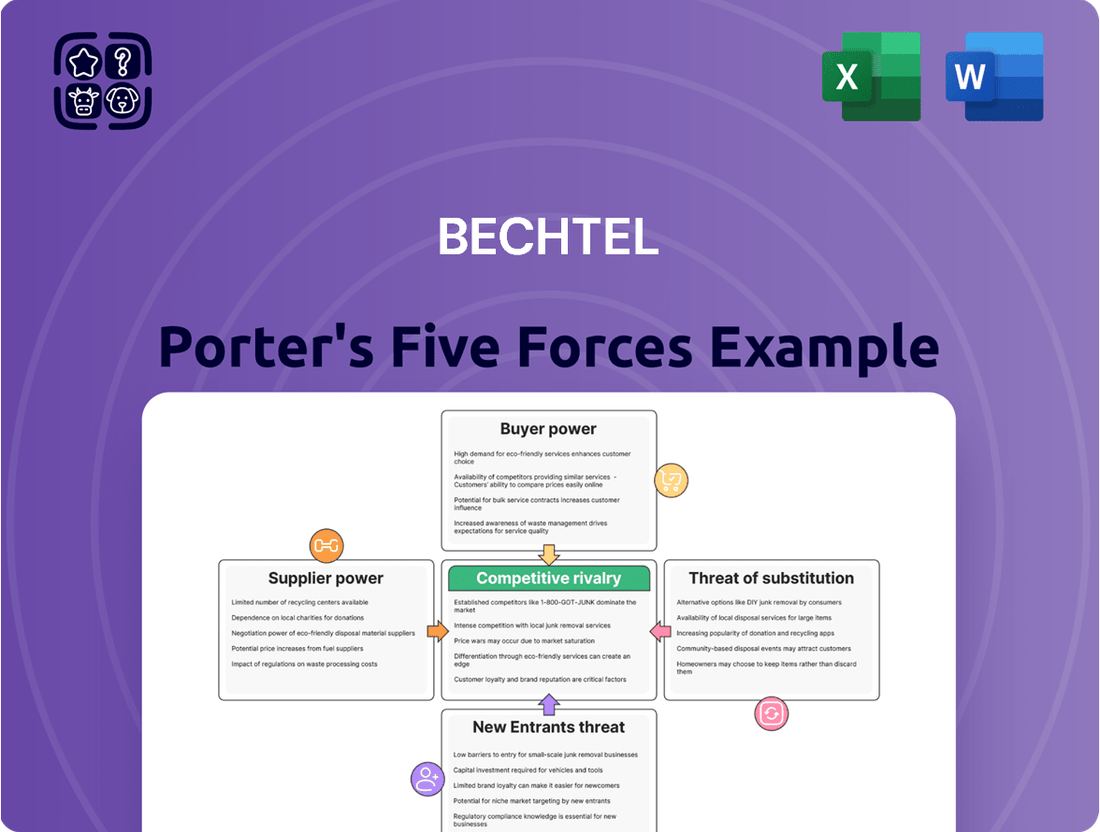

Bechtel Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bechtel Bundle

Bechtel's competitive landscape is shaped by powerful forces, from the intense rivalry among existing players to the significant bargaining power of its clients. Understanding these dynamics is crucial for any strategic decision-making.

The complete report reveals the real forces shaping Bechtel’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Bechtel, a major player in global Engineering, Procurement, and Construction (EPC), often faces concentrated supplier power when sourcing highly specialized materials and equipment. In 2024, the demand for advanced components in renewable energy projects, such as specialized turbines or custom-designed solar panels, can be met by only a handful of manufacturers worldwide. This limited supply base grants these specialized suppliers considerable leverage in price negotiations and delivery timelines.

