BCE Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BCE Bundle

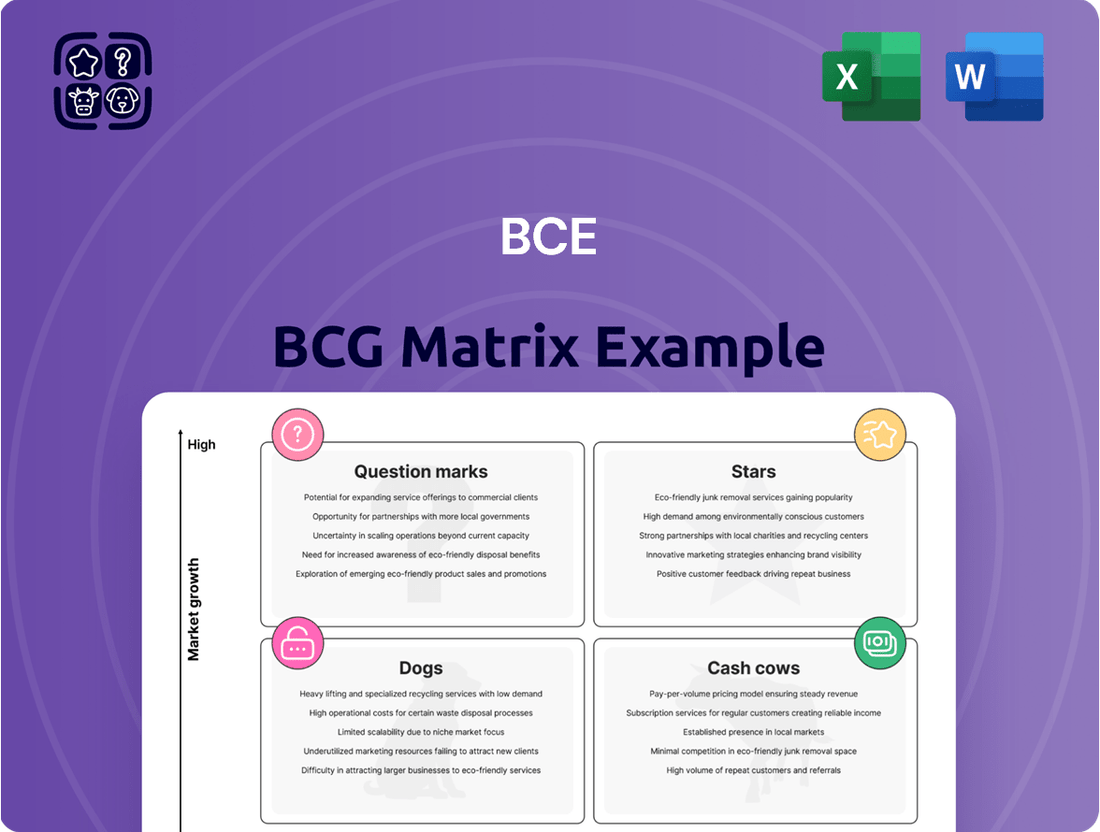

Unlock the secrets to a thriving product portfolio with the BCG Matrix! This powerful tool categorizes your offerings into Stars, Cash Cows, Dogs, and Question Marks, guiding your strategic decisions. See where your company's products are positioned for growth and where they might be holding you back.

Don't settle for a glimpse; dive into the full BCG Matrix to gain actionable insights and a clear roadmap for optimizing your investments. Purchase the complete report to understand your market share and industry growth rate for each product, empowering you to make smarter, data-driven choices.

The full BCG Matrix is your key to unlocking strategic clarity and driving business success. Get instant access to a comprehensive analysis that reveals your product's potential and guides your capital allocation. Buy now to transform your product strategy!

Stars

BCE's 5G and 5G+ networks are positioned as Stars in its portfolio, reflecting their strong market performance. Independent testing in 2024 recognized BCE's 5G network as the leading national wireless carrier in Canada, a significant validation of its technological capabilities and service quality.

The company's strategic focus on expanding its 5G+ coverage is evident in its ambitious goal to reach over 70% of the Canadian population by the end of 2025. This aggressive rollout signifies BCE's commitment to capturing a dominant share in the rapidly growing 5G market, reinforcing its Star status.

