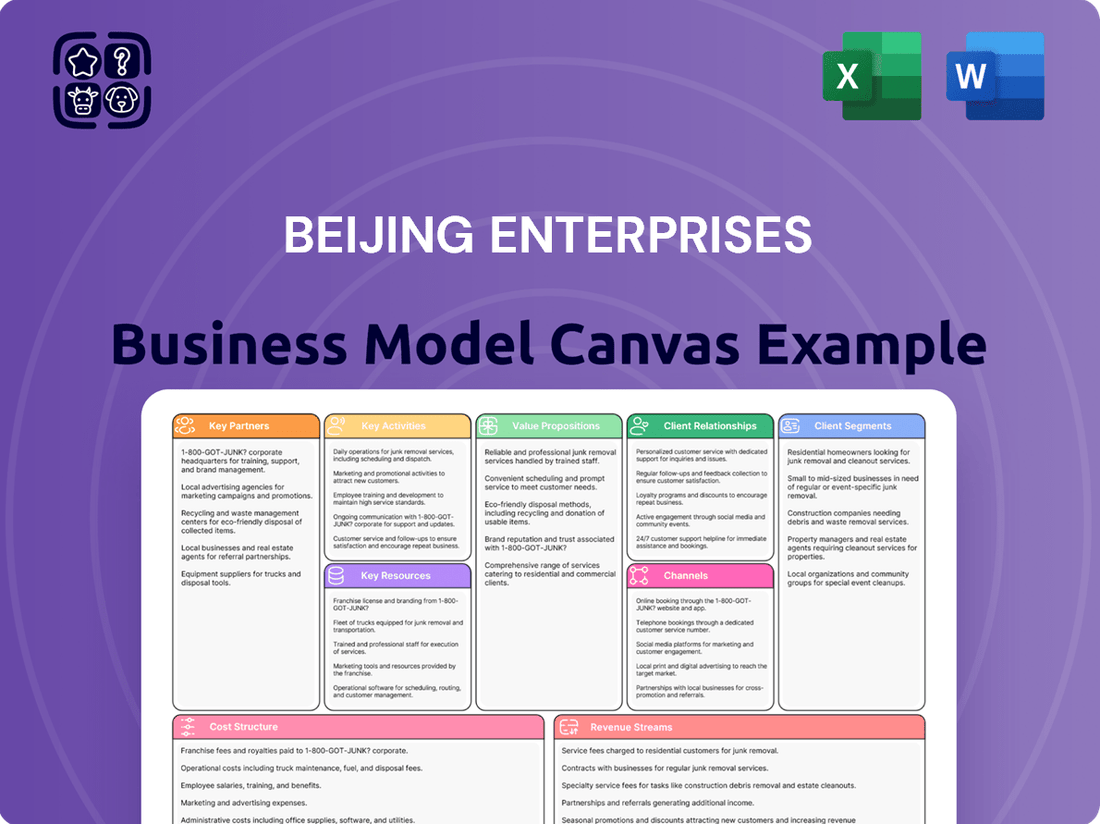

Beijing Enterprises Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beijing Enterprises Bundle

Unlock the full strategic blueprint behind Beijing Enterprises's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Beijing Enterprises Holdings Limited (BEHL) relies heavily on its relationships with government entities and regulators across China. These partnerships are fundamental for obtaining essential licenses and permits to operate in its core sectors like gas, water, and environmental services. For instance, securing long-term concession agreements for vital infrastructure projects, such as gas pipeline expansion or water treatment facilities, is directly facilitated by these governmental collaborations. In 2023, BEHL's gas segment, a key area of government interaction, contributed significantly to its revenue, highlighting the importance of regulatory alignment.

Beijing Enterprises Holdings Limited (BEHL) actively collaborates with local municipalities and urban developers to drive sustainable urban growth. These partnerships are crucial for extending BEHL's utility networks, such as gas and water infrastructure, into burgeoning urban areas, supporting the expansion of essential services.

These collaborations are vital for integrating advanced environmental solutions within smart city initiatives. For instance, BEHL's involvement in projects contributing to Beijing's environmental targets, such as the city's commitment to reducing PM2.5 levels, often involves close cooperation with municipal planning bodies and developers in new district constructions.

Partnership models frequently include joint ventures for developing new infrastructure projects, ensuring alignment with urban planning goals and BEHL's strategic objectives. Additionally, service provision contracts for large-scale residential or commercial developments solidify these relationships, allowing BEHL to deliver its core utility and environmental services efficiently.

Beijing Enterprises Holdings Limited (BEHL) collaborates with key technology and equipment suppliers to ensure its operations remain at the forefront of efficiency and innovation. These partnerships are crucial for areas such as waste-to-energy, advanced water treatment, and smart gas grids, enabling BEHL to integrate the latest advancements.

For instance, in 2024, BEHL continued to invest in upgrading its waste-to-energy facilities, relying on suppliers for advanced combustion and emissions control technologies. Similarly, its water treatment segment benefits from partnerships providing state-of-the-art membrane filtration and purification systems, vital for meeting stringent environmental standards.

These collaborations often involve joint research and development initiatives or technology licensing agreements, ensuring BEHL has access to cutting-edge solutions. Long-term procurement contracts also play a role, guaranteeing a steady supply of specialized equipment necessary for maintaining and expanding its infrastructure.

Financial Institutions and Investors

Beijing Enterprises relies heavily on financial institutions and investors for its extensive infrastructure projects. These partnerships are crucial for raising the substantial capital needed for development and expansion. For instance, securing loans from major banks and investment funds allows the company to finance large-scale undertakings like utility networks and transportation systems.

Furthermore, relationships with institutional investors, including pension funds and asset managers, are key to issuing bonds and attracting equity. This diverse funding base helps optimize Beijing Enterprises' capital structure. In 2023, the company successfully raised approximately HKD 10 billion through various debt issuances to support its ongoing capital expenditure plans.

- Bank Loans: Essential for project-specific financing and working capital needs.

- Bond Issuances: Provides long-term funding for infrastructure development and refinancing.

- Equity Investments: Attracts capital from institutional and strategic investors for growth initiatives.

- Financial Advisory Services: Leverages expertise for capital structuring and risk management.

Strategic Industry Partners and Joint Ventures

Beijing Enterprises Holdings Limited (BEHL) actively cultivates strategic industry partnerships and joint ventures to bolster its market presence and operational capabilities. These collaborations are crucial for expanding its reach both within China and globally, effectively sharing the inherent risks of large-scale projects, and capitalizing on the specialized knowledge of its partners.

