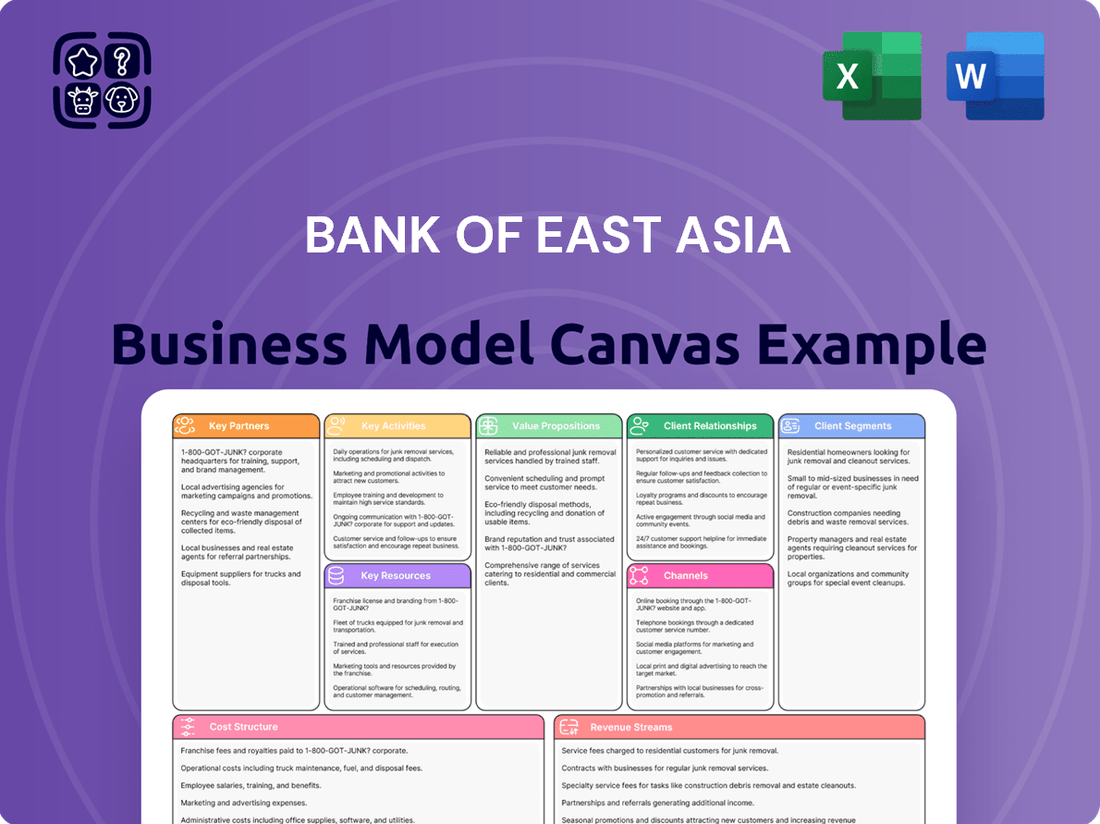

Bank of East Asia Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of East Asia Bundle

Unlock the strategic blueprint behind Bank of East Asia's success with our comprehensive Business Model Canvas. Discover how they effectively serve diverse customer segments, build robust partnerships, and leverage key resources to deliver compelling value propositions. This detailed analysis reveals their revenue streams and cost structure, offering invaluable insights into their operational efficiency and market positioning. Ideal for anyone looking to understand and replicate successful banking strategies, this canvas provides a clear, actionable roadmap.

Partnerships

Bank of East Asia actively collaborates with fintech and technology solution providers to bolster its digital banking capabilities. This strategic approach enhances customer experience and operational efficiency. For example, BEA partnered with Amazon Web Services (AWS) to refine its mobile application, a move that significantly accelerated its omnichannel strategy, making digital interactions smoother and more integrated.

Further strengthening its customer engagement, BEA teamed up with GienTech to implement a new Customer Relationship Management (CRM) system. This partnership is designed to create a more cohesive customer journey and facilitate informed, data-driven decision-making across the bank's operations. In 2024, a significant portion of BEA's IT spending was directed towards digital transformation initiatives, underscoring the importance of these technological partnerships.

Bank of East Asia (BEA) actively collaborates with insurance underwriters and brokers to offer a broad spectrum of financial solutions. These partnerships are crucial for enabling BEA to provide various insurance products, from life coverage to general insurance, catering to both individual and corporate customers.

This strategic alliance allows BEA to significantly broaden its product portfolio beyond core banking services, enhancing its appeal to a wider client base. For instance, in 2024, the insurance segment contributed to BEA's non-interest income, underscoring the value of these collaborations in diversifying revenue streams.

Bank of East Asia (BEA) relies heavily on partnerships with major payment networks such as Visa, MasterCard, and UnionPay. These alliances are vital for enabling the smooth processing of credit and debit card transactions for BEA's customers. This global acceptance ensures cardholders can transact seamlessly both within Hong Kong and internationally, forming a cornerstone of BEA's retail banking services.

Correspondent Banks and Financial Institutions

Correspondent banks and financial institutions are crucial partners for Bank of East Asia (BEA), particularly for its extensive international operations. These relationships are the backbone for facilitating cross-border transactions, enabling efficient international payments and trade finance services. In 2024, BEA continued to leverage its strong correspondent banking network to support its global reach.

These partnerships are essential for BEA's strategic presence in key markets, especially mainland China. By working with these institutions, BEA can offer a comprehensive suite of global banking services to its clients, ensuring seamless transactions and access to international financial markets. This network is vital for maintaining BEA's competitive edge in international banking.

- Facilitation of Global Transactions: Correspondent banks enable BEA to process payments and clear checks in foreign currencies, thereby streamlining international trade and investment activities.

- Trade Finance Support: These relationships are fundamental for providing essential trade finance instruments like letters of credit and documentary collections, crucial for businesses engaged in international commerce.

- Market Access: Partnerships with financial institutions in other countries grant BEA access to local markets, allowing it to serve its customers' needs effectively in diverse geographic regions.

- Risk Mitigation: Working with established correspondent banks helps in managing and mitigating risks associated with cross-border financial activities.

Strategic Alliances for Wealth Management Connect

Bank of East Asia (BEA) prioritizes strategic alliances, especially with mainland Chinese banks, to bolster its cross-boundary wealth management services. This focus is particularly evident in its engagement with the Wealth Management Connect scheme, aiming to broaden its reach and offerings.

