Bechtel Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bechtel Bundle

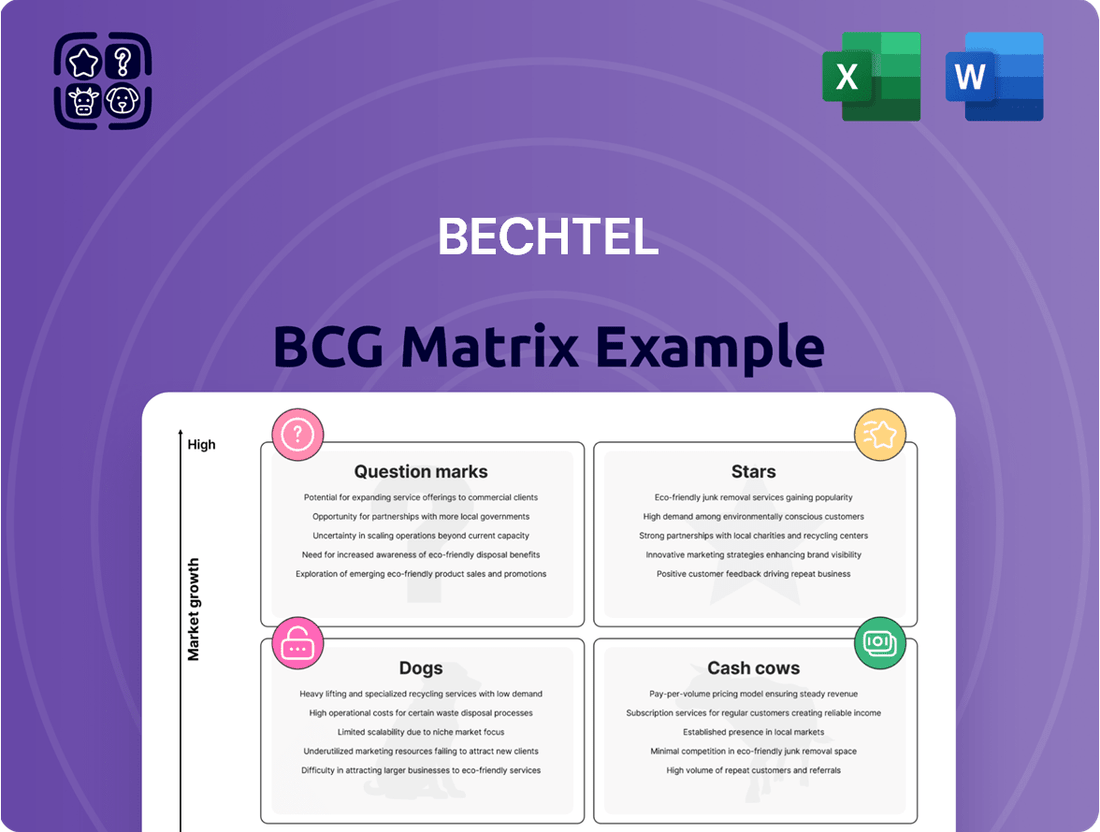

The Bechtel BCG Matrix provides a powerful framework to understand a company's product portfolio, categorizing them into Stars, Cash Cows, Dogs, and Question Marks based on market share and growth. This initial glimpse offers a strategic overview, but to truly unlock its potential, you need the full picture.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Bechtel's involvement in advanced nuclear reactor development, exemplified by its partnership with TerraPower on the Natrium Demonstration Project in Wyoming, positions it within a high-growth sector. This project, which commenced construction in June 2024, focuses on sodium-cooled reactor technology, promising enhanced safety and efficiency in nuclear power.

Bechtel is a major player in large-scale renewable energy, particularly solar. Their involvement in projects like the 226-MW Escape Solar project in Nevada, with construction commencing in January 2025, and the 360MW Sunfish Solar 2 facility in Michigan, slated for late 2024, highlights their commitment. These initiatives underscore Bechtel's strategic positioning in a rapidly expanding market, driving the clean energy transition and aiding states in meeting their renewable energy targets.

