Bank of East Asia Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of East Asia Bundle

The Bank of East Asia faces moderate buyer power due to the availability of alternative banking services and the relative ease with which customers can switch providers. However, the loyalty programs and established relationships offered by the bank can mitigate this force to some extent.

The threat of new entrants in the banking sector is generally considered moderate to high, influenced by regulatory hurdles and capital requirements, but also by the rise of agile fintech companies. Bank of East Asia must continually innovate to stay ahead of potential disruptors.

The bargaining power of suppliers, particularly technology providers and talent, presents a manageable challenge for Bank of East Asia, as the market offers multiple options for essential services and skilled employees.

The intensity of rivalry among existing competitors in the East Asian banking landscape is high, with established players and emerging fintech firms constantly vying for market share through competitive pricing and innovative product offerings.

The threat of substitute products, such as peer-to-peer lending platforms and digital payment solutions, is growing, requiring Bank of East Asia to adapt its service portfolio and embrace digital transformation to remain relevant.

This snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Bank of East Asia’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of depositors, especially large institutional investors and high-net-worth individuals, is substantial for The Bank of East Asia (BEA). These depositors form the bedrock of the bank's capital, enabling its lending and investment activities. Their ability to move funds easily to competitors offering better terms, such as higher interest rates, significantly influences BEA's funding costs.

In 2023, Hong Kong's interbank offered rates (HIBOR) saw fluctuations, directly impacting deposit rates that banks like BEA needed to offer to retain funds. For instance, the one-month HIBOR averaged around 3.6% in late 2023, a key benchmark for deposit pricing. BEA's ability to offer competitive rates, coupled with its perceived financial stability and the quality of its services, is crucial in mitigating this supplier power.

Technology and infrastructure vendors, particularly those providing core banking software, cybersecurity, and cloud services, exert moderate bargaining power over the Bank of East Asia (BEA). This is amplified when their solutions are specialized or proprietary, which is often the case in a bank's digital transformation journey. BEA's significant investments in upgrading its IT infrastructure, as seen in its continued focus on digital banking initiatives, underscore its reliance on these suppliers.

The switching costs associated with changing core IT systems can be substantial, ranging into millions of dollars and involving complex integration processes. This high barrier to entry for new vendors grants existing suppliers leverage in negotiating pricing and service level agreements (SLAs). For instance, a disruption in cloud services from a major provider could impact BEA's operations significantly, necessitating robust SLAs.

In 2024, the global IT services market, which includes the segments relevant to BEA, continued to see strong demand, particularly for cloud and cybersecurity solutions. While specific figures for BEA's vendor relationships are not publicly disclosed, the broader trend indicates that vendors in these critical areas possess considerable influence due to the specialized nature of their offerings and the integral role they play in the bank's operational efficiency and security.

The bargaining power of suppliers, specifically concerning human capital, is notably high for Bank of East Asia (BEA). Skilled employees in specialized financial fields such as wealth management, cybersecurity, data analytics, and regulatory compliance hold significant leverage. This is exacerbated by intense competition for top talent within Hong Kong and mainland China's financial services industry.

Attracting and retaining these sought-after professionals necessitates substantial investment in competitive remuneration packages, robust career advancement pathways, and a positive organizational culture. For instance, the average annual salary for a cybersecurity analyst in Hong Kong can exceed HKD 700,000, reflecting the premium placed on these skills. This directly influences BEA's operational expenses and its ability to effectively implement strategic initiatives.

Interbank Market and Wholesale Funding

The bargaining power of suppliers in the interbank and wholesale funding markets is a critical consideration for Bank of East Asia (BEA). Banks like BEA depend heavily on these markets to manage their liquidity and capital needs. In 2024, as global interest rates remained elevated, the cost of wholesale funding increased, giving greater leverage to these suppliers. For instance, during periods of market stress, the rates at which banks lend to each other can surge, directly impacting BEA's profitability and operational flexibility.

The strength of these suppliers—other banks, institutional investors, and money market funds—is not static. It shifts based on the overall health of the financial system, prevailing interest rate policies set by central banks, and the market's perception of BEA's financial stability and credit risk. A perceived weakening of BEA's creditworthiness could lead suppliers to demand higher rates or even withdraw funding, thereby increasing their bargaining power.

BEA's strategy to mitigate this power involves diversifying its funding sources. This includes not only interbank loans but also deposits, debt issuance, and other forms of wholesale financing. However, systemic events, such as the banking sector turmoil experienced in early 2023 and its lingering effects into 2024, can rapidly consolidate market power among the remaining, more stable institutions, amplifying their influence over funding costs for all participants, including BEA.