A prime example of BEHL's strategic alliances is its significant equity stake in China Gas Holdings Limited. This partnership allows BEHL to tap into China Gas's extensive distribution network and customer base, enhancing its own market penetration in the vital natural gas sector. Such alliances are fundamental to BEHL's strategy of deepening its engagement in key energy markets.

Further underscoring this approach, BEHL engages in collaborative ventures focused on natural gas transmission infrastructure. These joint efforts enable the company to leverage shared expertise and capital investment, facilitating the development and operation of critical energy pipelines. By participating in these alliances, BEHL not only diversifies its business operations but also strengthens its position as a key player in China's energy landscape.

- Equity Stake in China Gas Holdings: This partnership provides BEHL with access to a vast retail network and a substantial customer base, crucial for its downstream gas operations.

- Collaborations in Natural Gas Transmission: Joint ventures in pipeline infrastructure development allow for risk sharing and the efficient expansion of natural gas delivery networks.

- International Partnerships: BEHL seeks alliances with international players to gain access to advanced technologies and explore new market opportunities beyond China.

Key partnerships for Beijing Enterprises Holdings Limited (BEHL) are essential for its infrastructure development and operational efficiency. These include collaborations with financial institutions for capital raising, government entities for regulatory approvals and concessions, and industry peers for market expansion and risk sharing.

BEHL's strategic alliances, such as its stake in China Gas Holdings, are vital for expanding its reach in the natural gas sector. These partnerships leverage shared expertise and networks to enhance market penetration and operational capabilities.

Furthermore, collaborations with technology and equipment suppliers are critical for integrating advanced solutions in waste-to-energy and water treatment, ensuring BEHL remains at the forefront of innovation.

| Partner Type | Purpose | Example | 2023/2024 Impact |

|---|---|---|---|

| Government Entities | Licenses, Concessions, Regulatory Alignment | Concession agreements for gas pipelines | Gas segment revenue significant; alignment crucial for operations. |

| Municipalities & Developers | Urban network expansion, Smart City Integration | Extending utility networks into new districts | Facilitates service delivery in growing urban areas. |

| Technology Suppliers | Operational Efficiency, Innovation | Advanced waste-to-energy or water treatment tech | Investments in facility upgrades relying on supplier tech. |

| Financial Institutions | Capital Raising, Financing | Bank loans, bond issuances | Raised ~HKD 10 billion in 2023 for CAPEX. |

| Industry Peers | Market Expansion, Risk Sharing | Equity stake in China Gas Holdings | Access to extensive distribution network and customer base. |

What is included in the product

A meticulously crafted Business Model Canvas for Beijing Enterprises, detailing its diverse customer segments, multi-channel approach, and multifaceted value propositions across its energy, water, and environmental protection businesses.

This model offers a strategic overview of Beijing Enterprises' operations, highlighting key resources, activities, and partnerships that drive its integrated approach to providing essential public services.

Beijing Enterprises' Business Model Canvas acts as a pain point reliever by visually mapping out customer segments and value propositions, ensuring the company addresses specific market needs effectively.

It simplifies complex strategies into a clear, actionable framework, reducing the pain of strategic ambiguity and facilitating focused execution.

Activities

Beijing Enterprises' core activities revolve around the distribution and sale of piped natural gas. This involves managing a vast network of pipelines to deliver gas to residential, commercial, and industrial users. The company focuses on ensuring a dependable supply and expanding its infrastructure to cater to increasing demand.

In 2023, Beijing Enterprises Gas Holdings Limited reported that its gas sales volume reached 24.7 billion cubic meters, a significant increase reflecting the growing reliance on natural gas. This expansion is supported by ongoing investments in pipeline construction and upgrades to enhance delivery efficiency and reach.

Beyond just supplying gas, the company offers value-added services. These include providing gas technology consultation and essential maintenance for its customers, further solidifying its role as a comprehensive energy provider.

Beijing Enterprises Holdings Limited (BEHL) is deeply involved in water treatment, encompassing sewage treatment, water distribution, and the processing of reclaimed water. These operations are vital for maintaining public health and supporting the growth of urban areas.

Beyond water, BEHL's environmental services include solid waste management, specifically waste incineration and the subsequent generation of power from this process. This dual approach addresses waste disposal challenges while contributing to renewable energy sources.

In 2024, BEHL's commitment to environmental services is underscored by its extensive infrastructure. For instance, the company operates numerous water treatment plants across various cities, handling significant volumes of wastewater daily to meet stringent environmental standards.

Beijing Enterprises' brewery operations, spearheaded by Yanjing Brewery, are central to its business. This segment is dedicated to the entire lifecycle of beer products, from brewing and rigorous quality control to extensive marketing efforts and the management of a vast distribution network spanning across China.

In 2023, Yanjing Brewery, a key player in the Chinese beer market, continued to be a significant contributor to Beijing Enterprises' overall performance. The company’s commitment to maintaining high production standards and innovative marketing strategies has solidified its presence in a competitive landscape.

Infrastructure Investment and Management

Beijing Enterprises Holdings Limited (BEHL) actively invests in and manages a diverse infrastructure portfolio, focusing on essential utility and environmental services. This strategic involvement encompasses the entire lifecycle of projects, from initial development and construction through to ongoing operation. These long-term capital commitments are fundamental to building and expanding the company's robust asset base.

The company's key activities in this domain include the development, construction, and operation of critical infrastructure. This involves significant projects such as extensive gas pipeline networks, advanced water treatment facilities, and modern waste-to-energy plants. For instance, in 2024, BEHL continued to expand its gas pipeline network, reaching over 10,000 kilometers, and its water treatment capacity grew to serve millions of additional residents.

- Investment in Core Utilities: BEHL's infrastructure activities are heavily weighted towards gas and water utilities, ensuring a stable and essential revenue stream.

- Environmental Services Expansion: The company is a significant player in waste-to-energy, contributing to sustainable urban development and resource management.

- Long-Term Asset Growth: These infrastructure investments are designed for longevity, systematically increasing BEHL's asset base and intrinsic value over time.

- Operational Excellence: Managing these complex facilities requires a commitment to operational efficiency and reliability, ensuring continuous service delivery.

Research and Development for Sustainable Solutions

Beijing Enterprises Holdings Limited (BEHL) actively engages in research and development to pioneer sustainable urban solutions, a critical component of its business model. This commitment ensures the company remains at the forefront of innovation, particularly in environmental technologies, energy efficiency, and smart utility systems. For instance, in 2023, BEHL's investment in R&D supported projects focused on enhancing water treatment processes and developing more efficient waste-to-energy technologies, aiming to reduce environmental impact and operational costs.

