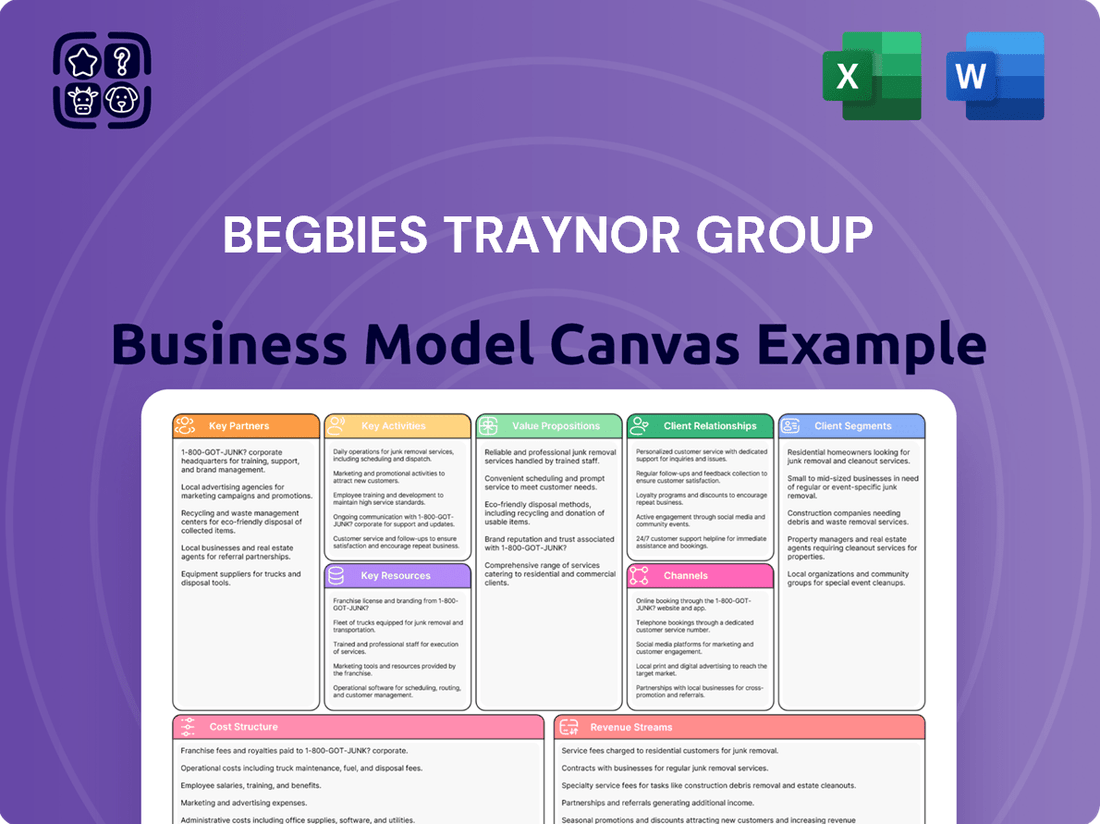

Begbies Traynor Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Begbies Traynor Group Bundle

Discover the strategic core of Begbies Traynor Group with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer relationships, revenue streams, and key resources, offering invaluable insights into their operational success.

Unpack the genius behind Begbies Traynor Group's market positioning. Our full Business Model Canvas provides a clear, actionable roadmap of their value proposition and cost structure, perfect for anyone looking to understand or replicate their strategic advantages.

Ready to gain a competitive edge? Download the complete Business Model Canvas for Begbies Traynor Group and unlock a detailed view of their key partnerships and activities, empowering your own strategic planning.

Partnerships

Begbies Traynor Group maintains vital relationships with major banks and lenders, acting as a key partner for these institutions when their clients face financial distress. These collaborations are essential for the referral of distressed asset management, loan recovery, and restructuring mandates.

These financial institutions rely on Begbies Traynor's expertise to navigate complex cases involving various stakeholders, ensuring efficient resolution and asset management. The group's ability to handle these intricate situations solidifies its role as a trusted advisor within the financial ecosystem.

Further underscoring the strength of these partnerships, Begbies Traynor secured a new debt facility from HSBC Bank in February 2024. This facility is instrumental in supporting the company's ongoing acquisition strategy, demonstrating the financial sector's confidence in Begbies Traynor's growth and operational capabilities.

Begbies Traynor Group actively cultivates relationships with accountancy and law firms. These professional intermediaries are crucial as they often identify businesses facing financial distress or requiring restructuring, subsequently referring these clients to Begbies Traynor’s expertise.

This referral network is a cornerstone of Begbies Traynor's business development, significantly expanding their market reach and client acquisition. For instance, in the fiscal year ending April 30, 2023, the group reported revenue of £115.4 million, a substantial portion of which is driven by these vital professional relationships.

Begbies Traynor Group actively partners with government bodies and regulators, a crucial element for navigating the UK's corporate insolvency landscape. These relationships are vital for ensuring compliance with legal frameworks and securing appointments in insolvency and advisory roles. For instance, the Insolvency Service, a key government agency, oversees insolvency practitioners, making adherence to its regulations paramount.

Property Developers and Investors

Begbies Traynor Group actively collaborates with property developers and investors through its specialized property services division. These partnerships are crucial for navigating complex real estate transactions, particularly during periods of financial difficulty or corporate restructuring. For instance, the group's Eddisons brand offers comprehensive property consultancy, including valuations and asset sales, supporting clients in maximizing value from their real estate portfolios.