- Interbank Market Dependence: BEA, like other banks, relies on the interbank market for short-term liquidity needs.

- Wholesale Funding Costs: In 2024, rising interest rates generally increased the cost of wholesale funding, giving suppliers more leverage.

- Creditworthiness Impact: BEA's perceived credit risk directly influences its access to and cost of funds from these suppliers.

- Diversification as Mitigation: Accessing a broad range of funding sources helps reduce reliance on any single supplier group.

Regulatory and Compliance Service Providers

Suppliers of regulatory and compliance services, such as legal counsel, auditors, and specialized advisors, wield considerable bargaining power over banks like the Bank of East Asia. This is due to the highly complex and ever-changing regulatory landscapes in key markets like Hong Kong and mainland China. Banks are fundamentally dependent on these experts to interpret and implement intricate rules, ensuring they avoid costly penalties and maintain operational integrity.

The specialized knowledge and critical nature of these services mean that few providers can offer the necessary expertise. For instance, in 2023, the financial services sector globally saw significant spending on compliance technology and advisory, with estimates suggesting billions were invested to meet new data privacy and anti-money laundering (AML) regulations. This reliance on a limited pool of highly qualified professionals grants them substantial leverage in setting fees and contract terms.

- High Barriers to Entry: The specialized skills and certifications required to provide effective regulatory and compliance services create significant barriers to entry for new players.

- Criticality of Service: Banks cannot operate without adhering to regulations; failure to do so can result in severe financial penalties and reputational damage, making these services indispensable.

- Limited Substitute Options: For complex regulatory challenges, there are often few, if any, viable substitutes for expert legal and compliance advice.

- Industry Demand: The ongoing evolution of financial regulations ensures consistent and often increasing demand for these specialized services, strengthening supplier power.

The bargaining power of suppliers for Bank of East Asia (BEA) is generally moderate but can be high in specific areas like technology and skilled human capital. Key suppliers include those providing core banking software, cybersecurity solutions, and specialized financial talent. These entities often have proprietary technology or in-demand skills, granting them leverage in negotiations.

In 2024, the demand for advanced IT services, particularly in cloud computing and cybersecurity, remained robust. This increased the negotiating power of vendors in these critical sectors. For instance, the global cybersecurity market was projected to grow significantly, with many banks like BEA investing heavily to protect against evolving cyber threats, making these suppliers essential and influential.

BEA's reliance on specialized personnel in areas like wealth management and regulatory compliance also contributes to the bargaining power of human capital suppliers. The competition for top talent in Hong Kong's financial hub drives up compensation expectations, impacting BEA's operational costs and strategic execution.