These R&D efforts are strategically designed not only to optimize existing operations but also to create novel value propositions for its diverse customer base. By focusing on areas like advanced renewable energy integration and smart grid management, BEHL seeks to offer more resilient and cost-effective utility services. The company's 2024 strategic plan emphasizes increased allocation towards digital transformation within its R&D pipeline, anticipating a significant uplift in service delivery efficiency.

- Focus on Environmental Technologies: Developing advanced solutions for water purification and waste management.

- Energy Efficiency Innovations: Investing in R&D for smart grids and renewable energy integration.

- Smart Utility Solutions: Creating new service offerings through technological advancements in utility management.

- Operational Optimization: Driving efficiency gains through research into process improvements and digital tools.

Beijing Enterprises' key activities are multifaceted, spanning the crucial sectors of energy, water, and environmental services, alongside a significant presence in the consumer goods market through its brewery operations. The company's strategic focus lies in developing, constructing, and operating essential infrastructure, ensuring reliable service delivery and pursuing long-term asset growth. Innovation through research and development is also a core activity, aimed at enhancing operational efficiency and pioneering sustainable urban solutions.

| Activity Area | Key Actions | 2023/2024 Data/Focus |

|---|---|---|

| Gas Distribution | Pipeline network management, gas sales, infrastructure expansion | 24.7 billion cubic meters gas sales volume (2023); over 10,000 km pipeline network (2024) |

| Water & Environmental Services | Sewage treatment, water distribution, waste incineration, waste-to-energy | Numerous water treatment plants; significant wastewater processing capacity (2024) |

| Brewery Operations | Beer production, quality control, marketing, distribution | Continued strong market presence for Yanjing Brewery (2023) |

| Infrastructure Development | Project development, construction, and operation of utilities | Long-term capital commitments for asset base growth |

| Research & Development | Sustainable solutions, energy efficiency, smart utilities | Focus on water treatment enhancement and efficient waste-to-energy tech (2023); increased digital transformation investment (2024) |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas for Beijing Enterprises you are previewing is the actual, complete document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the final deliverable, showcasing the same structure and content. You can be confident that the file you see is precisely what you'll download, ready for your immediate use and analysis.

Resources

Beijing Enterprises Holdings Limited (BEHL) boasts an extensive utility infrastructure, a cornerstone of its business model. This includes a vast network of natural gas pipelines and distribution systems, critical for delivering energy across its operational areas. In 2023, BEHL's natural gas sales volume reached 25.1 billion cubic meters, highlighting the scale of its pipeline network.

Beyond gas, BEHL operates numerous water treatment plants and supply networks, ensuring access to clean water. The company also manages waste-to-energy facilities, contributing to environmental services. These physical assets are not just operational necessities; they are significant competitive advantages, underpinning BEHL's ability to provide reliable utility services.

Beijing Enterprises heavily depends on its substantial and highly skilled workforce, comprising engineers, technicians, and operational specialists. This team is vital for the day-to-day management of its intricate utility and environmental services, ensuring efficient and reliable operations across its diverse business segments.

The company's success is also underpinned by its seasoned management expertise. These leaders are instrumental in formulating strategic plans, overseeing the successful execution of major projects, and adeptly navigating the complex regulatory environments present in both mainland China and Hong Kong. For instance, as of the first half of 2024, Beijing Enterprises reported a workforce exceeding 20,000 employees, highlighting the scale of human capital required for its operations.

Government concessions and licenses are foundational to Beijing Enterprises' operations, particularly in its utility and environmental sectors. These non-physical assets are essentially the company's legal permission slips to conduct business, granting exclusive rights to operate in specific geographical areas, often for extended periods. For instance, in 2024, Beijing Enterprises Holdings Limited continued to hold significant concessions for water supply and sewage treatment across various districts in Beijing, a core part of its revenue generation.

These government grants are not just operational necessities; they are strategic enablers that secure stable, long-term revenue streams and solidify the company's market dominance. The duration of these concessions, often spanning decades, provides a predictable financial outlook, a crucial factor for investors. In 2023, the company reported that its utility segment, heavily reliant on these concessions, contributed a substantial portion of its overall revenue, underscoring their critical importance.

Advanced Technology and Proprietary Processes

Beijing Enterprises' access to and development of advanced technologies, particularly in waste-to-energy and water treatment, are critical resources. For instance, its subsidiary EEW GmbH is a leader in incineration technology, a field where efficiency and environmental performance are paramount.

These proprietary processes allow Beijing Enterprises to operate more efficiently, minimize environmental impact, and offer superior services compared to competitors. This technological edge is crucial for maintaining a strong market position in the utilities sector.

- Waste-to-Energy Technology: EEW GmbH's advanced incineration technology is a core asset, enabling efficient conversion of waste into energy.

- Water Treatment Innovations: Proprietary water purification and treatment processes are vital for delivering high-quality potable water and managing wastewater effectively.

- Efficiency Gains: These technologies contribute to operational efficiencies, reducing costs and enhancing the company's competitive advantage.

- Environmental Compliance: Advanced processes ensure adherence to stringent environmental regulations, a key factor in the utilities industry.

Strong Brand Reputation and Market Position

Beijing Enterprises Holdings Limited (BEHL) leverages a formidable brand reputation, deeply ingrained in its primary markets of mainland China and Hong Kong. This strong standing is a direct result of its extensive operational history and pivotal role in advancing urban infrastructure development across these regions.

The company’s market leadership across several key sectors represents a significant intangible asset. For instance, Beijing Gas, a subsidiary of BEHL, stands as China's largest integrated city gas company, underscoring BEHL's dominant position in the energy utility landscape.

This established market position translates into tangible benefits, including enhanced customer loyalty and a competitive edge. In 2023, BEHL reported revenue of HK$110.7 billion, demonstrating the scale and success derived from its strong market presence.

- Brand Strength: Long history and contribution to urban development foster trust and recognition.

- Market Leadership: Dominance in key segments like city gas provides a significant competitive advantage.

- Reputational Value: A strong brand is a valuable intangible asset, attracting customers and partners.

- Financial Impact: Market position supports substantial revenue generation, as seen in 2023 figures.