Fibre-to-the-Home (FTTH) Internet represents a significant growth opportunity for BCE, aligning with the characteristics of a Star in the BCG Matrix. By the close of 2024, BCE had successfully connected 3 million residential internet customers to its FTTH network, marking a substantial 10% expansion from the previous year.

BCE is strategically investing in further expanding its FTTH footprint, with plans to make pure fibre internet accessible to an additional 1.1 million locations by the end of 2025. This ambitious expansion will bring the total number of FTTH-enabled locations to 9 million, underscoring the company's commitment to this high-growth segment.

BCE's Business Solutions and Enterprise Services are a key growth driver, reflecting its strategic shift towards technology leadership. In 2024, this segment saw impressive revenue growth of 18%, underscoring its increasing importance within the company's portfolio.

This segment targets enterprise clients, a market segment experiencing robust demand for sophisticated technology solutions. BCE is well-positioned to capitalize on this trend, offering services that enhance business operations and digital transformation.

Bell Media's Digital Platforms (e.g., Crave)

Bell Media's digital platforms, including the popular streaming service Crave, represent a significant growth area for the company. In 2024, digital revenues surged by 19%, now accounting for a substantial 42% of Bell Media's total media revenue, a notable increase from 35% in 2023. This shift underscores a clear consumer preference for digital content consumption.

The strong performance of streaming services like Crave is further evidenced by record hours viewed, signaling robust subscriber growth. This trend positions Bell Media's digital ventures as potential stars within the BCG matrix, demonstrating high market share in a growing industry.

- Digital Revenue Growth: 19% increase in 2024.

- Digital Revenue Share: 42% of total media revenue in 2024, up from 35% in 2023.

- Streaming Performance: Record hours viewed on services like Crave.

- Market Position: Strong subscriber growth and preference for digital content.

Mobile Connected Devices and IoT Services

Mobile connected devices are a significant growth area, reflecting the expanding Internet of Things (IoT) ecosystem. Bell's performance in this sector underscores the increasing reliance on connected technologies across various industries.

Bell reported robust growth in mobile connected devices, with net activations soaring by 27.4% in the fourth quarter of 2024. For the entirety of 2024, the company saw a healthy 6.0% increase in these activations. This upward trend is largely attributed to the strong demand for Bell's IoT services.

- Bell's net activations for mobile connected devices increased by 27.4% in Q4 2024.

- Full-year 2024 net activations for mobile connected devices saw a 6.0% increase.

- Growth is driven by strong demand for Bell's IoT services, including business solutions and connected car subscriptions.

BCE's 5G and 5G+ networks are strong contenders for Star status due to their leading performance and aggressive expansion. Independent testing in 2024 confirmed BCE's 5G network as the top national wireless carrier in Canada. The company aims to cover over 70% of the Canadian population with 5G+ by the end of 2025, signaling its intent to dominate this high-growth market.

Fibre-to-the-Home (FTTH) Internet also exhibits strong Star characteristics, with significant customer growth and ongoing network expansion. By the end of 2024, BCE had connected 3 million residential customers to its FTTH network, a 10% increase year-over-year. Plans are in place to extend pure fibre to an additional 1.1 million locations by the end of 2025, reaching a total of 9 million FTTH-enabled locations.

Bell Media's digital platforms, particularly the streaming service Crave, are showing considerable growth, positioning them as potential Stars. In 2024, digital revenues jumped 19%, now making up 42% of Bell Media's total revenue, up from 35% in 2023. This trend is supported by record streaming hours and subscriber growth, indicating a clear consumer preference for digital content.

Mobile connected devices, driven by IoT services, are another area of rapid expansion for BCE. Net activations for these devices surged by 27.4% in the fourth quarter of 2024, contributing to a 6.0% increase for the full year. This growth highlights the increasing adoption of connected technologies across various sectors.

| Business Segment | BCG Category | Key Performance Indicator (2024/2025) | Growth Driver |

|---|---|---|---|

| 5G and 5G+ Networks | Star | Leading national wireless carrier (2024 testing) | Aggressive network expansion to 70%+ population by end of 2025 |

| Fibre-to-the-Home (FTTH) Internet | Star | 3 million residential connections (end of 2024) | Expansion to 9 million FTTH-enabled locations by end of 2025 |

| Bell Media Digital Platforms (e.g., Crave) | Star | 19% digital revenue growth (2024) | Increasing digital revenue share to 42% of total media revenue |

| Mobile Connected Devices (IoT) | Star | 27.4% Q4 2024 net activation growth | Strong demand for IoT services and connected solutions |

What is included in the product

Highlights which units to invest in, hold, or divest based on market share and growth.

