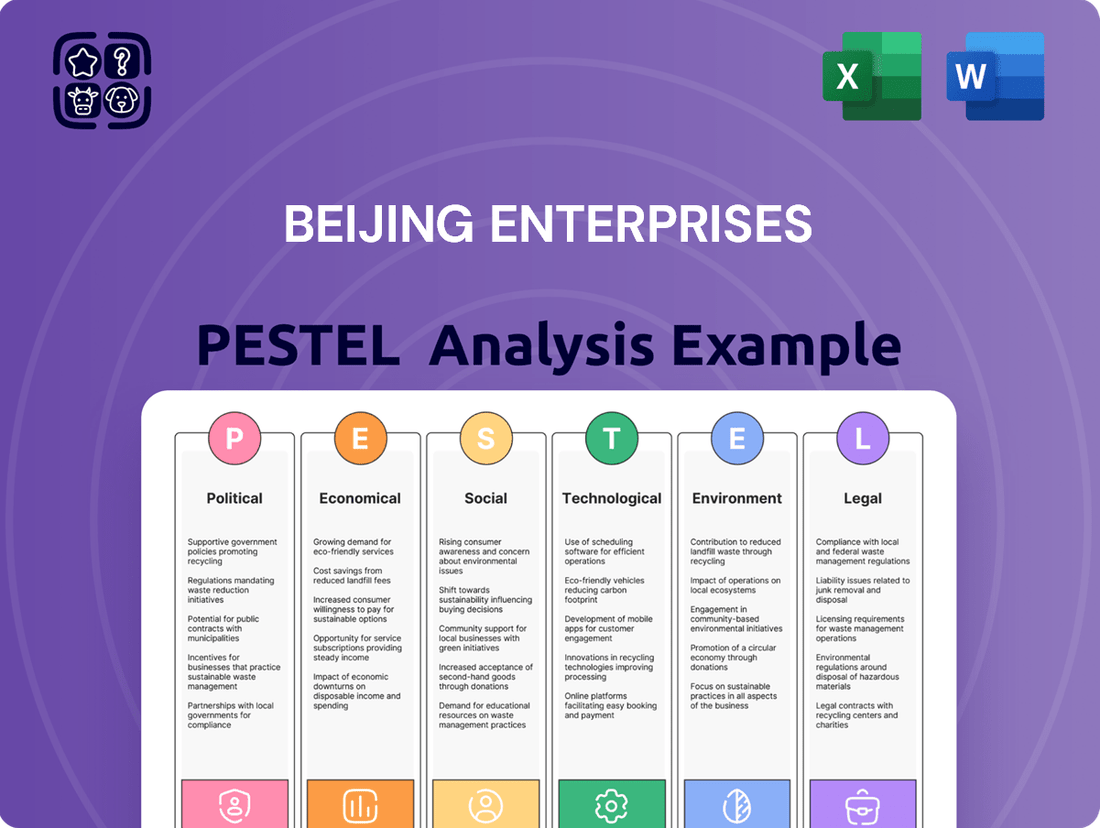

Beijing Enterprises PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beijing Enterprises Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Beijing Enterprises's trajectory. Our expert-crafted PESTLE analysis provides actionable intelligence to navigate this complex landscape. Equip yourself with the insights needed to anticipate challenges and capitalize on opportunities. Download the full version now and gain a definitive competitive advantage.

Political factors

The Chinese government's commitment to new urbanization initiatives, with an expectation of utility pricing reforms, directly benefits Beijing Enterprises Holdings Limited. This policy direction, particularly evident in plans for 2024 and 2025, creates a supportive environment for the company's core utility operations in gas, water, and environmental services.

China's national energy conservation and carbon reduction targets for 2024-2025 are a significant political factor for Beijing Enterprises Holdings Limited (BEHL). The government aims to reduce energy consumption and CO2 intensity per unit of GDP, a commitment reinforced by various action plans. For instance, the 14th Five-Year Plan (2021-2025) targets a 15% reduction in energy intensity and a 10% reduction in carbon intensity by 2025 compared to 2020 levels.

These ambitious goals create a policy landscape that directly impacts BEHL's energy and environmental business segments. The national push for a green transformation, emphasizing renewable energy development and stricter environmental regulations, provides a favorable operating environment. This includes potential incentives for companies contributing to carbon reduction goals and increased demand for services related to environmental protection and sustainable energy solutions.

