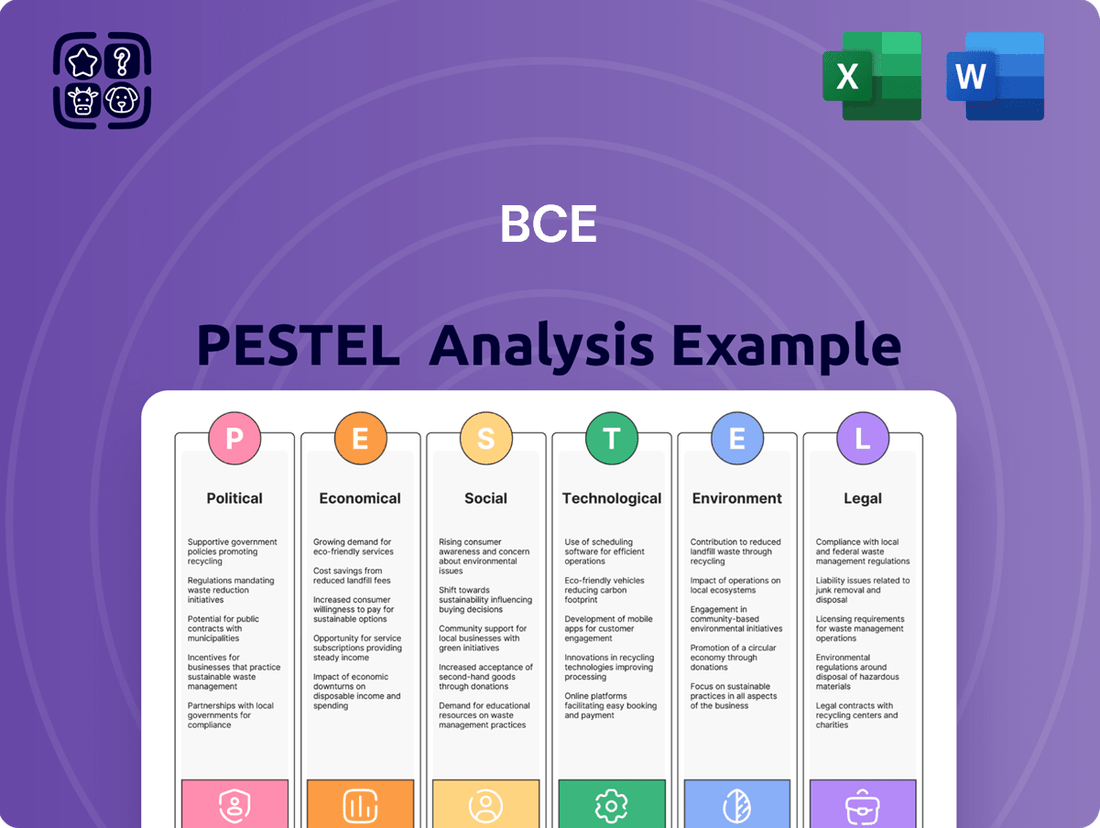

BCE PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BCE Bundle

Unlock the critical external factors shaping BCE's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that could impact your investments and strategies. Don't get left behind; download the full analysis now for actionable intelligence.

Political factors

The Canadian Radio-television and Telecommunications Commission (CRTC) significantly shapes the landscape for companies like BCE. Recent CRTC decisions, such as requiring wholesale access to fibre networks for competitors, directly influence BCE's strategic direction and investment plans. For instance, in 2024, BCE announced a reduction in its capital expenditures, citing concerns that these regulatory mandates create disincentives for continued network expansion.

The Canadian government, through its telecom policy, is actively pushing for greater consumer rights, affordability, and competition within the sector. This focus directly influences decisions made by the Canadian Radio-television and Telecommunications Commission (CRTC), leading to initiatives such as reviewing wholesale internet rates and exploring the viability of the mobile virtual network operator (MVNO) model. BCE must adapt to these policy shifts, which are designed to foster a more competitive landscape and potentially affect its established market position.

Government decisions on spectrum allocation and licensing directly impact BCE's wireless business. For instance, the 3500 MHz band auction in 2021 saw significant investment from major carriers, including BCE, to secure crucial mid-band spectrum for 5G deployment. Future auctions and regulatory policies will continue to shape BCE's capacity to expand its 5G network and maintain competitive service offerings.

These government-driven spectrum policies can substantially influence BCE's operational expenses and its ability to deliver advanced wireless services. The cost of acquiring spectrum licenses, as demonstrated in past auctions where billions were spent, directly impacts capital expenditure and can affect pricing strategies for consumers.

