Begbies Traynor Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Begbies Traynor Group Bundle

Begbies Traynor Group operates in a landscape shaped by moderate buyer power and significant threat from new entrants, with established competitors also exerting considerable pressure. Understanding these dynamics is crucial for navigating its market.

The complete report reveals the real forces shaping Begbies Traynor Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Begbies Traynor Group's reliance on specialized professionals like insolvency practitioners and chartered surveyors means that a shortage of top-tier talent can significantly shift bargaining power. These highly skilled individuals, or the agencies that place them, can command higher salaries and more favorable terms, directly influencing the firm's recruitment expenses and operational capacity.

Begbies Traynor's reliance on specialized technology and software for its operations, particularly in areas like insolvency case management and financial analytics, means software providers can hold significant bargaining power. If these providers offer unique, highly integrated solutions with substantial switching costs, their influence increases. The UK financial services sector's continued push for digitalization, with an estimated 15% increase in cloud adoption by financial institutions in 2024, underscores this dependence on key software vendors.

Begbies Traynor Group relies heavily on data and information providers for accurate market intelligence, economic forecasts, and property data, which are vital for their advisory, valuation, and restructuring services. Suppliers offering comprehensive, authoritative, and proprietary data sets, especially those with granular local market insights, possess significant bargaining power. The exclusivity and quality of this data directly impact Begbies Traynor's capacity to deliver informed advice and sustain its competitive advantage in the market.

Acquisition Targets

Begbies Traynor Group's strategy hinges on acquiring smaller firms and specialized teams to broaden its service offerings and geographic footprint. Owners of businesses that align with this growth model, particularly those with established client bases or unique expertise, wield significant influence over acquisition terms.

This supplier bargaining power directly affects the cost of Begbies Traynor's expansion. For instance, in 2024, the firm continued to actively seek and integrate acquisitions, with the valuation of these targets being a key negotiation point. The ability of sellers to command premium prices can impact the overall profitability and return on investment for these strategic moves.

- Strong Client Relationships: Targets with loyal and recurring client revenue streams are highly attractive, giving their owners leverage in negotiations.

- Niche Expertise: Firms possessing specialized skills or knowledge in areas like insolvency or corporate restructuring that Begbies Traynor wishes to enhance can negotiate favorable terms.

- Robust Work Pipeline: Companies with a predictable and substantial flow of future business present a lower risk and higher potential return, increasing their bargaining power.

- Market Conditions: The overall economic climate and the demand for advisory services in 2024 influenced the availability and valuation of potential acquisition targets, impacting supplier power.

Regulatory and Compliance Service Providers

Firms offering regulatory and compliance services, including legal advice on insolvency law and professional training, represent a crucial, albeit indirect, supplier group for Begbies Traynor. As UK insolvency regulations continue to evolve, the demand for specialized compliance expertise is likely to rise, potentially increasing the bargaining power of these service providers. For instance, the Insolvency Service regularly updates guidance, requiring continuous professional development for licensed insolvency practitioners, a service often provided by external bodies.

The increasing complexity of financial regulations and reporting standards, particularly in the wake of economic shifts, can empower these specialized service providers. Their ability to interpret and advise on these intricate requirements means Begbies Traynor must engage with them, potentially at a higher cost if demand outstrips supply. This dynamic is amplified by the need for ongoing professional development, with bodies like the Insolvency Practitioners Association setting mandatory CPD hours, often fulfilled through courses from external training providers.

- Increased regulatory scrutiny necessitates specialized compliance advice.

- Evolving insolvency laws grant leverage to legal and compliance experts.

- Mandatory professional development strengthens the position of training providers.

- Expertise in niche areas allows service providers to command higher fees.

Begbies Traynor Group's reliance on specialized talent, proprietary software, and high-quality data sources means suppliers in these areas can exert significant bargaining power. This is particularly true for providers of unique solutions or exclusive data sets, as seen with the 15% increase in cloud adoption by UK financial institutions in 2024, highlighting dependence on key vendors.

