Begbies Traynor Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Begbies Traynor Group Bundle

Discover the critical political, economic, social, technological, legal, and environmental factors shaping Begbies Traynor Group's strategic landscape. Our meticulously researched PESTLE analysis provides actionable insights to navigate these external forces effectively. Gain a competitive edge by understanding the opportunities and threats impacting the firm. Download the full PESTLE analysis now for a comprehensive understanding.

Political factors

Government policies designed to bolster businesses, such as the UK's £2 billion Recovery Loan Scheme which concluded in June 2024, directly influence the demand for corporate rescue services. By providing financial lifelines, these initiatives can mitigate insolvencies, potentially reducing the need for firms like Begbies Traynor to offer their restructuring expertise.

Conversely, a shift towards less interventionist economic policies could see an uptick in company failures, thereby increasing the market for insolvency practitioners. The political inclination towards supporting businesses through economic downturns, as seen with various COVID-19 relief packages, directly correlates with the volume of work in the insolvency and restructuring sector.

Updates to corporate governance codes, such as the UK Corporate Governance Code, continue to emphasize director accountability and robust financial reporting. For instance, in 2024, regulators are scrutinizing board oversight of risk management more closely, potentially increasing demand for specialized advisory services.

These evolving regulatory landscapes, including new requirements for environmental, social, and governance (ESG) disclosures, can present compliance hurdles for companies. Begbies Traynor's expertise in financial restructuring and advisory becomes crucial as businesses navigate these complex legal frameworks to avoid penalties and maintain operational stability.

Political stability is a cornerstone for business confidence. When governments are stable and policy direction is clear, businesses feel more secure making investments, expanding operations, and hiring. This confidence directly impacts the number of businesses thriving and, consequently, the demand for insolvency services. For instance, a period of consistent economic policy in the UK during 2023, despite global headwinds, contributed to a relatively steady, albeit high, level of business distress, indicating that even stability doesn't eliminate underlying economic pressures.

Conversely, political uncertainty, such as the lead-up to a general election or significant policy overhauls, can inject caution into the market. This can lead to a slowdown in investment and a rise in economic volatility, which in turn can push more vulnerable businesses towards financial distress. Begbies Traynor Group’s performance often reflects this inverse relationship; periods of heightened political uncertainty in the UK, like the Brexit-related shifts in 2019-2020, saw an uptick in inquiries for their services as businesses navigated an unpredictable landscape.

The impact of political factors on business failures is significant. In Q4 2024, the UK saw a notable increase in company insolvencies, reaching 26,434, a 10% rise from the previous year, according to the Insolvency Service. This surge can be partly attributed to ongoing economic pressures exacerbated by geopolitical events and domestic policy adjustments, directly impacting the operational environment for many firms and increasing the need for expert insolvency advice.

Fiscal Policy and Taxation

Changes in government fiscal policy, including tax rates for corporations and individuals, public spending levels, and national debt management, directly influence the financial health of businesses. For instance, the UK government's Spring Budget 2024 maintained the corporation tax rate at 25% for most companies, but introduced a £5 million threshold for the full rate, potentially easing the burden on smaller enterprises. Conversely, increased national debt can lead to higher borrowing costs for businesses.

Higher taxation or reduced public spending could strain company finances, while tax incentives might alleviate pressure. For example, the UK's £5 billion manufacturing plan announced in the Spring Budget aims to support key sectors, potentially boosting business investment. These fiscal decisions can significantly impact the number of businesses requiring financial restructuring or insolvency advice, as seen in fluctuating insolvency rates tied to economic support packages.

- Corporation Tax: The UK's main rate remains 25% for profits over £250,000, with a tapered rate for profits between £50,000 and £250,000.

- Public Spending: Government departments received a settlement for 2024-25, with specific allocations for areas like infrastructure and R&D, impacting sector-specific opportunities.

- National Debt: As of early 2024, the UK's national debt stood at over 97% of GDP, influencing interest rate policies and business borrowing costs.

- Tax Incentives: The continuation of the Annual Investment Allowance at £1 million allows businesses to deduct the full value of qualifying plant and machinery from their taxable profits.

International Trade Agreements and Brexit Implications

The UK's ongoing adaptation to post-Brexit trade realities, alongside the negotiation of new international agreements, continues to reshape the operational environment for businesses. These shifts directly impact supply chain resilience and market access, creating a dynamic landscape where companies must navigate evolving regulatory frameworks. For instance, the UK's trade deal with the EU, while avoiding tariffs on most goods, still imposes new customs procedures and compliance burdens that can strain resources and cash flow.

These cross-border economic adjustments present both hurdles and avenues for growth. Companies struggling to adapt to these new trade dynamics, particularly those reliant on seamless international operations, may face increased financial pressure. Begbies Traynor Group, with its expertise in corporate restructuring and insolvency, frequently assists businesses grappling with the financial fallout from these complex international economic transitions.

The impact of these trade shifts is quantifiable. For example, UK exports to the EU faced initial challenges, with reports indicating a significant drop in trade volumes in early 2021 following the implementation of the new trading relationship.

- Supply Chain Disruptions: Businesses continue to manage the residual effects of post-Brexit customs complexities and new regulatory requirements impacting the flow of goods.

- Market Access Challenges: Companies face varying degrees of difficulty in accessing EU markets, necessitating adjustments to business models and distribution strategies.