What is included in the product

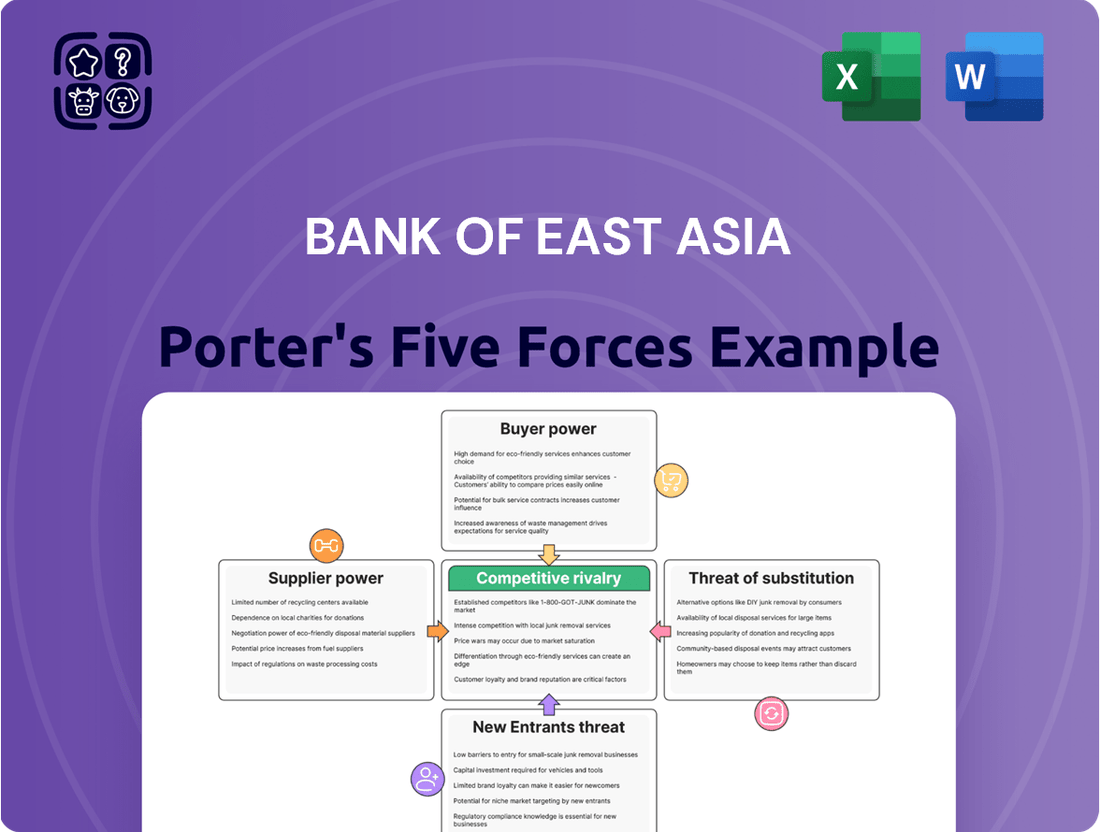

This analysis of the Bank of East Asia examines the intensity of rivalry, the power of customers and suppliers, and the threat of new entrants and substitutes within its operating environment.

Effortlessly identify competitive advantages and threats with a pre-built, yet customizable, Porter's Five Forces framework for Bank of East Asia.

Customers Bargaining Power

The bargaining power of individual retail banking customers is typically moderate. Low switching costs for straightforward services, like opening a new savings account, empower customers. Furthermore, digital platforms enhance transparency, allowing easy comparison of interest rates and fees across institutions. For instance, in 2024, the Financial Conduct Authority in the UK reported that over 70% of consumers found it easy to switch current accounts, highlighting this low-friction environment.

While customer inertia can be a factor, keeping them with their existing bank, the rapid growth of digital banks and FinTech innovators presents a significant challenge. These entities often provide streamlined onboarding and competitive rates for deposits, loans, and payment services, making it simpler than ever for consumers to explore alternatives. This increased accessibility for comparison shopping directly amplifies customer leverage.

To effectively manage this power, Bank of East Asia (BEA) needs to focus on delivering compelling value propositions. This includes offering competitive product pricing, ensuring a seamless and intuitive digital banking experience, and providing personalized services that foster loyalty. For example, banks that invest in AI-driven personalized financial advice often see higher customer retention rates.

Corporate and commercial clients, from small and medium-sized enterprises to large multinational corporations, wield considerable bargaining power. Their substantial transaction volumes and need for customized financial solutions mean they can negotiate favorable terms on loans, trade finance, and cash management services.

These clients often maintain relationships with several banking institutions, increasing their leverage. For example, in 2024, the average corporate client surveyed by a leading financial industry group indicated they actively solicited quotes from at least three banks for major financing deals, highlighting the competitive pressure on banks like BEA.

BEA's strategy to mitigate this power involves offering a comprehensive suite of integrated financial services, including expert advisory. By providing value beyond basic transactions, the bank aims to build strong, long-term relationships that reduce price sensitivity and retain these high-value customers.

Wealth management clients, particularly high-net-worth and ultra-high-net-worth individuals, wield considerable bargaining power. The sheer volume of assets they entrust to institutions like Bank of East Asia (BEA), coupled with their complex financial requirements, necessitates a highly tailored service. These clients often engage with several wealth managers globally, allowing them to compare offerings and negotiate fees or service levels.

Their sophisticated needs translate into demands for exclusive investment products, personalized advisory services, and demonstrable performance. In 2023, the global wealth management industry saw significant shifts, with clients increasingly prioritizing digital access alongside personalized human interaction, putting pressure on firms to innovate their service models.

BEA, to effectively capture and retain these valuable clients, must continuously refine its wealth management proposition. This involves not only offering competitive pricing but also demonstrating superior expertise, a commitment to client-centric solutions, and a robust understanding of individual client goals. The ability to provide differentiated value is key in this competitive landscape.

Insurance Policyholders

Policyholders, particularly those with substantial or intricate insurance policies, possess a notable degree of bargaining power when dealing with Bank of East Asia (BEA). They can actively compare the terms, premiums, and coverage offered by different insurance companies to secure the best deal.

While the cost and effort to switch insurance providers for basic policies may be low, the complexity inherent in certain insurance products can lead to increased customer loyalty and reduced switching. This complexity can create a form of "stickiness" for BEA's insurance offerings, making it less likely for customers to move to a competitor for specialized coverage.

BEA's strategy to integrate insurance services within its broader financial offerings is designed to mitigate this customer bargaining power. By leveraging existing banking relationships, BEA aims to cross-sell insurance products, thereby fostering deeper customer engagement and potentially reducing the inclination of policyholders to shop around. For instance, in 2024, BEA continued to emphasize its bancassurance partnerships to offer a wider range of insurance solutions to its banking clientele.