The firm's acquisition strategy also means that owners of attractive target businesses, especially those with strong client bases or niche expertise, can negotiate favorable terms. This was evident in 2024 as Begbies Traynor continued its acquisition drive, with seller valuations being a critical negotiation point.

Furthermore, the evolving regulatory landscape in the UK, particularly concerning insolvency, enhances the bargaining power of compliance and legal service providers. Mandatory professional development requirements for insolvency practitioners, often met through external training, also strengthen the position of these specialized suppliers.

| Supplier Type | Factors Influencing Bargaining Power | Impact on Begbies Traynor |

|---|---|---|

| Specialized Professionals | Scarcity of top-tier talent, demand for expertise | Increased recruitment costs, potential operational constraints |

| Technology & Software Providers | Unique solutions, high switching costs, industry digitalization trends | Potential for higher software licensing fees, dependence on vendor roadmaps |

| Data & Information Providers | Exclusivity, data quality, proprietary market insights | Higher data acquisition costs, impact on advisory service quality |

| Acquisition Targets | Established client bases, niche expertise, robust work pipeline | Higher acquisition valuations, potential impact on ROI |

| Compliance & Legal Services | Regulatory complexity, evolving laws, mandatory training needs | Increased costs for compliance advice and professional development |

What is included in the product

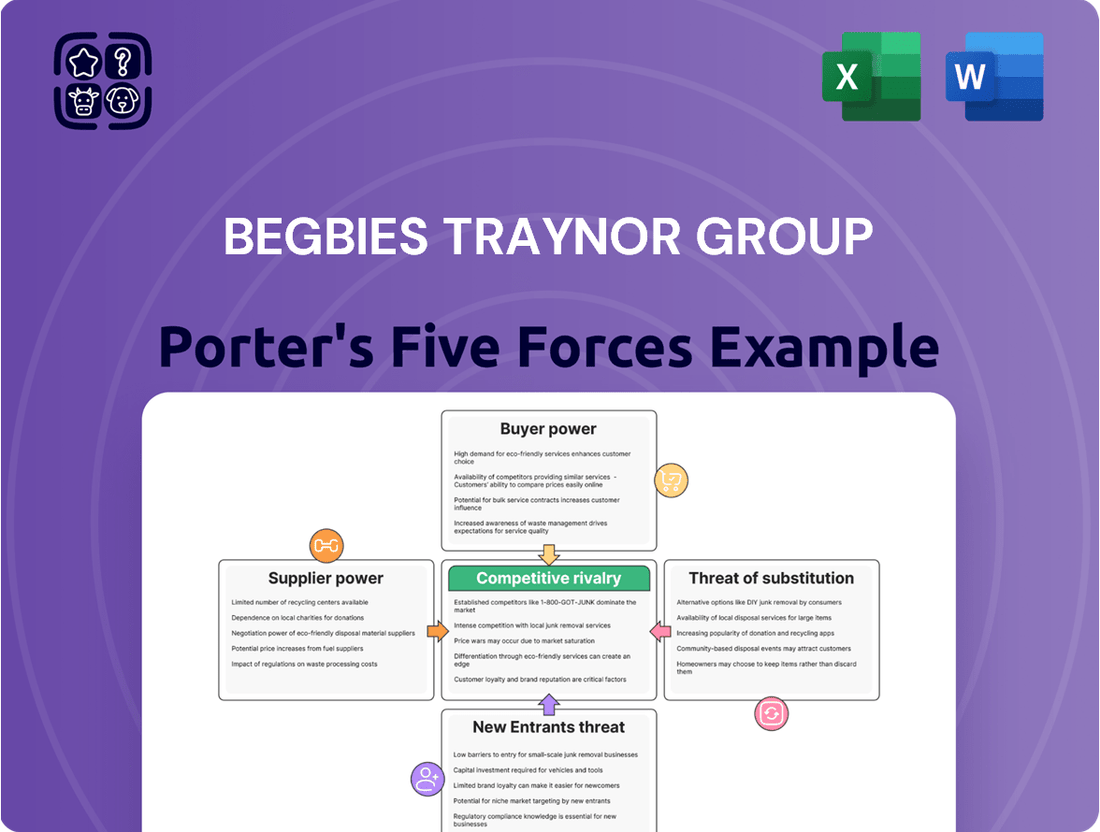

This Porter's Five Forces analysis for Begbies Traynor Group thoroughly examines the industry's competitive intensity, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Effortlessly identify and quantify competitive pressures, allowing for targeted strategies to mitigate threats and capitalize on opportunities.

