Boise Cascade Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Boise Cascade Bundle

Unlock the full strategic blueprint behind Boise Cascade's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Boise Cascade's key partnerships with timberland owners and raw material suppliers are foundational to its operations. These relationships ensure a steady flow of logs and veneer, vital for manufacturing its diverse range of wood products. For instance, in 2023, the company's procurement efforts focused on securing high-quality timber to meet demand for its lumber and plywood offerings.

Boise Cascade, as a wholesale distributor, cultivates strong relationships with numerous building material manufacturers. These partnerships are crucial for expanding their product offerings beyond their own manufactured wood products.

They source items like siding, composite decking, doors, millwork, metal products, roofing, and insulation from these partners. This allows Boise Cascade to present itself as a convenient one-stop-shop for contractors and builders.

For instance, in 2023, Boise Cascade's wholesale business generated $7.0 billion in revenue, underscoring the scale of their distribution network and the importance of these manufacturer relationships in achieving that volume.

Boise Cascade relies heavily on logistics and transportation providers to manage its vast distribution network. These partners are crucial for the timely movement of raw materials, like timber, to their manufacturing plants and for delivering finished products, such as plywood and engineered wood, to lumber yards and construction sites across North America. In 2023, Boise Cascade's transportation expenses were a significant part of their cost of goods sold, reflecting the scale of their operations and the necessity of these partnerships for supply chain efficiency.

Technology and Software Partners

Boise Cascade actively partners with technology and software firms to streamline its extensive operations. These collaborations are crucial for everything from fine-tuning manufacturing efficiency to making its complex supply chain more robust and elevating customer interactions.

The company invests in advanced digital tools specifically for tracking environmental data, a key area for sustainability reporting. Furthermore, they utilize specialized software designed to assist their customers with crucial design and project management tasks, thereby enhancing the overall customer experience and project success rates.

- Cloud Computing Services: Partnerships with major cloud providers ensure scalable and secure data management for operational analytics and customer platforms.

- Manufacturing Execution Systems (MES): Collaborations with MES providers help optimize production flow, track work-in-progress, and improve quality control on the factory floor.

- Customer Relationship Management (CRM) Software: Investing in sophisticated CRM systems allows for better customer engagement, sales tracking, and personalized service delivery.

- Supply Chain Visibility Tools: Partnerships in this area provide real-time tracking and analytics, enabling better inventory management and logistics coordination across their network.

Strategic Acquisition Targets

Boise Cascade actively pursues strategic acquisitions to bolster its distribution network and broaden its product portfolio. A prime example is the acquisition of BROSCO, which significantly enhanced its market presence and product reach.

These strategic moves are not merely about adding companies; they are about integrating capabilities to achieve greater market penetration and operational efficiency. This approach allows Boise Cascade to enter new geographic territories or solidify its standing in established markets.

For instance, in 2023, Boise Cascade reported net sales of $7.5 billion, with acquisitions playing a role in this revenue generation by expanding their service areas and product lines, contributing to their overall market share growth.

- BROSCO Acquisition: Expanded distribution footprint and product offerings.

- Market Expansion: Enabled entry into new geographic regions and strengthened existing market positions.

- Revenue Contribution: Acquisitions contribute to overall net sales, with $7.5 billion reported in 2023.

- Strategic Integration: Focus on integrating acquired entities to maximize operational synergies and market impact.

Boise Cascade's key partnerships with timberland owners and raw material suppliers are crucial for securing essential inputs for its manufacturing operations. These relationships ensure a consistent supply of high-quality timber, vital for producing lumber and plywood. In 2023, the company's procurement strategy emphasized sourcing sustainable timber to meet growing demand.

As a wholesale distributor, Boise Cascade collaborates with a wide array of building material manufacturers to offer a comprehensive product range. These partnerships allow them to provide customers with a one-stop-shop experience, sourcing items like siding, composite decking, and insulation. This extensive product offering contributed to their wholesale segment generating $7.0 billion in revenue in 2023.

Logistics and transportation partners are indispensable for Boise Cascade's extensive distribution network. These collaborations facilitate the efficient movement of raw materials to production facilities and finished goods to customer locations across North America. Transportation costs represented a significant portion of their cost of goods sold in 2023, highlighting the importance of these partnerships for supply chain efficiency.

| Partnership Type | Key Role | 2023 Impact/Data |

| Timberland Owners & Raw Material Suppliers | Securing timber for manufacturing | Ensured consistent supply for lumber and plywood production. |

| Building Material Manufacturers | Expanding product portfolio for wholesale | Generated $7.0 billion in wholesale revenue; offered diverse products like siding and decking. |

| Logistics & Transportation Providers | Managing distribution network | Critical for timely delivery; transportation costs a significant part of COGS. |

What is included in the product

This Boise Cascade Business Model Canvas provides a structured overview of their operations, detailing key customer segments like builders and remodelers, and their value proposition of providing quality building products and services. It outlines their channels, customer relationships, revenue streams, key resources, activities, partnerships, and cost structure.

Boise Cascade's Business Model Canvas acts as a pain point reliever by providing a clear, visual roadmap that simplifies complex strategic challenges.

It offers a structured approach to identify and address operational inefficiencies and market gaps, ultimately streamlining their business processes.

Activities

Boise Cascade's core operations revolve around manufacturing a diverse portfolio of wood products. This includes essential building materials like plywood and lumber, alongside higher-value engineered wood products such as laminated veneer lumber (LVL) and I-joists. The company actively manages intricate manufacturing processes, ensuring quality and efficiency throughout production.

