Beijing Enterprises Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beijing Enterprises Bundle

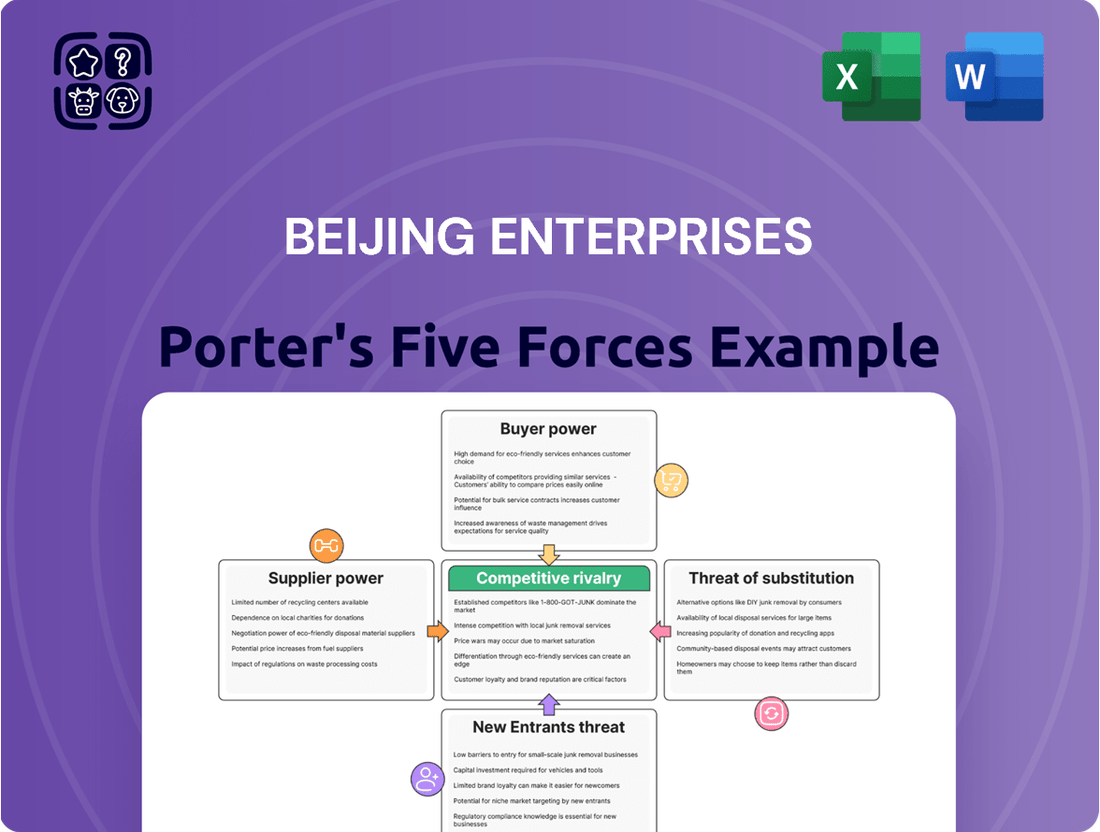

Beijing Enterprises faces a dynamic competitive landscape, with moderate bargaining power from both suppliers and buyers influencing its operations. The threat of new entrants is a significant factor, requiring continuous innovation and cost management.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Beijing Enterprises’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Beijing Enterprises Holdings' core natural gas business faces a significant challenge from supplier concentration. A few major upstream producers, both within China and internationally, control a substantial portion of the natural gas supply. This limited number of suppliers, including large state-owned enterprises and global liquefied natural gas (LNG) exporters, inherently grants them considerable leverage in negotiations.

This supplier power is particularly evident in the terms of long-term supply agreements and the pricing of natural gas. In 2023, China's reliance on imported LNG remained substantial, with imports accounting for a significant percentage of its total natural gas consumption, underscoring the influence of international suppliers. While China's efforts to boost domestic production and enhance energy security are ongoing, the dependence on these concentrated foreign sources continues to shape the bargaining dynamics.

The availability of substitute inputs significantly impacts the bargaining power of suppliers for Beijing Enterprises Holdings Limited (BEHL). While natural gas is a crucial input, the presence of alternatives like coal and renewable energy sources for industrial and power generation purposes can dilute the leverage of natural gas suppliers. If BEHL, or its customers, can readily switch to more cost-effective or accessible alternatives, it naturally weakens the negotiating position of gas providers.