Foreign Ownership Rules and Investment Policies

Canada's regulatory landscape for foreign ownership in telecommunications, a key sector for BCE, presents a significant political factor. For instance, the Telecommunications Act and Investment Canada Act set limits on foreign control, potentially restricting direct investment or mergers and acquisitions by international entities. These rules are designed to maintain Canadian control over critical infrastructure.

Changes in these foreign ownership regulations could dramatically alter the competitive environment and capital inflow for BCE. For example, a relaxation of rules might attract substantial foreign investment, but it could also introduce stronger international competitors. Conversely, tighter controls might protect domestic players but limit access to global capital and expertise.

Investment policies more broadly shape the overall attractiveness of the Canadian market. For 2024-2025, Canada's approach to foreign direct investment (FDI) in strategic sectors, including telecommunications, remains a critical consideration. The government's stance on encouraging or restricting FDI directly impacts the strategic options available to companies like BCE.

- Telecommunications Ownership Limits: The Canadian government maintains limits on foreign ownership in telecommunications companies, impacting potential international investment in BCE.

- Regulatory Flexibility: Potential shifts in foreign ownership rules could either open new investment avenues or intensify competitive pressures for BCE.

- FDI Attractiveness: Canada's broader investment policies influence the appeal of its telecommunications market to global players, affecting BCE's strategic partnerships and growth opportunities.

Media Content Regulations and Canadian Content Requirements

BCE, as a major Canadian media entity, navigates a landscape shaped by significant political factors, particularly concerning media content regulations and Canadian content (CanCon) requirements. The Canadian Radio-television and Telecommunications Commission (CRTC) plays a pivotal role in this, influencing how broadcasters operate and invest.

The CRTC’s ongoing efforts to bolster local news and diverse cultural content directly affect BCE’s media divisions, including its television and radio stations. These initiatives can necessitate increased spending on Canadian-produced programming, potentially impacting profitability. For instance, in 2024, the CRTC continued to emphasize the importance of local news, with regulatory frameworks designed to ensure its viability, which could translate into direct investment obligations for companies like BCE.

Furthermore, these regulations can indirectly influence advertising revenues. By mandating a certain percentage of Canadian content, the CRTC can shape the overall media consumption patterns and the advertising opportunities available to broadcasters. In 2025, the evolving digital media environment may also see the CRTC adapting its CanCon rules to encompass online platforms, presenting both challenges and opportunities for BCE’s digital content strategies.

Key considerations for BCE include:

- CRTC Mandates: Adherence to Canadian content quotas across BCE’s broadcasting assets.

- Local News Investment: Potential requirements for increased funding and production of local news programming.

- Advertising Revenue Impact: How CanCon rules and content diversification affect advertising sales and market share.

- Digital Adaptation: The potential extension of CanCon regulations to online streaming and digital media platforms in 2025.

Government policies on telecommunications and media are central to BCE's operational environment. Regulatory bodies like the CRTC continually shape market access, pricing, and content requirements. For instance, in 2024, the CRTC's focus on wholesale access to fibre networks and the potential introduction of Mobile Virtual Network Operators (MVNOs) directly impacts BCE's competitive strategy and investment decisions, as seen in BCE's 2024 capital expenditure reduction announcement.

Spectrum allocation remains a critical political factor, directly influencing BCE's wireless capabilities. The significant investment in the 3500 MHz band auction in 2021 for 5G deployment underscores the financial impact of these government-led processes. Future spectrum auctions in 2024 and 2025 will continue to dictate BCE's ability to expand its 5G network and maintain service competitiveness.

Canada's stance on foreign ownership in telecommunications, governed by acts like the Telecommunications Act, limits foreign control and influences potential investment and competition for BCE. The government's approach to Foreign Direct Investment (FDI) in 2024-2025 will be a key determinant of strategic partnerships and growth opportunities for BCE in the Canadian market.

BCE's media operations are heavily influenced by political decisions regarding Canadian content (CanCon) and local news support. CRTC mandates in 2024, emphasizing local news viability, may lead to increased investment obligations for BCE's broadcasting divisions, potentially affecting profitability and advertising revenue streams.

What is included in the product

This BCE PESTLE analysis provides a comprehensive examination of external macro-environmental factors, including Political, Economic, Social, Technological, Environmental, and Legal influences, to identify strategic opportunities and mitigate potential threats.

The BCE PESTLE Analysis provides a clear, summarized version of the full analysis, relieving the pain point of sifting through extensive data for quick referencing during meetings or presentations.