A significant aspect of their key activities involves strategic investments in modernizing their facilities. These capital expenditures are aimed at boosting production efficiency and expanding overall capacity to meet market demand. For instance, in 2023, Boise Cascade reported capital expenditures of $157.1 million, with a substantial portion dedicated to improving their manufacturing assets.

The company places a strategic emphasis on producing veneer-based products. This focus is driven by the potential for higher profit margins associated with these specialized wood components, contributing significantly to their overall financial performance and competitive positioning in the market.

Boise Cascade's core activity is the wholesale distribution of a wide array of building materials. This includes their own engineered wood products and items sourced from other manufacturers, serving a vast customer network across the country.

Managing an extensive nationwide network of distribution centers is crucial. This requires meticulous inventory optimization and streamlined logistics to ensure timely deliveries, a key component of their operational efficiency.

In 2023, Boise Cascade's Building Materials Distribution segment generated $7.5 billion in revenue, highlighting the scale and importance of this key activity. This segment's success relies heavily on its ability to maintain a robust supply chain and responsive distribution infrastructure.

Boise Cascade's supply chain management is a cornerstone of its operations, focusing on the efficient procurement of wood products, lumber, and engineered wood components. This includes managing inventory levels at their numerous manufacturing facilities and distribution centers to ensure consistent product availability for their diverse customer base.

In 2023, Boise Cascade reported significant investments in optimizing its supply chain. For instance, their focus on efficient logistics helped manage transportation costs, a key factor in the building materials industry. Effective inventory control across their network of sawmills and distribution yards is crucial for meeting fluctuating market demands.

Sales and Marketing

Boise Cascade actively pursues sales and marketing to connect with its core customers, which include builders, contractors, and industrial clients. This outreach focuses on nurturing client relationships and clearly communicating the benefits of their wood products.

The company's strategy involves actively promoting the value of its offerings and staying responsive to shifts in market demand. For example, in 2024, Boise Cascade emphasized its engineered wood products, which offer advantages in construction efficiency and sustainability, appealing to a growing segment of environmentally conscious builders.

- Customer Relationship Management: Boise Cascade invests in dedicated sales teams to build and maintain strong, long-term relationships with its diverse customer base.

- Product Promotion: The company utilizes various channels, including digital marketing and industry trade shows, to highlight the quality and performance of its lumber and building materials.

- Market Responsiveness: Boise Cascade closely monitors market trends and adjusts its sales and marketing efforts to capitalize on demand for specific product lines, such as those used in residential construction.

Strategic Investments and Capital Allocation

Boise Cascade actively directs capital towards enhancing its manufacturing and distribution infrastructure. This strategy focuses on boosting operational efficiency, expanding production capacity, and introducing innovative product lines. For instance, in 2023, the company reported capital expenditures of $234.1 million, a significant portion of which was allocated to improving its existing facilities and building new distribution centers to better serve its customer base.

The company balances these strategic investments with a commitment to shareholder returns. This dual approach ensures both long-term operational strength and immediate value for investors. In 2023, Boise Cascade returned $158.1 million to shareholders through dividends and share repurchases, demonstrating a disciplined approach to capital allocation.

- Manufacturing Modernization: Investments in upgrading sawmills and plywood facilities to improve yield and reduce operating costs.

- Distribution Network Expansion: Building new distribution centers and expanding existing ones to increase market reach and delivery efficiency.

- Shareholder Returns: Consistent dividend payments and active share repurchase programs to enhance shareholder value.

- Strategic Acquisitions: Evaluating and executing strategic acquisitions that complement existing operations or expand into new product categories.

Boise Cascade's key activities center on manufacturing and distributing a wide range of wood products, including lumber, plywood, and engineered wood items. They also focus on managing their extensive supply chain and engaging in sales and marketing efforts to connect with builders and contractors.

Strategic capital allocation is another crucial activity, with significant investments in modernizing manufacturing facilities and expanding their distribution network. This is balanced with returning value to shareholders through dividends and buybacks.

| Key Activity | Description | 2023 Data/Impact |

| Manufacturing Wood Products | Producing lumber, plywood, engineered wood products (LVL, I-joists). | Focus on veneer-based products for higher margins. |

| Wholesale Distribution | Distributing own products and sourced materials nationwide. | Building Materials Distribution segment revenue: $7.5 billion. |

| Supply Chain Management | Procuring wood products, managing inventory, optimizing logistics. | Investments in optimizing logistics and inventory control. |

| Sales & Marketing | Connecting with builders, contractors; promoting product value. | Emphasis on engineered wood products in 2024. |

| Capital Expenditures | Investing in facility upgrades, capacity expansion, network growth. | Total capital expenditures: $234.1 million in 2023. |

| Shareholder Returns | Returning capital via dividends and share repurchases. | Returned $158.1 million to shareholders in 2023. |

