Boise Cascade Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Boise Cascade Bundle

Discover how Boise Cascade leverages its product portfolio, pricing strategies, distribution channels, and promotional activities to capture market share. This analysis dives into the core elements of their marketing mix, revealing the strategic decisions that drive their success in the building materials industry.

Go beyond the surface-level understanding and gain access to an in-depth, ready-made Marketing Mix Analysis covering Boise Cascade's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants seeking actionable strategic insights.

Product

Boise Cascade's engineered wood products (EWP), such as I-joists and laminated veneer lumber (LVL), offer superior strength and stability compared to traditional lumber. These products are crucial for modern construction, enabling more efficient building with longer lengths and fewer joints, which is a significant advantage in the current market. For instance, the demand for EWP has been robust, with the global engineered wood market projected to reach over $100 billion by 2027, indicating strong growth potential for Boise Cascade's offerings.

Boise Cascade offers a broad selection of plywood products, encompassing structural grades for building, appearance grades for visible applications, and industrial grades for various manufacturing needs. This product diversity allows them to serve a wide array of markets, from residential construction to industrial manufacturing and the repair and remodel segments.

While plywood remains a core offering, Boise Cascade is strategically shifting focus towards Engineered Wood Products (EWP). EWPs typically command higher profit margins and exhibit less price volatility compared to traditional plywood. This strategic pivot means a portion of their internally produced veneer, a key raw material for plywood, will be redirected to EWP production.

In 2023, Boise Cascade reported total net sales of $7.1 billion, with their Building Products segment, which includes plywood, contributing significantly. However, the company's stated strategy indicates a deliberate move to allocate more resources towards higher-margin EWPs, potentially impacting future plywood production volumes as they optimize their product mix for profitability and stability.

Boise Cascade's Wood Products segment extends beyond engineered wood and plywood to include ponderosa pine lumber, a key offering for industrial converters and home centers. This diversification broadens their market reach and customer appeal.

In 2023, the Wood Products segment generated $3.4 billion in revenue, showcasing the significant contribution of lumber and other wood byproducts to Boise Cascade's overall financial performance. This segment's strength lies in its ability to cater to diverse industrial and retail needs.

The inclusion of various residual byproducts within the Wood Products segment further enhances Boise Cascade's value proposition. This comprehensive approach allows them to leverage all aspects of wood processing, providing a more complete solution for their clientele.

Building Materials Distribution

Boise Cascade's Building Materials Distribution (BMD) segment offers a vast product catalog essential for construction. This includes their engineered wood products (EWP) alongside essential commodities like OSB and lumber, plus a wide range of siding, metal goods, insulation, roofing, and composite decking. This broad offering positions BMD as a vital partner for builders and contractors seeking a single, reliable source for their project needs.

The BMD segment is a cornerstone of Boise Cascade's market presence, acting as a critical intermediary in the construction supply chain. In 2023, Boise Cascade's Building Materials Distribution segment generated approximately $6.6 billion in revenue, highlighting its significant contribution to the company's overall financial performance. This segment's success is driven by its ability to provide a diverse and readily available inventory.

- Product Breadth: Distributes EWP, OSB, lumber, siding, metal products, insulation, roofing, and composite decking.

- Market Reach: Serves as a key supplier to builders and contractors across various construction sectors.

- Revenue Contribution: Generated approximately $6.6 billion in revenue in 2023 for Boise Cascade.

- Supply Chain Integration: Acts as a crucial link, ensuring product availability for construction projects.

Value-Added Solutions and Support

Boise Cascade extends beyond mere product provision, offering comprehensive support and integrated solutions. This commitment is particularly evident in their engineered wood products, where they supply technical assistance, dedicated customer service, and a sophisticated software suite. This software streamlines crucial processes like design optimization, estimating, and material take-offs, directly contributing to project efficiency and customer satisfaction.

These value-added services are designed to bolster customer success, ensuring smoother and more efficient construction projects. For instance, their integrated software solutions can significantly reduce design time and material waste. In 2024, companies leveraging advanced design software in the construction sector reported an average of 15% reduction in project timelines and a 10% decrease in material costs.

- Technical Support: Expert guidance for product application and problem-solving.

- Customer Service: Responsive assistance to address inquiries and ensure smooth transactions.

- Design Optimization Software: Tools for efficient structural design and material estimation, particularly for engineered wood.

- Project Streamlining: Aiming to enhance customer success and simplify construction workflows.