High switching costs significantly bolster the bargaining power of Bechtel's suppliers. For instance, in the complex world of large-scale infrastructure, a supplier providing specialized, custom-engineered components might command higher prices because replacing them mid-project would necessitate costly re-engineering, rigorous re-qualification processes, and could lead to substantial project delays and contractual penalties. In 2024, the average cost of project delays in the construction industry globally was estimated to be around 10-15% of the total project value, underscoring the financial risk Bechtel faces when considering supplier changes.

The bargaining power of suppliers significantly influences Bechtel's operational costs and project feasibility. Fluctuations in the prices and availability of essential raw materials such as steel, cement, and specialized engineering components directly impact Bechtel's project budgets. For instance, in 2024, global steel prices saw considerable volatility, with some benchmarks experiencing a nearly 15% increase in the first half of the year due to production cuts and strong demand from infrastructure projects.

Geopolitical events and ongoing supply chain disruptions further amplify this supplier power. These external factors can lead to shortages or increased lead times for critical materials, granting suppliers leverage to dictate terms and prices. This was evident in late 2023 and early 2024, where shipping container costs, a key component for material delivery, remained elevated, adding an average of 10-12% to the overall cost of imported materials for large construction firms like Bechtel.

Labor Shortages and Specialized Skills

The construction and engineering sectors, including the EPC industry, are grappling with persistent labor shortages, especially for those with specialized skills. This scarcity directly enhances the bargaining power of skilled labor suppliers and subcontractors. They can leverage this demand to push for higher wages and more favorable contract terms, potentially impacting project timelines and costs if a sufficient workforce isn't secured promptly.

In 2024, the U.S. Bureau of Labor Statistics reported a significant deficit in skilled trades. For instance, the demand for electricians and construction managers continues to outpace the available supply, a trend expected to persist. This imbalance empowers these specialized labor providers, allowing them to command premium rates and dictate terms, which can increase overall project expenses for companies like Bechtel.

- Skilled Labor Scarcity: Ongoing shortages in specialized construction and engineering roles.

- Increased Supplier Power: Labor suppliers and subcontractors gain leverage due to high demand.

- Wage Inflation: Specialized workers can demand higher compensation, driving up labor costs.

- Project Risk: Potential for delays and cost overruns if adequate skilled labor cannot be secured.

Technological Advancements in Supplier Offerings

Suppliers integrating cutting-edge technologies like modular construction and prefabrication can significantly elevate their offerings. For instance, companies specializing in advanced Building Information Modeling (BIM) or digital twin solutions can streamline project workflows and reduce on-site complexities.

This technological edge allows these suppliers to command premium pricing, as their innovations directly translate to enhanced efficiency and quality for clients like Bechtel. In 2024, the global construction technology market was valued at approximately $17.8 billion, with significant growth driven by digital transformation initiatives.

Bechtel's reliance on such technologically adept suppliers can increase their bargaining power, as adopting these advanced methods may become crucial for maintaining a competitive advantage in project delivery and innovation.

- Advanced Technologies: Suppliers offering modular construction, prefabrication, and digital solutions (BIM, digital twins, AI) differentiate themselves.

- Premium Pricing: These technological advancements enable suppliers to justify higher prices due to improved project efficiency and quality.

- Competitive Edge: Bechtel may need to depend on these suppliers to stay competitive and enhance project execution.

- Market Growth: The construction technology market is expanding, with digital solutions playing a key role in driving adoption and supplier influence.

The bargaining power of Bechtel's suppliers is substantial, particularly for specialized equipment and materials. In 2024, the limited number of manufacturers for advanced components in renewable energy projects, like custom solar panels, grants these suppliers significant leverage in negotiations. This concentration means Bechtel has fewer alternatives, directly impacting pricing and delivery terms.

| Factor | Impact on Bechtel | 2024 Data/Context |

|---|---|---|

| Supplier Concentration | Limited suppliers for specialized components increase their power. | Few global manufacturers for advanced renewable energy equipment. |

| Switching Costs | High costs to change suppliers mid-project. | Project delays due to supplier changes can cost 10-15% of project value. |

| Material Price Volatility | Fluctuations in raw material costs affect budgets. | Steel prices rose nearly 15% in H1 2024 due to production cuts. |

| Geopolitical/Supply Chain Issues | Shortages and increased lead times enhance supplier leverage. | Elevated shipping costs added 10-12% to imported material costs in late 2023/early 2024. |

What is included in the product

Analyzes the five competitive forces impacting Bechtel's industry, including threat of new entrants, bargaining power of buyers and suppliers, threat of substitutes, and intensity of rivalry.

