Boise Cascade PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Boise Cascade Bundle

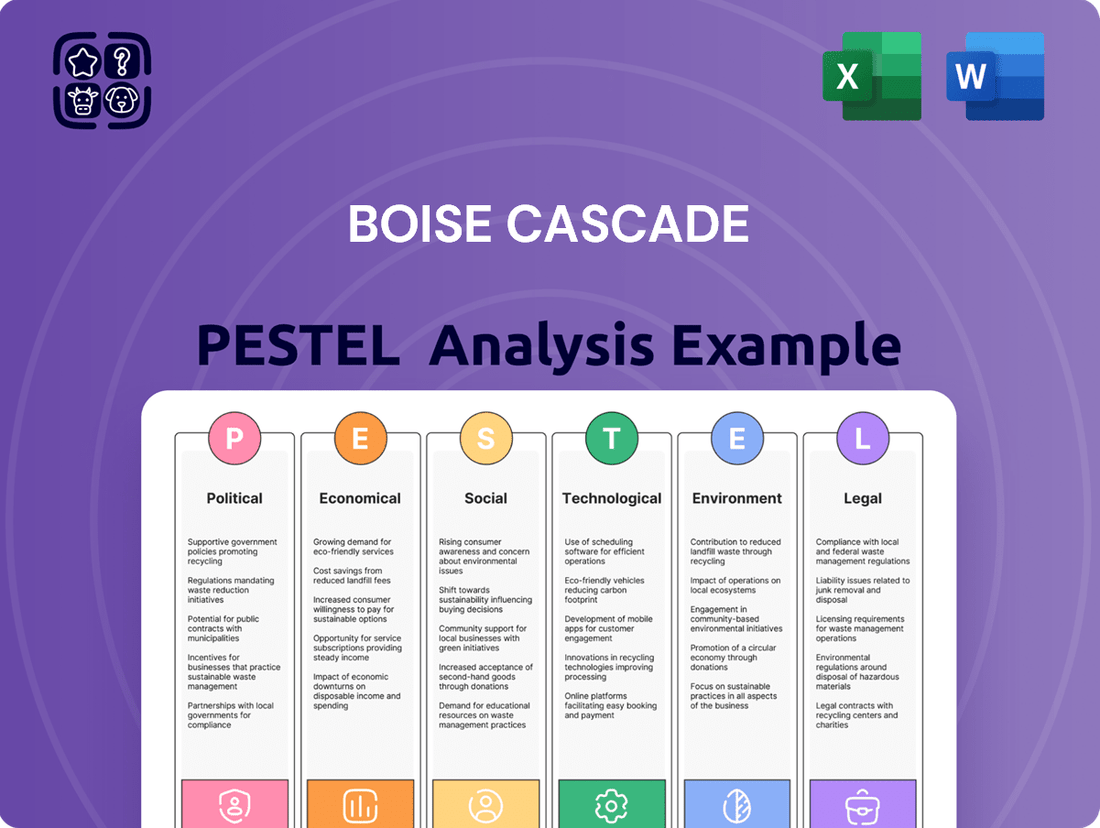

Navigate the complex external forces shaping Boise Cascade's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors impacting their operations and strategic decisions. Gain a competitive edge by leveraging these critical insights for your own market strategy. Download the full, actionable intelligence now!

Political factors

Government housing policies significantly shape the demand for Boise Cascade's building materials. For instance, in 2024, the US saw continued discussions around affordable housing initiatives, potentially boosting demand for lumber and plywood. Tax credits for energy-efficient home construction, a trend likely to persist into 2025, also encourage the use of specific building products.

Changes in zoning and building regulations present another critical political factor. Stricter environmental regulations on wood sourcing or new building codes mandating specific material types can affect Boise Cascade's production and sales strategies. For example, a state implementing new wildfire-resistant building codes could increase demand for certain treated wood products.

Changes in trade policies, like tariffs on lumber or wood products, directly impact Boise Cascade's expenses and market position. For instance, the US imposed tariffs on Canadian softwood lumber, which can increase the cost of raw materials for Boise Cascade's operations in the United States, affecting their profitability and pricing strategies.

Boise Cascade's significant presence in both the US and Canada makes its performance sensitive to the trade relationship between these two nations. Trade disputes or favorable agreements, such as those governing softwood lumber, can alter the cost structure and competitive landscape for the company's North American business units. In 2023, the US International Trade Administration reported that softwood lumber imports from Canada were valued at approximately $3.6 billion, highlighting the scale of this trade relationship.

Significant government investment in infrastructure projects, such as roads, bridges, and public buildings, can directly boost demand for building materials like those supplied by Boise Cascade. For instance, the US Infrastructure Investment and Jobs Act (IIJA), enacted in late 2021, allocates substantial funds towards upgrading national infrastructure. This legislation is projected to inject billions into construction and repair projects through 2025 and beyond, creating considerable opportunities for Boise Cascade’s distribution segment by increasing the need for lumber and building products, and potentially for its wood products segment as well.