For instance, in 2023, China's energy mix saw continued diversification. While natural gas consumption grew, coal remained a significant contributor to the power generation sector, especially in certain regions. This availability of coal as a substitute, particularly for large-scale industrial users, can cap the pricing power of natural gas suppliers. Similarly, the increasing investment and capacity in renewable energy sources like solar and wind power offer longer-term alternatives, further pressuring gas suppliers.

However, the extent to which these substitutes truly diminish supplier power for BEHL is nuanced. In many urban utility applications, such as residential heating and specific industrial processes, switching costs from natural gas to alternatives can be prohibitively high due to existing infrastructure and specialized equipment. This means that while substitutes exist, their practical adoption by BEHL or its end-users in certain segments remains limited, thereby preserving some degree of bargaining power for natural gas suppliers in those specific markets.

For Beijing Enterprises Holdings, the bargaining power of suppliers in its natural gas segment is significantly influenced by high switching costs. The intricate nature of natural gas distribution, requiring extensive pipeline infrastructure, adherence to long-term supply agreements, and navigating complex regulatory approvals, makes it exceptionally costly and time-consuming for Beijing Enterprises to change its gas suppliers. This inherent dependency on current providers amplifies their leverage.

Uniqueness of Supplier Offerings

For specialized equipment or advanced technologies in Beijing Enterprises' water treatment and environmental services, suppliers offering unique or proprietary solutions can wield significant bargaining power. This is because finding readily available alternatives for these critical inputs is challenging.

Conversely, for more commoditized inputs such as basic chemicals or standard construction materials, Beijing Enterprises faces considerably lower supplier power. The availability of numerous alternative suppliers for these items means that no single supplier can dictate terms easily.

- Specialized Technology: Suppliers of advanced membrane filtration systems or proprietary wastewater treatment chemicals can command higher prices due to limited alternatives.

- Commoditized Inputs: For bulk chemicals like chlorine or standard PVC pipes, a competitive market with many suppliers keeps prices in check.

- Supplier Concentration: In 2024, the global market for certain high-efficiency water treatment membranes was dominated by a few key players, indicating higher supplier power in that segment for Beijing Enterprises.

Supplier's Threat of Forward Integration

The threat of suppliers integrating forward into Beijing Enterprises Holdings' (BEHL) core distribution and utility services is generally low. This is primarily due to the substantial capital requirements and the heavily regulated environment governing these sectors in China. For instance, the national grid and water infrastructure development often involve multi-billion dollar investments and long-term government concessions, making it a difficult undertaking for typical commodity suppliers.

Furthermore, Beijing Enterprises Holdings benefits from its established market presence and strong relationships within the Chinese utility landscape. The government's stringent oversight and licensing requirements for utility operations act as significant barriers. In 2024, China continued its focus on state-controlled infrastructure, reinforcing the challenges for private or supplier-driven forward integration in these critical sectors.

- Low Likelihood of Supplier Forward Integration: The high capital expenditure and regulatory hurdles in China's utility sector make it improbable for BEHL's natural gas and water treatment suppliers to move into distribution.

- Government Oversight as a Deterrent: China's robust regulatory framework and state control over essential utilities significantly discourage new entrants, including suppliers, from integrating forward.

- BEHL's Market Position: BEHL's long-standing market share and operational expertise in its core businesses further solidify its competitive advantage against potential supplier encroachment.

Beijing Enterprises Holdings' natural gas segment faces considerable supplier power due to a concentrated supply base, particularly for imported liquefied natural gas (LNG). While domestic production is growing, reliance on a few large international exporters in 2023 meant these suppliers could dictate terms. High switching costs, stemming from extensive pipeline infrastructure and long-term contracts, further cement their leverage.

In contrast, suppliers for commoditized inputs in BEHL's water treatment business, like standard chemicals, have minimal power due to a competitive market with many providers. However, suppliers of specialized technologies, such as advanced membrane filtration systems, can exert significant influence. For example, in 2024, a few dominant global players controlled the market for high-efficiency water treatment membranes, granting them pricing power.

