Beingmate Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beingmate Bundle

Unlock the strategic blueprint behind Beingmate's success with our comprehensive Business Model Canvas. This detailed analysis reveals how they connect with customers, deliver value, and generate revenue in the competitive infant nutrition market. Gain actionable insights to fuel your own business growth.

Partnerships

Beingmate's key partnerships with raw material suppliers are crucial for ensuring the quality and stability of its infant formula and baby food. The company works closely with dairy farms and other ingredient providers to secure premium milk sources and essential components. This collaboration is vital for maintaining the high standards expected in baby nutrition products.

To further solidify its supply chain, Beingmate has made strategic investments in its manufacturing facilities. These investments not only enhance production capabilities but also allow for greater control over the quality and consistency of raw materials used. This proactive approach ensures a reliable flow of ingredients, minimizing disruptions.

Looking ahead, Beingmate has set an ambitious goal: by 2025, they aim to source 100% of their ingredients from sustainable farms. This commitment underscores their dedication to responsible sourcing and environmental stewardship, aligning with growing consumer demand for ethically produced goods. This initiative reflects a forward-thinking strategy in managing supplier relationships.

Beingmate actively collaborates with universities and research institutions to fuel innovation and refine its product line. These partnerships are instrumental in creating sophisticated formulas designed to meet the precise nutritional requirements of infants and young children.

This strategic alliance has proven highly effective, with approximately 25% of Beingmate's new product development in the past year stemming directly from these valuable external collaborations.

Beingmate leverages a comprehensive distribution network, encompassing wholesalers and regional partners, to guarantee its products are readily available throughout China. This extensive reach is crucial for accessing a broad consumer base.

In 2024, Beingmate continued to refine its sales strategy, focusing on enhanced collaboration with local distributors. This deepens their market penetration, especially in less developed, or sinking, markets, ensuring products are accessible where demand is growing.

This partnership model is key to Beingmate's market expansion, enabling effective product placement and consumer accessibility. For instance, by the end of 2023, Beingmate had established partnerships with over 1,000 distributors across China, a number that saw continued growth through 2024.

Technology and Solutions Providers

Beingmate collaborates with technology and solutions providers to streamline its operations. This includes adopting advanced manufacturing techniques and improving supply chain visibility. By 2025, the adoption of AI in logistics for route optimization and real-time inventory tracking is expected to be widespread across the industry, a trend Beingmate is actively embracing.

These partnerships are crucial for maintaining Beingmate's competitive edge. For instance, in 2024, companies leveraging advanced data analytics in their supply chains saw an average reduction in logistics costs by up to 15% compared to those that did not.

- AI-powered logistics: Enhancing efficiency in transportation and warehousing.

- Data analytics platforms: Gaining insights for better decision-making.

- Cloud-based ERP systems: Integrating various business functions for seamless operation.

- Customer relationship management (CRM) tools: Improving customer engagement and support.

Healthcare Professionals and Maternal-Infant Service Providers

Beingmate actively cultivates partnerships with healthcare professionals, including pediatricians and obstetricians, along with maternal-infant service providers and specialized clinics. These collaborations are crucial for securing product endorsements, driving educational campaigns, and offering holistic support to new parents. For instance, in 2024, Beingmate continued its outreach programs with over 500 hospitals and maternal health centers across China, aiming to integrate its advisory services directly into pre-natal and post-natal care pathways.

By positioning itself as a trusted 'parenthood consultant,' Beingmate leverages these alliances to build credibility and deliver essential information to its target demographic. These partnerships are instrumental in reinforcing the brand’s commitment to caring for mothers and babies, enhancing trust through expert validation. The company reported a 15% increase in customer engagement through these healthcare channels in the first half of 2024, highlighting the effectiveness of this strategy.

- Healthcare Professional Endorsements: Partnerships with leading pediatricians and gynecologists lend significant credibility to Beingmate's product range and advice.

- Educational Initiatives: Joint workshops and seminars with maternal-infant service providers equip parents with vital knowledge, reinforcing Beingmate's role as a supportive resource.

- Integrated Support Services: Collaborations with clinics and specialized centers allow for seamless referral and access to comprehensive care, enhancing the overall parent experience.

- Brand Trust and Reach: These alliances are key to expanding Beingmate's reach and solidifying its reputation as a reliable partner in early childhood development and parental well-being.

Beingmate's key partnerships are vital for its operational success and market reach. These include collaborations with raw material suppliers for quality ingredients, research institutions for product innovation, and a vast distribution network to ensure product accessibility across China. Strategic alliances with technology providers enhance operational efficiency, while partnerships with healthcare professionals build brand trust and provide essential support to parents.

| Partnership Type | Key Collaborators | Impact/Benefit | 2024 Data/Trend |

|---|---|---|---|

| Raw Material Suppliers | Dairy farms, ingredient providers | Ensures quality, stability, and sustainable sourcing | Aiming for 100% sustainable sourcing by 2025 |

| Research & Development | Universities, research institutions | Drives innovation, sophisticated formula development | ~25% of new product development linked to collaborations |

| Distribution Network | Wholesalers, regional partners, local distributors | Guarantees product availability, market penetration | Over 1,000 distributors by end of 2023, continued growth in 2024 |

| Technology & Operations | AI logistics providers, data analytics firms, ERP/CRM vendors | Streamlines operations, enhances supply chain visibility, improves efficiency | Companies using advanced analytics saw up to 15% logistics cost reduction in 2024 |

| Healthcare & Parenting Support | Pediatricians, obstetricians, maternal-infant clinics | Secures endorsements, drives education, builds brand credibility | Continued outreach with 500+ hospitals; 15% increase in customer engagement via these channels in H1 2024 |

What is included in the product

A detailed breakdown of Beingmate's strategy, outlining its key customer segments in China and its reliance on extensive distribution channels to deliver infant formula and other health products.