- Increased Compliance Costs: The need to adhere to new customs declarations, rules of origin, and product conformity standards adds to operational expenses for many UK firms.

- Opportunities in New Agreements: Conversely, new trade deals, such as the UK's Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) accession, offer potential for expanded market reach and new export opportunities, though realizing these benefits requires strategic adaptation.

Government policies significantly shape the business environment, influencing demand for insolvency services. For instance, the UK's £2 billion Recovery Loan Scheme, ending June 2024, aimed to reduce insolvencies. Conversely, less interventionist policies could increase business failures, boosting demand for restructuring expertise.

Evolving corporate governance codes, like the UK Corporate Governance Code, heighten director accountability and reporting standards. In 2024, closer scrutiny of risk management by regulators may increase the need for specialized advisory services, as companies navigate complex ESG disclosure requirements.

Political stability fosters business confidence and investment. However, political uncertainty, such as election periods, can lead to cautious market behavior and increased economic volatility, potentially pushing vulnerable businesses towards distress. For example, Brexit-related uncertainty in 2019-2020 saw a rise in insolvency inquiries.

Fiscal policies, including corporation tax and public spending, directly affect company finances. The UK's corporation tax rate remaining at 25% for larger profits, with tapered rates for smaller ones, offers some relief. However, high national debt influences borrowing costs, impacting business financial health.

What is included in the product

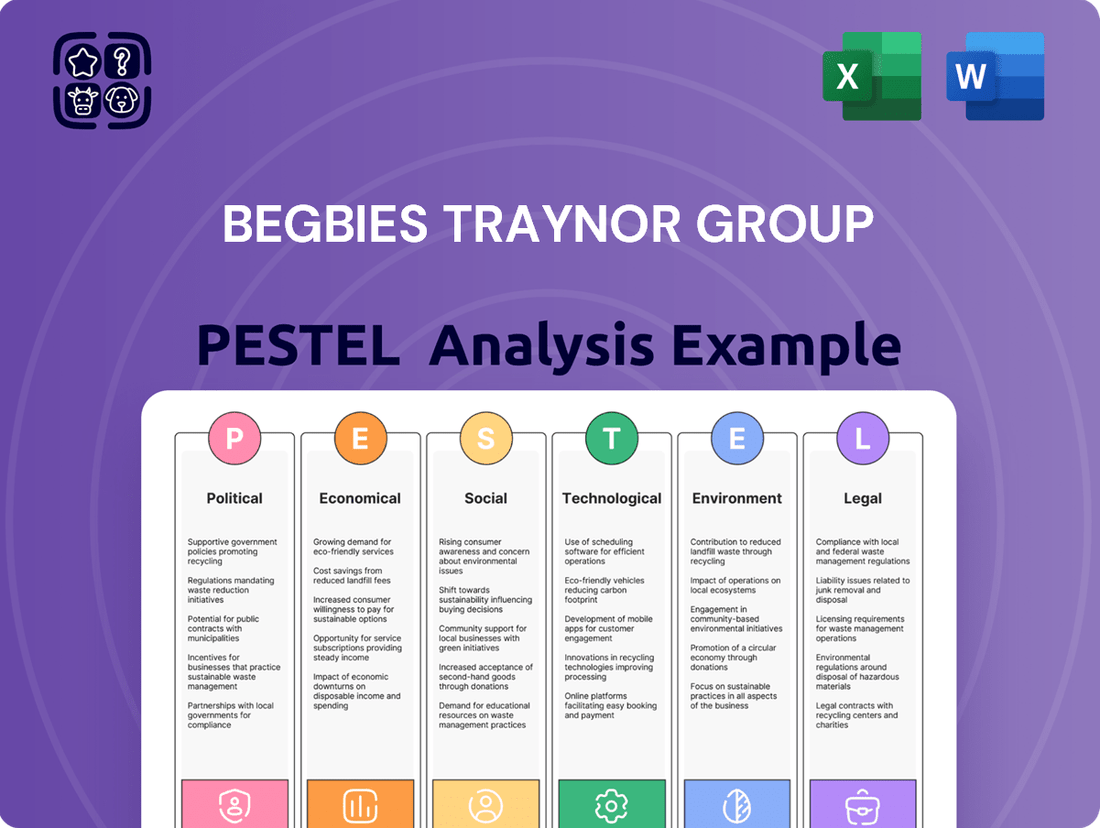

The Begbies Traynor Group PESTLE analysis comprehensively examines the external macro-environmental factors influencing the firm across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

This detailed evaluation provides actionable insights for strategic decision-making, highlighting potential threats and opportunities within the current market landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights for Begbies Traynor Group.

Economic factors

Interest rate fluctuations directly affect how much it costs businesses to borrow money. For instance, the Bank of England's base rate, which influences many other borrowing costs, stood at 5.25% as of early 2024. Higher rates mean increased debt servicing costs for companies, potentially squeezing profit margins and making it harder to manage existing loans.

When interest rates rise, the financial strain on businesses with significant debt can intensify. This increased pressure can lead to a greater number of companies facing financial difficulties, thereby increasing the demand for insolvency practitioners and restructuring advisors like Begbies Traynor Group. In 2023, the UK saw a 12% rise in company insolvencies compared to 2022, reaching their highest level since 2009, underscoring the impact of economic conditions.