Boise Cascade's product strategy centers on a core of engineered wood products (EWP) like I-joists and LVL, prized for their strength and efficiency in construction. This is complemented by a diverse plywood offering catering to various structural and aesthetic needs. The company is strategically emphasizing higher-margin EWPs, even repurposing internal veneer production to support this growth, a move projected to align with the growing global engineered wood market, which is anticipated to exceed $100 billion by 2027.

Beyond its own manufacturing, Boise Cascade's Building Materials Distribution (BMD) segment provides a comprehensive suite of construction essentials. This includes their manufactured EWPs alongside sourced products like OSB, lumber, siding, insulation, and roofing. In 2023, this distribution arm generated a substantial $6.6 billion in revenue, underscoring its critical role in supplying the construction industry.

| Product Category | Key Offerings | 2023 Revenue Contribution (BMD Segment) | Strategic Focus |

|---|---|---|---|

| Engineered Wood Products (EWP) | I-joists, LVL | Included within BMD's $6.6B | Growth, Higher Margins |

| Plywood | Structural, Appearance, Industrial Grades | Included within BMD's $6.6B | Core Offering, Market Diversification |

| Other Building Materials (Distributed) | OSB, Lumber, Siding, Insulation, Roofing, Metal Goods, Composite Decking | $6.6 Billion (BMD Segment Total) | Comprehensive Supply Chain Solution |

What is included in the product

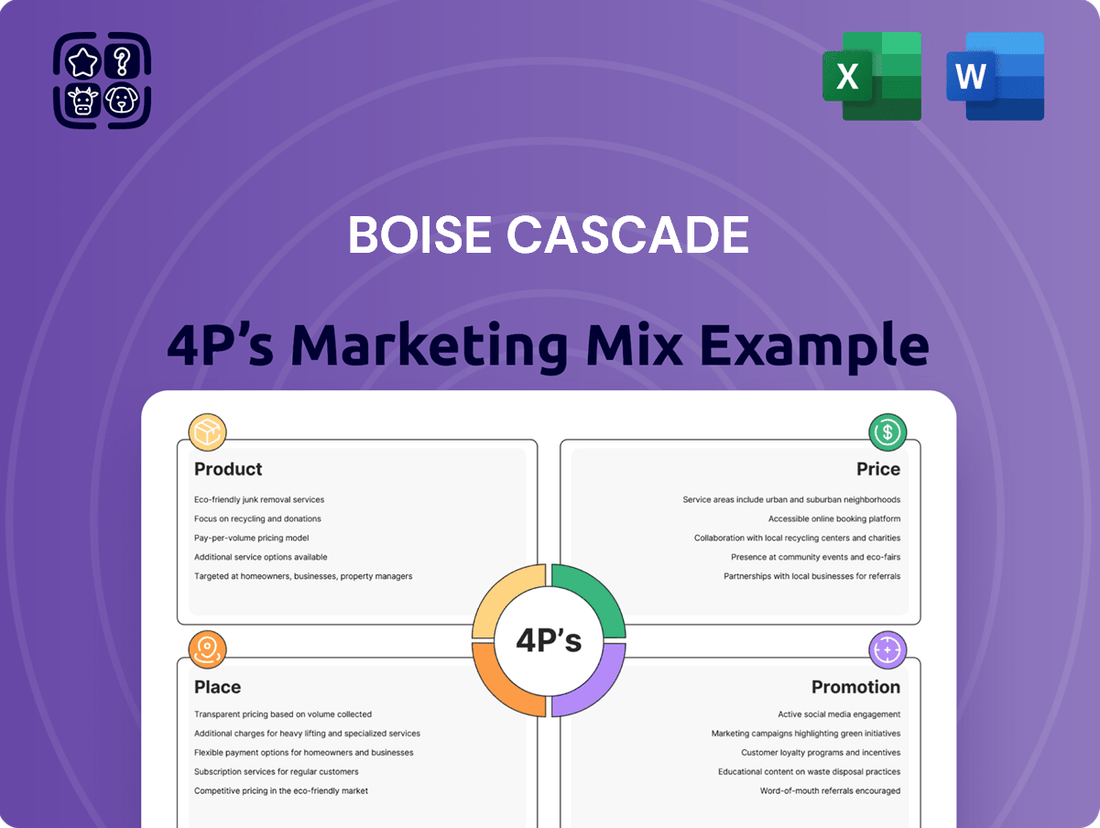

This analysis provides a comprehensive breakdown of Boise Cascade's Product, Price, Place, and Promotion strategies, offering insights into their market positioning and competitive advantages.

Simplifies complex marketing strategies into actionable insights, addressing the pain point of understanding Boise Cascade's market approach.