Customers Bargaining Power

Customers seeking corporate rescue or personal insolvency solutions are often in a vulnerable state, which can initially dampen their bargaining power. Their immediate need for a service often outweighs their ability to negotiate terms.

However, their financial constraints are significant, making them highly sensitive to the cost and the projected success of any intervention. This sensitivity drives a demand for demonstrable value and clear, effective solutions from service providers like Begbies Traynor Group.

For instance, in the UK, personal insolvencies saw an increase in early 2024, with a notable rise in individual voluntary arrangements (IVAs). This trend highlights the critical need for accessible and perceived value-driven services for individuals facing financial distress, directly impacting their focus on cost-effectiveness and successful outcomes.

Large financial institutions, banks, and major creditors are key clients for Begbies Traynor, frequently engaging their services for debt recovery, asset realization, and restructuring. These institutional customers, due to the significant volume of business they can generate and their deep market knowledge, wield considerable bargaining power. They expect competitive pricing and exceptional service delivery, influencing Begbies Traynor's fee structures and operational efficiency.

For property advisory, valuation, and management services, clients typically possess greater choice and experience less immediate pressure than insolvency clients, granting them increased bargaining power. The competitive nature of the property services sector means clients can readily obtain multiple quotes, influencing their negotiation leverage.

Begbies Traynor's ability to command pricing is therefore contingent on the perceived uniqueness and depth of its expertise within particular property niches, as clients weigh the value of specialized knowledge against readily available alternatives.

Client Concentration and Repeat Business

Begbies Traynor Group serves a broad range of clients, which generally dilutes the bargaining power of any single customer. However, the firm's reliance on a core group of larger, recurring clients does present a concentration risk. These established relationships, built on consistent delivery of insolvency and advisory services, can lead to increased customer leverage.

The firm's success in securing repeat business is a testament to its ability to provide ongoing value and maintain high levels of client satisfaction. This is crucial, as strong client retention directly impacts the bargaining power of those who consistently engage Begbies Traynor's services.

- Client Diversification: Begbies Traynor's broad client base across various sectors limits the power of individual customers.

- Repeat Business Impact: A high volume of recurring engagements with key clients can consolidate their collective bargaining power.

- Value Proposition: Consistent delivery of expert advice and successful case resolutions are key to mitigating customer power by fostering loyalty.

Cost-Benefit Analysis and Outcome Focus

Customers, especially those in financial distress, carefully weigh the costs of Begbies Traynor's services against the expected benefits. This cost-benefit analysis is central to their decision-making process.

Their bargaining power is amplified by a strong focus on achieving the most favorable outcome, whether that means maximizing asset recovery, reducing debt, or facilitating a successful business turnaround. They actively seek the best possible resolution to their financial difficulties.

Furthermore, customers are increasingly inclined to solicit and compare proposals from multiple insolvency practitioners. This competitive landscape empowers them to negotiate terms and ensure they are receiving value for money.

- Cost-Benefit Scrutiny: Clients rigorously assess service fees against projected financial improvements.

- Outcome-Driven Negotiations: The pursuit of optimal results (e.g., asset maximization, liability minimization) strengthens customer leverage.

- Provider Comparison: A willingness to shop around and compare offers from various firms enhances customer bargaining power.

Customers' bargaining power with Begbies Traynor Group is influenced by their financial situation and the availability of alternatives. While those in immediate distress may have less leverage, cost-sensitive clients and those with significant transaction volumes can exert considerable influence.

