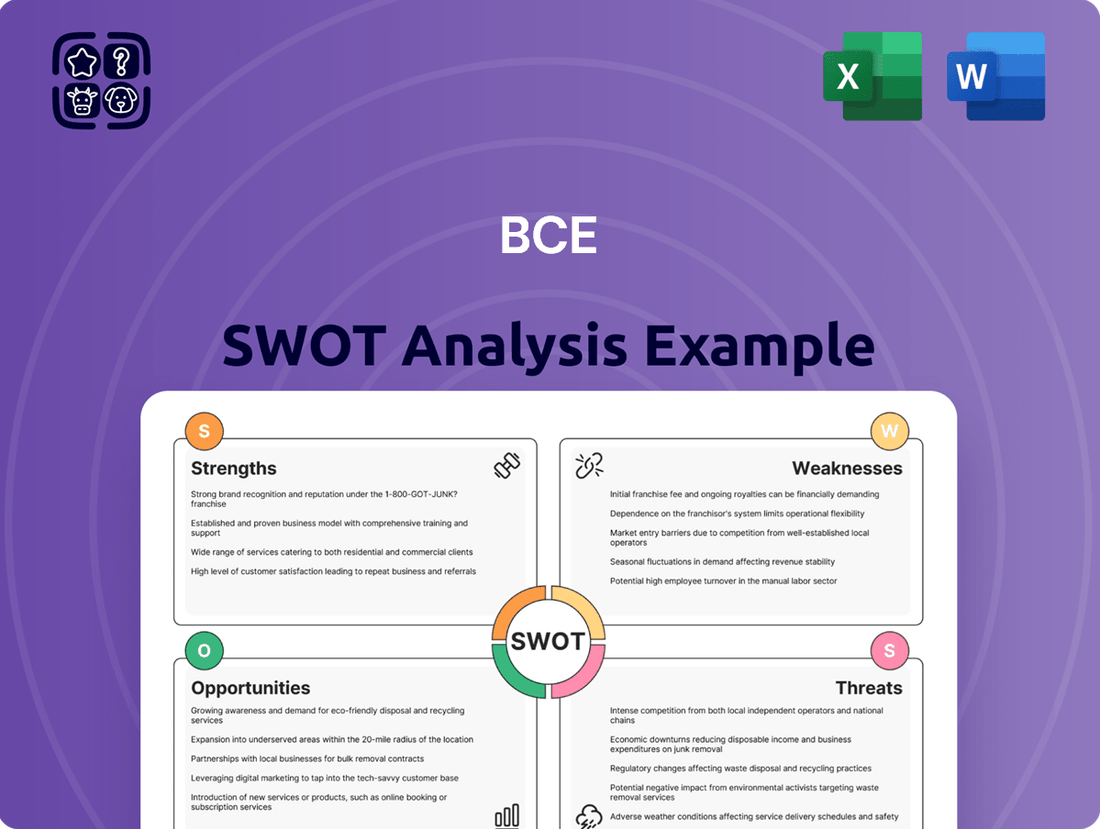

BCE SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BCE Bundle

Uncover the hidden strengths and potential pitfalls of BCE with our comprehensive SWOT analysis. This detailed report dives deep into the company's competitive advantages, market opportunities, and potential threats, offering a clear roadmap for strategic decision-making. Ready to transform insights into action and gain a decisive edge?

Strengths

BCE Inc. commands a dominant position as Canada's largest communications company, offering a full spectrum of telecommunication services and media assets. This extensive reach is underscored by its significant market share and a vast customer base nationwide.

BCE's advanced network infrastructure, featuring world-class fiber and 5G wireless capabilities, is a significant strength. These networks are fundamental to providing the high-speed and dependable services that customers increasingly demand.

Bell's 5G and 5G+ networks have consistently received top rankings among Canadian national wireless carriers. This recognition underscores their superior performance, extensive reach, and technological leadership in the Canadian market as of early 2024.

BCE's strength lies in its extensive and diversified service portfolio. The company provides a comprehensive suite of offerings, encompassing wireless, internet, television, and home phone services. This broad range of essential telecommunications services forms a robust foundation.

Beyond core telecom, BCE significantly leverages its media assets, which include major television networks, radio stations, and various digital platforms. This integration allows for cross-promotional activities and appeals to a wider customer base.