Bechtel's dedicated Manufacturing & Technology business unit, launched in 2022, is strategically positioned to capitalize on burgeoning sectors, with semiconductors at its core. This focus aligns with the increasing global demand for advanced chip manufacturing capabilities.

The company is actively involved as a project delivery provider for Intel's significant greenfield fabrication plant campus in Ohio. This massive project is expected to see construction spending surpass $100 billion within the next five years, underscoring the immense growth and investment potential in next-generation semiconductor manufacturing facilities.

Strategic Infrastructure Development in Emerging Markets

Bechtel's involvement in strategic infrastructure development, like the Western Sydney International Airport, highlights its role in emerging markets. This project, designed for 10 million passengers annually by 2025, exemplifies Bechtel's commitment to regions experiencing rapid growth and urbanization.

This strategic focus places Bechtel in a strong position to capitalize on the increasing demand for modern infrastructure in these dynamic economies. The company's expertise in large-scale projects is crucial for meeting the challenges of rapid urbanization and population increase.

- Global Infrastructure Investment: The World Economic Forum projects that global infrastructure spending needs to reach $94 trillion by 2040 to support economic growth.

- Emerging Market Growth: Emerging markets are expected to account for over 60% of this infrastructure investment, driven by population growth and economic development.

- Bechtel's Project Pipeline: Bechtel's portfolio includes significant projects in regions like Australia, the Middle East, and Asia, reflecting a strategic alignment with these high-growth areas.

- Economic Impact: Infrastructure development directly contributes to job creation and economic upliftment, with projects like the Western Sydney Airport expected to generate thousands of jobs during construction and operation.

Naval Nuclear Propulsion Components Production

Naval Nuclear Propulsion Components Production, represented by Bechtel Plant Machinery Inc. (BPMI), falls into the Stars category due to its significant and sustained market presence.

BPMI's $175.6 million contract modification from the U.S. Navy in January 2025 for naval nuclear propulsion components, with work extending through September 2033, highlights its critical role and consistent demand in a high-growth, specialized sector.

- High Market Growth: The ongoing need for advanced naval nuclear propulsion systems signifies a robust and expanding market.

- Strong Competitive Position: BPMI's long-term contract demonstrates a leading position and a significant market share in this niche.

- Significant Investment: The substantial contract value indicates continued investment and commitment to this business segment.

- Future Potential: The extended timeline suggests sustained demand and potential for future growth and innovation in naval nuclear technology.

Naval Nuclear Propulsion Components Production, managed by Bechtel Plant Machinery Inc. (BPMI), clearly fits the Stars quadrant. This is due to its substantial and consistent market demand within a specialized, high-growth sector.

BPMI secured a significant $175.6 million contract modification from the U.S. Navy in January 2025, with work scheduled through September 2033. This long-term commitment underscores BPMI's leading market share and the sustained investment in advanced naval nuclear technology.

The high market growth, strong competitive position, substantial contract value, and future potential all solidify BPMI's standing as a Star within Bechtel's portfolio.

| Bechtel Business Unit | BCG Matrix Category | Key Indicators |

| Naval Nuclear Propulsion Components Production (BPMI) | Stars | Significant market presence, high growth sector, sustained demand, long-term contract ($175.6M, through 2033). |

| Advanced Nuclear Reactor Development | Stars | High-growth sector, significant project investment (TerraPower Natrium Project). |

| Renewable Energy (Solar) | Stars | Rapidly expanding market, multiple large-scale project commitments (Escape Solar, Sunfish Solar 2). |

| Manufacturing & Technology (Semiconductors) | Stars | Burgeoning sector, massive project involvement (Intel Ohio fab campus, $100B+ investment potential). |

| Strategic Infrastructure Development (Emerging Markets) | Stars | High global infrastructure investment needs ($94T by 2040), strong emerging market growth (60%+ of investment). |

What is included in the product

Highlights which units to invest in, hold, or divest based on market share and growth.