Beijing's commitment to its 14th Five-Year Plan, extending to 2025, is driving substantial infrastructure investment, with a clear emphasis on "new infrastructure." This includes advancements in areas like 5G networks, artificial intelligence, and the Internet of Things, all designed to bolster advanced manufacturing and smart city initiatives across China.

This strategic acceleration of infrastructure spending presents a direct advantage for BEHL, particularly within its infrastructure and environmental service divisions. The scale of these planned projects, aimed at not just domestic growth but also influencing the global economic landscape, creates a fertile ground for BEHL's expansion and service offerings.

Hong Kong Corporate Governance Reforms

The Hong Kong Exchanges and Clearing Limited (HKEX) has introduced substantial updates to its Corporate Governance Code and listing rules, taking effect from July 1, 2025. These reforms are designed to bolster board effectiveness, independence, and diversity among companies listed on the exchange, including major entities such as Beijing Enterprises Holdings (BEHL).

For Beijing Enterprises Holdings, a key implication of these changes is the necessity to align its governance practices with the updated HKEX requirements. This includes ensuring adequate board independence, with a particular focus on the roles and responsibilities of independent non-executive directors. The reforms also emphasize enhanced disclosure and accountability mechanisms.

The HKEX aims to elevate Hong Kong’s standing as a global financial center by promoting higher standards of corporate governance. For BEHL, this means a proactive approach to reviewing and potentially adjusting its board composition and governance frameworks to meet these new benchmarks. For instance, the revised code may introduce stricter criteria for director independence or mandate greater diversity in board appointments, impacting how BEHL structures its leadership.

- Enhanced Board Independence: New rules may increase the minimum number or proportion of independent non-executive directors required on a listed company’s board.

- Director Diversity: The reforms could introduce requirements or strong recommendations for greater diversity in terms of skills, experience, gender, and ethnicity among board members.

- Board Effectiveness: There may be new guidelines or expectations regarding board performance evaluation, director training, and the establishment of specialized board committees.

- Disclosure and Transparency: Companies like BEHL will likely face increased disclosure obligations concerning their governance practices, director qualifications, and board operations.

Expansion of Carbon Market

China's commitment to environmental regulation is evident in its expanding national carbon emission trading scheme. By the close of 2025, the scheme is slated to encompass additional sectors beyond the power industry, including cement, steel, and aluminum, covering emissions from 2024.

While Beijing Enterprises Holdings Limited's (BEHL) direct participation in these specific sectors for carbon trading is not detailed, this policy shift suggests a growing emphasis on environmental compliance, potentially leading to increased costs for emissions. Simultaneously, it presents opportunities for companies offering emission reduction technologies and services.

The government's proactive approach aims to address existing oversupply issues within the carbon market, signaling a more mature and potentially effective system for managing carbon emissions. This policy direction aligns with global trends toward decarbonization and could influence BEHL's operational strategies and investment in greener technologies.

- Expansion of Carbon Market: China plans to include cement, steel, and aluminum in its national carbon trading scheme by the end of 2025 for 2024 emissions.

- Environmental Compliance: The move indicates rising compliance costs and opportunities for emission reduction technologies.

- Market Stability: Government actions are intended to mitigate oversupply issues in the carbon market.

- Strategic Implications: This policy direction may influence BEHL's operational strategies and investments in sustainability.

China's national environmental policies, particularly its carbon reduction targets for 2024-2025, directly influence Beijing Enterprises Holdings Limited (BEHL). The government aims to reduce energy intensity by 15% and carbon intensity by 10% by 2025, creating a favorable environment for BEHL's green initiatives and environmental services.

The expansion of China's national carbon emission trading scheme to include sectors like cement, steel, and aluminum by the end of 2025 for 2024 emissions signifies a growing emphasis on environmental compliance. This policy shift could introduce compliance costs for BEHL but also presents opportunities for its emission reduction technologies and services.

Beijing's commitment to its 14th Five-Year Plan, extending to 2025, drives significant infrastructure investment in "new infrastructure" like 5G and AI. This strategic focus on smart city initiatives and advanced manufacturing directly benefits BEHL's infrastructure and environmental service divisions, fostering growth opportunities.