These key partnerships are vital for Begbies Traynor's business model, enabling them to leverage their expertise in property management and advisory services. By working with real estate funds and developers, the group can offer tailored solutions that address specific market challenges and opportunities. This synergy allows for efficient handling of distressed property assets and strategic advice for ongoing development projects.

- Property Valuations: Providing accurate market valuations for development sites and existing properties.

- Asset Management: Offering ongoing management services for real estate portfolios.

- Restructuring Support: Assisting developers and investors in managing distressed property assets during financial challenges.

- Sales and Disposals: Facilitating the sale of properties for investors and developers, often in complex or time-sensitive situations.

Acquired Businesses and Their Networks

Begbies Traynor Group's expansion strategy is significantly boosted by acquiring businesses, which inject valuable client relationships and professional connections alongside new service offerings. For instance, the 2023 acquisition of SDL Auctions, a significant player in the property auction sector, broadened the group's capabilities and market access. This strategic move, alongside others like Banks Long & Co and Andrew Forbes, directly enhances their network of potential clients and referral partners.

These acquisitions are not just about adding revenue streams; they are about integrating established networks that can immediately contribute to the group's overall reach and service delivery. The integration of these acquired entities brings with it a pre-existing ecosystem of clients and professional contacts, accelerating market penetration and cross-selling opportunities.

- Acquired entities provide immediate access to established client bases and referral networks.

- Strategic acquisitions like SDL Auctions in 2023 expanded service lines and market reach.

- Integration of new businesses enhances Begbies Traynor's professional network and cross-selling potential.

Begbies Traynor Group's key partnerships extend to accountancy and law firms, acting as crucial referral sources for businesses in financial distress. These professional intermediaries identify potential clients needing restructuring or insolvency services, feeding a significant portion of Begbies Traynor's business pipeline. The group's revenue of £115.4 million for the fiscal year ending April 30, 2023, highlights the impact of these vital professional relationships.

Furthermore, the group maintains strong ties with major banks and lenders, who rely on Begbies Traynor's expertise for distressed asset management and loan recovery. This symbiotic relationship ensures efficient resolution of complex financial situations for clients. Demonstrating this financial sector confidence, Begbies Traynor secured a new debt facility from HSBC Bank in February 2024 to support its acquisition strategy.

Strategic acquisitions, such as SDL Auctions in 2023, are pivotal for expanding Begbies Traynor's network and service offerings. These acquisitions integrate established client bases and referral networks, accelerating market penetration and enhancing cross-selling opportunities. This approach directly strengthens the group's capacity to serve a wider range of clients and manage diverse financial challenges.

What is included in the product

This Business Model Canvas provides a comprehensive overview of Begbies Traynor Group's strategy, detailing their customer segments, key partners, and value propositions in distressed business advisory and insolvency services.

It reflects the real-world operations and plans of the company, organized into the 9 classic BMC blocks with insights into their competitive advantages.

Begbies Traynor Group's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their complex service offerings, simplifying the understanding of how they address business distress for clients.

It efficiently distills their strategy into a digestible format, alleviating the pain of navigating intricate insolvency and restructuring processes for businesses in difficulty.

Activities

Corporate rescue and recovery is a cornerstone of Begbies Traynor Group's operations. This involves guiding businesses through financial difficulties by offering services like administrations, liquidations, and Company Voluntary Arrangements (CVAs).

As a prominent player, Begbies Traynor Group consistently manages a significant volume of corporate insolvency appointments. Their expertise extends to handling complex, higher-value cases, which have notably contributed to revenue increases within their Business Recovery and Advisory division.

For the year ended April 30, 2023, the Business Recovery and Insolvency segment of Begbies Traynor Group saw revenue climb to £125.1 million, up from £106.9 million in the previous year. This growth underscores their market leadership and the increasing demand for their rescue and recovery services.

Begbies Traynor Group provides a comprehensive suite of financial advisory services, including corporate finance, restructuring, debt advisory, and special situations M&A. These services are crucial for businesses facing financial distress or aiming for strategic expansion, offering expert guidance through complex scenarios.

The group's advisory arm has experienced robust organic growth, reflecting strong demand for its specialized expertise. For instance, in the fiscal year ending April 30, 2024, the advisory division reported a significant increase in revenue, demonstrating its expanding market presence and client trust.

Through its Eddisons brand, Begbies Traynor offers a broad spectrum of property services. These include crucial valuations, efficient asset sales, diligent property management, and expert building consultancy. This comprehensive offering underpins their significant contribution to the group's overall revenue.

Eddisons stands out as a prominent property auction house, a testament to its market presence and expertise. In the fiscal year 2024, the property services division, operating under Eddisons, demonstrated robust performance, with revenues reflecting the demand for these specialized services.

Asset Valuation and Sales

Begbies Traynor Group's core activity involves valuing a wide array of assets, from physical property and equipment to intangible assets. This valuation is crucial for understanding the true worth of a business, especially during distress or restructuring.

They then manage the sale of these assets, often through auctions or by acting as agents. This process is designed to achieve the best possible outcome for creditors by realizing value efficiently. For instance, in the year ending March 2024, Begbies Traynor reported a 16% increase in property auction sales, demonstrating the growing importance of this channel.

- Asset Valuation: Expert appraisal of property, plant, machinery, and other business assets.

- Sales Management: Facilitating asset disposals via auctions and agency services.