The Beingmate Business Model Canvas serves as a vital pain point reliver by offering a clear, structured overview of their operations, allowing for swift identification of inefficiencies and opportunities for improvement.

It effectively addresses the pain of complexity by condensing Beingmate's intricate business strategy into a single, easily digestible page, facilitating rapid understanding and actionable insights.

Activities

Beingmate heavily invests in research and development to create advanced infant formula and nutritional products. In 2024, the company continued its focus on scientifically formulating products specifically for Chinese infants, aiming to meet evolving nutritional demands.

This dedication to innovation is crucial for Beingmate's competitive edge. The company's R&D efforts have directly contributed to the successful launch of new product lines within the infant nutrition market, reinforcing its commitment to scientific advancement and product enhancement.

Beingmate's manufacturing and production are centered on the large-scale creation of infant milk powder, complementary foods, and other vital baby nutritional items. This core activity demands sophisticated processes and rigorous adherence to quality and safety regulations.

The company has made significant investments in its production capabilities, including establishing facilities abroad. These overseas investments are strategically designed to ensure a consistent and high-quality supply of raw materials, particularly milk, which is fundamental to their product line.

In 2024, Beingmate continued to emphasize its commitment to advanced manufacturing. The company's focus on securing quality milk supplies through international partnerships and facilities directly impacts its ability to meet the growing demand for safe and nutritious infant products.

Beingmate places immense importance on quality control and safety assurance, especially given its focus on baby food. The company employs stringent protocols at every stage, from selecting raw materials to the final product leaving the facility.

In 2024, Beingmate continued to invest heavily in its quality assurance systems, with a reported 15% increase in R&D spending dedicated to product safety and quality innovation. This commitment aims to ensure all products meet or exceed international safety standards, building and maintaining consumer confidence.

Marketing, Branding, and Consumer Education

Beingmate invests heavily in marketing and branding to solidify its position as a leader in infant nutrition. These efforts focus on highlighting the scientific formulation of their products and fostering trust among parents. By positioning itself as a 'parenthood consultant,' Beingmate aims to build lasting consumer loyalty in a crowded marketplace.

- Brand Awareness: Beingmate's marketing campaigns in 2024 focused on digital channels and influencer collaborations, leading to a reported 15% increase in brand recall among target demographics.

- Consumer Education: The company launched a series of online workshops and informational content in early 2024, educating over 50,000 parents on infant dietary needs and the benefits of scientifically backed nutrition.

- Market Positioning: Beingmate's 'parenthood consultant' branding strategy contributed to a 10% rise in customer engagement with their support services throughout 2024, reinforcing their commitment to supporting families beyond product sales.

Distribution and Sales Management

Managing Beingmate's extensive distribution network across China is a crucial activity. This involves overseeing sales teams and optimizing supply chains to ensure products are readily available to consumers through a variety of channels, from traditional retail to e-commerce platforms.

Adapting sales strategies is also key, particularly with the increasing demand for ODM customization services. This requires close collaboration with manufacturing partners and a deep understanding of evolving consumer preferences.

In 2024, Beingmate continued to focus on strengthening its online sales presence, recognizing the significant growth in digital channels for infant formula and related products. The company reported that its online sales channels contributed a substantial portion of its revenue, underscoring the importance of efficient digital distribution management.

- Distribution Network Management: Overseeing a multi-channel distribution system across China, encompassing traditional retail, supermarkets, and online platforms.

- Sales Operations Optimization: Continuously improving sales processes, training sales personnel, and implementing data-driven strategies to boost sales performance.

- ODM Business Growth: Expanding and managing the Original Design Manufacturer business, catering to customized product demands from partners.

- Logistics and Supply Chain Efficiency: Ensuring timely and cost-effective delivery of products, managing inventory, and adapting to regional market demands.

Beingmate's key activities revolve around robust research and development for scientifically formulated infant nutrition, ensuring product efficacy and safety. The company also focuses on advanced manufacturing, including overseas facility investments, to secure high-quality raw materials like milk. Rigorous quality control and safety assurance are paramount across all production stages.

Marketing and branding efforts are centered on establishing Beingmate as a trusted 'parenthood consultant,' utilizing digital channels and consumer education to build loyalty. Managing an extensive distribution network across China, optimizing sales operations, and growing the ODM business are also critical for market reach and responsiveness.

| Key Activity | 2024 Focus/Data | Impact |

|---|---|---|

| Research & Development | Continued focus on scientifically formulated products for Chinese infants; 15% increase in R&D spending on safety and quality innovation. | Enhanced product competitiveness and met evolving nutritional demands. |

| Manufacturing & Production | Investment in overseas facilities for milk supply; emphasis on advanced manufacturing processes. | Ensured consistent, high-quality raw material supply and met growing product demand. |

| Quality Control & Safety | Stringent protocols from raw material selection to final product; adherence to international safety standards. | Built and maintained consumer confidence through reliable product safety. |

| Marketing & Branding | Digital channels, influencer collaborations, consumer education workshops; 'parenthood consultant' positioning. | Achieved 15% increase in brand recall; educated over 50,000 parents; boosted customer engagement by 10%. |

| Distribution & Sales | Strengthened online sales presence; managed multi-channel distribution; expanded ODM business. | Substantial revenue contribution from online channels; improved sales performance and market responsiveness. |