The bargaining power of customers in the insurance sector is influenced by several factors:

- Information Availability: Increased access to online comparison tools and financial advice empowers customers to make more informed decisions, thereby strengthening their negotiating position.

- Product Standardization: For highly standardized insurance products, price becomes a primary differentiator, giving customers more leverage.

- Switching Costs: While some insurance policies have low switching costs, others, especially those with accumulated benefits or long-term commitments, can present higher barriers to changing providers.

- Brand Loyalty and Service Quality: A strong reputation for service and established brand loyalty can, conversely, reduce customer bargaining power, as policyholders may prioritize trust and reliability over minor price differences.

Digital-Savvy Customers

The increasing number of digitally-savvy customers significantly boosts their bargaining power. As more individuals, especially younger generations, embrace digital channels, they demand seamless online and mobile banking experiences. This includes instant transactions, personalized services, and intuitive app interfaces.

These digitally-empowered customers are less hesitant to switch to financial institutions, including FinTechs, that offer superior digital capabilities. For instance, in 2024, the adoption of mobile banking continued its upward trend, with a significant portion of transactions occurring through digital platforms. This willingness to migrate puts considerable pressure on established banks like Bank of East Asia (BEA) to continuously invest in and upgrade their technological infrastructure to retain and attract these customers.

- Digital Adoption: In 2024, global mobile banking usage continued to rise, with many regions reporting over 70% of customers preferring digital channels for routine banking.

- Customer Expectations: Savvy customers expect personalized offers and proactive service, often delivered via AI-powered chatbots and tailored app notifications.

- Switching Behavior: Research indicates that a poor digital experience is a primary driver for customer churn, with many willing to switch for better usability and features.

- FinTech Competition: The agility of FinTechs in delivering innovative digital solutions forces traditional banks to accelerate their own digital transformation efforts.

The bargaining power of customers for Bank of East Asia (BEA) is generally moderate, with variations across customer segments. Individual retail customers often benefit from low switching costs and increased transparency due to digital platforms, enabling easy comparison of services and pricing. For instance, in 2024, a significant percentage of consumers found it easy to switch banking providers, demonstrating this trend.

Same Document Delivered

Bank of East Asia Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for the Bank of East Asia, detailing competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. This analysis provides critical insights into the strategic positioning and competitive landscape of the Bank of East Asia, enabling informed decision-making. You're looking at the actual document. Once you complete your purchase, you’ll get instant access to this exact file, allowing immediate application of its strategic intelligence.

Rivalry Among Competitors

The Hong Kong banking market, a key arena for Bank of East Asia (BEA), is exceptionally mature and crowded. This saturation means intense rivalry among many local and global institutions vying for customers and market share.

Major established banks like HSBC, Standard Chartered, and Bank of China (Hong Kong) are formidable competitors. Additionally, the emergence of several virtual banks is further intensifying this competitive landscape, forcing traditional players to adapt.

This high concentration of banks naturally leads to pressure on profit margins. In 2023, Hong Kong's banking sector saw a net interest margin average of around 1.3%, a figure reflecting this competitive environment.

To stand out, banks must constantly innovate and offer unique value propositions. This could involve enhanced digital services, specialized product offerings, or superior customer experiences to attract and retain clients.

Bank of East Asia (BEA) confronts intense rivalry from major state-owned commercial banks in mainland China. These giants, such as ICBC and China Construction Bank, possess vast branch networks, enjoying significant government backing and deeply entrenched customer loyalty.

These state-owned entities often hold a dominant position across both corporate and retail banking sectors. For instance, by the end of 2023, the five largest state-owned banks in China controlled over 60% of total banking assets, making market penetration difficult for foreign and regional players like BEA.

This market dominance by state-owned banks presents a substantial barrier to BEA's aggressive expansion strategies. Their scale and government support allow for pricing advantages and broader product offerings, directly impacting BEA's market share potential.

To navigate this competitive landscape, BEA must strategically focus on its unique strengths. Leveraging its international connectivity and specialized services can help BEA carve out a distinct position and compete effectively within the massive Chinese market.

For many fundamental banking products, such as savings accounts, personal loans, and basic transaction services, there's a significant degree of similarity across institutions. This homogeneity naturally leads to competition primarily based on price, like interest rates and fees.

Banks find it challenging to create truly unique offerings in these core areas, pushing them to vie for customers through competitive pricing and operational efficiency. For instance, in 2024, the average interest rate on savings accounts across major banks remained relatively low, reflecting this price sensitivity.