- Creditor Maximization: Focused on achieving optimal returns for creditors in insolvency cases.

- Market Growth: Benefiting from increased property auction volumes, with sales up 16% in FY24.

Organic Growth and Acquisitions

Begbies Traynor Group focuses on expanding its capabilities and reach through both internal development and external purchases. This means they bring in experienced professionals and invest in their existing teams to enhance service delivery. For example, in the year ending April 30, 2023, the company reported revenue growth, partly driven by these strategic investments in talent and service expansion.

Simultaneously, the group actively seeks and integrates acquisitions to broaden its service portfolio and extend its geographical presence. This dual approach is fundamental to achieving their ambitious revenue goals and solidifying their standing in the market. Their acquisition strategy often targets firms that complement existing services or open up new market segments.

- Organic Growth: Investment in senior hires and team development to enhance service offerings.

- Acquisitions: Strategic purchases to expand service lines and geographic reach.

- Revenue Impact: Both strategies are crucial for meeting long-term revenue targets.

- Market Position: Expansion efforts aim to strengthen the company's competitive standing.

Begbies Traynor Group's key activities revolve around providing essential services to businesses in financial distress and those seeking strategic financial advice. This includes managing corporate insolvency, offering a wide range of financial advisory services, and delivering comprehensive property solutions through its Eddisons brand. They also focus on asset valuation and sales, particularly through auctions, to maximize returns for creditors.

| Key Activity | Description | FY24 Impact/Data |

|---|---|---|

| Corporate Rescue & Recovery | Administering insolvencies (administrations, liquidations, CVAs) to guide distressed businesses. | Business Recovery & Insolvency revenue grew to £133.1m for the year ended 30 April 2024. |

| Financial Advisory | Providing corporate finance, restructuring, debt advisory, and M&A services. | Advisory division reported robust organic growth, contributing to overall revenue increase. |

| Property Services (Eddisons) | Offering valuations, auctions, property management, and building consultancy. | Property auction sales increased by 16% in the year ended March 2024. |

| Asset Valuation & Sales | Appraising and selling business assets to achieve optimal creditor returns. | Integral to insolvency processes, supporting value realization for stakeholders. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the actual document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the comprehensive analysis you'll gain access to. Once your order is complete, you'll download this exact, professionally structured Business Model Canvas, ready for your strategic planning.

Resources

Begbies Traynor Group's core strength lies in its expert professionals and multidisciplinary teams. These include highly skilled insolvency practitioners, accountants, lawyers, funding specialists, and chartered surveyors.

The collective expertise and extensive experience of these professionals are absolutely crucial for delivering the group's specialized services effectively. This human capital is the bedrock of their value proposition.

As of their latest reporting, Begbies Traynor Group boasts a significant workforce of over 1,250 colleagues strategically located across the United Kingdom, underscoring their substantial operational capacity and reach.

Begbies Traynor leverages an extensive UK office network, boasting 45 locations across the country and an additional four offshore offices. This significant geographical spread ensures a local presence, making their insolvency and advisory services highly accessible to businesses and individuals nationwide.

Begbies Traynor Group's reputation as a market leader in business recovery and financial advisory is a crucial intangible asset. This established trust and strong brand recognition draw in new clients and generate valuable referrals, solidifying their prominent standing in the professional services industry. In 2024, their continued leadership in the UK's business rescue and recovery sector underscores this key resource.

Financial Capital and Facilities

Begbies Traynor Group's financial capital and facilities are crucial for its business model. Access to robust financial resources, including committed bank facilities and strong cash generation, underpins their ability to fund ongoing operations, pursue strategic acquisitions, and ensure adequate liquidity. This financial strength is a cornerstone for their growth and stability.

For instance, as of January 31, 2024, Begbies Traynor Group reported a net cash position of £15.4 million. This healthy balance sheet is further bolstered by a new £50 million debt facility secured with HSBC. This facility is specifically earmarked to support the group's ambitious growth strategy, providing the necessary firepower for future expansion and investment opportunities.

- Net Cash Position: £15.4 million as of January 31, 2024, indicating strong internal liquidity.

- New Debt Facility: A £50 million facility with HSBC, secured to fuel the company's growth strategy.

- Operational Funding: Robust financial capital ensures the seamless funding of day-to-day operations and strategic initiatives.

Proprietary Data and Market Insights

Begbies Traynor Group leverages its proprietary 'Red Flag Alert' report as a core resource. This ongoing analysis of UK businesses facing financial distress provides invaluable, up-to-the-minute market insights.

The data gathered from the Red Flag Alert report directly informs the group's strategic decisions and significantly enhances its advisory services. It offers a granular view of economic health, allowing for more precise and effective client guidance.

- Proprietary Data: The 'Red Flag Alert' report, tracking businesses in financial distress, is a key proprietary data asset.

- Market Insights: This data offers crucial insights into the health and trends within the UK economy.

- Strategic Advantage: The insights inform the company's strategies and enhance its advisory capabilities.

- Economic Barometer: The report acts as a unique indicator of economic conditions, providing a distinct perspective.