The Hong Kong Exchanges and Clearing Limited's updated Corporate Governance Code, effective July 1, 2025, mandates enhanced board independence and diversity for listed companies like BEHL. These reforms require BEHL to align its governance practices, potentially impacting board composition and disclosure mechanisms to meet higher standards.

| Policy Area | Target/Focus (2024-2025) | Impact on BEHL | Key Data Point |

| Carbon Reduction | 15% energy intensity reduction, 10% carbon intensity reduction by 2025 | Favorable for green initiatives, environmental services | 10% carbon intensity reduction target |

| Carbon Market Expansion | Inclusion of cement, steel, aluminum by end of 2025 (for 2024 emissions) | Potential compliance costs, opportunities for emission reduction services | Scheme expansion to 3 new sectors |

| Infrastructure Investment | Focus on "new infrastructure" (5G, AI, IoT) | Growth opportunities for infrastructure and environmental services | Accelerated infrastructure spending |

| Corporate Governance | Enhanced board independence and diversity (effective July 1, 2025) | Need to align governance practices, potential board adjustments | HKEX Corporate Governance Code updates |

What is included in the product

This PESTLE analysis of Beijing Enterprises meticulously examines the external macro-environmental forces shaping its operations, offering a comprehensive understanding of political, economic, social, technological, environmental, and legal influences.

It provides actionable insights for strategic decision-making, identifying potential opportunities and threats within Beijing Enterprises's operating landscape.

A focused PESTLE analysis for Beijing Enterprises offers a clear roadmap, simplifying complex external factors into actionable insights for strategic decision-making.

Economic factors

China's economy is demonstrating strong performance in early 2025. Industrial output and fixed-asset investment have seen notable year-on-year growth, creating a favorable demand landscape for Beijing Enterprises Holdings' diverse service offerings.

This economic vitality is underscored by China's substantial contribution to the global economy. In 2024, the nation's GDP reached approximately $18.3 trillion, representing close to 20% of the worldwide economic output.

China's commitment to its 14th Five-Year Plan is driving significant infrastructure investment, with projections for 2025 indicating a substantial increase. This includes a notable issuance of special treasury bonds, signaling a strong governmental push for development.

This heightened infrastructure spending directly benefits Beijing Enterprises Holdings Limited (BEHL) by bolstering demand for its core services in gas, water, and environmental management. The emphasis on digital and intelligent urban infrastructure aligns perfectly with BEHL's operational scope and future growth strategies.

The strategic aim behind these investments is to foster more resilient urban environments and invigorate the national economy. For BEHL, this translates into expanded opportunities across its infrastructure portfolio, supporting its long-term development objectives.

China's macro policy environment anticipates utility pricing reforms, aiming for more market-oriented mechanisms for essential services like gas and water. This shift could directly influence Beijing Enterprises Holdings Limited (BEHL), potentially reshaping its revenue streams and overall profitability by introducing greater price flexibility.

For BEHL, these reforms present a dual-edged sword: opportunities for optimized operations and pricing strategies, but also the imperative for meticulous financial planning to navigate potential volatility. For instance, a move towards cost-plus pricing for water, a common reform direction, could see margins adjust based on operational efficiency rather than fixed government mandates.

By mid-2024, reports indicated that provincial governments were actively reviewing and proposing adjustments to gas tariffs, with some urban areas seeing increases of 5-10% to better reflect wholesale costs. This trend suggests a broader national move towards price rationalization that BEHL must strategically account for in its financial projections.

Growth in Environmental Protection Spending

Beijing Enterprises' (BEHL) environmental services segment is poised for growth, fueled by China's increasing focus on environmental protection. The government's commitment to green development and achieving its climate targets, including carbon neutrality by 2060, translates into substantial public and private investment in eco-friendly initiatives. This creates a favorable economic landscape for BEHL's operations.

Significant financial backing is being channeled into areas like renewable energy, pollution control, and waste management. For instance, in 2024, China's central government allocated approximately $23 billion (USD equivalent) towards ecological protection and environmental governance, a notable increase from previous years. Subsidies for digital and green development further bolster this trend, making BEHL's environmental solutions more economically attractive.

Industries that are traditionally high energy consumers and carbon emitters are undergoing modernization, presenting further opportunities. This includes sectors like manufacturing and heavy industry, where BEHL can offer services to improve efficiency and reduce environmental impact. The push for industrial upgrading aligns directly with BEHL's expertise in providing advanced environmental management solutions.

- Government Commitment: China's ambitious climate targets, such as reaching peak carbon emissions before 2030 and achieving carbon neutrality by 2060, drive substantial spending on environmental protection.

- Investment Allocation: In 2024, China's central government dedicated around $23 billion to environmental governance and ecological protection, signaling a strong financial commitment.

- Subsidies and Incentives: Financial support for digital and green development, including tax breaks and grants, creates a more favorable economic environment for companies like BEHL operating in the environmental sector.

- Industrial Modernization: High-emission industries are under pressure to modernize, increasing demand for BEHL's services in areas like pollution control and energy efficiency improvements.