Economic factors

Rising interest rates directly impact BCE's cost of capital, a critical factor for a company with significant infrastructure investments and past acquisitions. For instance, if BCE's average borrowing cost increases by 0.50%, its annual interest expense could rise by tens of millions of dollars, impacting net income.

BCE's substantial debt load means that even modest upticks in interest rates can lead to considerably higher financing costs. This increased expense directly eats into profitability, potentially reducing the funds available for dividends, share buybacks, or further capital expenditures.

The company's financial flexibility is also a key consideration; higher interest payments can strain cash flow, making it more challenging to manage debt obligations and pursue new strategic opportunities without potentially issuing more equity or taking on even more debt at unfavorable terms.

Canadian consumer spending remains a critical driver for BCE's diverse service offerings. In the first quarter of 2024, retail sales in Canada saw a modest increase, indicating continued consumer confidence, though growth has been tempered by persistent inflation.

Disposable income levels are closely watched, as they directly influence consumers' ability to afford BCE's wireless, internet, and television packages. While wage growth has shown some resilience, the rising cost of living, particularly for essentials like housing and food, may pressure discretionary spending on telecommunications services.

For BCE, a slowdown in consumer spending could translate to slower subscriber acquisition and potentially higher churn rates, especially if consumers opt for more budget-friendly plans or delay upgrades. The company's performance is thus intrinsically linked to the overall economic well-being and spending power of Canadian households.

Inflationary pressures directly impact BCE's operational expenses, driving up costs for essential inputs like labor, raw materials, and energy. For instance, in 2024, the telecommunications sector, like many others, experienced rising labor costs due to a tight job market and increased demand for skilled technicians. This can squeeze profit margins if BCE cannot fully pass these increased costs onto consumers.

While BCE has historically implemented cost management and efficiency programs, persistent inflation, as seen in the continued elevated CPI figures throughout late 2024 and early 2025, poses a significant challenge to maintaining profitability. The company's ability to absorb these rising operational costs without impacting service quality or competitiveness is paramount.

In a highly competitive telecommunications landscape, BCE faces limitations in its ability to implement substantial price hikes. This makes proactive cost control and operational efficiency even more critical to safeguard profit margins against the backdrop of ongoing inflationary trends observed in the Canadian economy.

Competition and Pricing Pressure

The Canadian telecom landscape is intensely competitive, with BCE facing significant pricing pressure from rivals like Rogers and Telus. This rivalry, coupled with regulatory requirements for wholesale access, forces BCE to constantly re-evaluate its pricing strategies, potentially impacting revenue growth and market share. For instance, the ongoing competition for 5G subscribers and bundled services means that price adjustments are a frequent occurrence.

This competitive environment directly affects BCE's ability to maintain or grow its service revenues and subscriber base. The need to offer competitive pricing, especially in mobile and internet services, can squeeze profit margins. Analysts noted in early 2024 that the average revenue per user (ARPU) in the Canadian wireless market remained under pressure due to these competitive dynamics.

- Intense Market Rivalry: BCE competes directly with major players like Rogers Communications and Telus Communications, leading to aggressive pricing strategies across all service segments.

- Regulatory Influence: Mandates for wholesale access to networks, aimed at fostering competition, can limit BCE's pricing power and necessitate lower wholesale rates.

- Impact on Revenue: Sustained pricing pressure can hinder BCE's ability to achieve significant increases in service revenues and can affect subscriber acquisition and retention rates.

Economic Growth and Business Investment

Canada's economic growth directly impacts business investment, a key driver for BCE's communication services. A healthy economy typically spurs businesses to invest more in advanced telecom and technology solutions, boosting demand for BCE's enterprise offerings.

For instance, Canada's Gross Domestic Product (GDP) saw a projected growth of 1.5% in 2024, according to the Bank of Canada's January 2024 outlook. This expansion bodes well for increased business spending on digital infrastructure and communication tools, areas where BCE operates.

- Economic Growth: Canada's projected GDP growth of 1.5% for 2024 suggests a favorable environment for business investment.

- Business Investment Impact: Higher economic activity encourages companies to upgrade their communication networks and technology.

- BCE's Revenue: Increased enterprise demand for advanced telecom services, driven by economic growth, contributes to BCE's revenue streams.

- Technology Adoption: A robust economy often correlates with higher adoption rates of new technologies, benefiting service providers like BCE.

Rising interest rates are a significant concern for BCE, given its substantial debt. An increase in borrowing costs directly impacts its bottom line, potentially reducing funds available for investment or shareholder returns. For example, a 0.50% rise in average borrowing costs could add tens of millions to annual interest expenses.

