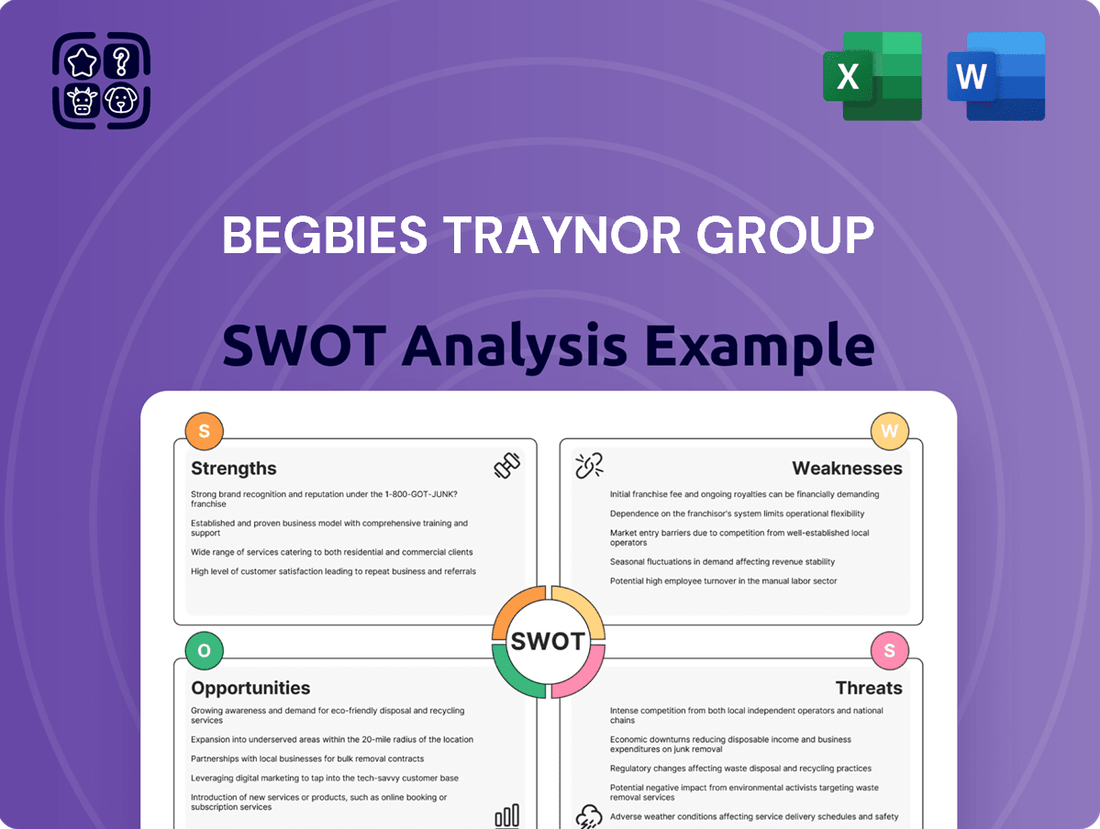

Begbies Traynor Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Begbies Traynor Group Bundle

Begbies Traynor Group demonstrates robust strengths in its established market presence and diverse service offerings, but also faces potential threats from economic downturns and increased competition.

Want the full story behind the company’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Begbies Traynor Group's strength lies in its diversified service portfolio, extending well beyond its initial focus on corporate recovery. The group now offers a comprehensive suite of services, including financial advisory, corporate finance, restructuring, valuations, and property management. This strategic diversification allows them to cater to a broader spectrum of client needs.

This wide-ranging service offering enables Begbies Traynor Group to navigate different economic conditions more effectively. By not being solely reliant on insolvency work, the company can maintain stability and growth even when the economic climate shifts. For instance, in the fiscal year ending April 30, 2024, the group reported revenue growth driven by strong performance across its advisory and transaction services, underscoring the benefit of this diversification.

Begbies Traynor Group has achieved a remarkable ten consecutive years of profitable growth, a testament to its resilient business model. For the year ended April 30, 2025, the company reported a substantial increase in revenue, reaching £124.5 million, and a significant rise in adjusted profit before tax to £32.1 million. This consistent financial performance underscores the effectiveness of their strategic initiatives and operational efficiency.

