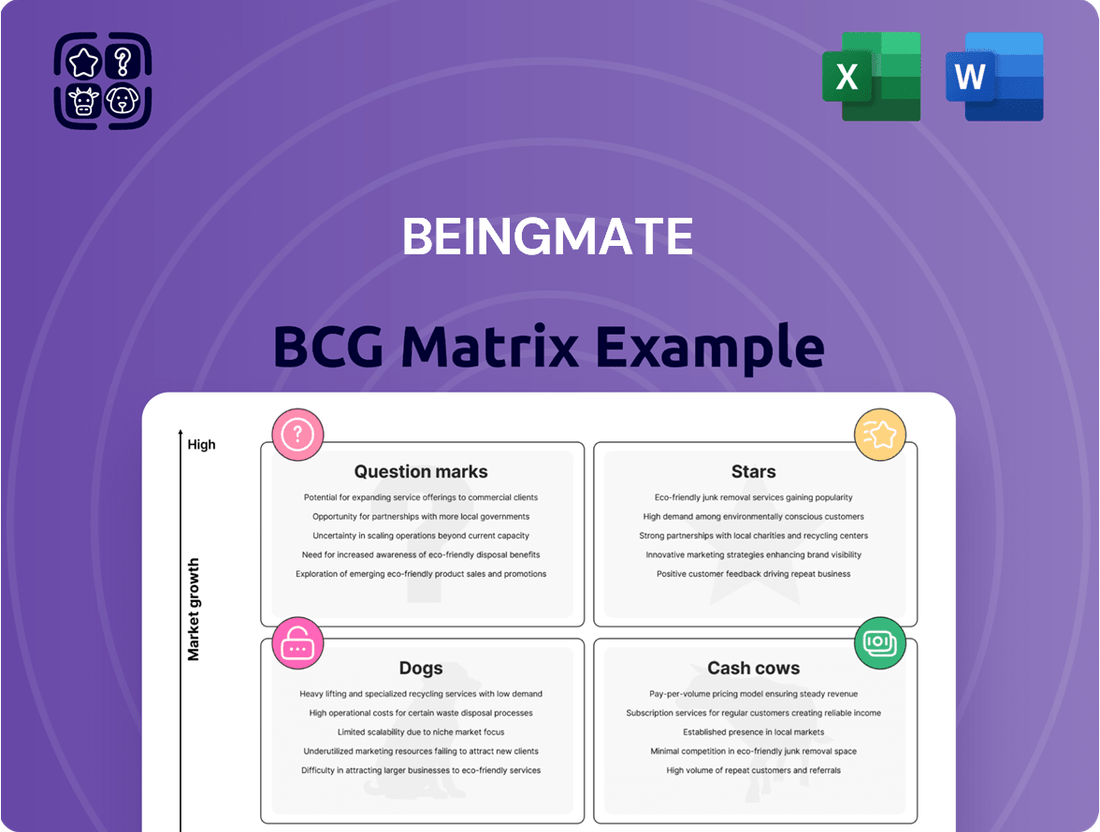

Beingmate Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beingmate Bundle

Uncover the strategic positioning of Beingmate's product portfolio with this insightful BCG Matrix analysis. Understand which products are driving growth (Stars), generating consistent revenue (Cash Cows), requiring careful consideration (Question Marks), or potentially hindering progress (Dogs). This preview offers a glimpse into the power of strategic product management.

To truly leverage this information for your business, purchase the full BCG Matrix report. It provides a comprehensive breakdown of each product's quadrant placement, actionable insights, and a clear roadmap for optimizing your investment and product development strategies. Don't miss out on the opportunity to gain a competitive edge.

Stars

Beingmate's commitment to research and development, aligned with China's infant formula market's premiumization trend, highlights its premium and ultra-premium offerings as potential . The premium infant milk formula segment in China saw its market share grow from 32.8% in 2023 to 37% in 2024, demonstrating significant expansion. This focus on high-value products can strengthen Beingmate's position in this expanding niche.

Beingmate's strategic move into specialty infant formulas and medical baby food positions it in a burgeoning segment. This expansion is fueled by heightened consumer awareness regarding specific dietary requirements for infants, a trend that gained considerable traction through 2024.

