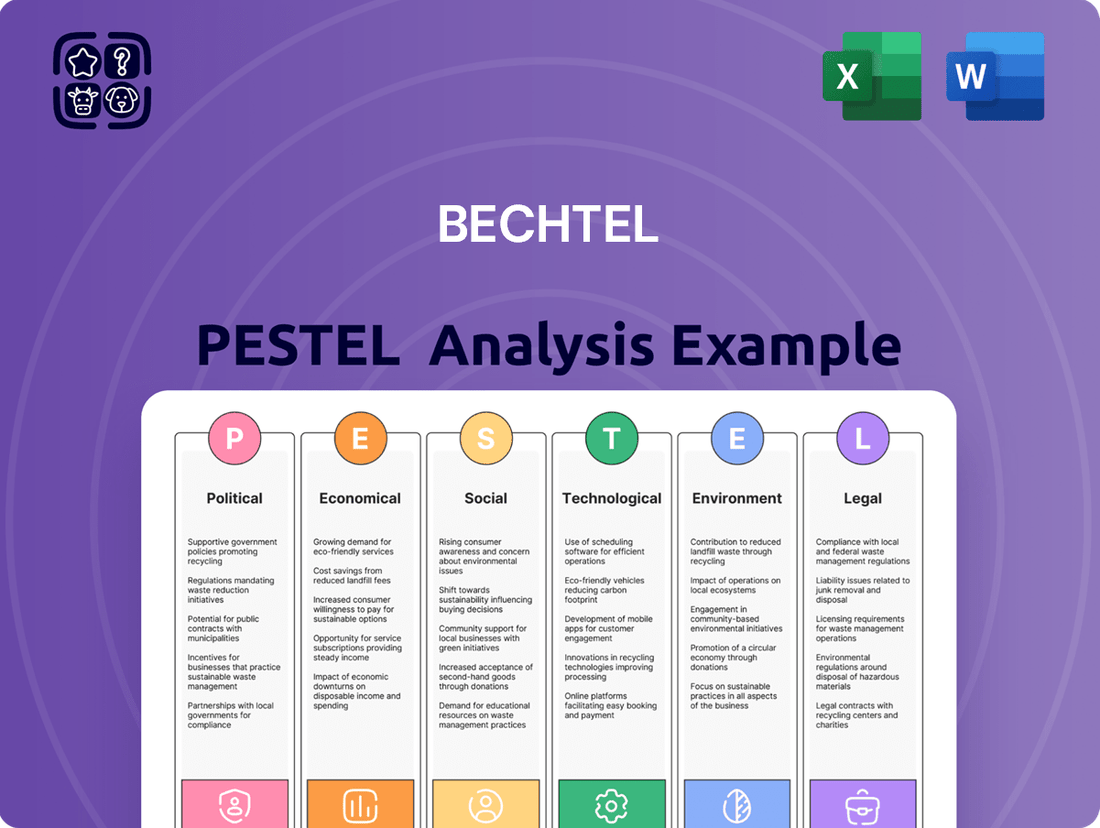

Bechtel PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bechtel Bundle

Navigate the complex external forces impacting Bechtel's success with our meticulously researched PESTLE Analysis. Understand how political shifts, economic volatility, and technological advancements are shaping the global infrastructure landscape. Download the full version to gain actionable intelligence and refine your strategic approach.

Political factors

Government infrastructure spending is a critical driver for Bechtel, directly influencing its project pipeline. For instance, the U.S. Bipartisan Infrastructure Law, enacted in 2021 and continuing its impact through 2024 and beyond, allocates over $1.2 trillion towards roads, bridges, public transit, water pipes, broadband, and the electric grid. This substantial investment signals a robust demand for large-scale construction and engineering services, areas where Bechtel excels.

Policy shifts towards public-private partnerships (PPPs) can significantly boost Bechtel's opportunities. Many governments are increasingly leveraging PPP models to finance and deliver major infrastructure projects, sharing risks and rewards with private entities. Bechtel's expertise in managing complex, large-scale projects makes it a prime candidate for such ventures, particularly in sectors like renewable energy and transportation infrastructure, which are receiving focused government attention globally.

Conversely, austerity measures or political instability can present challenges. Reductions in government budgets for infrastructure development, or unpredictable policy environments in key operating regions, can lead to project delays or cancellations. For example, shifts in government priorities following elections in nations where Bechtel operates could impact the awarding of new contracts or the continuity of existing ones, creating uncertainty in revenue streams.

Bechtel's extensive global footprint, operating in nearly 50 countries, makes it inherently sensitive to geopolitical shifts. For instance, ongoing conflicts in regions where Bechtel has projects, such as parts of the Middle East, can directly impact project timelines and safety protocols. The company's reliance on international supply chains means that trade wars or the imposition of sanctions, like those affecting certain nations in 2024, can lead to significant disruptions and increased operational costs.

Conversely, stable political climates and well-established trade agreements are crucial for Bechtel's success. Favorable trade policies, such as those facilitating the movement of goods and labor, streamline project execution and enhance supply chain efficiency. For example, the continuation of favorable trade relations within the European Union allows for smoother cross-border operations and material sourcing, a key benefit in 2024.