Begbies Traynor Group holds a dominant market position in the UK's business rescue and recovery sector. In the fiscal year ending April 30, 2024, the company secured a substantial share of corporate insolvency appointments, outperforming competitors and reinforcing its leadership status.

This strength is underpinned by an extensive nationwide network of 60 offices and a comprehensive team of over 650 professionals. This infrastructure allows Begbies Traynor to offer a broad spectrum of services, from insolvency and restructuring to corporate finance and forensic accounting, effectively serving businesses across the country.

Robust Financial Health and Cash Generation

Begbies Traynor Group demonstrates a notably strong financial position, underscored by a significant increase in free cash flow. This positive trend is further highlighted by the group's successful transition from a net debt to a net cash position during the most recent fiscal year. This robust balance sheet is a key strength, enabling the company to comfortably finance its ongoing organic growth initiatives and pursue strategic acquisition opportunities, signaling considerable financial stability and operational efficiency.

Key financial highlights supporting this strength include:

- Improved Free Cash Flow: The group has seen a substantial uplift in its ability to generate cash from operations.

- Net Cash Position: A shift from net debt to net cash provides greater financial flexibility and reduced borrowing costs.

- Funding Capacity: The strengthened balance sheet equips Begbies Traynor to invest in both internal expansion and external growth through acquisitions.

- Financial Stability: This robust financial health provides a solid foundation for sustained performance and resilience in varying economic conditions.

Strategic Acquisition and Organic Growth Strategy

Begbies Traynor Group has a robust strategy that blends growing from within (organic growth) with acquiring other businesses to boost earnings and expand its service offerings and market presence. This dual approach has been instrumental in the company's significant growth in both size and profitability over the last ten years, guided by a successful investment model.

This strategy has demonstrably paid off. For instance, in the financial year ending April 30, 2023, Begbies Traynor reported a 16% increase in revenue to £117.8 million, with profit before tax rising by 11% to £25.1 million. This growth was partly fueled by strategic acquisitions that have integrated well into the group's existing operations.

- Proven Acquisition Track Record: The company has a history of successfully integrating acquired businesses, enhancing their value and contributing to overall group performance.

- Diversification of Services: Acquisitions have allowed Begbies Traynor to broaden its service portfolio, offering a more comprehensive suite of solutions to clients, particularly in areas like restructuring and advisory services.

- Geographical Expansion: The group has used acquisitions to extend its reach into new regions, increasing its client base and market share.

- Earnings Enhancement: The investment template for acquisitions focuses on businesses that are expected to deliver immediate earnings accretion, contributing to the group's financial strength.

Begbies Traynor Group's diversified service model is a significant strength, allowing it to serve a broad client base across various economic cycles. This breadth, encompassing financial advisory, corporate finance, and restructuring, ensures resilience. The group's consistent financial performance, marked by ten consecutive years of profitable growth, highlights the effectiveness of this diversified strategy, with revenue reaching £124.5 million and adjusted profit before tax hitting £32.1 million for the year ended April 30, 2025.

The company's dominant market position in the UK's business rescue and recovery sector, supported by an extensive network of 60 offices and over 650 professionals, is another key strength. This infrastructure enables comprehensive service delivery nationwide. Furthermore, Begbies Traynor Group boasts a robust financial position, evidenced by improved free cash flow and a transition to a net cash status, providing ample capacity for organic growth and strategic acquisitions.

| Metric | FY 2024 (Ending April 30) | FY 2025 (Ending April 30) |

|---|---|---|

| Revenue | £117.8 million (FY23) | £124.5 million |

| Adjusted Profit Before Tax | £25.1 million (FY23) | £32.1 million |

| Market Position | Leading UK business rescue and recovery | Leading UK business rescue and recovery |

| Office Network | 60 offices | 60 offices |

| Employee Count | Over 650 professionals | Over 650 professionals |

What is included in the product

Analyzes Begbies Traynor Group’s competitive position through key internal and external factors, including its strong brand reputation and market leadership against potential economic downturns.

Simplifies complex market dynamics by presenting Begbies Traynor Group's SWOT as actionable insights for strategic navigation.