This diversification is a key risk mitigator, as BCE is not solely dependent on any single revenue stream. For instance, in the third quarter of 2024, BCE reported total operating revenues of $6.0 billion, with its Bell Media segment contributing $0.8 billion, showcasing the balance across its business units.

Strategic Focus on Digital and Business Solutions

BCE is making significant strides by sharpening its strategic focus on digital and business solutions. This pivot is evident in Bell Media's robust performance, particularly its digital revenue streams, which are demonstrating impressive growth.

The company's ambition is clear: to establish itself as a dominant player in the tech services sector. BCE has set an ambitious target to generate substantial revenue from its business solutions segment by the year 2030, signaling a major commitment to this area.

- Bell Media's Digital Revenue Growth: Bell Media's digital segment has been a key driver, with reports indicating strong year-over-year increases in digital advertising and subscription revenues throughout 2024.

- Target for Business Solutions: BCE aims for its business solutions division to represent a significant portion of its overall revenue by 2030, reflecting a strategic shift towards enterprise-level technology services.

- Investment in Innovation: The company is actively investing in digital infrastructure and new technologies to support this strategic focus, enhancing its competitive edge in the evolving market.

Improved Free Cash Flow

BCE's free cash flow saw a substantial boost in the first quarter of 2025, reaching $798 million. This marks a significant jump from the $85 million reported in the same quarter of the previous year. Such an improvement highlights enhanced operational efficiency and stronger cash generation capabilities.

This upward trend in free cash flow is a key strength, signaling improved financial health and greater flexibility for BCE. It suggests that the company is effectively managing its operations and investments, leading to a more robust liquidity position.

The substantial increase in free cash flow provides BCE with increased capacity for:

- Debt reduction: Allowing for deleveraging and a stronger balance sheet.

- Shareholder returns: Potentially leading to increased dividends or share buybacks.

- Strategic investments: Funding future growth initiatives or acquisitions.

- Operational resilience: Providing a cushion against economic uncertainties.

BCE's extensive, diversified service portfolio, including wireless, internet, and television, provides a stable foundation. Its leading 5G and 5G+ networks, consistently ranked top in Canada as of early 2024, offer superior performance and reach.

The company's media assets, such as major TV networks and radio stations, complement its telecom services, enabling cross-promotion and broader customer engagement. This diversification mitigates risk, as seen in Q3 2024 where Bell Media contributed $0.8 billion to total operating revenues of $6.0 billion.

BCE is strategically focusing on digital and business solutions, with Bell Media's digital revenue showing strong growth. The company aims for its business solutions segment to be a significant revenue driver by 2030.

A key financial strength is BCE's free cash flow, which surged to $798 million in Q1 2025, a significant increase from $85 million in Q1 2024. This improved cash generation enhances financial flexibility for debt reduction, shareholder returns, and strategic investments.

| Metric | Q1 2024 | Q1 2025 | Change |

|---|---|---|---|

| Free Cash Flow (Millions CAD) | 85 | 798 | +839% |

| Bell Media Revenue (Millions CAD) | N/A | 800 (Q3 2024) | N/A |

| Total Operating Revenue (Millions CAD) | N/A | 6,000 (Q3 2024) | N/A |

What is included in the product

Delivers a strategic overview of BCE’s internal and external business factors, analyzing its strengths, weaknesses, opportunities, and threats.

Simplifies complex strategic thinking into actionable insights for immediate problem-solving.

Weaknesses

BCE faces significant headwinds from intense price competition within the Canadian telecom sector. This aggressive pricing environment has directly contributed to subscriber churn, notably impacting BCE's postpaid mobile segment. For instance, in the first quarter of 2024, BCE reported a net loss of 66,000 postpaid wireless subscribers, a clear indicator of this competitive pressure.

BCE operates within a challenging regulatory landscape, significantly shaped by decisions from the Canadian Radio-television and Telecommunications Commission (CRTC). A prime example is the CRTC's mandate for wholesale access to BCE's fiber networks, compelling the company to share its infrastructure with competitors.

This regulatory pressure has directly influenced BCE's investment strategy, leading to a reduction in planned capital expenditures. For instance, in response to these directives, BCE announced in early 2024 that it would scale back its fiber rollout plans, potentially impacting the pace of network expansion and future growth opportunities.