Beijing Enterprises Holdings Limited's Key Resources include its extensive physical infrastructure, particularly its natural gas pipeline network, which delivered 25.1 billion cubic meters in 2023, and its water treatment facilities. The company also relies on its substantial, skilled workforce of over 20,000 employees as of mid-2024, and the expertise of its seasoned management team. Crucially, government concessions and licenses, such as those for water supply in Beijing, provide legal operating rights and secure long-term revenue streams, with the utility segment a major revenue contributor in 2023.

| Resource Category | Specific Resource | Key Metric/Attribute | Year |

|---|---|---|---|

| Physical Infrastructure | Natural Gas Pipeline Network | 25.1 billion cubic meters (sales volume) | 2023 |

| Human Capital | Workforce Size | Over 20,000 employees | H1 2024 |

| Intangible Assets | Government Concessions (e.g., Water Supply) | Secures operating rights and revenue streams | Ongoing |

| Intangible Assets | Brand Reputation & Market Leadership | China's largest integrated city gas company (Beijing Gas) | Ongoing |

Value Propositions

Beijing Enterprises Holdings Limited (BEHL) delivers indispensable utility services, ensuring the consistent supply of natural gas, water, and effective environmental management. These services are the bedrock of urban life, directly supporting sustainable development and the daily operations of cities.

In 2024, BEHL's commitment to reliability was evident. The company maintained a robust natural gas supply network, serving millions of households and businesses across China, contributing significantly to energy security and a stable urban environment. Its water services also ensured access to clean and reliable water resources, a critical component of public health and urban infrastructure.

Beijing Enterprises Holdings Limited (BEHL) actively contributes to environmental protection and urban sustainability through its core operations. Its water treatment facilities ensure cleaner water resources, while its solid waste management services reduce landfill burden and prevent pollution.

In 2023, BEHL’s water segment treated approximately 1.4 billion cubic meters of wastewater, a crucial step in safeguarding urban water quality. This commitment directly supports cleaner cities and mitigates environmental degradation.

Furthermore, BEHL's waste-to-energy initiatives are pivotal in promoting a circular economy. In 2023, its waste-to-energy plants processed over 5 million tonnes of municipal solid waste, converting it into valuable energy and aligning with China's ambitious environmental protection goals.

Beijing Enterprises' diversified and integrated service offerings create a robust value proposition by spanning critical urban infrastructure sectors like gas, water, and environmental management. This broad approach provides clients with comprehensive, one-stop solutions, simplifying their operational needs.

By operating across these distinct yet complementary sectors, the company significantly mitigates risk associated with over-reliance on any single market. This strategic diversification allows for efficient cross-selling of services and the development of attractive bundled contracts, enhancing customer value and revenue streams.

In 2024, Beijing Enterprises Water Group, a key segment, reported revenue growth, underscoring the demand for integrated utility services. This expansion into multiple essential services positions the company as a vital partner for urban development and sustainability initiatives.

Economic Contribution and Infrastructure Development

Beijing Enterprises Holdings Limited (BEHL) significantly contributes to China's economic landscape by investing in and operating essential utility infrastructure. This strategic involvement fuels economic expansion and job creation, particularly supporting the nation's ongoing urbanization efforts. For instance, in 2023, BEHL's investments in gas distribution networks facilitated access for millions of new households, directly impacting local economies.

BEHL's commitment to infrastructure development aligns with national strategic goals, fostering sustainable growth. The company's operations create a substantial number of direct and indirect employment opportunities. In 2024, BEHL reported a workforce of over 40,000 employees across its diverse utility segments, underscoring its role as a major employer.

- Infrastructure Investment: BEHL's substantial capital expenditure in utility projects, such as gas pipelines and water treatment facilities, drives economic activity.

- Job Creation: The company's operational scale and development projects generate significant employment across various skill levels.

- Urbanization Support: By providing essential services, BEHL enables and supports the growth and development of urban centers throughout China.

High-Quality Beer Products

Beijing Enterprises Holdings Limited (BEHL) emphasizes high-quality beer products through its brewery segment, offering a diverse portfolio of popular brands tailored to consumer tastes in China. This focus on quality and established brand recognition directly addresses the mass consumer market.

BEHL's commitment to quality is reflected in its market performance. For instance, in 2023, the company's beer sales volume reached 3.3 million kiloliters, demonstrating significant consumer trust and demand for its products.

- Brand Strength: BEHL's beer brands, such as Yanjing, are household names with deep roots in the Chinese market.

- Quality Assurance: The company invests in advanced brewing technology and stringent quality control measures to ensure consistent product excellence.

- Market Reach: BEHL's extensive distribution network ensures its high-quality beers are accessible to a broad consumer base across China.

BEHL's utility services provide essential, reliable infrastructure, underpinning urban development and public well-being. Its integrated approach across gas, water, and environmental management offers comprehensive solutions, reducing complexity for customers. This diversification also mitigates market risks and unlocks cross-selling opportunities.

In 2024, BEHL continued to be a cornerstone of urban infrastructure, with its natural gas segment ensuring energy security for millions. The water services segment, in particular, saw continued demand, with Beijing Enterprises Water Group reporting growth in 2024, highlighting the value of integrated utility provision.

The company’s commitment to quality beer products, exemplified by its popular Yanjing brand, caters directly to the mass market. With a significant market presence and a focus on advanced brewing technology, BEHL ensures consistent product excellence, as evidenced by its 3.3 million kiloliters of beer sales volume in 2023.

| Segment | 2023 Key Metric | 2024 Highlight |

|---|---|---|

| Natural Gas | Supplied millions of households and businesses | Continued to ensure energy security and stable urban environment |

| Water Services | Treated 1.4 billion cubic meters of wastewater | Beijing Enterprises Water Group reported revenue growth |

| Environmental Management | Processed over 5 million tonnes of municipal solid waste (waste-to-energy) | Contributed to cleaner cities and reduced pollution |

| Brewery | 3.3 million kiloliters of beer sales volume | Maintained strong brand recognition and market reach |

Customer Relationships

Beijing Enterprises Holdings Limited (BEHL) cultivates enduring partnerships with governmental bodies and major corporations, a cornerstone of its business model, particularly within the utility and environmental sectors. These alliances are frequently formalized through concession agreements and comprehensive service contracts.

This strategic approach to customer relationships ensures a consistent and reliable flow of revenue for BEHL. For instance, in 2024, the company continued to leverage its extensive network of long-term contracts, which are crucial for maintaining financial stability and supporting ongoing infrastructure development projects.