Provides a clear, concise overview of Boise Cascade's 4Ps, alleviating the difficulty of synthesizing broad marketing information.

Place

Boise Cascade boasts an extensive distribution network, with over 60 distribution facilities strategically located across the United States and Canada. This vast footprint ensures their engineered wood products and building materials are readily available to customers from coast to coast.

This widespread accessibility is crucial for serving a diverse customer base, including home builders, contractors, and industrial clients. In 2023, Boise Cascade reported that its distribution segment generated approximately $6.5 billion in revenue, highlighting the significant impact of its broad market reach.

Boise Cascade's integrated supply chain is a significant advantage, especially evident in its Wood Products segment's direct access to customers via its Building Materials Distribution (BMD) segment. This vertical integration allows for greater control over product flow and quality.

This seamless connection between manufacturing and distribution enables Boise Cascade to capture margins at various stages of the value chain. For instance, in the first quarter of 2024, the company reported strong performance in its BMD segment, highlighting the effectiveness of this integrated model.

Boise Cascade is strategically enhancing its distribution network to better serve customers. This includes significant investments in new facilities, such as the greenfield distribution centers planned for Hondo, Texas, with an anticipated completion in 2025, and Walterboro, South Carolina, expected to be operational in 2026. These expansions are designed to improve product availability and delivery times across key markets.

Direct Sales to Diverse Customer Base

Boise Cascade's direct sales strategy effectively reaches a broad spectrum of customers, from individual builders and contractors to larger industrial clients. This multi-pronged approach ensures their wood products and building materials are accessible across various market segments.

While the company's robust distribution network is a key component, direct sales also flow through established channels like wholesale distributors, national home improvement centers, and local retail lumberyards. This extensive reach is crucial for market penetration and customer engagement.

- Diverse Customer Segments: Builders, contractors, and industrial users are primary direct sales targets.

- Key Sales Channels: Wholesalers, home improvement centers, and retail lumberyards facilitate direct product access.

- Market Reach: In 2024, Boise Cascade's extensive dealer network served thousands of customers across North America, demonstrating the effectiveness of their direct sales approach.

Focus on Efficiency and Convenience

Boise Cascade's approach to "Place" in its marketing mix centers on making it incredibly easy for customers to get their products. This means having a strong distribution system that gets building materials to lumberyards and construction sites efficiently. Their goal is to be where the customers are, precisely when they need them, which is key for keeping projects on schedule.

To achieve this, Boise Cascade has invested heavily in its logistics and supply chain. This includes a network of manufacturing facilities, distribution centers, and transportation assets designed for maximum reach and speed. By optimizing these elements, they ensure product availability and reduce lead times, directly impacting customer satisfaction and sales.

Consider these points regarding their "Place" strategy:

- Extensive Distribution Network: Boise Cascade operates numerous manufacturing plants and distribution centers across North America, ensuring broad market coverage. For example, as of early 2024, they maintained a significant footprint with dozens of facilities strategically located to serve key construction markets.

- Logistics Optimization: The company continually refines its transportation and warehousing operations to enhance delivery speed and reduce costs. This focus on efficiency means customers experience reliable and timely access to essential building products.

- Customer Accessibility: Their placement strategy prioritizes making products readily available through a wide range of lumber and building material dealers, catering to both large contractors and smaller builders. This widespread accessibility is a cornerstone of their market penetration.

Boise Cascade's "Place" strategy is built on extensive accessibility and seamless distribution, ensuring their building materials reach customers efficiently. This involves a robust network of manufacturing facilities and distribution centers strategically positioned across North America.

The company's commitment to optimizing its supply chain means customers, from large contractors to smaller builders, experience reliable and timely access to products. This focus on logistical excellence is crucial for meeting the demands of the construction industry.

For instance, Boise Cascade's Building Materials Distribution (BMD) segment, which serves as a critical link to customers, generated approximately $6.5 billion in revenue in 2023, underscoring the scale and importance of their distribution reach.

Further enhancing their "Place" strategy, Boise Cascade is investing in new distribution centers, such as the planned facility in Hondo, Texas, expected to be operational in 2025, and another in Walterboro, South Carolina, slated for 2026. These expansions aim to bolster product availability in key markets.

| Key Distribution Metrics | 2023 Data | 2024 Outlook |

| Number of Distribution Facilities | 60+ | Expansion underway |

| BMD Segment Revenue | ~$6.5 Billion | Projected growth |

| New Facility Investments | Hondo, TX (2025), Walterboro, SC (2026) | Strategic expansion |

Preview the Actual Deliverable

Boise Cascade 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Boise Cascade 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring full transparency and value.