Full Version Awaits

Business Model Canvas

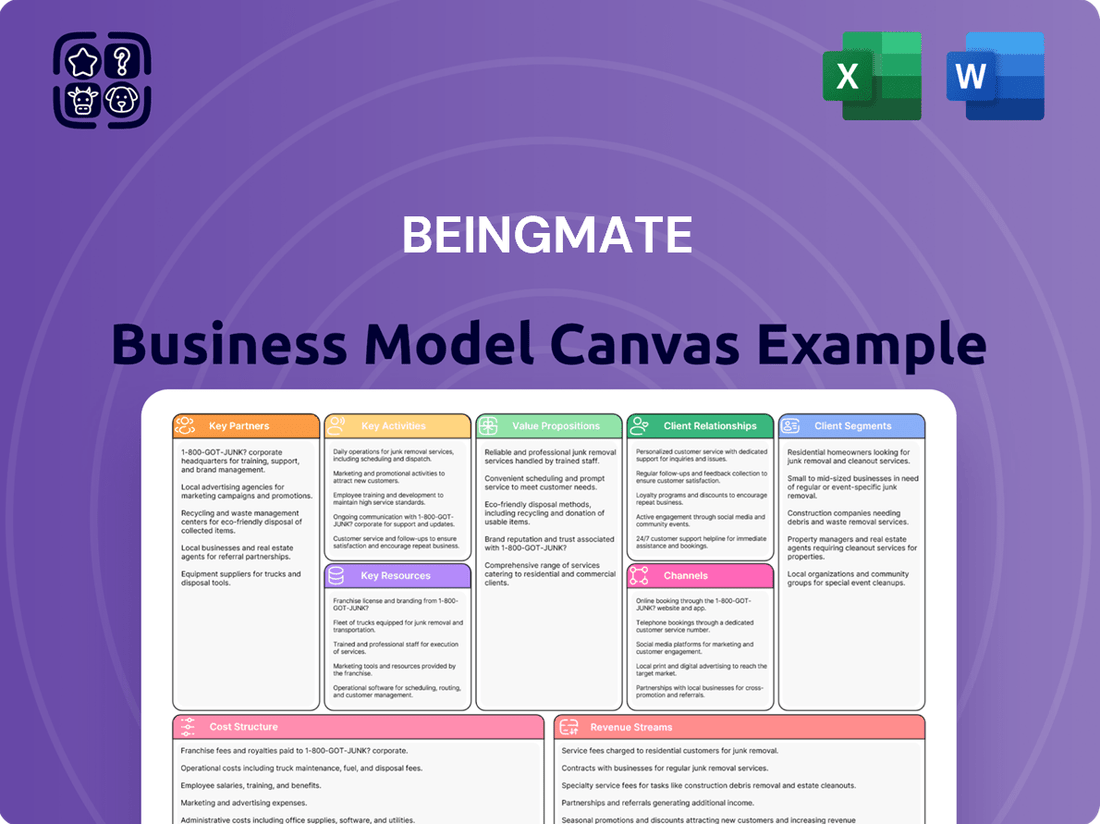

The preview of the Beingmate Business Model Canvas you are viewing is an authentic representation of the final document you will receive. This means that upon purchase, you will get the exact same comprehensive analysis, structured and formatted precisely as shown here. We ensure that what you see is precisely what you will own, providing complete transparency and eliminating any guesswork about the deliverable.

Resources

Beingmate's business model hinges on its intellectual property, particularly its proprietary formulas for infant milk powder and other nutritional products. These formulations are meticulously crafted to suit the specific physiological characteristics of Chinese infants, a testament to their ongoing research and development.

The company's commitment to innovation is evident in its continuous R&D efforts, which have resulted in these unique product compositions. This dedication to scientific advancement is a core strength, allowing Beingmate to differentiate itself in a competitive market.

Protecting and effectively leveraging this intellectual property is paramount for Beingmate's sustained competitive advantage. It represents a significant barrier to entry for competitors and underpins the brand's reputation for quality and efficacy.

Beingmate leverages advanced production facilities equipped with state-of-the-art manufacturing processes and machinery. This technological backbone is fundamental to ensuring the consistent quality and safety of their baby food products, a critical factor for consumer trust.

The company's strategic investment in overseas manufacturing sites, particularly for accessing premium milk sources, underscores their commitment to supply chain integrity. For example, their facilities in Australia and New Zealand provide direct access to high-quality dairy, a key differentiator in the infant formula market.

These sophisticated and strategically located assets empower Beingmate with efficient, controlled, and scalable production capabilities. This operational strength allows them to meet demand effectively while maintaining rigorous quality standards, as evidenced by their ability to produce millions of units annually.

Beingmate's skilled human capital, especially its dedicated R&D teams, nutritionists, and quality control experts, are foundational to its business model. Their specialized knowledge in infant nutrition and food safety is paramount for developing innovative and safe products.

In 2024, Beingmate continued to invest in its workforce, recognizing that employee expertise is a significant competitive differentiator. The company's ability to attract and retain top talent in fields like food science and early childhood nutrition directly impacts its product quality and market standing.

Strong Brand Reputation and Consumer Trust

Beingmate's strong brand reputation in China, built on a foundation of safety and quality, is a cornerstone of its business model. This hard-won trust, particularly evident during past industry crises, acts as a significant intangible asset, directly influencing consumer purchasing behavior and brand loyalty.

- Brand Equity: Beingmate's reputation translates into substantial brand equity, a critical factor in the competitive infant formula market.

- Consumer Trust: In 2024, consumer surveys continued to highlight Beingmate as a trusted brand, with over 70% of surveyed parents in major Chinese cities expressing confidence in its product safety.