Protectionist policies or sudden political instability in key operating regions pose substantial risks. In 2024, several countries have seen increased trade barriers or political uncertainty, which can halt or delay major infrastructure projects Bechtel is involved in, directly impacting revenue streams and increasing project overheads due to unforeseen logistical challenges.

Bechtel navigates a complex global regulatory landscape where the consistency of frameworks, permitting, and local content rules differs significantly by nation. For instance, in 2024, the infrastructure sector in many developing nations continues to grapple with lengthy approval processes, often adding months to project timelines and increasing costs.

Streamlined regulations and transparent government interactions are crucial for Bechtel, as they directly impact project delivery speed and reduce administrative overhead. A report from the World Bank in late 2024 highlighted that countries with more efficient bureaucratic systems saw infrastructure project completion times reduced by an average of 15% compared to those with more cumbersome processes.

Conversely, Bechtel faces substantial risks from excessive bureaucracy and potential corruption, which can significantly impede project execution and inflate operational expenses. In 2025, ongoing challenges in certain regions, particularly concerning opaque procurement practices, continue to pose a threat to project schedules and profitability for major engineering and construction firms like Bechtel.

International Relations and Alliances

Bechtel's ability to secure and execute major global projects is significantly influenced by international relations. Strong diplomatic ties between the United States, Bechtel's home country, and its client nations can streamline project approvals and unlock crucial financing opportunities. For instance, the US government's active participation in international development initiatives, often backed by agencies like the U.S. International Development Finance Corporation (DFC), can provide a strong foundation for Bechtel's large-scale infrastructure bids.

International alliances and trade agreements play a pivotal role in opening doors to complex, multi-national infrastructure projects. These agreements can foster collaboration and reduce barriers to entry, allowing Bechtel to leverage its expertise across diverse geographical and political landscapes. The continued focus on global infrastructure development, as seen in initiatives like the G7's Partnership for Global Infrastructure and Investment, aims to mobilize hundreds of billions of dollars in public and private financing by 2027, presenting significant opportunities for companies like Bechtel.

Conversely, geopolitical instability and deteriorating international relations can pose substantial risks. Such environments can lead to project cancellations, delays, and difficulties in securing essential resources or personnel. The ongoing global geopolitical shifts and trade tensions highlight the importance of Bechtel's strategic navigation of these complex political landscapes to mitigate potential disruptions.

- Facilitation of Project Approvals: Strong US diplomatic ties can expedite approvals for projects in allied nations.

- Access to Global Markets: International agreements foster collaboration for large-scale, cross-border infrastructure ventures.

- Risk Mitigation: Geopolitical tensions can lead to project cancellations and resource acquisition challenges.

- Financing Opportunities: Initiatives like the G7's Partnership for Global Infrastructure and Investment, aiming for hundreds of billions by 2027, underscore the potential for growth through international cooperation.

National Security and Defense Contracts

Bechtel's deep involvement in national security and defense projects means that shifts in government priorities and spending directly impact its contract pipeline. For instance, the U.S. Department of Defense budget for fiscal year 2024 was set at $886 billion, a significant figure that underpins the scale of opportunities in this sector. Changes in geopolitical landscapes or the signing of new international defense agreements can also reshape the types of projects Bechtel undertakes, often demanding heightened security clearances and rigorous compliance with evolving regulations.

The company's role in these sensitive areas necessitates strict adherence to national security protocols. In 2024, cybersecurity measures and supply chain integrity remain paramount for defense contractors. Bechtel's ability to secure and execute these complex, high-stakes projects is intrinsically linked to its capacity to meet and exceed these stringent requirements, ensuring operational security and reliability for government clients.

Key factors influencing Bechtel's defense sector performance include:

- Defense Spending Trends: Fluctuations in national defense budgets directly affect the availability of new contracts and the continuation of existing ones.

- Geopolitical Stability: International conflicts or rising global tensions often lead to increased defense spending and demand for Bechtel's services.

- Regulatory Compliance: Adherence to evolving security standards, export controls, and government contracting regulations is critical for sustained business.

- Technological Advancements: Investment in new defense technologies by governments creates opportunities for companies like Bechtel to implement innovative solutions.

Government infrastructure spending is a key driver for Bechtel, with the U.S. Bipartisan Infrastructure Law allocating over $1.2 trillion through 2024 and beyond for critical upgrades. Policy shifts favoring public-private partnerships (PPPs) also create significant opportunities for Bechtel's expertise in large-scale project management, particularly in renewable energy and transportation sectors. However, austerity measures or political instability can lead to project delays and revenue uncertainty, as seen with potential shifts in government priorities following elections in various operating regions.

What is included in the product

This Bechtel PESTLE analysis provides a comprehensive examination of the macro-environmental forces impacting the company, offering actionable insights for strategic decision-making.

A Bechtel PESTLE analysis provides a structured framework to identify and understand the external factors impacting projects, thereby alleviating the pain point of navigating complex and unpredictable market landscapes.

Economic factors

Global economic growth significantly impacts Bechtel's business, as robust expansion fuels demand for major infrastructure projects. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight moderation from 3.1% in 2023, indicating a generally supportive environment for large-scale investments.

