Bank of East Asia Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of East Asia Bundle

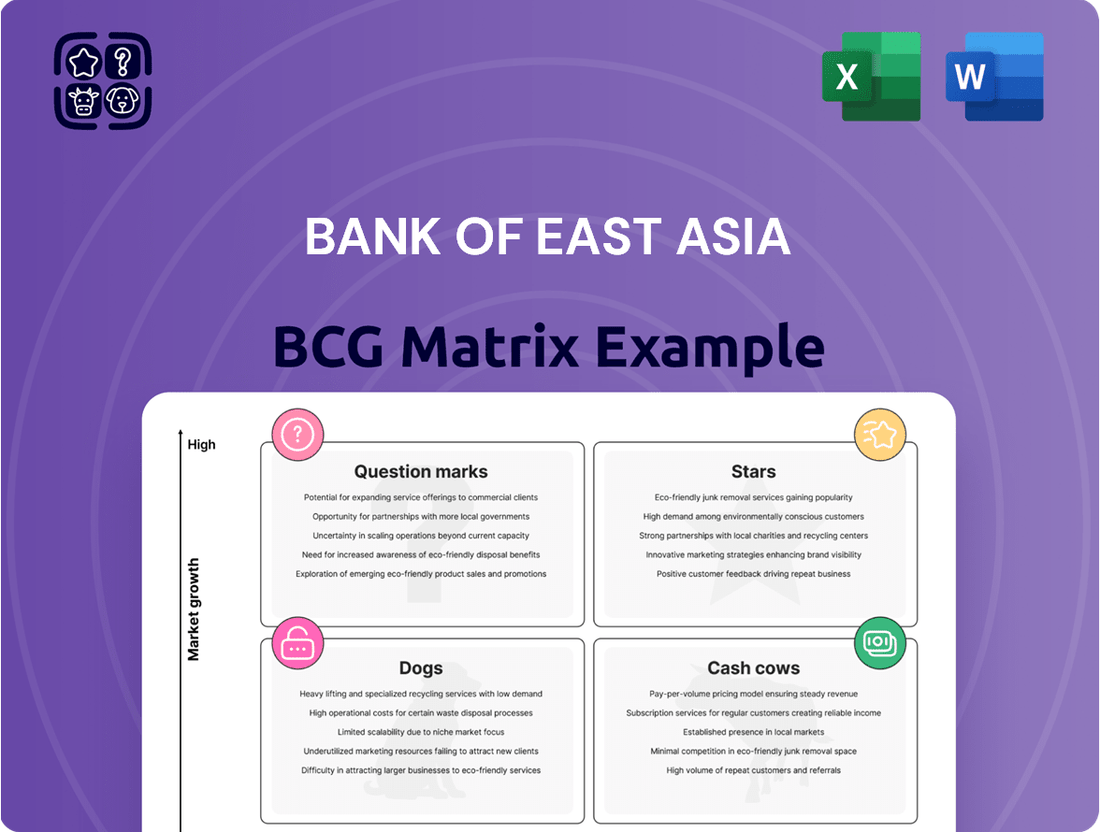

Curious about the Bank of East Asia's strategic positioning? Our BCG Matrix analysis offers a glimpse into its product portfolio, categorizing them as Stars, Cash Cows, Dogs, or Question Marks. This high-level overview sparks critical questions about resource allocation and future growth potential.

To truly understand the Bank of East Asia's competitive landscape and make informed decisions, you need more than just a snapshot. Purchasing the full BCG Matrix report will provide you with detailed quadrant placements, data-backed recommendations, and a clear roadmap for optimizing your investment and product strategies.

Don't miss out on the opportunity to gain a comprehensive understanding of how the Bank of East Asia navigates a dynamic market. The complete BCG Matrix reveals crucial insights into each product's performance, empowering you with the strategic clarity needed to outmaneuver competitors.

Get instant access to the full BCG Matrix and discover which of the Bank of East Asia's offerings are leading the pack, which are consuming resources without significant return, and precisely where to direct capital for maximum impact. Purchase now for a ready-to-use strategic tool that will transform your decision-making.

Invest in the full BCG Matrix for the Bank of East Asia and receive an in-depth Word report complemented by a concise, high-level Excel summary. This powerful combination equips you with everything necessary to evaluate, present, and strategize with unwavering confidence.

