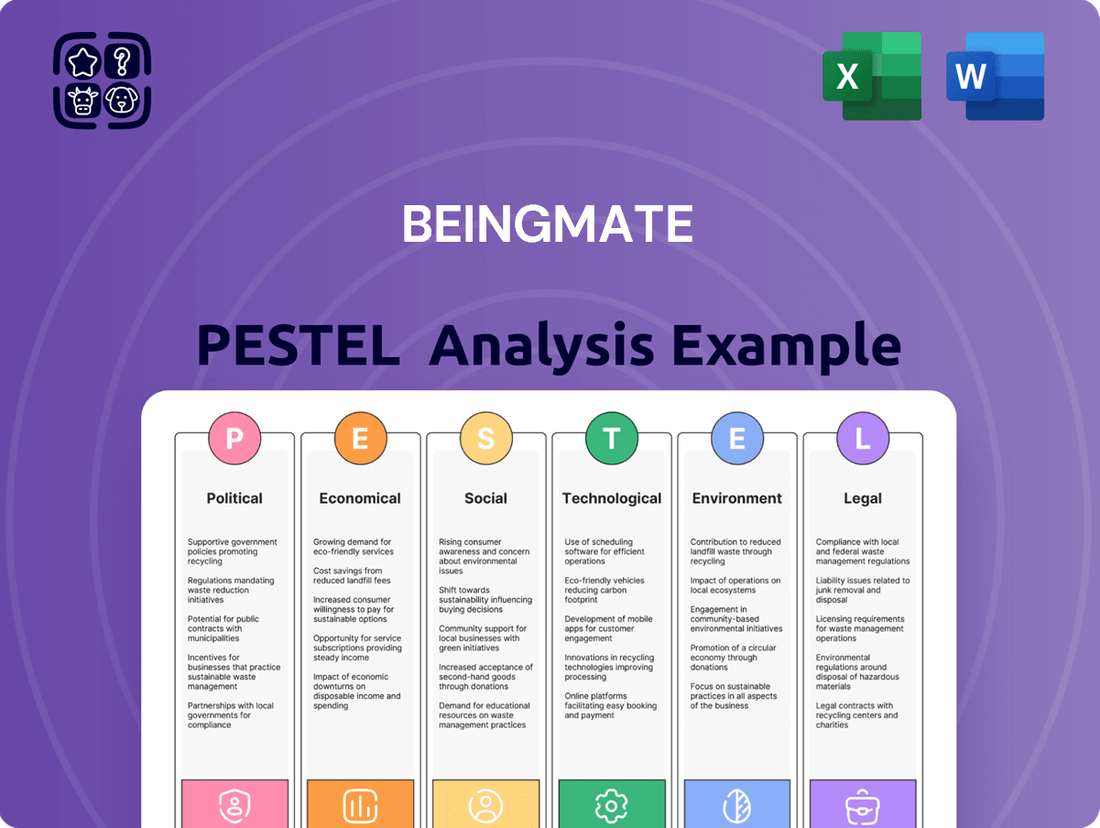

Beingmate PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beingmate Bundle

Navigate the complex external forces shaping Beingmate's future with our expert PESTLE analysis. Understand how political shifts, economic fluctuations, and evolving social trends create both challenges and opportunities for the company. Equip yourself with actionable intelligence to refine your market strategy and gain a competitive edge. Download the full PESTLE analysis now for a comprehensive overview.

Political factors

China's pronatalist policies, such as the three-child policy introduced in 2021 and various financial incentives, aim to reverse the declining birth rate. These measures are designed to boost the number of newborns, directly influencing the market for infant products.

For Beingmate, a significant player in the baby food sector, the success of these government initiatives is crucial. An increase in birth rates would translate to higher demand for its products, impacting sales and market share.

While the long-term impact is still unfolding, initial data from 2023 showed a slight stabilization in birth rates compared to previous years, though the overall numbers remain low. For instance, China's National Bureau of Statistics reported around 9.02 million births in 2023, a slight increase from 9.56 million in 2022, indicating the challenge these policies face.

The Chinese government has significantly ramped up food safety regulations for infant formula and baby food, requiring more rigorous product testing and registration processes. For instance, the updated Food Safety Law and specific national standards for special medical purpose infant formulas (FSMP) are designed to bolster consumer trust and product quality.