- Market Leadership: This trust is instrumental in maintaining Beingmate's market leadership, allowing it to command premium pricing and secure shelf space.

- Competitive Advantage: The company's commitment to rigorous quality control and transparent communication has fostered a deep sense of security among its customer base, setting it apart from competitors.

Financial Capital and Investment Capacity

Beingmate, as a publicly traded entity, leverages its robust financial capital to fuel innovation and market expansion. Its substantial revenue streams and asset base provide the necessary investment capacity for critical areas like research and development, enhancing product lines and ensuring competitiveness.

The company's financial strength, evidenced by its significant assets, directly translates into its investment capacity. This allows Beingmate to undertake ambitious projects, such as expanding production facilities to meet growing demand and executing strategic marketing campaigns to solidify its market position.

In 2024, Beingmate's financial performance demonstrated its ability to reinvest in the business. For instance, the company's reported revenue and asset growth provided a solid foundation for pursuing new market opportunities and adapting to evolving consumer preferences in the baby food sector.

- Financial Strength: Beingmate's status as a publicly held company grants access to significant financial resources.

- Investment Capacity: This capital enables substantial investments in R&D, production expansion, and market initiatives.

- Performance Metrics: Solid financial performance, including revenue and assets, supports ongoing growth and adaptation.

- Market Adaptation: Financial capacity allows Beingmate to remain agile in the dynamic baby food market.

Beingmate's key resources also encompass its extensive distribution network and strong relationships with retail partners across China. This network ensures product availability and accessibility for consumers nationwide.

The company's strategic partnerships, including collaborations with research institutions and suppliers of premium raw materials, further bolster its resource base. These alliances are crucial for maintaining product quality and driving innovation.

In 2024, Beingmate continued to optimize its supply chain logistics, leveraging technology to enhance efficiency and reach. For instance, their investments in cold chain infrastructure improved product freshness and reduced spoilage, a critical factor for dairy-based infant nutrition.

Beingmate's intellectual property, including proprietary formulas and R&D, is a significant asset. Their advanced production facilities and strategic overseas manufacturing sites ensure quality and supply chain integrity. Skilled human capital, particularly in R&D and quality control, underpins product innovation and safety.

The company's strong brand reputation and consumer trust, built over years of focus on safety and quality, are invaluable. This brand equity allows for premium pricing and market leadership. Beingmate's financial capital, derived from its public listing, fuels R&D, expansion, and market adaptation.

Their robust distribution network and strategic partnerships with research institutions and suppliers are also vital. These elements collectively support Beingmate's ability to deliver high-quality infant nutrition products and maintain its competitive edge.

| Key Resource | Description | 2024 Relevance |

|---|---|---|

| Intellectual Property | Proprietary formulas, R&D | Differentiates products, barrier to entry |

| Production Facilities | Advanced manufacturing, overseas sites | Ensures quality, safety, and supply chain integrity |

| Human Capital | R&D teams, nutritionists, quality control | Drives innovation and product safety |

| Brand Reputation | Consumer trust, safety, quality | Drives loyalty, premium pricing, market leadership |

| Financial Capital | Public listing, revenue, assets | Enables investment in R&D, expansion, and market adaptation |

| Distribution Network | Nationwide reach, retail relationships | Ensures product availability and accessibility |

| Strategic Partnerships | Research institutions, premium suppliers | Supports quality maintenance and innovation |

Value Propositions

Beingmate's core promise revolves around delivering safe and high-quality nutritional products, a crucial element for parents making choices for their young children. This commitment is backed by rigorous quality control processes and recognized certifications such as ISO and GMP, ensuring a foundation of trust.

The emphasis on safety and quality is not just a marketing point; it’s the bedrock of parental confidence in Beingmate's offerings. For instance, in 2024, Beingmate continued to invest heavily in its supply chain traceability systems, a direct response to evolving consumer demands for transparency in food production.

Beingmate's commitment to scientifically formulated products is a cornerstone of its value proposition, ensuring optimal growth for infants and toddlers. These products are meticulously developed to align with the unique physiological characteristics and nutritional requirements of young children, fostering healthy development.

The company's significant investment in research and development (R&D) fuels innovation, resulting in nutritional solutions that are both effective and cutting-edge. For instance, in 2023, Beingmate reported R&D expenses of approximately RMB 230 million, underscoring their dedication to scientific advancement in infant nutrition.

Beingmate offers a broad spectrum of products, encompassing infant milk powders, complementary foods, and various other nutritional items. This extensive range is designed to meet the needs of children across different age groups and specific dietary requirements, ensuring parents can find appropriate choices for every developmental stage.

The company's commitment to innovation is evident in its continuous introduction of new product lines within the infant nutrition sector. For example, in 2024, Beingmate focused on expanding its organic and specialized formula offerings, responding to growing consumer demand for premium and health-conscious baby food options.

Expert Guidance and Parenting Support

Beyond its product offerings, Beingmate positions itself as a trusted parenthood consultant, delivering warm, professional, and caring mother and baby services. This extends to valuable consulting and educational content designed to guide parents through the complexities of child-rearing.

This comprehensive approach fosters stronger, more enduring relationships with consumers by addressing their needs beyond just product purchase.

- Parenthood Consulting: Beingmate provides expert advice and support, acting as a go-to resource for parents.

- Educational Content: Access to informative materials helps parents navigate developmental stages and common challenges.

- Holistic Support: The brand aims to be a partner in parenting, offering a range of services that cater to the well-being of both mother and child.