The bargaining power of suppliers for Beijing Enterprises Holdings is notably high in its core natural gas operations. This is largely driven by the concentration of upstream producers, both domestic and international, who supply the bulk of the gas. For instance, in 2023, China's significant reliance on imported LNG meant that a limited number of global exporters held substantial sway over pricing and contract terms.

Furthermore, the substantial investments required for natural gas infrastructure, including pipelines and storage, create high switching costs for BEHL. These costs make it difficult and expensive to change suppliers, thereby strengthening the position of existing providers. This dynamic is particularly pronounced for long-term supply agreements, where suppliers can negotiate favorable terms due to BEHL's dependence.

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Beijing Enterprises' diverse portfolio of businesses, including utilities and consumer products.

Effortlessly navigate competitive landscapes by visualizing the intensity of each Porter's Five Forces for Beijing Enterprises, offering immediate clarity on strategic vulnerabilities.

Customers Bargaining Power

Beijing Enterprises Holdings serves a massive customer base across its gas, water, and environmental services. While the company boasts millions of residential users, their individual impact on pricing is minimal, especially given the essential nature of these utilities and often limited alternative providers in specific regions. This broad residential reach, however, contributes to the company's overall revenue stability.

Conversely, large industrial and commercial clients, or even major municipal contracts, can wield significant bargaining power. Their substantial consumption volumes mean that losing even one such customer could represent a considerable revenue loss, compelling Beijing Enterprises to offer more favorable terms or pricing to retain them. For instance, in 2023, industrial gas consumption represented a significant portion of Beijing Enterprises' gas segment revenue, highlighting the importance of these larger accounts.

For core utility services like piped natural gas and water supply, direct substitutes are scarce, particularly for residential consumers where existing infrastructure heavily influences availability. This lack of readily available alternatives strengthens Beijing Enterprises' position.

Industrial clients, however, possess more options. They can explore alternative energy sources such as coal or electricity for heating and power generation, introducing a degree of substitutability for natural gas. In 2023, China's coal production reached approximately 4.7 billion tonnes, highlighting its significant presence as an energy alternative.

Regarding environmental services, while crucial, there's a potential for demand shifts as businesses increasingly implement in-house waste reduction and recycling programs. This trend could marginally impact the bargaining power of customers in this segment.

For Beijing Enterprises Holdings Limited (BEHL), residential customers for gas and water exhibit price sensitivity, but government regulation of utility prices significantly moderates this influence on BEHL's revenue per unit. This means while customers might prefer lower prices, the actual pricing is largely determined by regulatory bodies, not direct market negotiation.

Industrial and commercial clients, however, can display greater price sensitivity. If utility expenses represent a substantial part of their operational costs, these customers may engage in negotiations. These discussions still occur within the boundaries set by regulatory frameworks, ensuring that any price adjustments are managed and approved by the relevant authorities.

Customer's Threat of Backward Integration

The threat of Beijing Enterprises' customers, such as industrial users or municipalities, integrating backward to provide their own gas, water, or waste treatment services is exceptionally low. The immense capital expenditure needed for such infrastructure, estimated in the billions of dollars for a single utility, presents a formidable barrier.

For instance, establishing a new gas distribution network can cost upwards of $10 billion, and water treatment facilities require significant ongoing investment in technology and maintenance. These financial outlays, coupled with the need for specialized technical expertise and navigating complex regulatory landscapes, render backward integration highly impractical for the vast majority of Beijing Enterprises' customer base.

This low threat of backward integration significantly diminishes the bargaining power of customers, as they are largely reliant on Beijing Enterprises for essential services.

- High Capital Investment: Building new utility infrastructure often requires billions in capital, making it prohibitive for most customers.

- Technical Expertise Required: Operating and maintaining these complex systems demands specialized knowledge and skilled personnel.

- Regulatory Hurdles: Obtaining permits and complying with stringent environmental and safety regulations adds significant complexity and cost.

- Economies of Scale: Existing utility providers like Beijing Enterprises benefit from economies of scale, making their per-unit costs lower than what a new entrant could achieve.

Government Regulation and Policy

The Chinese government's influence over utility tariffs and service standards significantly shapes customer bargaining power in the gas sector. For instance, policies enacted in 2024 to gradually liberalize natural gas pricing, while aiming for market efficiency, also provide avenues for customers to benefit from lower wholesale costs if supply outpaces demand.