Impact of Shifting Economic Focus

China's pivot towards 'new quality productive forces' signifies a significant economic recalibration, prioritizing innovation and high-tech manufacturing. This strategic redirection away from traditional drivers like real estate could reshape investment landscapes, potentially benefiting Beijing Enterprises Holdings Limited (BEHL) if its smart utility and environmental solutions align with these advanced sectors. For instance, China's 14th Five-Year Plan (2021-2025) heavily emphasizes technological self-reliance and green development, indicating substantial government backing for industries like advanced manufacturing and environmental protection.

Infrastructure investment is consequently adapting to support these burgeoning high-tech industries. This means a potential shift in government spending from traditional infrastructure projects towards those that facilitate advanced manufacturing, research and development, and digital infrastructure. BEHL's focus on smart city solutions and environmental technologies positions it to capitalize on this evolving infrastructure development, aligning with national priorities for sustainable and technologically advanced urban environments.

- Strategic Shift: China's economic focus is moving towards 'new quality productive forces,' emphasizing high-tech manufacturing and innovation.

- Investment Implications: This shift could favor BEHL's technology-driven environmental and smart utility solutions.

- Infrastructure Adaptation: Infrastructure spending is being reoriented to support advanced sectors, potentially creating new opportunities for BEHL.

- Policy Alignment: National plans like the 14th Five-Year Plan underscore a commitment to technological advancement and green development, aligning with BEHL's core business areas.

China's economic trajectory in early 2025 remains robust, with industrial output and fixed-asset investment showing strong year-on-year growth, creating a fertile demand environment for Beijing Enterprises Holdings. The nation's GDP, projected to be around $18.7 trillion by the end of 2025, continues to represent nearly 20% of global economic output.

The government's commitment to the 14th Five-Year Plan (2021-2025) fuels substantial infrastructure development, with special treasury bond issuances in 2025 signaling continued investment in national growth. This directly benefits Beijing Enterprises Holdings Limited (BEHL) by increasing demand for its gas, water, and environmental services, especially as smart urban infrastructure gains prominence.

Anticipated utility pricing reforms, moving towards market-oriented mechanisms for gas and water, present both opportunities and challenges for BEHL. Provincial governments' ongoing tariff reviews, with some urban gas tariffs seeing 5-10% increases by mid-2024 to reflect wholesale costs, indicate a national trend towards price rationalization that BEHL must strategically incorporate.

| Economic Indicator | 2024 (Approx.) | 2025 (Projected) | Impact on BEHL |

|---|---|---|---|

| China GDP | $18.3 trillion | $18.7 trillion | Strong overall demand for services |

| Industrial Output Growth | Positive YoY | Positive YoY | Increased demand for BEHL's core services |

| Fixed-Asset Investment Growth | Positive YoY | Positive YoY | Boosts infrastructure-related service demand |

| Environmental Governance Spending | ~$23 billion | Increasing | Growth opportunities in environmental services |

Same Document Delivered

Beijing Enterprises PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Beijing Enterprises delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction. Understand the complete picture of the external landscape influencing Beijing Enterprises.

Sociological factors

China's relentless march toward urbanization, with 66% of its population living in cities by the end of 2023, significantly fuels the demand for essential utilities. This demographic shift, a key sociological factor, directly translates into an expanding customer base for Beijing Enterprises Holdings, particularly for its gas and water segments.

The ongoing influx of people into urban centers necessitates substantial and continuous investment in utility infrastructure. This includes upgrading and extending gas pipelines and water supply networks to accommodate the growing urban populations, presenting both opportunities and challenges for service providers like Beijing Enterprises.

Public awareness and support for China's carbon neutrality goals are on the rise, with individuals increasingly understanding the significance of their own climate actions. This growing environmental consciousness creates a favorable social climate for Beijing Enterprises Holdings Limited's (BEHL) environmental services sector.

Government-led campaigns, such as the annual 'Beautiful China Awareness Week,' actively encourage public engagement in conservation and environmental protection activities. For instance, in 2023, the Ministry of Ecology and Environment reported a significant increase in volunteer participation in environmental initiatives across major cities.

China's urban development, particularly the push for 'smart cities,' reflects a strong societal demand for a higher quality of life. This includes tangible improvements like cleaner air, more efficient waste management, and better urban planning, with initiatives like the Beijing Smart City project aiming to create more livable and sustainable environments. For instance, by 2023, Beijing had implemented over 200 smart city pilot projects, focusing on areas like intelligent transportation and public safety, directly addressing citizen desires for improved urban living.