Instantly identify and mitigate competitive threats with a dynamic visualization of all five forces.

Customers Bargaining Power

Bechtel's clientele comprises major entities like governments and large corporations in sectors such as energy, mining, and transportation, alongside public-private partnerships. These clients engage in massive, intricate infrastructure endeavors, frequently requiring substantial capital outlay and extended timelines.

The sheer scale and complexity of these projects, often valued in the billions of dollars, grant these customers significant leverage. For instance, the company's involvement in projects like the expansion of the Jubail Industrial City in Saudi Arabia, a multi-billion dollar undertaking, highlights the substantial financial commitments involved, directly impacting Bechtel's negotiation power.

This considerable project value translates into substantial influence over contract terms, pricing structures, and the detailed specifications of the work. Customers can dictate favorable payment schedules and demand stringent quality controls, thereby increasing their bargaining power.

Customers in Bechtel's sector, particularly large corporations and governments, wield significant bargaining power due to the highly specialized and critical nature of the projects undertaken. These clients often dictate extremely detailed specifications and performance benchmarks, directly influencing project execution and cost. For instance, a major infrastructure project might require adherence to specific environmental impact standards or advanced technological integration, giving the client leverage in negotiations.

The sheer scale and complexity of Bechtel's undertakings mean that clients can impose stringent regulatory compliance and quality assurance demands. This necessitates meticulous planning and execution, empowering customers to hold Bechtel accountable for every detail and outcome. In 2024, the global infrastructure spending was projected to reach trillions, with a significant portion allocated to projects with exacting requirements, underscoring the customer's strong position.

Bechtel's customers, particularly large government entities and major corporations, frequently leverage competitive bidding. For instance, in 2024, many large infrastructure projects, such as those in the renewable energy sector or transportation, saw an average of 5-7 qualified bidders vying for contracts, intensifying price pressure.

This rigorous procurement process grants customers significant bargaining power. They can solicit detailed proposals, compare technical capabilities and pricing across multiple leading EPC firms, and negotiate aggressively on contract terms, potentially impacting Bechtel's profitability on awarded projects.

Long-Term Relationships and Repeat Business

While customers hold considerable sway in individual project negotiations, Bechtel actively cultivates long-term relationships to ensure repeat business. This strategic approach aims to shift the power dynamic by fostering loyalty through consistent delivery of high-quality work and value. However, the prospect of future contracts still allows clients to exert influence on current terms and conditions.

Bechtel's focus on building enduring partnerships means that while a customer might have strong bargaining power on a single project, the potential for ongoing work can moderate that power. This creates a delicate balance where Bechtel seeks to be a preferred partner, but clients can leverage their future business to negotiate favorable terms today.

- Customer Loyalty as a Mitigator: Bechtel's success in securing repeat business, exemplified by its long-standing contracts with entities like the U.S. Department of Defense, demonstrates a strategy to reduce customer bargaining power over time.

- Value Proposition for Retention: The company's emphasis on delivering exceptional project outcomes and maintaining strong client relationships is a key factor in retaining customers, thereby lessening their ability to dictate terms on future engagements.

- Strategic Partnerships over Transactions: By framing engagements as strategic partnerships rather than one-off transactions, Bechtel aims to align interests and reduce the adversarial nature of negotiations, even when individual projects are large.