Visually clarifies strategic priorities, easing the pain of resource allocation decisions.

Cash Cows

BCE's traditional wireless postpaid mobile phone services function as a Cash Cow within its BCG Matrix. The segment boasts a large, stable subscriber base exceeding 9.5 million as of Q1 2025, generating consistent revenue despite competitive pricing pressures.

While the first quarter of 2025 saw a net subscriber loss, this was attributed to a less active market and a strategic focus on retaining higher-value customers. The stable churn rate reinforces the mature, reliable income stream characteristic of a Cash Cow, ensuring steady cash flow for BCE.

Legacy Broadband Internet Services (Non-Fibre) represent a significant cash cow for BCE. Despite the company's strategic push towards Fibre-to-the-Home (FTTH) and a strong customer preference for this newer technology, BCE maintains a substantial base of subscribers on its established non-fibre broadband infrastructure. This segment, while mature, continues to be a reliable generator of substantial cash flow, a testament to its enduring market presence.

BCE's traditional television services, encompassing IPTV and Satellite TV, represent a classic Cash Cow within its business portfolio. These services, while mature, continue to generate substantial and reliable cash flow, requiring minimal incremental investment to maintain their market position.

In the first quarter of 2025, BCE observed a 1.5% year-over-year increase in its retail IPTV subscribers, indicating a stable and persistent demand for these offerings. This steady subscriber base is crucial for its cash-generating capabilities.

Despite the ongoing trend of consumers shifting towards internet-based entertainment solutions, BCE's traditional TV services remain profitable. The company can leverage the existing infrastructure and customer relationships to continue extracting value from this segment, even as growth moderates.

Traditional Radio and Linear TV Advertising Revenue

Traditional Radio and Linear TV Advertising Revenue within BCE's portfolio can be viewed as a classic Cash Cow in the BCG Matrix. While Bell Media saw its advertising revenue climb in Q4 2024, this growth was significantly bolstered by digital advertising and strong performance in sports specialty channels. This highlights a shift in advertising spend, leaving traditional broadcast TV advertiser demand soft.

This soft demand in traditional broadcast TV signals a mature segment. It’s a market that, while perhaps not offering explosive growth, reliably generates consistent cash flow. Think of it as a steady income stream that helps fund other, more dynamic parts of the business.

- Mature Market: Traditional linear TV and radio advertising is a well-established market with limited growth potential.

- Consistent Cash Flow: Despite soft advertiser demand, these segments typically provide a predictable and stable revenue stream.

- Funding Growth: The cash generated from these Cash Cows can be reinvested into higher-growth areas like digital advertising or new media ventures.

- Low Investment Needs: Mature businesses generally require less capital investment to maintain their operations, further enhancing their cash-generating ability.

Home Phone (Legacy Wireline Services)

BCE's Home Phone, or legacy wireline services, continues to experience net losses in retail residential Network Access Services (NAS). This trend, evident in Q1 2025, highlights the persistent shift away from traditional landlines towards wireless and internet-based communication solutions.

Despite the decline, this segment remains a cash cow for BCE. It operates in a mature, shrinking market, yet it still generates significant cash flow without requiring substantial new investment. This allows BCE to allocate capital to its growth areas.

- Market Position: Mature, declining revenue streams.

- Cash Flow Generation: Generates positive cash flow with low capital expenditure needs.

- Strategic Role: Funds investment in higher-growth segments like 5G and fiber.

- Customer Trend: Ongoing substitution to wireless and internet services.

BCE's traditional wireless postpaid mobile phone services are a strong Cash Cow. With over 9.5 million subscribers in Q1 2025, this segment delivers consistent revenue despite market competition. The focus on retaining high-value customers, even with a slight subscriber dip, ensures a stable income stream crucial for funding other ventures.