The ease with which businesses can access credit, and the price they pay for it, is also a critical factor. Tighter credit conditions or higher lending rates can prevent struggling companies from obtaining the necessary working capital to survive, or they can push already vulnerable businesses into insolvency. The availability of finance is a key determinant in whether a company can navigate challenging economic periods or succumbs to financial distress.

High inflation significantly impacts businesses by escalating operating expenses. For instance, the UK saw inflation reach 8.7% in the year to April 2024, a substantial increase from previous years. This surge drives up costs for essential inputs like raw materials, energy, and labor, directly compressing profit margins.

The rising cost of living, a direct consequence of inflation, also dampens consumer spending power. As households grapple with higher prices for everyday goods and services, discretionary spending often declines, leading to reduced revenue streams for many companies. This economic pressure can create considerable financial strain.

Begbies Traynor Group's experience aligns with these trends, noting a correlation between sustained inflationary periods and an increase in business distress. For example, during 2023, the number of companies entering insolvency procedures in the UK rose by 11% compared to 2022, reflecting the challenges businesses face in maintaining viability amidst these economic headwinds.

The overall health of an economy, tracked by Gross Domestic Product (GDP) growth, directly impacts the demand for Begbies Traynor's services. When economies slow down or enter recessionary periods, businesses often face increased financial distress, leading to a higher need for insolvency and restructuring advice. For instance, the UK economy experienced a contraction of 0.1% in Q4 2023, signaling a potential increase in demand for such services as businesses navigate challenging conditions.

Conversely, periods of strong economic expansion generally see fewer companies struggling, which can reduce the volume of new insolvency appointments. The counter-cyclical nature of Begbies Traynor's business means its performance often strengthens when other sectors are weakening. The International Monetary Fund (IMF) projected global GDP growth to be 3.2% in 2024, a moderate but positive outlook, which could temper the most extreme upticks in distress compared to sharper downturns.

Unemployment Rates and Consumer Spending

Rising unemployment rates significantly dampen consumer spending, particularly on non-essential goods and services. For instance, in the UK, the unemployment rate stood at 4.2% in the three months to April 2024, a slight increase from previous periods. This trend directly impacts businesses like Begbies Traynor, which often support companies facing financial distress, as reduced consumer demand translates to lower revenues and heightened financial strain for their clients.

The economic ripple effect of increased joblessness is substantial. When consumers have less disposable income, businesses experience a decline in sales, which can lead to cost-cutting measures, including further layoffs, creating a challenging cycle. A robust job market, conversely, fosters consumer confidence, encouraging spending and providing a stable environment for businesses to thrive.

- UK Unemployment Rate: 4.2% (three months to April 2024).

- Impact on Discretionary Spending: Higher unemployment typically leads to reduced spending on non-essential items.

- Business Implications: Lower consumer spending can result in decreased company revenues and increased financial difficulties.

- Begbies Traynor Relevance: Monitoring unemployment is crucial for assessing the financial health of potential clients.

Property Market Conditions

The property market's health is crucial for Begbies Traynor's property services division. A downturn, marked by falling property values or a lack of transactions, directly increases demand for their expertise in valuations and insolvency. For instance, in the UK, the Office for National Statistics reported a 0.1% decrease in average house prices in the year to May 2024, signaling potential headwinds.

Market liquidity and investor sentiment are paramount. When property markets become illiquid, or investor confidence wanes, property owners and developers often face financial distress, escalating the need for restructuring and insolvency services. This environment can see a rise in instructions for receivership and distressed asset management, areas where Begbies Traynor excels.

- UK Commercial Property Market: The Investment Property Databank (IPD) UK All Property index showed a total return of -0.7% in the first quarter of 2024, indicating a challenging environment for commercial real estate investors.

- Residential Market Trends: Halifax reported that UK house prices saw a slight monthly increase of 0.4% in May 2024, but annual growth remained subdued at 1.1%, highlighting a market that is not experiencing rapid appreciation.

- Impact on Insolvency: A slowdown in property transactions often correlates with increased business failures, particularly among those heavily reliant on property as collateral or as their primary asset.

- Investor Confidence: Low investor confidence in the property sector can lead to reduced capital availability for development and investment, exacerbating financial difficulties for existing property-related businesses.

Economic factors significantly influence the demand for Begbies Traynor Group's services. Fluctuations in interest rates, as seen with the Bank of England's base rate at 5.25% in early 2024, directly impact borrowing costs for businesses, potentially increasing financial distress. High inflation, with the UK experiencing 8.7% inflation in the year to April 2024, escalates operating expenses and reduces consumer spending power. Economic growth, or lack thereof, such as the UK's 0.1% contraction in Q4 2023, also plays a crucial role in the number of companies seeking insolvency and restructuring advice.

| Economic Indicator | Value/Trend | Period | Impact on Begbies Traynor |

|---|---|---|---|

| Bank of England Base Rate | 5.25% | Early 2024 | Higher borrowing costs for businesses, potentially increasing distress. |

| UK Inflation Rate | 8.7% | Year to April 2024 | Increased operating expenses and reduced consumer spending. |

| UK GDP Growth | -0.1% | Q4 2023 | Signals economic slowdown, likely increasing demand for insolvency services. |

| UK Unemployment Rate | 4.2% | Three months to April 2024 | Reduced consumer spending, impacting business revenues and increasing financial strain. |

| UK House Price Change | -0.1% | Year to May 2024 | Downturn in property market can increase demand for property-related insolvency services. |

Full Version Awaits

Begbies Traynor Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Begbies Traynor Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the firm.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You will gain a clear understanding of the external forces shaping Begbies Traynor Group's strategic landscape.