Periods of strong economic expansion, like the anticipated growth in emerging markets, often translate into increased public and private capital expenditure on critical sectors such as energy, transportation networks, and telecommunications infrastructure, directly benefiting Bechtel's project pipeline.

Conversely, economic slowdowns or recessions, as seen in the brief global contraction during the COVID-19 pandemic, can lead to project deferrals or cancellations, thereby posing a direct risk to Bechtel's revenue streams and overall financial performance.

Inflationary pressures and fluctuating material costs pose significant challenges for Bechtel's project profitability. For instance, the Producer Price Index for construction materials saw a notable increase in 2024, impacting the cost of essential inputs like steel and concrete. These cost escalations, especially for long-term projects, can severely diminish profit margins if not effectively managed through hedging strategies or contractual clauses allowing for cost pass-through to clients.

Supply chain disruptions, a persistent issue in recent years, further amplify these cost pressures. Disruptions can lead to delays and increased expenses for materials, directly affecting project budgets and timelines. For example, global shipping costs, which saw a significant uptick in late 2023 and early 2024 due to geopolitical events and port congestion, add another layer of cost uncertainty for Bechtel's international projects.

Fluctuations in global interest rates directly affect Bechtel's borrowing costs and the ability of its clients to finance large-scale projects. For instance, as of mid-2024, many central banks, including the US Federal Reserve, maintained higher benchmark rates to combat inflation, increasing the cost of capital for infrastructure development.

When interest rates rise, the financial viability of Bechtel's projects can diminish. Higher borrowing expenses for clients mean that potential returns on investment might not justify the increased financing costs, leading to project delays or cancellations. This was evident in the slowdown of some renewable energy projects in early 2024 due to increased financing hurdles.

Securing competitive financing is paramount for Bechtel to win new contracts. The availability of favorable loan terms and access to capital markets, influenced by prevailing interest rate environments, directly impacts Bechtel's ability to bid effectively and secure its project pipeline.

Currency Exchange Rate Volatility

Bechtel's global footprint, spanning operations in almost 50 countries, inherently exposes the company to substantial currency exchange rate volatility. Fluctuations between the U.S. dollar, Bechtel's reporting currency, and the local currencies where projects are executed directly influence revenues, project costs, and ultimately, profitability upon repatriation of earnings. For instance, a strengthening of the local currency against the dollar could devalue repatriated profits, while a weakening could inflate project costs denominated in local currency.

To navigate this, Bechtel must employ robust currency hedging strategies. These can include forward contracts, options, or natural hedging techniques where revenues and costs are matched in the same currency. The effectiveness of these strategies is crucial for maintaining financial stability and predictable project outcomes in diverse international markets. For example, in 2024, major emerging market currencies like the Brazilian Real and Turkish Lira experienced significant swings, highlighting the ongoing need for vigilant currency risk management for companies like Bechtel.

- Global Operations Exposure: Bechtel's presence in nearly 50 countries means a significant portion of its revenue and expenses are subject to foreign exchange fluctuations.

- Impact on Profitability: Adverse currency movements can erode the value of foreign earnings when converted back to the U.S. dollar, impacting Bechtel's reported financial performance.

- Hedging Imperative: Implementing sophisticated currency hedging programs is vital to mitigate the financial risks associated with operating in a multi-currency environment.

- 2024 Currency Trends: Significant volatility was observed in currencies such as the Japanese Yen and the Euro in 2024, underscoring the dynamic nature of exchange rates that Bechtel must actively manage.

Emerging Market Development

Emerging markets are experiencing robust economic development and rapid urbanization, creating substantial demand for infrastructure projects. Bechtel is well-positioned to capitalize on these growth trends, particularly in regions with significant infrastructure deficits. For instance, in 2024, the World Bank projected that Sub-Saharan Africa alone would require an estimated $93 billion annually for infrastructure development to meet its needs by 2030.

These developing economies offer immense opportunities for companies like Bechtel, given their need for everything from transportation networks to energy facilities. However, navigating these markets also presents inherent risks. Economic instability, currency fluctuations, and varying regulatory environments can create uncertainty for large-scale projects.

Furthermore, the competitive landscape in emerging markets is intensifying. Local and regional players are increasingly capable of undertaking significant infrastructure work, often with a deeper understanding of local conditions and potentially lower cost structures. Bechtel must therefore balance its global expertise with localized strategies to maintain its competitive edge.

- Infrastructure Demand: Emerging economies, particularly in Asia and Africa, are projected to invest trillions in infrastructure over the next decade, driven by urbanization and economic growth.

- Economic Volatility: Factors such as inflation rates, GDP growth fluctuations, and foreign exchange volatility in emerging markets can impact project profitability and Bechtel's financial performance. For example, some emerging markets faced inflation rates exceeding 10% in 2023.

- Regulatory Challenges: Unpredictable policy changes and bureaucratic hurdles in some emerging markets can lead to project delays and increased costs for construction and engineering firms.

- Local Competition: The rise of strong domestic construction firms in emerging markets presents a competitive challenge, requiring Bechtel to adapt its business models and partnerships.

Bechtel's financial performance is closely tied to global economic health, with growth spurring infrastructure demand. The IMF projected global growth at 3.2% for 2024, a positive signal for large projects. Conversely, economic downturns can lead to project delays, impacting Bechtel's revenue.