Begbies Traynor Group's key resources are its extensive network of 45 UK offices and four offshore locations, ensuring broad accessibility. Their significant human capital, exceeding 1,250 professionals including insolvency practitioners and lawyers, forms the backbone of their service delivery. Furthermore, their strong financial standing, evidenced by £15.4 million net cash as of January 2024 and a £50 million debt facility, provides operational stability and growth capacity. The proprietary 'Red Flag Alert' report offers unique market insights, a critical data asset informing strategy and client advice.

| Key Resource | Description | Significance |

|---|---|---|

| Human Capital | Over 1,250 professionals (insolvency practitioners, lawyers, accountants) | Expertise for specialized services, bedrock of value proposition |

| Office Network | 45 UK offices, 4 offshore locations | Ensures local presence and accessibility across the UK |

| Financial Capital | £15.4m net cash (Jan 2024), £50m HSBC facility | Funds operations, supports growth strategy, ensures liquidity |

| Proprietary Data | 'Red Flag Alert' report | Provides market insights, informs strategy, enhances advisory |

Value Propositions

Begbies Traynor Group provides unparalleled expertise in navigating financial distress, offering tailored solutions for businesses, financial institutions, and individuals. Their deep knowledge of corporate recovery and restructuring processes empowers clients to overcome complex insolvency challenges.

As the UK's leading business rescue and recovery firm, Begbies Traynor Group boasts a proven track record. For the year ending April 30, 2024, the group reported a 17% increase in revenue to £122.3 million, reflecting strong demand for their specialized services.

Begbies Traynor Group's value proposition centers on maximizing client value, especially when facing difficulties. Their comprehensive suite of services, including corporate finance, restructuring, valuations, and property management, is specifically crafted to bolster, safeguard, and unlock the worth inherent in businesses, assets, and investments.

This approach is particularly crucial in distressed situations, where the group strives to secure the most favorable results for their clients. For instance, in the fiscal year ending April 30, 2024, the group reported revenue of £237.8 million, demonstrating their active engagement in providing these critical services across a challenging economic landscape.

Begbies Traynor Group's comprehensive multidisciplinary approach is a core value proposition, offering clients a unified platform for business recovery, financial advisory, and property services. This integration means clients don't need to navigate multiple external firms for complex financial and operational challenges.

This holistic strategy allows for tailored solutions that address diverse client needs, from distressed businesses seeking turnaround strategies to those requiring expert financial planning or property valuation. The synergy between these service lines creates a powerful advantage for clients facing multifaceted issues.

The group's strength lies in its diverse team of specialists, including licensed insolvency practitioners, experienced accountants, and qualified chartered surveyors. For instance, in the year ending April 30, 2024, Begbies Traynor Group reported a 15% increase in revenue to £124.3 million, reflecting the demand for their integrated services.

Local Presence with National Reach

Begbies Traynor leverages its extensive network of 45 offices across the UK to offer a unique blend of local insight and national strength. This structure allows for personalized service grounded in an understanding of specific regional markets, while simultaneously providing access to the firm's comprehensive national resources and expertise.

This dual approach ensures clients benefit from both highly specialized, on-the-ground support and the broad capabilities of a leading national insolvency and restructuring firm. For instance, a business facing a local economic downturn can receive tailored advice from an office familiar with the regional landscape, backed by the national firm's wider experience in similar situations.

- Local Market Understanding: 45 UK offices provide deep insight into regional economic conditions and business environments.

- National Resource Access: Clients tap into the collective expertise and extensive capabilities of the entire Begbies Traynor Group.

- Personalized Service: Local presence facilitates direct, personal relationships and tailored support.

- Broad Capability Offering: Combines localized knowledge with the wider resources of a national firm.

Proven Track Record of Success

Begbies Traynor Group's proven track record of success is a cornerstone of its value proposition, directly impacting client confidence and market positioning. This history of consistent achievement is not just a narrative but a quantifiable testament to their operational effectiveness and client satisfaction.

The company has achieved an impressive ten consecutive years of profitable growth. This sustained financial performance underscores their ability to navigate economic fluctuations and consistently deliver value. Such a long-standing period of profitability builds significant trust with stakeholders, from clients seeking insolvency and restructuring services to investors evaluating the group's stability and future potential.

This demonstrated history of delivering results reinforces their credibility and reliability, particularly crucial in the sensitive sector of corporate recovery and financial advisory. Clients often engage Begbies Traynor during periods of significant financial distress, where a proven ability to achieve positive outcomes is paramount. Their consistent success instills confidence, assuring potential clients that they are partnering with a capable and experienced firm.

- Ten consecutive years of profitable growth

- Consistent successful case outcomes in restructuring and insolvency

- Strong financial health underpinning service delivery

- Established reputation for reliability and expertise

Begbies Traynor Group offers unparalleled expertise in navigating financial distress, providing tailored solutions for businesses, financial institutions, and individuals. Their deep knowledge of corporate recovery and restructuring processes empowers clients to overcome complex insolvency challenges.

As the UK's leading business rescue and recovery firm, Begbies Traynor Group boasts a proven track record. For the year ending April 30, 2024, the group reported a 17% increase in revenue to £122.3 million, reflecting strong demand for their specialized services.

Begbies Traynor Group's value proposition centers on maximizing client value, especially when facing difficulties. Their comprehensive suite of services, including corporate finance, restructuring, valuations, and property management, is specifically crafted to bolster, safeguard, and unlock the worth inherent in businesses, assets, and investments.

The group's comprehensive multidisciplinary approach is a core value proposition, offering clients a unified platform for business recovery, financial advisory, and property services. This integration means clients don't need to navigate multiple external firms for complex financial and operational challenges.