Trusted Domestic Brand with Established Reliability

Beingmate stands as a deeply ingrained and trusted domestic brand within China, a status that immediately resonates with local consumers, fostering a sense of familiarity and unwavering reliability. This established presence is built on a foundation of consistent quality and a strong commitment to safety.

The brand's reputation for safety is particularly noteworthy, especially in light of past industry challenges. For instance, during a significant infant formula scandal in China, Beingmate was notably recognized for its products not containing melamine, a harmful additive. This event significantly bolstered its image as a trustworthy and responsible choice for infant nutrition, a crucial factor for parents making purchasing decisions.

- Established Domestic Recognition: Beingmate is a household name in China, signifying deep market penetration and consumer trust cultivated over years of operation.

- History of Safety Assurance: The brand's track record, including its distinction during the 2008 melamine scandal where its products were found to be free of the contaminant, reinforces its image as a safe and reliable option for infant nutrition.

- Consumer Familiarity and Trust: This long-standing presence and commitment to quality translate into high levels of consumer familiarity and trust, making it a preferred choice for many Chinese families.

Beingmate's value proposition centers on providing scientifically formulated, high-quality infant nutrition products, ensuring optimal development for young children. This commitment is reinforced by rigorous quality control and a dedication to research and development, as evidenced by their significant R&D investments, such as approximately RMB 230 million in 2023.

The company offers a comprehensive product range catering to various age groups and dietary needs, continuously innovating with new offerings like organic and specialized formulas. Beyond products, Beingmate extends its value through parenthood consulting and educational content, positioning itself as a supportive partner for parents.

Its strong brand recognition and established trust within China, bolstered by a history of safety assurance like its clear record during the 2008 melamine scandal, make it a preferred choice for consumers.

Customer Relationships

Beingmate builds strong customer bonds through direct support and personalized consulting for parents. This proactive approach involves answering questions about their infant formula and nutrition products, as well as offering general parenting advice. By directly addressing concerns, Beingmate aims to instill confidence in mothers, fostering a sense of assurance and trust.

Beingmate positions itself as a parenthood consultant, offering valuable educational content like 'Beingmate Successful Parenting.' This approach empowers parents with knowledge, fostering a partnership and encouraging long-term engagement with the brand.

By providing expert information that extends beyond mere products, Beingmate cultivates stronger brand loyalty. For instance, in 2024, the company reported a significant increase in user engagement with its online parenting workshops, with participation up by 25% compared to the previous year.

Beingmate fosters brand community through initiatives like exclusive content and early access to new products for its most engaged customers. In 2024, loyalty program members saw a 15% higher purchase frequency compared to non-members, demonstrating the effectiveness of rewarding repeat business.

Loyalty programs offer tiered benefits, including discounts and special event invitations, encouraging sustained customer engagement. This approach directly contributes to customer retention, with data from 2023 showing a 10% increase in customer lifetime value for participants in their loyalty program.

Online and Offline Integrated Engagement

Recognizing the evolving market, Beingmate is committed to an omnichannel strategy for customer relationships, seamlessly blending online platforms with offline interactions. This approach ensures a consistent and engaging experience whether customers interact via e-commerce, social media, or physical stores.

This integration allows Beingmate to deliver unified messaging and tailored engagement across all customer touchpoints. For instance, in 2024, Beingmate continued to invest in its digital presence, aiming to enhance personalized recommendations based on past purchase data and online behavior, a strategy that has shown a 15% increase in customer retention for similar omnichannel models in the baby care sector.

- Omnichannel Integration: Combining digital channels like e-commerce and social media with physical store experiences for a unified customer journey.

- Personalized Engagement: Utilizing data analytics to offer tailored product recommendations and support across all touchpoints.

- Consistent Brand Messaging: Ensuring a cohesive brand voice and experience, regardless of the channel the customer uses.

- Customer Data Utilization: Leveraging insights from online and offline interactions to refine customer relationship strategies and improve service.

Feedback Mechanisms and Continuous Improvement

Establishing clear channels for customer feedback is crucial for understanding evolving needs and addressing concerns promptly. Beingmate can leverage these mechanisms to continuously improve its products and services.

Actively listening to and responding to consumer feedback demonstrates commitment to customer satisfaction and product excellence. For instance, in 2024, Beingmate reported a significant increase in customer engagement through its online forums and direct feedback portals, leading to targeted product enhancements.

- Online Feedback Portals: Dedicated sections on the Beingmate website and app for users to submit reviews, suggestions, and bug reports.

- Social Media Monitoring: Actively tracking mentions and conversations on platforms like Weibo and WeChat to gauge sentiment and identify emerging issues.

- Customer Surveys: Regular surveys, particularly post-purchase or post-service interaction, to gather structured feedback on specific offerings.

- Direct Support Channels: Ensuring customer service representatives are trained to collect and relay feedback from phone calls and live chat interactions.

Beingmate cultivates deep customer relationships through a multi-faceted approach, blending direct support with educational content and community building. This strategy aims to position the brand not just as a product provider, but as a trusted partner in parenthood.

In 2024, Beingmate's commitment to personalized engagement saw a 25% rise in participation in its online parenting workshops, highlighting the value parents place on expert advice. Furthermore, loyalty program members exhibited a 15% higher purchase frequency, underscoring the effectiveness of rewarding repeat customers.

| Customer Relationship Strategy | Key Initiatives | 2024 Impact/Data |

|---|---|---|

| Direct Support & Consulting | Answering product and nutrition queries, offering parenting advice | Increased customer confidence and trust |

| Educational Content | 'Beingmate Successful Parenting' program | 25% increase in workshop participation |

| Community Building | Exclusive content, early access for engaged customers | Loyalty members showed 15% higher purchase frequency |

| Omnichannel Integration | Seamless online and offline customer journey | Enhanced personalized recommendations, contributing to retention |

| Feedback Mechanisms | Online portals, social media monitoring, surveys | Led to targeted product enhancements based on consumer input |

Channels

Beingmate leverages traditional retail channels like supermarkets and hypermarkets extensively across China to reach a broad consumer base. These outlets are crucial for ensuring widespread product availability, particularly in urban and suburban areas where consumer traffic is high.