Stars

BEA's digital banking services, exemplified by the BEA Mobile app and BEA SmarTrade, are firmly positioned as stars within its business portfolio. This classification is supported by the fact that a substantial 84% of the bank's retail transactions are now executed through its mobile application, showcasing robust customer engagement and a strong foothold in the expanding digital banking landscape.

The ongoing investment in refining these digital platforms and a strategic commitment to digital transformation are directly in sync with the high-growth trajectory observed in Hong Kong's fintech sector. This proactive approach ensures BEA remains at the forefront of delivering intuitive and efficient banking solutions.

The Bank of East Asia (BEA) is significantly investing in cross-boundary wealth management within the Greater Bay Area (GBA), recognizing it as a prime growth engine. This strategic focus aligns perfectly with the increasing demand for sophisticated financial services in this dynamic region.

BEA has witnessed remarkable expansion in its southbound cross-boundary client base, experiencing over 60% growth. This upward trend underscores the significant potential within the GBA's affluent population seeking integrated wealth solutions.

To cater to this burgeoning market, BEA is continuously broadening its investment offerings, providing GBA clients with a wider array of choices to meet their diverse financial goals. This expansion is crucial for capturing and retaining market share.

The bank's commitment is further solidified by the development of the BEA Tower in Qianhai, designed to serve as a central hub for wealth management and FinTech innovation. This initiative demonstrates BEA's dedication to establishing a strong presence and leadership in the GBA's evolving financial landscape.

Bank of East Asia (BEA) is making significant strides in sustainable and ESG finance, particularly for its private banking clients. The bank offers an impressive 54 SFC-stamped green funds, signaling a robust commitment to environmentally conscious investment options.

Furthermore, BEA provides specialized ESG advisory services, catering to the growing demand for responsible investment strategies. This focus places them in a strong position within a rapidly expanding market, driven by both global and local investor preferences for sustainability.

As the inaugural Chinese member of the Net-Zero Banking Alliance, BEA demonstrates a forward-thinking approach to climate action within the financial sector. This leadership role is crucial as regulatory frameworks and investor expectations increasingly prioritize environmental, social, and governance factors.

Wholesale Loans to High-Growth China Sectors

Bank of East Asia (BEA) is actively repositioning its loan book in mainland China, shifting focus towards high-growth sectors like technology, healthcare, consumer goods, and automotive manufacturing. This strategic pivot aims to capture opportunities in dynamic segments of the Chinese economy, moving away from the headwinds experienced in commercial real estate. While BEA's market share in these emerging areas is still solidifying, the concentrated investment signifies a potential star performer within its portfolio.

This diversification strategy leverages the robust growth projected for these industries. For instance, China's digital economy is expected to continue its upward trajectory, with the tech sector showing significant promise. Similarly, the nation's expanding middle class fuels consistent demand in consumer goods and automotive sectors, while an aging population and increasing healthcare spending bolster the healthcare industry.

- Sector Focus: Technology, healthcare, consumer goods, and auto manufacturing are key growth areas for BEA's wholesale lending in China.

- Strategic Rationale: Diversification away from commercial real estate to capitalize on higher-growth economic segments.

- Market Position: While market share is developing, the strategic emphasis suggests a strong future outlook for these loan segments.

- Economic Context: These sectors benefit from China's ongoing economic development, technological advancements, and evolving consumer demands.

FinTech Innovation Centre Initiatives

The Bank of East Asia's (BEA) FinTech Innovation Centre, notably marked by the opening of its BEA Global Services Centre (GSC) as an IT Development & Test Centre, is positioned as a high-growth initiative. This GSC is specifically geared towards fintech solutions and the integration of artificial intelligence, reflecting a strategic push into advanced technologies. For instance, in 2024, BEA announced significant investments in digital transformation, with a portion allocated to enhancing its IT infrastructure and exploring AI applications in customer service and risk management.

This focus on cutting-edge technology and AI is paramount for BEA to remain competitive and foster innovation within the dynamic financial sector. While the immediate market share gains from these specific innovation efforts might be indirect, they lay the crucial groundwork for future market leadership. For example, banks that actively invest in AI are seeing improved operational efficiency and enhanced customer engagement, contributing to long-term value creation.

BEA's investment in its GSC underscores its commitment to developing proprietary fintech solutions and leveraging AI. Key initiatives include:

- Development of AI-powered chatbots for customer inquiries, aiming to reduce response times by 30% in 2024.