This intense competition on standard products pressures banks like the Bank of East Asia (BEA) to differentiate themselves through more specialized financial services, wealth management, or superior customer engagement to ensure healthy profit margins.

Aggressive Digital Transformation and Innovation

The intensifying digital race among banks significantly fuels competitive rivalry. Many institutions, including BEA's peers, are pouring substantial resources into upgrading online and mobile banking capabilities and integrating with FinTech solutions. This pursuit of digital excellence is not just about staying current; it's about gaining a competitive edge through enhanced customer experience and operational efficiency.

Competitors are leveraging advanced technologies like artificial intelligence, big data analytics, and blockchain to differentiate themselves. For instance, DBS Bank, a regional competitor, has consistently been recognized for its digital banking prowess, often cited for its customer-centric digital offerings. BEA needs to match or exceed these technological investments to remain competitive in service delivery and product innovation.

The pressure to innovate digitally means that banks failing to keep pace risk obsolescence. In 2024, the financial services sector saw continued acceleration in digital adoption, with many banks reporting increased investment in AI-driven customer service and personalized digital offerings. BEA's strategic response to these trends is crucial for maintaining its market position.

- Increased Investment in Digital Channels: Many banks reported double-digit percentage increases in their digital transformation budgets for 2024, aiming to bolster online and mobile platforms.

- FinTech Partnerships and Acquisitions: The trend of banks acquiring or partnering with FinTech firms to quickly integrate new technologies continued throughout 2024, with several major deals announced.

- AI and Data Analytics Adoption: Banks are increasingly deploying AI for fraud detection, personalized marketing, and customer service chatbots, with adoption rates for these technologies showing significant year-over-year growth.

- Focus on Seamless User Experience: Competitors are prioritizing intuitive and user-friendly digital interfaces to attract and retain customers, often benchmarked against leading tech companies.

High Exit Barriers in the Banking Sector

The banking sector, including institutions like Bank of East Asia, faces substantial exit barriers. These high barriers stem from the immense investment in physical infrastructure, such as extensive branch networks, and critical IT systems, which represent significant sunk costs. For instance, in 2024, the average cost to establish and maintain a bank branch, including staffing and technology, remains a considerable outlay, making it difficult for underperforming banks to divest these assets without substantial losses.

Furthermore, regulatory hurdles significantly impede a swift exit from the banking industry. Banks operate under stringent oversight from financial authorities, and winding down operations or selling off parts of a business often requires complex approvals and adherence to intricate legal frameworks. This regulatory environment, designed to protect depositors and ensure financial stability, means that even financially distressed banks cannot simply cease operations or easily exit the market, thus prolonging the competitive presence of weaker players.

The social importance of financial institutions also contributes to high exit barriers. Banks are seen as essential service providers, and their failure can have widespread economic and social repercussions. This societal expectation often leads to interventions or prolonged restructuring processes rather than a clean exit, as governments and regulators seek to avoid disruption. Consequently, these factors collectively ensure that competitive rivalry in banking remains intense, as struggling firms are compelled to remain operational, often intensifying price competition and service offerings to survive.

- High Fixed Assets: Banks like Bank of East Asia have significant investments in branches and IT infrastructure, making divestment costly.

- Regulatory Complexity: Exiting the banking market involves navigating complex approval processes and compliance requirements.

- Social Importance: The critical role of banks in the economy discourages rapid exits, prolonging competition.

- Sustained Rivalry: These barriers keep less efficient competitors in the market, intensifying overall industry competition.

The Bank of East Asia operates in a highly competitive banking environment, particularly in Hong Kong and mainland China. This intense rivalry is driven by a large number of established players, including global giants and significant state-owned banks in China, alongside emerging virtual banks.

Homogeneity in core banking products forces competition onto price, such as interest rates and fees, pressuring margins. For example, in 2024, average savings account interest rates remained low across major banks, reflecting this price sensitivity.

The digital race is a key battleground, with banks investing heavily in technology to enhance customer experience and operational efficiency. By 2024, digital transformation budgets saw double-digit percentage increases, with AI and data analytics adoption growing significantly year-over-year.

High exit barriers, due to substantial investments in infrastructure and stringent regulations, mean that even weaker competitors remain, sustaining intense rivalry and the need for continuous innovation to maintain market position.

SSubstitutes Threaten

The rapid growth of FinTech payment solutions presents a substantial threat of substitutes for Bank of East Asia (BEA). Companies like Alipay and WeChat Pay have revolutionized payments, offering convenience and often lower fees. In 2023, global digital payment transaction volume reached an estimated 1.5 trillion, highlighting the immense scale of this shift away from traditional methods.