The firm's reliance on institutional clients, such as banks, means these entities can negotiate favorable terms due to the scale of business they represent. This is particularly relevant as UK personal insolvencies, including Individual Voluntary Arrangements (IVAs), saw an increase in early 2024, indicating a strong demand for insolvency services where cost-effectiveness is paramount.

For property services, clients often have more options and less urgency, allowing them to compare quotes and negotiate effectively. Begbies Traynor's ability to retain clients through consistent value delivery is key to mitigating this customer power.

| Key Factor | Impact on Bargaining Power | Example/Data Point (Early 2024) |

| Financial Distress | Initially Low, increases with cost sensitivity | Rise in UK IVAs |

| Client Volume (Institutional) | High | Banks and major creditors engaging for debt recovery |

| Service Alternatives | High | Property services clients comparing multiple quotes |

| Focus on Outcomes | High | Clients seeking maximum asset recovery or debt reduction |

Preview Before You Purchase

Begbies Traynor Group Porter's Five Forces Analysis

This preview showcases the complete Begbies Traynor Group Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate access to this professionally crafted report. You can be confident that the insights and strategic evaluations presented are exactly what you'll download, ready for immediate application.

Rivalry Among Competitors

The UK's corporate recovery, financial advisory, and property services sector is highly fragmented, featuring a wide array of competitors from small local firms to large global entities. This diversity means intense competition across all service areas.

This crowded landscape fuels aggressive rivalry as businesses of all sizes compete for mandates and market share. For instance, in 2023, the Insolvency Service reported over 20,000 company insolvencies in the UK, creating a significant but highly contested demand for recovery services.

The increasing volume of UK insolvencies, projected to remain elevated through 2024 and into 2025, presents a dual-edged sword for firms like Begbies Traynor Group. While this trend expands the overall market for insolvency services, it simultaneously intensifies competitive rivalry.

This heightened activity acts as a magnet for both established players seeking to capitalize on the surge and new entrants eyeing a growing sector. For instance, data from the Insolvency Service showed a 12% increase in company insolvencies in England and Wales in the first quarter of 2024 compared to the same period in 2023. This larger pie naturally draws more participants, leading to a more crowded and competitive landscape.

Competition in the restructuring and insolvency sector is intensely driven by how effectively firms differentiate their services. This often comes down to specialized expertise in niche areas, a deep understanding of specific industries, extensive geographic coverage, or the development of truly innovative client solutions.

Begbies Traynor Group actively leverages its comprehensive service portfolio, which spans corporate insolvency, debt advisory, and other financial advisory services, to carve out a distinct market position. Their emphasis on being a market leader in corporate insolvency, a critical and specialized field, serves as a significant differentiator.

Furthermore, Begbies Traynor's widespread UK presence, with numerous offices across the country, allows them to offer localized support and a deep understanding of regional economic conditions. This broad reach, combined with their specialized insolvency expertise, helps them stand out in what is a very competitive landscape.

Price Competition and Fee Structures

Begbies Traynor Group faces intense price competition, particularly in its more standardized service offerings. This pressure often leads to adjustments in fee structures as firms vie for market share. For instance, in the insolvency sector, which can be somewhat commoditized, competitive pricing is a significant factor in client acquisition.

The group may offer flexible fee arrangements, such as fixed fees for certain services or performance-based structures, to attract and retain clients. This is a common strategy across the professional services industry to cater to diverse client needs and budgets. In 2024, many accounting and advisory firms reported increased client sensitivity to fees, leading to more negotiation on pricing for routine services.

- Fee Pressure: Commoditized services within the insolvency and advisory sectors are susceptible to downward pressure on fees.

- Flexible Structures: Begbies Traynor may employ varied fee models, including fixed and performance-based pricing, to remain competitive.

- Value Over Cost: For complex, high-stakes cases, such as major corporate restructurings or distressed M&A, a firm's established reputation and demonstrable track record of success typically command a premium and are prioritized over minor cost savings.