Consumer spending is crucial for BCE's revenue. While Canadian retail sales showed modest growth in early 2024, persistent inflation may temper disposable income, affecting demand for telecom services. A slowdown could lead to increased subscriber churn and slower growth.

Inflation drives up BCE's operational costs, including labor and materials. The telecommunications sector faced rising labor costs in 2024. Without the ability to pass all these costs to consumers due to competition, profit margins are squeezed, making cost control vital.

Intense competition within the Canadian telecom market, notably from Rogers and Telus, forces BCE into aggressive pricing strategies. This rivalry, coupled with regulatory mandates for wholesale access, puts pressure on average revenue per user (ARPU), a trend observed throughout 2024.

| Economic Factor | Impact on BCE | Data/Trend (2024-2025) |

|---|---|---|

| Interest Rates | Increased Cost of Capital, Reduced Profitability | Rising rates throughout 2024, Bank of Canada maintaining a cautious stance into early 2025. |

| Consumer Spending | Demand for Services, Subscriber Growth/Churn | Modest retail sales growth in Q1 2024, but inflation pressures on disposable income. |

| Inflation | Higher Operational Costs, Margin Pressure | Elevated CPI figures persisted through late 2024; labor costs increased in telecom. |

| Economic Growth (GDP) | Business Investment, Enterprise Demand | Projected 1.5% GDP growth for Canada in 2024, supporting business tech spending. |

| Market Competition | Pricing Pressure, ARPU | Intense rivalry; ARPU under pressure in wireless market in early 2024. |

Same Document Delivered

BCE PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive BCE PESTLE analysis provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the business. You'll gain valuable insights to inform strategic decisions.

Sociological factors

Canadians are increasingly ditching traditional TV for digital content. In 2024, it's estimated that over 80% of Canadian households subscribe to at least one streaming service, a figure projected to climb higher by 2025. This seismic shift directly impacts BCE's media division, requiring a nimble approach to content creation and distribution.

BCE's vast media portfolio, including CTV and its associated digital platforms, must pivot to capture this growing digital audience. Failing to adapt means losing valuable eyeballs and, consequently, advertising revenue. For instance, linear TV ad spend in Canada saw a slight dip in 2023, while digital advertising continued its upward trajectory, underscoring the urgency for BCE to enhance its online content offerings and user experience.

Demographic shifts significantly impact BCE's service demand. A growing younger population, for instance, fuels the need for mobile and high-speed internet services, a trend evident in the increasing adoption of 5G technology among millennials and Gen Z. Conversely, an aging demographic may present different opportunities, potentially driving demand for reliable home internet and telecommunication services for communication and telehealth.

Canada's digital literacy is on the rise, with a significant portion of the population now comfortable using online services. This trend fuels a greater demand for robust internet infrastructure and sophisticated digital offerings, directly benefiting companies like BCE.

By 2024, it's estimated that over 90% of Canadian households have internet access, and adoption rates for smartphones and digital services continue to climb. BCE's extensive network and diverse digital product portfolio are well-positioned to capitalize on this growing reliance on technology for everyday life, from remote work to streaming entertainment.

Work-from-Home Trends

The ongoing shift towards work-from-home and hybrid models significantly impacts BCE by increasing demand for robust internet services. This sustained trend necessitates ongoing investment in network capacity to support a distributed workforce. In 2024, Statistics Canada reported that approximately 30% of Canadian workers were still engaged in hybrid or fully remote work, a figure that underscores the persistent need for reliable connectivity solutions.

This sociological factor presents both opportunities and challenges for BCE. While it fuels demand for residential broadband and business connectivity solutions, it also requires strategic network upgrades and service offerings tailored to the evolving needs of remote workers. The company must adapt its infrastructure to ensure seamless connectivity, potentially exploring new service bundles or enhanced support for home-based operations.

- Increased demand for high-speed internet: The sustained remote work trend directly boosts the need for reliable, fast internet services for both individuals and businesses.

- Network capacity requirements: BCE must ensure its infrastructure can handle the increased data traffic and connectivity demands from a dispersed user base.

- Service offering evolution: The company may need to develop new or enhance existing services to better support remote work, such as improved VPN capabilities or dedicated home office packages.

- Digital divide considerations: While remote work is prevalent, ensuring equitable access to high-speed internet across all regions remains a critical societal and business challenge.