A prime example of this strategy is BEA Union Investment Management's partnership with BEA. Together, they are launching investment funds specifically designed to qualify as Southbound Cross-boundary Wealth Management Connect products. This collaboration directly enhances investment choices for customers situated in the Greater Bay Area.

- Cross-Border Expansion: BEA's alliances, particularly with mainland Chinese institutions, are crucial for its cross-boundary wealth management growth, especially through programs like Wealth Management Connect.

- Product Development: BEA Union Investment Management's collaboration with BEA to create qualifying Southbound Cross-boundary Wealth Management Connect products exemplifies this partnership strategy.

- Customer Acquisition: These strategic product launches are designed to attract and onboard customers within the Greater Bay Area, leveraging the Wealth Management Connect framework.

- Market Access: By partnering with mainland entities, BEA gains enhanced access to a larger customer base and a more integrated financial ecosystem in the region.

Bank of East Asia (BEA) actively cultivates partnerships with technology providers, payment networks like Visa and Mastercard, and correspondent banks to enhance its digital offerings and global transaction capabilities. These collaborations are vital for seamless cross-border operations and efficient customer service. In 2024, significant investments were made in digital transformation, emphasizing the critical role of these tech and financial alliances.

Strategic alliances with mainland Chinese banks are paramount for BEA's expansion in cross-boundary wealth management, particularly through initiatives like the Wealth Management Connect scheme. This focus on collaboration, exemplified by BEA Union Investment Management's product development for the Greater Bay Area, directly addresses market access and customer acquisition strategies.

| Partnership Type | Key Collaborators | Strategic Importance | Example |

| Technology Providers | Fintech firms, AWS | Enhance digital banking, improve customer experience | AWS partnership for mobile app acceleration |

| Payment Networks | Visa, Mastercard, UnionPay | Facilitate global transaction processing | Ensuring seamless cardholder transactions |

| Correspondent Banks | International Financial Institutions | Enable cross-border transactions, trade finance | Supporting international operations and market access |

| Wealth Management | Mainland Chinese Banks, BEA Union Investment | Expand cross-boundary wealth services | Developing Wealth Management Connect products |

What is included in the product

A structured overview of The Bank of East Asia's operations, detailing its core customer segments, diverse revenue streams, and key partnerships.

This canvas highlights the bank's strategic approach to customer relationships, value delivery through various channels, and essential resources for sustained growth.

The Bank of East Asia's Business Model Canvas effectively addresses the pain point of fragmented financial planning by consolidating customer segments, value propositions, and key resources into a single, coherent framework.

It streamlines complex banking operations by offering a clear visualization of revenue streams and cost structures, simplifying strategic decision-making.

Activities

Bank of East Asia's key activities revolve around offering a comprehensive suite of retail and corporate banking services. This includes essential functions like accepting deposits, providing loans, and facilitating trade finance. For instance, in 2023, the bank continued to leverage its extensive network of branches and digital channels to cater to a broad customer base, from individual consumers to large enterprises.

The bank's operational focus is on efficiently managing these diverse banking services. This involves maintaining robust infrastructure for both physical branches and online platforms to ensure seamless customer interactions. BEA consistently invests in upgrading these capabilities to adapt to changing market demands and client expectations, a strategy evident in their ongoing digital transformation initiatives.

Bank of East Asia's wealth management and investment services form a core part of its business. This includes offering private banking, unit trusts, and securities trading to clients. These services are crucial for attracting and retaining high-net-worth individuals.

BEA is strategically focusing on expanding its wealth management capabilities, especially within the Greater Bay Area. This expansion leverages the bank's established expertise and its growing digital infrastructure to reach a wider client base.

In 2024, BEA continued to bolster its investment product suite and refine its personalized advisory services. For instance, the bank has been introducing new funds and enhancing digital tools to provide more tailored investment guidance, aiming to capture a larger share of the burgeoning wealth management market.

Bank of East Asia (BEA) is actively pursuing digital transformation by enhancing its mobile banking app and online platforms. This includes a focus on developing innovative fintech solutions to streamline transactions and improve user experience.

BEA has invested in establishing fintech innovation centers and data labs to foster the development of cutting-edge digital banking services. Their strategy aims to provide customers with seamless and convenient access to financial products and services through these digital channels.

In 2024, BEA continued to emphasize the migration of its services online, a trend accelerated by global shifts towards digital engagement. This commitment is designed to meet evolving customer expectations for accessibility and efficiency in their banking interactions.

Risk Management and Compliance

Bank of East Asia places significant emphasis on risk management and compliance due to the highly regulated banking sector. This involves actively managing credit risk, especially in sectors like commercial real estate, alongside operational risks. The bank is committed to strengthening its risk controls and broadening its loan diversification strategies.

In 2024, BEA continued to refine its approach to risk. For instance, the bank's focus on commercial real estate lending necessitates stringent credit assessment processes to mitigate potential downturns in that market. Operational risk management is also a key area, encompassing everything from cybersecurity to internal process failures.

Adherence to a complex web of regulatory requirements is non-negotiable for BEA. This includes ensuring compliance with capital adequacy ratios, anti-money laundering legislation, and data privacy regulations. By prioritizing these activities, BEA aims to maintain financial stability and stakeholder trust.

- Credit Risk Mitigation: Implementing stricter underwriting standards for commercial real estate loans.

- Operational Resilience: Enhancing cybersecurity measures and business continuity planning.

- Regulatory Adherence: Ensuring full compliance with evolving banking regulations and directives.

- Portfolio Diversification: Reducing concentration risk by broadening loan exposure across various sectors.

Sustainable and Green Finance Initiatives

Bank of East Asia (BEA) actively pursues sustainable and green finance initiatives by embedding environmental, social, and governance (ESG) principles into its core business. This commitment translates into tangible actions like developing innovative green and sustainable finance products designed to support environmentally conscious projects and businesses.

A significant aspect of BEA's strategy involves setting ambitious targets for reducing its environmental impact. Notably, the bank has committed to achieving net-zero financed emissions by 2050, a crucial step in aligning its operations with global climate goals. This long-term vision guides its financial decision-making and product development.

BEA also prioritizes robust climate-risk management, recognizing the financial implications of climate change. This includes enhancing its assessment and mitigation strategies for climate-related risks across its lending and investment portfolios.