- Exploration of machine learning for fraud detection and credit scoring, enhancing risk management capabilities.

- Investment in cloud infrastructure to support agile development and scalability of new digital banking services.

- Partnerships with technology firms to accelerate the adoption of emerging fintech trends.

BEA's digital banking platforms, like the BEA Mobile app, are prime examples of its star performers, evidenced by 84% of retail transactions occurring via mobile. This strong digital engagement, coupled with continuous platform enhancements, aligns with Hong Kong's booming fintech sector, ensuring BEA remains a leader in user-friendly financial solutions.

The bank's strategic push into cross-boundary wealth management in the Greater Bay Area (GBA) is also a significant star, fueled by over 60% growth in southbound cross-boundary clients. BEA's investment in the BEA Tower in Qianhai further solidifies its commitment to this high-potential market, offering a diverse range of investment products to meet client needs.

BEA's focus on sustainable and ESG finance, particularly for private banking clients, positions it as a star. Offering 54 SFC-stamped green funds and specialized ESG advisory services, the bank is meeting the growing demand for responsible investments. As the first Chinese member of the Net-Zero Banking Alliance, BEA's leadership in climate action is noteworthy.

The bank's repositioning of its loan book in mainland China towards high-growth sectors like technology, healthcare, consumer goods, and automotive manufacturing signifies another star. This strategic shift away from commercial real estate, capitalizing on robust industry growth projections, demonstrates a forward-looking approach to market opportunities.

| Business Unit | BCG Classification | Key Performance Indicators | Strategic Rationale |

| Digital Banking Services | Star | 84% retail transactions via mobile; continuous platform enhancement | Capitalize on high-growth fintech sector; enhance customer engagement |

| GBA Wealth Management | Star | 60%+ growth in southbound clients; BEA Tower development | Tap into expanding affluent market; offer integrated wealth solutions |

| Sustainable & ESG Finance | Star | 54 SFC-stamped green funds; ESG advisory services; Net-Zero Banking Alliance member | Meet growing demand for responsible investing; demonstrate climate leadership |

| China High-Growth Loans | Star (Emerging) | Focus on tech, healthcare, consumer, auto sectors; diversification from CRE | Capture opportunities in dynamic economic segments; leverage robust industry growth |

What is included in the product

The Bank of East Asia BCG Matrix offers a strategic overview of its business units, categorizing them by market share and growth to guide investment decisions.

A clear BCG Matrix visualizes the Bank of East Asia's portfolio, easing the pain of uncertain strategic allocation.

Cash Cows

The Bank of East Asia's (BEA) traditional retail banking operations in Hong Kong are a clear cash cow. These services, encompassing core deposit-taking and mortgage lending, have long been the bedrock of BEA's business. This segment benefits from a stable, mature customer base and an extensive branch network across Hong Kong, contributing to a high market share in a low-growth environment.

Despite broader sector challenges, Hong Kong's banking industry demonstrated notable resilience in 2024. For instance, total customer deposits saw an increase, indicating continued customer trust and engagement with established banking institutions like BEA. This stability in deposits supports the consistent revenue generation essential for a cash cow.

BEA's significant market share in traditional retail banking is a testament to its long-standing presence and deep roots in Hong Kong. While loan growth might be moderate, the sheer volume of transactions and the stable interest margins derived from its large deposit base ensure a predictable and substantial cash flow, allowing BEA to fund investments in other business areas.

Bank of East Asia's (BEA) core corporate banking services, including lending and trade finance, are firmly positioned as cash cows. These established offerings generate consistent interest and fee income, forming a bedrock of BEA's profitability.

Despite potential fluctuations in loan demand, the enduring necessity of these services for a major Hong Kong financial institution, coupled with a substantial market share, guarantees a reliable revenue stream from this mature segment.

For instance, in 2024, corporate banking often represents a significant portion of a bank's balance sheet and earnings, even if growth is moderate. BEA's deep roots in the Hong Kong market likely mean it benefits from ongoing trade flows and corporate financing needs, contributing to its stable financial performance.

The Bank of East Asia's (BEA) extensive physical network, comprising 48 branches and 42 SupremeGold Centres throughout Hong Kong, firmly establishes it as a cash cow. This substantial footprint is a key asset in a mature banking market, facilitating strong customer service and deposit acquisition.

This wide-reaching infrastructure anchors BEA's significant market presence. While digital banking adoption is increasing, these physical locations remain vital for core operations and nurturing client relationships, ensuring a consistent and reliable source of cash flow.