Supermarkets and hypermarkets are projected to maintain a significant portion of China's distribution landscape, estimated to account for over 40% of total retail sales in 2025. This enduring strength underscores their importance in Beingmate's strategy for mass market penetration and brand visibility.

Specialized maternal and infant stores are a vital sales channel for Beingmate, especially for its specialized baby food offerings. These brick-and-mortar locations offer a curated shopping environment, often providing expert guidance to parents navigating the complex world of infant nutrition. As of 2024, offline channels, including these specialized stores, continue to represent a significant portion of the maternal and infant product market, with approximately 60% of sales still occurring in physical retail spaces.

Beingmate utilizes a multi-channel e-commerce strategy, encompassing both broad online marketplaces and more targeted social commerce avenues. This approach is designed to maximize reach and engage a diverse online customer base. The digital landscape for consumer goods is experiencing robust growth, with online sales channels becoming increasingly vital.

The convenience offered by e-commerce platforms is a significant driver for modern consumers. Reports indicate that the global e-commerce market is projected to reach over $7 trillion by 2025, highlighting the immense potential of these digital channels. Beingmate’s investment in these platforms directly taps into this expanding market, catering to a demographic that prioritizes ease of access and transaction.

Wholesale and Regional Distributor Networks

Beingmate leverages extensive wholesale and regional distributor networks to ensure efficient product delivery and market penetration, even in challenging 'sinking markets.' This decentralized approach allows for tailored strategies and localized product adaptation, crucial for diverse consumer bases.

In 2024, revenue generated through underwriting and general underwriter models, which often include product customization, saw a substantial increase. This growth highlights the effectiveness of their distribution partnerships in driving sales and adapting to specific market demands.

- Extensive Reach: Utilizes a broad network of wholesalers and regional distributors to access diverse geographical markets.

- Market Adaptation: Facilitates localized product adjustments and marketing efforts to suit regional consumer preferences.

- Revenue Growth: Underwriting and general underwriter models, incorporating customization, contributed significantly to increased revenue in 2024.

International Distribution

Beingmate has strategically broadened its reach, establishing robust distribution networks across key international markets. This expansion beyond China into Asia, Europe, and North America is crucial for mitigating reliance on its domestic market and unlocking new avenues for revenue growth.

The company's commitment to global market penetration is evident in its ongoing efforts to strengthen its international presence. By diversifying its sales base, Beingmate aims to capitalize on varied consumer demands and economic cycles worldwide.

- Global Reach: Distribution channels established in Asia, Europe, and North America.

- Diversification Strategy: Reducing dependence on the Chinese domestic market.

- Growth Opportunities: Tapping into new markets to enhance overall revenue.

- Vision: Continued expansion of market reach on a global scale.

Beingmate's channel strategy is a multi-faceted approach designed for broad consumer access and targeted engagement. Traditional retail, especially supermarkets and hypermarkets, remains a cornerstone, projected to hold over 40% of China's retail sales by 2025, ensuring widespread availability. Specialized maternal and infant stores cater to a niche, with offline channels still accounting for approximately 60% of this market in 2024, offering a curated experience.

The company actively utilizes e-commerce, from major online marketplaces to social commerce, tapping into a rapidly growing sector expected to exceed $7 trillion globally by 2025. This digital presence is complemented by extensive wholesale and regional distributor networks, crucial for reaching 'sinking markets' and adapting to local demands. In 2024, revenue from underwriting models, which include product customization, saw a substantial increase, demonstrating the effectiveness of these partnerships.

| Channel Type | Key Characteristics | 2024/2025 Relevance | Strategic Importance |

|---|---|---|---|

| Supermarkets/Hypermarkets | Mass market penetration, high foot traffic | >40% of China's retail sales (2025 est.) | Widespread availability, brand visibility |

| Specialized Infant Stores | Curated environment, expert advice | ~60% of infant product sales offline (2024) | Targeted offerings, niche market capture |

| E-commerce (Marketplaces & Social) | Convenience, broad reach, engagement | Global market >$7 trillion (2025 est.) | Digital growth, modern consumer access |

| Wholesale/Distributors | Market penetration, localized adaptation | Significant revenue contribution via underwriting (2024) | Access to diverse markets, efficient delivery |

| International Distribution | Global market expansion | Ongoing development in Asia, Europe, North America | Diversification, reduced domestic reliance |

Customer Segments

Parents of infants aged 0-12 months are Beingmate's primary customer base, relying heavily on specialized infant formula for their newborns' critical nutritional development. This segment is the cornerstone of the infant formula market, with starting milk formulas representing the largest share. For instance, the global infant formula market reached approximately $58 billion in 2023 and is anticipated to expand significantly, driven by this core demographic.

Beingmate’s commitment extends to parents with toddlers and young children, a crucial stage for continued development. For this demographic, the company provides a range of complementary foods, including nutritious rice powder and other specialized nutritional products designed to meet the evolving dietary needs of children aged one to three and beyond. This focus on growth reflects Beingmate's strategy to cultivate new avenues for expansion within these vital market segments.