Ability to Influence Project Scope and Changes

Customers can significantly influence Bechtel's projects by requesting changes to the scope, design, or timeline. These change orders, while potentially revenue-generating, can disrupt Bechtel's resource allocation and financial forecasts. For instance, a major infrastructure project might see numerous scope adjustments, impacting the original budget and completion date, thereby demonstrating customer leverage.

- Customer-driven scope changes: Clients often have the contractual right to request modifications to project specifications.

- Impact on Bechtel's operations: Unexpected or frequent changes can strain Bechtel's planning, scheduling, and workforce deployment.

- Financial implications: While change orders can add revenue, they also introduce cost overruns and can delay payment, affecting Bechtel's cash flow and profitability.

- Project lifecycle influence: This power extends throughout the project, allowing customers to exert influence even after initial agreements are set.

Bechtel's customers, primarily governments and large corporations undertaking massive infrastructure projects, possess substantial bargaining power. This leverage stems from the immense value of these contracts, often in the billions, and the critical nature of the services Bechtel provides. For example, in 2024, global infrastructure investment was projected to exceed $3 trillion, with large-scale projects demanding rigorous client oversight.

The scale of Bechtel's projects, like the multi-billion dollar Jubail Industrial City expansion, means clients can dictate terms, pricing, and stringent quality controls. This power is amplified by competitive bidding processes, where in 2024, many major infrastructure bids saw an average of 5-7 qualified bidders, intensifying price pressure on Bechtel.

Customers can also exert influence through change orders, altering scope or timelines, which can disrupt Bechtel's planning and profitability. While Bechtel aims to build long-term partnerships to mitigate this, the potential for future business still allows clients leverage in current negotiations.

| Customer Characteristic | Impact on Bechtel's Bargaining Power | Example/Data Point (2024) |

|---|---|---|

| Project Scale & Value | High leverage due to significant financial commitment | Multi-billion dollar projects (e.g., Jubail Industrial City) |

| Competitive Bidding Environment | Intensified price pressure and negotiation | Average 5-7 bidders for major infrastructure projects |

| Client Specificity & Control | Ability to dictate detailed specifications and quality | Stringent environmental and technological integration demands |

| Change Order Authority | Potential for disruption to Bechtel's operations and finances | Impact on budget, schedule, and resource allocation |

What You See Is What You Get

Bechtel Porter's Five Forces Analysis

This preview shows the exact Bechtel Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual, professionally written document detailing Bechtel's competitive landscape, ready for your immediate use. Once you complete your purchase, you’ll get instant access to this exact file, providing comprehensive insights into industry rivalry, buyer power, supplier power, threat of new entrants, and threat of substitutes for Bechtel.

Rivalry Among Competitors

The global engineering, procurement, and construction (EPC) market, where Bechtel operates, is characterized by its vastness and a significant degree of fragmentation. Despite the prominence of giants like Bechtel, the landscape is populated by a multitude of regional and niche players, intensifying competitive pressures.

Bechtel contends with formidable rivals such as Fluor Corporation, Jacobs Engineering Group, and KBR, all of whom possess substantial global reach and diverse project portfolios. Furthermore, the market is segmented, with specialized firms excelling in specific sectors like renewable energy or industrial infrastructure, presenting Bechtel with a broad spectrum of competitive threats.

For instance, in 2024, the global EPC market size was estimated to be around $1.5 trillion, with significant portions driven by infrastructure development and energy projects, areas where Bechtel is a key participant but also faces intense competition from both established international firms and emerging regional specialists.

The Engineering, Procurement, and Construction (EPC) sector, where Bechtel operates, is marked by substantial fixed costs. These include investments in specialized heavy machinery, a highly skilled workforce, and ongoing research and development, all of which are necessary to compete effectively. For instance, major construction projects often require upfront capital expenditures that can run into billions of dollars.

This industry's project-based structure intensifies rivalry. Companies are in a perpetual cycle of bidding for new contracts to keep their operations running and their expensive assets utilized. This often results in aggressive pricing strategies as firms vie for market share and try to avoid underutilization, which can significantly erode profitability.