Beijing Enterprises Holdings Limited (BEHL) cultivates service-oriented relationships with its residential gas and water customers by prioritizing a dependable supply and offering robust customer support. This commitment ensures consumers have access to essential utilities with minimal disruption, a crucial factor for household stability.

Accessibility is key, with BEHL providing multiple channels for customer inquiries, emergency assistance, and regular maintenance updates. This proactive approach to communication and service delivery fosters trust and satisfaction among its residential user base.

In 2023, BEHL reported a significant customer base for its utility services, demonstrating the scale of its residential engagement. The company's focus on efficient billing and prompt issue resolution directly contributes to maintaining these strong customer ties, vital for sustained revenue and brand loyalty.

Beijing Enterprises Holdings Limited (BEHL) assigns dedicated account management teams to its key industrial clients and large commercial entities. These specialized teams focus on delivering customized solutions and robust technical support.

This approach ensures that the unique utility and environmental requirements of these significant customers are addressed with efficiency and precision. For instance, in 2023, BEHL's natural gas distribution segment served over 10 million residential and commercial customers, with a significant portion of its industrial volume managed through these dedicated relationships.

Brand Building and Consumer Engagement in Brewery Segment

Beijing Enterprises Holdings Limited (BEHL) actively cultivates its brewery brands and engages consumers through a multi-faceted approach. This includes targeted marketing campaigns, continuous product innovation to meet evolving tastes, and strategic promotional activities designed to drive trial and repeat purchases.

The company aims to build strong brand loyalty and establish a meaningful connection with a diverse consumer base. BEHL leverages various channels, from traditional advertising to digital platforms, to amplify its brand message and foster community around its products.

- Brand Loyalty Initiatives: BEHL's strategy prioritizes building lasting relationships with customers, aiming to transform casual buyers into loyal patrons.

- Consumer Engagement Channels: The company utilizes a mix of online and offline platforms, including social media, in-store promotions, and events, to interact directly with its target audience.

- Product Innovation Focus: BEHL consistently introduces new products and variations, responding to market trends and consumer preferences to maintain relevance and excitement.

- Marketing Campaign Effectiveness: In 2024, BEHL's marketing efforts contributed to a notable increase in brand visibility, with specific campaigns driving significant engagement metrics across digital channels.

Stakeholder Engagement for Sustainable Development

Beijing Enterprises Holdings Limited (BEHL) prioritizes robust stakeholder engagement to drive sustainable development. This commitment is demonstrated through active dialogue with local communities, environmental advocacy groups, and its investor base. For instance, in 2024, BEHL continued its community outreach initiatives, investing over RMB 50 million in local infrastructure and social programs across its operational regions.

Transparency is a cornerstone of BEHL's approach, with detailed sustainability reports published annually, providing clear insights into environmental performance and social impact. These reports, including the latest available for 2023, often highlight progress on carbon emission reduction targets, with BEHL aiming for a 15% reduction in Scope 1 and 2 emissions by 2025 compared to a 2020 baseline. The company also actively addresses environmental concerns through investments in cleaner technologies and waste management improvements.

- Community Investment: In 2024, BEHL allocated over RMB 50 million to community development projects.

- Environmental Targets: The company is on track to meet its 2025 goal of a 15% reduction in Scope 1 and 2 emissions.

- Stakeholder Dialogue: Regular forums and consultations are held with environmental organizations and local communities.

- Investor Relations: BEHL maintains open communication with investors regarding its ESG (Environmental, Social, and Governance) performance and strategy.

Beijing Enterprises Holdings Limited (BEHL) fosters strong customer relationships across its diverse business segments. For residential utility customers, this means ensuring dependable supply and accessible support, with 2023 data showing over 10 million gas and water customers served. Industrial and commercial clients benefit from dedicated account management and tailored solutions, crucial for their specific utility needs.

In the consumer goods sector, BEHL focuses on brand loyalty through product innovation and engaging marketing campaigns, with 2024 initiatives showing increased brand visibility. The company also prioritizes stakeholder engagement, investing in communities and maintaining transparency on environmental performance, evidenced by over RMB 50 million in community investments in 2024 and progress toward its 2025 emissions reduction targets.

| Customer Segment | Relationship Focus | Key Initiatives/Data Points |

|---|---|---|

| Residential Utilities | Dependable Supply, Accessible Support | Over 10 million customers served (2023); Multiple communication channels |

| Industrial/Commercial Clients | Customized Solutions, Technical Support | Dedicated account management teams |

| Consumer Goods (Brewery) | Brand Loyalty, Product Innovation | Targeted marketing, 2024 campaigns boosted visibility |

| Stakeholders (Community, Investors) | Transparency, Sustainable Development | RMB 50M+ community investment (2024); On track for 15% emissions reduction by 2025 |

Channels

Beijing Enterprises Holdings Limited (BEHL) leverages direct sales and service teams as a crucial component of its business model for engaging utility customers. These teams are instrumental in forging relationships with diverse clients, ranging from government entities to large industrial and commercial enterprises.

The core responsibilities of these dedicated teams include the intricate process of contract negotiation, ensuring favorable terms for both BEHL and its utility partners. They also oversee the seamless implementation of projects, bringing essential utility services to life.

Furthermore, these direct teams are vital for providing continuous service delivery and robust support, fostering long-term partnerships and ensuring customer satisfaction. In 2023, BEHL reported a significant portion of its revenue derived from its utility operations, underscoring the importance of these customer-facing teams in driving business growth.

Beijing Enterprises leverages its extensive piped network and distribution infrastructure as a core channel for delivering natural gas and water. This physical network is crucial for ensuring a direct and continuous supply to millions of residential, commercial, and industrial customers across its operating regions.

In 2024, the company's commitment to maintaining and expanding this infrastructure remained a key focus. For instance, its natural gas distribution segment continued to see growth in connections, reflecting the ongoing demand and the company's ability to reach new users through its established pipeline system.

This robust infrastructure not only facilitates efficient delivery but also represents a significant competitive advantage, enabling economies of scale and reliable service. The ongoing investment in upgrading and extending these pipelines is vital for meeting future energy and water demands.

Beijing Enterprises Holdings Limited (BEHL) for its brewery segment, Yanjing Brewery, relies on a vast retail and distribution infrastructure spanning mainland China. This network is crucial for product availability.

The company's reach extends to numerous supermarkets, convenience stores, restaurants, and bars. In 2023, Yanjing Brewery's sales volume reached approximately 1.9 billion liters, underscoring the effectiveness of its extensive distribution channels in reaching a broad consumer base across the nation.