These FinTech alternatives, including mobile wallets and peer-to-peer apps, effectively bypass conventional banking channels. This disintermediation directly impacts BEA's revenue streams, particularly from transaction fees, and reduces valuable customer interactions. For instance, the global mobile payment market was valued at over $2.5 trillion in 2023 and is projected to grow substantially.

BEA faces the challenge of either integrating with these burgeoning FinTech platforms or developing its own competitive digital offerings. Failure to adapt risks losing market share and customer loyalty in the payments sector. The increasing adoption of these digital services, with projections indicating continued double-digit annual growth, underscores the urgency for BEA to address this competitive pressure.

The rise of direct investment platforms and robo-advisors presents a significant threat of substitution for traditional bank wealth management services like those offered by Bank of East Asia (BEA). Investors, particularly younger demographics, increasingly opt for these digital solutions due to their lower fee structures and user-friendly interfaces. For instance, by the end of 2023, the global robo-advisor market was valued at over $20 billion, with projections indicating substantial growth in the coming years. This trend compels BEA to differentiate its offerings by emphasizing superior, personalized financial advice and access to unique investment products to retain its client base.

The rise of peer-to-peer (P2P) lending and other alternative financing avenues presents a significant threat of substitutes for traditional banking services. These platforms, such as Funding Circle or Prosper, offer borrowers, especially small and medium-sized enterprises (SMEs) and individuals who might find traditional routes challenging, alternative ways to secure capital.

These substitutes often boast quicker application and approval times and can provide more tailored or flexible loan conditions than many banks. For instance, in 2023, the global P2P lending market was valued at approximately $134.5 billion, demonstrating substantial adoption.

While regulatory frameworks are evolving, the growing accessibility and perceived efficiency of these platforms can siphon away lending business from established institutions like the Bank of East Asia. This is particularly true for less complex or unsecured loan types, where speed and flexibility are paramount decision factors for borrowers.

Cryptocurrencies and Decentralized Finance (DeFi)

The rise of cryptocurrencies and Decentralized Finance (DeFi) poses a developing threat to traditional banking services offered by institutions like Bank of East Asia (BEA). These digital assets and platforms are beginning to offer alternatives for functions such as currency exchange, international remittances, and even lending and borrowing, potentially bypassing conventional financial intermediaries.

While the cryptocurrency market remains characterized by volatility and faces ongoing regulatory scrutiny, its inherent potential for lower transaction fees and borderless operations presents a significant long-term disruption risk to core banking revenue streams. For instance, global remittance markets, which are a significant area for many banks, are increasingly seeing interest from crypto-based solutions due to their speed and cost-effectiveness.

BEA must actively monitor the evolution of these technologies and their adoption rates. Early engagement or integration with blockchain and DeFi protocols could be crucial for mitigating this threat and potentially capitalizing on new service delivery models. In 2024, the total value locked in DeFi protocols reached hundreds of billions of dollars, indicating a substantial and growing ecosystem that cannot be ignored.

- Growing DeFi Adoption: The total value locked in DeFi protocols surpassed $200 billion in early 2024, signaling a significant shift towards alternative financial systems.

- Remittance Market Disruption: Cryptocurrencies offer significantly lower fees for cross-border payments compared to traditional banking channels, impacting a key revenue source for many financial institutions.

- Regulatory Uncertainty: While adoption is growing, the evolving regulatory landscape for digital assets remains a key factor influencing the pace and nature of this substitution threat.

Specialized Non-Bank Financial Institutions (NBFIs)

Specialized non-bank financial institutions (NBFIs) present a significant threat of substitution for Bank of East Asia (BEA). These entities, such as dedicated asset management firms or niche lenders, offer focused financial services that can directly compete with specific segments of BEA's broader offerings. For instance, in 2024, the global alternative asset management market was projected to reach over $14 trillion, highlighting the scale of specialized players.

These NBFIs often operate with fewer regulatory constraints than traditional banks, allowing them to be more agile and cost-effective in their specialized areas. This agility enables them to respond quickly to market demands and innovate at a faster pace. Consider the rise of fintech lenders in the SME financing space, which in 2023 accounted for an increasing share of new business lending in many Asian markets, often bypassing traditional banking channels.

BEA faces the challenge of differentiating its integrated financial services model against these nimble, specialized competitors. While BEA offers a holistic suite of banking, wealth management, and insurance products, NBFIs can cherry-pick profitable niches.

- Specialized NBFIs: Asset managers, insurance companies, and dedicated lenders.

- Competitive Advantage: Lower regulatory burdens and greater agility in niche markets.

- Market Growth Example: Global alternative asset management market exceeding $14 trillion in 2024 projections.

- BEA's Challenge: Competing with specialized offerings while highlighting the benefits of an integrated model.