In 2024, the global EPC market faced continued pressure from intense competition, with companies like Fluor and KBR actively pursuing large-scale infrastructure and energy projects. This competition is further fueled by the need to deploy significant capital investments, making securing a steady pipeline of work crucial for survival and growth.

In the high-stakes world of infrastructure development, a company's reputation and its history of successful project execution are incredibly powerful differentiators. For Bechtel, a long-standing track record, coupled with a strong safety record and consistent on-time, on-budget delivery, forms a significant competitive moat. These attributes build trust with clients, especially for massive, complex projects where failure is not an option.

While Bechtel's legacy is a formidable asset, competitors are actively working to build and showcase their own credentials. Companies like Fluor and Jacobs, for instance, emphasize their engineering expertise and project management capabilities, often highlighting their safety statistics and successful completion rates on major global projects to rival Bechtel's established standing. The industry constantly sees new players or existing ones investing heavily in building this crucial trust.

Technological Adoption and Innovation Race

The construction industry's competitive rivalry is significantly fueled by a relentless race to adopt and innovate with new technologies. Companies that can successfully integrate solutions like Building Information Modeling (BIM), digital twins, artificial intelligence (AI), robotics, and modular construction are gaining a substantial advantage. This technological prowess translates directly into improved efficiency, lower costs, and faster project completion, compelling competitors to pour resources into similar advancements to remain relevant.

This innovation race is not just about staying current; it's about leading. For instance, the global construction technology market was valued at approximately $10.7 billion in 2023 and is projected to reach $37.8 billion by 2028, showcasing the massive investment and growth in this area. Firms excelling in digital transformation are better positioned to win bids and execute projects more profitably.

- BIM Adoption: Over 70% of large construction firms in the US reported using BIM in 2023, a significant increase from previous years, highlighting its growing importance.

- AI in Construction: AI applications in construction are projected to grow, with early adopters seeing benefits in areas like predictive maintenance and risk management.

- Robotics and Automation: The use of robotics in construction is expanding, particularly for repetitive tasks like bricklaying and welding, aiming to address labor shortages and improve safety.

- Modular Construction Growth: The modular construction market is experiencing robust growth, with a compound annual growth rate expected to exceed 6% through 2027, driven by efficiency and sustainability benefits.

Geographic and Sectoral Competition

Bechtel navigates a complex competitive landscape where rivalry shifts significantly based on both geographic location and the specific industry sector in which it operates. For instance, competition in the energy sector, particularly in regions with established infrastructure, differs greatly from that in emerging markets for transportation projects.

The company's involvement in diverse areas such as energy, infrastructure, and mining means it encounters a unique set of established competitors in each segment. This necessitates tailored strategies to address the varying competitive pressures. For example, in 2024, the global infrastructure market, a key area for Bechtel, saw intense bidding for major projects, especially in North America and Europe, with local and international firms vying for contracts.

- Sectoral Diversification: Bechtel competes in energy, infrastructure, and mining, each with distinct competitor sets.

- Geographic Nuances: Rivalry intensity varies by region, with mature markets often presenting higher competition for limited opportunities.

- Market Maturity Impact: In 2024, sectors with slower growth or saturated markets, like certain segments of the mature oil and gas construction market, experienced heightened competitive pressures.

The competitive rivalry within the EPC sector, where Bechtel operates, is intense, driven by a large number of global and regional players vying for significant projects. This competition is further amplified by the substantial fixed costs associated with the industry, including heavy machinery and a skilled workforce, pushing firms towards aggressive pricing strategies to ensure asset utilization and maintain profitability.

Bechtel faces direct competition from major global EPC firms like Fluor Corporation, Jacobs Engineering Group, and KBR, all of whom possess extensive project portfolios and international reach. Additionally, specialized firms focusing on niche sectors such as renewable energy or specific industrial infrastructure add another layer of competitive pressure, requiring Bechtel to continuously adapt its strategies across diverse market segments.