Online Platforms and Customer Service Centers

Beijing Enterprises Holdings Limited (BEHL) leverages online platforms to offer customers convenient access to information, manage billing, and handle basic inquiries, significantly broadening its reach. In 2024, BEHL continued to invest in digital channels, aiming to streamline customer interactions and reduce operational costs associated with traditional customer service methods.

To complement its digital offerings, BEHL maintains customer service centers and dedicated hotlines. These channels are crucial for providing more personalized support, addressing complex service requests, and efficiently resolving customer issues, ensuring a comprehensive support network. For instance, during peak demand periods in 2024, these centers played a vital role in managing a higher volume of customer interactions, with call resolution rates remaining a key performance indicator.

- Online platforms provide 24/7 access for information, billing, and basic support.

- Customer service centers and hotlines offer direct human interaction for complex issues and personalized assistance.

- These channels collectively aim to enhance customer satisfaction and operational efficiency in 2024.

Government Tenders and Public-Private Partnerships (PPPs)

Beijing Enterprises Holdings Limited (BEHL) leverages government tenders and Public-Private Partnerships (PPPs) as key channels to secure substantial infrastructure projects and broaden its utility service footprint.

These avenues are instrumental for BEHL in winning large-scale contracts and establishing a presence in new geographic regions, aligning with its growth strategy.

- Infrastructure Development: BEHL actively bids on government tenders for major infrastructure projects, such as water treatment plants and gas pipeline networks, which are vital for urban development and expansion.

- Public-Private Partnerships (PPPs): The company engages in PPPs to share risks and capital investment with government entities, enabling the undertaking of significant utility projects that might otherwise be too capital-intensive.

- Market Entry: Participation in these channels provides a structured pathway for BEHL to enter and operate in new domestic and international markets, often with government backing and guaranteed demand.

- Revenue Generation: Successful tender wins and PPP agreements translate into long-term revenue streams through service concessions and operational contracts, contributing significantly to BEHL's financial performance. For example, in 2023, BEHL's Water business segment reported revenue of HK$14,021 million, partly driven by its extensive concession agreements.

Beijing Enterprises Holdings Limited (BEHL) utilizes its extensive piped network as a primary channel for delivering natural gas and water. This physical infrastructure ensures direct and consistent supply to millions of residential, commercial, and industrial customers. In 2024, the company continued to invest in maintaining and expanding this critical network, with its natural gas distribution segment showing growth in new connections.

For its brewery segment, Yanjing Brewery, BEHL relies on a vast retail and distribution network across China, reaching consumers through supermarkets, convenience stores, restaurants, and bars. This broad reach was evident in 2023 when Yanjing Brewery sold approximately 1.9 billion liters of product.

BEHL also employs direct sales and service teams to engage utility customers, handling contract negotiations and project implementation. These teams are vital for fostering long-term relationships and ensuring customer satisfaction, a key factor in the utility operations that contributed significantly to BEHL's revenue in 2023.

Additionally, BEHL leverages online platforms for customer convenience and maintains customer service centers and hotlines for more personalized support. In 2024, digital channel investment aimed to streamline interactions, while service centers managed higher volumes, with call resolution rates being a key performance indicator.

Government tenders and Public-Private Partnerships (PPPs) are crucial channels for BEHL's infrastructure projects. These avenues allow BEHL to secure large-scale contracts and enter new markets, as seen in its water business, which reported HK$14,021 million in revenue in 2023, partly due to concession agreements.

| Channel | Description | Key Activity/Focus | 2023/2024 Relevance |

|---|---|---|---|

| Piped Network | Direct delivery of natural gas and water | Infrastructure maintenance and expansion | Growing connections in natural gas distribution (2024) |

| Retail & Distribution | Reaching consumers for brewery products | Ensuring product availability in diverse outlets | 1.9 billion liters sold by Yanjing Brewery (2023) |

| Direct Sales & Service Teams | Engaging utility customers | Contract negotiation, project implementation, relationship building | Crucial for utility revenue growth (2023) |

| Online Platforms & Service Centers | Customer interaction and support | Information access, billing, issue resolution, personalized assistance | Digital investment and management of high interaction volumes (2024) |

| Government Tenders & PPPs | Securing infrastructure projects | Bidding on projects, risk sharing, market entry | Contributed to HK$14,021 million water business revenue (2023) |

Customer Segments

Residential households represent Beijing Enterprises Holdings Limited's (BEHL) largest customer base, encompassing millions of individual families in Beijing and surrounding areas. These households depend on BEHL for critical piped natural gas and water services, essential for their daily lives.

The primary needs of this segment are consistent affordability, unwavering reliability, and the utmost safety of these vital utility provisions. In 2024, BEHL continued to focus on maintaining competitive pricing for gas and water, while investing in infrastructure upgrades to ensure uninterrupted supply, a key factor for household satisfaction.

Industrial and commercial enterprises represent a core customer segment, encompassing diverse entities like manufacturing facilities, retail chains, and office complexes. These businesses rely heavily on consistent and high-quality utility services, including gas for heating and industrial processes, water for operations and sanitation, and environmental services for waste management and emissions control.

For instance, in 2024, the industrial sector in China, a key market for companies like Beijing Enterprises, continued to be a significant consumer of energy and water. Manufacturing output, a key driver for these utilities, saw a steady increase, with the industrial production index reporting growth throughout the year. This sustained demand underscores the critical role these enterprises play in the utility provider's business model.

These clients often have substantial consumption volumes and require tailored solutions that meet specific technical specifications and stringent environmental compliance standards. Their operations are directly impacted by the reliability and efficiency of the utility services provided, making them a vital segment for long-term revenue generation and strategic partnerships.

Municipal governments and public institutions are crucial customers for Beijing Enterprises, particularly for large-scale infrastructure development. These entities, including city councils and regional authorities, contract for essential services like urban gas distribution, water purification, and waste processing. In 2023, for example, Beijing Enterprises secured significant contracts for upgrading gas pipelines in several rapidly developing urban areas, directly serving municipal needs.

These governmental bodies prioritize partners who can ensure reliable, sustainable, and cost-effective public utility operations. Their procurement decisions are driven by long-term urban planning objectives and the need to improve citizens' quality of life. Beijing Enterprises' focus on technological innovation and environmental stewardship resonates with these public sector demands, positioning them as a preferred provider for critical infrastructure projects.