Legacy Broadband Internet Services (Non-Fibre) also function as a Cash Cow. While BCE prioritizes fibre expansion, this established infrastructure continues to provide substantial and reliable cash flow. This segment demonstrates the enduring profitability of mature services.

BCE's traditional television services, including IPTV and Satellite TV, are classic Cash Cows. Q1 2025 saw a 1.5% year-over-year increase in retail IPTV subscribers, underscoring the stable demand. These services require minimal investment to maintain their market position and continue generating significant cash.

Traditional Radio and Linear TV Advertising Revenue, despite soft demand in broadcast TV, acts as a Cash Cow. While digital and specialty channels saw growth in Q4 2024, the mature broadcast segment provides a predictable revenue stream, essential for supporting higher-growth areas within Bell Media.

Home Phone, or legacy wireline services, despite a decline in residential Network Access Services in Q1 2025, remains a cash cow. This mature, shrinking market still generates significant cash flow with low capital expenditure needs, effectively funding BCE's investments in growth areas like 5G and fiber.

| Segment | BCG Category | Key Characteristics | Q1 2025 Data/Notes |

|---|---|---|---|

| Wireless Postpaid Mobile | Cash Cow | Large, stable subscriber base; consistent revenue generation. | Over 9.5 million subscribers; focus on high-value customers. |

| Legacy Broadband (Non-Fibre) | Cash Cow | Mature infrastructure; reliable cash flow despite fibre push. | Continues to be a substantial cash generator. |

| Traditional TV (IPTV, Satellite) | Cash Cow | Mature services; minimal investment needed; stable demand. | 1.5% YoY increase in retail IPTV subscribers (Q1 2025). |

| Traditional Advertising | Cash Cow | Mature market; predictable revenue stream. | Soft demand in broadcast TV, but provides steady income. |

| Home Phone (Legacy Wireline) | Cash Cow | Shrinking market; low capex; generates significant cash. | Net losses in retail NAS, but cash flow funds growth areas. |

Preview = Final Product

BCE BCG Matrix

The BCG Matrix document you are currently previewing is precisely the same comprehensive report you will receive immediately after completing your purchase. This means you'll get the fully formatted, analysis-ready file without any watermarks or sample data, ensuring you have a professional tool for strategic decision-making from the moment of acquisition.

Dogs

Traditional landline voice services are firmly in the Dogs quadrant of the BCG Matrix. These legacy offerings are grappling with significant declines, with a notable trend of consumers migrating to mobile and internet-based communication platforms. For instance, by the end of 2023, the number of residential landline connections in many developed nations continued its downward trajectory, often seeing year-over-year decreases exceeding 5%.

This segment exhibits both low growth prospects and a diminishing market share, positioning it as a prime candidate for divestiture or at best, minimal strategic investment. Companies often find that the resources required to maintain these declining services outweigh the potential returns, leading to a focus on shedding these assets or reducing operational expenditure to the bare minimum.

Satellite TV services, like those offered by BCE, are categorized as Dogs in the BCG Matrix. This is because they operate in a declining market, with consumers increasingly opting for streaming platforms and internet-based television (IPTV).

In 2024, the trend of cord-cutting continued, with a significant portion of households discontinuing traditional cable and satellite subscriptions. This shift directly impacts the market share and revenue potential for satellite TV providers.

Consequently, satellite TV represents a low-growth, low-market-share business for BCE, demanding resources without generating substantial returns, fitting the profile of a Dog within the BCG framework.

The permanent closure of The Source stores, a move stemming from BCE's strategic distribution partnership with Best Buy Canada, signifies a deliberate shift away from this traditional retail channel. This action highlights a recognition of the declining relevance of this particular product/channel within BCE's broader strategy.

This strategic pivot suggests The Source stores were likely a cash trap, draining resources without commensurate returns, prompting BCE to minimize its footprint in this area. In 2023, BCE reported a significant reduction in its retail segment, with efforts focused on streamlining operations and optimizing distribution networks.

Very Low to Non-Revenue Generating Business Mobile Subscribers

In Q1 2024, BCE made a strategic adjustment to its mobile phone postpaid subscriber count, specifically by removing business market subscribers who generated very little to no revenue. This move aligns with the principles of the BCG Matrix, where such segments are categorized as 'dogs'.