Preview Before You Purchase

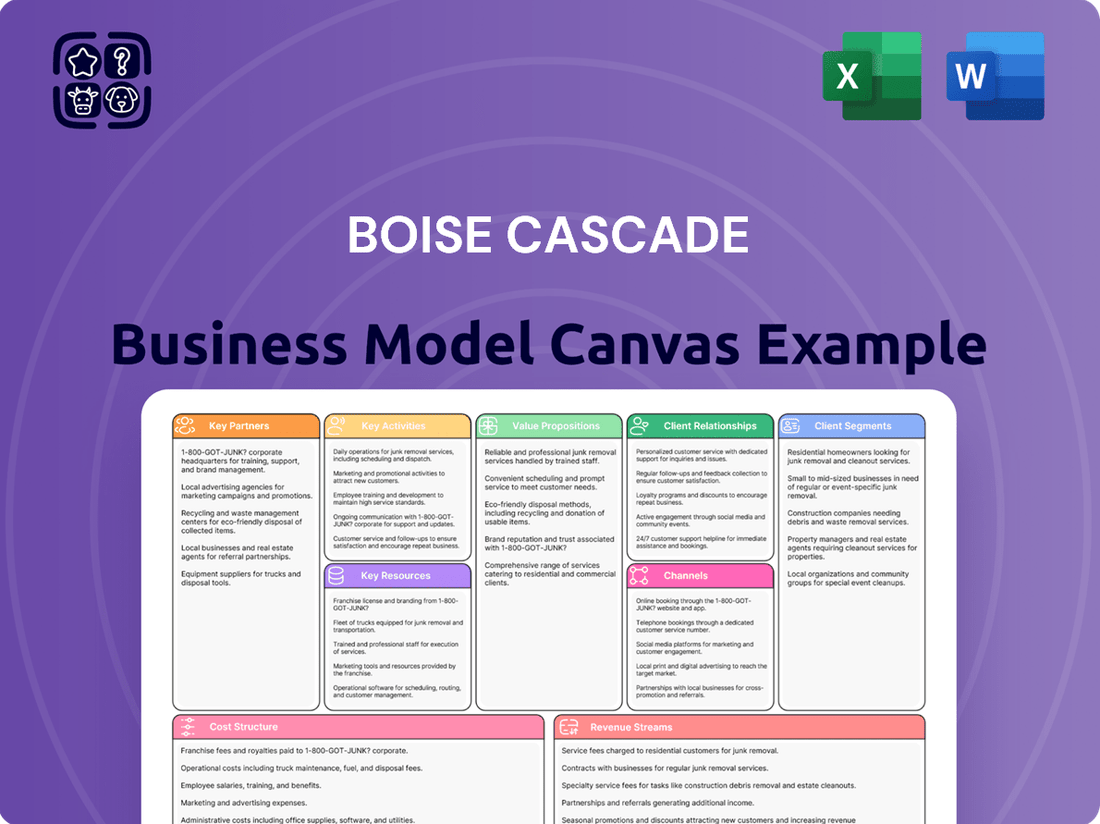

Business Model Canvas

The Boise Cascade Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or mockup; it's a direct representation of the comprehensive analysis you'll gain access to. Once your order is complete, you'll download this identical, fully detailed Business Model Canvas, ready for your strategic planning.

Resources

Boise Cascade operates a robust network of manufacturing facilities, primarily located in the Pacific Northwest and Southeastern United States. These mills are outfitted with modern equipment crucial for producing a wide range of wood products, including plywood, lumber, and engineered wood components.

In 2023, Boise Cascade's Wood Products segment, heavily reliant on these manufacturing assets, generated $4.0 billion in sales. The company's significant investment in its production capabilities, including upgrades to machinery, directly supports its ability to meet market demand and maintain a competitive edge in the wood products industry.

Boise Cascade's extensive nationwide network of over 40 distribution branches and 16 millwork door shops is a cornerstone of its business model. These strategically located facilities are vital for the efficient storage, handling, and distribution of a broad spectrum of building materials throughout North America.

Boise Cascade's success hinges on its approximately 7,500 dedicated associates. This workforce includes highly skilled manufacturing personnel adept at wood product creation and logistics experts ensuring efficient material flow. Their combined knowledge is a cornerstone of the company's operations.

The management team brings invaluable experience in the building materials sector, guiding strategic decisions and operational execution. This leadership, coupled with the hands-on skills of the manufacturing and distribution teams, forms a powerful human capital asset. In 2023, Boise Cascade reported total employee compensation and benefits of $1.1 billion, underscoring the significant investment in its people.

Proprietary Products and Brands

Boise Cascade's proprietary engineered wood products, including BCI® I-joists and Versa-Lam® LVL, are cornerstones of its business. These specialized offerings provide enhanced structural performance compared to traditional lumber. In 2023, the company reported significant revenue from its Building Materials Distribution segment, which heavily features these engineered wood products, underscoring their market importance.

The company's established brands, such as AJS® I-joists and Boise Glulam® beams, represent valuable intellectual capital. These brands are recognized for quality and reliability in the construction industry. This brand recognition allows Boise Cascade to command premium pricing and fosters customer loyalty, contributing directly to its competitive advantage.

- BCI® and AJS® I-joists: Known for their strength and consistency, these products offer design flexibility for builders.

- Versa-Lam® LVL: Laminated Veneer Lumber provides superior load-bearing capacity for beams and headers.

- Boise Glulam® beams: These engineered wood beams are strong, stable, and aesthetically pleasing for various structural applications.

Strong Financial Position and Liquidity

Boise Cascade's strong financial position is a cornerstone of its business model. A robust balance sheet, featuring substantial cash and cash equivalents, alongside significant undrawn credit lines, grants the company considerable financial flexibility. This allows for strategic investments in growth initiatives, effective management of operational hurdles, and the return of value to shareholders. For instance, as of the first quarter of 2024, Boise Cascade reported cash and cash equivalents of approximately $587 million, underscoring its liquidity.

This financial strength is not just about having cash on hand; it's about the capacity to act decisively. The company's access to substantial undrawn credit facilities further enhances its ability to navigate market fluctuations and pursue opportunities. This financial resilience is a critical enabler for its business model, supporting everything from capital expenditures to potential acquisitions.

- Robust Balance Sheet: Boise Cascade maintains a healthy financial foundation, crucial for stability and investment.