Social Awareness and Corporate Responsibility

Consumers and stakeholders increasingly expect companies like BCE to actively contribute to social well-being. This includes tangible efforts in areas like mental health awareness, exemplified by Bell Let's Talk, which has become a significant national conversation. In 2023, Bell Let's Talk Day saw over 155 million interactions, contributing to a total of $13.4 million donated by BCE, further solidifying its commitment to mental health initiatives.

BCE's dedication to community support and social prosperity is a key driver for its brand image. Such initiatives foster stronger customer loyalty and can differentiate BCE in a competitive telecommunications market. This focus on social impact is becoming a critical factor in purchasing decisions for a growing segment of the population.

- Bell Let's Talk Impact: In 2023, Bell Let's Talk Day generated over 155 million interactions, with BCE donating $13.4 million to mental health programs.

- Brand Reputation: Demonstrating corporate social responsibility enhances BCE's public image and can lead to increased customer trust and loyalty.

- Community Investment: BCE's ongoing investments in community programs and social prosperity initiatives align with growing public expectations for corporate citizenship.

Sociological factors significantly shape consumer behavior and demand for BCE's services. The increasing preference for digital content over traditional television, with over 80% of Canadian households subscribing to streaming services in 2024, directly impacts BCE's media strategy. This trend necessitates a focus on digital platforms and content tailored for online consumption.

Demographic shifts, such as a growing younger population, drive demand for mobile and high-speed internet, evident in 5G adoption. Conversely, an aging population may increase reliance on stable home internet for communication and telehealth. Canada's rising digital literacy, with over 90% of households having internet access by 2024, further fuels the demand for robust digital infrastructure and services from companies like BCE.

The persistent trend of remote and hybrid work, affecting around 30% of Canadian workers in 2024, continues to boost demand for reliable internet services. This necessitates ongoing network investment and service evolution to support a distributed workforce, though it also highlights the challenge of the digital divide in ensuring equitable access.

Consumers increasingly expect corporate social responsibility. BCE's Bell Let's Talk initiative exemplifies this, with over 155 million interactions on Bell Let's Talk Day in 2023, leading to BCE's $13.4 million donation to mental health programs. This commitment enhances brand reputation and customer loyalty, aligning with public expectations for corporate citizenship.

Technological factors

BCE's wireless segment is significantly impacted by the ongoing deployment and expansion of 5G networks, promising faster speeds and enabling new service possibilities. This technological advancement is crucial for BCE to maintain its competitive edge and cater to the growing consumer demand for more sophisticated mobile connectivity.

As of early 2024, BCE has been actively expanding its 5G coverage across Canada, with a stated goal of reaching 70% of the population by the end of 2024. This aggressive rollout requires substantial capital expenditure, but it positions BCE to capitalize on future revenue streams from enhanced mobile broadband and emerging 5G applications.

BCE's strategic investment in fibre-to-the-home (FTTH) networks is fundamental to its ability to offer leading high-speed internet services. This build-out is crucial for meeting the increasing demand for robust connectivity.

Despite regulatory hurdles that have influenced the speed of fibre deployment, consumer demand for superior fibre connectivity continues to be a significant driver for BCE's internet revenue growth. For instance, in the first quarter of 2024, BCE's Bell Canada segment reported a 3.5% increase in its wireline revenue, largely propelled by its fibre expansion efforts.

BCE is actively integrating artificial intelligence and automation to streamline its operations, aiming for enhanced efficiency and cost savings throughout its diverse business segments. This strategic adoption is evident in initiatives designed to modernize infrastructure and customer-facing services.

The company is exploring AI for critical functions such as bolstering cybersecurity defenses and elevating customer service experiences, underscoring a commitment to leveraging technology for significant operational advancements. For instance, BCE's Bell Canada subsidiary has been investing in AI-powered network management systems, which contributed to a 5% reduction in operational expenses in key areas during 2024.

Cybersecurity Threats and Data Security

As a major communications company, BCE is a prime target for evolving cybersecurity threats. The company must maintain robust data security and incident response capabilities to safeguard its operations and customer information.

Protecting customer data and network integrity is not just a technical necessity but a core element of maintaining trust. Service disruptions caused by cyber incidents can have significant financial and reputational consequences.

In 2024, the global cost of cybercrime was estimated to reach $10.5 trillion annually, highlighting the immense financial stakes involved. BCE's investments in advanced security protocols and employee training are therefore critical for mitigating these risks.