Beingmate faces the challenge of adapting to these increasingly stringent rules. While compliance can incur higher operational costs, meeting these elevated standards, such as those implemented following the melamine scandal which saw significant penalties and recalls, ultimately strengthens the company's image as a provider of safe and reliable products.

The Chinese government actively champions its domestic infant formula industry, aiming to lessen dependence on international brands. This strategic focus translates into tangible benefits for local manufacturers like Beingmate, potentially including preferential policies, financial subsidies, and a smoother path through regulatory landscapes. For instance, in 2023, China's State Council reiterated its commitment to supporting high-quality domestic brands, a move that directly benefits companies like Beingmate by fostering an environment conducive to growth and innovation.

Trade Policies and Import Regulations

Changes in international trade policies and import regulations directly influence Beingmate's competitive landscape in China. While China prioritizes domestic production, imported baby food brands often carry a perception of higher quality and safety among certain consumer segments. Any adjustments to tariffs or import procedures could therefore significantly alter the competitive dynamics for Beingmate.

For instance, as of early 2024, China's trade policies continue to emphasize support for domestic industries, potentially creating an environment more favorable to local manufacturers like Beingmate. However, the General Administration of Customs of the People's Republic of China (GACC) also maintains stringent import requirements for infant formula, ensuring that international competitors must meet high standards. This dual approach means that while domestic support exists, the market remains open to quality imports, necessitating Beingmate's continuous focus on product quality and safety to compete effectively.

- Tariff Adjustments: Fluctuations in import tariffs on baby food can directly impact the landed cost of competing foreign products, influencing their price competitiveness against Beingmate.

- Import Quotas and Licensing: Stricter import quotas or licensing requirements could limit the volume of foreign products entering the market, potentially benefiting domestic players like Beingmate.

- Product Standards and Certification: Evolving import regulations regarding product safety, ingredients, and certification processes can create barriers for foreign competitors, requiring them to invest more in compliance, which could indirectly support Beingmate.

- Geopolitical Influences: Broader trade relations and geopolitical tensions between China and other nations can lead to unexpected policy shifts impacting trade flows of baby food products.

Government Initiatives for Digital Transformation

The Chinese government's commitment to digital transformation, exemplified by strategies like Made in China 2025 and the Digital Economy Plan, directly impacts industries like food and beverage. These policies actively foster the adoption of advanced technologies such as artificial intelligence, big data analytics, and smart factory solutions. For a company like Beingmate, this presents a significant opportunity to streamline operations.

Beingmate can capitalize on these government-driven advancements to achieve notable improvements. Specifically, the focus on smart manufacturing and data-driven decision-making can lead to enhanced production efficiency, more robust supply chain management, and a general uplift in overall operational capabilities. For instance, China's digital economy was projected to reach 50 trillion yuan by 2025, indicating a strong governmental push for technological integration across sectors.

- Government Support: Initiatives like Made in China 2025 and the Digital Economy Plan provide a framework and potential incentives for tech adoption.

- Technology Integration: The push for AI, big data, and smart factories offers Beingmate avenues to modernize its production and logistics.

- Operational Enhancement: Leveraging these political factors can lead to improved efficiency, better supply chain visibility, and cost reductions.

China's pronatalist policies, including the three-child policy and financial incentives, aim to boost birth rates, directly impacting the demand for infant products. While initial data from 2023, showing 9.02 million births, indicates a slight stabilization, the overall numbers remain a challenge for companies like Beingmate.

Stringent food safety regulations, such as updated laws and specific standards for medical-purpose infant formulas, require rigorous compliance from manufacturers. Meeting these elevated standards, reinforced by past scandals, is crucial for building consumer trust and maintaining product quality.

Government support for domestic infant formula brands, as reiterated by the State Council in 2023, offers potential benefits like preferential policies and subsidies to local players such as Beingmate.

International trade policies and import regulations influence the competitive landscape. While China prioritizes domestic production, stringent import requirements ensure that foreign competitors must meet high standards, necessitating Beingmate's continuous focus on quality.

What is included in the product

This Beingmate PESTLE analysis examines how external macro-environmental factors, including Political, Economic, Social, Technological, Environmental, and Legal influences, impact the company's strategic landscape.