Government directives on environmental protection and energy efficiency can also impact Beijing Enterprises' operations and, by extension, customer costs. Initiatives promoting the use of cleaner energy sources or mandating specific service quality levels, as seen in urban development plans for 2024-2025, can indirectly empower customers by influencing the overall cost structure and service offerings.

- Government Oversight: Beijing Enterprises operates within a heavily regulated environment where the National Development and Reform Commission (NDRC) sets key pricing and operational guidelines for the gas industry.

- Tariff Adjustments: In 2024, the NDRC continued its policy of phased adjustments to residential gas prices, balancing affordability for consumers with the need for utility companies to recover costs and invest in infrastructure.

- Service Standards: Government policies also dictate minimum service standards, including supply reliability and safety protocols, which customers can leverage to ensure adequate service delivery.

Beijing Enterprises' customers, particularly large industrial and commercial entities, possess moderate bargaining power, primarily due to their significant consumption volumes. However, this power is tempered by the essential nature of utility services and regulatory price controls. For instance, in 2023, industrial gas consumption was a key revenue driver for the gas segment, underscoring the importance of these large clients.

The threat of backward integration by customers is extremely low due to the massive capital investment and technical expertise required to establish utility infrastructure, estimated to be in the billions of dollars. This reliance on Beijing Enterprises for essential services significantly limits customer leverage.

Government oversight plays a crucial role in moderating customer bargaining power. Policies enacted in 2024, such as phased natural gas price adjustments by the NDRC, balance consumer affordability with company investment needs. These regulations, alongside service standard mandates, shape the negotiation landscape.

| Customer Segment | Bargaining Power Factor | Mitigating Factors for Beijing Enterprises | Example Data (2023/2024) |

| Residential | Low (individually) | Essential service, limited alternatives, regulatory pricing | Millions of users, price sensitivity moderated by NDRC tariffs |

| Industrial/Commercial | Moderate | High consumption volume, potential for alternative energy sources | Significant portion of gas segment revenue, China's coal production ~4.7 billion tonnes (2023) |

| Overall | Low to Moderate | High CAPEX for backward integration, government regulation, economies of scale | Infrastructure costs > $10 billion for new gas networks |

Same Document Delivered

Beijing Enterprises Porter's Five Forces Analysis

This preview shows the exact, comprehensive Porter's Five Forces analysis of Beijing Enterprises you'll receive immediately after purchase. It details the competitive landscape, including the bargaining power of suppliers and buyers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. You'll gain direct access to this professionally formatted document, ensuring no surprises or placeholders.

Rivalry Among Competitors

Beijing Enterprises Holdings faces a dynamic competitive landscape across its diverse business segments. In the utilities sector, particularly gas and water supply, while major state-owned entities hold significant sway, the presence of numerous regional players and the ongoing liberalization of markets in 2024 introduce a notable degree of rivalry.

The environmental services sector, especially waste management, presents a more fragmented picture. This market is experiencing robust growth, attracting a multitude of local and international companies, leading to intensified competition for contracts and market share. For instance, the increasing focus on circular economy initiatives and advanced waste treatment technologies in China during 2024 has spurred new entrants and innovation among existing participants.

The natural gas and environmental services sectors in China are seeing consistent expansion, fueled by increasing urbanization and supportive environmental regulations. This growth environment can help to moderate the severity of price-driven competition. For instance, China's natural gas consumption grew by approximately 10.5% in 2023, indicating robust demand.

Conversely, the water sector, particularly in more developed urban areas, might exhibit slower growth rates. This maturity in some segments of the water market could translate into more pronounced competitive pressures as companies vie for market share.

In utility sectors like gas and water, product differentiation is minimal; instead, competitive advantage stems from network reach, service reliability, and customer support. Beijing Enterprises Holdings Limited (BEHL) leverages its extensive infrastructure, including a vast gas pipeline network, to offer reliable service across its operating regions. This broad coverage acts as a significant differentiator in a market where accessibility is paramount.

For environmental services, differentiation often hinges on technological sophistication and the comprehensiveness of the solutions offered. BEHL's involvement in waste-to-energy projects, for instance, showcases differentiation through advanced processing technologies and integrated waste management approaches. The company's commitment to operational efficiency in these areas further distinguishes its offerings.