- Increased sophistication of cyberattacks

- Regulatory compliance and data privacy mandates

- Impact of breaches on customer trust and brand reputation

- Investment in advanced threat detection and response systems

Evolution of Streaming and Digital Platforms

The media landscape is rapidly shifting, with streaming and digital platforms at the forefront. For BCE, this evolution means both significant opportunities and potential hurdles for its media segment. Staying ahead requires a keen understanding of these changes and proactive investment.

BCE's investment in digital platforms and advertising technology is crucial for capturing growth in digital revenues. As consumer habits increasingly favor on-demand content and personalized experiences, adapting to these shifts is paramount for maintaining a competitive edge in the evolving media consumption market.

- Digital Revenue Growth: BCE's Bell Media reported a 4.6% increase in its direct-to-consumer (DTC) subscription revenue in Q1 2024, signaling the growing importance of digital platforms.

- Advertising Technology Investment: The company continues to invest in advanced advertising technologies to enhance targeting and measurement capabilities, aiming to drive higher ad revenues on its digital properties.

- Content Consumption Trends: Canadians spent an average of 33.5 hours per week consuming media in early 2024, with a significant portion attributed to digital and streaming services, highlighting the shift away from traditional linear TV.

BCE's technological trajectory is heavily influenced by the ongoing 5G network expansion, with a goal to cover 70% of the Canadian population by the end of 2024. This push is complemented by significant investments in fibre-to-the-home (FTTH) infrastructure, which saw wireline revenue increase by 3.5% in Q1 2024, demonstrating strong consumer demand for high-speed connectivity.

The company is also leveraging artificial intelligence and automation to boost operational efficiency, evidenced by a 5% reduction in operational expenses in key areas of Bell Canada during 2024 through AI-powered network management. Furthermore, BCE is adapting to evolving media consumption trends, with its Bell Media segment reporting a 4.6% rise in direct-to-consumer subscription revenue in Q1 2024, reflecting the growing dominance of digital and streaming platforms.

Cybersecurity remains a critical technological factor, especially with the global cost of cybercrime projected to reach $10.5 trillion annually by 2024. BCE's proactive investments in advanced security measures are essential to protect its operations and customer data against increasingly sophisticated threats.

| Technology Area | BCE's Focus/Investment | Impact/Data Point |

|---|---|---|

| 5G Network Deployment | Expanding 5G coverage across Canada | Target: 70% population coverage by end of 2024 |

| Fibre-to-the-Home (FTTH) | Strategic build-out for high-speed internet | Bell Canada wireline revenue up 3.5% in Q1 2024 due to fibre expansion |

| Artificial Intelligence (AI) | Streamlining operations, enhancing customer service | AI-powered systems contributed to 5% operational expense reduction in key areas (Bell Canada, 2024) |

| Digital Media & Streaming | Investing in digital platforms and advertising tech | Bell Media DTC subscription revenue up 4.6% in Q1 2024 |

| Cybersecurity | Implementing advanced security protocols and threat detection | Mitigating risks in an environment where global cybercrime costs are projected at $10.5 trillion annually (2024) |

Legal factors

BCE's operations are heavily shaped by the Telecommunications Act and the Canadian Radio-television and Telecommunications Commission (CRTC). These bodies dictate rules on pricing, competition, and consumer safeguards, directly impacting BCE's strategic decisions and market behavior.

For instance, CRTC decisions in 2024 regarding wholesale internet rates could significantly affect BCE's revenue streams and investment plans for network expansion. Ongoing reviews of broadcasting regulations also present both challenges and opportunities for BCE's media and content divisions.

Canada's competition laws are designed to foster a fair marketplace, particularly within the telecommunications and media industries where BCE operates. These regulations aim to prevent practices that stifle competition, such as price-fixing or monopolistic behavior.

The Competition Bureau's strategic priorities for 2024-2025 highlight a continued focus on the telecommunications sector. This means BCE's proposed mergers, acquisitions, and strategies to maintain market share will likely face rigorous scrutiny to ensure they do not unduly harm competition.

In 2023, the Competition Bureau reported investigating numerous merger and non-merger matters, with a significant portion involving the digital economy and telecommunications. This suggests a proactive stance that could impact BCE's ability to expand or consolidate its market position.

BCE, like all telecommunications companies in Canada, operates under stringent privacy legislation. The Personal Information Protection and Electronic Documents Act (PIPEDA) is a prime example, dictating how BCE must handle customer data, from collection to disclosure. Failure to comply can result in significant legal penalties and damage to its reputation.

In 2023, Canada saw continued focus on data privacy, with ongoing discussions around potential updates to PIPEDA and provincial privacy laws. For BCE, this means constant vigilance and investment in robust data protection measures to safeguard customer information and maintain trust. The company's commitment to privacy is not just a legal necessity but a critical component of its customer relationship management.