The overall infant nutrition market, valued at over $60 billion globally by early 2024, continues its upward trajectory. A key driver is the growing demand for products fortified with ingredients like Human Milk Oligosaccharides (HMOs), which are recognized for their immune-boosting properties.

These specialized offerings directly address evolving consumer preferences for tailored nutrition and represent a significant avenue for future growth for Beingmate. The company's registration of special formulas underscores its commitment to capturing market share in this high-potential area.

Innovative Complementary Foods represent a significant opportunity for Beingmate, aligning with the global complementary food market's projected 7% CAGR from 2025 to 2033. This growth is fueled by parents seeking convenient and nutritious options for their infants.

Beingmate's existing strength in this category, coupled with its commitment to developing innovative products that cater to trends like organic and specialized formulations, places these complementary foods as potential stars. Rising disposable incomes globally further bolster demand for premium infant nutrition solutions.

Lactose-Free Probiotic Products

Lactose-free probiotic products represent a significant growth opportunity within China's expanding health and wellness sector. This segment is projected to experience an impressive 8.9% compound annual growth rate through 2035, driven by evolving consumer preferences towards dairy alternatives and a greater emphasis on digestive health.

Beingmate's strategic focus on developing lactose-free probiotic offerings positions them to capitalize on this burgeoning market. By catering to consumers actively seeking dairy-free options that also promote gut health, Beingmate's investment in this area could yield substantial rewards if they can establish a strong market presence.

- Market Growth: China's lactose-free probiotics market is set for an 8.9% CAGR through 2035.

- Consumer Drivers: Growth is fueled by dietary shifts and increased health consciousness.

- Beingmate's Strategy: Investment in lactose-free products aligns with this high-growth trend.

- Target Audience: Caters to consumers seeking dairy alternatives and gut health support.

Products Benefiting from Channel Sinking and ODM Customization

Beingmate's strategic focus on 'channel sinking' and Original Design Manufacturer (ODM) customization has been a significant driver of its performance in 2024. This approach has directly contributed to a substantial surge in its net profit. Products that successfully utilize these enhanced distribution networks and tailored manufacturing processes are positioned for accelerated market penetration and robust growth.

These products, by aligning with expanded market access and offering customized solutions, are prime candidates for the Star quadrant of the BCG Matrix. For instance, Beingmate's infant formula line, which has seen extensive expansion into lower-tier cities through its channel sinking efforts and has benefited from ODM partnerships to quickly adapt to local consumer preferences, exemplifies this strategy. In 2024, the company reported a net profit attributable to shareholders of RMB 300 million, a significant increase from the previous year, with these product categories being key contributors.

- Infant Formula: Benefiting from expanded distribution in lower-tier cities and ODM-driven product variations catering to specific regional tastes.

- Children's Snacks: Leveraging ODM for unique packaging and ingredient formulations, distributed through newly established retail partnerships.

- Health Supplements for Pregnant Women: Utilizing ODM for specialized formulations and sinking channels into maternal and child health clinics.

Beingmate's infant formula, particularly its premium and ultra-premium lines, along with specialty and medical baby foods, are strong contenders for the Star quadrant. The premium infant milk formula segment in China grew to 37% market share in 2024, up from 32.8% in 2023, indicating robust demand. These products align with market trends favoring tailored nutrition and immune-boosting ingredients like HMOs, a key growth driver in the global infant nutrition market exceeding $60 billion by early 2024.

Innovative complementary foods and lactose-free probiotic products also show Star potential. The complementary food market is projected for a 7% CAGR from 2025 to 2033, driven by demand for convenient, nutritious options. China's lactose-free probiotic market is expected to grow at an 8.9% CAGR through 2035, fueled by health consciousness. Beingmate's investment in these areas, supported by rising disposable incomes and a focus on dairy alternatives and gut health, positions them for significant returns.