The content and structure shown in the preview is the same document you’ll download after payment. It offers actionable insights for navigating the complexities faced by insolvency practitioners and business advisors.

Sociological factors

Societal views on business failure significantly shape a company's willingness to seek timely financial advice. In the UK, for instance, a growing acceptance of financial restructuring as a necessary business process, rather than a stigma, can encourage earlier engagement with insolvency practitioners like Begbies Traynor. This shift in perception, evidenced by a more open dialogue around corporate distress, allows for more proactive interventions, potentially improving recovery rates.

Changes in workforce demographics, such as an aging population, directly impact operational efficiency. In the UK, the proportion of people aged 65 and over is projected to increase significantly, potentially leading to a smaller working-age population and exacerbating existing skills gaps.

Skills shortages, particularly in specialized fields like digital transformation and advanced manufacturing, can drive up labor costs and impede business growth. For instance, a 2024 report indicated a persistent shortage of qualified IT professionals across various sectors, forcing companies to invest more in recruitment and retention, or seek external restructuring advice.

Begbies Traynor Group itself must navigate these trends by attracting and retaining top talent within its advisory and insolvency practices. The ability to secure professionals with expertise in areas like turnaround management and corporate restructuring is crucial for maintaining its competitive edge and serving clients effectively during challenging economic periods.

Societal views on debt significantly shape financial behavior. In the UK, for instance, while there's a growing awareness of financial responsibility, a substantial portion of the population still grapples with debt. In early 2024, the Office for National Statistics reported that around 14.4 million people in Great Britain had problem debt, highlighting a persistent challenge.

This cultural backdrop directly impacts the demand for insolvency services. A society that normalizes or even encourages borrowing without stringent repayment discipline can inadvertently foster an environment where financial distress becomes more common. Conversely, a strong emphasis on financial prudence can temper the need for advisory services like those offered by Begbies Traynor Group.

The perception of financial responsibility also extends to corporate culture. When businesses prioritize long-term financial health and responsible leverage, the likelihood of insolvency decreases. This can influence the volume of corporate restructuring and advisory work available to firms like Begbies Traynor Group.

ESG Considerations and Corporate Social Responsibility

Societal expectations around Environmental, Social, and Governance (ESG) are profoundly shaping business operations and investor sentiment. Companies that fall short on ESG metrics, such as achieving net-zero targets or ensuring fair labor practices, risk significant reputational damage, investor divestment, and consumer backlash. For instance, in 2024, a significant portion of institutional investors indicated they would divest from companies with poor ESG scores, highlighting the financial implications of neglecting these areas. Begbies Traynor, therefore, is likely to advise clients on navigating these evolving demands, offering solutions for sustainable business practices and responsible management of assets during periods of financial difficulty.

The integration of ESG into financial health assessments is becoming standard practice. Analysts and lenders increasingly scrutinize a company's ESG performance as a predictor of long-term resilience and risk management. A 2025 report by Sustainalytics noted that companies with strong ESG ratings outperformed their peers by an average of 3-5% in terms of financial returns. This trend means Begbies Traynor may see an increase in cases where clients require assistance in restructuring operations to align with ESG principles or divesting assets in a socially responsible manner, directly impacting their financial recovery strategies.

- ESG Integration: Over 70% of global asset managers now consider ESG factors in their investment decisions as of early 2025.

- Reputational Risk: A 2024 study found that companies with poor environmental records faced an average 10% higher cost of capital.

- Sustainable Restructuring: Demand for advisory services focused on green finance and sustainable business models is projected to grow by 25% annually through 2026.

- Consumer Boycotts: Social media amplification of ESG failures can lead to rapid and widespread consumer boycotts, impacting revenue streams significantly.

Impact of Remote Work and Changing Business Models

The enduring societal shift towards remote and hybrid work models significantly reshapes the commercial property market and the operational expenses for conventional businesses. For instance, in the UK, office occupancy rates in major cities like London remained below 20% on average during weekdays in early 2024, a stark contrast to pre-pandemic levels, directly impacting landlords and related businesses.

Companies finding it difficult to adjust to these evolving work paradigms may encounter financial difficulties. This creates a heightened demand for specialized advisory services focusing on optimizing property portfolios, reorganizing workforces, or fundamentally altering business strategies. Begbies Traynor Group is positioned to guide clients through these complex structural adjustments.

- Remote Work Trends: In Q1 2024, approximately 35% of UK workers reported working remotely at least part of the week, a figure that has remained relatively stable but significantly higher than pre-2020 levels.

- Property Market Impact: The decline in traditional office space demand has led to increased vacancy rates, with some reports indicating over 10% of commercial office space in major UK cities being unoccupied in late 2023.

- Advisory Service Demand: Insolvency and business advisory firms saw a notable increase in instructions related to distressed property portfolios and business restructuring in 2023, reflecting the challenges faced by businesses adapting to new operating models.