Promotion

Boise Cascade prioritizes transparent communication with its stakeholders through robust investor relations. The company regularly disseminates news releases, detailed financial reports including annual and quarterly filings, and insightful investor presentations. These materials offer a clear view into the company's operational performance, strategic direction, and future projections, crucial for informed decision-making by investors and financial professionals.

For instance, Boise Cascade's 2023 annual report, filed in early 2024, highlighted a net sales figure of $7.6 billion, with a focus on operational efficiency and strategic capital allocation. The company's commitment to providing timely financial data, such as their first-quarter 2024 earnings report released in April 2024, allows the market to assess their progress against strategic goals and industry benchmarks.

Boise Cascade actively promotes its dedication to sustainability and product quality through prestigious industry certifications, notably the Sustainable Forestry Initiative (SFI). This commitment underscores their eco-friendly construction practices and responsible timber sourcing, a significant draw for environmentally aware consumers.

Boise Cascade’s promotional efforts zero in on the exceptional performance and resilience of their engineered wood products. They stress how these materials offer consistent results, leading to fewer costly callbacks for builders and significantly quicker installation times, a crucial advantage in the fast-paced construction industry.

The company effectively communicates the long-term financial advantages of choosing their solutions. By focusing on durability and ease of use, Boise Cascade positions its engineered wood as a cost-effective investment that pays dividends over the lifespan of a project, appealing to both builders and end-users seeking enduring value.

Targeted Communication to Building Professionals

Boise Cascade's promotional strategy hones in on building professionals, emphasizing product adaptability for both custom residential projects and substantial commercial developments. This targeted approach ensures their message resonates with those who specify and utilize their materials.

Key to their outreach is offering robust technical support, a critical factor for contractors and builders seeking reliable solutions. This support, coupled with showcasing product innovation, aims to solidify Boise Cascade as a go-to supplier in the construction industry.

- Targeted Outreach: Focus on builders, contractors, and industrial clients.

- Product Versatility: Highlight suitability for custom homes and large-scale projects.

- Technical Support: Provide comprehensive assistance to professionals.

- Industry Engagement: Participate in trade shows and digital platforms frequented by building professionals.

Digital Presence and Content Marketing

Boise Cascade actively manages its digital presence through its website, offering detailed product information, catalogs, and helpful software tools. This digital hub also highlights their commitment to sustainability, providing valuable resources for customers and stakeholders.

The company leverages content marketing to engage its audience, sharing news updates and insights relevant to the building materials industry. This approach aims to position Boise Cascade as a knowledgeable and reliable partner.

- Website Traffic: In Q1 2024, Boise Cascade's website likely saw consistent traffic from professionals seeking product specifications and solutions.

- Content Engagement: Key content pieces, such as sustainability reports and new product announcements, are designed for high engagement among their target audience.

- Digital Tools: The availability of online tools, like project estimators or design software, enhances user experience and drives digital interaction.

- Information Dissemination: Digital platforms serve as a primary channel for communicating company news and market updates to investors and customers.

Boise Cascade's promotional strategy emphasizes the performance and durability of its engineered wood products, highlighting cost savings through reduced callbacks and faster installation for builders. They effectively communicate the long-term value proposition, positioning their materials as a sound investment for project longevity. The company also actively engages building professionals through robust technical support and digital platforms, reinforcing their role as a trusted supplier in both residential and commercial construction sectors.

Price

Boise Cascade employs value-based pricing for its engineered wood products, highlighting long-term benefits that justify a potentially higher initial investment compared to traditional lumber. This strategy focuses on the total cost of ownership for builders and developers.

The company emphasizes that features like reduced future maintenance needs, faster installation times, and enhanced durability translate into significant cost savings and improved project efficiency over the lifespan of a building. For example, the increased strength of engineered wood can lead to fewer material requirements and faster construction cycles, contributing to overall project profitability.

Boise Cascade's pricing for commodity products like lumber and plywood is heavily influenced by market forces. Factors such as economic outlook, how busy mills are, and any snags in getting materials to customers all play a role in price swings. For instance, in late 2024, lumber prices saw fluctuations influenced by housing market sentiment and global supply chain adjustments.

Boise Cascade's pricing strategy is dynamic, actively monitoring competitor pricing and fluctuating market demand to maintain a competitive edge. For instance, in early 2024, lumber prices saw significant volatility, with futures trading around $400-$500 per thousand board feet, influencing how Boise Cascade positioned its engineered wood products against traditional lumber alternatives.