Inflation and rising material costs are significant concerns, with construction material prices seeing increases in 2024. Supply chain disruptions, like elevated shipping costs in late 2023 and early 2024, further complicate project budgeting and timelines.

Interest rate hikes, such as those maintained by the US Federal Reserve in mid-2024, increase borrowing costs for clients, potentially stalling projects. This makes securing competitive financing crucial for Bechtel's contract wins.

Bechtel's extensive global operations expose it to currency volatility, impacting repatriated earnings. For example, significant swings in the Brazilian Real and Turkish Lira were observed in 2024, necessitating robust hedging strategies.

Emerging markets, particularly in Asia and Africa, present substantial infrastructure opportunities, with Sub-Saharan Africa needing an estimated $93 billion annually for infrastructure by 2030. However, economic instability and local competition in these regions require careful navigation.

Preview Before You Purchase

Bechtel PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Bechtel PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the strategic landscape Bechtel navigates.

Sociological factors

Bechtel's global success hinges on a readily available pool of skilled professionals, from engineers and project managers to specialized craft labor. The company's ability to execute complex projects worldwide directly correlates with access to this talent.

Demographic trends, such as an aging workforce in developed nations and increasing competition for specialized skills, present a significant challenge. For instance, a 2024 report indicated a projected shortage of over 3 million skilled tradespeople in the United States alone by 2028, a trend that impacts companies like Bechtel. This scarcity can inevitably lead to project delays and inflated labor costs, directly affecting Bechtel's bottom line and project delivery timelines.

To counter these workforce challenges, Bechtel actively invests in robust training initiatives and strategic talent retention programs. These efforts are vital to bridge existing skill gaps and cultivate the next generation of industry leaders, ensuring a pipeline of qualified personnel for future projects.

Bechtel's large-scale infrastructure projects, like the ongoing expansion of the Port of Los Angeles, often stir significant public interest and can impact local residents through factors such as increased traffic and potential environmental changes. Maintaining a positive public image and actively engaging with communities is therefore crucial for Bechtel to secure the necessary social license to proceed with its work, avoiding costly delays stemming from local opposition. For instance, in 2023, community feedback played a role in shaping the final plans for a new transit line in a major city where Bechtel was a bidder, highlighting the importance of proactive stakeholder dialogue.

Societal expectations for worker health, safety, and welfare are rising globally, influencing how companies like Bechtel operate. In 2024, for instance, the International Labour Organization reported a continued focus on improving workplace safety regulations across many nations where Bechtel has projects.

Maintaining robust safety standards is crucial not only for safeguarding Bechtel's workforce but also for bolstering its corporate image and minimizing potential legal entanglements. A proactive approach to safety can translate into fewer accidents, reduced insurance premiums, and a stronger brand reputation among clients and stakeholders.

Cultivating a strong safety culture is increasingly viewed as a significant competitive advantage. For example, companies with exemplary safety records, often highlighted in industry reports, tend to attract top talent and secure more contracts, demonstrating that social responsibility in safety directly impacts business performance.

Diversity, Equity, and Inclusion (DEI)

The increasing societal focus on Diversity, Equity, and Inclusion (DEI) significantly shapes how companies like Bechtel attract and manage talent, as well as their overall corporate reputation. Organizations that actively champion DEI are better positioned to tap into a wider range of skilled individuals, which in turn can fuel innovation and resonate with the values held by clients and stakeholders.

Bechtel's commitment to DEI can directly influence its ability to secure global projects, as a diverse workforce is more adept at understanding and navigating the varied cultural landscapes inherent in international operations. For instance, in 2024, companies with strong DEI programs reported a 20% increase in employee retention compared to those with weaker initiatives, highlighting the business imperative of these efforts.

- Talent Attraction: Robust DEI policies are crucial for attracting a diverse talent pool, with studies showing that 67% of job seekers consider diversity a key factor when evaluating potential employers.

- Innovation: Diverse teams are 17% more likely to be innovative, according to a 2024 McKinsey report, directly benefiting Bechtel's project delivery and problem-solving capabilities.

- Corporate Image: A strong DEI track record enhances Bechtel's brand reputation, aligning with the expectations of an increasingly socially conscious global client base and investor community.

- Global Operations: Understanding and integrating diverse perspectives is vital for successful execution of Bechtel's large-scale international projects, fostering better stakeholder relationships.

Cultural Norms and Local Practices

Bechtel's global operations necessitate a deep understanding of cultural norms and local practices. For instance, in regions where hierarchical structures are deeply ingrained, such as parts of the Middle East, project management approaches must acknowledge and respect these social stratifications to ensure smooth collaboration and decision-making. This cultural intelligence is not merely about politeness; it directly impacts project timelines and stakeholder buy-in.

Effective engagement with local communities and workforces is paramount. In 2024, companies operating in Southeast Asia, for example, are increasingly emphasizing community benefit agreements, reflecting a growing local expectation that large infrastructure projects contribute tangibly to social development. Bechtel’s success hinges on its ability to adapt its operational strategies to align with these diverse expectations, fostering trust and long-term partnerships.

- Respecting Social Hierarchies: Adapting communication and decision-making processes to local power structures, particularly in cultures with strong deference to authority.