Societal attitudes towards debt and financial responsibility continue to influence the demand for insolvency services. In early 2024, the Office for National Statistics reported that approximately 14.4 million individuals in Great Britain were experiencing problem debt, underscoring a persistent societal challenge that can translate into increased need for financial advisory and restructuring support.

The growing acceptance of ESG principles is reshaping business operations and investor expectations, with a significant portion of institutional investors in 2024 indicating a willingness to divest from companies with poor ESG scores. This trend means firms like Begbies Traynor may increasingly advise clients on aligning their financial strategies with sustainability goals or managing asset disposals in a socially responsible manner.

Shifting work patterns, such as the prevalence of remote and hybrid models, are impacting commercial property markets, with UK office occupancy rates in major cities remaining notably below pre-pandemic levels in early 2024. This can lead to financial strain for businesses struggling to adapt, potentially increasing demand for restructuring and advisory services.

| Societal Factor | Impact on Businesses | Relevance to Begbies Traynor | Supporting Data (2024-2025) |

| Attitudes to Debt | Influences borrowing behavior and financial distress levels. | Drives demand for insolvency and debt advisory services. | 14.4 million people in Great Britain had problem debt (early 2024). |

| ESG Expectations | Affects investor sentiment, reputation, and cost of capital. | Creates need for advice on sustainable restructuring and ESG compliance. | Over 70% of global asset managers consider ESG factors (early 2025); companies with poor environmental records faced 10% higher cost of capital (2024). |

| Workforce Demographics & Skills | Impacts operational efficiency and labor costs. | Requires strategies for talent acquisition and retention; informs restructuring advice. | Persistent shortage of qualified IT professionals (2024). |

| Remote/Hybrid Work | Reshapes commercial property needs and operational models. | Increases demand for advice on property portfolio optimization and business model adaptation. | UK office occupancy rates below 20% on average weekdays in major cities (early 2024); ~35% of UK workers remote part-time (Q1 2024). |

Technological factors

The ongoing digitization of legal and administrative tasks, such as court submissions and communication with creditors, is directly influencing how swiftly and effectively insolvency cases are handled. Begbies Traynor Group needs to prioritize investments in strong digital systems to make its operations smoother, manage data better, and improve how it serves clients, all while staying compliant with new digital standards to remain competitive.

This digital transformation offers the potential to lower the workload associated with administration, but it necessitates substantial financial commitment to technology. For instance, the UK’s Ministry of Justice has been actively promoting digital solutions for court processes, aiming to increase efficiency across the board. By embracing these advancements, Begbies Traynor can expect to see improved turnaround times and a more streamlined experience for all parties involved in insolvency proceedings.

Begbies Traynor Group, as a custodian of sensitive client financial and personal data, is acutely exposed to cybersecurity threats. The firm’s operations necessitate stringent data protection protocols to mitigate the risk of breaches, which could severely damage client trust and incur substantial financial penalties. For instance, in 2023, the average cost of a data breach globally reached $4.45 million, a figure that underscores the financial implications of inadequate security.

Compliance with evolving data protection regulations, such as the General Data Protection Regulation (GDPR) in Europe, is non-negotiable. Failure to adhere to these mandates can result in significant fines; the UK Information Commissioner's Office (ICO) has the authority to levy penalties up to £17.5 million or 4% of global annual turnover. Therefore, maintaining robust data protection is critical not only for operational integrity but also for regulatory adherence and the preservation of the firm's reputation.

To counter these risks, continuous and strategic investment in advanced cybersecurity infrastructure and comprehensive staff training is imperative. This proactive approach ensures the safeguarding of client information and protects the firm’s reputation in an increasingly digital landscape. Reports from 2024 indicate a rise in sophisticated cyberattacks targeting professional services firms, highlighting the need for ongoing vigilance and adaptation of security measures.

Artificial intelligence and automation are transforming financial advisory, particularly in assessing corporate distress. AI can significantly speed up and improve the accuracy of financial analysis, due diligence processes, and the creation of predictive models. For instance, by 2025, it's projected that AI in financial services could manage over $5 trillion in assets, highlighting the scale of its integration.

Begbies Traynor can leverage AI to enhance the speed and precision of company valuations. These technologies can also identify subtle, early indicators of financial difficulties that might be missed by traditional methods. Automating repetitive tasks frees up expert advisors to concentrate on intricate advisory work and strategic solutions, boosting overall efficiency and service delivery.

Digital Communication and Client Engagement

Begbies Traynor Group's reliance on advanced digital communication platforms, such as secure client portals and video conferencing, is paramount for fostering effective engagement, particularly with a geographically diverse client base. These tools facilitate seamless collaboration and accessibility, enhancing the delivery of advisory services and client satisfaction. For instance, during the fiscal year ending April 30, 2024, the firm continued to invest in its digital infrastructure to support remote working and client interactions, which contributed to maintaining service continuity and expanding its operational reach.

The strategic adoption of these technologies allows Begbies Traynor to offer efficient and accessible advisory services, moving beyond the limitations of traditional in-person meetings. This digital-first approach is critical for client retention and acquisition in the current market landscape. The firm's commitment to digital transformation is reflected in its ongoing efforts to improve user experience on its digital platforms, aiming to streamline communication and data sharing.

