Beijing Enterprises Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beijing Enterprises Bundle

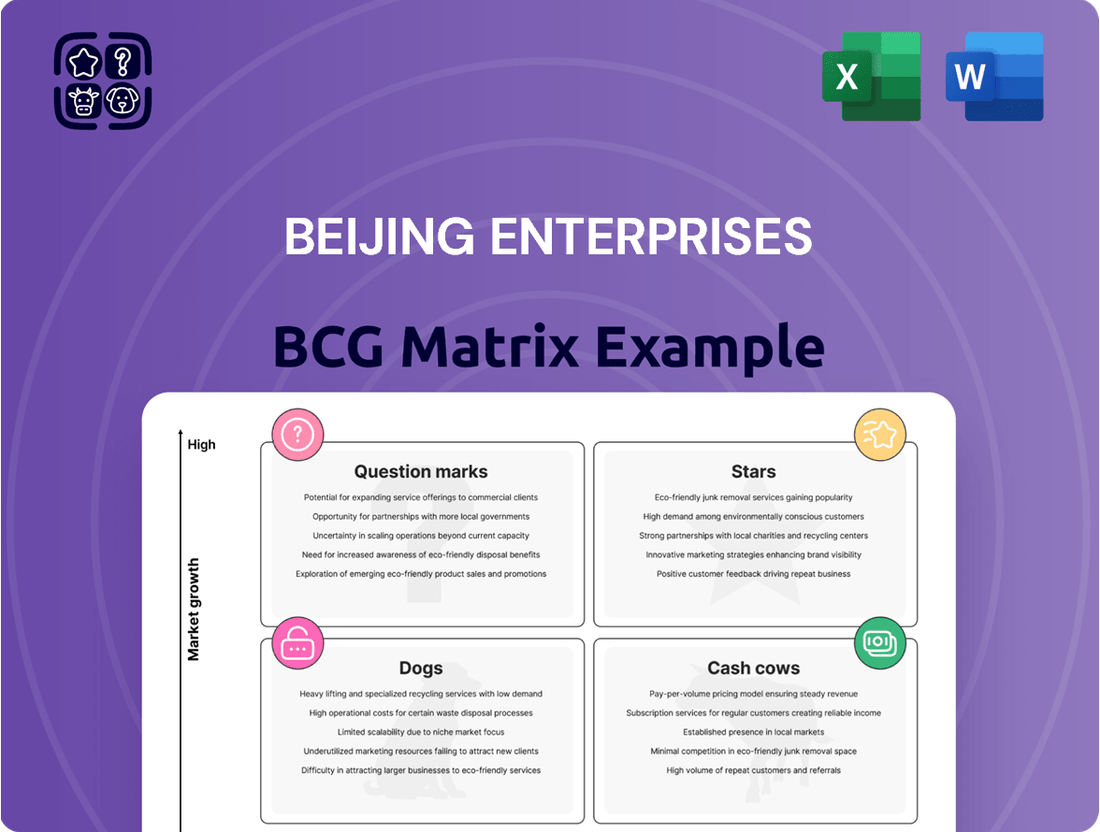

Beijing Enterprises' BCG Matrix is a powerful tool for understanding its diverse portfolio. This preview offers a glimpse into how its products are positioned in the market, but to truly unlock strategic advantage, you need the full picture.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Beijing Enterprises' natural gas distribution and transmission segment, spearheaded by Beijing Gas Group, is a clear Star in its BCG matrix. The company is a dominant force in Beijing's urban gas distribution, consistently adding new residential and public sector customers.

China's natural gas market is robust, with consumption projected to grow by 6.5% in 2025, hitting 456 billion cubic meters. This significant market expansion, coupled with Beijing Gas's established leadership, solidifies this segment's Star status, necessitating ongoing investment in infrastructure to capitalize on escalating demand.