Acquisition-Driven Consolidation

Begbies Traynor Group’s acquisition-driven strategy actively shapes the competitive landscape. This approach to consolidation reduces the number of smaller, independent players in the market. For instance, in the fiscal year ending April 30, 2024, Begbies Traynor completed several acquisitions, integrating new capabilities and market presence.

While this consolidation pares down the competition, it simultaneously fosters the growth of larger, more powerful entities. This can intensify the rivalry among the remaining significant firms as they vie for market share and talent. The trend suggests a maturing market where scale and integrated service offerings become increasingly important differentiators.

- Begbies Traynor’s acquisition strategy is a direct driver of industry consolidation.

- Acquisitions reduce the sheer number of competitors, particularly smaller practices.

- This consolidation can lead to a more concentrated market with fewer, but larger, dominant players.

- The emergence of these larger entities is likely to heighten competitive pressures among them.

The competitive rivalry within the UK's corporate recovery and financial advisory sector is fierce, characterized by a fragmented market with numerous firms vying for business. This intensity is amplified by the rising number of company insolvencies, which reached over 20,000 in the UK in 2023, a trend expected to continue through 2024 and 2025, attracting more players to the market.

Begbies Traynor Group differentiates itself through specialized expertise, a broad UK presence, and a comprehensive service portfolio, including corporate insolvency and debt advisory, to stand out amidst this competition. While price competition is a factor, particularly for commoditized services, firms like Begbies Traynor may employ flexible fee structures to attract clients, with many reporting increased client sensitivity to fees in 2024.

Begbies Traynor's acquisition strategy actively consolidates the market, reducing the number of smaller competitors and fostering the growth of larger entities, which in turn intensifies rivalry among these dominant players.

SSubstitutes Threaten

Businesses in financial difficulty might try to fix things themselves. This could mean talking directly to lenders or finding ways to cut costs, bypassing the need for formal insolvency advice. For example, in 2023, many UK firms explored debt restructuring options outside of formal insolvency proceedings to manage rising interest rates.

These informal efforts, like securing new investment or renegotiating loan terms, directly compete with Begbies Traynor’s core business of formal restructuring and advisory services. The availability of these self-help strategies can reduce the demand for external insolvency practitioners.

For individuals seeking alternatives to traditional debt resolution, a range of options exist beyond formal bankruptcy. These include debt management plans, Debt Relief Orders (DROs), and Individual Voluntary Arrangements (IVAs) offered by various insolvency practitioners. The growing availability and reduced barriers to entry, such as the elimination of upfront fees for DROs in the UK, make these increasingly viable substitutes.

Larger corporations and financial institutions often maintain robust internal teams, including legal, finance, and property management departments. This in-house capability allows them to manage distressed situations, conduct valuations, and handle property-related matters without external assistance, directly substituting for services offered by firms like Begbies Traynor.

For instance, a major property developer might have a dedicated team of surveyors and legal counsel capable of navigating complex insolvency proceedings or property disposals. This internal capacity effectively negates the need for external advisory services, representing a significant threat of substitution.

Mediation and Alternative Dispute Resolution

The threat of substitutes for Begbies Traynor Group's core insolvency services is present from alternative dispute resolution (ADR) methods. Parties facing financial distress or disputes may choose mediation, arbitration, or other ADR processes as a less confrontational and often more cost-efficient alternative to formal insolvency proceedings or litigation.

These ADR mechanisms can offer swifter resolutions and preserve business relationships, thereby bypassing the need for traditional insolvency practitioners. For instance, in 2024, the UK's Ministry of Justice reported a continued increase in the use of mediation in civil disputes, indicating a growing preference for out-of-court settlements.

- Growing adoption of mediation and arbitration in commercial disputes.

- Potential for faster and more cost-effective resolutions compared to formal insolvency.

- Reduced adversarial nature can preserve business relationships.

Digital Platforms and Self-Service Tools

The increasing digitalization of financial and property services presents a growing threat of substitutes for traditional advisory roles. Online platforms and sophisticated self-service tools are emerging, offering capabilities that can perform basic financial analysis and property valuations.