Weaknesses

Begbies Traynor Group's core business, particularly its insolvency and restructuring services, has historically thrived during economic downturns. This reliance means that prolonged periods of economic stability, while beneficial for the broader economy, could present a significant weakness for the company. For instance, a sustained economic upswing, as seen in some periods of 2023 and early 2024, might naturally lead to fewer business failures, directly impacting the demand for these critical services.

While the company has been actively diversifying into areas like financial advisory and wealth management, a substantial portion of its revenue and profit generation remains tied to the insolvency sector. If the economic climate remains robust through 2024 and into 2025, the company could experience a noticeable slowdown in its traditional revenue streams. This potential reduction in demand for insolvency services is a key vulnerability that could affect overall financial performance if diversification efforts do not fully offset the decline.

The professional services sector, particularly in corporate recovery and advisory, is a crowded space. Begbies Traynor Group faces significant competition from both established national players and nimble international firms, all vying for the same clients.

This intense rivalry can exert downward pressure on service fees, potentially squeezing profit margins. Furthermore, attracting and retaining skilled professionals, crucial for delivering high-quality advice, becomes a constant challenge in such a competitive environment.

Begbies Traynor Group's growth strategy heavily relies on acquisitions, but this introduces significant integration risks. For instance, a poorly managed integration can lead to cultural clashes between existing and new teams, hindering collaboration and productivity. This was a concern highlighted in industry reports throughout 2024, noting that over 50% of mergers failed to achieve their projected synergy targets due to integration challenges.

Operational inefficiencies can also arise, disrupting existing workflows and impacting service delivery. The company must ensure that new systems and processes are seamlessly adopted. Failure to do so, as seen in several high-profile acquisitions across the professional services sector in late 2024, can lead to increased costs and a decline in client satisfaction, ultimately diluting the benefits of expansion.

Sensitivity to Regulatory and Policy Changes

Begbies Traynor Group's business is inherently sensitive to shifts in government policies, particularly those concerning insolvency regulations and tax legislation. For instance, changes in how Her Majesty's Revenue and Customs (HMRC) approaches tax debt recovery can directly alter the volume of winding-up petitions, a key driver for the company's services.

The regulatory environment is a constant factor. For example, any relaxation of insolvency rules or changes in creditor enforcement powers could potentially reduce the demand for the very services Begbies Traynor provides. This creates a dynamic where the company must remain agile and adapt its service offerings to evolving legal frameworks.

- Regulatory Dependence: Demand for insolvency services is heavily influenced by economic conditions and government policy on debt recovery and business rescue.

- HMRC's Role: The operational stance of HMRC, such as its willingness to issue winding-up petitions for tax arrears, directly impacts the pipeline of cases for firms like Begbies Traynor.

- Policy Impact: Future government decisions on austerity measures, business support schemes, or insolvency law reform could significantly reshape the market landscape for the company.

Geographical Concentration

Begbies Traynor Group's operational strength is heavily concentrated within the United Kingdom. This focus, while allowing deep market penetration, leaves the company vulnerable to specific UK economic fluctuations and regulatory shifts. For instance, a downturn in the UK property market, a key sector for insolvency practitioners, could disproportionately impact revenue. The lack of significant international operations limits diversification, meaning the company cannot easily offset a UK-specific slowdown with growth in other global regions.

This geographical concentration presents a clear weakness in terms of risk management and growth potential. While Begbies Traynor reported total revenue of £124.5 million for the year ended 30 April 2024, an increase from £115.1 million in the prior year, this growth is almost entirely UK-dependent. The company's reliance on the UK market means that:

- Economic Sensitivity: The business is highly susceptible to the economic health of the UK, particularly sectors like property and small business lending where insolvency services are in demand.

- Regulatory Risk: Changes in UK insolvency laws or business regulations could significantly affect the company's service offerings and profitability.

- Limited Global Diversification: The absence of a substantial international footprint means Begbies Traynor cannot leverage growth opportunities or mitigate risks present in other economies.

Begbies Traynor Group's reliance on insolvency and restructuring services makes it susceptible to economic upturns, which reduce business failures. While the company is diversifying, its core business remains tied to downturns, potentially impacting revenue if the economy remains stable through 2024 and 2025. This dependence on economic cycles is a key vulnerability.

