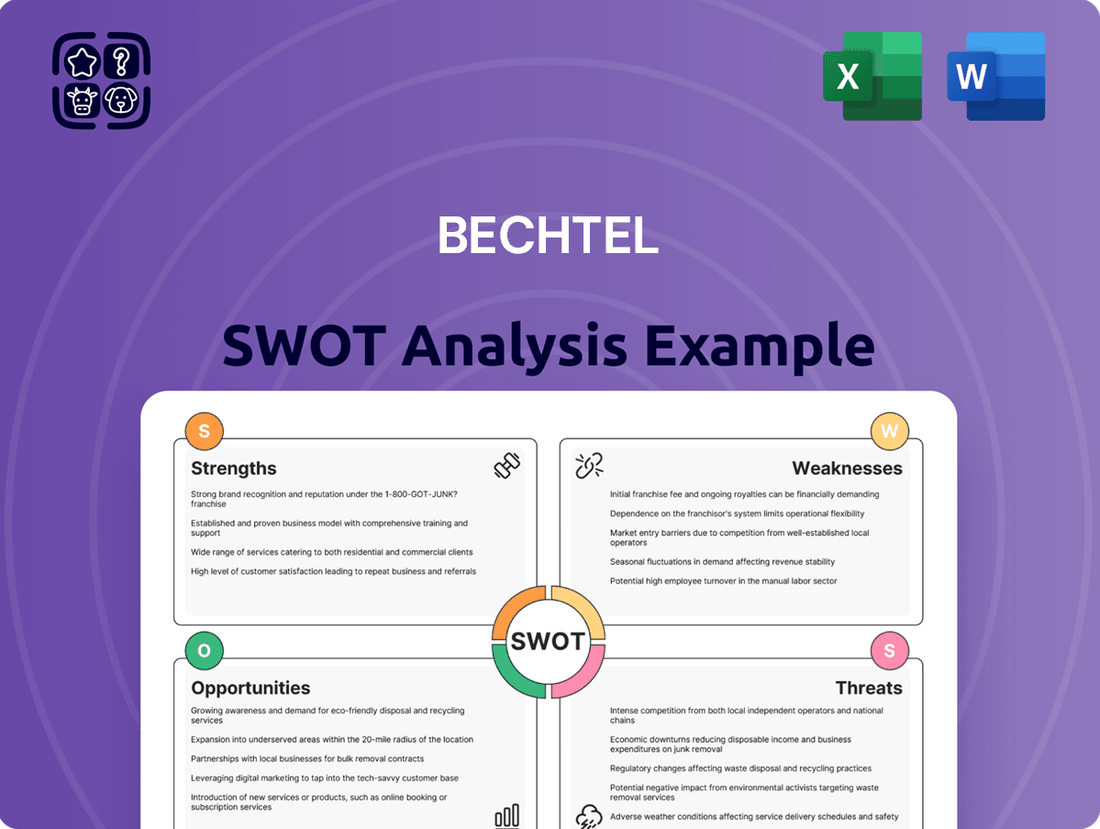

Bechtel SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bechtel Bundle

Bechtel, a titan in global engineering and construction, boasts immense strengths in its project execution capabilities and a diversified portfolio. However, understanding the nuances of its market opportunities and potential threats is crucial for strategic advantage.

Want the full story behind Bechtel’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Bechtel's global footprint is truly impressive, with operations spanning nearly 50 countries. This extensive reach, built over more than a century of work, means they've successfully navigated diverse markets and regulatory environments. They've completed over 25,000 projects across all seven continents, showcasing an unparalleled depth of experience in managing complex, large-scale undertakings.

This vast operational history and geographic diversity are significant strengths. It allows Bechtel to attract major clients worldwide who value proven expertise and reliability. Furthermore, operating in so many different regions naturally diversifies their revenue streams and reduces dependence on any single economy, making them more resilient to localized downturns.