The company strives to align its pricing with the perceived value and market positioning of its diverse product portfolio, which includes engineered wood products, plywood, and particleboard. This approach ensures that customers recognize the quality and utility of Boise Cascade's offerings relative to their cost.

Impact of Economic Conditions and Housing Starts

Boise Cascade's product pricing, particularly for its commodity building materials, is highly sensitive to broader economic health and the pace of new home construction. When the economy is strong and housing starts are robust, demand for lumber and other building products naturally increases, supporting higher prices. For instance, in early 2024, while interest rates remained a factor, a projected increase in single-family housing starts to around 1.4 million units was anticipated to provide a tailwind for lumber prices, benefiting companies like Boise Cascade.

Conversely, economic downturns or a slowdown in residential construction can lead to significant price volatility and pressure on sales volumes. A decrease in housing starts, such as the dip seen in late 2023, directly translates to lower demand for Boise Cascade's core products, potentially forcing price adjustments to move inventory. This dynamic underscores the importance of monitoring macroeconomic indicators and housing market trends for accurate sales and profit forecasting.

- Economic Outlook: A strong economy generally correlates with increased consumer spending and business investment, boosting demand for building products.

- Housing Starts: New single-family housing starts are a primary driver of demand for lumber, plywood, and other materials Boise Cascade produces.

- Price Volatility: Fluctuations in housing starts and economic activity can cause significant swings in commodity prices, impacting Boise Cascade's revenue and margins.

- 2024 Projections: Analysts projected a rebound in housing starts in 2024, suggesting a more favorable pricing environment for building materials compared to earlier periods.

Capital Allocation and Shareholder Returns

Boise Cascade's commitment to shareholder returns is a direct outcome of its robust financial performance and strategic capital allocation. The company's strong balance sheet, a testament to its effective pricing and sales strategies, enables consistent reinvestment in growth initiatives while also rewarding shareholders.

In 2023, Boise Cascade demonstrated this commitment through its capital return program. For instance, the company repurchased approximately $150 million of its common stock and paid out $119 million in dividends. This dual approach highlights their strategy to enhance shareholder value by both reducing outstanding shares and providing direct income.

- Financial Health: Boise Cascade maintained a strong financial position throughout 2023, with total assets reaching $6.7 billion by year-end.

- Capital Allocation: The company actively returned capital to shareholders, allocating $150 million to share repurchases and $119 million to dividends in 2023.

- Reinvestment and Growth: Despite significant shareholder returns, Boise Cascade continues to invest in its business, evidenced by capital expenditures of $200 million in 2023, supporting ongoing growth strategies.

Boise Cascade's pricing strategy for engineered wood products leverages value-based principles, emphasizing long-term benefits and total cost of ownership for customers. This approach justifies potentially higher upfront costs by highlighting reduced maintenance, faster installation, and enhanced durability, ultimately contributing to project profitability and efficiency.

For commodity products like lumber and plywood, pricing is primarily dictated by market forces, including economic conditions, mill activity, and supply chain dynamics. For example, in early 2024, lumber prices experienced volatility, trading in the $400-$500 per thousand board feet range, influenced by housing market sentiment and global supply adjustments.

The company's pricing is dynamic, closely monitoring competitor pricing and market demand to remain competitive. This adaptability is crucial, especially given the sensitivity of commodity building material prices to macroeconomic indicators and housing market trends. A projected increase in single-family housing starts to around 1.4 million units in 2024 was expected to positively impact lumber prices.

Boise Cascade's pricing aligns with the perceived value and market positioning of its diverse product range, ensuring customers recognize the quality and utility relative to cost. This strategy is supported by the company's strong financial health, with total assets reaching $6.7 billion in 2023, enabling strategic capital allocation and shareholder returns.

| Product Segment | Pricing Strategy | Key Influencing Factors | 2024/2025 Outlook |

|---|---|---|---|

| Engineered Wood Products | Value-Based Pricing | Long-term benefits, total cost of ownership, durability, installation efficiency | Continued emphasis on value proposition, potential for premium pricing |

| Commodity Building Materials (Lumber, Plywood) | Market-Driven Pricing | Economic outlook, housing starts, supply chain, competitor pricing, mill capacity | Price volatility influenced by interest rates and housing market activity; projected rebound in housing starts supports demand |

4P's Marketing Mix Analysis Data Sources

Our Boise Cascade 4P's Marketing Mix Analysis is built upon a foundation of publicly available company data, including annual reports, investor relations materials, and official press releases. We also incorporate insights from industry publications and market research reports to provide a comprehensive view of their strategies.