- Developing green and sustainable finance products: BEA offers a range of financial solutions that support environmentally friendly projects, contributing to a greener economy.

- Setting net-zero financed emissions targets: The bank is committed to reaching net-zero financed emissions by 2050, demonstrating a clear dedication to decarbonization.

- Strengthening climate-risk management: BEA is enhancing its frameworks to effectively manage and mitigate climate-related financial risks.

- Joining key alliances: As the first Hong Kong-headquartered bank to join the Partnership for Carbon Accounting Financials and the Net-Zero Banking Alliance, BEA actively participates in global efforts to promote sustainable finance practices.

Bank of East Asia's key activities are centered on providing a wide array of banking and financial services. This includes core operations such as deposit-taking, lending, and trade finance, alongside specialized wealth management and investment services. The bank also actively engages in digital transformation, enhancing its online and mobile platforms, and maintaining robust risk management and compliance frameworks.

Furthermore, BEA is committed to sustainable finance, developing green products and setting ambitious net-zero emissions targets. These activities collectively support its mission to serve a diverse customer base while adapting to evolving market demands and regulatory landscapes. For instance, BEA's focus on digital transformation saw continued investment in 2024 to enhance customer experience and operational efficiency.

| Key Activity Area | Description | 2024 Focus/Data Point |

|---|---|---|

| Retail & Corporate Banking | Deposit-taking, lending, trade finance | Continued expansion of digital banking services. |

| Wealth Management & Investment | Private banking, unit trusts, securities trading | Bolstered investment product suite and personalized advisory services. |

| Digital Transformation | Mobile banking app, online platforms, fintech solutions | Emphasis on migrating services online for accessibility and efficiency. |

| Risk Management & Compliance | Credit, operational, and regulatory risk mitigation | Refined approach to risk, particularly in commercial real estate lending. |

| Sustainable Finance | ESG integration, green finance products, net-zero targets | Strengthened climate-risk management frameworks. |

What You See Is What You Get

Business Model Canvas

The Bank of East Asia Business Model Canvas preview you are viewing is an authentic representation of the final document you will receive. This is not a generic sample or a mockup, but a direct glimpse into the actual content and structure of the business model canvas. Upon completing your purchase, you will gain full access to this identical, comprehensive document, ready for your strategic analysis and application.

Resources

Financial capital is the lifeblood of the Bank of East Asia (BEA). This includes the substantial deposits entrusted to them by customers, the equity invested by shareholders, and their ability to borrow from other financial institutions in the interbank market. These sources collectively form the foundation for BEA's lending and investment activities.

Maintaining robust capital buffers and ample liquidity is paramount for BEA's operational stability and growth. These elements are essential for meeting the bank's obligations, supporting its diverse lending portfolio, and adhering to stringent regulatory mandates designed to ensure financial system health.

As of December 31, 2024, BEA reported impressive financial strength, with total consolidated assets reaching HK$877.8 billion. This significant asset base underscores the bank's substantial financial resources and its capacity to engage in large-scale financial intermediation.

Bank of East Asia (BEA) leverages its extensive physical footprint as a crucial key resource. As of 2024, the bank operates approximately 130 outlets across Hong Kong, mainland China, and other international locations. This robust network of branches and ATMs ensures broad customer accessibility, facilitating both traditional banking transactions and face-to-face customer service.

Bank of East Asia’s advanced IT infrastructure is a cornerstone of its business. This includes robust core banking systems and user-friendly digital platforms like the BEA Mobile app and online portals, all designed for seamless customer interaction.

Significant investments in cloud services, such as Amazon Web Services (AWS), and cutting-edge fintech solutions are central to BEA's digital transformation strategy. These technological advancements are key to delivering efficient and integrated customer experiences across all touchpoints.

This sophisticated digital backbone directly supports BEA’s omnichannel strategy, ensuring that customers can access banking services consistently and conveniently, whether online, via mobile, or in-branch. This integration is vital for maintaining competitiveness in the modern financial landscape.

Skilled Human Capital and Relationship Managers

Bank of East Asia's skilled human capital, including experienced bankers, financial analysts, and technology experts, is a cornerstone of its operations. These professionals are crucial for delivering specialized services across diverse banking sectors.

Dedicated relationship managers are particularly vital, offering personalized financial advice and fostering strong client connections. This human element is key to driving the bank's strategic growth, especially in high-value areas like wealth management and corporate banking.

In 2024, the bank continued to invest in its workforce, recognizing that their expertise directly translates to client satisfaction and business development. The ability of these individuals to navigate complex financial landscapes and provide tailored solutions is a significant competitive advantage.

- Expertise in Specialized Banking: Employees possess deep knowledge in areas such as corporate finance, retail banking, and wealth management.

- Client Relationship Management: Relationship managers are instrumental in building and maintaining client loyalty through personalized service.

- Innovation and Technology: Technology specialists ensure the bank stays ahead with digital offerings and operational efficiency.

- Strategic Initiative Drivers: Skilled staff are essential for executing the bank's strategic plans and achieving business objectives.

Brand Reputation and Trust

Bank of East Asia (BEA) leverages its deep roots, having been incorporated in 1918, to cultivate a robust brand reputation and engender significant customer trust. This century-long presence as a prominent Hong Kong-based financial services group is a cornerstone of its business model, acting as a powerful intangible asset.

This established reputation is crucial for attracting and retaining clients, particularly within the fiercely competitive financial sector. In 2024, BEA's continued commitment to responsible business practices and consistent operational performance further solidifies this hard-won trust among its customer base.

- Longevity: Incorporated in 1918, providing over a century of financial services.

- Market Position: A leading financial services group headquartered in Hong Kong.

- Customer Loyalty: Strong brand reputation directly correlates with client retention.

- Competitive Advantage: Trust is a key differentiator in the dynamic financial industry.