Bechtel's strength lies in its remarkably diversified project portfolio, touching vital industries like energy, transportation, communications, mining, oil and gas, and government services. This broad reach is a significant advantage, enabling the company to consistently secure large contracts across various economic landscapes.

This diversification directly translates into financial resilience. For instance, Bechtel secured over $24 billion in new project awards during 2024, a testament to its capacity to win business across its wide spectrum of expertise and buffer against sector-specific downturns.

Bechtel boasts a remarkably strong financial position, notably absent of external debt on its balance sheet. This financial resilience is further bolstered by substantial cash reserves, providing significant capacity for strategic investments in digital transformation and a strong buffer against economic volatility.

The company’s financial health is clearly demonstrated by its performance for the year ending December 31, 2024. Bechtel Limited reported a substantial leap in pre-tax profit to over £34.8 million, a notable increase from £22.4 million in 2023. Furthermore, its net assets stood at an impressive £126.6 million, underscoring a robust and growing financial foundation.

Commitment to Innovation and Technology

Bechtel consistently demonstrates a strong commitment to innovation, actively integrating digital solutions and cutting-edge technologies across its operations. This focus on technological advancement is designed to enhance project efficiency, improve safety outcomes, and proactively address evolving customer needs. For instance, the company is a proponent of Digital Twin Technology, which allows for real-time project monitoring and predictive maintenance.

The company's investment in research and development underscores this dedication. In 2024 alone, Bechtel allocated $1.2 billion towards R&D initiatives, signaling a significant drive to pioneer new methods and solutions within the engineering and construction sectors. This investment fuels the adoption of advanced tools like AI-powered automation, which streamlines complex processes and drives productivity gains.

- Digital Integration: Bechtel leverages digital solutions for enhanced project management and execution.

- Technological Advancement: Active adoption of cutting-edge technologies like Digital Twins and AI.

- R&D Investment: Significant financial commitment, with $1.2 billion invested in R&D in 2024.

- Efficiency and Safety Focus: Technology integration aims to boost project efficiency and safety standards.

Focus on Sustainability and Decarbonization

Bechtel's strong focus on sustainability and decarbonization is a significant advantage. The company has set ambitious goals, including achieving net-zero Scope 1, 2, and 3 emissions by 2050, and a 50% reduction in fleet emissions by 2030. This commitment positions Bechtel to capitalize on the growing global demand for environmentally responsible projects.

They are actively developing innovative solutions to help clients meet their own decarbonization targets. This includes exploring and implementing hybrid and electric equipment, which not only reduces environmental impact but can also lead to operational cost savings. Furthermore, Bechtel is extending these sustainable practices into its supply chain, ensuring a holistic approach to environmental stewardship.

- Net-Zero Emissions Target: Bechtel aims for net-zero Scope 1, 2, and 3 emissions by 2050.

- Fleet Emission Reduction: A roadmap is in place to cut fleet emissions by 50% by 2030.

- Customer Decarbonization Support: Developing programs to assist clients in achieving their decarbonization goals.

- Sustainable Equipment and Supply Chain: Investing in hybrid/electric equipment and promoting sustainability throughout its supply chain.

Bechtel's extensive global presence, operating in nearly 50 countries with over a century of experience, allows them to navigate diverse markets and secure large-scale projects. This geographic diversification naturally spreads revenue streams, enhancing financial resilience against localized economic downturns. Their proven track record across all seven continents demonstrates an unparalleled ability to manage complex, international undertakings.

The company's financial health is robust, notably marked by the absence of external debt and substantial cash reserves. This strong financial footing, evidenced by a pre-tax profit of over £34.8 million in 2024 and net assets of £126.6 million, provides significant capacity for strategic investments and a solid buffer against market volatility.

Bechtel's commitment to innovation is backed by a substantial R&D investment of $1.2 billion in 2024, focusing on digital solutions like Digital Twins and AI to boost efficiency and safety. This dedication to technological advancement ensures they remain at the forefront of the industry, offering clients cutting-edge project execution.