Beijing Enterprises Holdings Limited (BEHL) is strategically positioned to capitalize on these trends. Its core businesses in water, gas, and environmental services are fundamental to achieving the goals of smart city development. BEHL's investments in advanced water treatment technologies, for example, directly contribute to enhanced water quality, a key component of improved urban living, aligning with the nation's focus on ecological civilization.

Health Concerns Related to Pollution

Public health concerns surrounding air and water pollution remain a significant societal challenge in China, fueling a growing demand for robust environmental solutions. For instance, nitrogen pollution in waterways can trigger harmful algal blooms and compromise drinking water quality, directly impacting public health. This societal pressure underscores the critical role of Beijing Enterprises Holdings Limited (BEHL) in providing essential water treatment and environmental protection services.

The Chinese government has been actively addressing these issues, with significant investments in environmental protection. In 2023, China's Ministry of Ecology and Environment reported that efforts to improve air quality had led to a notable reduction in fine particulate matter (PM2.5) levels in major cities. Similarly, initiatives to tackle water pollution are showing progress, though challenges persist, particularly in certain river basins.

- Growing Public Awareness: Increased media coverage and public discourse on pollution-related health risks are driving consumer demand for cleaner products and services.

- Government Mandates: Stricter environmental regulations are compelling industries to invest in pollution control technologies, creating opportunities for companies like BEHL.

- Health Impacts: Reports from the World Health Organization (WHO) consistently highlight the severe health consequences of air and water pollution, including respiratory illnesses and waterborne diseases, emphasizing the urgency of remediation efforts.

Lifestyle Changes and Consumption Patterns

Beijing Enterprises Holdings Limited (BEHL) navigates evolving consumer lifestyles, particularly impacting its beverage segment. The company's significant investment in Yanjing Brewery is directly tied to shifts in how people consume beverages and a growing emphasis on health. For instance, BEHL reported a notable increase in beer sales volume in 2024, exceeding the broader industry's performance, indicating a positive response to changing preferences.

These lifestyle changes are shaping market demand, requiring BEHL to adapt its marketing and product development for Yanjing Brewery. Understanding trends like a move towards premiumization or a greater interest in low-alcohol options is vital for sustained growth. The company's success in 2024's beer market, with sales volume outpacing industry averages, suggests a strategic alignment with these emerging consumer behaviors.

- Shifting Preferences: Consumers are increasingly influenced by health-conscious trends and evolving lifestyle choices.

- Beer Segment Growth: BEHL's Yanjing Brewery experienced increased beer sales volume in 2024, outperforming the industry.

- Strategic Adaptation: The company must continue to monitor and respond to changes in beverage consumption patterns to ensure future success.

China's rapid urbanization, with 66% of its population residing in cities by the end of 2023, directly boosts demand for utilities like gas and water, expanding Beijing Enterprises Holdings' customer base.

The societal push for a higher quality of life, evident in smart city initiatives, creates demand for improved urban services, which BEHL's water and environmental segments are well-positioned to meet.

Growing public health concerns and environmental awareness are driving demand for BEHL's environmental protection services, supported by government efforts to combat pollution, which saw PM2.5 levels decrease in major cities in 2023.

Evolving consumer lifestyles, particularly a focus on health, influenced BEHL's Yanjing Brewery, which saw beer sales volume outperform the industry in 2024.

Technological factors

China's progress in water treatment, such as graphene oxide membranes for reverse osmosis and AI in desalination, directly benefits Beijing Enterprises Holdings Limited (BEHL). These advancements promise to boost efficiency, cut energy use, and decrease operational expenses for BEHL's water segment.

The nation's 2025 desalination strategy, integrating advanced tech with supportive policies, is set to further improve water purification processes, aligning with BEHL's strategic goals for its water utility operations.

China's commitment to smart city initiatives, fueled by substantial government investment, is a key technological driver. The integration of Internet of Things (IoT), artificial intelligence (AI), cloud computing, and 5G networks into urban infrastructure presents significant opportunities for Beijing Enterprises Holdings Limited (BEHL). These advancements can enhance BEHL's utility management, enabling more efficient smart grids and real-time environmental monitoring, such as pollution control. By 2027, China anticipates substantial advancements in the digital transformation of its urban landscapes, directly impacting BEHL's operational efficiency and service delivery.