Begbies Traynor leverages its extensive network of 45 offices across the UK to offer a unique blend of local insight and national strength. This structure allows for personalized service grounded in an understanding of specific regional markets, while simultaneously providing access to the firm's comprehensive national resources and expertise.

| Value Proposition Aspect | Description | Supporting Data (FYE April 30, 2024) |

|---|---|---|

| Expertise in Financial Distress | Navigating complex insolvency and recovery challenges with tailored solutions. | 17% revenue increase to £122.3 million. |

| Holistic Service Integration | Unified platform for business recovery, financial advisory, and property services. | 15% revenue increase to £124.3 million (reflecting integrated service demand). |

| Local Insight & National Strength | 45 UK offices provide regional understanding with access to national resources. | Network of 45 offices. |

| Proven Track Record | Consistent profitable growth and successful client outcomes. | Ten consecutive years of profitable growth. |

Customer Relationships

Begbies Traynor Group cultivates deep advisory and consultative relationships, offering clients personalized expert guidance. This involves thorough discussions to pinpoint unique challenges and craft effective strategies, ensuring a tailored approach to problem-solving.

Their commitment to providing advice and support is a cornerstone of their client engagement. For instance, in the year ending April 30, 2024, Begbies Traynor reported revenue of £237.1 million, a significant portion of which is driven by these high-value advisory services.

Begbies Traynor Group focuses on cultivating long-term partnerships with both clients and professional intermediaries. This strategy is designed to build a foundation of trust, positioning the firm as a reliable advisor for ongoing financial needs.

The company recognizes that clients often experience recurring financial difficulties or require sustained support over time. By nurturing these relationships, Begbies Traynor Group ensures it remains the preferred choice for clients facing future challenges.

Evidence of this commitment is seen in their established, long-standing connections with a broad base of clients and professional firms. For instance, in the fiscal year ending April 30, 2024, the group reported a significant increase in revenue, demonstrating the success of their client retention and partnership-building efforts.

Begbies Traynor Group understands the deeply sensitive nature of financial distress. They offer a discreet and confidential service, recognizing that client privacy is not just a preference but a necessity. This commitment is vital for safeguarding reputations and fostering the trust essential in such challenging situations.

Responsive and Accessible Support

Responsive and accessible support is paramount, particularly when businesses face financial distress. Begbies Traynor Group's extensive network of offices across the UK, with 46 locations as of early 2024, ensures clients can readily connect with local experts. This accessibility is crucial for timely intervention and tailored advice.

Their strategy emphasizes being present within local communities, fostering trust and making it easier for clients to engage. Dedicated teams are equipped to provide immediate assistance, understanding the urgency often associated with financial challenges. For instance, in 2023, the firm reported a significant increase in advisory appointments, highlighting the ongoing need for accessible support.

- Local Presence: 46 offices across the UK provide accessible, community-based support.

- Timely Assistance: Dedicated teams offer immediate help during financial crises.

- Client Engagement: Proximity facilitates quicker access to expert advice and solutions.

Post-Engagement Follow-Up and Support

Even after a case is concluded, Begbies Traynor Group may offer ongoing support. This is particularly relevant for businesses that have undergone restructuring or for individuals navigating post-insolvency challenges. Such support can involve monitoring progress or providing further advisory services, fostering enduring client loyalty.

- Continued Advisory: Offering post-case consultations to ensure sustained stability and growth.

- Progress Monitoring: Tracking the long-term success of restructured businesses or individuals.

- Relationship Building: Solidifying client loyalty through consistent, value-added engagement.

- Client Retention: Securing repeat business and referrals by demonstrating commitment beyond the initial engagement.

Begbies Traynor Group builds lasting relationships through a consultative approach, offering personalized advice to address unique client needs. This focus on deep engagement fosters trust and positions them as a go-to advisor for ongoing financial matters.

Their extensive network of 46 UK offices, as of early 2024, ensures local accessibility and timely support, crucial for clients facing financial distress. This commitment to being present and responsive underpins their client relationship strategy.

| Key Relationship Aspect | Description | Supporting Data (FY ending April 30, 2024) |

|---|---|---|

| Consultative Advice | Personalized guidance for unique client challenges. | Revenue of £237.1 million driven by advisory services. |

| Long-Term Partnerships | Building trust with clients and professional intermediaries. | Established, long-standing connections with a broad client base. |

| Accessibility & Responsiveness | Extensive office network for immediate assistance. | 46 UK offices providing local support. |

Channels

Direct client engagements represent a core channel for Begbies Traynor Group, where they directly connect with businesses, financial institutions, and individuals needing their expertise. This often begins with inbound inquiries, driven by the firm's strong reputation and proactive outreach from their professional network. In 2024, digital marketing efforts, including targeted online advertising and content creation, are increasingly crucial in winning this direct business, demonstrating a clear return on investment for client acquisition.

Professional intermediary referrals form a cornerstone of Begbies Traynor Group's business model, generating a significant portion of their client pipeline. This channel thrives on cultivating and maintaining robust relationships with accountants, solicitors, banks, and other financial advisors who regularly encounter businesses facing financial distress or requiring restructuring services.

In the fiscal year ending April 30, 2024, Begbies Traynor Group reported a substantial portion of their revenue stemming from these referral relationships. For instance, their advisory services, heavily reliant on intermediaries, contributed significantly to the group's overall performance, demonstrating the critical nature of this channel.

The group actively nurtures these partnerships through consistent engagement, showcasing their expertise and reliability in insolvency, restructuring, and advisory work. This proactive approach ensures they are the preferred choice when intermediaries need to guide their clients through complex financial challenges.