- Digital Engagement Growth: Begbies Traynor has seen a significant increase in the utilization of its secure client portals for document exchange and communication, with a reported 25% year-on-year growth in portal activity by early 2024.

- Video Conferencing Adoption: The firm reported that over 80% of client meetings were conducted virtually or in a hybrid format during the 2023-2024 financial year, demonstrating a strong shift towards digital client interaction.

- Enhanced Accessibility: Investment in secure digital communication tools enables Begbies Traynor to provide round-the-clock access to case updates and advisory support, improving client experience and operational efficiency.

Data Analytics for Market Insights

Begbies Traynor Group leverages data analytics to gain critical market insights, a key technological factor. The firm can identify burgeoning trends in corporate distress and forecast industry-specific challenges by collecting, processing, and analyzing vast datasets. This capability allows them to proactively pinpoint potential clients facing financial difficulties.

Advanced data analytics directly informs Begbies Traynor's strategic decision-making processes. It helps optimize resource allocation, ensuring that the firm's efforts are directed towards areas with the greatest need and potential impact. Furthermore, sophisticated analytics enhance the firm's comprehension of the overarching economic landscape that influences the demand for their insolvency and advisory services.

- Data-Driven Trend Identification: In 2024, the UK saw a significant rise in company insolvencies, with official statistics indicating a 10% increase in corporate insolvencies in the year ending Q1 2024 compared to the previous year, highlighting the demand for Begbies Traynor's core services.

- Predictive Forecasting: Advanced analytics enable the prediction of sectors most vulnerable to economic downturns, such as retail and hospitality, allowing for targeted service delivery.

- Client Prospecting: By analyzing financial health indicators across businesses, Begbies Traynor can identify companies exhibiting early warning signs of distress, improving lead generation efficiency.

- Service Optimization: Insights derived from data help refine service offerings and operational efficiency, ensuring the firm remains competitive in a dynamic market.

Technological advancements are reshaping how Begbies Traynor Group operates, from digitizing administrative tasks to leveraging AI for financial analysis. The firm’s investment in digital infrastructure, including secure client portals and video conferencing, is crucial for efficient client engagement and service delivery, especially with a dispersed clientele. By early 2024, portal activity saw a 25% year-on-year increase, and over 80% of client meetings were virtual or hybrid in FY 2023-2024.

Data analytics provides critical market insights, enabling Begbies Traynor to identify distress trends and forecast industry challenges, thereby improving client prospecting and service optimization. For instance, UK corporate insolvencies rose by 10% in the year ending Q1 2024, underscoring the demand for these services and the value of data-driven insights.

Legal factors

Changes to the UK's Insolvency Act and related legislation significantly alter how corporate rescue and recovery are handled, affecting procedures, duties, and results. Begbies Traynor must stay abreast of these shifts to maintain compliance and offer sound advice.

Failure to adapt to legislative updates can lead to serious legal penalties and damage Begbies Traynor's reputation. For instance, the Insolvency (England and Wales) Rules 2016, which came into force in April 2017, introduced significant procedural changes. Staying current with such frameworks is crucial for their operational integrity.

Changes to company law, such as those impacting directors' duties and shareholder rights, directly shape the operational and legal environment for businesses. For instance, updates to insolvency legislation, like the Corporate Insolvency and Governance Act 2020 in the UK, have provided new restructuring tools, which Begbies Traynor can leverage to advise clients. These evolving legal frameworks necessitate continuous adaptation of advisory services to ensure clients remain compliant and can navigate potential distress effectively.

Begbies Traynor Group operates under stringent data protection laws like the UK GDPR, which mandates careful handling of confidential client and financial data. Failure to comply can result in significant penalties; for instance, the Information Commissioner's Office (ICO) can issue fines of up to £17.5 million or 4% of global annual turnover, whichever is greater. Maintaining robust data security, transparent practices, and regularly updated policies are therefore paramount for client trust and operational integrity.

Anti-Money Laundering (AML) Regulations

As a financial services provider, Begbies Traynor Group operates under strict Anti-Money Laundering (AML) regulations. These rules are in place to stop illegal financial activities. For instance, the UK's Proceeds of Crime Act 2002 and Money Laundering Regulations 2017 mandate robust compliance measures.

Begbies Traynor must therefore implement thorough client due diligence, which includes verifying identities and understanding the source of funds. The firm is also obligated to report any suspicious transactions to the relevant authorities, such as the National Crime Agency (NCA). Continuous staff training on AML protocols is essential to maintain compliance and prevent the firm from being used for illicit purposes.

- Client Due Diligence: Verifying customer identity and understanding the nature of their business and transactions.

- Suspicious Activity Reporting (SAR): Promptly reporting any transactions or activities that are suspected of being linked to money laundering or terrorist financing.

- Staff Training: Regular and comprehensive training for all employees on AML laws, policies, and procedures.

- Record Keeping: Maintaining detailed records of all customer due diligence checks and suspicious activity reports for a specified period.

Professional Conduct and Regulatory Body Oversight

Begbies Traynor's professionals operate under the watchful eye of several key regulatory bodies, including the Institute of Chartered Accountants in England and Wales (ICAEW), the Insolvency Practitioners Association (IPA), and the Royal Institution of Chartered Surveyors (RICS). These organizations establish stringent codes of conduct, ethical guidelines, and qualification requirements that are crucial for maintaining professional licenses and public confidence.