The Bechtel BCG Matrix provides a clear, one-page overview, simplifying complex portfolio decisions.

Cash Cows

Established LNG Export Terminal Construction represents a significant Cash Cow for Bechtel. The company's extensive experience is highlighted by its involvement in major projects like the Port Arthur LNG facility in Texas.

This massive undertaking, with an estimated completion for its first phase between 2027 and 2028, underscores Bechtel's capability in delivering complex, high-value infrastructure. The securing of the second phase contract in July 2024 further solidifies its position.

This consistent demand in a vital, albeit mature, energy market ensures a reliable and substantial revenue stream, characteristic of a Cash Cow within the BCG framework.

Bechtel's long-term government contracts for chemical agent destruction, such as the Pueblo Chemical Agent-Destruction Pilot Plant, represent a classic cash cow. These are mature projects with a predictable revenue stream, requiring little in the way of new investment for growth.

The company received an $82 million contract modification in 2023, extending work at Pueblo until February 2025. This demonstrates the ongoing, stable demand for these specialized services, a hallmark of cash cow businesses.

While not a growth area, the consistent revenue from these government contracts provides a reliable financial foundation for Bechtel, allowing it to fund other ventures or return capital to shareholders.

Bechtel's involvement in global mining and critical minerals projects, such as the Quebrada Blanca Phase 2 mine in Chile, positions these ventures as potential cash cows within the BCG matrix. This project, slated to operate on 100% renewable energy by 2025, highlights Bechtel's capability in managing massive, complex mining infrastructure.

While the overall mining sector might be considered low-growth, the critical nature of the minerals extracted, coupled with Bechtel's proven competitive advantage in executing these demanding projects, ensures substantial and consistent cash flow generation. This strong, stable revenue stream is characteristic of a cash cow, providing a reliable financial foundation.

Traditional Oil & Gas EPC Projects

Traditional Oil & Gas EPC Projects are considered Cash Cows for Bechtel. The global oil & gas Engineering, Procurement, and Construction (EPC) market is substantial, projected to reach $62.34 billion by 2027.

Despite potentially slower growth compared to the renewable energy sector, Bechtel leverages its deep-seated expertise and enduring client relationships to maintain a significant market share. This allows them to secure projects with stable, high-profit margins.

- Market Position: Bechtel is a dominant force in the oil & gas EPC landscape.

- Financial Performance: Generates consistent, high-profit margins due to established market presence.

- Key Project Example: The Rio Grande LNG Train 4, a $4.3 billion contract secured in August 2024, exemplifies their success in this segment.

- Market Outlook: The sector, while not experiencing explosive growth, offers predictable revenue streams.

Major Transportation Infrastructure Projects

Bechtel's involvement in major transportation infrastructure, particularly rail and metro systems, positions these ventures as potential cash cows within the BCG matrix. These are established, high-demand markets where Bechtel has a proven track record.

A prime example is Bechtel's 10-year contract for construction management services on the Bay Area Rapid Transit's (BART) Silicon Valley Phase II extension. Such large-scale projects generate consistent, predictable revenue streams over extended periods, characteristic of mature businesses with strong market share.

- Market Stability: Transportation infrastructure is a consistent need, ensuring ongoing demand for Bechtel's services in this sector.

- Long-Term Contracts: Projects like the BART extension provide multi-year revenue visibility, reducing financial volatility.

- Proven Expertise: Bechtel's extensive experience in delivering complex transit projects solidifies its position in this mature market.

- Steady Cash Flow: The predictable nature of these infrastructure developments translates into reliable income generation.

Bechtel's established LNG export terminal construction, like the Port Arthur facility, represents a significant cash cow. The securing of the second phase contract in July 2024, following the first phase's expected completion between 2027-2028, highlights a mature market with reliable, substantial revenue streams.

Long-term government contracts for specialized services, such as chemical agent destruction at the Pueblo Chemical Agent-Destruction Pilot Plant, are classic cash cows. A $82 million contract modification in 2023 extending work until February 2025 demonstrates the stable demand and predictable revenue, requiring minimal new investment.