BCE's decision to slash its common share dividend by a significant 56% in Q1 2025, reducing the annualized payout from $3.60 to $1.60 per share, represents a major weakness. This move, aimed at bolstering its balance sheet and reducing debt, could alienate income-focused investors who have relied on BCE's consistent dividend history.

Declining Legacy Service Revenues

BCE is facing a persistent challenge with declining revenues from its older services. Think of things like traditional phone lines, older internet connections, and satellite television. These areas are shrinking, and it's a significant hurdle for the company.

For instance, BCE reported a decline in its legacy segment revenues. This trend highlights the ongoing need to pivot towards more modern, high-demand services to compensate for these losses. The company's financial performance is increasingly reliant on its ability to grow in areas like 5G and broadband internet.

- Legacy Revenue Decline: Continued pressure on revenues from wireline voice and traditional data services.

- Satellite TV Challenges: Subscriber losses in the satellite TV segment are impacting overall legacy performance.

- Strategic Pivot Needed: The company must accelerate its transition to high-growth areas like 5G and fiber internet to offset these declines.

Workforce Reductions and Restructuring Impacts

BCE experienced significant workforce reductions in 2024, cutting thousands of jobs primarily within its telecom and media divisions. These measures, intended to streamline operations and reduce costs, resulted in substantial severance payouts, impacting the company's financial performance in the short term. The restructuring also raised concerns about potential dips in employee morale and the continuity of essential operations across its various business units.

The scale of these workforce changes is notable, with reports indicating the elimination of approximately 3,000 positions throughout 2024. This strategic move aimed to improve efficiency and adapt to evolving market conditions, but the immediate financial cost of these layoffs, including severance packages, needs to be factored into the company's overall financial health. Furthermore, the long-term effects on operational capacity and employee engagement remain a critical consideration for BCE's future.

- Workforce Reduction Numbers: Approximately 3,000 jobs eliminated in 2024.

- Financial Impact: Significant costs associated with severance payments.

- Operational Concerns: Potential impact on employee morale and continuity of services.

BCE's reliance on legacy services, such as traditional wireline voice and satellite television, presents a significant weakness as these segments face ongoing revenue declines. The company's Q1 2024 results showed continued subscriber losses in its postpaid wireless segment, directly linked to intense price competition. Furthermore, the substantial 56% dividend cut announced for Q1 2025, reducing the annualized payout to $1.60 per share, signals financial strain and could deter income-focused investors.

| Segment | Q1 2024 Subscriber Change (Postpaid Wireless) | Legacy Revenue Trend | Dividend Change (Annualized) |

|---|---|---|---|

| Telecom | -66,000 net loss | Declining | -56% |

| Media | N/A | Declining | N/A |

| Overall Impact | Subscriber churn due to price wars | Need for strategic pivot to growth areas | Investor confidence potentially shaken |

Same Document Delivered

BCE SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

The preview you see is the actual, complete document you'll receive. No hidden surprises, just the full, professional analysis.

You're viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

BCE's strategic acquisition of Ziply Fiber represents a significant opportunity to penetrate the robust U.S. fiber market. This move is designed to broaden BCE's operational reach beyond Canada, enhancing its scale and tapping into the substantial growth potential south of the border.

BCE is well-positioned to capitalize on the expanding market for business technology services. The company has demonstrated robust growth in this segment, evidenced by its increasing revenue from enterprise clients, which is a key driver for future expansion.

The company has set ambitious revenue targets for its business technology services, signaling a strategic focus on this high-growth area. This segment offers a significant opportunity for BCE to leverage its expertise and infrastructure to capture a larger share of the enterprise IT market.

BCE's Bell Media is capitalizing on the ongoing surge in digital media consumption. In 2024, digital advertising and the streaming service Crave are showing robust growth, contributing significantly to overall revenue.

The company's strategic focus on enhancing its digital platforms and investing in advanced advertising technology positions it well to capture an even larger share of the dynamic media market. This continued expansion is a key opportunity for sustained revenue generation.

5G Network Evolution and Adoption

The continued expansion and uptake of 5G across Canada presents a significant opportunity for BCE. As more Canadians gain access to and utilize 5G, it fuels a greater need for data-intensive services and premium offerings, directly boosting revenue streams.