BEA's key resources are multifaceted, encompassing financial capital, a strong physical presence, advanced IT infrastructure, and skilled human capital. These elements collectively enable the bank to serve its customers effectively and maintain its competitive edge. The bank's established brand reputation, built over a century, further enhances its value proposition.

| Resource Category | Key Components | 2024 Data/Significance |

|---|---|---|

| Financial Capital | Customer Deposits, Shareholder Equity, Interbank Borrowings | Total consolidated assets of HK$877.8 billion as of December 31, 2024. |

| Physical Presence | Branch Network, ATMs | Approximately 130 outlets across Hong Kong, mainland China, and international locations. |

| IT Infrastructure | Core Banking Systems, Digital Platforms (BEA Mobile, Online Portals), Cloud Services (AWS) | Supports omnichannel strategy for seamless customer interaction. |

| Human Capital | Experienced Bankers, Analysts, Tech Experts, Relationship Managers | Investments in workforce expertise drive client satisfaction and business development. |

| Brand Reputation | Longevity, Market Position, Customer Trust | Incorporated in 1918, a leading Hong Kong-based financial services group. |

Value Propositions

Bank of East Asia (BEA) positions itself as a comprehensive financial solutions provider, acting as a true one-stop shop for a wide array of client needs. This integrated model covers everything from everyday retail banking to intricate corporate finance, sophisticated wealth management, and essential insurance products.

This holistic approach streamlines financial management for customers, allowing them to consolidate their banking, investment, and insurance activities with a single, trusted institution. For instance, as of the first half of 2024, BEA reported a significant customer base across its retail and corporate segments, highlighting the broad appeal of its integrated offerings.

By offering such diverse financial services under one roof, BEA enhances customer convenience and operational efficiency. This broad spectrum of services caters effectively to both individual consumers managing personal finances and larger corporations requiring complex financial instruments and support.

Bank of East Asia offers personalized wealth management and advisory, specifically catering to affluent, high-net-worth, and ultra-high-net-worth individuals. These clients receive bespoke wealth plans and investment advice from dedicated relationship managers, a service designed to boost investment performance and provide strategic financial guidance.

This tailored approach emphasizes enhancing investment returns and offering comprehensive strategic financial planning. The bank's commitment extends to providing cross-generational wealth management solutions, ensuring continuity and growth for client assets across family lines.

In 2024, BEA's wealth management segment saw significant growth, with assets under management for its private banking clients increasing by 12% year-on-year. This growth underscores the effectiveness of their personalized advisory services in attracting and retaining top-tier clientele.

Bank of East Asia offers a highly convenient digital banking experience via its BEA Mobile app and online platforms. Customers can effortlessly manage their finances, perform transactions, and access a wide range of services 24/7. This commitment to digital accessibility is crucial in today's fast-paced environment. As of the first half of 2024, BEA reported a significant increase in digital transaction volume, highlighting customer adoption.

Strong Regional Presence and Cross-Boundary Connectivity

Bank of East Asia (BEA) leverages its robust regional footprint across Hong Kong, mainland China, and key international locations to offer unparalleled cross-boundary banking services. This extensive network is a significant value proposition for clients navigating business and personal interests that span these territories, enabling smooth cross-border transactions and sophisticated wealth management solutions.

BEA is actively bolstering its cross-boundary wealth management initiatives, with a strategic focus on the Greater Bay Area (GBA). This expansion aims to capture the growing demand for integrated financial services among individuals and businesses operating within this dynamic economic zone. For instance, by the end of 2023, BEA reported a significant increase in its wealth management customer base, with over 70% of new wealth management customers in Hong Kong being younger than 45, indicating a growing appeal to a digitally-savvy demographic looking for cross-border financial opportunities.

- Extensive Network: BEA's presence in Hong Kong, mainland China, and other international markets facilitates seamless cross-border financial activities.

- Cross-Boundary Expertise: The bank specializes in providing integrated banking and wealth management solutions for clients with multi-jurisdictional needs.

- Greater Bay Area Focus: Strategic expansion in the GBA highlights BEA's commitment to serving this rapidly developing economic region.

- Growing Wealth Management Base: By late 2023, BEA saw substantial growth in its wealth management segment, particularly among younger demographics interested in cross-border financial services.

Reliability and Security

As a financial institution with a legacy spanning over a century, Bank of East Asia (BEA) inherently offers a profound sense of reliability and security to its customers. This long-standing presence, dating back to 1918, underscores a stable foundation and a deep understanding of financial markets, reassuring clients about the safety of their funds and the integrity of their transactions.

BEA's commitment to reliability is further solidified by its rigorous adherence to stringent regulatory standards. In 2024, for instance, financial institutions like BEA are continuously adapting to evolving global and local banking regulations, ensuring compliance and safeguarding customer interests. This dedication to regulatory compliance is a cornerstone of building and maintaining trust.

Robust risk management practices are integral to BEA's value proposition of security. By implementing comprehensive strategies to identify, assess, and mitigate various financial risks, the bank protects its assets and, by extension, the assets of its customers. This proactive approach is crucial in an environment marked by economic fluctuations and evolving cyber threats.

The trust and confidence BEA cultivates among its clientele are direct results of this unwavering focus on reliability and security. For example, in its 2023 annual report, BEA highlighted its strong capital adequacy ratios, a key indicator of financial health and security, which stood at 19.2% as of December 31, 2023, well above regulatory requirements.

- Established Legacy: Over 100 years of operation since 1918.

- Regulatory Compliance: Adherence to current and evolving banking regulations as of 2024.

- Risk Management: Robust frameworks to protect customer funds and transactions.

- Financial Strength: Demonstrated by strong capital adequacy ratios, e.g., 19.2% as of December 31, 2023.

BEA offers a comprehensive suite of financial services, acting as a single point of contact for retail banking, corporate finance, wealth management, and insurance needs. This integrated approach simplifies financial management for customers, fostering convenience and operational efficiency across both individual and corporate client segments.

The bank provides personalized wealth management and advisory services tailored for affluent and high-net-worth individuals, focusing on enhancing investment performance and offering strategic financial planning. This commitment includes cross-generational wealth solutions, ensuring long-term asset growth and continuity for client families.

BEA's digital platforms, including the BEA Mobile app, ensure 24/7 access to financial management and transactions, catering to the demand for convenient, on-the-go banking. In the first half of 2024, digital transaction volumes saw a notable increase, reflecting strong customer adoption of these services.

Leveraging its extensive regional footprint across Hong Kong, mainland China, and international markets, BEA facilitates seamless cross-boundary banking and wealth management. The bank is particularly focused on the Greater Bay Area, aiming to meet the growing demand for integrated financial services in this dynamic economic zone.