- Substantial Liquidity: Significant cash reserves and available credit lines provide ample financial flexibility.

- Growth Investment Capability: Financial strength enables strategic investments in expansion and operational improvements.

- Shareholder Value: The company's financial health supports its ability to return value through dividends and share repurchases.

Boise Cascade's key resources include its extensive manufacturing facilities, a nationwide distribution network, and a skilled workforce of approximately 7,500 associates, as of 2023. The company also leverages its proprietary engineered wood products like BCI® I-joists and Versa-Lam® LVL, alongside established brands such as AJS® and Boise Glulam®. Its strong financial position, with $587 million in cash and cash equivalents as of Q1 2024, further supports its operations and growth.

| Key Resource | Description | Relevance |

| Manufacturing Facilities | Modern mills in the Pacific Northwest and Southeast US | Production of lumber, plywood, and engineered wood products; $4.0 billion in Wood Products sales in 2023 |

| Distribution Network | Over 40 distribution branches and 16 millwork door shops | Efficient storage, handling, and distribution of building materials across North America |

| Human Capital | Approximately 7,500 associates (2023) | Skilled manufacturing, logistics, and management expertise; $1.1 billion in employee compensation and benefits (2023) |

| Proprietary Products & Brands | BCI® I-joists, Versa-Lam® LVL, AJS® I-joists, Boise Glulam® | Enhanced structural performance, market recognition, and premium pricing potential |

| Financial Strength | Robust balance sheet, substantial liquidity | Enables strategic investments, operational flexibility, and shareholder value return; $587 million cash (Q1 2024) |

Value Propositions

Boise Cascade offers a vast selection of building materials, encompassing both their own manufactured wood products, such as plywood, lumber, and engineered wood products (EWP), and a wide range of general building materials. This includes items like siding, decking, and roofing, ensuring customers have access to nearly everything they need for construction projects.

This extensive product catalog simplifies the procurement process for customers, enabling them to consolidate their purchases with a single, dependable supplier. For instance, in 2023, Boise Cascade reported net sales of $7.2 billion, reflecting the significant volume of materials they distribute across their extensive network.

Boise Cascade's value proposition centers on a robust supply chain and distribution network, ensuring customers receive essential building materials reliably. Their integrated manufacturing facilities, combined with a nationwide distribution footprint, mean consistent product availability and timely deliveries. This operational strength is crucial for customers, enabling them to maintain project timelines and avoid costly delays. For instance, in 2023, Boise Cascade's extensive network facilitated the distribution of a wide array of wood products, a testament to their logistical prowess.

Boise Cascade's commitment to quality engineered wood products (EWP) sets them apart, offering construction professionals superior performance and stability over traditional lumber. Their BCI® and AJS® I-joists, along with Versa-Lam® LVL, represent advanced framing solutions designed for efficiency and reliability.

These EWP are engineered for enhanced strength-to-weight ratios and consistent dimensions, leading to less waste and faster installation times on job sites. In 2024, the demand for sustainable and high-performing building materials continued to grow, with EWP playing a crucial role in meeting these industry needs.

Technical Support and Solutions

Boise Cascade extends its value beyond just lumber and building materials by offering robust technical support and solutions. They aim to streamline the often complex design and construction process for their clientele.

This commitment involves providing customers with essential tools, cutting-edge technology, and specialized software designed to simplify project management and execution. For instance, in 2024, Boise Cascade continued to invest in digital platforms that help builders visualize projects and optimize material usage, directly addressing common pain points in the industry.

Their technical expertise is a cornerstone of this value proposition, offering builders and contractors crucial assistance to ensure the effective and efficient application of Boise Cascade's product range. This support can range from product selection guidance to on-site troubleshooting, ultimately enhancing project outcomes and customer satisfaction.

- Design Simplification: Providing tools, technology, and software to ease the design process for customers.

- Project Management: Offering solutions to help manage complex jobs, improving efficiency for builders.

- Technical Expertise: Delivering specialized knowledge and support to ensure effective product utilization.

- Customer Empowerment: Assisting builders and contractors in maximizing the benefits of Boise Cascade's offerings.

Sustainability and Responsible Sourcing

Boise Cascade champions sustainability through rigorous forest stewardship and environmental management, appealing to a growing segment of consumers and business partners who value eco-conscious building materials and ethical supply chains. In 2023, the company reported that 99% of its timberlands were certified by the Sustainable Forestry Initiative (SFI), underscoring its dedication to responsible sourcing. This commitment resonates with customers seeking to reduce their environmental footprint and with investors focused on Environmental, Social, and Governance (ESG) factors.

This focus on responsible sourcing translates into tangible benefits for Boise Cascade. By adhering to stringent environmental standards, the company mitigates risks associated with resource scarcity and regulatory changes, ensuring a stable and reliable supply of raw materials. This also enhances brand reputation, making Boise Cascade a preferred supplier for businesses that prioritize sustainability in their own operations and product offerings.

- Forest Stewardship: 99% of Boise Cascade's timberlands were SFI-certified as of 2023, demonstrating a commitment to responsible harvesting and land management.

- Environmental Management: The company actively implements practices to minimize its ecological impact throughout the production process.

- Customer Appeal: Attracts environmentally conscious customers and partners seeking sustainable building materials and ethical supply chain partners.

- Risk Mitigation: Proactive environmental management reduces operational risks and ensures a consistent supply of responsibly sourced materials.

Boise Cascade provides a comprehensive selection of building materials, including their own engineered wood products and general construction supplies, simplifying procurement for customers. Their extensive product catalog and nationwide distribution network ensure reliable access to essential materials, as evidenced by their $7.2 billion in net sales in 2023.