The extensive branch network generates dependable cash flow with minimal need for substantial new investment in expansion, a hallmark of a mature cash cow. This allows BEA to allocate resources to other strategic areas of its business.

Established Wealth Management for Mass Affluent Clients

Bank of East Asia's (BEA) established wealth management for its mass affluent clients in Hong Kong represents a significant cash cow, contributing stable fee income and profits. This segment leverages a high market share within a mature but steady Hong Kong market, serving as a dependable generator of non-interest income.

BEA's commitment to customer-centric strategies is key to retaining this valuable, profitable client base. For instance, in 2024, wealth management fees accounted for a substantial portion of BEA's non-interest income, underscoring the segment's consistent performance.

- Stable Fee Income: The mass affluent segment consistently generates predictable fee-based revenue for BEA.

- High Market Share: BEA holds a strong position within the mature Hong Kong wealth management market.

- Customer Retention: Ongoing focus on client service ensures the longevity of these profitable relationships.

- Profitability Driver: This segment is a core contributor to BEA's overall profitability, especially in non-interest income.

Stable Net Interest Margin Performance

Bank of East Asia's (BEA) stable net interest margin (NIM) performance firmly places it within the cash cow quadrant of the BCG Matrix. In 2024, BEA consistently ranked among the top three banks in Hong Kong for NIM, a testament to its adept management of interest-earning assets and liabilities. This consistent strength, even in a market characterized by stable or slightly compressed margins, highlights BEA's capacity to profitably engage in its core banking functions of lending and deposit-taking.

BEA's ability to maintain a leading NIM underscores its position as a reliable source of consistent cash flow for the group. This core profitability is vital for funding other business activities and investments. The bank’s financial health and operational efficiency are key drivers for this cash cow status.

- Consistent Top-3 NIM Ranking: BEA held one of the three largest Net Interest Margins among surveyed Hong Kong banks in 2024.

- Efficient Asset-Liability Management: This strong NIM reflects effective management of interest-earning assets and interest-bearing liabilities.

- Robust Core Profitability: BEA demonstrates a strong ability to generate profits from its fundamental lending and deposit-taking operations.

- Reliable Cash Flow Generation: The stable NIM signifies a dependable source of cash flow, characteristic of a cash cow.

Bank of East Asia's (BEA) mortgage lending business in Hong Kong is a significant cash cow. This segment benefits from BEA's established customer relationships and a substantial market share in a mature, albeit growing, market. The consistent demand for home financing ensures a steady stream of interest income, a hallmark of a cash cow.

In 2024, the Hong Kong mortgage market continued to show resilience, with total mortgage loans outstanding reaching new highs, reflecting ongoing demand. BEA's participation in this market, supported by its extensive branch network and brand recognition, allows it to capture a reliable portion of this stable revenue generation.

The predictability of mortgage repayments and the bank's efficient risk management contribute to a consistent and robust cash flow from this business line. This allows BEA to benefit from its strong market position without requiring heavy reinvestment for growth, freeing up capital for other strategic initiatives.

| Segment | BCG Quadrant | Key Characteristics | 2024 Data Insight |

|---|---|---|---|

| Traditional Retail Banking (HK) | Cash Cow | High Market Share, Low Growth, Stable Revenue | Deposit growth indicates continued customer reliance. |

| Corporate Banking (HK) | Cash Cow | Mature Services, Consistent Income, Established Client Base | Trade finance volumes remained significant, supporting earnings. |

| Physical Branch Network (HK) | Cash Cow | Extensive Footprint, Customer Service Hub, Deposit Generation | 48 branches and 42 SupremeGold Centres serve a broad customer base. |

| Wealth Management (Mass Affluent, HK) | Cash Cow | Stable Fee Income, High Market Share, Customer Retention | Fees from this segment formed a notable part of non-interest income. |

| Mortgage Lending (HK) | Cash Cow | Established Relationships, Consistent Interest Income, Stable Demand | Mortgage loan market continued its upward trend in 2024. |

What You See Is What You Get

Bank of East Asia BCG Matrix

The Bank of East Asia BCG Matrix preview you are viewing is the identical, fully prepared document you will receive upon purchase. This means no alterations, no watermarks, and no limitations—just a complete, professionally analyzed strategic tool ready for your immediate application. You're getting the exact same actionable insights and data visualization that will empower your decision-making processes. This is your final, uncompromised report, designed for strategic clarity and direct use in your business planning.