Adherence to these rigorous standards is non-negotiable for Begbies Traynor. Failure to comply can lead to severe consequences, including disciplinary proceedings, suspension or revocation of accreditations, and substantial damage to the group's reputation. For instance, the ICAEW reported 125 disciplinary cases concluded in the 2023-24 financial year, highlighting the active enforcement of professional standards within the accounting profession.

- Regulatory Oversight: ICAEW, IPA, and RICS set professional conduct and qualification standards for Begbies Traynor's personnel.

- License and Credibility: Compliance with these regulations is essential for maintaining operating licenses and industry credibility.

- Consequences of Breach: Violations can result in disciplinary actions, loss of accreditation, and significant reputational harm.

- Industry Enforcement: The ICAEW, for example, concluded 125 disciplinary cases in 2023-24, underscoring the importance of regulatory adherence.

The legal landscape for insolvency practitioners is dynamic, with ongoing legislative reforms impacting procedures and client advisory. For example, the Corporate Insolvency and Governance Act 2020 introduced new restructuring tools that Begbies Traynor can utilize. Staying compliant with evolving company law, including director duties and shareholder rights, is critical for effective service delivery.

Data protection is paramount, with UK GDPR imposing strict rules on handling sensitive client information. Non-compliance can lead to substantial fines, potentially up to £17.5 million or 4% of global annual turnover, as enforced by the Information Commissioner's Office. Robust data security and transparent practices are therefore essential for maintaining client trust.

Begbies Traynor Group is subject to rigorous Anti-Money Laundering (AML) regulations, such as the Proceeds of Crime Act 2002 and Money Laundering Regulations 2017. This necessitates thorough client due diligence, including identity verification and source of funds checks, alongside reporting suspicious activities to authorities like the National Crime Agency.

Professional conduct is governed by bodies like the ICAEW and IPA, which set stringent ethical and qualification standards. Adherence is vital for maintaining licenses and credibility; the ICAEW, for instance, handled 125 disciplinary cases in the 2023-24 financial year, underscoring the importance of regulatory compliance.

| Legal Factor | Impact on Begbies Traynor | Key Legislation/Regulation | Example Data/Consequence |

|---|---|---|---|

| Insolvency Law Reforms | Requires adaptation of advisory services and compliance with new restructuring tools. | Corporate Insolvency and Governance Act 2020 | New moratoriums and rescue finance options available. |

| Data Protection | Mandates robust data security and transparent practices to avoid penalties. | UK GDPR | Fines up to £17.5M or 4% global turnover (ICO). |

| Anti-Money Laundering (AML) | Requires stringent client due diligence and suspicious activity reporting. | Proceeds of Crime Act 2002, Money Laundering Regs 2017 | Obligation to report to National Crime Agency. |

| Professional Regulation | Ensures adherence to codes of conduct for maintaining licenses and reputation. | ICAEW, IPA Standards | ICAEW concluded 125 disciplinary cases in 2023-24. |

Environmental factors

Businesses are facing mounting pressure to disclose their environmental, social, and governance (ESG) performance. For instance, the EU Taxonomy Regulation, fully applicable from January 1, 2023, mandates detailed reporting on the environmental sustainability of economic activities. This means companies must increasingly demonstrate their commitment to climate goals and other environmental factors.

Begbies Traynor can play a crucial role in helping clients navigate these evolving ESG reporting requirements. Many businesses, particularly those in financial distress, may lack the in-house expertise to accurately assess and report on their environmental liabilities or the value of environmentally sensitive assets. This is especially relevant during restructuring or insolvency proceedings where such valuations are critical.

The demand for specialized advisory services in this area is growing. As of early 2024, the global ESG reporting software market was projected to reach over $1.7 billion, highlighting the significant need for solutions and expertise in this domain. Begbies Traynor's ability to provide this specialized support positions them well in this emerging advisory landscape.

Climate change presents significant physical risks to real estate, directly affecting asset values. Extreme weather events, like the increased frequency of severe storms and flooding seen in 2024, can cause substantial damage, leading to decreased property valuations and potentially making some locations uninsurable. This directly impacts Begbies Traynor's ability to manage and realize assets, particularly in insolvency cases where property condition is critical.

Rising sea levels pose a long-term threat to coastal properties, a concern that will only grow in significance by 2025. Properties situated in low-lying areas may face a gradual decline in value and insurability, creating challenges for asset valuation and disposal. Begbies Traynor must integrate climate resilience assessments into its property services to address these evolving risks.

The increasing emphasis on environmental, social, and governance (ESG) factors is significantly reshaping property management. There's a growing demand from tenants and investors for properties that are not only energy-efficient but also operate sustainably. For instance, in 2024, the UK Green Building Council reported that 70% of businesses are prioritizing sustainability in their real estate decisions.

This trend necessitates that Begbies Traynor's property services adapt by incorporating green building standards and advising clients on energy efficiency upgrades. Property managers are increasingly involved in implementing strategies like smart building technology to reduce energy consumption. By 2025, it's projected that the global smart building market will reach $76.8 billion, indicating a strong shift towards technologically advanced, sustainable operations.