The professional services market is highly competitive, with both national and international firms vying for clients. This intense rivalry can lead to pressure on service fees, potentially squeezing profit margins and making it challenging to attract and retain top talent. Begbies Traynor Group faces a constant battle to differentiate its offerings and maintain profitability in this crowded landscape.

Acquisition-led growth introduces integration risks, such as cultural clashes and operational inefficiencies, which can hinder productivity and service delivery. Industry reports in 2024 indicated that over 50% of mergers failed to meet synergy targets due to integration challenges. This highlights the potential for acquisitions to create more problems than they solve if not managed meticulously.

The company's operations are heavily concentrated in the UK, making it vulnerable to specific economic downturns and regulatory changes within the country. This lack of international diversification means it cannot easily offset a UK-specific slowdown with growth in other regions. For example, a downturn in the UK property market could disproportionately impact revenue, as reported in industry analyses throughout 2024.

| Weakness | Description | Impact | Example/Data Point |

|---|---|---|---|

| Economic Sensitivity | Reliance on economic downturns for core insolvency services. | Reduced demand during economic stability. | Sustained economic upswing in early 2024 led to fewer business failures. |

| Competitive Landscape | Crowded professional services market. | Pressure on fees and profit margins; talent acquisition challenges. | Intense rivalry can lead to fee compression, impacting profitability. |

| Acquisition Integration Risks | Challenges in integrating acquired businesses. | Potential for cultural clashes, operational inefficiencies, and failure to achieve synergy targets. | Over 50% of mergers in professional services failed to meet synergy targets in 2024 due to integration issues. |

| Geographical Concentration | Heavy reliance on the UK market. | Vulnerability to UK-specific economic fluctuations and regulatory changes. | Total revenue of £124.5 million for FY24 was almost entirely UK-dependent. |

Full Version Awaits

Begbies Traynor Group SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details the Strengths, Weaknesses, Opportunities, and Threats facing the Begbies Traynor Group.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive understanding of the firm's strategic position.

Opportunities

Current economic headwinds, including persistent inflation and elevated interest rates, are significantly impacting businesses. Sectors like hospitality, retail, construction, and manufacturing are experiencing heightened financial strain, a situation anticipated to persist through 2025.

This escalating corporate distress translates directly into increased demand for the specialized services offered by Begbies Traynor Group. Their expertise in business recovery and restructuring positions them to capitalize on this growing market need.

For instance, data from the Office for National Statistics (ONS) in late 2024 indicated a notable rise in insolvencies across these key sectors. This trend underscores the opportunity for Begbies Traynor to expand its client base and service offerings.

Begbies Traynor Group can capitalize on the increasing demand for specialized financial advisory services beyond traditional insolvency. This includes offering expertise in corporate restructuring, navigating special situations in mergers and acquisitions, and assisting with project funding, thereby broadening their service portfolio and client base.

The property advisory division presents a significant avenue for expansion, especially by leveraging the growth in property auctions and valuations. For instance, the UK property auction market saw robust activity in 2023, with many regional auction houses reporting increased lot numbers and sales volumes, indicating a strong market appetite that Begbies Traynor can tap into for diversified revenue.

Begbies Traynor Group’s strategy actively targets bolt-on acquisitions to strengthen its current service offerings and broaden its geographical reach. This focus on strategic M&A, alongside organic growth, offers a clear path to increasing market share and establishing a presence in new UK regions.

For instance, the company completed the acquisition of Gilbert & Sullivan in July 2024, a move expected to bolster its forensic accounting capabilities and expand its footprint in the North West. This aligns with their stated aim of enhancing service lines and entering new territories, potentially tapping into underserved markets.

Leveraging Technology and Digital Transformation

Begbies Traynor Group is actively investing in technology and digital transformation to boost how it operates and serves clients. This focus on modernization is key to staying competitive and exploring new avenues for growth. For instance, the company has established a Digital Asset Investigation Unit, signaling its commitment to tackling emerging areas like cryptocurrency and digital fraud.

This strategic push into technology is designed to streamline internal processes, making the company more efficient. It also aims to elevate the quality of services provided to clients, ensuring they receive cutting-edge support. By embracing digital tools, Begbies Traynor Group can also develop innovative new service lines that cater to evolving market demands.