It provides a comprehensive overview of the opportunities and threats arising from these forces, offering actionable insights for strategic decision-making.

The Beingmate PESTLE Analysis provides a clear, summarized version of external factors, acting as a pain point reliver by simplifying complex market dynamics for easier referencing during strategy meetings.

Economic factors

China's birth rate has been on a downward trend since 2016, with the population officially shrinking starting in 2022. This demographic shift directly affects the potential market size for baby food products, posing a significant long-term challenge for companies like Beingmate.

Despite the declining birth rate, the overall market value for baby food in China is still expected to grow. This growth is attributed to factors such as increasing per capita consumption and a rising demand for premium and specialized infant nutrition products.

China's economic growth continues to fuel rising disposable incomes, particularly in urban areas. By the end of 2024, the average disposable income for urban Chinese households was projected to exceed RMB 50,000, a significant increase that directly impacts consumer spending habits. This upward trend is particularly evident in the demand for premium and organic baby food, as parents prioritize safety and nutrition for their children.

As urbanization accelerates, more Chinese families are experiencing improved living standards, leading them to allocate a larger portion of their income towards higher-quality goods. This shift in consumer behavior, observed throughout 2024 and into early 2025, creates a strong opportunity for companies like Beingmate to capitalize on the demand for value-added baby food products.

China's economic growth in early 2025, with a projected GDP expansion, provides a generally favorable backdrop. However, this is tempered by a mixed consumer confidence landscape.

Despite overall economic gains, consumer sentiment remains cautious in 2025, influenced by lingering job security concerns and the impact of declining property values. This translates to more pragmatic and value-conscious spending habits among consumers.

For companies like Beingmate, this economic environment necessitates a strategic shift towards catering to this demand for value. Adapting product offerings and marketing strategies to align with these evolving consumer priorities will be key to success in the 2025 market.

Competition and Market Consolidation

The Chinese baby food market is incredibly competitive, with numerous domestic and international brands battling for consumer loyalty. This intense rivalry is a significant factor for companies like Beingmate.

New, more stringent baby food regulations implemented in 2023 have had a notable impact. These stricter standards have unfortunately forced many smaller and medium-sized companies out of the market. This regulatory shift has consequently bolstered the market position of larger, more established brands, including Beingmate.

This market consolidation, driven by regulatory changes, presents a dual effect. While it offers established players like Beingmate an opportunity to capture increased market share, it simultaneously heightens the competitive pressure among the remaining major brands. The landscape is shifting, favoring those with the resources to adapt to higher standards.

- Market Share Dynamics: Following the 2023 regulatory tightening, the market share for established brands like Beingmate is expected to grow as smaller competitors exit.

- Intensified Rivalry: The remaining players face increased competition from each other, necessitating continuous innovation and marketing efforts.

- Regulatory Impact: Stricter standards are a key driver of consolidation, impacting the operational and compliance costs for all participants.

Inflation and Cost Pressures

Inflationary pressures and rising raw material costs present a significant challenge for Beingmate, directly impacting its profitability. For instance, global commodity prices, particularly for dairy and other key ingredients, saw notable increases throughout 2024.

Despite demonstrating resilience in its profit margins, Beingmate must continue to effectively manage these escalating input costs. Maintaining competitive pricing in a sensitive market while absorbing some of these increases will be a delicate balancing act.

- Rising Input Costs: Global dairy prices, a key component for infant formula, experienced an average increase of 8-10% in the first half of 2024 compared to the previous year.

- Margin Management: Beingmate's ability to maintain a gross profit margin around 30-32% in recent quarters highlights its cost control efforts, but sustained pressure could challenge this.

- Consumer Price Index (CPI) and Producer Price Index (PPI): CPI figures in key markets for Beingmate, such as China, remained elevated in early 2025, averaging around 2.5%, while PPI also indicated ongoing cost pressures for manufacturers.

China's economic trajectory in 2024 and early 2025 presents a complex picture for Beingmate. While overall GDP growth is projected to continue, consumer sentiment remains cautious due to job security concerns and property market fluctuations, leading to more value-conscious spending. This necessitates a strategic focus on affordability and demonstrable value in product offerings.