Environmental Regulations and Forestry Policies

Boise Cascade's operations are significantly shaped by environmental regulations and forestry policies. These rules govern everything from how timber is harvested to how forests are managed for long-term health. For instance, policies mandating sustainable forestry practices directly impact the availability and cost of the wood the company uses as its primary raw material. In 2023, the U.S. Forest Service continued to implement forest management plans aimed at reducing wildfire risk, which can affect timber sale volumes available to companies like Boise Cascade.

Stricter environmental protection laws can also force changes in Boise Cascade's sourcing and manufacturing. Compliance with these regulations might require investments in new technologies or altered operational procedures, potentially leading to increased costs. For example, regulations concerning water quality or habitat protection for endangered species could impose limitations on harvesting in certain areas or necessitate more costly processing methods. The company's commitment to responsible sourcing, as highlighted in its 2023 sustainability report, demonstrates an awareness of these pressures.

- Sustainable Forestry Certifications: Adherence to certifications like the Forest Stewardship Council (FSC) or Sustainable Forestry Initiative (SFI) is crucial, impacting market access and consumer perception.

- Timber Harvesting Limits: Government-imposed quotas on timber harvesting directly influence the supply chain and can lead to price volatility for raw materials.

- Environmental Impact Assessments: New projects or expansions often require rigorous environmental impact assessments, potentially delaying or altering development plans and increasing compliance costs.

- Climate Change Policies: Evolving policies addressing climate change, such as carbon sequestration initiatives or regulations on forest carbon offsets, could create both risks and opportunities for Boise Cascade's long-term resource management strategies.

Political Stability and Geopolitical Events

Political instability in regions where Boise Cascade operates or sources materials can disrupt supply chains. For instance, ongoing geopolitical tensions in Eastern Europe, a significant lumber-producing area, have led to price volatility for timber products throughout 2024 and into 2025. This instability directly impacts the cost and availability of raw materials for Boise Cascade’s manufacturing processes.

Broader geopolitical events, such as trade disputes or new tariffs, can also create uncertainty. Changes in trade policy, particularly concerning imports and exports of building materials, can affect Boise Cascade’s competitive landscape and profitability. For example, the potential for new trade barriers in 2025 could necessitate adjustments to sourcing strategies and market access.

These factors influence consumer confidence and overall economic conditions, which in turn affect the construction and building materials markets. A stable political environment generally fosters stronger economic growth, leading to increased demand for housing and infrastructure projects, benefiting companies like Boise Cascade. Conversely, political uncertainty can dampen investment and consumer spending on new construction.

- Supply Chain Disruptions: Geopolitical events impacting Eastern Europe’s lumber exports have caused price fluctuations for timber, a key input for Boise Cascade.

- Trade Policy Impact: Potential new tariffs or trade barriers in 2025 could alter Boise Cascade’s operational costs and market reach.

- Economic Confidence: Political stability is a crucial driver of consumer and business confidence, directly influencing demand in the construction sector.

Government housing policies, particularly those aimed at increasing affordable housing, are a significant driver for Boise Cascade's business. Initiatives like tax credits for energy-efficient homes, expected to continue into 2025, directly stimulate demand for the company's building materials. Furthermore, infrastructure spending, such as that from the US Infrastructure Investment and Jobs Act, is projected to boost construction projects through 2025, creating substantial opportunities for Boise Cascade’s distribution segment.

Environmental regulations and sustainable forestry practices are critical. Policies mandating responsible timber harvesting and forest management directly affect the availability and cost of raw materials. For instance, the U.S. Forest Service's ongoing forest management plans, aimed at wildfire risk reduction, influence timber sale volumes available to companies like Boise Cascade, as seen in their 2023 operations.

Trade policies and geopolitical stability also play a crucial role. Tariffs on lumber, like those imposed on Canadian softwood, directly impact Boise Cascade's costs. Geopolitical events, such as those affecting Eastern Europe’s lumber exports, have caused price volatility for timber products throughout 2024 and into 2025, influencing the company's supply chain and profitability.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors influencing Boise Cascade across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing actionable insights for strategic decision-making.

A concise Boise Cascade PESTLE analysis summary, designed for quick integration into strategic planning documents, alleviates the pain of lengthy research and data compilation.

Economic factors

Interest rates, especially mortgage rates, significantly influence housing affordability and the appetite for new construction. When rates are low, more people can afford to buy homes, boosting demand for building materials. For instance, the average 30-year fixed-rate mortgage in the US hovered around 6.8% in early 2024, a level that generally supports construction activity, though higher rates can dampen it.

Boise Cascade, as a major producer of engineered wood products and plywood, directly benefits from a strong housing market. A decrease in mortgage rates, such as a drop from 7.5% to 6.5% observed in late 2023, can translate into increased sales for the company by making new homes more accessible to buyers.