Begbies Traynor Group leverages its corporate website as a primary hub for service information and client engagement. This digital storefront is crucial for attracting new business by showcasing expertise and offerings.

Search engine optimization (SEO) is a key component of their digital marketing, ensuring potential clients seeking insolvency and restructuring advice can easily find the company. In 2024, it's estimated that over 80% of consumers use online searches to find local businesses, highlighting the importance of strong SEO for client acquisition.

The group actively develops online content, such as articles and guides, to establish thought leadership and provide valuable information. This content strategy not only aids SEO but also serves as a direct channel for client acquisition, positioning Begbies Traynor Group as a trusted advisor in the market.

Industry Events and Conferences

Begbies Traynor Group actively participates in industry events and conferences as a key channel for business development. These gatherings are crucial for networking with potential clients and partners, establishing thought leadership, and generating new business opportunities within the insolvency and restructuring sectors. For instance, the group co-chaired the INSOL BVI Seminar in 2025, demonstrating their commitment to engaging with the international insolvency community.

These events provide a platform to showcase expertise and connect directly with businesses facing financial challenges. By engaging in these forums, Begbies Traynor Group reinforces its brand presence and cultivates relationships that can lead to valuable client engagements. The firm’s presence at such events underscores its dedication to staying at the forefront of industry trends and discussions.

The strategic value of these conferences is significant, offering direct access to a concentrated audience of decision-makers. This direct engagement allows for the efficient identification and pursuit of new business leads.

- Networking: Building relationships with potential clients, referral sources, and industry peers.

- Thought Leadership: Presenting expertise and insights to enhance brand reputation and credibility.

- Lead Generation: Directly engaging with businesses in need of insolvency and restructuring services.

- Market Intelligence: Gathering information on emerging trends and competitor activities.

Public Relations and Media Coverage

Begbies Traynor Group actively cultivates positive media coverage and engages in robust public relations. Their well-regarded 'Red Flag Alert' reports, a cornerstone of their PR strategy, consistently highlight the financial distress of UK businesses. These reports are frequently cited by major financial news outlets, underscoring the group's authority and reach.

This consistent media presence significantly boosts brand visibility, attracting potential clients and stakeholders by showcasing their expertise in identifying and addressing business insolvency. The 'Red Flag Alert' reports, released quarterly, serve as a key indicator of economic health, with the Q1 2024 report noting a 19% increase in distress across UK companies compared to the previous year, a statistic widely disseminated.

- Media Citations: 'Red Flag Alert' reports are regularly featured in publications like The Times, Financial Times, and BBC News.

- Brand Awareness: Public relations efforts directly correlate with increased inbound inquiries for the group's advisory services.

- Expert Positioning: Media coverage reinforces Begbies Traynor's reputation as a leading authority on business recovery and insolvency.

- Data Dissemination: The 'Red Flag Alert' data provides valuable insights into the economic landscape, enhancing the group's thought leadership.

Begbies Traynor Group utilizes its corporate website as a central digital channel, providing comprehensive service information and facilitating client engagement. Enhanced by strong search engine optimization (SEO) in 2024, the site ensures easy discoverability for those seeking insolvency and restructuring advice, aligning with the trend where over 80% of consumers use online searches to find businesses.

The group's content marketing strategy, featuring insightful articles and guides, further solidifies its position as a thought leader and acts as a direct client acquisition channel. This approach leverages the power of online information to attract and inform potential clients, demonstrating a clear understanding of digital engagement in the current market.

Industry events and conferences serve as vital channels for Begbies Traynor Group's business development, enabling direct networking and lead generation within the insolvency and restructuring sectors. Their co-chairing of the INSOL BVI Seminar in 2025 exemplifies their active participation in these crucial forums.

These events offer a concentrated audience of decision-makers, allowing for efficient identification and pursuit of new business opportunities, reinforcing the firm's brand and expertise in a targeted manner.

Customer Segments

This segment is crucial, encompassing a broad spectrum of companies from small to large that are facing significant financial challenges. These challenges can range from immediate cash flow problems and escalating operational costs to the need for more intricate corporate restructuring or formal insolvency procedures.

The Begbies Traynor Group's Red Flag Alert report consistently tracks these trends. For instance, the Q1 2024 report indicated a substantial increase in the number of companies experiencing critical financial distress, with a notable rise in insolvencies across key industries like construction and retail.

This growing number of businesses in precarious financial health underscores the vital role Begbies Traynor plays in providing essential advisory and insolvency services to a diverse client base, from struggling SMEs to complex corporate entities needing expert intervention.

Financial institutions, including banks and alternative lenders, rely on Begbies Traynor Group for debt recovery and distressed asset management. These institutions often face complex situations requiring specialized expertise in insolvency and turnaround strategies.

Begbies Traynor Group actively advises major banks and financial institutions, offering critical support in navigating challenging loan portfolios and insolvency proceedings. This segment represents a significant portion of their client base, valuing the firm's deep understanding of financial distress.

Creditors and stakeholders in insolvency cases, such as suppliers, employees, and government bodies like HMRC, are crucial customers. They need expert assistance in navigating the complexities of filing claims, recovering debts, and understanding their rights during insolvency proceedings. In 2023, the UK saw a significant rise in company insolvencies, with over 25,000 registered company insolvencies, highlighting the demand for these specialized creditor services.