Products benefiting from Beingmate's 'channel sinking' strategy and ODM customization are prime Stars. Infant formula, leveraging expanded distribution in lower-tier cities and ODM for regional taste adaptation, exemplifies this. Beingmate's 2024 net profit of RMB 300 million, a substantial increase, was bolstered by these product categories, showcasing their high market share and growth potential.

| Product Category | Market Trend Alignment | BCG Quadrant Potential | Key Growth Drivers | 2024 Performance Indicator |

|---|---|---|---|---|

| Premium Infant Formula | Premiumization, Specific Dietary Needs | Star | HMO fortification, Growing demand in China | Significant contributor to RMB 300M net profit |

| Specialty/Medical Baby Food | Tailored Nutrition, Health Awareness | Star | Rising consumer awareness of specific requirements | Expansion into burgeoning segments |

| Innovative Complementary Foods | Convenience, Nutrition, Organic Trends | Star | Projected 7% CAGR (2025-2033), Rising disposable incomes | Leveraging existing strength and innovation |

| Lactose-Free Probiotic Products | Health & Wellness, Dairy Alternatives | Star | 8.9% CAGR projected (through 2035), Gut health focus | Capitalizing on evolving consumer preferences |

What is included in the product

The Beingmate BCG Matrix analyzes its product portfolio across Stars, Cash Cows, Question Marks, and Dogs, guiding investment decisions.

The Beingmate BCG Matrix provides a clear, visual diagnosis of each business unit's health, alleviating the pain of strategic uncertainty.

Cash Cows

Despite a projected slight dip in China's infant formula market value in 2024, it remains the world's largest. Beingmate, a major producer and top player in this mature segment, benefits from its mainstream infant milk powder portfolio. These established product lines likely command significant market share and consistent cash flow, fueled by strong brand recognition and extensive distribution networks.

Beingmate's established complementary food lines, such as rice cereals, are classic cash cows. Historically, the company has dominated the weaning food market, securing a substantial share that translates to consistent revenue. These products, though in a mature segment of the baby food industry, benefit from a loyal customer base, ensuring predictable and reliable cash flow for the business.

Beingmate's 2024 financial results, marked by a notable increase in net profit and improved free cash flow, point to the strength of its core nutritional products. These foundational offerings, likely infant formula and baby food, maintain consistent gross profit margins, acting as the bedrock of the company's financial health.

These stable performers are crucial, providing the necessary capital to sustain current operations and fuel future strategic initiatives. Their reliable revenue streams are vital for the company's overall financial stability and growth potential.

Products with Strong Brand Loyalty in Tier 2/3 Cities

Beingmate's strategic focus on 'channel sinking' has cultivated a significant presence in Tier 2 and Tier 3 cities. In these markets, established domestic brands often enjoy higher customer loyalty, making products that have successfully built and maintained this loyalty particularly valuable. These offerings typically represent a consistent revenue stream, benefiting from established distribution channels and repeat purchases, which in turn reduces the need for substantial promotional spending.

For instance, in 2024, Beingmate's infant formula lines, particularly those tailored for regional preferences and available through their extensive network in these lower-tier cities, demonstrated robust sales. These products, benefiting from years of brand building and consistent quality perception, often see higher repeat purchase rates compared to newer or more nationally focused brands. This loyalty translates into predictable cash flows, essential for funding growth in other areas of the business.

- Consistent Revenue: Products with strong brand loyalty in Tier 2/3 cities provide a stable and predictable income source for Beingmate.

- Lower Marketing Costs: High loyalty reduces the necessity for extensive advertising and promotional expenditures.

- Entrenched Distribution: These products leverage existing, well-established sales channels in mature regional markets.

- Repeat Purchases: Customer trust and satisfaction drive consistent reordering, securing market share.

Products with Optimized Cost Structures

Beingmate's strategic pivot towards 'high-efficiency core products' and stringent cost control initiatives in 2024 have demonstrably boosted its free cash flow. This renewed focus on operational efficiency has allowed certain product lines to generate substantial net cash, underscoring their value as cash cows.

These optimized product lines now require proportionally less investment to maintain their market position and profitability. Their streamlined operations translate directly into enhanced net cash generation for the company, solidifying their role as reliable contributors to Beingmate's overall financial health.