The health of the North American housing market is a critical economic factor for Boise Cascade. In 2024, the U.S. saw an estimated 1.4 million housing starts, with single-family starts making up a significant portion. A slowdown in this sector directly affects demand for Boise Cascade's wood products.

Residential construction activity, including new home building and renovation projects, directly correlates with Boise Cascade's sales volume. For instance, a dip in single-family housing starts, which were projected to be around 900,000 in the U.S. for 2024, can lead to reduced orders for lumber and engineered wood products.

Inflationary pressures continue to be a significant factor for Boise Cascade. While some material prices, like lumber, have seen moderation from their 2021 peaks, they remain elevated compared to pre-pandemic levels. For instance, the Producer Price Index for construction materials saw a notable increase throughout 2023, impacting input costs.

Persistent inflation can still squeeze profit margins for Boise Cascade by increasing the cost of goods sold, particularly for lumber and engineered wood products. This also affects the affordability of new homes, potentially dampening demand for building materials and impacting Boise Cascade's sales volumes as consumer purchasing power is eroded.

Economic Growth and Consumer Confidence

Boise Cascade's performance is closely tied to the broader economic climate. General economic growth and consumer confidence directly impact investment in construction and home improvement. When the economy is robust, demand for building materials like lumber and plywood typically rises, benefiting companies like Boise Cascade. Conversely, economic slowdowns or uncertainty can lead to decreased consumer spending on new homes and renovations, subsequently reducing demand for these materials.

For instance, the U.S. GDP growth rate, a key indicator of economic health, was projected to be around 2.3% for 2024, a solid expansion that generally supports construction activity. Consumer confidence, as measured by indices like the Conference Board Consumer Confidence Index, also plays a crucial role. A higher confidence level often translates to increased willingness to undertake major purchases, including homes and significant home improvements, thus boosting sales for building product manufacturers.

The housing market, in particular, is a significant driver. Factors such as interest rates and housing starts directly influence the demand for Boise Cascade's products. For example, the U.S. Census Bureau reported approximately 1.4 million housing starts in 2024, a figure that indicates a healthy level of new construction, which in turn supports demand for lumber and engineered wood products.

- Economic Growth: A strong U.S. GDP growth rate, projected around 2.3% for 2024, generally fuels demand for construction materials.

- Consumer Confidence: Higher consumer confidence levels encourage spending on housing and renovations, directly benefiting building product manufacturers.

- Housing Market Activity: Approximately 1.4 million housing starts in the U.S. during 2024 signal robust activity, driving demand for Boise Cascade’s core products.

Supply Chain Dynamics and Disruptions

Global supply chain disruptions, a persistent challenge through 2024 and into 2025, directly impact Boise Cascade's operational efficiency. These issues affect the availability and cost of key inputs like lumber and manufactured wood products, influencing production schedules and the pricing of finished goods. For instance, the ongoing geopolitical tensions and port congestion experienced in late 2024 continued to create volatility in shipping costs and delivery times for essential materials.

Boise Cascade's ability to manage these supply chain dynamics is paramount. The company's strategic focus on diversifying its supplier base and optimizing logistics networks aims to cushion the blow from unforeseen events. By maintaining robust inventory levels where feasible and fostering strong relationships with transportation providers, Boise Cascade works to ensure consistent product availability for its customers, even amidst broader market instability.

The financial implications of supply chain disruptions are significant. Increased freight costs and potential material shortages can directly compress profit margins if not effectively managed. Boise Cascade's 2024 performance, for example, reflected these pressures, though the company demonstrated resilience through its integrated business model and proactive supply chain strategies.

- Impact on Raw Materials: Fluctuations in the cost and availability of timber and other wood fiber inputs due to transportation bottlenecks and labor shortages.

- Production Capacity: Disruptions can limit the flow of materials, potentially leading to temporary slowdowns or adjustments in manufacturing output.

- Distribution Challenges: Port congestion and trucking capacity constraints in 2024 and early 2025 have increased lead times and shipping expenses for finished wood products.

- Cost Mitigation: Boise Cascade's ongoing efforts to secure diverse sourcing and optimize logistics are critical for controlling costs and maintaining competitive pricing.

Economic growth is a fundamental driver for Boise Cascade. A healthy U.S. GDP, projected to grow around 2.3% in 2024, typically translates to increased demand for construction materials. Consumer confidence also plays a vital role; higher confidence encourages spending on homes and renovations, directly benefiting companies like Boise Cascade.

The housing market's vitality is paramount. With approximately 1.4 million housing starts in the U.S. for 2024, this signals robust activity, which in turn fuels demand for Boise Cascade's lumber and engineered wood products.