The drive for technological innovation is a critical battleground, with companies investing heavily in areas like Building Information Modeling (BIM), AI, and robotics to gain efficiency and cost advantages. In 2024, the global construction technology market's significant growth, projected to reach $37.8 billion by 2028, underscores this intense technological race, where early adopters are better positioned to secure profitable contracts.

| Competitor | Key Strengths | 2024 Market Focus Areas |

|---|---|---|

| Fluor Corporation | Global reach, diverse project experience | Infrastructure, Energy Transition, Advanced Facilities |

| Jacobs Engineering Group | Strong technical expertise, digital solutions | Water, Buildings, Aerospace & Defense, Energy |

| KBR | Technology-driven solutions, government services | Sustainable technology, government solutions, space |

SSubstitutes Threaten

While Bechtel excels in massive, intricate engineering, procurement, and construction (EPC) projects, some colossal clients, especially in oil and gas or mining, might possess or cultivate substantial in-house engineering and construction expertise. This internal capacity can serve as a substitute, potentially reducing reliance on external EPC contractors like Bechtel for specific project segments or even full-scale undertakings.

Traditional Engineering, Procurement, and Construction (EPC) contracts, where Bechtel assumes complete project lifecycle responsibility, confront growing competition from alternative delivery methods. These substitutes, such as Design-Build (DB) or Construction Management (CM) approaches, allow clients to retain more direct control or engage specialized firms for distinct project phases.

Public-Private Partnerships (PPPs) also represent a significant substitute, shifting risk and management responsibilities to the client or a consortium, thereby diminishing Bechtel's end-to-end engagement. For instance, in 2024, the global infrastructure market saw a notable increase in PPP adoption for projects ranging from transportation to utilities, indicating a trend towards more collaborative or fragmented delivery models.

The rise of modular and prefabricated construction presents a significant threat of substitutes for traditional on-site building methods. Companies can achieve substantial cost reductions and accelerated project timelines by manufacturing components off-site. For example, the global modular construction market was valued at approximately $104.9 billion in 2023 and is projected to reach $197.9 billion by 2030, demonstrating a strong growth trajectory. This shift could directly impact demand for Bechtel's conventional large-scale, on-site construction services if clients opt for these more efficient alternatives.

Technological Solutions for Project Management

The threat of substitutes for Bechtel's project management services is growing due to rapid technological advancements. Clients are increasingly able to leverage sophisticated digital tools to manage their own projects, potentially reducing their need for Bechtel's extensive offerings.

Advances in project management software, digital collaboration platforms, and AI-driven analytics are key drivers of this trend. These technologies empower clients with greater control and visibility, enabling them to handle more aspects of project execution internally.

- Client Self-Sufficiency: Sophisticated software allows clients to manage timelines, budgets, and resources more effectively, lessening reliance on external project managers.

- Digital Collaboration Tools: Platforms like Asana, Trello, and Microsoft Teams facilitate seamless communication and task management, reducing the need for Bechtel's integrated project oversight.

- AI-Powered Analytics: Artificial intelligence can now provide predictive insights into project risks and performance, offering clients advanced capabilities previously exclusive to specialized firms.

- Reduced Scope: As clients gain these in-house capabilities, the scope of services they require from companies like Bechtel may shrink, impacting Bechtel's market share and revenue potential in certain segments.

Shift to Smaller, Decentralized Projects

The growing trend towards smaller, decentralized infrastructure projects poses a significant threat of substitution for Bechtel. These localized solutions, such as microgrids and distributed energy generation, can be managed by regional or specialized contractors, bypassing the need for large Engineering, Procurement, and Construction (EPC) firms like Bechtel.

For instance, the global microgrid market was valued at approximately $26.9 billion in 2023 and is projected to reach $67.5 billion by 2030, indicating a substantial and growing demand for these alternative solutions. This shift means that projects previously requiring massive, centralized infrastructure might now be broken down into smaller, more manageable, and potentially more cost-effective decentralized components.