With a legacy dating back to 1918, BEA offers a strong sense of reliability and security, underpinned by rigorous adherence to regulatory standards and robust risk management practices. This focus on stability and client asset protection is demonstrated by strong capital adequacy ratios, such as 19.2% as of December 31, 2023, well above regulatory benchmarks.

| Value Proposition | Description | Supporting Data / Fact |

| Comprehensive Financial Solutions | One-stop shop for retail, corporate, wealth management, and insurance. | Broad customer base across retail and corporate segments as of H1 2024. |

| Personalized Wealth Management | Bespoke plans and advice for affluent clients. | 12% year-on-year increase in assets under management for private banking clients in 2024. |

| Digital Convenience | 24/7 access via BEA Mobile app and online platforms. | Significant increase in digital transaction volume in H1 2024. |

| Cross-Boundary Expertise | Seamless services across Hong Kong, mainland China, and international markets. | Strategic focus on Greater Bay Area wealth management initiatives. |

| Reliability and Security | Over 100 years of operation and strong regulatory compliance. | Capital adequacy ratio of 19.2% as of December 31, 2023. |

Customer Relationships

For its high-net-worth individuals and corporate clients, Bank of East Asia (BEA) provides dedicated relationship managers. These professionals offer bespoke services and tailored financial advice, a strategy that fosters strong, long-term connections and effectively addresses complex financial requirements.

This high-touch strategy is central to BEA's customer relationship model. In 2024, BEA continued to invest in its relationship manager team, aiming to enhance the personalized wealth management services delivered to its valued clientele. This focus ensures that client needs are met with expert guidance.

Bank of East Asia (BEA) heavily relies on its digital platforms, the BEA Mobile app and online banking, to offer robust automated self-service. This empowers customers to handle everyday tasks like checking balances, transferring funds, and paying bills without direct human interaction, aligning with the increasing preference for digital convenience.

These digital channels are increasingly becoming the go-to for daily banking activities. In 2024, a significant portion of BEA’s customer transactions were processed through these self-service portals, highlighting their critical role in customer engagement and operational efficiency.

The Bank of East Asia (BEA) prioritizes robust customer service through dedicated hotlines and support channels, ensuring clients across all segments receive prompt assistance. These channels act as a vital touchpoint for resolving inquiries and addressing issues, complementing their digital and in-branch offerings.

In 2024, BEA continued to invest in its customer support infrastructure. While specific call volumes are proprietary, similar banking institutions reported handling millions of customer interactions monthly through their contact centers, underscoring the importance of these direct communication lines.

Community Engagement and Brand Building

Bank of East Asia (BEA) actively fosters community engagement to build its brand and strengthen customer relationships. Through targeted marketing campaigns and impactful corporate social responsibility (CSR) programs, the bank aims to create a deeper connection with its customers and the broader public.

These efforts are crucial for enhancing brand awareness and cultivating loyalty. For instance, BEA's commitment to sustainability and community development projects not only benefits society but also reinforces its image as a responsible corporate citizen, thereby deepening customer trust.

- Community Investment: BEA's commitment to community development, including sponsorships and local event participation, enhances brand visibility.

- Digital Engagement: Leveraging social media and digital platforms for customer interaction and information dissemination increases reach and engagement.

- CSR Initiatives: Corporate Social Responsibility programs, focusing on areas like environmental protection and education, build goodwill and brand reputation.

- Customer Loyalty: These multifaceted engagement strategies are designed to foster long-term customer loyalty and a stronger brand identity.

Financial Advisory and Education

Beyond routine transactions, Bank of East Asia (BEA) actively fosters stronger connections through dedicated financial advisory and education. This commitment is particularly evident in their wealth management offerings, where personalized guidance helps clients navigate intricate investment waters. For instance, in 2024, BEA continued to emphasize its role as a trusted advisor, aiming to equip customers with the knowledge to make sound financial choices.

This value-added approach extends to comprehensive customer education initiatives. By offering insights into financial planning and market trends, BEA empowers its clientele. This focus on informed decision-making not only benefits the customer but also solidifies BEA's position as a knowledgeable and caring financial partner. Their efforts in 2024 underscored a strategy to build long-term loyalty through enhanced financial literacy.

- Personalized Guidance: BEA offers tailored financial advisory, especially in wealth management, to assist clients.

- Customer Empowerment: Through educational programs, the bank equips customers to make informed financial decisions.

- Relationship Strengthening: These services demonstrate expertise and care, building deeper customer bonds.

- Market Navigation: BEA helps clients understand and manage complex investment landscapes.

Bank of East Asia (BEA) cultivates customer relationships through a dual approach: personalized high-touch services for affluent clients and robust digital self-service for the broader customer base. Dedicated relationship managers provide tailored advice, while digital platforms like the BEA Mobile app and online banking facilitate convenient everyday transactions. Complementing these are responsive customer support channels and community engagement initiatives, all aimed at fostering loyalty and trust.

In 2024, BEA continued to invest in its relationship manager teams and digital infrastructure, recognizing the evolving needs of its diverse clientele. These investments underscore a strategic commitment to providing both personalized expertise and efficient digital solutions, enhancing overall customer satisfaction and engagement. The bank’s focus on financial education further empowers customers, solidifying its role as a trusted advisor.

| Customer Relationship Strategy | Key Channels/Methods | 2024 Focus/Data Points |

| Personalized Wealth Management | Dedicated Relationship Managers | Continued investment in RM teams for bespoke services to high-net-worth and corporate clients. |

| Digital Self-Service | BEA Mobile App, Online Banking | Increased transaction processing via digital channels, meeting growing customer preference for convenience. |

| Customer Support | Hotlines, Support Channels | Investment in support infrastructure; industry trend of millions of monthly customer interactions via contact centers. |

| Community & Brand Building | CSR Initiatives, Local Sponsorships | Efforts to build goodwill and brand reputation through community involvement and responsible corporate citizenship. |

| Financial Education & Advisory | Workshops, Online Resources | Emphasis on empowering customers with financial knowledge and guidance for informed decision-making. |

Channels

The Bank of East Asia (BEA) boasts an extensive physical branch network across Hong Kong, mainland China, and select international locations. In 2024, BEA continued to leverage this network as a core component of its customer engagement strategy. These branches remain crucial for traditional banking needs, offering direct customer interaction and facilitating intricate financial transactions.

BEA is actively evolving its branch footprint to enhance its retail wealth management services. This strategic shift aims to optimize the branch experience, making them more efficient hubs for wealth advisory and sales. The bank's commitment to its physical presence underscores its dedication to serving a broad customer base through both digital and traditional channels.