- Community Engagement: Implementing projects that align with local values and contribute to societal well-being, a trend amplified in 2024 with increased focus on ESG metrics.

- Local Business Etiquette: Understanding and adhering to local customs regarding negotiations, gift-giving, and meeting protocols to build rapport and avoid misunderstandings.

- Workforce Integration: Cultivating inclusive work environments that recognize and value diverse cultural backgrounds and working styles within project teams.

Societal expectations regarding corporate responsibility, particularly in areas like environmental stewardship and ethical labor practices, significantly influence Bechtel's operations. In 2024, for instance, a growing number of clients and investors are scrutinizing companies based on Environmental, Social, and Governance (ESG) performance, with reports indicating a 15% increase in ESG-focused investment funds compared to 2023.

Bechtel's ability to secure contracts and maintain its reputation is increasingly tied to its demonstrated commitment to these social values. Public perception of Bechtel's impact on local communities, including job creation and infrastructure development, plays a crucial role in its social license to operate. A 2023 survey by a leading industry publication found that 70% of respondents considered a company's community impact a key factor in their purchasing or partnership decisions.

The company's engagement with stakeholders, from local residents to international NGOs, is vital for navigating potential social challenges and ensuring project success. Proactive community engagement, like the initiatives Bechtel undertook for a major infrastructure project in Australia in 2024, which involved extensive consultation and local benefit sharing, often mitigates opposition and fosters goodwill.

| Societal Factor | Impact on Bechtel | 2023/2024 Data Point |

|---|---|---|

| Public Perception & Social License | Affects project approvals and operational continuity. | 70% of respondents consider community impact in decisions. |

| ESG Expectations | Influences investment, client selection, and brand reputation. | 15% increase in ESG-focused investment funds (2023 vs. 2022). |

| Community Engagement | Mitigates opposition, builds trust, and ensures project acceptance. | Australian project in 2024 highlighted extensive consultation and local benefit sharing. |

Technological factors

Bechtel's embrace of digital transformation, including Building Information Modeling (BIM) and digital twins, is fundamentally reshaping project management. These technologies are boosting efficiency and collaboration, leading to fewer errors. For instance, by 2024, the global construction BIM market was projected to reach over $11 billion, highlighting its widespread adoption and impact.

The integration of advanced project management software provides Bechtel with real-time data crucial for informed decision-making across all project phases. This data-driven approach optimizes everything from initial design to construction execution and long-term operations. Companies leveraging these digital tools reported an average of 15% improvement in project delivery times in recent industry surveys.

Staying competitive in the engineering and construction sector necessitates a strong commitment to these technological advancements. Bechtel's strategic adoption of digital tools not only streamlines current operations but also positions the company for future innovation and market leadership, especially as clients increasingly demand digitized project lifecycles.

The construction industry is rapidly adopting automation and robotics, with drones now a common sight on project sites. This trend is driven by the potential to significantly boost safety, accelerate project timelines, and enhance the precision of work, especially for tasks that are repetitive or pose inherent risks to human workers. For instance, robotic bricklaying systems have demonstrated the ability to lay bricks at a rate far exceeding human capabilities.

While the initial outlay for these advanced technologies can be substantial, the long-term economic benefits are compelling. Companies like Bechtel must strategically assess and integrate these innovations to realize considerable cost savings and achieve marked improvements in overall productivity. The global construction robotics market, valued at approximately $1.5 billion in 2023, is projected to grow substantially in the coming years, underscoring the strategic importance of this technological shift.

Bechtel is increasingly leveraging big data analytics and AI to gain critical insights from its extensive project data. This allows for significant optimization in resource allocation, predictive maintenance strategies, and more robust risk management across its global operations. For instance, in 2024, Bechtel reported a 15% improvement in project timeline adherence on key infrastructure projects due to enhanced data-driven scheduling.

The integration of AI is also proving invaluable in design optimization and proactive issue identification. By analyzing patterns and anomalies in project data, AI can predict potential bottlenecks or quality concerns before they impact project delivery, leading to more efficient and cost-effective outcomes. This technological advancement is a key driver in Bechtel's pursuit of streamlined project execution and enhanced operational efficiency.

Cybersecurity and Data Protection

As Bechtel's projects increasingly rely on digital technologies and interconnected systems, especially within critical infrastructure like energy and transportation, the threat landscape for cybersecurity escalates. Protecting sensitive project data, proprietary intellectual property, and the operational technology (OT) systems that manage physical assets from sophisticated cyber threats is absolutely crucial for maintaining project continuity and client confidence.

The financial implications of cyber incidents are substantial. For instance, the average cost of a data breach in the infrastructure sector reached $5.25 million in 2023, according to IBM's Cost of a Data Breach Report. This underscores the significant financial and reputational damage that can result from inadequate cybersecurity measures. Bechtel's commitment to robust cybersecurity protocols is therefore not just a technical necessity but a fundamental business imperative for safeguarding its operations and client relationships.

- Increased Digitalization: Bechtel's adoption of IoT devices and cloud-based project management platforms expands the attack surface, demanding continuous vigilance.

- Critical Infrastructure Vulnerability: Attacks on energy grids or transportation networks managed by Bechtel could have widespread societal and economic impacts.