- Decentralized Energy Growth: The increasing adoption of distributed energy resources (DERs) like solar and battery storage is fueling the demand for microgrids, offering localized power solutions that can operate independently or in conjunction with the main grid.

- Regional Contractor Advantage: Smaller, regional players often possess greater agility and a deeper understanding of local regulations and community needs, making them attractive partners for these decentralized initiatives.

- Reduced Project Scale: The inherent nature of smaller projects means they may not reach the scale or complexity that typically warrants the involvement of global EPC giants, thus diverting potential business away from Bechtel.

The threat of substitutes for Bechtel's core EPC services is amplified by the growing capability of clients to manage projects internally or through alternative, more specialized delivery models. This trend is particularly evident in sectors where clients are developing advanced in-house engineering and project management expertise.

Alternative project delivery methods like Design-Build (DB) and Construction Management (CM) offer clients greater control and flexibility compared to traditional EPC contracts. Furthermore, Public-Private Partnerships (PPPs) are increasingly being adopted, especially in infrastructure, shifting risk and management away from single EPC providers.

The modular construction market, valued at roughly $104.9 billion in 2023, is expanding rapidly, presenting a substitute for traditional on-site construction. Similarly, the microgrid market, projected to reach $67.5 billion by 2030, highlights a shift towards decentralized solutions that may bypass large EPC firms.

| Substitute Type | Description | Market Trend/Data Point |

|---|---|---|

| Client In-House Capability | Clients developing internal engineering and project management expertise. | Reduction in reliance on external EPC for specific project segments. |

| Alternative Delivery Methods | Design-Build (DB), Construction Management (CM). | Increased client control and phased engagement of specialized firms. |

| Public-Private Partnerships (PPPs) | Risk and management shared with clients or consortia. | Growing adoption in global infrastructure projects (e.g., transportation, utilities) in 2024. |

| Modular Construction | Off-site manufacturing of components. | Global market valued at ~$104.9 billion in 2023, projected to reach $197.9 billion by 2030. |

| Decentralized Infrastructure | Microgrids, distributed energy generation. | Global microgrid market valued at ~$26.9 billion in 2023, projected to reach $67.5 billion by 2030. |

Entrants Threaten

Entering the massive Engineering, Procurement, and Construction (EPC) sector, particularly for large-scale projects like those Bechtel undertakes, demands colossal upfront capital. Think billions of dollars needed for specialized heavy machinery, cutting-edge design software, and establishing a robust global operational footprint. This financial hurdle significantly deters newcomers.

Few organizations can muster the sheer financial firepower required to even consider challenging established giants like Bechtel. For instance, a single major infrastructure project can easily cost tens of billions, necessitating substantial credit lines and direct investment that most aspiring EPC firms simply cannot secure.

Clients for massive infrastructure projects, like the ones Bechtel undertakes, demand a deep history of successful completion, unwavering safety records, and strict adherence to intricate regulations. This is a huge barrier for anyone looking to break into the market.

Newcomers simply don't have this crucial, hard-earned experience and established reputation. It makes it incredibly tough for them to even get a shot at major contracts when competing against firms with decades of proven performance, such as Bechtel.

Bechtel's global operations mean new entrants must contend with a labyrinth of international and local regulations, environmental standards, and permitting processes. For instance, projects in the energy sector often require adherence to stringent emissions standards, which can vary significantly by region. In 2024, the increasing focus on sustainability and ESG (Environmental, Social, and Governance) factors further complicates compliance, demanding substantial investment in specialized expertise and technology.

Access to Talent and Specialized Expertise

Bechtel's complex, large-scale projects require a very specific set of skills, from highly specialized engineers to experienced project managers and construction experts. New companies entering this arena will find it tough to gather this caliber of talent.