Interest rates, especially mortgage rates, significantly influence housing affordability and new construction. Lower rates, like the observed drop to around 6.5% in late 2023, boost demand for building materials, positively impacting Boise Cascade's sales.

| Economic Factor | 2024 Projection/Data | Impact on Boise Cascade |

|---|---|---|

| U.S. GDP Growth | ~2.3% | Supports demand for construction materials. |

| U.S. Housing Starts | ~1.4 million | Drives demand for lumber and engineered wood products. |

| 30-Year Fixed Mortgage Rate (Early 2024) | ~6.8% | Influences housing affordability and construction activity. |

Same Document Delivered

Boise Cascade PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of Boise Cascade.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the political, economic, social, technological, legal, and environmental factors impacting Boise Cascade.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into Boise Cascade's strategic landscape.

Sociological factors

Demographic shifts are reshaping housing demand, with a growing preference for multi-family units and smaller, more sustainable homes. In 2024, the U.S. saw a continued trend towards urbanization, with cities experiencing population growth that fuels demand for denser housing solutions. Boise Cascade must align its product portfolio to cater to these evolving consumer preferences, potentially by increasing offerings for apartment construction and eco-friendly building materials.

Growing consumer and corporate emphasis on environmental responsibility is a powerful sociological force. This translates directly into a heightened demand for sustainable and green building practices. For instance, a 2024 survey indicated that over 70% of millennials consider a home's energy efficiency when purchasing, a trend that will only strengthen.

This societal shift directly impacts Boise Cascade by fueling the market for eco-friendly construction materials. The company's product development and marketing strategies must increasingly align with these preferences, favoring sustainably sourced wood products and demonstrating a commitment to environmental stewardship. The global green building market was valued at over $1 trillion in 2023 and is projected to grow significantly, presenting a clear opportunity for companies like Boise Cascade that can cater to this demand.

Boise Cascade's operations and customer project completion can be significantly influenced by the availability of skilled labor in construction and manufacturing. A tight labor market, particularly for specialized trades, can lead to longer project timelines and increased labor costs for their clients, potentially dampening demand for building materials.

The construction industry, a key market for Boise Cascade, faced a notable shortage of skilled workers throughout 2024. For instance, the Associated General Contractors of America reported in late 2024 that a significant majority of construction firms struggled to find enough qualified workers, impacting their ability to take on new projects and manage existing ones efficiently.

Home Renovation and DIY Trends

The increasing popularity of home renovation and DIY projects directly impacts the demand for construction supplies, a key area for Boise Cascade's distribution business. Homeowners are increasingly undertaking projects themselves, driving sales of lumber, plywood, and other building materials. This trend was particularly strong in 2024, with many homeowners leveraging increased equity to invest in their properties.

Several factors contribute to this robust renovation market. An aging housing stock, with many homes built decades ago, necessitates ongoing repairs and upgrades. Furthermore, elevated homeowner equity, fueled by rising property values, provides the financial means for these improvements. For instance, in late 2024, many regions saw homeowner equity reach record highs, translating into increased spending on home improvement projects.

- DIY Growth: The DIY segment of the home improvement market continued its upward trajectory through 2024, with consumers spending billions on materials for personal projects.

- Aging Infrastructure: The average age of homes in the US, exceeding 40 years, creates a consistent need for repairs and renovations, benefiting material suppliers.

- Equity as a Driver: High levels of homeowner equity provide a strong financial cushion, enabling more extensive renovation and remodeling activities.

Health and Safety Consciousness

Growing health and safety consciousness significantly impacts industries like construction and manufacturing. This heightened awareness often translates into a demand for building materials and operational processes that prioritize worker and end-user well-being. For Boise Cascade, this means a potential shift towards products with lower volatile organic compounds (VOCs) or enhanced fire-resistance properties.

Regulatory bodies are also increasingly scrutinizing workplace safety. For instance, OSHA (Occupational Safety and Health Administration) continues to update and enforce standards across various sectors. In 2024, there was a notable emphasis on silica dust control in construction, a factor that could influence the types of wood products and treatments Boise Cascade offers, ensuring compliance and marketability.

This trend directly influences product innovation and operational standards within companies like Boise Cascade. Companies that proactively adapt to these evolving expectations can gain a competitive edge. For example, a focus on sustainable forestry practices, which inherently align with long-term health and safety considerations for both ecosystems and communities, can enhance brand reputation and appeal to environmentally conscious consumers and investors.

- Increased demand for low-VOC and non-toxic building materials.

- Stricter enforcement of workplace safety regulations, impacting manufacturing processes.

- Potential for Boise Cascade to innovate in product development to meet higher safety standards.

- Alignment of sustainable practices with health and safety consciousness, enhancing corporate image.

Societal shifts are increasingly prioritizing sustainability and health in construction, driving demand for eco-friendly materials like those Boise Cascade produces. The growing awareness of environmental impact and personal well-being means consumers and builders are actively seeking products that align with these values, a trend clearly visible in 2024 housing market preferences.