Exit Barriers

Beijing Enterprises Holdings, operating in sectors like water and waste management, faces significant exit barriers. The substantial capital investment required for infrastructure such as pipelines and treatment plants locks companies into the industry. For instance, in 2023, Beijing Enterprises invested heavily in upgrading its water treatment facilities, a commitment that makes exiting the market extremely costly.

Furthermore, long-term concession agreements, often spanning decades, bind companies to their operational commitments. These agreements, common in public utility services, mean that even if market conditions deteriorate, companies like Beijing Enterprises are contractually obligated to continue operations. This persistence in the face of adversity can intensify competitive rivalry, as firms are less likely to withdraw.

The high fixed costs associated with specialized infrastructure and the lengthy nature of concession contracts contribute to a situation where existing players are compelled to remain competitive. This dynamic can lead to prolonged price competition or service level battles, as firms strive to maintain market share and recover their substantial investments, rather than seeking an exit.

- High Capital Investment: Significant upfront costs for infrastructure like pipelines and treatment plants create a financial trap, making divestment difficult.

- Long-Term Concessions: Contractual obligations for decades limit flexibility and discourage premature exit, even during economic downturns.

- Intensified Rivalry: The inability to easily exit forces companies to compete more aggressively within the existing market structure.

Strategic Stakes

Beijing Enterprises Holdings, as a significant state-owned enterprise, operates with a dual mandate that extends beyond maximizing profits. Its strategic importance to Beijing's public service provision and national development objectives can temper aggressive competitive tactics. This often translates to a more stable competitive landscape, particularly in essential utility sectors where stability and public welfare are paramount.

This strategic positioning can influence how Beijing Enterprises interacts with rivals. Instead of engaging in intense price wars or aggressive market share grabs, the company might focus on operational efficiency and reliable service delivery. For instance, in the gas distribution sector, where Beijing Enterprises is a major player, competition often centers on regulatory frameworks and infrastructure development rather than disruptive market entry strategies.

The company's role in ensuring energy security for the capital city means its strategic decisions are often aligned with broader government policies. This can create a less volatile competitive environment compared to purely private sector-driven markets. In 2023, Beijing Enterprises' revenue from its gas business, a core utility, remained robust, reflecting the stable demand and less cutthroat competitive dynamics in this essential service area.

- State-Owned Mandate: Strategic importance for public service and national development influences competitive behavior.

- Stability Over Aggression: Prioritizes stable operations and public welfare over aggressive market share pursuit.

- Utility Sector Focus: Leads to a more predictable competitive environment in core utility businesses.

- 2023 Performance: Robust revenue in the gas sector highlights stable demand and competitive dynamics.

Beijing Enterprises Holdings faces varied competitive rivalry across its segments. In utilities, while state-owned firms dominate, numerous regional players and market liberalization in 2024 are increasing competition. The environmental services sector, particularly waste management, is more fragmented, attracting many local and international firms due to strong growth and innovation in areas like waste-to-energy projects, a trend highlighted by China's increasing focus on circular economy initiatives in 2024.

The natural gas and environmental services sectors in China are experiencing significant growth, with natural gas consumption rising about 10.5% in 2023. This expansion, driven by urbanization and supportive environmental policies, helps moderate intense price competition. However, mature segments within the water sector, especially in developed urban areas, may see more pronounced rivalry as companies fight for market share.

Competitive advantage in utilities for Beijing Enterprises hinges on network reach and service reliability, leveraging its extensive gas pipeline infrastructure. In environmental services, differentiation comes from technological sophistication and integrated solutions, such as waste-to-energy projects. High exit barriers, due to substantial capital investment in infrastructure and long-term concession agreements, compel existing firms to remain competitive, potentially intensifying rivalry.

| Business Segment | Key Competitive Factors | Rivalry Intensity | 2024 Outlook |

|---|---|---|---|

| Natural Gas Utilities | Network reach, service reliability, regulatory framework | Moderate to High | Stable demand, ongoing liberalization may increase competition |

| Water Utilities | Infrastructure, service reliability, operational efficiency | Moderate to High (higher in mature markets) | Mature markets may see intensified competition for market share |

| Environmental Services (Waste Management) | Technology, service comprehensiveness, contract acquisition | High | Strong growth attracting new entrants and driving innovation |

SSubstitutes Threaten

For Beijing Enterprises, the threat of substitutes in the natural gas market is significant, primarily from coal and electricity. While coal has historically been a cheaper alternative, China's stringent environmental regulations and ambitious decarbonization targets, aiming for peak carbon emissions before 2030 and carbon neutrality by 2060, are increasingly pushing industries away from coal. This shift benefits natural gas, positioning it as a cleaner transitional fuel.