The company differentiates itself through high-quality engineered wood products (EWP) like I-joists and LVL, which offer superior performance and efficiency. In 2024, the demand for these advanced framing solutions continued to rise, supporting faster construction and reduced waste.

Boise Cascade also offers significant value through technical support and digital tools, aiding customers in design and project management. Their investment in platforms that help visualize projects and optimize material usage in 2024 directly addresses common industry challenges.

Sustainability is a core value, with 99% of their timberlands certified by the Sustainable Forestry Initiative (SFI) as of 2023. This commitment appeals to environmentally conscious customers and partners, while also mitigating supply chain risks.

Customer Relationships

Boise Cascade cultivates enduring customer connections via specialized sales and account management teams. These professionals collaborate intimately with builders, contractors, and industrial clients, ensuring a deep comprehension of individual requirements.

This personalized engagement allows Boise Cascade to deliver precisely tailored solutions and ongoing support, fostering loyalty and repeat business. For instance, in 2023, the company reported strong performance in its Building Materials Distribution segment, underscoring the effectiveness of these customer-centric strategies.

Boise Cascade prioritizes forging enduring, trust-based connections with its clientele, striving to be a dependable ally. This commitment is demonstrated through open communication channels, ensuring a steady and predictable supply of their products, and actively showing dedication to their customers' growth and achievements.

In 2024, Boise Cascade's focus on these long-term relationships is a cornerstone of their strategy, particularly evident in their robust distribution segment. Their approach emphasizes reliability, a critical factor for customers in the construction and manufacturing sectors who depend on timely material delivery for project continuity and success.

Boise Cascade offers technical support and training for its engineered wood products, ensuring customers can effectively utilize these materials. This assistance helps users understand proper application techniques, leading to better project outcomes and increased product satisfaction.

In 2024, Boise Cascade continued to invest in customer education, recognizing that well-informed clients are more likely to achieve success with their building materials. This commitment translates to enhanced product performance and fosters stronger, long-term customer relationships.

Problem-Solving and Responsiveness

Boise Cascade prioritizes being a responsive partner, actively addressing customer needs and challenges. This includes swiftly resolving issues like supply chain disruptions or providing technical support, ensuring projects stay on track.

Their proactive and supportive customer service reinforces their position as a crucial ally in the construction industry. For instance, in 2024, Boise Cascade reported that over 90% of their customer inquiries were resolved within 24 hours, highlighting their commitment to efficient problem-solving.

- Proactive Issue Resolution: Addressing potential disruptions before they significantly impact clients.

- Technical Support: Offering expertise to overcome project-specific challenges.

- Supply Chain Agility: Mitigating and communicating effectively during logistical hurdles.

- Customer Satisfaction Metrics: Demonstrating responsiveness through timely query resolution.

Feedback and Improvement Mechanisms

Boise Cascade actively seeks customer input to refine its offerings. This is often achieved through direct interactions with their sales and service teams, who serve as a primary conduit for feedback from builders, dealers, and other partners.

Formal mechanisms like customer satisfaction surveys and post-project reviews are also likely utilized. These structured approaches provide quantifiable data on performance and areas needing attention, ensuring a systematic approach to improvement.

The company's commitment to continuous improvement is evident in its responsiveness to market demands and customer suggestions. For instance, in 2024, Boise Cascade continued to invest in product development, with a focus on materials that meet evolving building codes and sustainability preferences, directly informed by customer feedback.

- Direct Sales and Service Interaction: Sales representatives and customer service personnel are key channels for collecting real-time feedback from clients.

- Customer Satisfaction Surveys: Formal surveys are deployed to gauge satisfaction levels and identify specific areas for enhancement in products and services.

- Product Development Input: Customer insights directly influence Boise Cascade's product innovation pipeline, ensuring offerings align with market needs and trends.

- Market Responsiveness: Feedback mechanisms enable the company to adapt quickly to changing customer requirements and industry standards, as seen in their 2024 product updates.

Boise Cascade's customer relationships are built on personalized service and a commitment to being a reliable partner. Their dedicated sales and account management teams work closely with clients, understanding their unique needs to provide tailored solutions and ongoing support. This focus on deep client engagement, evident in their 2024 performance metrics, fosters strong loyalty and repeat business.

Channels

Boise Cascade leverages a dedicated direct sales force to cultivate strong relationships with major builders, contractors, and industrial clients. This approach ensures personalized service and efficient order management for their most significant customers.

In 2023, Boise Cascade reported that its sales force played a crucial role in securing key accounts, contributing to their overall revenue growth in the building materials sector.

Boise Cascade's Building Materials Distribution (BMD) network is a cornerstone of its business model, leveraging over 40 strategically located branches across North America. This extensive infrastructure acts as the primary conduit for delivering a diverse range of building products directly to regional and local customers, ensuring efficient market penetration and service delivery.

These BMD branches are crucial for providing localized inventory management, timely delivery services, and convenient customer pickup options. This decentralized approach allows Boise Cascade to cater effectively to the specific needs of different markets, fostering strong customer relationships and operational agility.

For 2024, Boise Cascade's BMD segment reported significant revenue contributions, demonstrating the network's vital role in the company's overall financial performance. The ability to maintain substantial inventory levels at these branches allows for prompt order fulfillment, a key competitive advantage in the fast-paced construction industry.