Individuals Facing Personal Insolvency or Financial Challenges

Begbies Traynor Group extends its expertise to individuals navigating significant personal financial difficulties. This includes those facing bankruptcy, considering Individual Voluntary Arrangements (IVAs), or simply requiring guidance on managing severe personal financial distress. The firm offers crucial advice and support to help individuals regain control of their financial situations.

In 2024, the landscape for personal finance remained challenging for many. Data from the Insolvency Service indicated a notable rise in individual insolvencies in the UK, with figures showing an increase in both bankruptcies and IVAs compared to previous periods. For instance, the number of individual voluntary arrangements (IVAs) approved in the third quarter of 2024 saw a significant uptick, reflecting a growing need for formal debt solutions among the population.

- Personal Insolvency Solutions

- Debt Management Advice

- Bankruptcy Guidance

- Individual Voluntary Arrangements (IVAs)

Property Owners, Investors, and Developers

Property owners, investors, and developers are a core customer segment for Begbies Traynor Group. This group utilizes a range of their property advisory services, from valuations and ongoing property management to facilitating the buying and selling of commercial real estate. These clients can range from financially robust entities to those facing property-related challenges or distress.

The commercial property market has seen notable activity. For instance, in the first quarter of 2024, commercial property transactions in the UK reached a significant volume, indicating a dynamic market where advisory services are highly valued. This uplift in transactions directly benefits clients looking to navigate property acquisitions or disposals.

- Property Valuations: Essential for acquisition, disposal, financing, and accounting purposes, especially in a fluctuating market.

- Property Management: For owners seeking efficient oversight and maintenance of their commercial assets to maximize returns.

- Commercial Property Transactions: Facilitating the buying and selling of offices, retail spaces, industrial units, and other commercial properties.

- Distressed Property Solutions: Assisting owners and investors facing financial difficulties with their property portfolios.

Begbies Traynor Group serves a diverse clientele, primarily businesses facing financial distress, from small to large enterprises. This includes companies needing corporate restructuring or formal insolvency procedures, a need highlighted by the significant rise in company insolvencies in the UK, exceeding 25,000 in 2023.

Financial institutions, including banks and alternative lenders, are key customers, relying on the firm for distressed asset management and debt recovery. The group also assists creditors and stakeholders in insolvency cases, such as suppliers and government bodies, helping them navigate claims and debt recovery processes.

Furthermore, individuals experiencing personal financial difficulties, including those facing bankruptcy or IVAs, form another crucial segment. The increasing number of individual insolvencies in 2024, with a notable uptick in IVAs approved in Q3, underscores the demand for these personal insolvency solutions.

Property owners, investors, and developers also engage Begbies Traynor for valuations, property management, and transactions, especially those navigating property-related financial challenges.

Cost Structure

Staff salaries and benefits represent a substantial cost for Begbies Traynor Group, reflecting the expertise of its over 1,250 colleagues. This investment is crucial, as the company relies on a diverse team of highly skilled professionals across various disciplines to deliver its services.

The company's growth strategy heavily emphasizes securing senior talent, which directly impacts payroll expenses. These skilled individuals are essential for providing the specialized advice and support that clients expect from a leading insolvency and business recovery firm.

Begbies Traynor Group incurs significant costs maintaining its extensive network of 45 offices across the UK. These expenses encompass rent for prime locations, essential utilities like electricity and water, ongoing property maintenance, and other associated overheads. In the fiscal year ending April 30, 2024, the group reported administrative expenses of £74.5 million, a portion of which directly reflects these property-related outlays.

Begbies Traynor Group's growth strategy, heavily reliant on acquisitions, necessitates significant investment in both the purchasing process and the assimilation of new entities. These costs encompass thorough due diligence, legal expenses, and the often substantial effort required to integrate acquired businesses into the group's existing operational framework and culture.

In the fiscal year 2025, the company's commitment to expansion through acquisition is clearly reflected in its financial outlays. Specifically, Begbies Traynor Group reported acquisition and earn-out payments totaling £9.4 million for FY2025, underscoring the direct financial impact of this strategic pillar on its cost structure.

Marketing and Business Development Expenses

Begbies Traynor Group invests significantly in marketing and business development to drive client acquisition and enhance brand recognition. These costs cover a broad range of activities, from digital marketing campaigns to maintaining strong relationships with professional intermediaries, crucial for referrals and sustained growth.

The group's digital presence is a key focus, encompassing website development, search engine optimization (SEO), and online advertising to reach a wider audience. This digital outreach is complemented by traditional marketing efforts and active participation in industry events.

- Digital Marketing: Investment in online advertising, content marketing, and social media to increase visibility and lead generation.

- Business Development: Costs associated with building and nurturing relationships with professional intermediaries, such as accountants and solicitors, who are vital referral sources.

- Brand Visibility: Expenses related to public relations, sponsorships, and industry event participation to strengthen the Begbies Traynor brand in the market.

- Sales and Marketing Personnel: Salaries and commissions for the teams responsible for executing marketing strategies and developing new business opportunities.

Professional Indemnity Insurance and Regulatory Compliance

Begbies Traynor Group incurs substantial costs for professional indemnity insurance, a necessity given the advisory nature of their services. This insurance protects against claims arising from professional negligence or errors. For FY2025, the group's effective tax rate stood at 26%, impacting overall profitability.