A forward-looking approach to sustainability, including a net-zero emissions target by 2050 and a 50% fleet emission reduction by 2030, positions Bechtel to capitalize on the growing demand for green projects. They actively support client decarbonization goals through innovative solutions and sustainable supply chain practices.

| Strength | Description | Supporting Data |

|---|---|---|

| Global Operations | Extensive international presence and experience. | Operations in ~50 countries; 25,000+ projects completed globally. |

| Financial Strength | Debt-free with significant cash reserves. | £34.8M pre-tax profit (2024); £126.6M net assets (2024). |

| Technological Innovation | Investment in digital solutions and R&D. | $1.2B R&D investment (2024); adoption of Digital Twins & AI. |

| Sustainability Focus | Commitment to decarbonization and green solutions. | Net-zero target by 2050; 50% fleet emission reduction by 2030. |

What is included in the product

Delivers a strategic overview of Bechtel’s internal and external business factors, highlighting its strengths in project execution and global reach, while also identifying potential threats from market volatility and competitive pressures.

Identifies critical vulnerabilities and opportunities for proactive risk mitigation and strategic advantage.

Weaknesses

Bechtel's significant involvement in massive, complex infrastructure projects inherently exposes the company to the risk of cost overruns and schedule delays. These challenges can directly impact profitability and strain relationships with clients, especially in the current economic climate. For instance, the ongoing global supply chain disruptions and inflationary pressures, which saw the Producer Price Index for construction inputs rise by 5.8% in the year ending May 2024, exacerbate these risks.

The company must navigate a landscape marked by volatile material costs, persistent labor shortages across skilled trades, and increasingly stringent regulatory frameworks. These factors, common in the global construction sector, can collectively contribute to unforeseen budget increases and extended project timelines, directly impacting Bechtel's financial performance and reputation.

While Bechtel boasts a diversified portfolio, a substantial portion of its revenue remains concentrated in specific large-scale projects and key geographic regions, notably the Middle East and Asia. This concentration exposes the company to heightened risks associated with economic downturns or political volatility within these areas.

For example, a slowdown in overseas projects directly impacted Bechtel's UK operations, leading to a revenue decline in 2024. Despite this, the company managed to improve profitability, highlighting an ongoing effort to navigate these regional dependencies.

The engineering and construction sector is notoriously competitive, often forcing companies like Bechtel to contend with significant pricing pressures. This intense rivalry, especially from global players, can directly impact profit margins, making it crucial for Bechtel to maintain stringent cost controls and consistently seek operational efficiencies to stay ahead.

Workforce Challenges and Labor Costs

Bechtel, like many in the construction sector, grapples with significant workforce challenges. The U.S. construction industry, in particular, is experiencing a critical shortage of skilled labor, exacerbated by an aging workforce and widening skill gaps. This scarcity directly translates into increased labor costs, as companies must offer higher wages and bonuses to attract and retain talent. For instance, in 2024, demand for specialized trades like welders and pipefitters has driven up compensation packages, impacting project budgets and potentially leading to schedule delays.

These labor cost pressures can strain project profitability and competitiveness. The need to offer premium wages to fill essential roles means that a larger portion of a project's budget is allocated to personnel, potentially reducing margins or requiring upward adjustments to contract pricing. This dynamic is a persistent concern for large-scale engineering and construction firms like Bechtel, influencing their bidding strategies and project execution plans.

- Labor Shortages: The U.S. construction sector faces a critical shortage of skilled workers, impacting project timelines and increasing operational costs.

- Aging Workforce: A significant portion of the skilled construction labor force is nearing retirement age, creating a pipeline problem for experienced professionals.

- Skill Gaps: There's a notable disconnect between the skills required for modern construction projects and the available workforce, necessitating extensive training and development.

- Rising Wage Costs: To attract and retain talent in a competitive market, companies like Bechtel are experiencing increased wage demands and bonus offerings for critical roles such as welders and pipefitters, impacting overall project budgets.