Boise Cascade leverages a dual approach to market access through its wholesale and retail partners. While the company maintains its own robust distribution network, it strategically collaborates with independent wholesale distributors. This partnership allows Boise Cascade to tap into established channels that reach a diverse customer base, including smaller contractors who might not directly engage with the company's primary distribution.

Furthermore, alliances with large retail chains are crucial for extending Boise Cascade's market penetration. These retail partnerships provide access to the do-it-yourself (DIY) consumer segment and smaller building professionals. For instance, in 2024, the building materials sector saw continued demand, with lumber prices fluctuating but generally remaining a significant component of construction costs. Boise Cascade's ability to reach these end-users through retail partners is vital for sustained sales volume.

Online Presence and Digital Tools

Boise Cascade leverages its corporate website as a primary channel for information dissemination, covering product details, investor relations, and sustainability efforts. This digital platform acts as a crucial touchpoint for stakeholders seeking comprehensive company data.

Digital tools and software are integral to Boise Cascade's operations, streamlining customer interactions and enhancing service delivery. These technologies facilitate efficient communication and support for their diverse customer base.

- Website Functionality: Boise Cascade's website serves as a central repository for product catalogs, technical specifications, and company news.

- Investor Relations Portal: Dedicated sections provide access to financial reports, SEC filings, and shareholder information, crucial for financial decision-makers.

- Customer Service Platforms: Digital tools facilitate order tracking, customer support inquiries, and access to relevant resources, improving the overall customer experience.

- Sustainability Reporting: The online presence highlights the company's commitment to environmental, social, and governance (ESG) principles, a key consideration for many investors and partners.

Industry Events and Trade Shows

Boise Cascade actively participates in key industry events and trade shows, such as the International Builders' Show (IBS) and the National Association of Home Builders (NAHB) annual convention. These gatherings are crucial for showcasing their extensive portfolio of engineered wood products and building materials. In 2024, IBS alone saw over 60,000 attendees, providing a vast audience for Boise Cascade to engage with builders, architects, and distributors.

These events serve as a vital channel for direct customer interaction, allowing Boise Cascade to gather feedback and understand evolving market demands. It's a prime opportunity for networking, fostering relationships with existing clients, and identifying new business prospects within the dynamic building and construction sector. The company leverages these platforms to demonstrate innovation and reinforce its position as a leading supplier.

Beyond product display, industry events enable Boise Cascade to monitor competitor activities and identify emerging trends and technological advancements. This strategic intelligence gathering is essential for maintaining a competitive edge and adapting their business model to future market shifts. For instance, discussions around sustainable building practices and new material technologies are often prominent at these shows.

- Showcasing Innovation: Boise Cascade uses industry events to highlight new product lines and sustainable building solutions.

- Customer Engagement: Direct interaction at trade shows facilitates feedback loops and strengthens client relationships.

- Market Intelligence: Participation provides insights into industry trends, competitor strategies, and technological advancements.

Boise Cascade utilizes a multi-faceted channel strategy, combining direct sales, a robust distribution network, strategic partnerships, and digital engagement to reach its diverse customer base. This approach ensures broad market coverage and tailored customer service.

The company's Building Materials Distribution (BMD) network, comprising over 40 branches, is a primary channel for serving regional and local customers with timely deliveries and accessible inventory. In 2024, this network continued to be a significant revenue driver, reflecting its operational efficiency and market reach.

Furthermore, Boise Cascade leverages wholesale and retail partnerships to access smaller contractors and the DIY market, expanding its footprint. Their corporate website also serves as a key information channel for product details and investor relations.

Customer Segments

Residential builders and homebuilders represent a core customer segment for Boise Cascade. This group encompasses both large-scale developers building entire communities and smaller, individual homebuilders focusing on single projects. They rely on a steady and dependable supply of construction materials like lumber, plywood, and engineered wood products to meet the demands of new home construction.

The health of the single-family housing market directly impacts this segment's purchasing power. For instance, in 2024, the U.S. Census Bureau reported that new privately owned housing units authorized by building permits in July 2024 were at a seasonally adjusted annual rate of 1,499,000. This figure indicates a robust level of activity, driving consistent demand for Boise Cascade's offerings.

Boise Cascade's commercial and industrial contractors are a key customer segment, relying on the company for a comprehensive suite of building materials. This includes specialized engineered wood products crucial for light commercial construction, industrial facilities, and unique building applications.

These contractors often manage diverse projects, demanding a wide array of materials beyond just engineered wood. Boise Cascade's ability to supply these varied needs, from framing lumber to roofing and siding, makes them a valuable partner in the construction lifecycle.

In 2024, the construction industry experienced a notable uptick in non-residential building permits, indicating increased demand from these very sectors. For instance, data from the U.S. Census Bureau showed a significant year-over-year increase in industrial construction starts, directly benefiting suppliers like Boise Cascade.

The residential repair and remodeling market represents a significant customer segment for Boise Cascade, encompassing contractors and larger retail chains focused on home improvement. This segment thrives on the need to maintain and upgrade existing housing stock, a demand that remains robust due to factors like aging properties and increasing homeowner equity. For instance, in 2023, the U.S. residential remodeling market was valued at approximately $450 billion, showcasing the substantial opportunity within this sector.

Industrial Customers

Boise Cascade's reach extends beyond the typical home builder. They also supply wood products to a variety of industrial customers. These clients might use the lumber for manufacturing processes, creating packaging materials, or other specialized industrial needs.

This diversification is a smart move for Boise Cascade. By serving industrial sectors, they reduce their dependence on the ups and downs of the residential construction market, which can be quite volatile. This broader customer base provides a more stable revenue stream.

- Industrial Applications: Wood products used in manufacturing, packaging, and other industrial processes.

