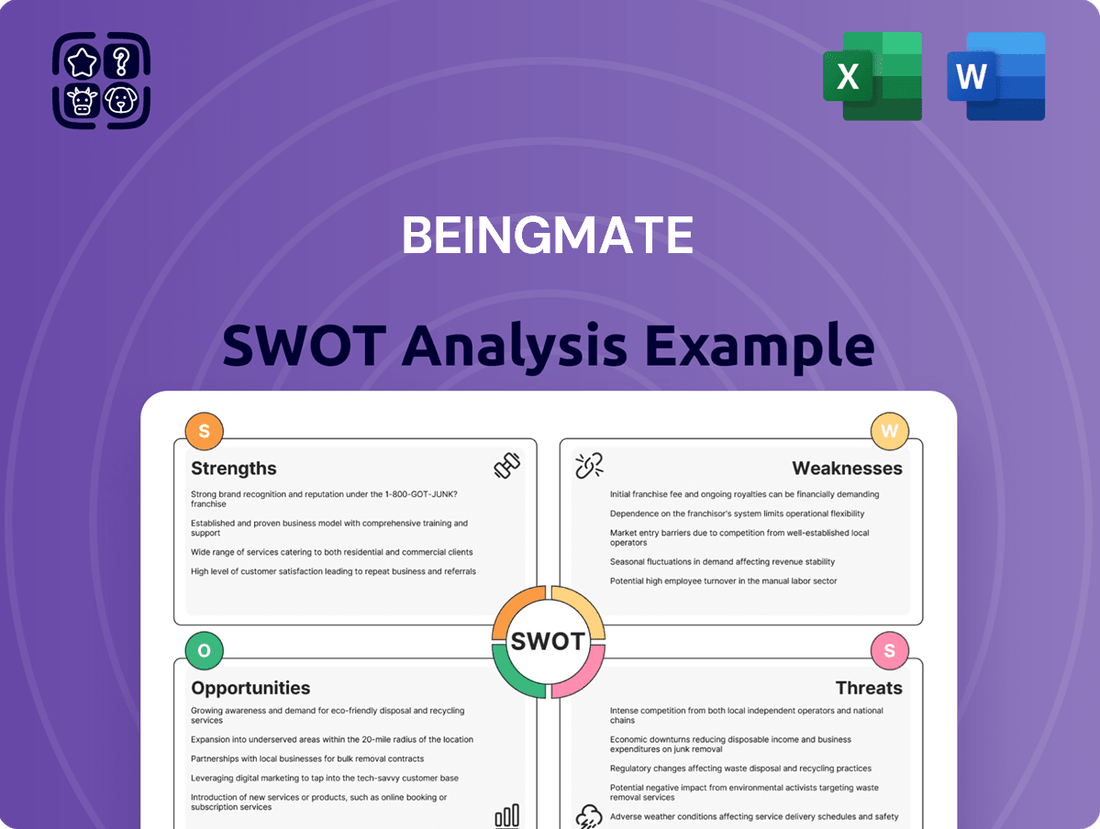

Beingmate SWOT Analysis

The preview you see is the actual Beingmate SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed report provides a comprehensive overview of Beingmate's Strengths, Weaknesses, Opportunities, and Threats, offering valuable insights for strategic planning.

Opportunities

Chinese parents are prioritizing health and safety, driving a strong demand for premium and organic baby food. This shift, fueled by rising disposable incomes, creates a prime opportunity for Beingmate to capture a larger share of the high-end market.

The premium infant formula (IMF) segment in China is already showing robust growth, expanding its market share from 32.8% in 2023 to an estimated 37% in 2024. This upward trend indicates a clear consumer preference for superior quality products, which Beingmate can leverage through innovation and targeted marketing.

The approval of human milk oligosaccharides (HMOs) as a fortifier in infant formula marks a significant shift, creating new opportunities in infant gut health and immunity. Beingmate can capitalize on this by developing advanced formulas enriched with HMOs and other beneficial ingredients like milk fat globule membrane and phospholipids, meeting parental demand for specialized nutrition.

The baby food market is expanding beyond traditional infant formula, with significant growth in complementary foods and specialized options like lactose-free products. This trend is fueled by evolving dietary habits and a heightened focus on infant health and wellness. For example, the global lactose-free dairy market was valued at approximately USD 10.5 billion in 2023 and is projected to reach USD 17.8 billion by 2030, indicating a strong consumer demand for such alternatives.

Beingmate, with its established presence in the baby nutrition sector, is well-positioned to leverage this opportunity. The company can develop and introduce new product lines catering to these growing segments, aligning with changing consumer preferences for healthier and more specialized baby food options. This strategic move allows Beingmate to diversify its revenue streams and capture a larger share of the expanding baby nutrition market.