The average disposable income for urban Chinese households was projected to exceed RMB 50,000 by the end of 2024, indicating increased purchasing power, particularly for premium baby food. However, this is counterbalanced by the aforementioned consumer caution, creating a bifurcated market where value and premium segments coexist, demanding tailored strategies.

Inflationary pressures, with CPI figures around 2.5% in early 2025, coupled with rising raw material costs, notably an 8-10% increase in global dairy prices in H1 2024, directly impact Beingmate's profitability. The company's ability to maintain its gross profit margin, around 30-32%, is contingent on effective cost management and strategic pricing.

| Economic Factor | 2024/2025 Data Point | Impact on Beingmate |

|---|---|---|

| Projected GDP Growth (China) | Positive, though varying by quarter | Generally supportive market conditions, but tempered by consumer sentiment. |

| Urban Household Disposable Income | Projected > RMB 50,000 by end of 2024 | Increased potential for premium product sales, but requires value proposition. |

| Consumer Confidence | Cautious/Mixed | Drives pragmatic spending, emphasizing value and essential nutrition. |

| Inflation (CPI) | ~2.5% in early 2025 | Increases operational costs and necessitates careful pricing strategies. |

| Raw Material Costs (e.g., Dairy) | 8-10% increase in H1 2024 | Directly pressures profit margins, requiring efficient supply chain management. |

Preview the Actual Deliverable

Beingmate PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Beingmate PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, offering critical insights for strategic planning.

Sociological factors

Chinese parents are showing a pronounced shift towards prioritizing their children's health and food safety. This heightened awareness fuels a strong demand for baby food that is organic, free from genetically modified organisms (GMOs), preservatives, and enriched with essential nutrients. This trend is projected to continue, with the Chinese organic baby food market expected to reach approximately $10 billion by 2025, demonstrating significant growth.

This evolving preference aligns with a broader adoption of 'scientific parenting' approaches, where parents are more informed and actively seek out products that meet rigorous quality standards. Consequently, they are willing to invest more in brands perceived as trustworthy and transparent about their sourcing and production processes. For instance, a 2024 survey indicated that over 70% of Chinese parents consider brand reputation and safety certifications as primary factors when purchasing baby formula.

Beingmate must respond by consistently innovating its product line and clearly communicating the safety assurances and nutritional advantages of its offerings. Highlighting stringent quality control measures and transparent ingredient sourcing will be crucial in capturing and retaining consumer trust in this increasingly discerning market.

The rising participation of mothers in China's workforce is a significant sociological shift, directly impacting the baby food market. As more mothers balance careers and family, there's a heightened demand for convenient, ready-to-eat baby food options. This trend is particularly strong in 2024 and projected to continue into 2025, as parents prioritize time-saving solutions that are also nutritious and easy to prepare.

This growing need for convenience perfectly suits Beingmate's expanded product portfolio beyond infant formula. The company's offerings of complementary foods and other convenient baby food formats are well-positioned to meet the demands of busy, working parents. In 2023, China's female labor force participation rate remained robust, exceeding 60%, underscoring the persistent demand for such solutions.

China's rapid urbanization has significantly reshaped family life, with city dwellers increasingly prioritizing convenience. This trend is particularly evident among parents who are juggling careers and family responsibilities. For instance, by 2023, over 65% of China's population resided in urban areas, a figure that continues to climb.

The evolving family structure, including a rise in dual-income households and smaller family units, further fuels the demand for convenient, high-quality baby food. Parents are actively seeking solutions like infant formula, organic meals, and ready-to-eat snacks that cater to busy schedules and a desire for nutritious options, reflecting a growing market for such products.

Impact of Westernization on Consumer Choices

Westernization is significantly reshaping consumer preferences in China's baby food sector, with a growing emphasis on health and nutrition. This trend is particularly evident in the increasing demand for premium products such as organic, non-GMO, and fortified infant formulas. For instance, the organic baby food market in China saw robust growth, with sales expected to climb further in 2024 and 2025, driven by these evolving consumer values.

This cultural shift toward Western ideals of health and convenience is directly influencing how parents make purchasing decisions for their children. Companies like Beingmate must adapt their product development and marketing strategies to cater to this demand for high-quality, internationally recognized standards in baby nutrition. The preference for brands perceived as offering superior nutritional profiles and safety standards is a direct consequence of this Western influence.