- Market Diversification: Reduces reliance on the cyclical residential construction sector.

- Revenue Stability: A broader customer base contributes to more consistent financial performance.

Wholesale Dealers and Lumberyards

Boise Cascade's wholesale dealers and lumberyards are crucial intermediaries, acting as direct customers who then serve a broader market. These partners are essential for extending the company's distribution network and reaching a diverse range of end-users.

- Key Distribution Partners: Independent lumberyards and other wholesale dealers form the backbone of Boise Cascade's reach, enabling product availability across numerous geographic locations.

- Market Extension: By supplying these businesses, Boise Cascade effectively expands its market presence without directly engaging with every individual contractor or builder.

- Sales Performance: In 2024, Boise Cascade reported strong performance in its Building Materials Distribution segment, which heavily relies on this wholesale channel. For instance, the segment's sales reflect the volume moving through these established dealer networks.

Boise Cascade also serves a segment of retail home improvement stores and building material distributors. These entities act as crucial channels, supplying products to a wide array of smaller contractors and individual consumers undertaking renovation or DIY projects.

The health of the repair and remodeling market is a key driver for this segment. In 2023, the U.S. residential remodeling market was valued at approximately $450 billion, indicating substantial demand for materials supplied through these retail and distribution partners.

Boise Cascade's ability to provide a consistent and diverse inventory of wood products, from framing lumber to finished goods, makes these retail and distribution partners valuable customers. Their extensive network ensures Boise Cascade's products reach a broad customer base, supporting both professional and consumer projects.

| Customer Segment | Key Characteristics | 2024/2023 Data Point |

| Residential Builders & Homebuilders | Develop new housing, require bulk materials. | U.S. housing permits at 1,499,000 (July 2024). |

| Commercial & Industrial Contractors | Build non-residential structures, need specialized products. | Increase in non-residential building permits in 2024. |

| Residential Repair & Remodeling | Focus on existing homes, DIYers and smaller contractors. | U.S. remodeling market valued at ~$450 billion (2023). |

| Industrial Applications | Manufacturers, packaging, other industrial uses. | Diversifies revenue beyond construction cycles. |

| Wholesale Dealers & Lumberyards | Intermediaries distributing to a wider market. | Strong performance in Boise Cascade's Distribution segment in 2024. |

Cost Structure

Boise Cascade's cost structure heavily relies on raw materials, with timber and veneer being the most significant expenses. In 2024, the company’s cost of goods sold was $7.3 billion, a substantial portion of which is directly tied to these essential inputs.

The price of timber, a key commodity, can be volatile. For instance, lumber prices saw significant swings in recent years, directly impacting Boise Cascade's procurement costs and necessitating robust inventory management strategies to mitigate these fluctuations.

Boise Cascade's manufacturing and production costs are a significant component of its overall cost structure. These expenses include the direct costs of running its wood products mills, such as wages for its workforce, the energy needed to power machinery, routine maintenance to keep equipment running smoothly, and the depreciation of its substantial investment in manufacturing equipment. For instance, in 2023, the company reported cost of goods sold of $6.4 billion, reflecting these operational expenditures.

The company actively invests in modernization projects across its manufacturing facilities. These strategic investments are designed to enhance operational efficiency and, consequently, optimize these production costs. By upgrading technology and improving processes, Boise Cascade aims to reduce waste, lower energy consumption, and increase output per labor hour, thereby strengthening its competitive position.

Boise Cascade's distribution and logistics costs are significant, reflecting the substantial investment in its nationwide network. These expenses cover warehousing facilities, the operation and maintenance of its transportation fleet, and payments to third-party logistics providers to ensure efficient delivery of building products across the country.

For example, in 2023, Boise Cascade's selling, general, and administrative expenses, which include many of these distribution and logistics outlays, amounted to approximately $1.1 billion. This figure underscores the scale of operations required to manage such an extensive supply chain and get products to customers efficiently.

Selling, General, and Administrative (SG&A) Expenses

Boise Cascade's Selling, General, and Administrative (SG&A) expenses represent the significant overhead required to run its operations beyond direct production costs. These costs encompass everything from the sales force and marketing campaigns aimed at reaching customers to the corporate salaries of executives and support staff, and other essential non-production related expenditures. Effective control and management of these SG&A costs are absolutely vital for maintaining and improving the company's overall profitability.

For 2024, Boise Cascade's SG&A expenses are a key area of focus for operational efficiency. While specific quarterly breakdowns evolve, these costs are a direct reflection of the company's investment in its sales network, brand presence, and corporate infrastructure necessary to support its diverse product lines in the building materials sector.

- Sales and Marketing: Investments in advertising, promotions, and sales force compensation to drive demand for wood products and building materials.

- General and Administrative: Costs associated with corporate management, legal, finance, human resources, and IT functions.

- Other Non-Production Costs: Includes expenses like rent for non-manufacturing facilities, insurance, and professional services.

- Impact on Profitability: Efficient SG&A management directly contributes to a healthier bottom line by reducing operational drag.

Capital Expenditures and Investments

Boise Cascade's cost structure includes significant capital expenditures for facility upgrades and new equipment. In 2023, capital expenditures totaled $315.3 million, primarily directed towards enhancing manufacturing capabilities and expanding their distribution network. These investments, while creating long-term assets, impact costs through depreciation and potential financing expenses.

The company also invests in greenfield distribution centers to bolster its market reach and operational efficiency. These strategic investments are crucial for maintaining a competitive edge in the building materials sector. For instance, ongoing investments in their logistics infrastructure aim to reduce transportation costs and improve delivery times.