The rapid proliferation of digital payment solutions, including mobile wallets and FinTech platforms, offers consumers and businesses convenient alternatives to traditional bank transfers and card payments. These substitutes, often with lower transaction fees and faster processing times, directly challenge Bank of East Asia's (BEA) established payment services. By the end of 2023, global digital payment transaction volume was estimated to have surpassed 1.5 trillion transactions, underscoring the significant shift in consumer behavior.

| Substitute Type | Key Characteristics | Market Indicator (2023/2024 Data) | Impact on BEA |

|---|---|---|---|

| FinTech Payment Solutions (e.g., Alipay, WeChat Pay) | Convenience, lower fees, speed | Global digital payment transaction volume: >1.5 trillion (2023) | Reduced transaction fee revenue, customer disintermediation |

| Robo-Advisors & Direct Investment Platforms | Lower fees, user-friendly interfaces, accessibility | Global robo-advisor market value: >$20 billion (end of 2023) | Threat to wealth management services, potential loss of AUM |

| Peer-to-Peer (P2P) Lending | Faster approvals, flexible terms, alternative financing | Global P2P lending market value: ~$134.5 billion (2023) | Loss of lending business, particularly for SMEs and individuals |

| Cryptocurrencies & DeFi | Borderless transactions, potentially lower fees, alternative financial functions | Total value locked in DeFi protocols: >$200 billion (early 2024) | Long-term disruption risk to remittances and lending, regulatory challenges |

| Specialized Non-Bank Financial Institutions (NBFIs) | Niche focus, agility, potentially lower regulatory burden | Global alternative asset management market: projected >$14 trillion (2024) | Competition in profitable niches, need for service differentiation |

Entrants Threaten

The banking sector, particularly in regions like Hong Kong and mainland China where Bank of East Asia (BEA) operates, faces significant hurdles for newcomers. For instance, the Hong Kong Monetary Authority (HKMA) mandates strict capital adequacy ratios, requiring banks to maintain a certain level of capital relative to their risk-weighted assets. As of the end of 2023, the average total capital ratio for authorized institutions in Hong Kong remained robust, underscoring the substantial financial commitment needed to enter this market.

These stringent licensing procedures, coupled with the need for extensive compliance infrastructure to navigate complex anti-money laundering and Know Your Customer regulations, represent substantial upfront investments. The sheer scale of capital required to establish a secure and compliant banking operation, often in the billions of US dollars, effectively limits the pool of potential entrants to well-capitalized institutions or private equity firms.

Furthermore, the ongoing evolution of regulatory frameworks, including those related to data privacy and cybersecurity, necessitates continuous investment and adaptation, adding to the cost and complexity for any new player. This dynamic regulatory environment creates a high barrier to entry, safeguarding incumbents like BEA from a large influx of new competition.

Established banks like Bank of East Asia (BEA) possess a significant advantage through decades of cultivated brand trust and deeply ingrained customer loyalty. This makes it exceedingly challenging for new entrants to swiftly gain traction, as replicating such established relationships and the associated confidence takes considerable time and consistent service excellence.

For instance, in 2024, BEA maintained a strong customer base, with over 8.7 million customer accounts, reflecting the enduring trust placed in its services. Newcomers often struggle to overcome customer inertia, particularly when offering essential financial services where perceived security and reliability are paramount.

This inherent hesitancy to switch to unproven entities means new entrants face a considerable hurdle in attracting and retaining customers. The cost and time investment required to build comparable brand equity and customer allegiance are substantial, acting as a powerful deterrent.

Establishing a full-service bank like Bank of East Asia (BEA) demands enormous initial outlays for technology. We're talking about core banking systems, robust IT networks, advanced cybersecurity defenses, and sophisticated digital customer interfaces. These aren't minor expenses; they represent significant capital commitments.

The sheer scale and intricate nature of these technological needs present a formidable hurdle for any new entrant. They must either develop these capabilities from the ground up, which is incredibly costly and time-consuming, or purchase and integrate already expensive, pre-existing solutions. This creates a high barrier.

For BEA, its established and continuously upgraded technological infrastructure offers a distinct competitive advantage. This existing foundation means they don't face the same prohibitive upfront costs that would challenge a newcomer trying to replicate their digital and operational capabilities.

Consider the ongoing investment in cloud migration and AI-driven fraud detection, areas where banks are pouring billions. For instance, in 2024, the global spending on financial technology is projected to reach over $300 billion, highlighting the immense scale of investment required just to stay competitive, let alone establish a new presence.

Emergence of Virtual Banks in Hong Kong

The threat of new entrants in Hong Kong's banking sector has evolved with the advent of virtual banks. While capital requirements and regulatory hurdles traditionally posed significant barriers, the Hong Kong Monetary Authority's (HKMA) proactive licensing of virtual banks has opened doors for digitally native competitors.