These digital tools, while not yet capable of handling the full complexity of intricate restructuring or bespoke financial advice, can indeed serve as viable alternatives for simpler client needs. For instance, a significant portion of the market seeking straightforward valuation estimates or basic financial health checks might opt for these readily available, often lower-cost digital solutions.

By mid-2024, the adoption of such digital tools has accelerated. Many fintech companies are actively developing and refining these platforms. For example, some property valuation portals reported a 25% year-over-year increase in user engagement for their automated valuation models (AVMs) in early 2024, indicating a tangible shift in consumer preference for self-service options.

- Digital Valuation Tools: Platforms offering automated property valuations are increasingly accurate and accessible, potentially reducing demand for traditional appraisal services for less complex transactions.

- Online Financial Planning: Robo-advisors and digital financial planning tools provide accessible, algorithm-driven investment advice and portfolio management, acting as substitutes for human financial advisors for a segment of the market.

- DIY Restructuring Software: While limited in scope, some software solutions are emerging that guide small businesses through simplified debt management or restructuring processes, offering an alternative to professional insolvency practitioners for less severe situations.

- Information Accessibility: The sheer volume of readily available financial data and analytical tools online empowers individuals and businesses to conduct their own preliminary research and analysis, reducing reliance on external experts for initial assessments.

The threat of substitutes for Begbies Traynor's services is significant, stemming from both informal business practices and readily available digital solutions. Businesses facing financial distress might attempt self-resolution through debt renegotiation or cost-cutting measures, bypassing the need for formal insolvency advice. For instance, in 2023, many UK firms actively explored debt restructuring outside formal insolvency to navigate rising interest rates.

Furthermore, the increasing sophistication and accessibility of digital tools pose a direct challenge. Online platforms offering automated valuations and basic financial analysis can cater to simpler client needs, reducing demand for traditional advisory services. By mid-2024, automated valuation models (AVMs) saw a notable increase in user engagement, with some portals reporting a 25% year-over-year rise in early 2024.

| Substitute Type | Description | Impact on Begbies Traynor | Example/Data Point (2023-2024) |

|---|---|---|---|

| Informal Restructuring | Businesses managing distress internally via cost cuts or debt renegotiation. | Reduces demand for formal insolvency practitioners. | UK firms exploring debt restructuring outside formal insolvency in 2023. |

| Digital Valuation Tools | Online platforms providing automated property valuations. | Substitutes for simpler valuation needs, impacting advisory revenue. | 25% YoY increase in AVM user engagement reported by some portals in early 2024. |

| DIY Financial Planning | Robo-advisors and digital tools for investment and financial management. | Appeals to a segment of clients seeking automated financial advice. | Growing adoption of robo-advisory services for wealth management. |

| Alternative Dispute Resolution (ADR) | Mediation, arbitration, and other out-of-court settlement methods. | Offers faster, potentially cheaper resolutions, bypassing formal insolvency. | Continued increase in mediation use in UK civil disputes in 2024. |

Entrants Threaten

The insolvency and financial advisory sectors in the UK face substantial barriers to entry due to stringent regulations and the necessity of professional qualifications. For instance, aspiring insolvency practitioners must obtain specific licenses and adhere to rigorous conduct rules, a process that can be both time-consuming and costly, deterring many potential new entrants.

Proposed regulatory changes, such as new authorization frameworks and the establishment of a public register for insolvency practitioners, further solidify these entry barriers. These measures ensure that only qualified and compliant firms can operate, effectively limiting the threat of new competitors entering the market and challenging established players like Begbies Traynor Group.

Building a strong reputation and trust in sensitive areas like corporate rescue, financial advisory, and property services takes considerable time and a proven track record of successful outcomes. For instance, in 2024, the financial advisory sector continued to emphasize client testimonials and case studies, with firms highlighting their success rates in navigating complex restructuring. New entrants, lacking this established credibility, find it challenging to attract clients, particularly for high-value engagements.