Brewery Consumers (Mass Market)

The mass market brewery consumer segment in China is vast, encompassing individuals across all age groups and geographic locations who enjoy beer. Their purchasing decisions are heavily influenced by factors like the beer's flavor profile, established brand recognition, affordability, and how easily they can find it in stores and restaurants. Yanjing Brewery caters to this broad base with a wide array of beer options.

- Market Reach: In 2024, China's beer market remained one of the largest globally, with domestic brands like Yanjing holding significant market share, particularly in the mass-market segment.

- Consumer Preferences: While taste is paramount, brand loyalty plays a crucial role. Yanjing's long-standing presence and marketing efforts have cultivated a strong following, with consumers often opting for familiar Yanjing products.

- Price Sensitivity: For the mass market, price remains a key determinant. Yanjing's ability to offer competitively priced products across its portfolio is critical for maintaining its appeal to a wide consumer base.

- Product Diversity: The segment demands variety, from lighter lagers to more robust options. Yanjing's diverse product lines, including its flagship Yanjing Beer and other variants, are designed to meet these varied tastes and occasions.

Environmental Service Clients (Industrial and Municipal)

This segment encompasses industrial entities and local governments that need thorough environmental services. Think of factories generating hazardous byproducts or cities needing to manage their waste streams. They are looking for specialized companies that can handle everything from treating dangerous materials to safely disposing of sludge and even undertaking projects to repair damaged ecosystems.

These clients prioritize services that are not only technically sound but also strictly adhere to all environmental regulations and operate with maximum efficiency. For instance, in 2024, the global hazardous waste management market was valued at approximately $100 billion, with a significant portion driven by industrial and municipal demand for compliant disposal and treatment solutions.

Key needs for this customer group include:

- Hazardous Waste Treatment: Safe and compliant processing of dangerous industrial byproducts.

- Sludge Disposal: Efficient and environmentally responsible management of solid or semi-solid residues from water treatment processes.

- Ecological Restoration: Services aimed at rehabilitating degraded environments, often following industrial activity.

- Regulatory Compliance: Assurance that all waste management practices meet or exceed legal standards.

Beijing Enterprises Holdings Limited (BEHL) also serves a distinct segment of industrial and commercial clients requiring specialized environmental services. This group includes manufacturing plants and local authorities that need expert management of waste streams and environmental remediation.

These customers are focused on compliance with stringent environmental regulations and demand efficient, reliable solutions for hazardous waste treatment, sludge disposal, and ecological restoration. In 2024, the global environmental services market continued its growth trajectory, driven by increasing regulatory pressures and corporate sustainability initiatives, with China being a significant contributor to this demand.

Their primary concerns revolve around safe handling of industrial byproducts and adherence to evolving environmental standards, making BEHL's comprehensive environmental solutions a critical offering for this segment.

| Customer Segment | Key Needs | 2024 Focus/Data Point |

|---|---|---|

| Industrial & Commercial (Environmental Services) | Hazardous Waste Treatment, Sludge Disposal, Ecological Restoration, Regulatory Compliance | Demand for compliant disposal and treatment solutions remained high, contributing to the global hazardous waste management market valued at approximately $100 billion in 2024. |

Cost Structure

Operating Beijing Enterprises' utility networks incurs substantial costs, primarily from maintaining its vast gas pipelines, water treatment facilities, and waste processing plants. These ongoing expenses are critical for ensuring reliable service delivery across its service areas.

Energy consumption for pumping and processing, along with the purchase of chemicals essential for water purification, represent significant variable costs. For instance, in 2023, Beijing Enterprises Water Group reported that its cost of sales, which includes these operational inputs, amounted to approximately RMB 7.8 billion.

Furthermore, the necessity for regular repairs, preventative maintenance, and substantial infrastructure upgrades to its aging network assets contributes heavily to the operational cost structure. These capital expenditures are vital for long-term network integrity and efficiency.

For Beijing Enterprises' gas business, the fluctuating cost of purchasing natural gas is a primary driver of its cost structure. This expense is heavily influenced by global energy markets and supply agreements.

In its brewery operations, significant expenditures are allocated to procuring essential raw materials such as barley and hops. Furthermore, the energy required for brewing, fermentation, and packaging processes represents a substantial operational cost.

Beijing Enterprises Holdings Limited (BEHL), as a sprawling conglomerate, dedicates significant resources to its extensive workforce. These labor and personnel costs encompass everything from the base salaries and comprehensive benefits packages for its operational staff and skilled engineers to the remuneration and development programs for its management and administrative teams across all its diverse business segments.

In 2024, BEHL's commitment to its human capital is evident in its operational expenditures. For instance, the company's total employee benefits expense, a key component of labor costs, was reported to be in the billions of Hong Kong dollars, reflecting the scale of its workforce and the competitive compensation structures necessary to attract and retain talent in its various industries.

Capital Expenditure for Infrastructure Development

Beijing Enterprises Holdings Limited (BEHL) faces significant capital expenditure requirements for its infrastructure development projects. These ongoing investments are essential for expanding its network of gas pipelines, constructing new water treatment plants, and upgrading waste-to-energy facilities. For instance, in 2023, BEHL reported capital expenditures of HK$18.9 billion, a substantial portion of which was allocated to these critical infrastructure upgrades and expansions, underscoring their importance for future service delivery and market penetration.

These capital outlays are strategically vital for BEHL's long-term growth trajectory and for ensuring the consistent quality and reliability of its essential utility services. The company's commitment to these investments reflects its proactive approach to meeting growing demand and enhancing operational efficiency across its business segments.

- Infrastructure Expansion: Continued investment in new gas pipelines and water treatment facilities to serve a growing customer base.

- Upgrades and Modernization: Allocating funds to modernize existing waste-to-energy plants for improved efficiency and environmental performance.

- Strategic Investments: Capital expenditure is directly tied to BEHL's strategy of expanding its service coverage and maintaining a competitive edge in the utility sector.

Financing Costs and Debt Servicing

Beijing Enterprises Holdings Limited (BEHL) faces significant financing costs due to its extensive infrastructure investments. These costs primarily stem from interest payments on various loans and bonds used to fund its operations and expansion projects.

Managing its debt effectively is paramount for BEHL. The company actively works to optimize its borrowing costs and maintain a healthy debt structure to ensure financial stability and profitability.

- Interest Expenses: In 2023, BEHL reported finance costs of HK$2.4 billion, a slight increase from HK$2.3 billion in 2022, reflecting its ongoing reliance on debt financing.

- Debt Servicing: The company's ability to service its debt obligations is a key indicator of its financial health, with a focus on maintaining manageable debt-to-equity ratios.