Electricity, especially from renewable sources like solar and wind, is emerging as a powerful substitute, particularly in power generation and heating. The cost-effectiveness and efficiency of renewables have seen substantial growth. For instance, by the end of 2023, China's installed renewable energy capacity surpassed 1.4 billion kilowatts, demonstrating a rapid expansion that directly challenges natural gas's market share in these sectors.

Customer propensity to substitute varies significantly depending on the specific service Beijing Enterprises offers. For residential heating, customers might consider electric heaters or even wood-burning stoves as alternatives to district heating, especially if there are significant price discrepancies or service interruptions.

In industrial settings, the decision to switch energy sources for heating or power is heavily influenced by economic factors and regulatory requirements. For example, a manufacturing plant might evaluate the total cost of ownership, including fuel, maintenance, and emissions compliance, when deciding between natural gas, electricity, or even renewable energy sources. In 2023, the average industrial electricity price in China was approximately ¥0.70 per kilowatt-hour, a factor that would heavily influence substitution decisions.

For water services, particularly potable water, direct substitution is extremely limited due to its essential nature. However, for non-potable uses like irrigation or industrial processes, alternative sources such as recycled water or treated wastewater could be considered, though infrastructure and quality standards are key determinants.

New technologies are a significant threat of substitution for Beijing Enterprises. Advances in renewable energy sources, like solar and wind, continue to lower costs, making them increasingly competitive with traditional energy generation methods. For example, the global renewable energy capacity saw substantial growth in 2023, with solar PV installations alone adding over 300 GW worldwide, according to the International Energy Agency.

Similarly, breakthroughs in energy storage technologies, such as improved battery efficiency and longer lifespans, reduce the intermittency issues associated with renewables, further strengthening their substitution potential. The energy storage market is projected to grow significantly, with global capacity expected to reach over 1,400 GW by 2030, indicating a strong trend away from conventional power sources.

Furthermore, innovations in water recycling and reuse technologies present a substitution threat to traditional water supply and treatment methods. As water scarcity becomes a more pressing issue globally, these advanced solutions offer more sustainable and potentially cost-effective alternatives for industrial and municipal use, impacting Beijing Enterprises' water utility operations.

Government Policy and Environmental Concerns

Government policies are a significant driver in the threat of substitutes for Beijing Enterprises, particularly in its energy and environmental segments. China's ambitious goals, such as achieving carbon neutrality by 2060 and the 'Beautiful China' initiative, directly encourage alternatives to traditional energy sources and waste management practices. This creates a strong impetus for adopting renewable energy and advanced resource recovery technologies, which can directly substitute for Beijing Enterprises' existing offerings.

These policy shifts are not merely aspirational; they are backed by substantial investment and regulatory frameworks. For instance, the rapid growth in China's renewable energy sector, with solar and wind power capacity expanding significantly in recent years, demonstrates the tangible impact of these policies. By 2023, China's installed renewable energy capacity surpassed 1.3 billion kilowatts, a clear indication of the accelerating adoption of substitutes.

The emphasis on environmental protection and resource efficiency also pushes for substitutes in waste management. Beijing Enterprises, historically involved in traditional waste incineration and landfill, faces increasing pressure to adopt circular economy principles and advanced recycling methods. This regulatory push makes innovative waste-to-energy solutions and sophisticated recycling technologies more competitive and appealing substitutes.

- Government Mandates: Policies promoting renewable energy sources like solar and wind directly challenge fossil fuel-based energy generation.

- Environmental Regulations: Stricter rules on emissions and waste disposal incentivize the adoption of cleaner technologies and resource recovery methods.

- Investment in Alternatives: Government funding and incentives for green technologies accelerate the development and deployment of substitute products and services.

- Shifting Consumer Preferences: Growing public awareness, often amplified by government campaigns, drives demand for environmentally friendly options.