Beijing Gas's Tianjin Nangang LNG project has processed over 1 million tons of LNG, showcasing robust operational capacity. This achievement underscores China's commitment to expanding its natural gas infrastructure, with significant investments pouring into pipelines and LNG terminals to bolster supply security and satisfy escalating demand.

The growth in LNG processing capabilities directly supports China's national energy strategy, which prioritizes increasing natural gas's share in the energy mix. This positions the LNG processing and infrastructure segment as a high-growth market where Beijing Enterprises is demonstrating a strong and expanding footprint.

EEW Energy from Waste GmbH, Beijing Enterprises' international environmental division, is strategically growing its waste collection networks and maximizing the efficiency of its facilities. The global market for environmental consulting, particularly in waste management and sustainability, is experiencing robust expansion.

EEW's strong presence in Europe, combined with the rising worldwide need for waste-to-energy technologies, positions this segment as a key growth driver with significant market share for Beijing Enterprises. For instance, EEW's German facilities processed approximately 2.2 million tonnes of waste in 2023, demonstrating substantial operational capacity and market penetration.

Environmental Technology and Solutions

Beijing Enterprises is strategically shifting towards a science and technology-driven, asset-light model, significantly boosting its research and development in key environmental technologies. This focus aligns with the broader environmental consulting services market, which is increasingly embracing innovative solutions powered by AI and machine learning. While concrete market share figures for Beijing Enterprises' emerging technologies are not yet publicly available, these investments are strategically positioning the company within a dynamic and expanding sector, suggesting potential for future growth.

The company's commitment to R&D is a critical element in its BCG matrix positioning for Environmental Technology and Solutions. This segment is characterized by high growth potential, driven by global demand for sustainable practices and regulatory pressures. Beijing Enterprises' targeted investments aim to capitalize on these trends.

- Focus on R&D: Beijing Enterprises is increasing R&D investments in core environmental technologies as part of its asset-light transformation.

- Market Trends: The environmental consulting market is adopting innovative technologies, including AI/ML-based solutions.

- Strategic Positioning: Investments in nascent technologies within a growing market indicate potential for future market leadership.

- Growth Potential: The environmental technology sector is experiencing high growth driven by sustainability demands and regulations.

Strategic Investments in New Energy (Hydrogen, EV Charging, Photovoltaic)

Beijing Enterprises is actively expanding its footprint in the burgeoning new energy sector, with significant investments directed towards hydrogen energy, electric vehicle (EV) charging and battery swapping infrastructure, integrated energy solutions, and photovoltaic power generation. These initiatives align with China's ambitious goals for carbon neutrality, positioning the company to capitalize on a market experiencing rapid expansion and robust policy backing. For instance, China's National Development and Reform Commission has outlined plans to significantly increase renewable energy capacity, with solar and wind power expected to play a dominant role, creating a favorable environment for companies like Beijing Enterprises.

These strategic ventures, though in their nascent stages for Beijing Enterprises, are designed to establish the company as a key player in future energy markets. The global push towards decarbonization is a major driver, with the International Energy Agency forecasting substantial growth in renewable energy installations worldwide through 2030. Beijing Enterprises' focus on these areas reflects a forward-looking strategy to secure a competitive advantage in a sector poised for sustained, high-paced development.

- Hydrogen Energy: Investing in hydrogen production, storage, and distribution infrastructure to support its growing use in transportation and industry.

- EV Charging and Battery Swapping: Expanding the network of EV charging stations and battery swapping facilities to meet the surging demand for electric mobility.

- Integrated Energy: Developing comprehensive energy solutions that combine various renewable sources and smart grid technologies for optimized efficiency.

- Photovoltaic: Increasing capacity in solar power generation through new project development and acquisitions.