The BEA Mobile application serves as a cornerstone digital channel for Bank of East Asia, providing a robust platform for fund transfers, bill payments, and investment trading. This app is engineered for a smooth, user-friendly experience, solidifying its role as the go-to channel for everyday banking needs. In 2023, the bank reported a significant increase in mobile banking transactions, with over 60% of customer interactions occurring through digital channels, including BEA Mobile.

The Bank of East Asia's Online Banking Portal serves as a crucial touchpoint, offering a secure and comprehensive platform for both individual and business customers to manage their finances. It allows for account oversight, transaction execution, and access to a wide array of banking services directly from a computer, enhancing convenience.

This digital channel acts as a vital complement to BEA's mobile banking application, providing an alternative for users who prefer or require desktop access. This dual approach ensures flexibility and broad accessibility for its customer base. As of the first half of 2024, BEA reported that its digital banking platforms, including the online portal, facilitated a significant portion of customer transactions, reflecting a growing reliance on these channels.

Automated Teller Machines (ATMs)

Bank of East Asia leverages its extensive Automated Teller Machine (ATM) network as a crucial customer service channel. This network offers around-the-clock accessibility for essential banking functions like cash withdrawals, deposits, and balance checks. As of 2024, the bank maintained a significant number of ATMs across its operating regions, facilitating convenient self-service for a broad customer base. This physical touchpoint remains vital for routine transactions, complementing digital offerings.

The ATM channel plays a key role in the bank's customer relationship management. It provides a reliable and accessible option for immediate cash needs, a core banking requirement for many individuals.

- Convenience: 24/7 access to fundamental banking services.

- Reach: Widespread network supports customer accessibility in various locations.

- Efficiency: Handles routine transactions, freeing up branch staff for more complex needs.

- Cost-Effectiveness: Lower operational cost per transaction compared to teller services.

Relationship Managers and Sales Force

The Bank of East Asia (BEA) leverages a dedicated team of relationship managers and sales professionals as a crucial direct channel. This approach is particularly vital for its corporate, private banking, and high-net-worth client segments, offering them a personalized banking experience.

These professionals act as trusted advisors, delivering expert financial guidance and crafting bespoke solutions to meet individual client needs. Their primary focus is on nurturing and strengthening long-term client relationships, which is fundamental to BEA's service model.

In 2024, BEA continued to emphasize the importance of its human capital in client engagement. For instance, its wealth management division, heavily reliant on relationship managers, reported steady growth in assets under management, underscoring the effectiveness of this personalized approach.

- Dedicated Client Focus: Relationship managers and sales staff provide a direct, personalized touchpoint for key client segments.

- Expert Advisory Role: These teams offer specialized financial advice and tailored product solutions.

- Relationship Building: A core function is to cultivate and maintain strong, lasting client connections.

- Driving Business Growth: This channel is instrumental in acquiring and retaining valuable customers, contributing significantly to the bank's overall performance.

Bank of East Asia’s channels are a blend of traditional and digital, designed for broad customer reach and diverse banking needs. The bank actively utilizes its extensive physical branch network, particularly for complex transactions and personalized advisory services, while also heavily promoting its mobile and online platforms for everyday banking. This multi-channel strategy ensures accessibility and convenience for its varied customer base.

Customer Segments

Bank of East Asia (BEA) caters to a wide array of individual customers, from everyday banking needs of the mass market to specialized wealth management for affluent and high-net-worth (HNW) clients. This segmentation allows BEA to offer relevant products and services across the financial spectrum.

For its affluent and HNW clientele, BEA provides dedicated programs like SupremeGold and SupremeGold Private. These initiatives are designed to offer more personalized and comprehensive financial solutions, reflecting the distinct requirements of these customer segments.

In 2024, the global wealth management market continued its growth trajectory, with a significant portion of this growth attributed to the affluent and HNW segments. BEA's focus on these groups aligns with market trends, aiming to capture a larger share of this valuable customer base.

Small and Medium-sized Enterprises (SMEs) are a cornerstone of Bank of East Asia's (BEA) customer base. The bank actively serves these businesses by offering a suite of essential financial products and services, including crucial financing solutions, comprehensive trade services, and a broad spectrum of corporate banking offerings tailored to their unique operational demands and growth aspirations.

BEA's commitment to SMEs extends beyond standard banking. For instance, in 2024, the bank continued to bolster its support for these enterprises by establishing dedicated SME Green and Sustainable Finance Advisory Teams. This initiative underscores BEA's dedication to helping SMEs navigate the evolving landscape of sustainable business practices and access green financing opportunities.

Bank of East Asia (BEA) is a key player for large corporations and institutions, offering a full suite of corporate banking solutions. This includes robust corporate lending, facilitating complex loan syndication, and providing sophisticated treasury market services to manage financial risks and opportunities. In 2024, BEA continued to emphasize its commitment to corporate clients, noting a steady demand for its structured finance products.

Beyond traditional services, BEA actively supports these clients in their environmental, social, and governance (ESG) journeys. The bank provides specialized green and sustainable finance advisory services, helping large entities navigate the complexities of sustainability goals and integrate them into their financial strategies. This focus is increasingly important, with global sustainable finance markets projected to continue their significant growth trajectory through 2025.

Cross-Boundary Clients (Hong Kong and Mainland China)

Bank of East Asia (BEA) specifically targets clients operating across Hong Kong and mainland China, recognizing the significant financial interplay between these two key markets. This segment includes individuals and businesses with dual residency, investment portfolios, or operational activities spanning both jurisdictions. The bank's strategy focuses on facilitating these cross-border financial flows, offering tailored solutions for wealth management and investment.

BEA is actively deepening its engagement in the cross-boundary wealth management space. A prime example of this is their participation in and leveraging of initiatives like the Wealth Management Connect program. This program, launched in 2020, aims to further open up cross-boundary investment channels, allowing investors in Hong Kong and the mainland to invest in wealth management products distributed by banks in the other region. By mid-2024, the Wealth Management Connect had seen substantial uptake, with billions of dollars in funds flowing through the scheme, highlighting the demand for such integrated financial services.

The bank's approach to this customer segment is designed to simplify the complexities often associated with cross-border financial management. BEA's offerings aim to provide a seamless experience for clients looking to manage their assets, conduct transactions, and access investment opportunities in both Hong Kong and mainland China. This strategic focus allows BEA to capture a significant share of a growing market driven by increasing economic integration.

- Cross-Boundary Client Focus: BEA serves individuals and businesses with financial interests and activities in both Hong Kong and mainland China.