The competition for skilled labor is already fierce, with industry-wide shortages impacting the availability of qualified professionals. For instance, the U.S. Bureau of Labor Statistics projected a need for over 1.2 million new construction workers by 2027, highlighting the existing talent gap that new entrants must navigate.

- Specialized Skill Demand: Bechtel's operations necessitate deep expertise in areas like nuclear engineering, advanced tunneling, and mega-project logistics.

- Talent Acquisition Challenges: New entrants face significant hurdles in recruiting individuals with proven track records in these niche fields.

- Retention Difficulty: Existing firms, like Bechtel, often have established reputation and robust compensation packages that make retaining top talent a challenge for newcomers.

- Labor Shortages Impact: The broader construction industry's ongoing labor shortages exacerbate the difficulty for new companies to build a capable workforce.

Established Client Relationships and Supply Chains

Bechtel benefits from deeply entrenched client relationships, often spanning decades and multiple large-scale projects. This loyalty makes it difficult for newcomers to secure initial contracts. For instance, Bechtel's long-standing partnerships with major energy companies and governments provide a consistent pipeline of work.

Furthermore, Bechtel possesses a robust and globally optimized supply chain, a significant barrier to entry. Establishing a comparable network, ensuring timely delivery of specialized equipment and materials, and negotiating favorable terms would require substantial investment and time for any new competitor. This established infrastructure is crucial for Bechtel's ability to execute complex projects efficiently and cost-effectively, a feat new entrants would find challenging to replicate.

- Established Client Relationships: Bechtel's history of successful project delivery fosters strong, repeat business with key clients in sectors like energy, infrastructure, and defense.

- Global Supply Chain Network: Bechtel leverages a vast network of suppliers and logistics partners, ensuring access to critical resources and competitive pricing.

- Barriers to Entry: New entrants face considerable hurdles in replicating Bechtel's client trust and supply chain efficiency, impacting their ability to compete on project execution.

The sheer scale of capital required to enter the massive Engineering, Procurement, and Construction (EPC) sector, especially for projects Bechtel handles, is a significant deterrent. Newcomers need billions for specialized equipment, advanced software, and global operations, a financial barrier few can overcome.

New entrants struggle to build the deep project history, safety records, and regulatory compliance expertise that clients demand. Bechtel's decades of proven performance create a formidable reputation barrier, making it difficult for new firms to secure initial contracts.

Navigating the complex web of international regulations, environmental standards, and permitting processes is another major hurdle. In 2024, the increasing emphasis on ESG compliance adds another layer of complexity, requiring substantial investment in specialized knowledge and technology.

The demand for highly specialized skills in areas like nuclear engineering and mega-project logistics is intense. New companies face significant challenges in attracting and retaining top talent, especially given existing industry-wide labor shortages, which the U.S. Bureau of Labor Statistics projected would require over 1.2 million new construction workers by 2027.

Bechtel's entrenched client relationships, often built over decades, provide a consistent project pipeline that new entrants find difficult to penetrate. Furthermore, Bechtel's globally optimized supply chain, ensuring timely delivery of critical resources, is a substantial barrier to replicate.

| Factor | Impact on New Entrants | Bechtel's Advantage |

|---|---|---|

| Capital Requirements | Extremely High (Billions USD) | Established financial capacity and access to credit |

| Project Experience & Reputation | Minimal to None | Decades of successful project delivery and strong client trust |

| Regulatory Compliance | Complex and Costly to Master | Extensive experience and dedicated compliance teams |

| Skilled Labor Availability | Challenging due to shortages | Strong employer brand and established talent acquisition strategies |

| Client Relationships | Difficult to Establish | Long-standing partnerships with major clients globally |

| Supply Chain Efficiency | Costly and time-consuming to build | Vast, optimized global network of suppliers and logistics partners |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bechtel is built upon a foundation of comprehensive data, including industry-specific market research, financial reports from key competitors, and government infrastructure spending data. We also leverage trade association publications and news archives to capture evolving industry trends and potential threats.