This evolution in network technology creates demand for new applications and services, from enhanced mobile broadband to the Internet of Things (IoT), which BCE is well-positioned to capitalize on. For instance, by the end of 2024, BCE reported reaching over 3 million households with its 5G+ fiber network, indicating strong progress in infrastructure deployment.

- Increased Data Consumption: 5G enables faster speeds and lower latency, encouraging users to consume more data, which translates to higher average revenue per user (ARPU) for BCE's mobile services.

- New Service Development: The capabilities of 5G open doors for innovative services in areas like augmented reality, virtual reality, and advanced IoT solutions, creating new revenue avenues.

- Enterprise Solutions: Businesses are increasingly looking to leverage 5G for private networks, enhanced connectivity, and new operational efficiencies, a market segment BCE can actively pursue.

- Network Upgrades: Ongoing 5G deployment requires significant investment in infrastructure, which can be a catalyst for further technological advancements and service offerings.

Leveraging AI for Efficiency and Customer Experience

BCE is strategically focusing on advanced AI solutions to elevate customer interactions and streamline internal operations. This initiative is designed to unlock substantial cost efficiencies and foster a more agile business framework.

The integration of AI is expected to yield tangible benefits, such as reduced customer service handling times and optimized network management. For instance, in 2024, telecom companies globally saw an average reduction of 15% in operational costs through AI-driven automation in customer support.

- AI-powered chatbots handling routine customer inquiries, freeing up human agents for complex issues.

- Predictive analytics for network maintenance, minimizing downtime and improving service reliability.

- Personalized customer offers and support based on AI-driven behavioral analysis.

- Automated fraud detection and prevention, safeguarding both the company and its customers.

BCE's acquisition of Ziply Fiber offers a prime opportunity to expand into the lucrative U.S. fiber market, increasing its scale and accessing significant growth potential beyond Canada. The company is also well-positioned to capitalize on the growing demand for business technology services, with increasing revenue from enterprise clients signaling a strong future for this segment.

Bell Media is benefiting from the rise in digital media consumption, with strong growth in digital advertising and its Crave streaming service contributing significantly to revenue in 2024. BCE's ongoing 5G network expansion across Canada is creating demand for data-intensive services and new applications like IoT, with over 3 million households reached by its 5G+ fiber network by the end of 2024.

The company's strategic adoption of AI solutions is expected to improve customer interactions and operational efficiency, potentially reducing operational costs. For example, global telecom companies saw an average 15% reduction in operational costs through AI-driven customer support automation in 2024.

| Opportunity Area | 2024/2025 Data/Trend | Impact |

|---|---|---|

| U.S. Fiber Market Entry (Ziply Fiber) | Significant U.S. fiber market growth potential. | Broadened operational reach, increased scale. |

| Business Technology Services Growth | Increasing enterprise client revenue. | Key driver for future expansion, high-growth segment. |

| Digital Media Consumption (Bell Media) | Robust growth in digital advertising and Crave streaming. | Significant revenue contribution, capture larger market share. |

| 5G Network Expansion | Over 3 million households reached by 5G+ fiber (end of 2024). | Fuels demand for data-intensive services, new revenue streams. |

| AI Integration | 15% average operational cost reduction via AI in telecom customer support (global 2024). | Enhanced customer interaction, operational efficiency, cost savings. |

Threats

BCE faces growing pressure from smaller and regional competitors in the Canadian telecom landscape. Regulatory shifts, such as facilitating access to incumbent networks for smaller players, are intensifying this competition. This environment could trigger aggressive pricing strategies, potentially impacting BCE's market share and profitability.

Ongoing regulatory reviews by Canada's telecom regulator, the CRTC, particularly concerning wholesale rates for network access, present a significant threat to BCE. Adverse rulings could force BCE to lower its prices for competitors using its network, impacting revenue streams and profitability.

Unfavorable decisions on wholesale rates, potentially announced in late 2024 or early 2025 following current reviews, could impose additional financial burdens on BCE and limit its pricing flexibility. This could discourage further substantial investments in upgrading and expanding its 5G and fiber optic networks, crucial for future growth.