- Wealth Management Connectivity: The bank leverages programs like the Wealth Management Connect to facilitate cross-border investment and asset management.

- Market Opportunity: This segment represents a substantial growth area due to the deepening economic ties between Hong Kong and mainland China.

- Simplified Financial Management: BEA aims to provide integrated solutions that streamline financial operations across both regions for its clients.

Insurance Policyholders

Bank of East Asia (BEA) extends its financial services to insurance policyholders, a crucial customer segment beyond traditional banking. This group comprises individuals and businesses looking for a broad spectrum of insurance solutions, demonstrating BEA's commitment to holistic financial planning.

The bank caters to diverse insurance needs, encompassing life insurance, general insurance, and provident fund products. This integrated approach allows BEA to offer a complete financial ecosystem, meeting clients' protection and long-term savings objectives through its well-established platform.

- Life Insurance: Providing financial security for beneficiaries and wealth accumulation opportunities.

- General Insurance: Offering protection against property damage, liabilities, and other risks.

- Provident Fund Products: Facilitating retirement planning and long-term investment growth.

In 2024, the insurance sector continued to see robust demand, with many consumers prioritizing financial resilience. BEA's strategy to embed insurance offerings within its banking services taps into this trend, enhancing customer loyalty and expanding its revenue streams.

Bank of East Asia (BEA) serves a diverse customer base, including individuals from the mass market to high-net-worth clients, alongside Small and Medium-sized Enterprises (SMEs) and large corporations. A key strategic segment for BEA is clients operating across Hong Kong and mainland China, leveraging programs like Wealth Management Connect to facilitate cross-border financial activities.

The bank also extends its services to insurance policyholders, offering life insurance, general insurance, and provident fund products, reflecting a commitment to comprehensive financial planning. In 2024, BEA's focus on affluent clients and SMEs, particularly with sustainable finance initiatives, aligns with significant market growth trends in these areas.

| Customer Segment | Key Offerings | 2024 Market Context |

|---|---|---|

| Mass Market Individuals | Everyday banking, loans, credit cards | Continued demand for digital banking solutions |

| Affluent & HNW Individuals | Wealth management, private banking, investment advice | Global wealth management market growth, particularly in HNW segment |

| SMEs | Corporate lending, trade finance, sustainable finance advisory | Strong need for financing and green finance support |

| Large Corporations | Corporate lending, treasury services, ESG advisory | Steady demand for structured finance and sustainable finance |

| Cross-Boundary Clients (HK & China) | Wealth Management Connect, cross-border investments, dual-jurisdiction services | Significant fund flows through Wealth Management Connect program |

| Insurance Policyholders | Life insurance, general insurance, provident funds | Robust demand for financial resilience and long-term savings products |

Cost Structure

Staff costs, encompassing salaries, wages, and comprehensive employee benefits, represent a significant operational expenditure for the Bank of East Asia. This category covers a diverse workforce, including essential banking personnel, IT specialists crucial for digital operations, vital support staff, and the relationship managers who drive client engagement.

In 2024, managing these human capital expenses effectively is paramount for maintaining the bank's overall operational efficiency and profitability. BEA's commitment to its employees is reflected in its investment in talent development and competitive compensation packages, which are critical for attracting and retaining the skilled professionals needed to navigate the evolving financial landscape.

Bank of East Asia (BEA) dedicates substantial resources to its IT infrastructure and ongoing digital transformation. These investments are crucial for maintaining competitive digital platforms, robust cybersecurity defenses, and efficient cloud computing services. For instance, in 2023, BEA announced plans to invest HK$4.5 billion in digital transformation over the next three years, aiming to enhance customer experience and operational efficiency through advanced technologies.

The maintenance and continuous improvement of these technological assets represent a significant portion of BEA's operational expenses. This includes costs associated with software licenses, hardware upgrades, data center operations, and specialized IT personnel. Such expenditures are not one-time but represent a consistent outflow to ensure the bank's digital capabilities remain current and secure in a rapidly evolving financial landscape.

The Bank of East Asia's extensive physical branch and ATM network incurs significant operating and maintenance costs. These include rent for prime locations, utilities, robust security systems, and ongoing upkeep for all facilities. In 2023, the bank continued its strategic branch network transformation, which involves optimizing the physical footprint while enhancing digital capabilities.

Regulatory Compliance and Legal Costs

Bank of East Asia (BEA), as a major financial institution, dedicates significant resources to navigating the complex web of financial regulations. These costs are essential for maintaining operational integrity and market trust. For instance, in 2024, the global financial services industry saw increased spending on compliance technologies, with projections indicating continued growth as regulatory landscapes evolve.

Key cost drivers within this category include:

- Regulatory Reporting: Expenses associated with generating and submitting reports to various financial authorities, ensuring data accuracy and timeliness.

- Risk Management Systems: Investments in sophisticated software and personnel to monitor, assess, and mitigate financial and operational risks.

- Legal and Advisory Services: Fees paid to legal counsel and consultants for advice on regulatory interpretation, contract review, and litigation.

- Audit and Assurance: Costs incurred for internal and external audits to verify compliance with established standards and regulations.

These expenditures are crucial for avoiding penalties and maintaining BEA's license to operate. The ongoing need to adapt to new regulations, such as those concerning anti-money laundering and data privacy, contributes to a sustained and often increasing cost base in this area.

Marketing and Brand Building Expenses

Bank of East Asia (BEA) dedicates significant resources to marketing and brand building to attract new customers and foster loyalty among its existing clientele. These investments are vital for maintaining a strong market presence and effectively communicating the value of its evolving product and service portfolio. In 2024, BEA continued its strategic brand marketing initiatives, aiming to deepen customer engagement and reinforce its position as a trusted financial partner.

These marketing efforts are a key cost driver, ensuring BEA remains top-of-mind for consumers and businesses alike. The bank's approach often involves a mix of digital advertising, traditional media, and targeted campaigns. For instance, in the period leading up to and including 2024, BEA has been observed to actively promote its digital banking solutions and personalized financial advisory services through various channels.

BEA's commitment to brand building is demonstrated through its consistent investment in advertising and promotional activities. These expenditures are not merely operational costs but strategic investments designed to enhance brand equity and drive long-term customer acquisition and retention. The bank's campaigns in 2024 were focused on highlighting its customer-centric approach and its role in supporting the financial well-being of the communities it serves.