Beijing Enterprises' natural gas distribution and transmission segment, led by Beijing Gas Group, is a prime example of a Star. This segment benefits from China's expanding natural gas market, which is projected to reach 456 billion cubic meters by 2025, showing a robust 6.5% growth rate. The company's dominance in Beijing's urban gas distribution and its successful Tianjin Nangang LNG project, which has processed over 1 million tons of LNG, highlights its strong market position and the segment's high-growth, high-market-share characteristics.

| Segment | BCG Category | Key Strengths | Market Dynamics | Investment Focus |

|---|---|---|---|---|

| Natural Gas Distribution & Transmission | Star | Dominant market share in Beijing, successful LNG project operations | High market growth (6.5% projected by 2025), increasing demand | Infrastructure expansion, capacity enhancement |

| Environmental Technology & Solutions | Star | Growing international presence (EEW), focus on R&D and asset-light model | Expanding global market for waste management and sustainability, adoption of AI/ML | Innovation in environmental tech, strategic investments in R&D |

| New Energy Sector (Hydrogen, EV, PV) | Question Mark (Emerging Star potential) | Strategic investments in high-growth areas, alignment with carbon neutrality goals | Rapid expansion driven by decarbonization policies, significant global growth forecasts for renewables | Capacity building, network expansion, integrated energy solutions |

What is included in the product

Highlights which units to invest in, hold, or divest based on Beijing Enterprises' portfolio.

A clear BCG Matrix visualizes Beijing Enterprises' portfolio, highlighting areas needing investment or divestment to alleviate strategic indecision.

Cash Cows

Beijing Enterprises Water Group (BEWG) stands as a titan in China's water sector, holding its leading position for 14 consecutive years. This sustained dominance in a mature utility market underscores its strong market share and operational stability.

While 2024 saw a modest dip in operating revenue and profit, BEWG's extensive network of water plants, boasting considerable design capacity, continues to be a reliable generator of substantial cash flow. This consistent cash generation is vital for supporting the broader strategic initiatives of the Beijing Enterprises conglomerate.

Beijing Enterprises' 40% stake in PipeChina Beijing Pipeline Co. is a prime example of a cash cow. This venture generated RMB1.24 billion in net profit during the first half of 2024, a testament to its strong performance. The significant increase in gas transmission volume by 21.5% further solidifies its position.

Operating within the essential infrastructure of natural gas transmission, this joint venture benefits from high barriers to entry. This creates a stable environment for consistent and substantial cash flow generation, a hallmark of a mature business with a dominant market share.

Yanjing Brewery's core beer products are firmly positioned as Cash Cows within Beijing Enterprises' BCG Matrix. In 2024, the company achieved a record net profit surpassing RMB1 billion, a testament to the enduring strength of these established brands. This consistent double-digit growth underscores their ability to generate substantial and reliable cash flow, even within a mature market.

The Chinese beer market, while experiencing slower growth overall, still sees Yanjing's core offerings commanding a significant market share. Their revenue in 2024 even edged past a major competitor, highlighting the continued consumer preference and brand loyalty. This robust performance from its foundational products ensures a steady stream of cash, supporting other ventures within the broader Beijing Enterprises portfolio.

Municipal Solid Waste Treatment (Domestic)

Beijing Enterprises' domestic solid waste treatment business, exemplified by Beijing Enterprises Environment Group, demonstrated robust performance with an increase in waste treatment volume during the first half of 2024. This sector is a cornerstone of their operations, reflecting a stable and essential service within a growing market.

The China waste management market is substantial, projected to grow from an estimated USD 177 billion in 2025 to USD 238 billion by 2030, with a compound annual growth rate of 6.10%. This sustained expansion underscores the enduring demand for such services.

- Strong Market Position: Beijing Enterprises' established presence and successful project execution in domestic waste treatment solidify its role as a key player.

- Consistent Demand: The essential nature of waste management ensures a steady revenue stream, characteristic of a cash cow.

- Growth Trajectory: The expanding Chinese waste management market offers continued opportunities for this segment to generate reliable profits.