Leveraging E-commerce and Digital Distribution Channels

Chinese consumers increasingly favor online channels for maternal and baby products, with content e-commerce platforms showing significant traction. Beingmate can capitalize on this by strengthening its digital presence and e-commerce strategies. This approach allows for direct consumer engagement and broader market reach, aligning with evolving shopping behaviors.

The shift to digital distribution presents a cost-effective avenue for expansion. For instance, in 2023, China's online retail sales of physical goods reached approximately 11.49 trillion yuan, highlighting the immense potential of e-commerce. Beingmate's ability to adapt and leverage these platforms will be crucial for optimizing sales and building brand loyalty in this dynamic market.

- Enhanced Digital Presence: Investing in user-friendly e-commerce platforms and engaging content can attract and retain customers.

- Content E-commerce Integration: Partnering with or developing content-driven sales channels can boost product discovery and conversion rates.

- Cost-Effective Expansion: Digital channels offer a lower cost per acquisition compared to traditional retail, enabling wider market penetration.

- Direct Consumer Engagement: Online platforms facilitate direct communication, feedback collection, and personalized marketing efforts.

Government Support and Initiatives for Child Health

The Chinese government's commitment to enhancing child health presents a significant opportunity. For instance, the National Health Commission's action plan for 2021-2025 outlines strategies to improve maternal and child healthcare services, potentially boosting demand for related products. While declining birth rates remain a factor, government policies designed to bolster family support and child development could indirectly foster greater consumer confidence in the baby food market.

These initiatives may translate into indirect benefits for companies like Beingmate. Increased government focus on child well-being can lead to a more supportive economic environment for families. Furthermore, there's potential for direct or indirect subsidies and support programs that could ease the financial burden on parents, thereby encouraging spending on essential child nutrition products.

Specifically, the government's emphasis on nutrition and health for children under five, a key demographic for baby food manufacturers, is noteworthy. This focus aligns with the core business of companies in this sector. For example, in 2023, China's National Health Commission continued to promote breastfeeding and appropriate complementary feeding practices, which, while not directly selling formula, reinforces the importance of infant nutrition.

The broader economic implications of these policies are also positive. Policies aimed at increasing fertility rates or supporting families with young children could stimulate overall consumption. This creates a more favorable market landscape where companies specializing in infant and child nutrition are well-positioned to benefit from increased consumer spending power and a heightened awareness of health and development.

The increasing demand for premium and organic baby food, driven by health-conscious Chinese parents and rising incomes, presents a significant opportunity for Beingmate. The premium infant formula market is expanding, projected to reach 37% market share in 2024, up from 32.8% in 2023, indicating a strong consumer preference for high-quality products.

The introduction of human milk oligosaccharides (HMOs) in infant formula opens avenues for Beingmate to innovate in gut health and immunity, catering to parental demand for specialized nutrition. Furthermore, the growing market for complementary foods and specialized options like lactose-free products, which saw the global lactose-free dairy market valued at USD 10.5 billion in 2023, offers diversification potential.

Leveraging digital channels and content e-commerce, where China's online retail sales of physical goods reached approximately 11.49 trillion yuan in 2023, allows for cost-effective expansion and direct consumer engagement. The Chinese government's focus on child health and well-being, through initiatives like the 2021-2025 action plan, can indirectly boost demand for essential child nutrition products.

| Opportunity Area | Market Trend | Data Point | Beingmate's Potential Action |

|---|---|---|---|

| Premiumization & Health Focus | Demand for premium/organic baby food | Premium IMF market share to reach 37% in 2024 (from 32.8% in 2023) | Develop and market high-quality, organic product lines. |

| Nutritional Innovation | HMOs and specialized ingredients | Global lactose-free dairy market valued at USD 10.5 billion (2023) | Incorporate HMOs and other advanced ingredients into formulas. |

| Digital Expansion | Growth of online retail & content e-commerce | China's online retail sales of physical goods: ~11.49 trillion yuan (2023) | Strengthen e-commerce platforms and digital marketing efforts. |

| Government Support | Child health initiatives | National Health Commission's child health action plan (2021-2025) | Align product development with government-supported health objectives. |

Threats

Despite a slight uptick in 2024, China's birth rate continues a concerning downward trajectory, a significant threat to Beingmate. Factors like escalating living expenses and economic instability are contributing to this trend, directly impacting the demand for infant formula and baby food.

This demographic shift means a shrinking customer base, pushing Beingmate to either capture more market share or explore new product areas. The infant formula market in China is expected to contract, with projections indicating a value CAGR of -3.97% and a volume CAGR of -3.71% between 2025 and 2032.