These new players, such as Livi Bank and MOX Bank, are leveraging technology to offer streamlined, customer-centric experiences. Their lower overheads compared to incumbent brick-and-mortar institutions, including The Bank of East Asia (BEA), allow them to potentially offer more competitive pricing and innovative digital products. For instance, by mid-2024, virtual banks were actively pursuing customer acquisition through unique digital offerings and partnerships.

BEA faces a direct challenge from these agile entities that are unburdened by legacy systems and extensive branch networks. To counter this, BEA must continue to enhance its own digital capabilities, focusing on user experience and the integration of new technologies. The success of these virtual banks underscores the need for traditional banks to remain adaptable and responsive to changing customer expectations in the digital age.

- Virtual Bank Licensing: The HKMA has issued licenses to several virtual banks, fostering a more competitive landscape.

- Digital-First Approach: New entrants prioritize digital channels, offering innovative services and potentially lower fees.

- Cost Structure Advantage: Virtual banks often operate with significantly lower overheads than traditional banks.

- Competitive Pressure: BEA needs to innovate its digital strategy to match the agility and offerings of these new players.

Large Tech Companies Expanding into Financial Services

Large tech companies are increasingly moving into financial services, posing a significant threat to traditional banks like Bank of East Asia. These tech giants, such as Ant Group and Tencent, possess massive user bases and substantial capital, enabling them to disrupt established markets. For instance, Ant Group's Alipay processed over $1.9 trillion in payments in 2023, highlighting its extensive reach.

While not always pursuing full banking licenses, these firms are expanding into key areas like payments, lending, and wealth management. They leverage their advanced technology and vast customer data to offer seamless, often lower-cost, financial solutions. This can directly impact traditional banking revenue streams by capturing market share in these lucrative segments.

BEA must recognize the disruptive potential of these new entrants. Their agility and digital-first approach can quickly erode the competitive advantage of incumbent institutions. For example, in 2024, digital payments globally are projected to grow by 13%, a sector where tech firms often lead.

- Tech giants leverage vast user bases; Ant Group processed over $1.9 trillion in payments in 2023.

- Expansion into payments, lending, and wealth management erodes traditional revenue.

- Disruptive potential is high due to advanced technology and data utilization.

- Digital payments growth is strong, projected at 13% globally in 2024, a key area for tech firms.

The threat of new entrants for Bank of East Asia (BEA) remains moderate, primarily due to high capital requirements, stringent licensing, and the need for extensive technological infrastructure. These factors create substantial upfront investment barriers, limiting the pool of potential competitors to well-capitalized firms. Established brand trust and customer loyalty also present a significant challenge for newcomers seeking to gain market share.

However, the rise of virtual banks in Hong Kong, supported by regulatory frameworks like those from the HKMA, has introduced more agile, digitally-native competitors. These entities often have lower overheads and can leverage technology to offer competitive pricing and innovative digital products, directly challenging BEA's traditional model. For instance, by mid-2024, virtual banks were actively growing their customer bases through digital-first strategies.

Furthermore, large technology companies are increasingly encroaching on financial services, leveraging their vast user bases and advanced technology. Firms like Ant Group, which processed over $1.9 trillion in payments in 2023, are expanding into key banking segments such as payments and lending, posing a direct competitive threat to BEA by capturing market share with often lower-cost solutions.

| Barrier | Description | Impact on New Entrants |

| Capital Requirements | High minimum capital adequacy ratios set by regulators like the HKMA. | Requires significant upfront financial commitment, limiting the number of potential entrants. |

| Regulatory Compliance | Complex licensing procedures, AML, and KYC regulations. | Demands substantial investment in compliance infrastructure and expertise. |

| Brand Trust & Loyalty | Decades of established customer relationships and reputation. | Makes it difficult for new entrants to attract and retain customers against proven incumbents. |

| Technological Investment | Need for advanced core banking systems, cybersecurity, and digital interfaces. | Requires massive initial outlays, creating a high barrier for replicating existing capabilities. |

| Virtual Banks | Digitally native competitors with lower overheads and agile operations. | Introduce competitive pressure through innovative digital offerings and potentially better pricing. |

| Tech Giants | Companies like Ant Group with large user bases and payment volumes. | Disrupt traditional revenue streams by offering seamless, lower-cost financial solutions in key segments. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bank of East Asia is built upon a foundation of publicly available financial statements, annual reports, and investor relations disclosures. We also incorporate insights from reputable industry research reports and macroeconomic data to provide a comprehensive competitive landscape.