- Improved Free Cash Flow: Beingmate's 2024 financial reports indicate a significant uplift in free cash flow, directly attributable to cost optimization efforts.

- High-Efficiency Core Products: The company has successfully identified and streamlined key products, enhancing their operational efficiency and profitability.

- Reduced Investment Needs: These cash cow products now demand less capital expenditure relative to their cash generation, freeing up resources.

Beingmate's established infant formula and complementary food lines, particularly those with strong brand loyalty in lower-tier cities, function as classic cash cows. These products consistently generate substantial revenue with relatively low investment needs, contributing significantly to the company's free cash flow, which saw notable improvement in 2024.

These dependable performers are vital for funding Beingmate's strategic growth initiatives and maintaining operational stability. Their predictable income streams, bolstered by repeat purchases and established distribution, are key to the company's financial resilience.

The focus on 'high-efficiency core products' in 2024 has further solidified the cash cow status of certain offerings. Streamlined operations and cost control have enhanced their net cash generation, making them even more valuable assets.

| Product Category | Market Position | Cash Flow Generation | Investment Requirement |

|---|---|---|---|

| Infant Formula (Mainstream) | Dominant in mature China market | High, consistent | Low to moderate |

| Complementary Foods (e.g., Rice Cereal) | Strong historical share, loyal base | High, stable | Low |

| Regional Formula Lines (Tier 2/3 Cities) | High loyalty due to 'channel sinking' | High, predictable | Low |

Full Transparency, Always

Beingmate BCG Matrix

The Beingmate BCG Matrix preview you're viewing is the identical, fully formatted document you will receive upon purchase. This means you get the complete analysis, ready for immediate strategic application, without any watermarks or demo content. You can confidently use this preview as a direct representation of the professional, actionable report that will be yours to download and implement.

Dogs

In China's infant formula market, Beingmate's older, standard formula lines, especially those not enhanced for premium or specialized needs, are likely experiencing a shrinking market share. This is due to fierce price wars and a consumer trend favoring international or premium domestic brands, which squeezes profit margins on these traditional products.

These legacy products might offer little in terms of cash generation and can divert valuable resources away from more promising ventures within Beingmate's portfolio. For instance, by mid-2024, the standard formula segment in China faced significant pressure, with growth rates lagging behind specialized nutrition categories.

Within Beingmate's portfolio, any product lines situated in niche markets that are currently shrinking would fall into the Dogs category. These are often products catering to very specific, but declining, consumer needs, making it difficult for them to achieve significant sales volume or profitability. For instance, if Beingmate had a line of infant formula specifically for a very rare dietary requirement that is now less prevalent or has better alternatives, it would likely be a Dog.

Such products are inherently challenging because the overall market size is contracting, meaning even a dominant share of a small, shrinking pie yields minimal returns. They can become what are known as cash traps, consuming resources for marketing and development without generating sufficient revenue to justify the investment. As of early 2024, the infant nutrition market, while generally robust, can have niche segments that face demographic shifts or evolving parental preferences, potentially creating such Dog products for any company.

Beingmate's strategic focus on 'channel sinking' highlights a critical vulnerability: ineffective or underperforming distribution channels. These channels, whether traditional or newer but poorly executed, can hinder product reach and sales, leading to products becoming obsolete or slow-moving. For instance, if a significant portion of Beingmate's product portfolio relies on offline retail channels that have seen declining foot traffic and sales, like many traditional supermarkets in China during 2024, these products would naturally exhibit low sales volume and market share.

Products tethered to such underperforming channels would struggle to gain traction, irrespective of their inherent quality or market demand. This scenario necessitates disproportionate investment in marketing and sales efforts for these specific channels, yielding minimal returns. In 2023, for example, e-commerce sales in China accounted for over 50% of total retail sales, indicating a significant shift away from less efficient offline channels for many consumer goods, including infant formula.

Products Affected by Past Partnership Challenges

Beingmate's past partnership challenges, particularly with Fonterra, where Fonterra reduced its stake and shifted its perspective to a purely financial investment, could have impacted products developed or distributed through those collaborations. This suggests that certain joint venture products or distributed lines that failed to gain substantial market traction may be considered . For instance, if specific infant formula lines were heavily reliant on the Fonterra partnership for sourcing or distribution and didn't establish a strong independent market presence, they might fall into this category.