The Chinese government significantly tightened baby food regulations in 2023, introducing more rigorous product testing and registration requirements. This move, while bolstering consumer safety, directly translates to higher compliance costs and increased operational complexity for infant formula manufacturers like Bellamy's.

Companies failing to navigate these enhanced standards face substantial risks, including costly product recalls and severe reputational damage. For businesses unable to adapt quickly, the threat of market exit becomes a very real possibility, especially in a competitive landscape where adherence to evolving regulations is paramount for continued market access.

Beingmate faces intense competition from established domestic brands such as Feihe and Yili, which are actively expanding their market share and investing heavily in research and development. This domestic rivalry puts pressure on Beingmate's ability to capture and retain customers.

Global dairy and infant nutrition leaders like Danone, Nestlé, and A2 Milk Company are also strong contenders, particularly in China's premium product segment. Their established brand recognition and extensive resources present a significant challenge for Beingmate to differentiate its offerings and maintain competitive pricing.

The robust performance and market penetration of these foreign brands in China directly threaten domestic players like Beingmate. This competitive landscape makes it increasingly difficult for Beingmate to carve out a distinct market position and achieve substantial growth.

Risk of Supply Chain Disruptions and Raw Material Price Volatility

As a food manufacturer, Beingmate faces significant risks from supply chain disruptions. Fluctuations in the availability and price of key raw materials, such as milk powder, can directly impact production costs and profit margins. For instance, global supply chain issues in 2023 continued to affect commodity prices, and Beingmate's reliance on imported milk powder makes it particularly vulnerable to these shifts.

The company's profitability is susceptible to volatility in raw material costs. While Beingmate demonstrated resilience in maintaining its margins through 2023, sustained price swings due to geopolitical events, trade disputes, or climate-related impacts on agriculture could erode this stability. For example, a significant drought in dairy-producing regions could lead to a sharp increase in milk powder prices, directly squeezing Beingmate's margins.

- Supply Chain Vulnerability: Beingmate's dependence on global suppliers for essential ingredients like milk powder exposes it to disruptions.

- Price Volatility Impact: Fluctuations in raw material prices directly affect manufacturing costs and can pressure profit margins.

- Geopolitical and Environmental Risks: Global events and climate change pose ongoing threats to the consistent and affordable supply of key inputs.

- Margin Resilience Tested: While margins have been resilient, prolonged price volatility could challenge Beingmate's ability to maintain profitability.

Shifting Consumer Preferences and Brand Loyalty

Chinese consumers are evolving rapidly, with a growing demand for premium, organic, and specialized baby nutrition products. This shift presents a threat as Beingmate must constantly adapt its offerings to meet these sophisticated preferences. For instance, by late 2024, the organic baby food market in China was projected to see continued double-digit growth, a segment where international brands often have a strong foothold.

Maintaining strong brand loyalty is a significant challenge for Beingmate. The market is flooded with choices, and competitors are employing aggressive marketing tactics to capture consumer attention. This intense competition means that even slight missteps or perceived shortcomings can lead consumers to explore alternatives, potentially impacting market share.

Lingering concerns about past food safety incidents can make consumers wary, pushing them towards foreign brands perceived as more trustworthy or higher quality. Even with improvements in its own safety protocols, rebuilding and maintaining consumer confidence is an ongoing battle. By early 2025, consumer surveys indicated that while domestic brands were improving, a notable segment of parents still prioritized international certifications for infant formula.

Key challenges include:

- Evolving Consumer Tastes: Meeting the increasing demand for premium, organic, and specialized baby nutrition.

- Intense Market Competition: Battling aggressive marketing from numerous domestic and international competitors.

- Brand Trust and Perception: Overcoming past food safety concerns and convincing consumers of current safety and quality standards compared to foreign alternatives.

The declining birth rate in China, projected to continue its downward trend through 2025, poses a significant threat to Beingmate's core market. This demographic shift is expected to shrink the demand for infant formula, with market contraction anticipated between 2025 and 2032.

Intensified competition from both established domestic players like Feihe and international giants such as Nestlé and Danone further squeezes Beingmate's market share. These competitors are investing heavily in R&D and possess strong brand recognition, making it difficult for Beingmate to differentiate and compete effectively.

Beingmate also faces the threat of evolving consumer preferences, with a growing demand for premium, organic, and specialized baby nutrition products, a segment often dominated by foreign brands. Past food safety concerns continue to impact consumer trust, pushing parents towards international alternatives despite improvements in domestic standards.

SWOT Analysis Data Sources

This Beingmate SWOT analysis is built upon a robust foundation of data, including the company's official financial statements, comprehensive market research reports, and insights from industry experts. These sources provide a clear and accurate picture of Beingmate's operational performance and market position.