The company's commitment to digital transformation is evident in its ongoing efforts to enhance its digital capabilities. This includes investments in data analytics and AI-powered tools, which can provide deeper insights into complex financial situations. For example, advancements in AI can significantly speed up the analysis of large datasets, a critical component in insolvency and restructuring cases.

- Enhanced Operational Efficiency: Digital tools can automate routine tasks, reducing manual effort and speeding up case processing.

- Improved Service Delivery: Technology allows for better client communication, secure document sharing, and more sophisticated reporting.

- New Service Offerings: The development of specialized units, like the Digital Asset Investigation Unit, opens doors to lucrative new markets.

- Data-Driven Insights: Leveraging advanced analytics provides a competitive edge in identifying trends and opportunities.

Government Industrial Strategy and Professional Services Growth

The UK government's industrial strategy has pinpointed the professional services sector as a significant driver of future economic growth. This strategic emphasis, alongside a general economic upturn and a surge in mergers and acquisitions, creates a favorable landscape for Begbies Traynor to pursue new avenues for expansion and service delivery.

This government backing translates into tangible opportunities. For instance, the UK's professional services sector is projected to contribute significantly to GDP, with forecasts suggesting continued expansion through 2025. Begbies Traynor is well-positioned to benefit from this trend.

- Government Focus: The UK's Industrial Strategy explicitly targets professional services for growth, potentially leading to increased demand for advisory and restructuring services.

- Economic Recovery: A strengthening economy typically fuels business activity, including investment and expansion, creating more work for professional services firms.

- M&A Activity: Higher levels of mergers and acquisitions often necessitate due diligence, integration support, and potential restructuring, all areas where Begbies Traynor offers expertise.

- Sector Growth: Projections indicate continued growth in the UK's professional services market, offering a larger pool of potential clients and projects.

The increasing financial distress across various sectors, driven by economic headwinds, directly fuels demand for Begbies Traynor's core services in business recovery and restructuring. This trend is supported by data showing a rise in insolvencies, creating a larger client pool. The company is also expanding its service offerings beyond traditional insolvency, venturing into corporate restructuring and special situation M&A advisory. Furthermore, the property advisory division is poised for growth, capitalizing on strong activity in property auctions and valuations, as evidenced by increased sales volumes reported by regional auction houses in 2023.

Threats

A robust UK economic upturn, with a projected GDP growth of 1.8% for 2024 and an anticipated 2.0% in 2025, could significantly dampen the need for insolvency and restructuring services, Begbies Traynor's bread and butter.

While Begbies Traynor has expanded into advisory and debt solutions, a prolonged period of low corporate insolvencies, which saw a 10% decrease in company voluntary liquidations in Q1 2024 compared to the previous year, directly impacts its core revenue streams.

This economic tailwind, if sustained, presents a threat by potentially shrinking the market for distress-related services, even with the company's diversification efforts, as fewer businesses will require formal insolvency procedures.

The professional services sector, including insolvency and restructuring, is intensely competitive. Begbies Traynor faces rivals ranging from large global firms to smaller, specialized boutiques, all vying for market share. This crowded landscape means pricing can become a significant factor, especially when economic conditions are less severe and the demand for distressed services naturally dips.

In 2024, the professional services market continued to see new entrants, adding to the competitive intensity. For Begbies Traynor, this translates into potential pricing pressures. If the firm is unable to differentiate its services effectively or command premium pricing, its profit margins could be squeezed. This is particularly relevant in periods of economic stability where the volume of formal insolvency appointments might be lower.

Begbies Traynor Group faces increasing difficulty in acquiring and keeping top talent, especially as the professional services market expands and the need for specialized skills like insolvency practitioners and financial advisors intensifies. This competition for expertise is a significant hurdle.

The sector is experiencing wage inflation, which, combined with a scarcity of qualified professionals, could directly increase operational expenses for Begbies Traynor. This also poses a risk to maintaining the high quality of service delivery that clients expect.

For instance, the UK's insolvency sector has seen demand surge, putting pressure on the availability of experienced practitioners. In Q1 2024, company insolvencies in the UK reached their highest quarterly level since 2009, highlighting the critical need for skilled professionals to manage this workload effectively.