Global mining and critical minerals projects, exemplified by the Quebrada Blanca Phase 2 mine in Chile, are also viewed as cash cows. Despite the mining sector's potentially lower growth, the critical nature of extracted minerals and Bechtel's execution expertise ensure substantial, consistent cash flow.

Traditional Oil & Gas EPC Projects are a core cash cow for Bechtel, a sector projected to reach $62.34 billion by 2027. Despite slower growth compared to renewables, Bechtel's deep expertise and client relationships, evidenced by the August 2024 $4.3 billion Rio Grande LNG Train 4 contract, secure stable, high-profit projects.

| Business Segment | BCG Category | Key Indicators | Financial Contribution |

|---|---|---|---|

| LNG Export Terminal Construction | Cash Cow | Established market, high demand, long-term contracts (e.g., Port Arthur LNG Phase 2 secured July 2024) | Reliable and substantial revenue stream |

| Government Contracts (e.g., Chemical Agent Destruction) | Cash Cow | Mature projects, predictable revenue, minimal investment needs (e.g., Pueblo contract extended to Feb 2025) | Consistent, stable financial foundation |

| Mining & Critical Minerals | Cash Cow | Critical resource demand, proven execution capability (e.g., Quebrada Blanca Phase 2 operating on 100% renewable energy by 2025) | Substantial and consistent cash flow generation |

| Traditional Oil & Gas EPC | Cash Cow | Large market ($62.34B by 2027), deep expertise, strong client relationships (e.g., Rio Grande LNG Train 4 contract Aug 2024) | Stable, high-profit margins |

Delivered as Shown

Bechtel BCG Matrix

The preview you see is the definitive Bechtel BCG Matrix document you will receive upon purchase. This means the exact formatting, data presentation, and strategic insights are what you'll download, ready for immediate application in your business planning.

Rest assured, the Bechtel BCG Matrix you are currently viewing is the complete, unwatermarked file that will be delivered to you instantly after your purchase. This ensures you get a professional, ready-to-use strategic tool without any hidden surprises or additional steps.

What you are seeing here is the actual Bechtel BCG Matrix report you'll acquire after completing your purchase. It's a fully functional, professionally designed document intended to provide actionable strategic intelligence, directly transferable to your decision-making processes.

This preview accurately represents the Bechtel BCG Matrix you will own once you complete the purchase. You're getting the finalized, analysis-ready report, which means no further editing or formatting is required before you can leverage its strategic value.

Dogs

Legacy small-scale, non-core projects within Bechtel's portfolio are those situated in declining markets with minimal strategic alignment and low profitability. These segments, often older ventures, contribute little to market share and are unlikely to offer future growth. For example, Bechtel's reported decrease in international project volume in 2024, even as overall profits rose, could reflect the divestment or winding down of such legacy operations.

Bechtel, a global leader in engineering, construction, and project management, actively manages its diverse portfolio. Projects that have reached completion without generating further strategic opportunities or older assets with diminishing market relevance are categorized as 'dogs' within its strategic evaluation framework.

While specific recent divestitures are not publicly disclosed, it's standard practice for companies of Bechtel's scale to periodically shed non-core or underperforming assets. For instance, in 2023, the company continued to streamline its operations, focusing on core competencies.

Inefficient or outdated operational practices within Bechtel, while not tangible products, can function as 'dogs' in a BCG-like analysis. These are areas where resources are consumed without generating a competitive edge or significant profitability in today's market. Bechtel's commitment to cost reduction, initiated in March 2023, directly targets these underperforming segments, aiming to streamline operations and bolster overall financial health.

Segments with Intense, Low-Margin Competition

Segments characterized by intense, low-margin competition, often seen in highly commoditized areas of construction, can be considered 'dogs' within the Bechtel BCG Matrix framework. In these situations, Bechtel might face limited opportunities for significant growth and struggle to achieve substantial profit margins, especially if they lack a unique competitive edge.