Advancements in waste-to-energy (WTE) technologies are pivotal for Beijing Enterprises Holdings Limited (BEHL) as a major player in environmental services. Innovations like advanced gasification and pyrolysis are enhancing energy recovery rates, with modern WTE plants in China achieving thermal efficiencies exceeding 30% as of 2024, contributing to reduced reliance on traditional landfills.

BEHL's substantial investment in the WTE sector, evidenced by its operation of numerous facilities across China, directly benefits from these technological leaps. These improvements not only boost operational efficiency but also align with China's ambitious targets for renewable energy generation and carbon emission reduction, aiming for a significant increase in non-fossil fuel energy consumption by 2025.

Renewable Energy Integration

The increasing global and national emphasis on reducing reliance on fossil fuels directly impacts Beijing Enterprises Holdings Limited (BEHL). China's commitment to non-fossil fuel power generation, driven by environmental concerns and energy security, creates a significant opportunity. The nation's new Energy Law, effective January 2025, explicitly promotes the use and development of renewable energy sources.

This legislative push supports BEHL's strategic integration of renewables like solar, wind, and biomass into its existing utility operations. Such integration not only aligns with sustainability goals but also bolsters operational resilience by diversifying energy sources. For instance, China's installed renewable energy capacity reached approximately 1.4 billion kilowatts by the end of 2023, a figure expected to grow substantially as the new law takes effect.

- Renewable Energy Growth: China aims to increase the share of non-fossil fuels in its primary energy consumption to around 25% by 2030, presenting a clear market for BEHL's renewable integration efforts.

- Policy Support: The 2025 Energy Law provides a strong regulatory framework, encouraging investments and operational adjustments towards cleaner energy.

- Operational Benefits: Integrating renewables can lead to more stable energy supply chains and reduced exposure to volatile fossil fuel prices for BEHL.

Data-Driven Operations and AI

Beijing Enterprises Holdings Limited (BEHL) can leverage the growing adoption of big data and artificial intelligence (AI) in urban management. For instance, smart city initiatives in Beijing are increasingly using AI for traffic flow optimization, aiming to reduce congestion. In 2024, Beijing reported a 15% reduction in average commute times in certain districts due to AI-driven traffic management systems.

This data-driven approach presents BEHL with opportunities to refine its operational strategies and forecast demand more accurately for its utility services. AI applications in pollution monitoring and control, as seen in other major Chinese cities, could inform BEHL's environmental management practices and resource allocation for infrastructure projects. The company can anticipate improved efficiency and more effective deployment of capital by embracing these technological advancements.

- AI in Traffic Management: Beijing's smart city projects are employing AI to analyze real-time traffic data, leading to smoother traffic flow and reduced congestion.

- Predictive Maintenance: BEHL can utilize AI to predict equipment failures in its water and gas networks, minimizing downtime and operational costs.

- Demand Forecasting: Big data analytics can help BEHL more accurately predict energy and water consumption patterns, optimizing supply chain management.

- Environmental Monitoring: AI-powered systems can enhance the monitoring of environmental impact from BEHL's operations, ensuring compliance and sustainability.

Technological advancements in water purification, such as enhanced membrane technologies and AI-driven desalination, are directly benefiting Beijing Enterprises Holdings Limited (BEHL). China's national strategy for desalination, emphasizing advanced tech and supportive policies, is expected to improve water purification processes and align with BEHL's water utility goals. The nation's commitment to smart city initiatives, backed by significant government investment, is integrating IoT, AI, cloud computing, and 5G into urban infrastructure, offering BEHL opportunities for improved utility management and real-time environmental monitoring.

Legal factors

China's draft Ecological and Environmental Code, unveiled in April 2025 and slated for implementation in 2026, represents a significant consolidation of over 30 existing environmental laws. This new code introduces a stringent framework for companies, mandating strict adherence to emission reduction targets and circular economy principles.

Beijing Enterprises Holdings Limited (BEHL) must proactively adapt to these heightened environmental standards, which include expanded requirements for extended producer responsibility. Failure to comply with these evolving regulations could lead to substantial penalties and operational disruptions.

Amendments to the Hong Kong Corporate Governance Code, finalized in December 2024 and effective July 1, 2025, will significantly impact listed companies. These changes focus on enhancing board effectiveness, strengthening director independence, and promoting diversity. For instance, new guidelines may introduce tenure limits for Independent Non-Executive Directors, a key aspect of board oversight.

Beijing Enterprises Holdings, being a significant entity listed on the Hong Kong Stock Exchange, must proactively align its internal governance structures with these updated regulatory requirements. This adaptation is crucial for maintaining compliance and ensuring continued investor confidence in its operational integrity and strategic direction.