BCE faces significant threats from macroeconomic instability and persistent inflation, which directly affect consumer spending on telecommunication services. For instance, in Q1 2024, Canada experienced a 1.6% annualized GDP growth, a slowdown that, coupled with inflation, can lead consumers to cut back on discretionary spending, including premium mobile plans or home internet upgrades.

These external economic forces introduce considerable uncertainty into BCE's future financial performance. Rising interest rates, a common response to inflation, can also increase BCE's borrowing costs, impacting profitability and investment capacity in crucial network infrastructure projects. The Bank of Canada's key policy rate, which stood at 5.00% as of early 2024, highlights this ongoing challenge.

High Capital Expenditure Requirements

The telecommunications sector, including BCE, faces a persistent challenge with high capital expenditure requirements. Maintaining and upgrading networks for technologies like 5G and expanding fiber optic coverage demands significant ongoing investment. For instance, BCE's capital expenditures were approximately $4.4 billion in 2023, a figure indicative of the industry's capital intensity.

These substantial outlays are critical for staying competitive and meeting escalating customer demand for faster, more reliable services.

- Network Upgrades: Continuous investment in fiber-to-the-home (FTTH) and 5G deployment remains a significant cost driver. BCE aims to expand its 5G standalone network coverage to 70% of the Canadian population by the end of 2024.

- Infrastructure Maintenance: Ongoing upkeep and modernization of existing copper and wireless infrastructure also contribute to high capital needs.

- Regulatory Impact: Potential regulatory decisions that might disincentivize or add costs to infrastructure investments could pose a threat to future growth and profitability.

Evolving Media Landscape and Rising Content Costs

The traditional media advertising market is experiencing ongoing softness, directly impacting revenue streams for companies like BCE. This economic pressure is compounded by the escalating costs associated with acquiring and producing compelling media content and programming. For instance, the Canadian advertising market saw a slight contraction in 2023, and projections for 2024 indicate continued challenges.

BCE's media segment faces a significant threat in this environment. Navigating this requires a strategic pivot towards adapting its content creation and acquisition strategies to be more cost-effective. Furthermore, the company must prioritize the effective monetization of its digital platforms to offset declining traditional advertising revenues and maintain profitability in a competitive landscape.

- Softness in Traditional Advertising: The Canadian advertising market faced headwinds in 2023, with continued pressure anticipated for 2024.

- Rising Content Expenses: The cost of acquiring rights for popular sports and entertainment programming continues to climb, straining media budgets.

- Digital Monetization Imperative: BCE must enhance its ability to generate revenue from its digital assets, such as streaming services and online content, to counter these rising costs.

- Competitive Content Environment: Increased competition from global streaming giants and domestic players necessitates higher investment in original and acquired content.

BCE faces intensified competition from smaller regional players, potentially leading to price wars that could erode market share and profitability. Regulatory decisions, especially concerning wholesale rates, could force price reductions, impacting revenue. Macroeconomic instability and persistent inflation also pose threats, reducing consumer spending and increasing borrowing costs, which could hinder crucial network investments.

| Threat Category | Specific Threat | Potential Impact | Relevant Data/Context |

|---|---|---|---|

| Competition | Increased competition from regional players | Market share erosion, price pressure | Ongoing regulatory reviews potentially facilitating smaller players' access to incumbent networks. |

| Regulatory Environment | Adverse CRTC rulings on wholesale rates | Reduced revenue, lower profitability, disincentive for investment | Potential late 2024/early 2025 decisions impacting pricing flexibility. |

| Macroeconomic Factors | Inflation and economic slowdown | Reduced consumer spending on telecom services, increased borrowing costs | Q1 2024 GDP growth at 1.6% annualized; Bank of Canada key policy rate at 5.00% (early 2024). |

| Capital Expenditures | High ongoing investment needs for network upgrades | Strain on financial resources, potential impact on profitability | BCE's 2023 capital expenditures were approximately $4.4 billion. BCE aims for 70% 5G standalone coverage by end of 2024. |

| Media Market Softness | Decline in traditional advertising revenue | Reduced profitability in media segment, increased content costs | Canadian advertising market saw slight contraction in 2023; continued challenges projected for 2024. |

SWOT Analysis Data Sources

This BCE SWOT analysis is built upon a robust foundation of data, drawing from official financial reports, comprehensive market intelligence, and the expert opinions of industry analysts to provide a well-rounded and actionable strategic overview.