- Growing Demand for Organic and Non-GMO Baby Food: By 2025, the Chinese organic baby food market is projected to reach billions in value, a testament to Western dietary influence.

- Emphasis on Nutritional Enhancement: Parents are actively seeking infant formulas with added vitamins, minerals, and DHA, mirroring Western nutritional science trends.

- Influence on Brand Perception: Brands aligning with Western quality and safety standards often gain a competitive edge in the premium segment.

- Shift Towards Convenience: Ready-to-feed formulas and convenient packaging, common in Western markets, are gaining traction among busy Chinese parents.

Influence of Social E-commerce and Online Communities

Chinese consumers increasingly favor online avenues for maternal and baby products, particularly content-driven e-commerce platforms such as Xiaohongshu and Douyin. These platforms foster vibrant communities where parents exchange advice and product reviews, making an active online presence and community engagement crucial for Beingmate.

For instance, in 2023, GMV (Gross Merchandise Volume) on Douyin's e-commerce platform saw significant growth, with the maternal and baby category being a substantial contributor. This trend underscores the necessity for Beingmate to leverage these social commerce channels effectively.

Beingmate's strategy should therefore focus on:

- Building strong relationships within online parent communities to foster trust and brand loyalty.

- Utilizing influencer marketing and user-generated content on platforms like Xiaohongshu to showcase product efficacy and gather authentic testimonials.

- Developing engaging content that addresses parental concerns and provides valuable information, thereby driving traffic and conversions.

Sociological factors highlight a significant shift in Chinese parenting towards prioritizing health and safety, driving demand for organic and nutrient-rich baby food. This trend is amplified by the rise of 'scientific parenting' and increasing female workforce participation, which boosts the need for convenient, high-quality options. Westernization also influences preferences for premium, internationally recognized standards in baby nutrition.

Technological factors

China's food processing sector is embracing a digital overhaul, with smart factories becoming a key focus. This involves integrating automated production lines, utilizing IoT devices for real-time monitoring, and employing AI for quality checks, alongside digital twin platforms. For Beingmate, adopting these advancements offers significant boosts in production efficiency and food safety, while enhancing manufacturing flexibility.

E-commerce platforms are the lifeblood of baby and maternity product sales in China. Giants like Tmall and JD.com, alongside burgeoning social commerce channels such as Douyin, command a significant share of the market. Beingmate's success hinges on its adeptness in leveraging these digital marketplaces to connect with consumers.

The online sales channel for baby and maternity products in China has seen robust expansion. In 2023, online retail sales of baby and child products in China reached approximately 470 billion yuan, a year-on-year increase of about 8%. This trend underscores the critical importance for Beingmate to maintain a strong digital presence and optimize its distribution strategies across these platforms to capture this growing market.

Technological advancements in nutritional science are significantly reshaping the infant formula market. For instance, the approval of human milk oligosaccharides (HMOs) as a nutritional fortifier, a key innovation, is driving new product development. These advancements allow companies like Beingmate to create formulas that more closely mimic the benefits of breast milk, focusing on areas like gut health and immune support.

Beingmate's investment in research and development is crucial to capitalize on these technological shifts. By introducing innovative products with enhanced health benefits, the company can meet the evolving demands of health-conscious consumers. This includes developing formulations that specifically address concerns like digestive wellness and boosting immunity, areas where consumers are increasingly seeking scientifically backed solutions.

Supply Chain Tracking and Traceability Technologies

The global supply chain visibility market is projected to reach $20.3 billion by 2027, highlighting the growing demand for tracking technologies. For Beingmate, investing in these systems is crucial for addressing heightened food safety concerns and regulatory mandates for traceability. This technology allows for real-time monitoring of products from raw material sourcing to the consumer, ensuring compliance and enhancing brand reputation.

Beingmate can leverage advanced technologies like blockchain and IoT sensors to provide unparalleled transparency. For instance, IoT sensors can monitor temperature and humidity throughout the supply chain, preventing spoilage and ensuring product integrity. Blockchain technology offers an immutable ledger of product movements, giving consumers verifiable proof of origin and quality.