Cybersecurity Risks

The increasing sophistication of cyberattacks presents a significant vulnerability for Bechtel. Protecting its vast operational data, critical systems, and extensive infrastructure demands continuous and substantial investment in advanced cybersecurity measures. A breach could lead to severe operational disruptions, impacting project timelines and profitability, and could also cause significant reputational damage in an industry built on trust and reliability.

Cybersecurity threats are a growing concern across the engineering and construction sector. For instance, reports from 2023 highlighted a significant rise in ransomware attacks targeting critical infrastructure companies, with average recovery costs escalating. Bechtel, managing complex global projects, is a prime target for such attacks, necessitating a proactive and robust defense strategy to mitigate these risks.

- Sophisticated Threats: Bechtel faces advanced cyber threats targeting operational technology (OT) and information technology (IT) systems.

- Investment Needs: Significant ongoing investment is required for state-of-the-art cybersecurity solutions and skilled personnel.

- Operational Impact: A successful cyberattack could halt critical project operations, leading to costly delays and financial losses.

- Reputational Damage: Compromised data or system failures can severely damage Bechtel's reputation for security and reliability.

Bechtel's reliance on massive, complex projects makes it susceptible to cost overruns and schedule delays, especially with ongoing global supply chain issues and inflation. The Producer Price Index for construction inputs rose 5.8% in the year ending May 2024, highlighting these pressures.

The company's revenue concentration in specific regions, particularly the Middle East and Asia, poses a risk due to potential economic downturns or political instability in those areas. For example, a slowdown in overseas projects impacted Bechtel's UK operations in 2024, though profitability improved.

Intense competition in the engineering and construction sector leads to significant pricing pressures, directly affecting Bechtel's profit margins. Maintaining stringent cost controls and operational efficiencies is crucial for competitiveness.

What You See Is What You Get

Bechtel SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Bechtel's strategic position.

This is the same SWOT analysis document included in your download. The full content is unlocked after payment, ensuring you receive the complete, professional assessment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, offering all strategic insights for Bechtel.

Opportunities

The global infrastructure market is poised for substantial growth, with projections indicating it will reach $9.3 trillion by 2025. This surge presents a prime opportunity for Bechtel to expand its footprint across critical sectors like transportation, energy, and urban development.

Government initiatives, such as the U.S. Infrastructure Investment and Jobs Act (IIJA), are injecting significant capital into infrastructure development. This legislative push directly translates into a robust pipeline of new projects, creating a favorable environment for Bechtel's business development efforts.

Bechtel is well-positioned to benefit from the significant growth in renewable energy and decarbonization initiatives. Global investments in clean energy surpassed $300 billion in 2024, a trend expected to accelerate as nations pursue net-zero targets.

This presents substantial opportunities for Bechtel in areas like solar power development, carbon capture technologies, and the emerging hydrogen economy. The company's expertise in large-scale project execution is a key advantage in these complex and capital-intensive sectors.

Bechtel can capitalize on the increasing adoption of digital transformation and advanced technologies. Integrating AI, robotics, and digital twins offers substantial gains in project efficiency, safety, and overall productivity. For instance, in 2024, the global construction technology market was projected to reach over $40 billion, highlighting the significant potential for companies like Bechtel to leverage these tools.

The company's ongoing investment in research and development, including its focus on digital solutions, positions it to effectively harness these technological advancements. This strategic focus allows Bechtel to not only improve its current project execution but also to develop innovative approaches that provide a distinct competitive advantage in the evolving engineering and construction landscape.

Emerging Markets and Strategic Partnerships

Bechtel's increasing presence in emerging markets, such as Southeast Asia and parts of Africa, presents significant growth opportunities. These regions are experiencing substantial infrastructure development needs, driven by urbanization and economic expansion. For instance, the Asian Development Bank projected that developing Asia would require $1.7 trillion annually for infrastructure investment through 2030, a substantial portion of which Bechtel is well-positioned to pursue.