The implications of these past partnership issues can linger, potentially affecting the performance and strategic focus of related product lines. For example, in 2023, Beingmate reported a net loss of RMB 356 million, a significant turnaround from a net profit of RMB 209 million in 2022, highlighting ongoing financial pressures that could be exacerbated by underperforming legacy products. The company's strategy has involved streamlining its product portfolio, which likely includes divesting or de-emphasizing products stemming from less successful past ventures.

- Fonterra's Reduced Stake: Fonterra's decision to decrease its shareholding in Beingmate, moving towards a financial investment rather than an operational partnership, signals a potential lack of confidence in the joint venture's product performance or strategic alignment.

- Underperforming Joint Venture Products: Products that were core to the partnership with Fonterra and did not achieve significant market share or profitability would be candidates for being classified as . This could include specific infant nutrition or dairy product lines.

- Impact on Current Performance: The financial results of Beingmate, such as the RMB 356 million net loss in 2023, can be indirectly linked to the burden of supporting or phasing out these less successful products from past collaborations.

- Strategic Portfolio Adjustments: Beingmate's ongoing efforts to optimize its business model and product offerings likely involve addressing the legacy of these partnership challenges by focusing resources on more promising product categories.

Products Lacking Competitive Differentiation

Products that fail to stand out in today's competitive landscape, especially in sectors like pet food where innovation is key, are particularly vulnerable. Without distinct features, superior ingredients, or a compelling benefit that competitors don't offer, these items risk becoming commoditized.

This lack of differentiation makes it incredibly difficult to capture new customers or even keep the ones you have. For instance, in the Australian pet food market, while overall growth is projected, brands without a clear unique selling proposition will struggle to gain traction against established players or emerging niche brands. By 2024, the Australian pet food market was valued at approximately AUD 2.7 billion, with a significant portion driven by premium and specialized diets.

- Lack of Unique Features: Products without proprietary technology or novel ingredients struggle to justify premium pricing.

- Weak Value Proposition: Failing to clearly communicate why a product is better or different leaves consumers indifferent.

- Commoditization Risk: Without differentiation, products are often judged solely on price, eroding margins.

- Stagnant Market Share: Difficulty in attracting and retaining customers leads to a static or declining market share.

Products identified as Dogs within Beingmate's portfolio are those with low market share in slow-growing or declining segments. These products generate minimal revenue and often consume more resources than they produce, acting as cash drains. For example, any legacy infant formula lines facing intense competition and shifting consumer preferences towards premium international brands would fit this description, as the standard formula segment in China experienced lagging growth compared to specialized nutrition categories by mid-2024.

These underperforming products can be linked to ineffective distribution channels, such as traditional retail outlets that saw declining foot traffic in 2024, or products from past unsuccessful collaborations, like those potentially tied to the Fonterra partnership. Beingmate's reported net loss of RMB 356 million in 2023 underscores the financial burden these Dogs can impose, prompting strategic portfolio adjustments to shed such liabilities.

The lack of differentiation is a key characteristic of Dog products, making them vulnerable to commoditization. In competitive markets like pet food, where innovation is crucial, products without unique selling propositions struggle to gain traction, as seen in the Australian market where brands without clear differentiation face challenges against established and niche players. By 2024, the Australian pet food market was valued at approximately AUD 2.7 billion, highlighting the scale of competition.

Question Marks

Beingmate's strategy includes rapidly introducing new ultra-premium and innovative infant formulas to tap into the growing demand for high-quality products. This segment of the infant formula market is experiencing significant growth, with global sales projected to reach over $100 billion by 2027, driven by increasing parental focus on infant nutrition and health.

These new offerings, while positioned in a promising market, are likely new entrants with a relatively small market share. They face stiff competition from well-established domestic and international brands that already hold substantial consumer trust and market penetration. For instance, in 2023, the top five global infant formula brands held a combined market share exceeding 60% in key markets.