The adoption of robust supply chain tracking technologies is directly linked to consumer trust and brand loyalty, especially in the infant formula and nutrition sector. A 2024 survey indicated that 78% of consumers are more likely to purchase products with clear traceability information. By implementing these solutions, Beingmate can differentiate itself in a competitive market and build stronger relationships with its customer base.

- Market Growth: The global supply chain visibility market is anticipated to grow significantly, reaching an estimated $20.3 billion by 2027, underscoring the increasing importance of tracking technologies.

- Consumer Trust: Approximately 78% of consumers in a 2024 study showed a preference for products with transparent traceability information, directly impacting purchasing decisions.

- Technological Integration: Technologies such as blockchain and Internet of Things (IoT) sensors are pivotal for enabling comprehensive, real-time tracking and ensuring product integrity from farm to fork.

Data Analytics and AI for Market Insights

The food and beverage sector is increasingly embracing AI and big data to uncover crucial information, sharpen decision-making, and better grasp consumer habits. This technological shift is a significant factor for companies like Beingmate.

By leveraging data analytics, Beingmate can gain deeper insights into evolving market trends and specific consumer preferences. This allows for more targeted product development and refined marketing campaigns, ensuring their offerings resonate with the intended audience.

For instance, in 2024, the global big data market was projected to reach over $300 billion, highlighting the significant investment and reliance on data-driven strategies across industries. Companies are actively using these tools to understand consumer sentiment and predict purchasing behavior.

- AI-driven market analysis: Beingmate can employ AI to process vast datasets, identifying emerging consumer tastes and dietary trends in real-time.

- Personalized marketing: Utilizing consumer data, Beingmate can tailor marketing messages and product recommendations, increasing engagement and conversion rates.

- Supply chain optimization: Data analytics can help Beingmate predict demand more accurately, leading to more efficient inventory management and reduced waste.

- Product innovation: Insights from consumer data can guide the development of new products that directly address unmet needs or preferences in the market.

Technological advancements are revolutionizing food production and safety. Beingmate can benefit from smart factories, IoT, and AI for enhanced efficiency and quality control. The global market for supply chain visibility is expected to reach $20.3 billion by 2027, with 78% of consumers in 2024 favoring traceable products, underscoring the need for technologies like blockchain and IoT sensors for transparency.

| Technology Area | Impact on Beingmate | Market Data/Projection |

|---|---|---|

| Smart Factories & Automation | Increased production efficiency, improved food safety, enhanced flexibility | Focus of China's food processing sector overhaul |

| E-commerce & Social Commerce | Crucial for reaching consumers and driving sales in the baby and maternity market | Dominated by platforms like Tmall, JD.com, and Douyin |

| Nutritional Science Innovations | Development of formulas mimicking breast milk benefits (e.g., HMOs) for gut health and immunity | Drives new product development in infant nutrition |

| Supply Chain Visibility (Blockchain, IoT) | Ensures traceability, compliance, and builds consumer trust; 78% of consumers prefer traceable products (2024) | Global market projected to reach $20.3 billion by 2027 |

| AI & Big Data Analytics | Deeper insights into consumer habits, market trends, and personalized marketing | Global big data market projected to exceed $300 billion in 2024 |

Legal factors

China's Food Safety Law is frequently updated, with recent proposals focusing on areas like liquid infant formula registration and stricter penalties for non-compliance. Beingmate needs to stay vigilant regarding these changes, ensuring its operations align with new regulations to prevent legal issues and maintain its market presence.

These amendments, such as potential bans on repackaging, directly impact Beingmate's supply chain and product presentation. Adherence to these evolving legal frameworks is crucial for avoiding fines, which in 2023 saw significant increases for food safety violations, potentially impacting profitability and brand reputation.

In China, manufacturers like Beingmate must navigate a stringent product registration process with the State Administration for Market Regulation (SAMR) for infant formula and formulas for special medical purposes (FSMP). This involves submitting comprehensive scientific and safety data, a crucial step for legal market access.

Protecting intellectual property is paramount for Beingmate, particularly in China's dynamic market. Safeguarding proprietary formulas and innovative nutritional products is essential to maintain a competitive edge. In 2024, China's efforts to strengthen IP enforcement, coupled with increased penalties for infringement, are a positive development for companies like Beingmate.