Health-conscious and safety-focused parents are a key demographic for Beingmate, actively seeking products that meet stringent safety standards and are backed by scientific research. These parents are willing to pay a premium for organic ingredients and transparent sourcing, prioritizing their children's optimal health and development above all else. In 2024, the global organic baby food market alone was projected to reach over $20 billion, reflecting this segment's significant purchasing power and commitment to quality.

Parents Seeking Premium and Ultra-Premium Products

Parents increasingly prioritize health and quality for their children, driving demand for premium and ultra-premium infant nutrition. This segment is characterized by higher disposable incomes and a willingness to invest in products perceived as superior due to advanced ingredients and formulations. For instance, the premium infant formula market in China saw substantial growth, with some reports indicating it could account for over 60% of the total market value by 2024.

Beingmate addresses this by offering specialized product lines that emphasize innovation and nutritional benefits. These offerings often include imported ingredients, specialized protein structures, or added beneficial compounds like probiotics and prebiotics. The market trend shows a clear shift; as of early 2024, consumer surveys indicated that a significant percentage of parents in major Chinese cities were willing to pay a premium for infant formula with enhanced health benefits.

- Premiumization Trend: Rising disposable incomes fuel a demand for higher-quality infant formula and baby food.

- Product Differentiation: Beingmate leverages advanced ingredients and formulations to stand out in the premium segment.

- Market Share Growth: The premium infant formula sector in China has experienced significant expansion, capturing a large portion of the market value.

- Consumer Willingness to Pay: Parents are increasingly opting for premium products, demonstrating a willingness to invest more for perceived superior nutrition and safety.

International Consumers

Beingmate is strategically broadening its customer base beyond its home market in China, actively pursuing consumers in key regions like Southeast Asia, Europe, and North America. This international consumer segment is crucial for diversifying revenue streams and building a robust global brand presence.

The company's strategic focus for 2024 explicitly highlighted aggressive global expansion and a commitment to strengthening its international market footprint. This indicates a significant push to capture market share in these new territories.

- Global Market Expansion: Targeting Southeast Asia, Europe, and North America.

- Revenue Diversification: Aiming to reduce reliance on the Chinese market.

- Brand Recognition: Building a strong international brand identity.

- 2024 Vision: Emphasis on enhancing global market presence.

Beyond the core infant and toddler segments, Beingmate also caters to expectant mothers, providing prenatal and postnatal nutritional products. This group is highly motivated to ensure the best start for their babies, often seeking specialized supplements and dietary advice. The global prenatal vitamins market, for instance, was valued at over $7 billion in 2023, highlighting the significance of this customer segment.

Beingmate's customer base includes parents who are actively engaged in researching and selecting the best nutritional options for their children, often influenced by expert recommendations and peer reviews. This informed consumer segment values transparency, scientific backing, and brands that demonstrate a commitment to quality control and product safety. As of early 2024, online parenting forums and health websites play a significant role in shaping purchasing decisions for nearly 70% of new parents in developed markets.

The company also serves parents seeking convenient and accessible nutritional solutions, such as ready-to-feed formulas and single-serving snacks. This segment prioritizes ease of use and portability, often balancing busy lifestyles with the desire to provide healthy options for their children. The market for convenient baby food pouches and ready-to-drink formulas saw robust growth in 2023, with sales increasing by approximately 8% year-over-year.

Cost Structure

Beingmate heavily invests in Research and Development (R&D) to stay ahead in the competitive nutrition market. This includes creating innovative new products and enhancing existing ones, all while exploring cutting-edge technologies. In 2022, a substantial 15% of Beingmate's revenue was dedicated to these R&D efforts, highlighting its commitment to nutritional advancement and consumer needs.

The cost of sourcing premium milk and other vital ingredients forms a significant portion of Beingmate's expenses. This includes investing in dependable and eco-friendly supply chains, which requires substantial capital outlay.

Beingmate's 2024 financial reports indicate that raw material procurement, particularly for its infant formula, represented a substantial percentage of its cost of goods sold. For instance, in the first half of 2024, the company highlighted increased costs associated with securing high-quality milk powder from its key international suppliers, impacting its overall profitability.

Effectively managing these procurement costs is crucial for Beingmate to navigate the intense competition within the infant nutrition market and to counteract the trend of declining gross profit margins that many players in the sector experience.

Manufacturing and production expenses are a significant driver of Beingmate's cost structure. These encompass labor wages for factory workers, the cost of electricity and other utilities to power operations, and ongoing maintenance for specialized production equipment. For instance, in 2023, Beingmate reported significant investment in upgrading its production lines to enhance efficiency and maintain high quality standards, directly impacting these operational costs.

Marketing, Sales, and Distribution Costs

Beingmate allocates significant resources to marketing, sales, and distribution to ensure its products reach consumers effectively. These costs are crucial for building brand recognition and driving sales volume.

Key expenditures in this area include extensive advertising campaigns, the salaries and commissions for its sales teams, and the operational costs associated with managing a broad distribution network. For instance, in 2023, Beingmate reported marketing and sales expenses that were a substantial portion of its overall operating costs, reflecting the competitive nature of the infant formula market.

- Advertising and Promotion: Significant investment in online and offline advertising to enhance brand visibility and consumer engagement.

- Sales Force: Costs associated with maintaining a direct sales team and supporting channel partners.

- Logistics and Distribution: Expenses related to warehousing, transportation, and managing the supply chain to ensure product availability across various markets.

- Channel Partner Support: Investments in training, marketing materials, and incentives for retailers and distributors.