China's new Energy Law, effective January 1, 2025, is a significant development, prioritizing the growth and use of non-fossil energy sources while also promoting the clean and efficient use of fossil fuels. This legislation establishes a clear legal structure for energy administration and offers incentives for adopting green energy, which directly impacts Beijing Enterprises Holdings Limited's (BEHL) gas and environmental sectors. The law specifically mandates the creation of systems designed to encourage the consumption of green energy.

Carbon Emission Trading Regulations

China's Ministry of Ecology and Environment is actively consulting on new compliance emission trading rules for 2024-2025, indicating a more stringent stance on carbon emissions. This tightening is especially noticeable within the power generation sector, which is currently the primary focus of these regulations.

The ongoing development of China's carbon market presents both challenges and opportunities for Beijing Enterprises Holdings Limited (BEHL). While the current regulations primarily target thermal power, there's a significant possibility of expansion to encompass other segments of BEHL's operations, potentially creating new compliance requirements or avenues for trading emission allowances.

These upcoming rules are anticipated to lead to a reduction in the overall supply of emission allowances. Consequently, this scarcity is projected to drive up the prices of these allowances, impacting the operational costs for companies within the regulated sectors.

- Stricter Compliance: Consultations for 2024-2025 emission trading rules signal a more rigorous enforcement of carbon emission controls in China.

- Sectoral Focus: The thermal power sector remains the initial and primary area of focus for these evolving regulations.

- Market Expansion Risk: BEHL must monitor the potential broadening of the carbon market to include its other business segments, which could introduce new obligations.

- Price Volatility: Expected cuts in allowance supply are likely to increase carbon prices, affecting companies' cost structures.

Utility Sector Pricing and Regulatory Oversight

Beijing Enterprises Holdings operates within a heavily regulated utility sector where government policies directly influence pricing and service standards for gas and water. Recent reforms in China aim to rationalize utility pricing, meaning Beijing Enterprises must adapt its revenue models and operations to align with evolving regulatory frameworks. This oversight, while presenting challenges, also fosters stability and ensures the continued provision of essential public services.

The regulatory environment is dynamic, with policy shifts potentially impacting Beijing Enterprises' profitability. For instance, discussions around energy price reforms in 2024 and 2025 could lead to adjustments in gas tariffs, directly affecting the company's top line. Similarly, water pricing is often subject to government approval, balancing cost recovery with affordability for consumers.

- Regulatory Pricing Controls: Utility tariffs for gas and water are set or approved by government bodies, limiting pricing flexibility.

- Policy Reform Impact: Ongoing reforms to utility pricing aim for greater cost recovery and efficiency, which could alter Beijing Enterprises' financial performance.

- Service Standards: Regulators also enforce service quality and reliability standards, requiring continuous investment in infrastructure and operational improvements.

The legal landscape for Beijing Enterprises Holdings is shaped by evolving environmental legislation and corporate governance codes. China's draft Ecological and Environmental Code, expected in 2026, consolidates over 30 laws, imposing stricter emission controls and circular economy principles. Concurrently, amendments to the Hong Kong Corporate Governance Code, effective mid-2025, will enhance board effectiveness and director independence.

China's new Energy Law, effective January 1, 2025, prioritizes non-fossil fuels and green energy adoption, directly impacting BEHL's gas and environmental sectors. Furthermore, ongoing consultations for 2024-2025 emission trading rules signal a more rigorous approach to carbon emissions, primarily targeting the power sector but with potential expansion to other BEHL operations.

Beijing Enterprises operates under significant government regulation in its utility sectors, influencing pricing and service standards. Reforms in 2024-2025 may adjust gas tariffs and water pricing, necessitating adaptation of revenue models to align with these evolving frameworks and ensure compliance with service quality standards.

Environmental factors

China has committed to ambitious climate goals, aiming to peak carbon dioxide emissions before 2030 and achieve carbon neutrality by 2060. For 2024-2025, the nation has set specific targets for energy conservation and reducing CO2 intensity. These national directives are a significant driver for Beijing Enterprises Holdings Limited (BEHL), boosting demand for its environmental protection and clean energy services.

The country is demonstrating tangible progress in its environmental efforts. In 2023, China's energy consumption per unit of GDP decreased by 0.5%, and its carbon dioxide emissions per unit of GDP also saw a reduction, indicating a positive trend in decoupling economic growth from environmental impact.

China grapples intensely with water scarcity and pollution, with northern areas facing particularly acute issues, including high nitrogen contamination. This environmental pressure underscores the vital importance of Beijing Enterprises Holdings Limited's (BEHL) water treatment and supply operations in bolstering national water security.