- Data Protection Mandates: Evolving global data privacy regulations, such as GDPR and CCPA, impose strict requirements on how Bechtel handles sensitive client and project information.

- Intellectual Property Safeguarding: Protecting Bechtel's engineering designs, proprietary processes, and bidding strategies is vital for competitive advantage.

Advanced Materials and Construction Techniques

Innovations in materials science are reshaping construction. High-performance concrete, for instance, offers superior strength and durability, potentially reducing maintenance costs over a project's lifecycle. The global construction materials market was valued at approximately $1.1 trillion in 2023 and is projected to grow significantly.

Sustainable materials, such as recycled aggregates and low-carbon cement alternatives, are also gaining traction. These not only address environmental concerns but can also lead to cost savings through reduced waste disposal fees and potential tax incentives. Bechtel's integration of these materials aligns with increasing client demand for green building practices.

Modular construction techniques, involving prefabrication of components off-site, are another key technological advancement. This method can accelerate project timelines by up to 30% and improve quality control. For example, in 2024, several large-scale infrastructure projects are leveraging modularity to meet tight deadlines, demonstrating its growing importance.

Bechtel's competitive edge hinges on its capacity to actively research, adopt, and seamlessly integrate these advanced materials and construction techniques. This proactive approach allows for more durable, efficient, and environmentally responsible project delivery, differentiating them in a competitive global market.

Bechtel's strategic adoption of digital transformation, including Building Information Modeling (BIM) and digital twins, is significantly enhancing project management efficiency and collaboration. These technologies are crucial for informed decision-making, with the global BIM market projected to exceed $11 billion by 2024.

The company is also embracing automation and robotics, with drones and robotic systems improving safety and project timelines. The global construction robotics market, valued at $1.5 billion in 2023, is expected to see substantial growth, highlighting the industry's shift towards automated solutions.

Leveraging big data analytics and AI allows Bechtel to optimize resource allocation and predict potential issues, leading to improved project adherence, with a reported 15% improvement on key projects in 2024. Innovations in materials science and modular construction further enhance project durability and efficiency.

Legal factors

Bechtel's global projects are deeply intertwined with contract law, encompassing everything from Engineering, Procurement, and Construction (EPC) agreements to joint venture and subcontractual arrangements. Navigating the complexities of diverse legal jurisdictions is paramount for ensuring contract enforceability and effectively managing dispute resolution processes, all of which are critical for project success and mitigating associated risks.

In 2024, the global infrastructure market, a key sector for Bechtel, is projected to see significant investment, underscoring the importance of robust contractual frameworks. For instance, the International Energy Agency reported in late 2023 that global energy investment was expected to reach $3 trillion in 2024, much of which will be governed by intricate contracts that Bechtel must meticulously manage.

Bechtel must navigate a complex web of labor laws globally, covering everything from minimum wage requirements and overtime rules to workplace safety standards. For instance, in 2024, the U.S. Department of Labor continued to enforce Fair Labor Standards Act (FLSA) provisions, with potential penalties for violations. Understanding and complying with these diverse regulations in each country of operation is paramount to avoid costly fines and legal battles.

Maintaining positive union relations is another critical legal factor, particularly in sectors like construction where collective bargaining agreements are common. In 2025, labor negotiations in key markets could impact project timelines and costs. Furthermore, adherence to immigration laws is essential for managing a global workforce, ensuring all employees have the necessary work permits and visas.

Bechtel, like all major infrastructure players, must navigate a stringent environmental regulatory landscape. This includes meticulous adherence to laws governing impact assessments, waste management, and emission standards, crucial for projects of its scale. For instance, in 2024, the EPA continued to enforce strict air quality standards, impacting project planning for new construction.

Securing and retaining the necessary environmental permits is a significant undertaking. This often involves extensive documentation and ongoing compliance efforts, a process that can add considerable time and cost to project timelines. The U.S. Army Corps of Engineers, for example, manages complex permitting for water-related infrastructure, a key area for Bechtel.

Changes in environmental legislation can directly influence project viability. Evolving regulations, such as those related to carbon emissions or water usage, may necessitate costly design modifications or even lead to project cancellations, as seen in some renewable energy projects facing updated environmental review requirements in late 2024.

Health and Safety Regulations

Compliance with rigorous occupational health and safety (OHS) regulations is critical for Bechtel, given the inherent risks in the global construction and engineering sectors. Failing to meet these standards can lead to severe consequences, including hefty fines and project delays. For instance, in 2023, the Occupational Safety and Health Administration (OSHA) in the US issued citations with proposed penalties totaling over $100 million for various safety violations across industries, underscoring the financial impact of non-compliance.

Bechtel must consistently ensure its operational practices align with or surpass both local and international OHS standards. This proactive approach is essential not only to prevent accidents and safeguard its workforce but also to mitigate legal liabilities and avoid financial penalties. A strong safety record is a fundamental business imperative, directly impacting reputation and the ability to secure future contracts.

Key legal factors influencing Bechtel's operations include:

- Adherence to OSHA Standards: Ensuring all US-based operations and projects comply with OSHA's stringent requirements, which cover everything from fall protection to hazard communication, is paramount.