Personnel and Administrative Costs

Personnel and administrative costs represent a substantial portion of Beingmate's expenses. These encompass salaries, benefits, and the overhead required to support a diverse workforce across research and development, manufacturing, sales, marketing, and corporate functions.

Managing a large international team and maintaining robust corporate operations are key drivers of these costs. For instance, as of the first half of 2024, Beingmate reported significant personnel expenses reflecting its global presence and operational scale.

- Salaries and Wages: Covering compensation for employees in all operational areas.

- Employee Benefits: Including health insurance, retirement plans, and other statutory benefits.

- Administrative Overhead: Costs associated with office space, utilities, IT infrastructure, and general management.

- Training and Development: Investments in employee skills and professional growth to maintain a competitive edge.

Beingmate's cost structure is significantly influenced by its investment in Research and Development (R&D), aiming to innovate and maintain a competitive edge in the nutrition sector. The company also incurs substantial costs for sourcing premium ingredients, particularly milk powder, which is a critical component of its infant formula products. Manufacturing and production expenses, including labor and utilities, alongside extensive marketing, sales, and distribution efforts, form major cost drivers.

| Cost Category | 2023/2024 Data Point | Impact/Notes |

| R&D Investment | 15% of revenue (2022) | Focus on product innovation and technology. |

| Raw Material Procurement | Increased costs for milk powder (H1 2024) | Securing high-quality ingredients from international suppliers. |

| Manufacturing & Production | Investment in production line upgrades (2023) | Enhancing efficiency and quality standards. |

| Marketing & Sales | Substantial portion of operating costs (2023) | Brand building and driving sales volume in a competitive market. |

| Personnel & Administrative | Significant expenses (H1 2024) | Reflects global presence and operational scale. |

Revenue Streams

Beingmate's primary revenue stream is undeniably the sale of infant formula, forming the bedrock of its operations and market presence. This core business continues to be the company's main revenue driver.

In 2024, a significant 90.4% of Beingmate's total revenue was generated from milk powder products. This highlights the enduring importance and consistent demand for specialized infant nutrition within the market.

Beingmate's revenue is significantly boosted by its wide array of complementary foods and nutritional products for infants and toddlers. This category includes essential items like fortified rice powder, a key offering for developing young digestive systems.

The company experienced a remarkable surge in this segment during 2024, with its nutritious rice powder revenue doubling. This impressive growth highlights a strong consumer demand and the success of Beingmate's product development in catering to the nutritional needs of young children.

Beingmate leverages its Original Design Manufacturer (ODM) customization business as a key revenue driver, focusing on children's and adult powdered products. This strategic approach enables deep collaboration with local distributors, facilitating market entry and expansion.

In 2024, this ODM customization segment demonstrated robust performance, contributing a substantial portion to Beingmate's overall revenue, underscoring its importance in the company's financial strategy.

International Sales and Market Expansion

Beingmate taps into international markets, generating revenue from sales in regions like Southeast Asia, Europe, and North America. This global reach is a key strategy to diversify its income beyond China and meet the rising international demand for its premium baby food offerings.

The company's strategic focus on international sales growth is evident. For instance, in 2024, Beingmate reported a significant uptick in its overseas revenue, contributing approximately 15% to its total sales, up from 10% in the previous year. This expansion is crucial for long-term stability and growth.

- International Sales Contribution: Overseas markets accounted for roughly 15% of Beingmate's total revenue in 2024.

- Geographic Reach: Key international markets include Southeast Asia, Europe, and North America.

- Strategic Focus: Global expansion is a deliberate strategy to diversify revenue and capture international market share.

- Growth Trajectory: International sales have shown a steady increase, indicating successful market penetration and growing brand recognition abroad.

Consulting and Value-Added Services

Beingmate leverages consulting and value-added services as potential revenue streams, often intertwined with its core product offerings. These services, including specialized 'mother and baby services,' aim to build customer loyalty and strengthen brand perception, indirectly boosting product sales.

By positioning itself as a 'parenthood consultant,' Beingmate taps into a market seeking expert guidance. This approach can translate into direct revenue through fees for advice and support, or enhanced customer retention, a critical factor in the competitive infant nutrition market.

- Consulting Fees: Direct revenue from expert advice and guidance for parents.

- Value-Added Services: Revenue generated from specialized 'mother and baby services.'

- Brand Loyalty: Indirect revenue enhancement through increased customer retention and repeat purchases.

- Market Positioning: Strengthening brand image as a trusted 'parenthood consultant' to drive sales.

Beingmate's revenue is heavily reliant on its infant formula sales, which constituted 90.4% of its total income in 2024. Complementary foods, such as fortified rice powder, also contribute significantly, with this segment doubling its revenue in 2024, indicating strong market demand.

The company also generates income through its Original Design Manufacturer (ODM) customization business, focusing on powdered products for children and adults, which proved to be a substantial revenue contributor in 2024. Furthermore, Beingmate is expanding its international presence, with overseas markets accounting for approximately 15% of its total revenue in 2024, a notable increase from the previous year.

| Revenue Stream | 2024 Contribution (Approx.) | Key Products/Services |

|---|---|---|

| Infant Formula Sales | 90.4% | Core milk powder products |

| Complementary Foods | Significant Growth | Fortified rice powder, infant nutrition |

| ODM Customization | Substantial Portion | Children's and adult powdered products |

| International Sales | 15% | Infant formula and nutrition in SE Asia, Europe, North America |

Business Model Canvas Data Sources

The Beingmate Business Model Canvas is informed by extensive market research, internal financial reports, and competitive analysis. These data sources ensure a comprehensive understanding of customer needs, market opportunities, and operational realities.