Established Infrastructure Investments

Beijing Enterprises Holdings' established infrastructure investments, such as toll roads and utilities, are classic cash cows. These assets operate in mature markets with predictable, long-term contracts, ensuring a steady and reliable revenue stream. For instance, in 2023, Beijing Enterprises Water Group, a significant infrastructure component, reported revenue growth driven by its extensive water treatment and supply network.

These infrastructure businesses typically hold a dominant market share in their respective, low-growth sectors. This strong market position allows them to generate substantial and consistent cash flow with minimal reinvestment needs. The company's commitment to these stable assets underscores their role as reliable contributors to overall profitability.

- Dominant Market Share: Infrastructure assets often command a leading position in their mature markets.

- Stable Revenue Streams: Long-term contracts and essential services provide predictable income.

- Low Growth, High Cash Flow: Mature sectors generate significant cash with limited need for expansion capital.

- Consistent Profitability: These segments are key to the company's overall financial stability.

Beijing Enterprises' portfolio includes several established businesses that function as cash cows, generating consistent and substantial profits with limited need for further investment. These are typically in mature markets where the company holds a dominant position.

The PipeChina Beijing Pipeline Co., in which Beijing Enterprises holds a 40% stake, exemplifies this. Its strong performance, with RMB1.24 billion in net profit in H1 2024 driven by a 21.5% increase in gas transmission volume, highlights its cash cow status.

Yanjing Brewery's core beer products also fit this category. Achieving a record net profit exceeding RMB1 billion in 2024, these brands demonstrate enduring consumer preference and brand loyalty, ensuring a steady cash inflow.

The domestic solid waste treatment segment, represented by Beijing Enterprises Environment Group, is another key cash cow. The increasing waste treatment volumes in a growing market, projected to reach USD 238 billion by 2030, solidify its role in generating reliable profits.

| Business Segment | Key Metric (2024 Data) | Cash Flow Generation | Market Characteristic |

|---|---|---|---|

| PipeChina Beijing Pipeline Co. | RMB1.24 billion net profit (H1 2024) | High, driven by 21.5% gas transmission volume increase | Mature, high barriers to entry |

| Yanjing Brewery (Core Products) | > RMB1 billion net profit (2024) | Substantial and reliable, double-digit growth | Mature, strong brand loyalty |

| Domestic Solid Waste Treatment | Increasing treatment volume | Consistent, supported by market growth | Growing, essential service |

Full Transparency, Always

Beijing Enterprises BCG Matrix

The Beijing Enterprises BCG Matrix preview you are viewing is the identical, fully completed document you will receive upon purchase. This means you'll get the exact same professionally analyzed and formatted report, ready for immediate strategic application, without any alterations or demo content.

Dogs

Beijing Enterprises Water Group saw a decline in its design capacity in 2024, with 1,136,300 tons removed due to project expirations and other divestments. This reduction points to underperforming assets within their portfolio, likely due to diminished profitability or less favorable contract structures.

These projects, now considered question marks or even dogs in the BCG matrix framework, represent areas where the company might consider divesting or significantly reducing its involvement to reallocate resources more effectively.

Beijing Enterprises is actively addressing inefficiencies within its environmental business units, aiming to streamline operations and cut costs. This focus implies that certain environmental segments or projects are not performing as expected, consuming resources without delivering adequate returns. For instance, in 2024, the company might be evaluating specific waste management facilities or renewable energy projects that have shown declining profitability or higher-than-anticipated operational expenses, indicating a need for strategic intervention.

Beijing Enterprises Holdings' real estate holdings might be classified as Dogs within the BCG Matrix. Despite a broad expansion into numerous projects, the sector hasn't shown significant recent positive highlights or substantial growth, particularly when contrasted with the company's core utility operations. This suggests a potential for underperforming assets within their real estate portfolio.