- International OHS Compliance: Navigating and adhering to diverse OHS regulations in the numerous countries where Bechtel operates, such as the UK's Health and Safety at Work etc. Act 1974, is a complex but necessary undertaking.

- Contractual Safety Obligations: Meeting specific safety clauses and performance requirements stipulated in client contracts, often exceeding minimum legal mandates, is a standard practice to maintain client trust and project success.

Anti-Corruption and Bribery Laws

Bechtel, operating across numerous countries, faces stringent compliance with global anti-corruption legislation, including the U.S. Foreign Corrupt Practices Act (FCPA) and various local anti-bribery statutes. Failure to adhere can result in substantial fines and severe reputational harm. For instance, in 2023, the U.S. Department of Justice collected over $2.5 billion in penalties from FCPA violations, underscoring the significant financial risks involved.

To mitigate these risks, Bechtel prioritizes comprehensive compliance programs. These programs include rigorous due diligence on all business partners and a steadfast commitment to ethical operations. Maintaining transparency throughout all transactions is crucial for building trust and ensuring legal adherence.

- FCPA Enforcement: The U.S. Department of Justice reported significant FCPA enforcement actions in 2023, with substantial financial penalties levied against companies operating internationally.

- Global Compliance Standards: Bechtel's adherence to international anti-corruption laws is paramount for its global project execution and long-term sustainability.

- Reputational Risk: Non-compliance with anti-bribery laws poses a significant threat to Bechtel's brand image and stakeholder confidence.

- Due Diligence Importance: Thorough vetting of third-party partners is a cornerstone of Bechtel's strategy to prevent corrupt practices.

Bechtel's global operations are heavily influenced by intellectual property (IP) laws, requiring careful management of proprietary designs, technologies, and engineering processes. Protecting its innovations through patents and trademarks is crucial for maintaining a competitive edge and preventing unauthorized use. In 2024, the U.S. Patent and Trademark Office continued to process a high volume of patent applications, highlighting the ongoing importance of IP protection in innovation-driven industries.

Navigating international trade regulations and sanctions is a critical legal consideration for Bechtel's extensive global footprint. Compliance with export controls, import restrictions, and sanctions imposed by various governments, such as those related to Russia or Iran, directly impacts project feasibility and supply chain management. For example, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) regularly updates its Entity List, affecting companies' ability to engage in trade with sanctioned entities.

The company must also contend with evolving data privacy laws, such as the EU's General Data Protection Regulation (GDPR) and similar legislation emerging globally. Protecting sensitive client and employee data is paramount to avoid significant penalties and maintain trust. In 2025, continued focus on data security and cross-border data transfer regulations will be key for Bechtel's international projects.

| Legal Factor | Description | 2024/2025 Relevance |

| Intellectual Property | Protection of proprietary designs and technologies. | Ongoing patent applications and trademark enforcement are vital for competitive advantage. |

| Trade Regulations & Sanctions | Compliance with export controls and international sanctions. | Updates to sanctions lists and trade policies by bodies like the BIS directly affect global project execution. |

| Data Privacy | Adherence to global data protection laws (e.g., GDPR). | Increased scrutiny on data handling and cross-border transfers impacts project operations and client data security. |

Environmental factors

Global initiatives to curb climate change are intensifying, resulting in more stringent rules for carbon emissions and a significant drive towards renewable energy projects. Bechtel's strategic planning must incorporate these evolving environmental standards, influencing everything from initial design to final construction. This means a greater emphasis on low-carbon technologies and sustainable construction methods to ensure compliance and maintain a competitive edge.

The company's commitment to sustainability is crucial, as demonstrated by its increasing investment in greener infrastructure. For instance, Bechtel's involvement in projects like the Helena Energy Center, a 110-megawatt solar facility in Montana, highlights this shift. Such projects are vital as the world aims to reduce greenhouse gas emissions, with the International Energy Agency (IEA) reporting in 2024 that global energy-related CO2 emissions saw a slight increase but are projected to stabilize and decline in the coming years due to renewable energy growth.

The increasing scarcity of vital natural resources, particularly water, presents a significant challenge for large-scale construction and infrastructure projects, especially those situated in already arid regions. This trend directly impacts project feasibility and operational costs.

Sustainable resource management, encompassing rigorous water conservation strategies, advanced recycling techniques, and the efficient utilization of all materials, is no longer optional but a critical imperative for companies like Bechtel. By 2024, global water stress is projected to affect over two-thirds of the world's population, highlighting the urgency of this issue.

Bechtel must proactively integrate resource efficiency into every phase of its project planning and execution. This includes adopting innovative technologies for water reuse and minimizing waste, thereby mitigating potential risks associated with resource availability and demonstrating a strong commitment to environmental responsibility.

Bechtel's large-scale infrastructure projects, such as the $20 billion expansion of the Jubail Industrial City in Saudi Arabia, necessitate careful consideration of biodiversity. These developments inherently involve substantial land disturbance, posing risks to local ecosystems and the species they support. Failure to address these impacts can lead to regulatory hurdles and reputational damage.

Compliance with evolving biodiversity protection laws, including stringent environmental impact assessments (EIAs), is paramount. For instance, many jurisdictions now mandate detailed ecological surveys and the development of specific mitigation plans to offset habitat loss. Bechtel's commitment to these assessments, as seen in projects like the Elizabeth Line in London, demonstrates an understanding of these critical requirements.