Impact on Core Business Segments

The threat of substitutes is most significant for Beijing Enterprises Holdings Limited (BEHL) in its natural gas segment. The increasing promotion and adoption of alternative energy sources, such as solar and wind power, directly challenge the demand for natural gas. For instance, in 2024, China continued its aggressive push towards renewable energy, with installations of solar and wind power capacity seeing substantial year-on-year growth, potentially impacting BEHL's gas consumption forecasts.

While BEHL's water and environmental services segments face fewer direct substitutes, indirect impacts are possible. A heightened societal focus on water conservation, driven by environmental awareness and potential regulatory changes in 2024, could lead to reduced overall demand for water supply and treatment services. Similarly, increased emphasis on waste reduction and circular economy principles might indirectly affect the volume of waste requiring BEHL's processing services.

BEHL's diversified business model, encompassing natural gas, water, and environmental services, is a key mitigating factor against the threat of substitutes. This diversification allows the company to spread the risk across different utility sectors, reducing its overall vulnerability to shifts in any single market. For example, while gas demand might face pressure, growth in water infrastructure projects or environmental remediation services could offset these challenges.

- Natural Gas Substitution: Growing adoption of renewables like solar and wind power presents a direct substitute threat to BEHL's natural gas business.

- Water Conservation Impact: Increased water conservation efforts and waste reduction initiatives could indirectly reduce demand for BEHL's water and environmental services.

- Diversification as a Mitigator: BEHL's broad portfolio across gas, water, and environmental services helps to spread the risk associated with substitutes.

The threat of substitutes for Beijing Enterprises is most pronounced in its natural gas operations, where renewable energy sources like solar and wind are increasingly competitive. China's ongoing commitment to decarbonization, evidenced by substantial investments in green energy infrastructure throughout 2023 and into 2024, directly challenges natural gas demand.

While electricity from renewables is a growing substitute, coal remains a significant alternative, particularly for industrial heating, though environmental policies are gradually curtailing its use. For Beijing Enterprises' water services, direct substitution is minimal, but water conservation efforts could indirectly impact demand.

New technologies in energy storage and water recycling further bolster the substitute threat, making cleaner and more efficient alternatives more viable. Government policies actively promote these substitutes, creating a dynamic market environment for Beijing Enterprises.

| Substitute Type | Key Drivers | Impact on Beijing Enterprises |

| Renewable Energy (Solar, Wind) | Government subsidies, falling technology costs, decarbonization goals | Directly competes with natural gas for power generation and heating. |

| Coal | Historically lower cost, existing infrastructure | Still a substitute for industrial uses, but facing regulatory headwinds. |

| Energy Storage | Improved battery technology, grid stability needs | Enhances the viability of intermittent renewables, increasing their substitution potential. |

| Water Recycling/Conservation | Water scarcity, environmental awareness, regulatory pressure | Indirectly reduces demand for traditional water supply services. |

Entrants Threaten

The capital requirements for entering China's gas and water utility sectors are exceptionally high. Building extensive pipeline networks, advanced treatment plants, and robust distribution systems demands billions of dollars in upfront investment. For instance, China's urban water supply infrastructure alone saw significant investment, with total fixed asset investment in the sector reaching approximately 250 billion yuan in 2023, highlighting the scale of capital needed.

Similarly, the environmental services sector, particularly waste-to-energy projects, necessitates substantial capital expenditure. Establishing modern waste-to-energy facilities, which often involve complex technology and large-scale operations, can cost hundreds of millions of dollars per plant. This immense financial barrier effectively deters many potential new entrants from challenging established players like Beijing Enterprises.

The Chinese utility sector, including areas where Beijing Enterprises operates, is heavily regulated. This means new companies need numerous licenses, permits, and government approvals, creating a significant barrier. For instance, in 2023, the National Development and Reform Commission (NDRC) continued to refine policies for renewable energy project approvals, emphasizing stringent environmental and technical standards.

As a state-owned enterprise, Beijing Enterprises Holdings has an advantage due to its existing relationships with government bodies and alignment with national policies. This established presence makes it difficult for new entrants to gain the necessary approvals and navigate the intricate regulatory framework. While there are ongoing efforts to open up the market, such as the pilot programs for private participation in certain infrastructure projects announced in late 2023, these still involve substantial government oversight and control.