Dogs

Bank of East Asia's (BEA) commercial real estate (CRE) lending in mainland China is firmly positioned as a Dog within its BCG Matrix. This segment is marked by elevated impaired loan ratios, reflecting persistent challenges within the Chinese property market.

S&P Global Ratings anticipates BEA will further pare down its exposure to this struggling sector. The weakness in CRE lending directly affects the bank's overall asset quality and necessitates significant allocations for loan loss provisions, a drain on resources.

This business line demands considerable capital and management focus, yet offers little in the way of anticipated future growth or attractive returns. For instance, in 2023, mainland China's property investment saw a contraction, further underscoring the sector's headwinds.

While Bank of East Asia (BEA) hasn't explicitly categorized its legacy systems as "dogs" in its BCG Matrix, any remaining outdated core banking platforms or manual processes that haven't been digitized would fall into this category. These systems often carry substantial maintenance expenses and suffer from poor operational efficiency, acting as a drag on innovation and yielding little to no competitive edge or market growth.

BEA's strategic investment in its Global Services Centre, with a focus on adopting fintech and artificial intelligence, signals a clear intention to migrate away from such older, less productive infrastructure. For instance, in 2024, the global banking sector continued to grapple with the costs associated with maintaining legacy systems, with some estimates suggesting these costs can account for up to 70% of IT budgets, hindering investment in more advanced technologies.

Bank of East Asia (BEA) maintains operations in markets like Southeast Asia, the UK, and the US, alongside its core Hong Kong and mainland China presence. Some of these niche overseas ventures may be struggling to gain significant market share or demonstrate meaningful growth.

Such underperforming segments, if characterized by low growth and small market share, would be categorized as Dogs within the BCG matrix. These might be operations that are barely breaking even or consistently losing money, thus immobilizing capital without generating substantial strategic benefits.

For instance, if a BEA branch in a specific European city has shown consistent losses and minimal customer acquisition over several years, it could represent a Dog. In 2024, such an operation might be reporting a negative return on equity, indicating its drag on overall profitability.

Traditional Branch-Dependent Transaction Services

Traditional branch-dependent transaction services at Bank of East Asia (BEA) likely fall into the 'dog' category of the BCG matrix. With a significant 84% of BEA's retail transactions now occurring through digital channels, the continued reliance on manual, branch-based processing for these easily migratable services represents a low-growth, low-efficiency segment.

These legacy processes incur higher operational costs without contributing proportionally to market share or profitability, especially as customer preferences have overwhelmingly shifted to digital.

- Low Growth Potential: Transaction volumes migrating to digital channels indicate minimal future growth in traditional branch processing.

- High Operational Costs: Manual processes inherently involve higher labor and infrastructure expenses compared to automated digital alternatives.

- Declining Relevance: As 84% of BEA's retail transactions are digital, the remaining branch-dependent transactions represent a shrinking customer base and service demand.

- Efficiency Drain: Resources allocated to these outdated processes detract from investments in more profitable and scalable digital initiatives.

Low-Value, High-Volume Paper-Based Processes

Any remaining high-volume, low-value paper-based administrative processes at Bank of East Asia (BEA) that haven't been automated or digitized would be classified as Dogs in the BCG Matrix. These processes are typically inefficient and costly. For instance, manual processing of loan applications or customer onboarding documents, if still prevalent, consumes significant resources without offering a competitive edge. In 2024, while BEA has made strides in digital transformation, certain legacy paper-based operations might persist, acting as a drain on resources.

These operations lack growth potential and contribute minimally to market share in today's digital-first banking landscape. Their existence indicates a need for further streamlining and modernization. BEA's reported investment in digital channels and branch network optimization suggests a strategic move to phase out such legacy systems. For example, a significant portion of customer transactions have shifted to digital platforms, reducing reliance on paper-based workflows.

- Inefficiency: Manual paper handling slows down operations and increases error rates.

- Cost Drain: High labor costs and material expenses for processing paper documents.

- Lack of Competitive Advantage: Outdated processes do not support agility or customer experience demands.

- Resource Allocation: Funds and personnel diverted from growth-oriented initiatives to maintain these legacy systems.