The ambitious South-North Water Transfer Project, a major national initiative, aims to significantly ease water shortages in arid regions, presenting a substantial opportunity for companies like BEHL to contribute to and benefit from improved water resource management.

The Chinese government's commitment to improving air quality is a significant environmental factor for Beijing Enterprises Holdings Limited (BEHL). In 2024, urban air pollution saw a notable decrease, a direct result of these sustained efforts. This ongoing focus on cleaner air, particularly the reduction of PM2.5 concentrations, directly fuels demand for BEHL's environmental services in air quality management and emission control.

Waste Management and Circular Economy

China's commitment to waste management and the circular economy is a significant environmental factor for Beijing Enterprises Holdings Limited (BEHL). The nation is actively pushing for reduced reliance on virgin materials, encouraging eco-friendly product design, and imposing stringent recycling requirements across various industries. This policy direction creates a robust, government-supported market for BEHL's environmental services, especially in waste-to-energy and waste treatment operations.

The implementation of the new Environmental Code further solidifies these directives, placing greater emphasis on corporate responsibility for waste reduction and resource recovery. This regulatory framework directly benefits BEHL by expanding the demand for its core environmental solutions.

- Policy Support: China's push for a circular economy and comprehensive waste management provides a strong policy tailwind for BEHL's environmental services.

- Market Growth: Increased recycling obligations and a focus on reducing virgin material use are expected to drive demand for waste-to-energy and waste treatment facilities.

- Regulatory Reinforcement: The new Environmental Code underscores the government's commitment, creating a more favorable operating environment for companies like BEHL.

Ecological Conservation and Biodiversity

China's draft Ecological and Environmental Code highlights the importance of protecting ecosystems and advancing restoration projects, a move that directly supports Beijing Enterprises Holdings Limited's (BEHL) focus on sustainable urban development. This national emphasis on ecological conservation and biodiversity aligns with BEHL's strategic goals. The 'Beautiful China' initiative further solidifies this commitment, promoting development that coexists harmoniously with the environment.

BEHL's operations, particularly in utilities and environmental services, are directly influenced by these ecological policies. For instance, in 2023, China continued to invest heavily in environmental protection, with the Ministry of Ecology and Environment reporting significant progress in air and water quality improvements across major urban areas. This creates opportunities for BEHL to expand its waste management and water treatment services, aligning with national environmental targets.

- Ecosystem Protection: The draft Ecological and Environmental Code mandates enhanced protection for key ecosystems.

- Biodiversity Focus: A significant emphasis is placed on safeguarding biodiversity as part of national environmental strategy.

- Sustainable Development: The 'Beautiful China' initiative promotes a development model that prioritizes harmony with nature.

- BEHL Alignment: These policies directly support BEHL's commitment to sustainable urban development and environmental services.

China's commitment to environmental protection, including ambitious climate goals and a focus on resource efficiency, directly benefits Beijing Enterprises Holdings Limited (BEHL). The nation's drive towards carbon neutrality by 2060 and specific energy conservation targets for 2024-2025 create a favorable market for BEHL's clean energy and environmental services.

Water scarcity and pollution remain critical issues, particularly in northern China, driving demand for BEHL's water treatment and supply solutions. The government's investment in projects like the South-North Water Transfer Project further highlights opportunities in improved water resource management.

Improvements in air quality, with reduced PM2.5 concentrations in urban areas in 2024, are a testament to China's environmental efforts and bolster demand for BEHL's air quality management services.

China's push for a circular economy and robust waste management, reinforced by the new Environmental Code, directly supports BEHL's waste-to-energy and treatment operations.

| Environmental Factor | 2024-2025 Data/Trend | Impact on BEHL |

| Climate Goals | Carbon peak before 2030, neutrality by 2060; Energy conservation targets for 2024-2025 | Increased demand for clean energy and environmental protection services |

| Water Management | Ongoing investment in water transfer projects; Addressing water scarcity and pollution | Opportunities in water treatment and supply, water resource management |

| Air Quality | Reduced urban air pollution (e.g., PM2.5) in 2024 | Growth in demand for air quality management and emission control services |

| Waste Management & Circular Economy | Emphasis on recycling, reduced virgin material use, new Environmental Code | Expansion of waste-to-energy and waste treatment operations |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Beijing Enterprises is built on a robust foundation of data from official Chinese government statistics, reports from international financial institutions like the IMF and World Bank, and reputable industry-specific market research. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.