If these real estate ventures possess a low market share and operate within a low-growth property market, their classification as Dogs becomes more pronounced. For instance, if a specific development in a saturated market is experiencing stagnant sales or declining property values, it would fit this category. As of late 2024, the global real estate market, while showing some regional recovery, still faces headwinds from higher interest rates and economic uncertainty, making it challenging for lower-performing assets to gain traction.

Legacy or Outdated Technologies in Environmental Services

As the environmental consulting services market increasingly embraces AI and machine learning, legacy technologies within Beijing Enterprises' environmental portfolio may face challenges. These older systems, often characterized by lower efficiency and higher maintenance costs, could be candidates for divestment or significant overhaul if their market share is declining in a rapidly evolving technological landscape. For instance, a 2024 market analysis indicated that environmental firms heavily reliant on manual data processing and traditional modeling experienced a 15% slower growth rate compared to those leveraging AI-driven analytics.

- Declining Market Relevance: Technologies that cannot integrate with or are outperformed by AI/ML solutions are losing competitive edge, potentially leading to reduced service demand and revenue.

- High Turnaround Costs: Investing heavily in upgrading outdated systems may not yield a proportional return, especially if newer, more cost-effective technologies are readily available.

- Resource Drain: Maintaining and operating legacy systems diverts valuable financial and human capital from more innovative and profitable ventures.

Non-Core, Low-Return Investment Holdings

Beijing Enterprises Holdings, as a broad conglomerate, likely possesses a portfolio of smaller investments that don't align with its primary strategic focus and yield very low returns. These could be legacy assets or ventures in nascent stages that haven't yet proven their profitability.

If these particular holdings operate within sectors experiencing minimal growth and command an insignificant market share, they would be categorized as Dogs within the BCG Matrix. This classification highlights their poor performance and potential drain on resources.

- Low Growth Sector Presence: These investments are typically found in industries with limited expansion prospects, hindering their ability to generate substantial revenue.

- Negligible Market Share: Their competitive standing is weak, meaning they capture only a tiny fraction of the available market, further limiting upside potential.

- Capital Immobilization: Holding these assets ties up valuable capital that could be reinvested in more promising ventures, potentially boosting overall company performance.

- Strategic Divestment Consideration: Management often considers divesting or phasing out these Dog assets to streamline operations and reallocate capital more effectively.

Beijing Enterprises Holdings likely has several assets fitting the Dogs category in its diverse portfolio. These are typically ventures with low market share in low-growth industries, consuming resources without significant returns. For instance, certain legacy environmental projects or smaller real estate developments might fall into this classification, especially if they face technological obsolescence or market saturation. As of late 2024, the challenge for these assets is compounded by economic uncertainties and evolving technological demands.

| Asset Type | BCG Classification | Rationale | Potential Action |

|---|---|---|---|

| Legacy Environmental Tech | Dog | Low market share due to AI/ML competition; high maintenance costs. | Divestment or significant upgrade. |

| Underperforming Real Estate | Dog | Stagnant sales in saturated markets; declining property values. | Strategic sale or repositioning. |

| Minority Investments | Dog | Low growth sectors; negligible market share; capital immobilization. | Phased divestment or write-off. |

Question Marks

Beijing Enterprises is actively increasing its investment in hydrogen energy projects, recognizing the sector's immense growth potential. The company's current market share in this emerging field is likely low, placing these initiatives in the "Question Marks" category of the BCG matrix. Significant capital is needed to build capacity and establish a competitive foothold.

Beijing Enterprises is strategically investing in battery charging and replacement infrastructure, recognizing the significant growth potential fueled by the accelerating adoption of electric vehicles (EVs). This sector is experiencing rapid expansion, with global EV sales projected to reach 30 million units by 2024, up from approximately 10 million in 2022, highlighting the increasing demand for related services.

While the growth prospects are high, Beijing Enterprises likely holds a relatively small market share in this highly competitive and rapidly evolving market. The ventures require substantial capital infusion to establish a strong presence and achieve scalability amidst numerous established and emerging players in the EV charging and battery swapping ecosystem.