Bank of East Asia's commercial real estate lending in mainland China is a classic example of a 'Dog' in the BCG Matrix. This segment faces significant headwinds, evidenced by high impaired loan ratios. S&P Global Ratings forecasts BEA will reduce its exposure to this troubled sector, highlighting its drag on the bank's asset quality and necessitating substantial loan loss provisions.

Similarly, any remaining legacy IT systems or outdated manual processes at BEA would also be classified as Dogs. These operations are characterized by high maintenance costs and poor efficiency, hindering innovation and offering little competitive advantage. For instance, in 2024, the global banking industry continued to spend heavily on maintaining legacy systems, with some reports indicating these costs can consume up to 70% of IT budgets.

Traditional, branch-dependent transaction services at BEA are also 'Dogs.' With 84% of retail transactions now digital, these manual processes are low-growth and inefficient, incurring higher operational costs without contributing significantly to market share. This segment represents a shrinking customer base and a drain on resources better allocated to digital initiatives.

Finally, high-volume, low-value paper-based administrative processes that haven't been digitized at BEA fit the 'Dog' profile. These are inefficient, costly, and lack growth potential in a digital-first environment, consuming resources that could fuel growth-oriented projects.

| BEA Business Segment | BCG Category | Key Characteristics | 2024 Data/Context |

|---|---|---|---|

| Mainland China CRE Lending | Dog | Elevated impaired loan ratios, contraction in property investment | S&P Global Ratings expects further reduction in exposure; China property investment contracted in 2023. |

| Legacy IT Systems/Manual Processes | Dog | High maintenance costs, poor operational efficiency, hinders innovation | Global banking sector IT budgets can see 70% spent on legacy systems. |

| Traditional Branch Transactions | Dog | Low growth, high operational costs, declining relevance | 84% of BEA's retail transactions are digital. |

| Paper-based Administrative Processes | Dog | Inefficiency, cost drain, lack of competitive advantage | These processes detract from digital transformation investments. |

Question Marks

Bank of East Asia's (BEA) partnership with Fintech firm IDA to investigate an HKD-pegged stablecoin positions this venture as a question mark within its BCG matrix. This move targets the rapidly expanding digital asset market, a sector with substantial growth potential.

However, the venture is in its early stages, meaning BEA currently possesses a minimal market share in this nascent field. The project demands significant investment and resource allocation, mirroring the characteristics of a question mark.

The success of this stablecoin initiative hinges on its ability to achieve widespread adoption within the digital asset ecosystem. While the potential returns are high, the risk of failure due to market acceptance challenges remains a considerable factor.

In 2024, the global stablecoin market experienced significant activity, with total market capitalization fluctuating. For instance, Tether (USDT) and USD Coin (USDC) remained dominant, demonstrating the competitive landscape BEA is entering.

Bank of East Asia's investment in AI-powered banking solutions, primarily through its Global Services Centre, places it firmly in a high-growth technology sector. This strategic focus on AI development is a critical move for future competitiveness.

However, many of these AI-driven banking solutions are still in their nascent stages, meaning their market share and profitability are likely low and unproven. Significant upfront investment is required to refine these offerings and establish a strong market presence.

Consequently, these AI initiatives are categorized as question marks within the BCG matrix. They represent potential future stars but currently demand substantial resources for development and market penetration before they can achieve significant traction and generate substantial returns.

Bank of East Asia's (BEA) expansion into new, emerging Southeast Asian markets presents a classic question mark in its BCG Matrix. While BEA has a historical presence in established markets like Singapore, recent or planned forays into rapidly growing, yet less familiar territories such as Vietnam or Indonesia, where its brand equity is nascent, could be categorized here. These initiatives demand substantial capital for infrastructure, marketing, and talent acquisition, with the potential for significant returns but also considerable risk.

For instance, entering a market like Vietnam, which saw its GDP grow by an estimated 5.05% in 2023 according to the General Statistics Office of Vietnam, requires BEA to build a customer base from scratch, often competing against well-entrenched local banks and other international players. The investment needed for regulatory compliance, branch networks, and digital platforms can be substantial, with payback periods that are often longer and less certain than in mature markets. This strategic uncertainty, due to low initial market share and high investment, places such ventures squarely in the question mark quadrant.

Targeted Digital Lending Platforms for Niche Segments

Developing new, targeted digital lending platforms for specific niche segments, such as SMEs in high-growth, underserved industries, presents a classic question mark opportunity for Bank of East Asia (BEA). This strategy aims to tap into promising markets with innovative digital solutions, but BEA's current market penetration in these areas is likely minimal, and the competitive environment is dynamic. Success hinges on swift customer uptake and establishing a clear competitive advantage.