Beijing Enterprises Holdings benefits from substantial economies of scale across its diverse utility operations, including gas, water, and environmental services, spanning China and international markets. This scale allows for significant cost efficiencies in procurement, infrastructure development, and operational management, making it challenging for new players to match its cost structure. For instance, in 2023, the company reported revenue of approximately HKD 109.8 billion, underscoring the breadth of its operations.

New entrants would face considerable hurdles in replicating Beijing Enterprises' operational experience and the associated cost advantages. Building a comparable network and expertise takes substantial time and investment, creating a high barrier to entry. This experience translates into optimized service delivery and a deeper understanding of regulatory landscapes, which are difficult for newcomers to quickly acquire.

Access to Distribution Channels and Resources

Established players like Beijing Enterprises Holdings Limited (BEHL) have already built extensive and often exclusive access to vital distribution channels. For instance, BEHL's vast city gas pipeline network across numerous Chinese municipalities represents a significant barrier. In 2023, BEHL reported serving over 28 million gas customers, highlighting the sheer scale of its existing infrastructure.

Securing reliable access to essential resources, such as natural gas supply contracts and water sources, is another formidable hurdle for potential new entrants. BEHL's long-term agreements with major gas suppliers provide a stable and cost-effective resource base. The capital investment required to replicate these secured resource streams and distribution networks would be substantial, likely running into billions of dollars for a new competitor aiming for comparable market reach.

- High Capital Investment: Replicating BEHL's extensive gas pipeline network, which serves millions of customers, requires immense upfront capital.

- Secured Resource Access: BEHL benefits from established, long-term contracts for natural gas supply, a critical resource that new entrants would struggle to secure on favorable terms.

- Regulatory Hurdles: Gaining approval to build and operate new distribution infrastructure, especially in densely populated urban areas, involves complex and time-consuming regulatory processes.

- Economies of Scale: BEHL's large operational scale allows for cost efficiencies in resource procurement and distribution that new, smaller entrants cannot immediately match.

Brand Identity and Customer Loyalty

While utilities may not inspire the same fervor as consumer brands, reliability and trust are paramount. Beijing Enterprises Holdings, benefiting from its extensive history and governmental affiliations, has cultivated a robust reputation for dependable service delivery. This established trust presents a significant hurdle for newcomers aiming to quickly win over customers.

- Established Reputation: Beijing Enterprises' long operational history fosters customer confidence.

- Government Backing: State support enhances perceived stability and reliability.

- Customer Inertia: Switching utility providers often involves hassle, encouraging existing customer retention.

- Service Quality: Consistent delivery of essential services reinforces customer loyalty.

The threat of new entrants for Beijing Enterprises Holdings is relatively low, primarily due to the immense capital requirements and stringent regulatory environment in China's utility sectors. Building out infrastructure like gas pipelines or water treatment facilities demands billions, a scale few new companies can match. For example, China's fixed asset investment in water supply infrastructure alone reached approximately 250 billion yuan in 2023, illustrating the financial commitment needed.

Furthermore, Beijing Enterprises benefits from established government relationships and economies of scale, making it difficult for newcomers to compete on cost or navigate the approval processes. Their extensive operational history and secured resource access, such as long-term gas supply contracts, create significant barriers that new entrants would struggle to overcome. In 2023, Beijing Enterprises reported serving over 28 million gas customers, showcasing their market penetration.

| Barrier to Entry | Description | Impact on New Entrants | Example Data (2023) |

|---|---|---|---|

| Capital Investment | Building utility infrastructure requires massive upfront capital. | Deters most potential entrants. | ~250 billion yuan in water infrastructure investment. |

| Regulatory Hurdles | Obtaining licenses and permits is complex and time-consuming. | Slows down or prevents market entry. | Stringent standards for renewable energy project approvals. |

| Economies of Scale | Large-scale operations lead to cost efficiencies. | New entrants cannot match cost structure. | ~HKD 109.8 billion in revenue for Beijing Enterprises. |

| Resource Access | Securing reliable supply contracts is difficult. | Limits operational capacity and cost competitiveness. | Serving over 28 million gas customers. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Beijing Enterprises is built upon a foundation of publicly available data, including their annual reports, investor presentations, and official company announcements. We also incorporate insights from reputable industry research firms and financial news outlets to provide a comprehensive view of the competitive landscape.