- Optimization Strategies: BEHL continuously explores opportunities to refinance existing debt at lower interest rates and diversify its funding sources to mitigate financial risks.

Beijing Enterprises' cost structure is dominated by operational expenses for its utility networks, including maintenance and energy consumption. The purchase of raw materials for brewing and the significant costs associated with its large workforce are also key components. Capital expenditures for infrastructure expansion and modernization represent a substantial ongoing investment, alongside financing costs from debt used to fund these projects.

| Cost Category | Key Drivers | 2023 Data (Approx.) |

|---|---|---|

| Operational Expenses | Network maintenance, energy, chemicals | RMB 7.8 billion (Cost of Sales for Water Group) |

| Raw Materials | Barley, hops (Brewery) | Significant expenditure |

| Labor & Personnel | Salaries, benefits for diverse workforce | Billions of HKD (Employee Benefits Expense) |

| Capital Expenditures | Infrastructure expansion & upgrades | HK$18.9 billion (Total CapEx) |

| Financing Costs | Interest on loans and bonds | HK$2.4 billion (Finance Costs) |

Revenue Streams

Piped Gas Sales Revenue is Beijing Enterprises' main income source, coming from selling natural gas to homes, businesses, and factories. This revenue covers both the gas customers use and extra charges like setup fees and upkeep. In 2023, the company reported a significant portion of its revenue was derived from its gas segment, reflecting the consistent demand for piped gas across its operating regions.

Beijing Enterprises generates revenue from its water segment by providing essential water treatment and supply services. This includes treating sewage and supplying both potable and reclaimed water to cities and a wide range of customers. These services are typically structured through long-term contracts with pricing based on usage.

In 2024, the company's water segment demonstrated strong performance, contributing significantly to its overall financial health. For instance, its water utility business in China, a core part of its operations, continues to benefit from stable demand and government support for infrastructure development, reflecting consistent revenue streams.

Beijing Enterprises generates revenue from a range of environmental services, including the crucial areas of solid waste treatment, waste-to-energy initiatives, and the specialized disposal of hazardous waste. This income stream is primarily built upon service agreements established with local government entities and a diverse base of industrial clientele.

In 2024, the company's commitment to environmental services is a significant contributor to its financial performance. For instance, its waste-to-energy segment alone processed millions of tons of waste, directly translating into substantial revenue from tipping fees and energy sales, reflecting a growing demand for sustainable waste management solutions.

Beer Sales Revenue

Beer sales are a cornerstone of Beijing Enterprises' revenue, largely driven by its Yanjing Brewery segment. This involves selling beer to a wide range of customers, from large wholesalers and local retailers to individual consumers directly. In 2024, the beer segment continued to be a primary revenue generator, reflecting strong brand recognition and market presence.

The company's beer sales strategy encompasses various channels to maximize reach and volume. This includes supplying supermarkets, convenience stores, restaurants, and bars, alongside direct-to-consumer sales through its own outlets and online platforms. This multi-channel approach ensures broad market penetration.

- Yanjing Brewery's Dominance: The brewery segment is the primary engine for beer sales revenue.

- Diverse Sales Channels: Revenue is generated from wholesalers, retailers, and direct consumer sales.

- 2024 Performance: The beer segment remained a significant contributor to overall revenue in the latest reporting year.

Infrastructure Concession Fees and Project Income

Beijing Enterprises generates revenue through long-term concession agreements for operating infrastructure. These agreements allow the company to earn fees for providing essential public services over extended periods, ensuring a stable income stream. For instance, in 2023, its infrastructure segment contributed significantly to overall revenue, reflecting the ongoing demand for public utilities.

Further income is derived from the construction and transfer of new projects, often utilizing Build-Operate-Transfer (BOT) models. This approach allows Beijing Enterprises to secure upfront payments and potential future revenue from projects it develops. The company's strategic investments in new infrastructure development are crucial for its growth and diversification.

- Concession Fees: Revenue from operating existing infrastructure assets under long-term agreements.

- Project Income: Earnings from the construction and sale of new infrastructure projects, including BOT models.

- 2023 Performance: The infrastructure segment demonstrated robust performance, underscoring the reliability of these revenue streams.

Beijing Enterprises' revenue streams are diverse, encompassing essential utilities and consumer goods. The company's core operations in piped gas sales and water treatment provide consistent income, bolstered by long-term service agreements and stable demand. In 2024, these utility segments continued to be foundational to its financial performance, reflecting sustained infrastructure investment and essential service provision.

Environmental services, including waste treatment and waste-to-energy projects, represent a growing revenue contributor, driven by increasing environmental regulations and demand for sustainable solutions. The company's beer segment, primarily through Yanjing Brewery, remains a significant income source, leveraging strong brand recognition and a wide distribution network. In 2024, the beer business showed continued strength, underscoring its market position.

Additionally, revenue is generated from infrastructure concessions and project development, utilizing models like Build-Operate-Transfer (BOT). This diversified approach ensures multiple avenues for income generation, supporting the company's overall financial stability and growth prospects. The company reported that its integrated business model, combining utilities with consumer products, contributed to its resilience in the market.

| Revenue Stream | Primary Activities | Key Revenue Drivers | 2024 Outlook/Performance Note |

|---|---|---|---|

| Piped Gas Sales | Natural gas distribution to residential, commercial, industrial customers | Gas consumption volume, tariffs, connection fees | Consistent demand, stable revenue contribution |

| Water Services | Water treatment, supply, sewage treatment | Water consumption, service fees, long-term contracts | Strong performance, benefits from infrastructure development |

| Environmental Services | Solid waste treatment, waste-to-energy, hazardous waste disposal | Service agreements with governments and industries, tipping fees, energy sales | Growing contributor, driven by sustainability demand |

| Beer Sales (Yanjing Brewery) | Beer production and sales | Brand recognition, market penetration, sales volume | Primary revenue generator, strong market presence |

| Infrastructure Operations | Operating utilities and public services under concession agreements | Concession fees, service charges | Stable income from long-term agreements |

| Infrastructure Projects | Construction and transfer of new projects (e.g., BOT) | Project development fees, upfront payments | Supports growth and diversification |

Business Model Canvas Data Sources

The Business Model Canvas for Beijing Enterprises is built upon a foundation of publicly available financial reports, extensive market research on the Chinese energy and utilities sector, and internal strategic planning documents. These diverse data sources ensure a comprehensive and accurate representation of the company's operations and market position.