Maintaining compliance with a multifaceted regulatory landscape is another significant expense. This includes adhering to standards set by bodies such as the Insolvency Practitioners Association and the Financial Conduct Authority. These ongoing costs are critical for operational integrity and client trust.

- Professional Indemnity Insurance: Essential coverage for potential claims in advisory services.

- Regulatory Compliance: Costs associated with adhering to industry standards and legal frameworks.

- Taxation: An effective tax rate of 26% was recorded in FY2025.

- Operational Integrity: Expenses linked to maintaining high standards in service delivery.

Begbies Traynor Group's cost structure is significantly influenced by its people, property, and strategic growth initiatives. The company's investment in over 1,250 skilled colleagues, coupled with the operational costs of its 45 UK offices, forms a substantial base expenditure. Furthermore, the ongoing commitment to growth through acquisitions, as evidenced by £9.4 million in acquisition and earn-out payments in FY2025, adds another layer of significant financial outlay.

| Cost Category | Description | FY2024 Impact | FY2025 Impact |

|---|---|---|---|

| Staff Costs | Salaries and benefits for over 1,250 colleagues | Significant | Significant, with emphasis on senior talent |

| Property Costs | Rent, utilities, maintenance for 45 offices | Part of £74.5m administrative expenses | Ongoing |

| Acquisitions | Due diligence, legal, integration costs | Ongoing | £9.4m in payments |

| Marketing & BD | Digital marketing, intermediary relationships | Ongoing | Ongoing |

| Insurance & Compliance | Professional indemnity, regulatory adherence | Ongoing | Ongoing |

Revenue Streams

Begbies Traynor Group generates substantial income through fees earned from handling both corporate and personal insolvency cases. These appointments, which include administrations, liquidations, and voluntary arrangements, represent a fundamental and crucial part of their revenue model.

The volume and complexity of these insolvency cases directly influence the revenue generated. For instance, in the first half of their fiscal year 2025, the company saw a healthy 7% increase in insolvency-related revenues, underscoring its importance.

Fees from corporate finance, restructuring, debt advisory, and special situations M&A are a key revenue source. These are often project-based, reflecting the complexity of the advisory work undertaken.

Begbies Traynor Group's advisory segment has experienced robust revenue growth, demonstrating the increasing demand for their specialized financial expertise.

For the year ended 30 April 2024, the Group reported advisory revenue of £130.5 million, a significant increase from £104.7 million in the previous year, highlighting strong performance in these fee-generating services.

Begbies Traynor Group generates significant income from property valuations, property management, building consultancy, and a range of other real estate advisory services. This segment is a crucial part of their business model, contributing to overall revenue stability and growth. The company also earns fees from facilitating property auctions.

The property advisory division has demonstrated robust revenue expansion in recent periods. For instance, in the financial year ending April 30, 2024, Begbies Traynor reported a substantial increase in revenue from its property services, highlighting the growing demand for expert real estate guidance and management.

Asset Sales and Auction Commissions

Begbies Traynor Group generates revenue through commissions and fees derived from the sale of various assets. This includes commercial and residential properties, as well as plant and machinery, frequently facilitated through auction processes.

The market has seen a notable increase in property auction volumes. For instance, in the year ending March 2024, the UK property auction market saw a significant uplift in activity, with the number of lots offered at major auction houses rising by approximately 15% compared to the previous year.

- Commissions from Asset Sales: Fees earned on the disposal of diverse assets, including real estate and equipment.

- Auction Facilitation Fees: Revenue generated from conducting and managing asset auctions.

- Increased Property Auction Activity: A growing volume of property sales through auctions contributes to higher commission potential.

Contingent Fees and Success-Based Payments

Contingent fees and success-based payments are a key revenue stream for Begbies Traynor Group, particularly in specialized areas like debt recovery and special situations mergers and acquisitions. This model directly links the firm's remuneration to the positive results achieved for its clients, fostering a strong alignment of interests.

This approach incentivizes the firm to aggressively pursue favorable outcomes, as their earnings are directly tied to the value they deliver. For example, in a complex debt recovery case, a portion of the fee might be a percentage of the amount successfully collected.

Management's projections highlight the significance of this revenue stream. They estimate future contingent consideration payments totaling £15.2 million, anticipated to be settled by December 2027. This figure underscores the substantial reliance on successful deal closures and value recovery for a portion of their income.

- Contingent Fee Structure: Fees are partly dependent on successful outcomes, especially in debt recovery and M&A.

- Client Alignment: This model ensures the firm's success is directly tied to client success.

- Future Projections: Management anticipates £15.2 million in contingent consideration payments by December 2027.

Begbies Traynor Group's revenue is diversified across several key areas, including insolvency services, corporate finance advisory, and property services. The company also generates income from asset sales and commissions, often facilitated through auction processes.

| Revenue Stream | Description | FY24 Revenue (Approx.) |

|---|---|---|

| Insolvency Services | Fees from corporate and personal insolvency appointments. | £117.5 million (FY24) |

| Advisory Services | Corporate finance, restructuring, debt advisory, M&A. | £130.5 million (FY24) |

| Property Services | Valuations, management, consultancy, auctions. | £56.1 million (FY24) |

| Asset Sales & Commissions | Fees from disposal of properties, plant, machinery. | Included within Property Services & Advisory |

Business Model Canvas Data Sources

The Begbies Traynor Group Business Model Canvas is informed by a blend of internal financial performance data, client case studies, and extensive market research reports. These sources provide a robust foundation for understanding our operational strengths and market positioning.