These 'dog' subscribers, while still active on the network, consume resources like customer service and network capacity without offering a commensurate return. By identifying and potentially phasing out these low-value relationships, BCE aims to streamline operations and focus investment on more promising growth areas.

This strategic pruning is crucial for optimizing resource allocation. For example, if a company has a significant portion of its subscriber base in such a low-revenue category, it could be tying up capital that could otherwise be invested in expanding high-growth services or improving customer experience for profitable segments.

- BCE's Q1 2024 adjustment targeted business market subscribers with minimal revenue generation.

- These subscribers are classified as 'dogs' in the BCG Matrix due to low revenue and growth potential.

- This strategic move aims to optimize resource allocation and operational efficiency.

Certain Acquired Internet Brands (e.g., Distributel, Acanac, Oricom, B2B2C)

Certain acquired internet brands, such as Distributel, Acanac, Oricom, and B2B2C, likely fall into the question marks or dogs category of the BCG Matrix for BCE. In the first quarter of 2025, BCE notably ceased offering new retail IPTV plans through these specific acquired brands. This strategic move indicates these brands or their associated services experienced low market share and limited growth, making them prime candidates for divestiture or a significant reduction in emphasis within BCE's portfolio.

The decision to discontinue new IPTV sales under these brands suggests a re-evaluation of their contribution to BCE's overall market position and profitability.

- Low Market Share: The brands likely held a minor share of the retail IPTV market, making continued investment less justifiable.

- Limited Growth Potential: Stagnant or declining subscriber numbers for IPTV services under these brands would place them in a low-growth scenario.

- Strategic Divestment Consideration: BCE may be preparing to sell off these underperforming assets to focus resources on more promising ventures.

- Brand Rationalization: This action is part of a broader strategy to streamline the brand portfolio and enhance operational efficiency.

The "Dogs" in the BCG Matrix represent business units or products with low market share and low market growth. For BCE, traditional landline voice services exemplify this category, experiencing significant declines as consumers shift to mobile and internet-based communication. By the end of 2023, residential landline connections saw year-over-year decreases often exceeding 5% in developed markets, underscoring their diminishing relevance and low return potential.

Satellite TV services also fit the Dogs quadrant due to a declining market, with streaming and IPTV gaining dominance. The continued trend of cord-cutting in 2024 directly reduced the market share and revenue for satellite providers. Consequently, these services represent a low-growth, low-market-share segment for BCE, demanding resources without substantial returns.

BCE's strategic closure of The Source stores in 2024, following a distribution partnership with Best Buy Canada, highlights a move away from underperforming channels. This action suggests The Source was a cash trap, draining resources without commensurate returns. In 2023, BCE reported a significant reduction in its retail segment, focusing on streamlining operations.

In Q1 2024, BCE reclassified mobile phone postpaid subscribers by removing low-revenue business market customers. These subscribers, consuming resources without significant return, are classified as 'dogs'. This strategic pruning aims to optimize resource allocation, allowing BCE to focus investment on more profitable and growing areas.

Acquired internet brands like Distributel and Acanac, which ceased new retail IPTV plan offerings in Q1 2025, also likely fall into the Dogs category. This decision indicates low market share and limited growth for these brands, making them candidates for divestiture or reduced emphasis within BCE's portfolio.

Question Marks

BCE's planned acquisition of Ziply Fiber positions the company within the U.S. fiber internet market, a sector with substantial growth potential. This move is characteristic of a question mark in the BCG matrix, as BCE is entering a high-growth industry where it currently holds a minimal market share.

The strategic rationale involves significant capital deployment to establish a stronger foothold, aiming to capture a larger portion of the expanding U.S. fiber market. For instance, the U.S. broadband market is projected to grow, with fiber-to-the-home (FTTH) deployments accelerating, indicating a fertile ground for expansion despite the initial low market penetration for BCE.

BCE's strategic focus on new digital platforms and advertising technology positions it within the question marks of the BCG matrix. The company is actively investing in these areas to capitalize on the burgeoning digital advertising market. For instance, BCE's Bell Media segment has seen significant digital revenue growth, with advertising revenue in digital media increasing by approximately 15% year-over-year in the first quarter of 2024, reflecting the ongoing expansion and adoption of its digital offerings.