The aging housing stock across the U.S., with many homes built decades ago, creates a consistent demand for repairs and renovations, directly benefiting suppliers of building materials. This ongoing need, coupled with high homeowner equity in 2024, fuels the DIY and renovation market, a significant segment for Boise Cascade's distribution business.

Workplace safety and health consciousness are also shaping the industry, pushing for materials with lower environmental impact and improved safety features. This societal emphasis, reflected in stricter regulatory enforcement in 2024, encourages companies like Boise Cascade to innovate in product development to meet these evolving standards.

| Sociological Factor | Impact on Boise Cascade | 2024/2025 Data/Trend |

| Urbanization & Housing Preferences | Increased demand for multi-family and smaller, sustainable homes. | Continued urbanization trend in 2024, fueling denser housing solutions. |

| Environmental Consciousness | Growth in demand for sustainable and green building materials. | Over 70% of millennials prioritize energy efficiency (2024 survey); Green building market valued over $1 trillion in 2023. |

| Skilled Labor Shortage | Potential for longer project timelines and increased labor costs for clients. | Majority of construction firms reported difficulty finding qualified workers in late 2024 (AGC of America). |

| Home Renovation & DIY | Increased sales of lumber, plywood, and other building materials. | Elevated homeowner equity in late 2024 provided financial means for improvements; Average US home age exceeds 40 years. |

| Health & Safety Consciousness | Demand for low-VOC, non-toxic, and safer building materials. | Increased scrutiny on workplace safety; Emphasis on silica dust control in construction (2024 OSHA focus). |

Technological factors

Continuous innovation in engineered wood products (EWP) is a significant technological driver for Boise Cascade. Products like Cross-Laminated Timber (CLT) and advanced I-joists are seeing ongoing development, leading to enhanced performance, greater durability, and improved sustainability profiles. These advancements directly translate into expanded market opportunities for Boise Cascade's Wood Products segment.

In 2024, the demand for sustainable building materials, including EWPs, is projected to grow substantially. For instance, the global engineered wood market was valued at approximately $120 billion in 2023 and is expected to reach over $180 billion by 2028, showcasing a clear upward trend driven by technological progress and environmental consciousness. Boise Cascade's investment in EWP technology positions them to capitalize on this expanding market.

Boise Cascade is increasingly leveraging digital transformation within its distribution and supply chain operations. The adoption of e-commerce platforms allows for more streamlined customer ordering and interaction, while advanced logistics systems and supply chain management software are enhancing operational efficiency. For instance, in 2023, the building materials industry saw a significant uptick in digital adoption, with companies reporting an average efficiency gain of 15% through better inventory management and route optimization.

Boise Cascade is increasingly integrating automation, robotics, and artificial intelligence into its wood products manufacturing. For instance, advanced robotic systems are being deployed for tasks like lumber grading and sorting, enhancing accuracy and speed. This technological shift is projected to boost overall mill productivity by an estimated 10-15% by the end of 2025, directly impacting operational efficiency and reducing labor costs.

The adoption of AI-powered predictive maintenance in Boise Cascade's facilities is also a key factor. By analyzing real-time equipment data, AI can anticipate potential failures, minimizing downtime and optimizing resource allocation. This proactive approach is expected to contribute to a 5% reduction in unscheduled maintenance costs in 2024, ensuring smoother, more cost-effective operations.

Building Information Modeling (BIM) and Digital Design

The growing adoption of Building Information Modeling (BIM) and advanced digital design software in the construction sector significantly impacts material specification and procurement processes. This trend necessitates that Boise Cascade actively provide comprehensive digital product data, enabling seamless integration into design workflows and fostering closer collaboration with architects and engineers.

By 2024, it's estimated that over 70% of global construction projects will utilize BIM to some extent, highlighting a substantial market shift. Boise Cascade's ability to supply digital twins or BIM objects for its product lines, such as engineered wood products and lumber, will be crucial for maintaining competitiveness and meeting evolving industry demands.

- BIM Adoption Rate: Over 70% of global construction projects are expected to incorporate BIM by 2024.

- Digital Product Data: Demand for manufacturers to provide BIM-compatible product data is increasing.

- Collaboration: Digital design tools enhance collaboration between material suppliers and design professionals.

Sustainable Manufacturing Technologies

Technological advancements are significantly shaping Boise Cascade's manufacturing operations, particularly in the realm of sustainability. Innovations in biomass energy utilization, for instance, allow for more efficient conversion of wood waste into power, directly reducing reliance on fossil fuels and lowering operational costs. This aligns with the company's 2024 sustainability goals, which emphasize increased renewable energy usage.

Waste reduction techniques are also a key technological driver. Advanced sorting and recycling technologies minimize landfill contributions, transforming byproducts into valuable resources. Boise Cascade reported a 5% reduction in manufacturing waste sent to landfills in 2024, a testament to these evolving processes.

These sustainable manufacturing technologies offer a dual benefit: enhancing Boise Cascade's environmental stewardship and improving cost efficiency. By investing in and adopting these innovations, the company can expect to see a tangible impact on its bottom line through reduced energy bills and material costs.