Advertising and Marketing Regulations

China's advertising and marketing landscape for infant formula and baby food is heavily regulated, with a strong emphasis on protecting infant health and promoting breastfeeding. Beingmate must navigate these stringent rules, which often prohibit exaggerated claims or comparisons that could undermine parental confidence in breastfeeding. For instance, in 2024, authorities continued to scrutinize marketing materials, with fines levied against companies for unsubstantiated health claims in their baby food promotions, underscoring the need for meticulous compliance.

Adherence to these regulations is crucial for maintaining brand trust. Beingmate's marketing efforts must be truthful and transparent, avoiding any language that could be perceived as misleading regarding product benefits or the superiority over breast milk. Failure to comply can result in significant penalties and reputational damage, impacting consumer perception and sales.

- Strict Advertising Laws: China enforces comprehensive regulations on infant formula and baby food marketing, prioritizing accurate information and discouraging misleading claims.

- Focus on Breastfeeding Promotion: Marketing strategies must align with national efforts to encourage and support breastfeeding, avoiding content that could discourage it.

- Brand Credibility and Compliance: Beingmate's ability to build and maintain brand credibility hinges on its strict adherence to these advertising standards, preventing penalties and fostering consumer trust.

- Enforcement and Penalties: Regulatory bodies actively monitor marketing practices, imposing fines on non-compliant companies, as seen in ongoing enforcement actions throughout 2024.

Environmental Protection Laws and Compliance

Environmental protection laws significantly impact food manufacturers like Beingmate, particularly concerning waste management and emissions. In 2024, the global food industry faced increasing scrutiny over its environmental footprint, with regulations tightening around packaging waste and carbon emissions from production and transportation.

Compliance often necessitates substantial investment in sustainable practices. For Beingmate, this could mean upgrading facilities to reduce energy consumption or adopting biodegradable packaging materials, which saw a significant market growth in 2024 driven by consumer demand and regulatory pressures. For instance, the EU's Single-Use Plastics Directive continued to influence packaging choices across the sector.

Key areas of focus for Beingmate's environmental compliance in 2024-2025 include:

- Waste Management: Implementing robust recycling programs and reducing food waste throughout the supply chain, aligning with national waste reduction targets.

- Emissions Control: Investing in cleaner technologies for manufacturing processes and optimizing logistics to lower greenhouse gas emissions.

- Sustainable Sourcing: Ensuring raw materials are sourced from suppliers adhering to environmental standards, a trend gaining momentum in the premium food segment.

- Packaging Innovation: Shifting towards recyclable, compostable, or reusable packaging solutions to meet evolving regulatory requirements and consumer expectations.

China's evolving legal landscape requires Beingmate to maintain rigorous compliance with food safety and product registration mandates. The State Administration for Market Regulation (SAMR) oversees a detailed process for infant formula and FSMP, demanding thorough scientific and safety documentation for market access.

Intellectual property protection is increasingly vital, with China strengthening enforcement and penalties in 2024, benefiting companies like Beingmate in safeguarding proprietary formulas. Stringent advertising regulations, particularly concerning infant formula, prohibit misleading claims and emphasize breastfeeding support, with active scrutiny and fines in 2024 for non-compliance.

Environmental regulations are also a key consideration, impacting waste management and emissions. Investments in sustainable packaging, like biodegradable materials which saw market growth in 2024, and cleaner production technologies are becoming essential for compliance and consumer appeal.

Environmental factors

Consumer demand for sustainable and organic products is a significant environmental factor influencing the baby formula market, extending to the sourcing of key ingredients like milk powder. Surveys in 2024 indicate that over 60% of parents consider sustainability when purchasing baby products, a trend that has steadily grown. Beingmate's focus on responsible dairy farming and ethical ingredient procurement directly addresses this growing consumer preference, potentially boosting its brand appeal among environmentally aware parents.

Growing environmental concerns, particularly around plastic waste and packaging, are directly impacting companies like Beingmate. In 2024, the global plastic waste crisis continues to escalate, with projections indicating that by 2050, there could be more plastic than fish in the ocean by weight, according to the Ellen MacArthur Foundation. This creates significant pressure for Beingmate to adopt more sustainable packaging materials and robust waste management strategies throughout its operations.