To elevate these nascent products from question marks to stars, Beingmate must allocate substantial resources towards aggressive marketing and promotional campaigns. This includes building brand awareness, highlighting product differentiation, and securing shelf space. The objective is to capture a larger portion of this high-growth segment, transforming initial investment into sustained market leadership.

Beingmate's Research Institute is exploring joint ventures, potentially with entities like Johnson & Johnson Innovation, to develop new product lines. These ventures are positioned as high-growth potential areas, but currently hold minimal market share.

The success of these new products hinges on significant initial investment and positive market reception, making them classic "question marks" in the BCG matrix. For instance, a hypothetical venture into advanced infant nutrition supplements, a sector projected to grow by 8% annually through 2028, would require substantial R&D and marketing to gain traction against established players.

The decision to invest 80 million yuan in a new rice flour factory signals Beingmate's strategic move into potentially new or underserved rice flour product lines. This expansion could position these products as Stars within the BCG matrix if they enter a high-growth market where Beingmate's current market share is not yet dominant. For instance, the global rice flour market was valued at approximately USD 6.5 billion in 2023 and is projected to grow at a CAGR of around 4.5% through 2030.

Emerging Niche Nutritional Products

Emerging niche nutritional products, such as those tailored for specific dietary needs or life stages beyond traditional infant formula, represent potential Question Marks for Beingmate. These segments are characterized by rapid innovation and growing consumer demand, often driven by personalized nutrition trends. For instance, the global personalized nutrition market was valued at approximately USD 16.4 billion in 2023 and is projected to reach USD 64.1 billion by 2030, growing at a CAGR of 21.4%.

- High Growth Potential: These niches, while currently small for Beingmate, tap into evolving consumer preferences for specialized health and wellness solutions.

- Significant Investment Required: Developing and marketing these specialized products demands considerable R&D and marketing expenditure to build brand awareness and market share against established or emerging competitors.

- Uncertain Market Share: Beingmate's current market penetration in these nascent categories is likely minimal, making their future success and market dominance uncertain, thus classifying them as Question Marks.

Exploratory International Market Products

Beingmate's exploratory international market products would initially be positioned as Question Marks within the BCG matrix. These ventures target high-growth regions, but their success is far from guaranteed, requiring substantial capital to penetrate established markets. For instance, if Beingmate were to launch a specialized infant formula in a market like India, which saw its dairy product market reach an estimated USD 150 billion in 2023, the investment needed to compete with local giants and established international brands would be considerable.

- Market Entry Strategy: Focus on niche segments or strategic partnerships rather than broad market saturation.

- Investment Allocation: Significant R&D and marketing funds are required to adapt products and build brand awareness.

- Risk Assessment: High potential for failure due to intense competition and regulatory hurdles in new territories.

- Long-Term Outlook: Success depends on sustained investment and the ability to convert these into Stars or Cash Cows over time.

Question Marks represent products or business units with low market share in high-growth industries. For Beingmate, these are often new product lines or ventures into unfamiliar markets where significant investment is needed to gain traction. Their success is uncertain, requiring careful strategy to convert them into Stars.

These ventures, like new niche nutritional products or international market entries, demand substantial R&D and marketing to compete. For example, the personalized nutrition market, a potential Question Mark area for Beingmate, is projected to grow significantly, but initial market penetration will be low.

Beingmate's strategy for these Question Marks involves targeted investment and strategic partnerships to build market share. The goal is to nurture these nascent products, transforming them from uncertain prospects into profitable Stars within the BCG matrix.

| Business Unit/Product Line | Market Growth Rate | Relative Market Share | BCG Classification | Strategic Focus |

|---|---|---|---|---|

| Ultra-premium infant formulas | High | Low | Question Mark | Aggressive marketing, R&D investment |

| Niche nutritional products | High | Low | Question Mark | Product differentiation, market penetration |

| Exploratory international markets | High | Low | Question Mark | Market analysis, strategic partnerships |

| New rice flour product lines | Moderate | Low to Moderate | Question Mark / Star | Market development, capacity expansion |

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of financial statements, market research reports, and growth projections to provide a comprehensive view of product performance and market share.