- Marketing Investment: BEA allocates substantial funds to advertising and brand-building campaigns to attract and retain customers.

- Market Presence: These expenses are crucial for maintaining visibility and promoting new products and services.

- Customer Engagement: The bank actively rolls out brand marketing initiatives to deepen relationships with its customer base.

- Strategic Allocation: Marketing costs are viewed as strategic investments to enhance brand equity and drive growth.

Staff costs, IT infrastructure, and regulatory compliance are significant expense categories for Bank of East Asia. In 2024, BEA's investment in digital transformation, including HK$4.5 billion over three years starting in 2023, highlights the importance of technology. Managing a vast physical branch network also contributes substantially to operational outlays.

The bank incurs considerable expenses related to regulatory reporting, risk management systems, and legal services to ensure operational integrity. Marketing and brand-building efforts, including digital and traditional media campaigns, are strategic investments to attract and retain customers, with a focus on digital solutions and advisory services in 2024.

| Cost Category | Description | 2023/2024 Relevance |

|---|---|---|

| Staff Costs | Salaries, wages, benefits for diverse workforce. | Crucial for talent attraction and retention in a dynamic financial landscape. |

| IT Infrastructure & Digital Transformation | Cybersecurity, cloud services, digital platforms. | HK$4.5 billion investment planned from 2023, emphasizing modernization. |

| Branch & ATM Network | Rent, utilities, security, maintenance. | Ongoing optimization and enhancement of physical footprint. |

| Regulatory Compliance | Reporting, risk management, legal, audit. | Essential for operational integrity and market trust; global spending increased in 2024. |

| Marketing & Brand Building | Advertising, promotions, customer engagement campaigns. | Strategic investment to enhance brand equity and drive customer acquisition. |

Revenue Streams

Net interest income is Bank of East Asia's (BEA) core revenue generator. It’s essentially the profit BEA makes from lending money out and paying interest on the money it takes in from depositors. This difference, the net interest margin, is crucial for its profitability.

For the year 2024, BEA reported a net interest margin of 2.09%. This figure highlights the efficiency with which the bank manages its interest-earning assets and interest-bearing liabilities, forming the fundamental basis of its banking business model.

Fees and commissions from wealth management are a cornerstone of the Bank of East Asia's (BEA) revenue. This includes income derived from offering services like private banking, expert investment advice, and managing unit trusts and other investment funds.

These services are designed to cater to a diverse client base with varying financial needs and goals. The bank leverages its expertise and network to provide tailored solutions, fostering long-term client relationships.

BEA specifically reported a substantial increase in this area, with BEA Private Banking's fee income experiencing a growth of over 30% in 2024. This highlights the increasing demand for sophisticated wealth management solutions and BEA's success in capturing that market.

Bank of East Asia generates revenue from its insurance operations through the sale of various insurance products, encompassing both life and general insurance. This income is primarily derived from commissions earned on these sales, as well as other associated fees.

In 2024, the financial services sector, including bancassurance, continued to be a vital contributor to overall bank profitability. While specific segment data for BEA's insurance arm in 2024 might be pending full annual reports, the trend in the industry shows consistent growth in fee-based income from insurance, often outpacing traditional lending revenues.

Fees and Commission Income from Corporate and Trade Finance

Bank of East Asia generates significant revenue through fees and commissions derived from its corporate and trade finance services. These income streams are crucial for its wholesale banking operations, supporting a wide range of business clients.

Services like loan syndication, where the bank arranges and manages large loans for corporations, and various trade finance solutions, such as letters of credit and guarantees, all come with associated fees. Furthermore, advisory services provided to businesses on financial strategy and transactions represent another important revenue component. For example, in 2024, the bank continued to leverage its expertise in these areas to facilitate complex financial deals for its corporate clientele.

- Loan Syndication Fees: Income generated from arranging and managing syndicated loans for corporate clients.

- Trade Finance Commissions: Revenue earned from facilitating international trade transactions through instruments like letters of credit and export credit.

- Advisory Service Fees: Charges for providing financial and strategic advice to businesses, including mergers and acquisitions support.

- Transaction Processing Fees: Income from processing various corporate financial transactions and payments.

Other Non-Interest Income

Bank of East Asia diversifies its revenue beyond core lending through various non-interest income streams. These include gains from foreign exchange transactions, income generated from trading in financial instruments, and a range of service charges levied on customers for different banking activities.

While net interest income remains the primary revenue driver for the bank, these non-interest income sources play a crucial role in enhancing overall profitability and bolstering financial resilience. For instance, in 2023, Bank of East Asia reported other non-interest income of HKD 4,479 million, a notable contribution to its financial performance.

- Foreign Exchange Gains: Revenue generated from favorable movements in currency exchange rates.

- Trading Income: Profits earned from buying and selling financial instruments like bonds and equities.

- Service Charges: Fees collected for services such as account maintenance, transaction processing, and wealth management.

Bank of East Asia (BEA) secures revenue through a variety of fee-based services, complementing its core net interest income. These include income from wealth management, insurance products, and corporate finance activities.

In 2024, BEA's wealth management segment saw significant growth, with its private banking fee income increasing by over 30%, demonstrating a strong client demand for these specialized financial services.

The bank also generates substantial revenue from corporate and trade finance, including fees for loan syndication, trade finance instruments, and advisory services, all supporting its wholesale banking operations.

Additional non-interest income streams contribute to BEA's profitability, such as foreign exchange gains, trading income from financial instruments, and various customer service charges.

| Revenue Stream | Description | 2024 Data/Trend |

|---|---|---|

| Net Interest Income | Profit from lending and deposit interest spread | Net Interest Margin of 2.09% |

| Fees and Commissions (Wealth Management) | Income from private banking, investment advice, fund management | BEA Private Banking fee income grew over 30% |

| Insurance Operations | Commissions and fees from life and general insurance sales | Industry trend shows consistent growth in bancassurance fee income |

| Corporate & Trade Finance Fees | Loan syndication, trade finance instruments, advisory services | Facilitated complex financial deals for corporate clients |

| Other Non-Interest Income | FX gains, trading income, service charges | HKD 4,479 million in 2023, a notable contribution |

Business Model Canvas Data Sources

The Bank of East Asia Business Model Canvas is constructed using a blend of internal financial statements, customer transaction data, and regulatory filings. This ensures a robust and accurate representation of the bank's operations and strategic direction.