Strategic partnerships with global suppliers and local entities in these emerging markets are crucial for navigating complex regulatory environments and leveraging local expertise. These collaborations can enhance Bechtel's capabilities, reduce project risks, and expand its market reach. By teaming up with established local firms, Bechtel can gain better access to resources and a deeper understanding of regional dynamics, fostering more successful project execution.

- Expanding Footprint: Targeting high-growth emerging economies with significant infrastructure deficits.

- Synergistic Alliances: Forming joint ventures and strategic alliances with global and local partners to share risk and resources.

- Leveraging Expertise: Applying Bechtel's extensive experience in large-scale projects to new, developing markets.

Demand for Specialized Facilities (e.g., Data Centers, Battery Manufacturing)

The increasing need for specialized infrastructure like data centers and battery manufacturing plants is a significant opportunity for Bechtel. These advanced manufacturing facilities are crucial for technological advancements and the green energy transition.

Bechtel is well-positioned to capitalize on this trend, as these projects are typically large-scale, complex, and require extensive engineering and construction expertise. For instance, the global data center market was valued at approximately $276 billion in 2023 and is projected to grow substantially. Similarly, the demand for EV battery manufacturing capacity is surging, with significant investments being made worldwide.

- Growing Data Center Demand: The expansion of cloud computing and AI is driving unprecedented demand for data center construction, a sector Bechtel has experience in.

- EV Battery Gigafactories: The global push for electric vehicles translates into a massive need for battery manufacturing facilities, creating long-term project pipelines.

- Semiconductor Manufacturing Boom: Government initiatives and supply chain resilience efforts are spurring investment in new semiconductor fabrication plants, requiring specialized construction.

- Long-Term Project Stability: These complex projects offer Bechtel sustained revenue streams and opportunities to leverage its global project management capabilities.

Bechtel can capitalize on the global infrastructure growth, projected to reach $9.3 trillion by 2025, by expanding into transportation, energy, and urban development sectors.

Government initiatives like the U.S. Infrastructure Investment and Jobs Act are creating a robust pipeline of projects, directly benefiting Bechtel's business development.

The company is also positioned to benefit from the over $300 billion invested in clean energy in 2024, leveraging its expertise in renewable energy and decarbonization projects.

Bechtel can further enhance efficiency and safety by integrating advanced technologies like AI and robotics, tapping into a construction technology market projected to exceed $40 billion in 2024.

| Opportunity Area | Market Size/Projection | Bechtel Relevance |

|---|---|---|

| Global Infrastructure Growth | $9.3 trillion by 2025 | Expansion in transportation, energy, urban development |

| Clean Energy Investment | >$300 billion (2024) | Renewable energy, decarbonization projects |

| Construction Technology | >$40 billion (2024) | AI, robotics for efficiency and safety |

| Emerging Markets Infrastructure | $1.7 trillion annually (Developing Asia) | Urbanization, economic expansion needs |

Threats

Economic downturns and market volatility are significant threats to Bechtel. Reduced demand for new projects, coupled with potential funding challenges and project cancellations, can directly impact revenue streams. For instance, fluctuations in U.S. construction spending, which saw a dip in early 2024, highlight the sensitivity of the sector to broader economic shifts.

Bechtel is vulnerable to fluctuating material prices, with steel costs, a key component in many infrastructure projects, showing significant volatility. For instance, average US hot-rolled coil steel prices saw a substantial rise in early 2024 compared to the previous year, directly impacting Bechtel's project budgeting and potential profit margins.

Supply chain disruptions, a persistent issue through 2023 and into 2024, pose another significant threat. These disruptions can lead to project delays, increased logistics costs, and the need to source materials from less efficient or more expensive suppliers, thereby challenging Bechtel's ability to maintain financial stability and adhere to project timelines.