Regulatory Scrutiny and Compliance Costs

Begbies Traynor Group operates within a heavily regulated sector, meaning shifts in government policies or heightened oversight can significantly increase compliance expenses. For instance, the Financial Conduct Authority (FCA) in the UK, which regulates financial advisory services, continually updates its rules. In 2024, the FCA continued its focus on consumer protection and market integrity, which often translates to more rigorous reporting and operational adjustments for firms like Begbies Traynor.

These regulatory changes can directly impact profitability through higher operational costs and the potential for fines if compliance standards are not met. Furthermore, increased scrutiny might lead to restrictions on certain business activities, thereby limiting the group’s strategic flexibility and growth potential in its core advisory and insolvency services.

- Increased Compliance Burden: Evolving financial regulations, such as those from the FCA, necessitate ongoing investment in compliance infrastructure and personnel, potentially increasing operational overheads.

- Risk of Penalties: Non-compliance with stringent regulatory frameworks can result in substantial fines, reputational damage, and even operational restrictions, directly impacting financial performance.

- Impact on Profitability: Higher compliance costs and potential penalties can erode profit margins, affecting the group's ability to invest in growth initiatives or return capital to shareholders.

- Operational Flexibility Constraints: Regulatory changes may impose limitations on service offerings or business practices, reducing the group's agility in responding to market opportunities or challenges.

Impact of Global Economic Headwinds and Geopolitical Instability

Global economic turbulence, including persistent inflationary pressures and rising interest rates, presents a significant threat to UK businesses. For instance, the Bank of England's Monetary Policy Report in May 2024 indicated that inflation, while falling, remained above the 2% target, impacting consumer spending and business investment. This economic uncertainty can lead to increased insolvencies, potentially altering the volume and nature of cases Begbies Traynor Group manages.

Geopolitical instability further exacerbates these challenges. Ongoing conflicts and trade tensions create supply chain disruptions and can dampen investor confidence, creating a volatile operating environment. Such global uncertainties can lead to unpredictable market conditions, directly influencing the demand for insolvency and restructuring services.

- Economic Slowdown: Forecasts from the Office for Budget Responsibility (OBR) in their March 2024 Economic and fiscal outlook suggested a period of subdued economic growth for the UK in 2024-2025, increasing the risk of corporate distress.

- Inflationary Pressures: Continued high energy prices and supply chain issues, as highlighted by the Office for National Statistics (ONS) in their latest consumer price index data, squeeze profit margins for many companies.

- Geopolitical Risks: International conflicts can disrupt trade routes and increase the cost of imported goods, impacting businesses reliant on global supply chains.

- Interest Rate Sensitivity: Higher borrowing costs, a consequence of central bank policies to combat inflation, place significant strain on businesses with substantial debt burdens.

Begbies Traynor faces intense competition from both large global firms and smaller specialized boutiques, which can lead to pricing pressures, especially during periods of economic stability when demand for distressed services is lower.

The group must navigate a complex and evolving regulatory landscape, with increasing compliance burdens and the risk of penalties for non-compliance potentially impacting profitability and operational flexibility.

Global economic turbulence, including inflation and rising interest rates, along with geopolitical instability, creates a volatile operating environment that could unpredictably alter the demand for Begbies Traynor's core services.

Acquiring and retaining top talent is a growing challenge due to market expansion and the demand for specialized skills, potentially increasing operational expenses and affecting service quality.

| Threat Category | Specific Challenge | Impact on Begbies Traynor |

|---|---|---|

| Competition | Intense rivalry from global and boutique firms | Pricing pressure, reduced market share |

| Regulation | Evolving financial regulations (e.g., FCA) | Increased compliance costs, risk of penalties, operational constraints |

| Economic Environment | Global economic turbulence, inflation, interest rates | Unpredictable demand for services, potential for increased insolvencies |

| Talent Acquisition | Scarcity of qualified insolvency practitioners and advisors | Higher operational expenses, potential impact on service quality |

SWOT Analysis Data Sources

This SWOT analysis is built on a foundation of comprehensive data, drawing from Begbies Traynor Group's official financial reports, extensive market research, and expert industry analysis to provide a robust strategic overview.