Establishing a national presence for a firm like Begbies Traynor Group, even without heavy manufacturing, demands considerable capital. This includes setting up a network of offices across the country, investing in robust technology infrastructure to support operations, and crucially, attracting and retaining highly skilled professionals in a competitive market. For instance, in 2023, the professional services sector saw significant investment in digital transformation, with many firms allocating substantial budgets to cloud computing and data analytics, underscoring the ongoing capital needs.

Begbies Traynor Group's growth strategy, which often involves acquiring smaller or complementary businesses, further emphasizes the capital intensity of entering this market at scale. New entrants lacking significant funding would struggle to match the reach and capabilities achieved through such strategic acquisitions. This financial barrier is a key deterrent, as undercapitalized competitors would find it exceedingly difficult to compete with established players who have already made these substantial investments.

Extensive Professional Networks and Referrals

The corporate recovery and advisory sector thrives on trust and established connections. Newcomers struggle to replicate the deep-rooted referral networks that firms like Begbies Traynor Group have cultivated over years with banks, legal professionals, and accountants. These relationships are vital for securing mandates and gaining access to distressed businesses.

Building these essential professional networks takes considerable time and effort. Without them, new entrants find it challenging to compete for lucrative advisory roles. For instance, a significant portion of deals in the insolvency and restructuring market are generated through these trusted intermediaries.

- High Barrier to Entry: The need for extensive, pre-existing professional networks acts as a significant deterrent for new firms entering the corporate recovery and advisory space.

- Client Acquisition Challenges: Without a strong referral base, new entrants face difficulties in acquiring clients, as established firms already have preferential access to potential business.

- Trust and Reputation: The sector relies heavily on reputation and trust, which are built over time through consistent successful engagements and strong relationships with professional partners.

Specialized Expertise and Talent Acquisition

The specialized nature of Begbies Traynor's services, particularly in insolvency and restructuring, demands a highly skilled workforce. New entrants face a significant challenge in acquiring the necessary expertise, as experienced insolvency practitioners, chartered surveyors, and financial advisors are in limited supply.

Established firms like Begbies Traynor benefit from a strong reputation and a proven track record, which aids in attracting and retaining top talent. This makes it difficult for newcomers to compete for the scarce pool of experienced professionals, who often seek the career development and diverse case exposure that established firms can provide.

- Scarcity of Qualified Professionals: The market for licensed insolvency practitioners is inherently limited, with stringent qualification and experience requirements.

- High Training Costs: New entrants must invest heavily in training and development to bring staff up to the required professional standards.

- Established Firm Advantage: Begbies Traynor Group, as of its latest reporting in 2024, continues to leverage its extensive network and established training programs to maintain a competitive edge in talent acquisition.

The threat of new entrants for Begbies Traynor Group is relatively low due to significant barriers. These include stringent regulatory requirements, the need for substantial capital to establish a national presence and invest in technology, and the critical importance of a strong reputation and established professional networks, which take years to build.

New firms struggle to attract clients without a proven track record and deep referral relationships with banks and legal professionals. Furthermore, the scarcity of highly skilled and qualified professionals in specialized areas like insolvency and restructuring makes talent acquisition a major hurdle for newcomers.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Regulatory Requirements | Licensing, conduct rules, and potential new authorization frameworks for insolvency practitioners. | High cost and time investment, deterring many. |

| Capital Investment | Setting up offices, technology infrastructure, and attracting talent. | Significant financial outlay required; undercapitalized firms struggle. |

| Reputation & Trust | Building credibility through successful outcomes and client testimonials. | New entrants lack established trust, making client acquisition difficult. |

| Professional Networks | Cultivating referral relationships with banks, lawyers, and accountants. | New firms struggle to gain access to mandates without existing connections. |

| Talent Acquisition | Attracting and retaining scarce, highly skilled insolvency practitioners and advisors. | Established firms have an advantage in talent retention due to career opportunities. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages a comprehensive suite of data, including publicly available financial reports from companies, detailed industry research from leading market intelligence firms, and macroeconomic indicators from reputable global economic databases.