- Facility Upgrades: Ongoing modernization of manufacturing plants to improve efficiency and capacity.

- New Equipment: Investment in advanced machinery to enhance product quality and production output.

- Distribution Centers: Expansion and development of new distribution hubs to broaden market access.

- Depreciation & Financing: Costs associated with the wear and tear of assets and any debt incurred for these investments.

Boise Cascade's cost structure is dominated by raw material procurement, with timber and veneer representing substantial expenses. In 2024, the company reported cost of goods sold of $7.3 billion, highlighting the direct link to these essential inputs.

Manufacturing and production costs, including labor, energy, and equipment depreciation, form another significant part of their expenses. In 2023, cost of goods sold was $6.4 billion, reflecting these operational outlays.

Distribution and logistics, encompassing warehousing and transportation, are also key cost drivers, with SG&A expenses in 2023 reaching approximately $1.1 billion.

Capital expenditures for facility upgrades and new equipment, such as the $315.3 million invested in 2023, also impact the cost structure through depreciation and financing.

| Cost Category | 2023 (Approx.) | 2024 (Approx.) |

|---|---|---|

| Cost of Goods Sold | $6.4 billion | $7.3 billion |

| Selling, General & Administrative (SG&A) | $1.1 billion | (Focus area for efficiency) |

| Capital Expenditures | $315.3 million | (Ongoing investments) |

Revenue Streams

Boise Cascade generates substantial revenue by selling a diverse range of manufactured wood products. This includes essential items like plywood and lumber, as well as more specialized engineered wood products (EWP) such as I-joists and Laminated Veneer Lumber (LVL). These products are fundamental to the construction industry, forming a core part of the company’s sales.

In 2023, Boise Cascade reported that its Wood Products segment generated $5.1 billion in sales, representing a significant portion of its overall revenue. This segment’s performance is closely tied to the health of the housing market and construction activity, making it susceptible to fluctuations in commodity prices.

Boise Cascade's building materials distribution segment is a cornerstone of its revenue, generating substantial income from the wholesale distribution of a vast array of construction products. This includes materials from numerous third-party manufacturers, complementing their own manufactured goods. This broad product offering contributes to a more resilient revenue stream, less susceptible to fluctuations in any single product category.

In 2023, Boise Cascade reported that its Building Materials Distribution segment generated approximately $7.4 billion in net sales. This highlights the significant scale and importance of this revenue stream within the company's overall financial performance.

Boise Cascade's revenue from Engineered Wood Products (EWP) is a significant driver within its Wood Products segment. These higher-margin items are a strategic focus for the company, aiming to boost overall profitability.

In 2023, EWP sales contributed substantially to Boise Cascade's financial performance, demonstrating their importance. The company's emphasis on EWP reflects a deliberate strategy to capitalize on products with less price volatility than traditional lumber, offering a more stable revenue stream.

Value-Added Services and Solutions

Boise Cascade also generates revenue through value-added services that complement its core product offerings. These services, such as expert technical support and customized design assistance, are crucial for differentiating the company and fostering stronger customer relationships.

These specialized services, while not always a direct profit center, significantly boost the overall value proposition, leading to increased product sales and enhanced customer loyalty. For example, in 2024, the company continued to invest in digital tools to streamline design processes for builders, a service that directly supports their engineered wood product sales.

- Technical Support: Providing expert advice and troubleshooting for product application and installation.

- Design Assistance: Offering specialized design services, particularly for engineered wood products, to help customers optimize their projects.

- Logistics Solutions: Developing and offering tailored transportation and delivery services to meet specific customer needs.

Byproduct Sales

Boise Cascade generates revenue from selling byproducts of its lumber and plywood manufacturing. These include items like wood chips, sawdust, and bark, which are often sold to other industries, such as pulp and paper mills or for biomass energy production. In 2023, the company reported that its wood products segment, which encompasses these byproduct sales, saw a net sales increase to $6.5 billion.

These byproduct sales, while not the primary revenue driver, are crucial for maximizing the value derived from each harvested tree and optimizing resource utilization. They contribute to offsetting production costs associated with the main lumber and plywood products.

- Byproduct Revenue: Sales of wood chips, sawdust, and bark.

- Customer Industries: Pulp and paper, biomass energy.

- Financial Impact: Contributes to offsetting production costs and optimizing resource utilization.

- 2023 Performance: Wood Products segment net sales reached $6.5 billion.

Boise Cascade's revenue streams are diverse, primarily driven by its manufactured wood products and building materials distribution. The company also generates income from value-added services and the sale of manufacturing byproducts.

In 2023, the Building Materials Distribution segment was the largest contributor, with net sales of approximately $7.4 billion. The Wood Products segment, which includes plywood, lumber, and engineered wood products (EWP), reported net sales of $6.5 billion in the same year, with EWP being a key focus for higher margins.

| Revenue Stream | 2023 Net Sales (Billions) | Key Products/Services |

| Building Materials Distribution | $7.4 | Wholesale distribution of construction products from various manufacturers |

| Wood Products | $6.5 | Plywood, lumber, engineered wood products (EWP) |

| Value-Added Services | N/A (Supports product sales) | Technical support, design assistance, logistics solutions |

| Byproduct Sales | Included in Wood Products | Wood chips, sawdust, bark |

Business Model Canvas Data Sources

The Boise Cascade Business Model Canvas is informed by a blend of internal financial disclosures, market research reports on the building materials sector, and operational data from their extensive supply chain. These sources provide a robust foundation for understanding customer segments, value propositions, and revenue streams.