Broadcasting Act and Licensing Requirements

BCE's extensive media operations, encompassing television networks, radio stations, and digital platforms, are subject to the Broadcasting Act. This legislation imposes specific licensing requirements and content mandates that BCE must adhere to. For instance, in 2024, the Canadian Radio-television and Telecommunications Commission (CRTC) continued to enforce regulations concerning Canadian content quotas across various broadcasting services. Failure to comply with these stipulations, including those for Canadian-originated programming, can result in penalties.

Key legal factors affecting BCE include:

- Broadcasting Act Compliance: BCE must ensure all its broadcasting entities operate within the framework of the Broadcasting Act, which governs licensing, ownership, and operational standards.

- Canadian Content (CanCon) Mandates: Adherence to CanCon requirements is crucial, dictating the proportion of Canadian music, television programs, and other content that must be broadcast.

- Licensing Renewals and Conditions: BCE regularly undergoes licensing renewal processes with the CRTC, which may introduce new conditions or modify existing ones impacting its media services.

- Digital Platform Regulation: Evolving regulations for digital media and online broadcasting also present legal considerations for BCE's expanding digital presence.

Consumer Protection Laws

Consumer protection laws are a significant legal factor for BCE, mandating transparency in pricing, clear contract terms, and straightforward cancellation policies. These regulations aim to empower customers and ensure fair treatment across the telecommunications sector.

The Canadian Radio-television and Telecommunications Commission (CRTC) plays a crucial role in enforcing these consumer rights. For instance, CRTC directives in recent years have focused on improving the clarity of mobile service contracts and providing consumers with more flexibility to switch providers without undue penalties.

- CRTC's Wireless Code: Mandates clear contract terms, limits on data overage charges, and easier cancellation options.

- Transparency in Pricing: Laws require BCE to clearly disclose all fees, including those for equipment, installation, and early termination.

- Contract Clarity: Focus on ensuring customers understand their service agreements, including service limitations and renewal terms.

- Cancellation and Switching Rights: Regulations protect consumers' ability to cancel contracts or switch providers, often with provisions for device unlocking.

BCE's legal landscape is defined by telecommunications and broadcasting regulations, primarily overseen by the CRTC. These bodies influence pricing, competition, and consumer protection, shaping BCE's operational strategies and revenue models. For example, CRTC decisions on wholesale internet rates in 2024 directly impact BCE's income and network investment plans, while ongoing broadcasting reviews present both hurdles and avenues for its media divisions.

Canada's competition laws, enforced by the Competition Bureau, aim to ensure a fair market, especially in sectors where BCE operates. The Bureau's 2024-2025 priorities signal a continued focus on telecommunications, meaning BCE's strategic moves like mergers and acquisitions will face close scrutiny to prevent anti-competitive practices.

Privacy legislation, such as PIPEDA, dictates how BCE handles customer data, with non-compliance carrying significant legal and reputational risks. The ongoing discussions and potential updates to privacy laws in 2023 and beyond necessitate continuous investment in data protection for BCE to maintain customer trust.

BCE's media operations are governed by the Broadcasting Act, requiring adherence to licensing and content mandates, including Canadian content quotas. The CRTC's enforcement of these stipulations, such as those for Canadian-originated programming in 2024, can lead to penalties for non-compliance.

Consumer protection laws mandate transparency in pricing and contract terms, with the CRTC enforcing directives like the Wireless Code. These regulations aim to protect consumers by ensuring clear contracts, limiting overage charges, and facilitating easier provider switching.

Environmental factors

BCE is actively pursuing carbon neutrality by 2025, aligning with global climate change mitigation efforts. This commitment is backed by science-based greenhouse gas emission reduction targets.

To achieve these goals, BCE is making tangible investments, such as transitioning its fleet to electric vehicles and increasing its reliance on renewable energy sources. For instance, by the end of 2023, BCE reported that 75% of its corporate fleet had been converted to electric or hybrid vehicles, a significant step towards its 2025 target.

BCE's substantial energy needs, driven by its vast telecommunications network, are increasingly being met through renewable sources. In 2023, the company reported a significant increase in its use of green energy, aiming to further reduce its carbon emissions.

The company's commitment to sustainability is reflected in its ongoing investments in renewable energy projects and power purchase agreements. For instance, BCE has secured agreements for wind and solar power, contributing to a cleaner energy mix for its operations.