Beingmate's commitment to eco-friendly products necessitates a strategic shift towards sustainable packaging solutions. For instance, the global market for sustainable packaging is expected to reach $413.8 billion by 2027, demonstrating a clear consumer and regulatory demand for change. Implementing these solutions will not only reduce Beingmate's environmental footprint but also align with evolving consumer expectations for responsible corporate behavior, potentially enhancing brand loyalty and market position.

Climate change poses a significant risk to Beingmate's supply chain, particularly concerning agricultural yields and the availability of key raw materials. For instance, extreme weather events, such as droughts or floods, can directly impact the production of dairy and other agricultural inputs crucial for infant formula and nutritional products. The UN's Intergovernmental Panel on Climate Change (IPCC) has consistently highlighted increasing weather volatility as a major global threat, directly affecting food security and commodity prices.

To counter these environmental challenges, Beingmate must prioritize developing and maintaining resilient supply chains. This involves diversifying sourcing locations, investing in climate-smart agricultural practices with suppliers, and exploring alternative ingredient options. Such strategies are vital for ensuring consistent access to high-quality ingredients, which is fundamental for long-term operational stability and maintaining consumer trust in their product quality, especially in the sensitive infant nutrition market.

Water and Energy Consumption in Production

Manufacturing baby food, like that produced by Beingmate, inherently requires significant water and energy. For instance, the global food processing industry, a sector Beingmate operates within, accounted for approximately 30% of total industrial energy consumption in 2023, with water use being equally critical for cleaning and processing.

By adopting advanced water and energy conservation technologies, Beingmate can achieve substantial operational cost savings. A 2024 report indicated that companies investing in water efficiency technologies saw an average reduction of 15% in their water-related operational expenses.

Furthermore, embracing these conservation measures aids Beingmate in meeting increasingly stringent environmental regulations and bolsters its reputation for corporate social responsibility. Many regions are implementing stricter water usage permits and carbon emission targets, making proactive environmental management a strategic imperative for companies like Beingmate.

- Water and energy are key inputs in baby food production.

- 2023 data shows food processing uses 30% of industrial energy.

- Water efficiency can cut operational costs by up to 15%.

- Conservation helps meet environmental regulations and corporate responsibility goals.

Carbon Footprint and Emissions Reduction

Companies are facing mounting pressure to actively measure and reduce their carbon footprint. Beingmate can strategically focus on minimizing greenhouse gas emissions across its entire value chain, from production facilities to logistics. This proactive approach not only supports global sustainability targets but also significantly bolsters the company's public image and brand value.

For instance, in 2024, the global focus on Scope 1, 2, and 3 emissions intensified, with many companies setting ambitious net-zero targets. Beingmate's commitment to reducing its environmental impact could involve:

- Investing in energy-efficient manufacturing processes and renewable energy sources for its facilities.

- Optimizing supply chain logistics to reduce transportation-related emissions.

- Exploring sustainable packaging solutions to minimize waste and carbon impact.

- Engaging with suppliers to encourage their own emissions reduction efforts.

The environmental factors impacting Beingmate are multifaceted, ranging from consumer demand for sustainable products to the escalating crisis of plastic waste. Climate change also presents a significant risk to its supply chain. Beingmate's operational efficiency, particularly in water and energy usage, is under scrutiny, alongside the imperative to reduce its carbon footprint.

| Environmental Factor | Impact on Beingmate | 2024/2025 Data/Trend |

|---|---|---|

| Consumer Demand for Sustainability | Influences ingredient sourcing and brand appeal. | Over 60% of parents consider sustainability when purchasing baby products. |

| Plastic Waste Crisis | Requires adoption of sustainable packaging and waste management. | Global plastic waste crisis escalating; projections of more plastic than fish by 2050. |

| Climate Change | Threatens supply chain stability and raw material availability. | Increasing weather volatility directly affects food security and commodity prices. |

| Water and Energy Consumption | Affects operational costs and regulatory compliance. | Food processing used ~30% of industrial energy in 2023; water efficiency can cut costs by ~15%. |

| Carbon Footprint Reduction | Impacts public image, brand value, and regulatory adherence. | Intensified focus on Scope 1, 2, and 3 emissions; many companies setting net-zero targets. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Beingmate is built on a robust foundation of data from official government publications, reputable market research firms, and international economic institutions. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.