These digital ventures, while demonstrating strong growth potential, are characterized by rapid evolution and intense competition, necessitating sustained investment to secure a leading market position. BCE's commitment to enhancing its advertising technology stack aims to provide more sophisticated targeting and measurement capabilities for advertisers, a crucial factor in capturing a larger share of the digital ad spend. The company's continued investment in this space is critical to transforming these question marks into stars.

Bell Smart Home is positioned as a Question Mark in the BCG Matrix for BCE. While the smart home market is experiencing robust growth, with projected global revenues to reach over $170 billion by 2024, Bell's penetration in this newer segment is likely lower than its established telecom services. This necessitates strategic investment to capture a larger market share and transition these offerings into Stars.

Emerging IoT Services Beyond Connected Cars

While BCE's connected car subscriptions are a solid performer, the company is also investing heavily in broader business IoT services. This strategic move targets the expansive Internet of Things market, which is experiencing robust growth.

However, some of these emerging IoT services are still in their early stages, meaning they may currently hold a low market share. Consequently, substantial investment is needed to foster their growth and achieve scalability.

- IoT Market Growth: The global IoT market was valued at approximately $1.1 trillion in 2023 and is projected to reach $2.1 trillion by 2027, indicating significant expansion potential.

- BCE's Investment: BCE has been actively expanding its enterprise IoT solutions, focusing on areas like smart cities, industrial automation, and supply chain management, which are all high-growth segments within the broader IoT landscape.

- Nascent Service Challenges: New IoT services, such as predictive maintenance for manufacturing or advanced fleet management analytics, often require considerable R&D and market development to gain traction against established players or alternative solutions.

Strategic Partnerships for US Fibre Infrastructure

BCE's strategic partnership with PSP Investments to bolster U.S. fibre infrastructure aligns with the Stars quadrant of the BCG Matrix. This venture targets a high-growth market, indicating significant future potential for revenue generation and market share expansion in the broadband sector.

These collaborations are essentially new ventures, meaning BCE's direct market share within these specific fibre expansion projects is still in its nascent stages, reflecting the characteristic uncertainty of Stars. For instance, BCE's investment in this U.S. fibre expansion is part of a broader strategy to capitalize on the increasing demand for high-speed internet, a market projected to see substantial growth through 2024 and beyond.

- Growth Potential: The U.S. fibre infrastructure market is experiencing robust growth, driven by demand for 5G, cloud services, and increased data consumption.

- Investment Focus: BCE's partnership with PSP Investments signifies a strategic allocation of capital towards high-potential, albeit developing, market segments.

- Market Share Development: While the overall market is promising, BCE's specific market share within these new fibre infrastructure projects is still being established.

- Future Outlook: This strategic move positions BCE to capture future market share as the demand for advanced connectivity solutions continues to escalate.

Question Marks represent business units or products in high-growth markets where the company has a low market share. These ventures require significant investment to increase market share and potentially become Stars. Failure to do so could result in them becoming Dogs.

BCE's investment in the U.S. fiber internet market through the acquisition of Ziply Fiber exemplifies a Question Mark. While the market is expanding, BCE's current share is minimal, necessitating substantial capital to establish a stronger presence.

Similarly, BCE's focus on new digital platforms and advertising technology places these initiatives in the Question Mark category. The company is actively investing to grow its share in the dynamic digital advertising landscape, as evidenced by a 15% year-over-year increase in digital media advertising revenue in Q1 2024.

| BCE Initiative | Market Growth | BCE Market Share | Strategic Need |

|---|---|---|---|

| Ziply Fiber Acquisition (U.S. Fiber Internet) | High | Low | Significant Investment for Market Share Growth |

| Digital Platforms & Advertising Technology | High | Developing | Sustained Investment for Market Leadership |

| Bell Smart Home | High (Global market > $170B by 2024) | Low | Investment to Capture Market Share |

| Broader Business IoT Services | High (Global market ~$1.1T in 2023, projected $2.1T by 2027) | Nascent for new services | R&D and Market Development |

BCG Matrix Data Sources

Our BCG Matrix leverages a blend of internal financial data, public company reports, and comprehensive market research to provide a clear strategic overview.