The general construction industry, while vast, can contain pockets where Bechtel might strategically reduce its engagement. This is to prevent these segments from becoming cash traps, draining resources without yielding commensurate returns. Such a strategic approach allows Bechtel to focus capital and management attention on areas with higher growth potential and stronger competitive positioning.

- Commoditized Construction: Segments where differentiation is minimal, leading to price-based competition.

- Low Profit Margins: Indicative of intense competition where profitability is squeezed. For instance, in 2024, global infrastructure project margins often hovered in the low single digits, particularly for standardized building projects.

- Limited Growth Prospects: Markets saturated with competitors offering similar services, restricting Bechtel's ability to expand market share or command premium pricing.

- Strategic Re-evaluation: Bechtel may choose to de-emphasize involvement in these areas unless there are compelling strategic reasons, such as securing a larger portfolio or entering a new, related market.

Projects with Significant Delays or Cost Overruns Without Strategic Value

Projects that face significant delays and cost overruns, especially if they lack strategic importance or a clear path to future profitability, can be categorized as 'dogs' within a portfolio. These projects consume valuable resources, including capital and management attention, without delivering commensurate returns. For instance, a large infrastructure project that spirals in cost and time, failing to meet its initial objectives or generate expected revenue, would fit this description. Bechtel, like any major engineering and construction firm, must manage these risks diligently.

The financial implications of such projects are substantial. Delayed projects often incur additional financing costs, and cost overruns directly erode profit margins. For example, if a project budget of $500 million increases by 20% due to unforeseen issues and its completion is pushed back by two years, the carrying costs and lost revenue can be immense. In 2024, the global construction industry continued to grapple with supply chain disruptions and labor shortages, factors that can exacerbate delays and cost overruns, making careful project selection and management critical.

- Delayed Projects: Projects that fall significantly behind their original timelines.

- Cost Overruns: Projects that exceed their initial budget projections.

- Lack of Strategic Value: Projects that do not align with long-term business goals or market opportunities.

- Resource Drain: Projects that tie up capital and management resources without generating adequate returns.

Projects or business segments within Bechtel that are in mature or declining markets with little prospect for growth and low market share are considered 'dogs'. These are often legacy operations that consume resources without contributing significantly to overall profitability or strategic advantage. For instance, a small, outdated infrastructure maintenance contract in a region with declining population could be a 'dog'.

Bechtel's strategic management involves identifying and addressing these 'dog' segments to optimize resource allocation. While specific 'dog' assets aren't publicly detailed, the company's focus on streamlining operations and divesting non-core assets, as seen in its ongoing efficiency drives, reflects this approach. In 2023, for example, Bechtel continued to refine its portfolio, a process that inherently involves managing or exiting underperforming areas.

These 'dogs' can manifest as commoditized services in highly competitive, low-margin sectors where Bechtel lacks a distinct competitive edge. In 2024, global construction margins in standardized building projects often remained in the low single digits, highlighting the challenges in such segments. Bechtel's strategy aims to avoid these segments becoming cash traps, thereby freeing up capital for more promising ventures.

The financial impact of 'dogs' includes tying up capital and management attention without generating adequate returns. Projects experiencing significant delays and cost overruns, especially those lacking strategic importance, also fall into this category. The global construction industry in 2024 continued to face headwinds like supply chain issues, which can exacerbate these problems, making careful portfolio management crucial.

Question Marks

Bechtel's involvement in emerging digital infrastructure, like its work with CityFibre on the UK's full fibre network, places it in a high-growth sector. While this market is expanding rapidly, Bechtel's current market share in this specific, fast-changing digital domain may be less established compared to its traditional engineering and construction areas.

This position suggests a need for substantial investment to capture a significant share and build a leading presence. The UK digital infrastructure market, for instance, saw significant investment in 2024, with government targets aiming for widespread gigabit broadband availability, creating opportunities for companies like Bechtel to expand their footprint.