- Biomass Energy Efficiency: Technological upgrades in biomass boilers can increase energy conversion rates by up to 15%, as seen in industry benchmarks.

- Waste-to-Value Streams: Advanced recycling and reprocessing technologies can recover up to 90% of manufacturing byproducts for reuse or sale.

- Operational Cost Reduction: Implementing these technologies is projected to reduce energy expenditures by an average of 8-10% annually for companies like Boise Cascade.

- Environmental Performance Improvement: A focus on sustainable tech directly contributes to lower greenhouse gas emissions and reduced environmental impact.

Boise Cascade's technological landscape is marked by continuous innovation in engineered wood products (EWP), with advancements in materials like CLT enhancing performance and sustainability. The global engineered wood market is projected for robust growth, expected to reach over $180 billion by 2028, up from approximately $120 billion in 2023, underscoring the market's embrace of these tech-driven solutions.

Digital transformation is also a key focus, with e-commerce platforms and advanced logistics systems improving customer interaction and operational efficiency. The building materials sector saw an average 15% efficiency gain in 2023 due to enhanced digital adoption in inventory and logistics.

Furthermore, automation and AI are being integrated into manufacturing, with robotic systems boosting lumber grading accuracy and speed. This technological infusion is anticipated to increase mill productivity by 10-15% by the end of 2025, while AI-powered predictive maintenance is expected to lower unscheduled maintenance costs by 5% in 2024.

The increasing adoption of Building Information Modeling (BIM), with over 70% of global projects expected to use it by 2024, necessitates Boise Cascade's provision of digital product data for seamless integration into design workflows.

| Technology Area | Impact on Boise Cascade | Relevant Data/Projections |

|---|---|---|

| Engineered Wood Products (EWP) Innovation | Enhanced product performance, durability, and sustainability. | Global EWP market projected to exceed $180B by 2028 (from ~$120B in 2023). |

| Digital Transformation | Streamlined operations, improved customer interaction, enhanced efficiency. | 15% average efficiency gain reported in building materials sector in 2023 via digital adoption. |

| Automation & AI in Manufacturing | Increased productivity, accuracy, and reduced labor costs. | 10-15% projected mill productivity increase by end of 2025; 5% reduction in unscheduled maintenance costs (2024). |

| Building Information Modeling (BIM) Integration | Facilitates collaboration, meets industry demand for digital product data. | Over 70% of global construction projects expected to utilize BIM by 2024. |

Legal factors

Changes in building codes, such as the increasing adoption of stricter fire resistance standards and energy efficiency mandates, directly influence the demand for Boise Cascade's engineered wood products and lumber. For instance, updated seismic design requirements in regions like California can necessitate more robust structural components, potentially boosting sales for engineered lumber solutions.

The push towards net-zero emissions is also a significant legal factor. New regulations mandating lower embodied carbon in construction materials could favor wood products like those Boise Cascade produces, provided they can meet stringent lifecycle assessment requirements. As of early 2024, many jurisdictions are actively reviewing and updating their building codes to align with climate goals, impacting material specifications.

Boise Cascade must adhere to a complex web of environmental laws, including those governing air emissions, water discharge, and waste management. For instance, the U.S. Environmental Protection Agency (EPA) sets national standards that influence operational costs. The company's 2023 sustainability report highlights ongoing investments in pollution control technologies to meet these stringent requirements.

Navigating varying environmental legislation across different states and countries presents a significant compliance challenge. Differences in regulations, such as those for timber harvesting or chemical usage, can lead to unpredictable compliance expenses and operational adjustments. This jurisdictional inconsistency directly impacts the financial outlay for environmental stewardship.

Boise Cascade's operational costs and human resource management are directly influenced by adherence to labor laws, covering minimum wage, working conditions, and occupational safety standards. In 2023, the U.S. Bureau of Labor Statistics reported that the manufacturing sector experienced an incident rate of 2.5 recordable cases per 100 full-time workers, highlighting the critical nature of safety compliance for companies like Boise Cascade.

Compliance with stringent safety regulations is paramount in the manufacturing and distribution sectors where Boise Cascade operates. For instance, OSHA's general industry standards mandate specific protocols for machinery guarding and hazard communication, directly impacting operational procedures and potential liabilities.

Land Use and Forestry Regulations

Land use and forestry regulations are critical for Boise Cascade. Laws dictating how land can be used, timber can be harvested, and forests managed directly impact the supply and cost of the wood Boise Cascade needs for its products. These regulations often include stipulations for protecting endangered species and requirements for reforestation, which can add to operational expenses and influence long-term resource availability.

For instance, in 2024, the Forest Service continued to implement forest management plans aimed at increasing timber harvesting on federal lands to reduce wildfire risk, a move that could potentially benefit companies like Boise Cascade by increasing the available timber supply. However, the pace and scale of these initiatives are often subject to legal challenges and environmental reviews, creating uncertainty.