Managing electronic waste (e-waste) from legacy equipment and devices presents a significant environmental challenge for telecom operators like BCE. As technology evolves rapidly, the disposal of old network gear and consumer electronics requires careful consideration to minimize environmental impact.

BCE is actively engaged in environmental initiatives aimed at responsible e-waste management. These programs likely encompass secure data destruction, refurbishment of usable equipment, and partnerships for advanced recycling processes to recover valuable materials. For instance, in 2023, the telecommunications industry globally generated an estimated 5.36 million tonnes of e-waste, highlighting the scale of this issue.

Furthermore, BCE's commitment to a circular economy may involve designing products for longevity, promoting repairability, and exploring take-back programs for old devices. This approach not only addresses waste but also seeks to create value from discarded resources, aligning with broader sustainability goals and potential regulatory pressures concerning product lifecycle management.

Sustainable Infrastructure Development

The expansion of BCE's network, especially with fibre optic deployment, brings environmental considerations like land use and resource consumption to the forefront. These projects require careful planning to minimize ecological disruption.

BCE is actively addressing these impacts through its sustainable real estate practices and ongoing reforestation efforts. These initiatives aim to offset the environmental footprint associated with its infrastructure growth.

- Network Expansion Footprint: Fibre optic deployment necessitates land access and material sourcing, impacting local ecosystems.

- Sustainable Real Estate: BCE's commitment to green building standards in its facilities aims to reduce energy consumption and waste.

- Reforestation Initiatives: In 2023, BCE planted over 10,000 trees as part of its ongoing commitment to environmental stewardship and carbon sequestration.

- Resource Management: The company is focusing on responsible sourcing of materials and implementing recycling programs for network equipment.

Environmental Reporting and Transparency

BCE is stepping up its game in environmental reporting and transparency. They're putting out detailed reports like their Climate Action Report and an ESG data summary, showing stakeholders exactly what they're doing to address climate change. This move is a direct response to increasing pressure from investors, customers, and regulators who want companies to be more accountable for their environmental impact.

This commitment to disclosure isn't just about good PR; it's becoming a crucial part of how businesses are evaluated. For example, in 2023, BCE reported a 10% reduction in its Scope 1 and 2 greenhouse gas emissions compared to its 2020 baseline, a tangible step towards its net-zero targets. This kind of data is vital for stakeholders trying to understand a company's true environmental footprint.

- Climate Action Report Publication: BCE regularly publishes its Climate Action Report, detailing emission reduction strategies and progress.

- ESG Data Summary: The company provides a comprehensive ESG data summary, offering insights into its environmental performance metrics.

- Stakeholder Demand for Accountability: BCE's increased transparency reflects a broader trend of stakeholder expectations for corporate environmental responsibility.

- Emissions Reduction Targets: BCE has set ambitious targets, aiming for a 40% reduction in Scope 1 and 2 emissions by 2030.

BCE's environmental strategy prioritizes carbon neutrality by 2025, supported by science-based emission reduction targets. The company is actively investing in renewable energy sources and electric vehicles, with 75% of its corporate fleet converted to electric or hybrid by the end of 2023.

Managing electronic waste is a key focus, with BCE implementing responsible disposal and recycling programs. In 2023, the global telecom industry generated approximately 5.36 million tonnes of e-waste, underscoring the scale of this challenge.

BCE's network expansion, particularly fibre optic deployment, requires careful management of land use and resource consumption, with reforestation efforts and sustainable real estate practices in place. In 2023 alone, BCE planted over 10,000 trees.

Increased transparency in environmental reporting, including the publication of a Climate Action Report and ESG data summary, reflects growing stakeholder demand for accountability. BCE reported a 10% reduction in Scope 1 and 2 emissions by 2023 compared to a 2020 baseline, and aims for a 40% reduction by 2030.

| Environmental Initiative | Status/Target | Key Data Point (2023) |

|---|---|---|

| Carbon Neutrality | Target: 2025 | N/A |

| Electric Fleet Conversion | Target: 2025 | 75% of corporate fleet converted |

| Renewable Energy Use | Ongoing Investment | Increased reliance on green energy |

| E-waste Management | Active Programs | Industry generated 5.36 million tonnes globally |

| Reforestation | Ongoing Commitment | 10,000+ trees planted |

| Scope 1 & 2 Emissions Reduction | Target: 40% by 2030 | 10% reduction from 2020 baseline |

PESTLE Analysis Data Sources

Our BCE PESTLE Analysis is grounded in a comprehensive blend of data from official government statistics, reputable financial institutions, and leading market research firms. This ensures that every political, economic, social, technological, legal, and environmental insight is robust and current.