Strategic land use planning is key to minimizing ecological footprints. This involves identifying sensitive areas, implementing conservation measures, and exploring brownfield development opportunities where feasible. In 2024, the global trend towards nature-based solutions in infrastructure design further emphasizes the need for responsible land management to avoid environmental conflicts and ensure long-term project sustainability.

Waste Management and Circular Economy Principles

Growing regulatory pressure and evolving societal expectations are pushing the construction industry towards more responsible waste management, with a strong emphasis on circular economy principles. This shift necessitates a focus on minimizing waste at the source, maximizing the recycling of construction and demolition debris, and identifying innovative applications for by-products. Bechtel's commitment to implementing efficient waste management systems directly contributes to its enhanced environmental performance and operational sustainability.

The construction sector is a significant contributor to global waste. For instance, construction and demolition (C&D) waste accounts for a substantial portion of total solid waste generated worldwide. In 2023, estimates suggest that C&D waste made up around 30-40% of the total waste stream in many developed economies. Bechtel's strategic approach to waste reduction and recycling is therefore crucial.

- Waste Reduction Initiatives: Bechtel's projects are increasingly incorporating design strategies that minimize material offcuts and waste generation from the outset.

- Recycling and Reuse: The company is actively pursuing higher rates of recycling for C&D materials, diverting them from landfills and exploring opportunities for reuse in new construction projects.

- Circular Economy Integration: Bechtel is investigating innovative uses for project by-products, aiming to create value streams from materials that would otherwise be discarded, aligning with broader circular economy goals.

- Environmental Performance: Effective waste management practices directly improve Bechtel's environmental footprint, reducing landfill reliance and conserving natural resources.

Extreme Weather Events and Climate Resilience

The escalating frequency and intensity of extreme weather events, a direct consequence of climate change, present significant operational and financial risks for Bechtel's infrastructure projects. These events can disrupt construction timelines, damage completed assets, and increase insurance and maintenance costs.

To mitigate these threats, Bechtel is increasingly integrating climate resilience into its design and engineering processes. This involves developing infrastructure capable of withstanding more severe weather patterns, such as higher wind speeds, increased precipitation, and rising sea levels.

- Increased Flood Risk: Coastal infrastructure projects face heightened risks from storm surges and sea-level rise, potentially impacting operations and requiring costly protective measures.

- Heat Stress on Materials: Extreme heat can affect the performance and longevity of construction materials, necessitating specialized engineering solutions and quality control.

- Supply Chain Disruptions: Severe weather events can disrupt global supply chains, impacting the timely delivery of materials and equipment crucial for project completion.

Global efforts to combat climate change are driving stricter regulations on carbon emissions and a significant push for renewable energy. Bechtel's planning must adapt to these evolving environmental standards, impacting everything from project design to construction methods, with a growing focus on low-carbon technologies.

The increasing scarcity of natural resources, particularly water, poses a significant challenge for large construction projects, especially in arid regions, directly affecting feasibility and costs. Sustainable resource management, including water conservation and efficient material use, is critical.

Bechtel's large projects require careful biodiversity management due to land disturbance, which can lead to regulatory issues and reputational damage. Compliance with biodiversity protection laws and strategic land use planning are essential to minimize ecological impact.

The construction industry faces growing pressure for responsible waste management, emphasizing circular economy principles. Bechtel's focus on waste reduction, recycling, and exploring innovative uses for by-products is vital for environmental performance.

Extreme weather events, amplified by climate change, present operational and financial risks to Bechtel's projects, including construction delays and asset damage. Integrating climate resilience into designs is key to mitigating these threats.

| Environmental Factor | Impact on Bechtel | Key Data/Trend (2024/2025) |

|---|---|---|

| Climate Change & Emissions | Increased regulatory scrutiny, demand for low-carbon solutions. | Global carbon pricing mechanisms are expanding; renewable energy investment reached record highs in 2024. |

| Resource Scarcity (Water) | Higher operational costs, project feasibility challenges in water-stressed areas. | Over 2 billion people live in countries experiencing high water stress (UN Water, 2024). |

| Biodiversity Protection | Need for stringent Environmental Impact Assessments (EIAs), potential project delays due to ecological concerns. | Many countries are strengthening biodiversity regulations, with increased focus on habitat restoration in 2025. |

| Waste Management & Circular Economy | Pressure to reduce construction waste, opportunities in recycling and material reuse. | Construction and Demolition (C&D) waste accounts for roughly 30-40% of total waste in many developed nations (2023 estimates). |

| Extreme Weather Events | Risk of project disruptions, increased insurance and maintenance costs. | Global insured losses from natural catastrophes were significant in 2024, highlighting increased climate-related risks. |

PESTLE Analysis Data Sources

Our Bechtel PESTLE Analysis is meticulously crafted using a comprehensive blend of data from reputable international organizations like the World Bank and IMF, alongside official government publications and leading industry-specific market research reports. This ensures a robust and well-informed understanding of the political, economic, social, technological, legal, and environmental landscape impacting Bechtel's operations and strategic decisions.