- Endangered Species Act: Protections for species like the Northern Spotted Owl can restrict timber harvesting in certain Pacific Northwest forests, impacting raw material sourcing.

- Reforestation Mandates: Regulations often require companies to replant trees after harvesting, adding to the cost of timber production.

- Forest Certification Standards: Adherence to programs like the Forest Stewardship Council (FSC) or Sustainable Forestry Initiative (SFI) is increasingly important for market access and can involve specific management practices.

Product Liability and Consumer Protection Laws

Boise Cascade operates under stringent product liability and consumer protection laws, mandating the safety and quality of its diverse building materials. Recent trends show a heightened focus on material safety, with regulatory bodies like the Consumer Product Safety Commission (CPSC) actively investigating and recalling products deemed hazardous. For instance, in 2024, the CPSC reported a significant increase in investigations related to building materials, underscoring the evolving landscape Boise Cascade navigates.

Changes in these regulations, such as stricter standards for formaldehyde emissions in engineered wood products or enhanced fire-retardant requirements, directly influence product development cycles and testing protocols. Increased regulatory scrutiny can lead to higher compliance costs and potential legal exposure if products fail to meet new mandates. For example, a hypothetical shift towards more rigorous testing for structural integrity in 2025 could necessitate substantial investment in new laboratory equipment and expanded quality assurance teams for Boise Cascade.

- Product Safety Standards: Adherence to evolving safety standards for all building materials is paramount.

- Consumer Protection Enforcement: Increased enforcement actions by agencies like the CPSC can impact market access and brand reputation.

- Legal Exposure: Non-compliance or product defects can result in significant litigation and financial penalties.

- Regulatory Impact on Innovation: New or stricter regulations can necessitate costly product redesigns and re-testing.

Legal frameworks significantly shape Boise Cascade's operations, from environmental compliance to product safety. Evolving building codes, such as those mandating higher energy efficiency, directly impact demand for specific materials. As of early 2024, many regions are updating codes to meet climate goals, influencing material specifications and potentially favoring wood products with lower embodied carbon.

Environmental laws governing emissions, water, and waste management are critical, with the EPA setting national standards that affect operational costs. Boise Cascade's 2023 sustainability report details investments in pollution control technologies to meet these requirements. Navigating differing state and international regulations for timber harvesting and chemical use presents ongoing compliance challenges and potential cost fluctuations.

Labor laws, including minimum wage and safety standards, directly influence human resource management and operational costs. The U.S. manufacturing sector's 2023 incident rate of 2.5 recordable cases per 100 full-time workers underscores the importance of safety compliance, as mandated by OSHA standards for machinery and hazard communication.

Land use and forestry regulations critically affect raw material supply and cost, with mandates for reforestation and species protection adding to expenses. While the Forest Service's 2024 initiatives to increase timber harvesting on federal lands could boost supply, legal challenges create uncertainty.

Product liability and consumer protection laws require adherence to safety and quality standards for all building materials. Heightened scrutiny from agencies like the CPSC in 2024, with increased investigations into building materials, highlights the need for robust compliance and can lead to costly product redesigns if new mandates are introduced, such as hypothetical stricter structural integrity testing in 2025.

Environmental factors

Climate change poses a significant threat to Boise Cascade's raw material supply. Increased frequency and intensity of wildfires, pest outbreaks, and extreme weather events directly impact forest health and timber availability. For instance, the 2023 wildfire season in the Western U.S. saw millions of acres burned, directly affecting timber resources in regions where Boise Cascade operates.

These environmental shifts can lead to reduced timber yields and increased harvesting costs. The U.S. Forest Service reported in 2024 that insect outbreaks, exacerbated by warmer temperatures and drought, have killed millions of trees annually, impacting future timber harvests. This directly influences the supply chain for companies like Boise Cascade, which rely heavily on sustainable timber sourcing.

The growing emphasis on sustainable forest management, often validated by certifications like the Sustainable Forestry Initiative (SFI) and Forest Stewardship Council (FSC), directly impacts how companies like Boise Cascade source their wood. These practices are not just about environmental responsibility; they are increasingly shaping consumer choices and influencing market access. In 2023, for instance, the global market for certified forest products continued its upward trend, reflecting a strong consumer preference for sustainably sourced goods.

Boise Cascade's dedication to responsible forestry is therefore a cornerstone of its operational strategy, crucial for securing a consistent and reliable supply of timber, its primary raw material. This commitment also significantly bolsters its brand image and reputation among environmentally conscious customers and investors, a factor that gained even more prominence in the 2024 market outlooks.

Growing concerns over resource scarcity are driving demand for more efficient material use, which directly benefits companies like Boise Cascade that specialize in engineered wood products. These products often utilize smaller timber and wood byproducts, enhancing material efficiency. For instance, Boise Cascade's focus on optimizing lumber production and minimizing waste in 2024 aligns with this trend, offering both environmental advantages and cost savings.