Beijing Enterprises is strategically venturing into integrated energy solutions, a sector characterized by its high growth potential and focus on energy efficiency. This segment combines diverse energy sources and services, aiming to optimize consumption and supply. In 2024, the global integrated energy solutions market was valued at approximately $1.2 trillion, with significant growth projected.

While this area presents substantial opportunities, Beijing Enterprises likely holds a relatively low market share given its nascent stage in this complex and competitive field. Significant strategic investment will be crucial for the company to establish a strong foothold and capture meaningful market presence in the integrated energy solutions space.

Photovoltaic (Solar) Projects

Beijing Enterprises' investment in photovoltaic projects positions them within a rapidly expanding global solar energy market, driven by the worldwide shift towards renewable energy. The International Energy Agency reported that renewable energy sources accounted for over 80% of global electricity capacity additions in 2023, with solar PV being a major contributor.

As Beijing Enterprises enters this dynamic sector, its photovoltaic projects are likely to be classified as Question Marks in the BCG matrix. This reflects the high growth potential of the solar market, but also the significant challenge of establishing a substantial market share against established players.

Consider these points for Beijing Enterprises' solar ventures:

- Market Growth: The global solar PV market is projected to reach $330.6 billion by 2026, according to Statista, indicating a strong growth trajectory.

- Competitive Landscape: Entry into this market requires substantial capital investment for scaling operations, technology development, and market penetration to compete effectively.

- Strategic Investment: Significant ongoing investment will be necessary to transform these Question Mark projects into Stars, requiring careful management and strategic positioning.

New Urban Services Projects (Post-Acquisition)

Beijing Enterprises Urban Resources Group significantly expanded its urban services portfolio in 2024, acquiring 64 new projects. This influx of new ventures, secured through public tenders and strategic acquisitions, positions the company for potential growth within the urban services sector. However, the immediate market share and profitability of these newly acquired assets remain to be determined, necessitating careful strategic planning.

These 64 new urban services projects, acquired in 2024, represent a classic example of potential Stars or Question Marks in the BCG Matrix. While they offer promising avenues for future revenue, their current market penetration and cash flow generation are not yet established. This phase requires significant investment and diligent operational oversight to nurture their development and assess their long-term viability.

- Acquisition Volume: 64 new urban services projects added in 2024.

- Growth Opportunity: Potential to capture increased market share in urban services.

- Uncertainty: Initial market share and profitability are not yet defined.

- Strategic Focus: Requires careful management and investment for integration and profitability.

Beijing Enterprises' ventures in hydrogen energy, battery charging, integrated energy solutions, and photovoltaic projects are all classified as Question Marks. These represent high-growth potential areas where the company is still establishing its market presence, requiring significant capital investment to compete effectively and transition into Stars.

The 64 new urban services projects acquired in 2024 also fall into the Question Mark category. While they offer future revenue potential, their current market penetration and profitability are not yet defined, necessitating strategic investment and careful management to assess their long-term viability.

| Business Area | BCG Category | Key Characteristics | Investment Need |

|---|---|---|---|

| Hydrogen Energy | Question Mark | High growth potential, low current market share | Significant capital for capacity building |

| Battery Charging & Replacement | Question Mark | Rapidly expanding market, competitive landscape | Substantial capital for market penetration |

| Integrated Energy Solutions | Question Mark | High growth, complex and competitive field | Crucial strategic investment for foothold |

| Photovoltaic Projects | Question Mark | Strong market growth, established competitors | Ongoing investment for market share gains |

| Urban Services (New Projects) | Question Mark | Promising future revenue, undefined market share | Careful management and investment for development |

BCG Matrix Data Sources

Our Beijing Enterprises BCG Matrix is built on comprehensive market data, including financial reports, industry growth rates, and competitor analysis to provide strategic insights.