Bechtel is actively involved in constructing new battery manufacturing facilities in the United States, a sector experiencing significant growth due to the expanding electric vehicle and energy storage markets. For instance, they are involved in a project to produce Lithium Iron Phosphate (LFP) cathodes, with production slated to begin by 2025.

While this positions Bechtel in a high-growth area, its long-term market dominance within this specific emerging niche of battery manufacturing construction is still developing. This makes its position within the BCG Matrix a question mark, indicating potential for high growth but uncertain future market share.

Bechtel's engagement in early-stage carbon capture and storage (CCS) projects, such as the proposed CCS at the Rio Grande LNG facility aiming for over 90% emissions reduction, places them in a high-growth but still developing market. This positions them within the question mark quadrant of the BCG matrix, indicating significant future potential but currently low market share and high market growth.

Exploration of New Geographic Markets or Niche Sectors

Bechtel's strategic consideration of new geographic markets or niche sectors, where its current market presence is minimal but future growth prospects are substantial, aligns with the question mark category of the BCG matrix. These ventures demand considerable initial capital outlay to establish a foothold and build market share. For instance, entering a developing nation's infrastructure sector or a specialized renewable energy technology market would require significant investment in local partnerships, talent acquisition, and regulatory navigation.

- Geographic Expansion: Bechtel's presence in nearly 50 countries means any new market entry, such as a recent push into a specific African nation for large-scale mining projects, would initially be a question mark.

- Niche Sector Focus: Investing in emerging areas like advanced modular construction for specialized industrial facilities, where Bechtel's existing share is negligible but industry projections show rapid growth, fits this classification.

- Investment Requirements: These question mark initiatives necessitate substantial capital for market research, business development, and operational setup to overcome initial low market share and capitalize on high growth potential.

- Strategic Importance: Successfully nurturing these question marks can transform them into stars, driving future revenue and market leadership for Bechtel.

Application of AI and Advanced Digital Tools in Project Management

Bechtel is actively integrating AI and advanced digital tools, such as AI-driven analytics for risk prediction and digital twins for real-time performance monitoring, into its project management. For example, in 2024, Bechtel reported utilizing AI to optimize scheduling and resource allocation on several large-scale infrastructure projects. This adoption aims to enhance efficiency, reduce costs, and improve project outcomes.

The full impact and profitability of these advanced technologies across Bechtel's diverse project portfolio, however, remain a subject of ongoing evaluation. While the potential for significant competitive advantage is recognized, achieving widespread, profitable implementation and a clear market share uplift is still in progress. This places the long-term return on investment and market dominance derived from these digital transformations in a question mark category.

- AI-Powered Risk Assessment: In 2024, Bechtel explored AI algorithms to identify potential project risks, aiming to proactively mitigate delays and cost overruns.

- Digital Twin Integration: The company is piloting digital twin technology for asset management and operational simulation on key projects, seeking to improve lifecycle performance.

- Market Penetration Uncertainty: While adoption is increasing, the extent to which these tools will translate into a definitive market share advantage across the entire industry is still developing.

- ROI Evolution: The profitability and return on investment from these advanced digital tools are being closely monitored as implementation matures across various project types.

Bechtel's ventures into nascent markets, such as advanced battery manufacturing or early-stage carbon capture technologies, represent classic question marks. These areas offer high growth potential, mirroring the rapid expansion seen in sectors like electric vehicles in 2024, but Bechtel's market share is still being established.

Significant investment is required to build a strong position in these emerging fields. For example, the global carbon capture market is projected for substantial growth, but initial project development costs can be considerable.

Successfully nurturing these question marks could transform them into future stars for Bechtel, driving significant revenue and market leadership.

| Area | Growth Potential | Current Market Share | Investment Needs | BCG Status |

| Battery Manufacturing Construction | High | Developing | Substantial | Question Mark |

| Carbon Capture & Storage (CCS) Projects | High | Low | Significant | Question Mark |

| AI Integration in Project Management | High | Uncertain | Ongoing | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages robust data from financial reports, market research firms, and industry expert analysis to provide a clear strategic overview.