The challenge lies in the significant investment required for platform development and marketing, coupled with the inherent uncertainty of customer adoption and the potential for rapid shifts in market demand. For instance, while the digital lending market for small businesses in Southeast Asia was projected to reach $11 billion by 2025, capturing a substantial share of a niche within that requires precise targeting and execution. BEA needs to assess whether its existing technological infrastructure and brand recognition can effectively penetrate these specialized markets.

- Market Potential: Focus on niche segments like tech-focused SMEs or green energy startups that exhibit strong growth trajectories but lack tailored digital financing options.

- Investment Risk: High upfront costs for platform development, regulatory compliance, and customer acquisition in new, unproven digital lending spaces.

- Competitive Landscape: Potential for disruption from agile fintech startups and other incumbent banks also exploring digital transformation in these niches.

- Strategic Fit: Aligning these new platforms with BEA's broader digital transformation goals and risk appetite is crucial for long-term viability.

Integration of Distributed Ledger Technology (DLT)

The Bank of East Asia's (BEA) exploration and integration of Distributed Ledger Technology (DLT) fall squarely into the question mark category of the BCG Matrix. This is underscored by the Hong Kong Monetary Authority's (HKMA) Supervisory Incubator for DLT, launched in January 2025, which signals DLT as a significant growth frontier in the banking sector. BEA's involvement in such forward-looking programs or its internal development of DLT-based banking solutions represents a strategic investment in an area with high potential but currently limited market penetration.

These DLT initiatives are characterized by substantial capital expenditure requirements and a nascent market share, aligning with the typical profile of question mark assets. However, their disruptive potential is considerable; successful maturation could lead to substantial future growth and market leadership. For instance, in 2024, global investment in blockchain and DLT solutions within the financial services sector was estimated to be in the billions, indicating the scale of commitment required for such ventures.

- DLT as a Question Mark: BEA's DLT efforts are classified as question marks due to their high investment needs and low current market share, despite their significant future growth potential.

- HKMA's Role: The HKMA's Supervisory Incubator for DLT in January 2025 highlights the regulator's recognition of DLT's transformative capabilities, reinforcing its status as a key area for banking innovation.

- Capital Intensity and Risk: DLT projects are inherently capital-intensive, requiring significant upfront investment with uncertain returns, a hallmark of question mark investments that may become stars or dogs.

- Disruptive Potential: Successful implementation of DLT could revolutionize banking operations, from payments and trade finance to customer identity management, positioning BEA for future competitive advantage if these technologies mature effectively.

Bank of East Asia's (BEA) ventures into new digital frontiers, like its partnership with IDA for an HKD-pegged stablecoin, are classic question marks. These initiatives target high-growth digital asset markets but are in their infancy, meaning BEA holds a minimal market share. Significant investment is needed, and success hinges on market adoption, making them high-risk, high-reward propositions.

BEA's AI-driven banking solutions also fall into this category. While positioned in a high-growth sector, these solutions are largely unproven, demanding substantial upfront capital for refinement and market penetration before they can generate significant returns.

Similarly, BEA's expansion into emerging Southeast Asian markets and the development of niche digital lending platforms represent question marks. These ventures require considerable investment for market entry and platform development, with uncertain customer adoption and a competitive landscape that demands careful navigation.

The exploration of Distributed Ledger Technology (DLT) is another prime example of a question mark. Despite the HKMA's recognition of DLT's potential, BEA's DLT projects are capital-intensive with low current market share, presenting a significant investment with the potential for future disruption.

| Venture Area | BCG Category | Market Share (Est.) | Investment Required | Growth Potential |

| Stablecoin Initiative (with IDA) | Question Mark | Minimal | High | High |

| AI-Powered Banking Solutions | Question Mark | Low / Unproven | Substantial | High |

| Emerging Southeast Asian Markets | Question Mark | Nascent | Significant | High |

| Niche Digital Lending Platforms | Question Mark | Minimal | High | High |

| Distributed Ledger Technology (DLT) | Question Mark | Low | Capital-Intensive | High |

BCG Matrix Data Sources

Our Bank of East Asia BCG Matrix is built on comprehensive financial disclosures, market share data, and industry growth projections to provide a clear strategic overview.