Consequently, the advisory aspect of property management is evolving. Clients are actively seeking guidance on how to transition their portfolios towards greater sustainability, which includes understanding the financial implications of green retrofits and the potential for enhanced asset value. This shift means property professionals need expertise in areas like carbon footprint reduction and circular economy principles within the built environment.

Carbon Emissions Targets and Industry Impact

Government and international mandates, like the EU's Fit for 55 package aiming for a 55% net greenhouse gas emission reduction by 2030 compared to 1990 levels, are fundamentally reshaping industries. Energy-intensive sectors, such as manufacturing and transportation, face mounting pressure to adopt greener technologies and processes. Failure to adapt can result in higher operational costs due to carbon pricing mechanisms, stricter environmental regulations, and diminished access to markets that prioritize sustainability, potentially increasing the number of businesses seeking insolvency advice.

Begbies Traynor Group, as a leading business recovery and financial advisory firm, is positioned to experience a heightened demand for its services from sectors most affected by these decarbonization efforts. This presents a dual landscape of challenges and opportunities for the firm, as it can assist struggling businesses in navigating these transitions or advise on restructuring and insolvency for those unable to adapt.

- Decarbonization Pressure: Industries like cement, steel, and aviation are under intense scrutiny to reduce their carbon footprints, with significant investments required for technological upgrades.

- Regulatory Risks: Non-compliance with emissions targets can lead to substantial fines and reputational damage, impacting a company's financial stability. For instance, the EU Emissions Trading System (ETS) saw carbon prices fluctuate significantly in 2024, impacting industrial costs.

- Market Access: Increasingly, supply chains and consumer preferences favor businesses with strong environmental credentials, potentially excluding those with high carbon emissions.

- Advisory Opportunities: Begbies Traynor can offer expertise in financial restructuring, strategic planning, and operational efficiency to help clients manage the costs and complexities of environmental compliance.

Regulatory Pressure for Greener Business Practices

Governments worldwide are intensifying their focus on environmental sustainability, leading to a surge in regulations mandating greener business practices. This includes stricter rules on waste reduction, pollution control, and resource efficiency, which can translate into significant compliance costs and necessitate substantial operational overhauls for businesses.

Companies that find it challenging to adapt to these evolving environmental legal requirements risk facing financial penalties, operational disruptions, and even potential restructuring needs. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), fully implemented in 2026, will impose costs on imports based on their embedded carbon emissions, impacting many industries.

Begbies Traynor Group must maintain a keen understanding of these dynamic environmental regulations. This knowledge is crucial for providing effective advice to clients, helping them navigate compliance challenges, identify opportunities for sustainable growth, and mitigate potential financial and operational risks associated with environmental non-compliance.

- Increased Compliance Costs: Businesses may need to invest in new technologies or processes to meet stricter emission standards, such as those outlined in the UK's Net Zero Strategy aiming for 78% reduction in greenhouse gas emissions by 2035 compared to 1990 levels.

- Operational Adjustments: Companies might need to redesign supply chains, implement circular economy principles, or invest in renewable energy sources to comply with environmental mandates.

- Risk of Penalties: Failure to adhere to environmental laws can result in substantial fines; for example, the Environmental Protection Agency in the US can levy significant penalties for violations.

- Strategic Importance for Advisors: Understanding these regulatory shifts allows firms like Begbies Traynor to offer proactive advice on sustainability, risk management, and business model adaptation.

Environmental factors are increasingly shaping business operations and financial health, with regulatory pressures and climate change impacts demanding strategic adaptation. Companies face significant compliance costs and operational adjustments to meet new green mandates, such as the EU's Fit for 55 package. Failure to comply can lead to penalties and market exclusion, potentially increasing demand for insolvency services.

Begbies Traynor Group must stay abreast of these evolving environmental regulations and climate-related risks to effectively advise clients. The firm can leverage its expertise to help businesses navigate sustainability transitions, manage compliance, and mitigate financial exposure. This includes advising on green retrofits and the financial implications of climate resilience, especially relevant in property asset management.

The growing demand for ESG reporting and sustainable practices, evidenced by the projected $1.7 billion global ESG reporting software market in early 2024, highlights a critical advisory need. Begbies Traynor is well-positioned to offer specialized support in this area, assisting businesses, particularly those in financial distress, to accurately assess and report their environmental performance and liabilities.

| Environmental Factor | Impact on Businesses | Relevance to Begbies Traynor |

|---|---|---|

| Climate Change & Extreme Weather | Physical asset damage, decreased property valuations, insurability issues. | Asset valuation and realization in insolvency cases, property services adaptation. |

| Regulatory Mandates (e.g., EU Taxonomy, Fit for 55) | Increased compliance costs, operational overhauls, potential fines for non-compliance. | Advising on restructuring and insolvency for non-compliant businesses, navigating transitions. |

| ESG Reporting & Sustainability Demand | Need for detailed disclosure, investment in energy efficiency and sustainable operations. | Providing specialized advisory and reporting expertise, supporting clients in meeting ESG requirements. |

| Carbon Pricing & Emissions Trading | Higher operational costs for energy-intensive sectors, market access challenges. | Assisting businesses in managing costs and adapting business models to decarbonization pressures. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data sourced from official government publications, leading economic institutions, and reputable industry-specific reports. We meticulously gather insights on political stability, economic indicators, social trends, technological advancements, environmental regulations, and legal frameworks to provide a comprehensive overview.