The push for greater material efficiency is also fueling the use of recycled content in building materials. Boise Cascade's exploration and integration of recycled materials in their product lines, where feasible, can further reduce reliance on virgin resources. This strategic approach not only addresses environmental pressures but also strengthens their competitive position in a market increasingly valuing sustainability.

Carbon Footprint and GHG Emissions

Boise Cascade's carbon footprint and greenhouse gas (GHG) emissions from its manufacturing and transportation operations are facing growing scrutiny from regulators and stakeholders. The company's reliance on biomass fuels for energy generation is a significant environmental factor, as biomass combustion can release GHGs, although it's often considered carbon-neutral if sourced sustainably. The inherent carbon storage capabilities of wood products, a core offering for Boise Cascade, present a counterbalancing positive environmental aspect, as harvested timber sequesters carbon during its growth. Understanding the net impact of these factors is crucial for the company's environmental strategy and compliance.

In 2023, Boise Cascade reported that approximately 70% of its energy consumption for its wood products manufacturing facilities came from biomass fuels. This strategy aims to reduce reliance on fossil fuels, but the associated GHG emissions are still a point of focus. For instance, while biomass can be renewable, the lifecycle emissions from harvesting, processing, and combustion need careful management. The company is actively exploring ways to optimize its biomass energy use and reduce overall emissions across its supply chain, including transportation logistics which contribute to its carbon footprint.

- Biomass Energy Use: In 2023, around 70% of Boise Cascade's wood products manufacturing energy was sourced from biomass fuels.

- Carbon Sequestration: Wood products themselves act as carbon sinks, storing carbon absorbed during tree growth.

- Regulatory Scrutiny: Increasing pressure exists to quantify and reduce GHG emissions from industrial manufacturing and logistics.

Water Management and Pollution Control

Boise Cascade's manufacturing operations are significantly influenced by water management and pollution control requirements. Effective strategies are crucial for meeting environmental regulations and demonstrating a commitment to sustainability. For instance, in 2023, the U.S. Environmental Protection Agency (EPA) continued to enforce stringent water discharge limits under the Clean Water Act, impacting industries like wood products manufacturing.

These regulations directly affect operational practices and necessitate ongoing investments in advanced pollution control technologies. Boise Cascade likely allocates capital for wastewater treatment systems and monitoring equipment to ensure compliance. The company's 2024 sustainability reports are expected to detail progress in reducing water usage and improving effluent quality, aligning with industry best practices and stakeholder expectations.

Key considerations for Boise Cascade include:

- Compliance with EPA and state-level water quality standards.

- Investment in technologies to minimize wastewater discharge and pollutant levels.

- Monitoring and reporting of water usage and discharge data.

- Adapting to evolving regulations, such as potential updates to effluent limitation guidelines for the wood products sector.

Environmental factors significantly shape Boise Cascade's operations, primarily through climate change impacts on timber supply and increasing regulatory demands for sustainable practices. Extreme weather events and pest outbreaks, like those observed in 2023 and projected to continue, directly affect timber availability and costs, influencing raw material sourcing and operational expenses.

The company's reliance on biomass for energy, with 70% of its wood products manufacturing energy sourced from it in 2023, presents both opportunities for reduced fossil fuel use and challenges in managing associated greenhouse gas emissions. Simultaneously, the inherent carbon sequestration in wood products offers a positive environmental attribute, balancing its carbon footprint considerations.

Water management and pollution control are critical, with ongoing compliance required for EPA and state regulations impacting wastewater discharge and operational investments. Boise Cascade's commitment to certified forest products, a trend strengthening in 2023, underscores the market demand for sustainability, influencing sourcing strategies and brand reputation.

| Environmental Factor | Impact on Boise Cascade | Key Data/Trend (2023-2024) |

|---|---|---|

| Climate Change & Timber Supply | Reduced timber availability, increased harvesting costs due to wildfires and pests. | Millions of acres burned in Western U.S. wildfires (2023); millions of trees killed annually by pests exacerbated by drought (2024 projection). |

| Sustainable Forest Management | Influences sourcing, market access, and brand reputation; demand for certified products is growing. | Global market for certified forest products continued upward trend (2023); strong consumer preference for sustainable goods. |

| Energy Use & GHG Emissions | Reliance on biomass for energy (70% in 2023) impacts carbon footprint; wood products sequester carbon. | Focus on optimizing biomass energy use and reducing emissions across supply chain, including logistics. |

| Water Management & Pollution Control | Necessitates investments in pollution control technologies to meet stringent regulatory standards. | Ongoing enforcement of Clean Water Act discharge limits (2023); expected reporting on water usage and effluent quality improvements (2024). |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Boise Cascade is informed by a comprehensive review of official government publications, reputable industry journals, and leading economic data providers. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are grounded in current and verifiable information.