Bechtel faces growing threats from stricter environmental regulations and increased scrutiny across its global operations. These evolving standards, particularly concerning carbon emissions and waste management, can significantly inflate project costs and introduce complex compliance hurdles. For instance, the global environmental services market is anticipated to reach $2.1 trillion by 2025, indicating a substantial increase in compliance demands for major engineering firms.

Failure to proactively adapt to these new regulatory landscapes could result in costly project delays and substantial financial penalties. This is a critical consideration as Bechtel undertakes large-scale infrastructure projects worldwide, where environmental compliance is increasingly a non-negotiable aspect of project execution and public acceptance.

Intensifying Competition and Pressure on Profit Margins

The global construction arena is fiercely competitive, creating significant pricing pressures that can erode profitability. With industry-wide profit margins hovering around 5-7% in 2024, Bechtel faces a constant challenge to maintain its financial health. This environment necessitates aggressive cost management and a strong focus on differentiation to stand out and secure profitable projects.

Key aspects of this threat include:

- Intense bidding wars: Competitors often underbid to win contracts, driving down potential profits.

- Commodity price volatility: Fluctuations in material costs can directly impact project profitability if not managed effectively.

- Emergence of new players: Lower barriers to entry in some segments can introduce new, aggressive competitors.

- Client demand for cost efficiency: Clients are increasingly seeking the lowest possible cost, putting further pressure on margins.

Geopolitical Instability and Trade Tensions

Geopolitical instability, including ongoing conflicts in regions like Ukraine and the Middle East, presents a significant threat to Bechtel's global operations. These situations can lead to project delays, increased costs due to supply chain disruptions, and heightened security concerns for personnel and assets. For instance, the prolonged conflict in Ukraine has impacted global energy markets and infrastructure development, areas where Bechtel is active.

Trade tensions and protectionist policies adopted by various nations can also hinder Bechtel's ability to secure international contracts and manage cross-border projects efficiently. Such policies may impose tariffs, restrict market access, or necessitate complex compliance measures, thereby affecting project profitability and Bechtel's competitive positioning. The ongoing trade disputes between major economies in 2024 continue to underscore this risk.

Bechtel must maintain agile strategies to navigate these turbulent geopolitical waters. This includes diversifying its project portfolio geographically, strengthening risk management protocols, and building resilient supply chains. Adapting to evolving international regulations and political landscapes is crucial for sustained success.

- Disrupted Supply Chains: Conflicts and trade wars can sever critical material and equipment supply lines, delaying projects and escalating costs.

- Increased Security Costs: Operating in unstable regions often requires significant investment in security measures for personnel and project sites.

- Contractual Uncertainty: Geopolitical shifts can lead to changes in government contracts or force majeure clauses, impacting revenue streams.

- Market Access Restrictions: Trade barriers and sanctions can limit Bechtel's ability to bid on or execute projects in certain countries.

Bechtel faces significant threats from intense global competition, which can lead to reduced profit margins as clients demand greater cost efficiency. The company must also contend with the volatility of commodity prices, particularly for materials like steel, which saw significant price increases in early 2024, impacting project budgets. Furthermore, ongoing supply chain disruptions, a persistent challenge through 2023 and into 2024, can cause project delays and increase logistics costs.

| Threat Category | Specific Risk | Impact on Bechtel | Supporting Data (2023-2024) |

|---|---|---|---|

| Competition & Pricing | Intense bidding wars, client demand for cost efficiency | Eroded profitability, pressure on margins | Industry profit margins around 5-7% in 2024 |

| Economic Factors | Commodity price volatility (e.g., steel) | Increased project costs, budget overruns | US hot-rolled coil steel prices rose significantly in early 2024 |

| Operational Disruptions | Supply chain disruptions | Project delays, increased logistics costs | Persistent issue through 2023-2024, impacting global projects |

SWOT Analysis Data Sources

This Bechtel SWOT analysis is built upon a robust foundation of data, drawing from Bechtel's official financial reports, comprehensive market intelligence, and expert industry analyses to provide a thorough strategic overview.