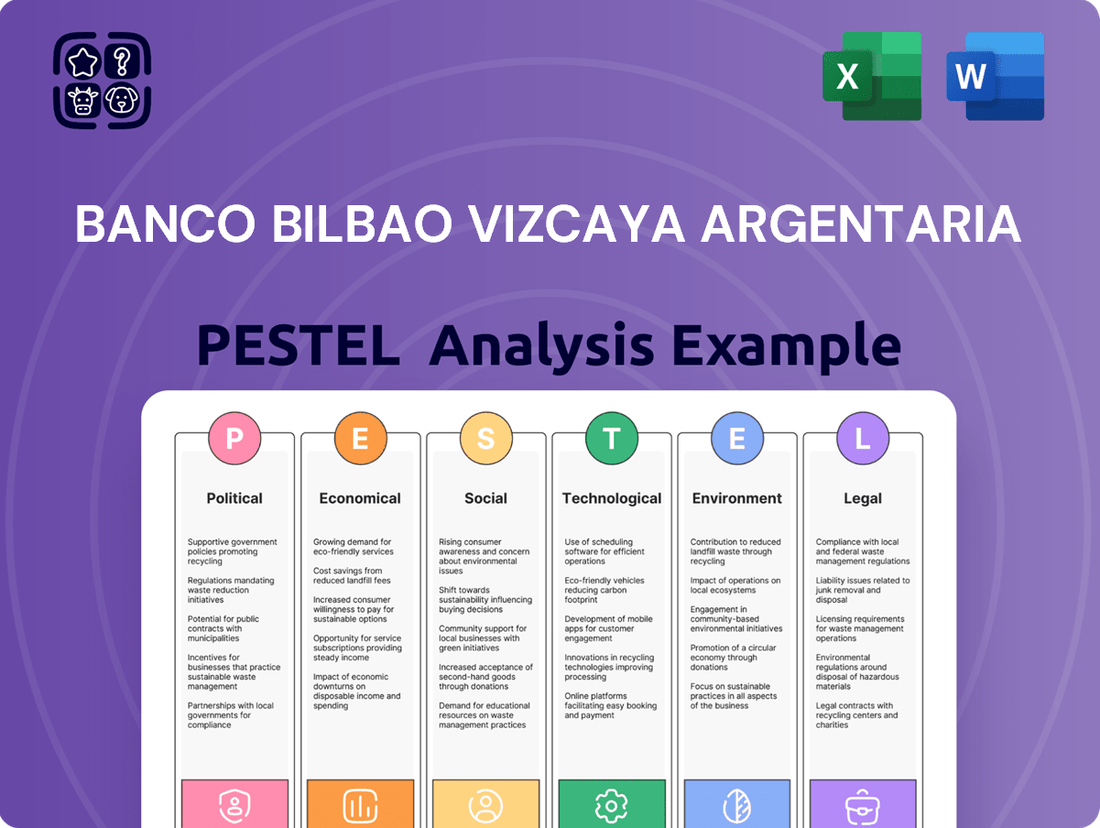

Banco Bilbao Vizcaya Argentaria PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banco Bilbao Vizcaya Argentaria Bundle

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Banco Bilbao Vizcaya Argentaria. Discover how political stability, economic fluctuations, and evolving social trends are shaping the company’s future. Understand the impact of technological advancements and environmental regulations. Use these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

BBVA's global presence, spanning regions like Spain, Mexico, and Turkey, means its operations are directly influenced by the political stability and policy frameworks of these countries. For instance, in 2024, Spain continued to navigate a complex political landscape, impacting regulatory certainty for financial institutions. Conversely, Mexico's economic policies, influenced by its government, directly affect BBVA's significant operations there, with inflation targets and fiscal measures being key considerations.

Political instability or sudden policy shifts can create substantial headwinds for BBVA. For example, a change in government in a key market could lead to altered fiscal policies, potentially impacting interest rates or the tax burden on financial services. The risk of nationalization, though often low, remains a consideration in certain emerging markets, as seen historically in other regions and could be a factor to monitor in 2024-2025, affecting asset values and operational continuity.

Government intervention in the banking sector, such as imposed lending restrictions or capital requirements beyond Basel III standards, poses another significant political risk. In 2024, several European countries discussed potential windfall taxes on banks, a policy that, if implemented, could affect BBVA's profitability in those markets. Such interventions can alter the competitive landscape and directly impact BBVA's strategic planning and financial performance.

The banking sector's stringent regulatory environment significantly shapes BBVA's operations. For instance, the European Central Bank's (ECB) capital requirements, such as the Common Equity Tier 1 (CET1) ratio, directly influence lending capacity and profitability. As of Q4 2024, BBVA maintained a robust CET1 ratio of 12.75%, exceeding regulatory minimums and demonstrating resilience against potential economic shocks.

Changes in lending standards and anti-money laundering (AML) protocols, like those enforced by the Financial Action Task Force (FATF), necessitate continuous investment in compliance infrastructure. These measures, while increasing operational costs, are crucial for maintaining market trust and avoiding substantial penalties, which can run into millions of euros for non-compliance in the EU.

Consumer protection laws, such as the General Data Protection Regulation (GDPR) and specific banking conduct rules, mandate transparency and fairness in customer dealings. Adherence to these regulations, which are increasingly harmonized across major markets like Spain and Mexico, is vital for customer retention and brand reputation, even as it adds layers to product development and service delivery.

The ongoing evolution of prudential regulations, including Basel III finalization in the EU impacting risk-weighted assets, presents both challenges and opportunities. While stricter capital adequacy might temper aggressive growth, it also fosters a more stable financial system, potentially leading to reduced systemic risk and a more predictable operating landscape for well-capitalized institutions like BBVA.

BBVA's extensive international operations, spanning countries like Spain, Mexico, Turkey, and South America, make it highly susceptible to shifts in global political landscapes. For instance, the ongoing trade tensions between major economic blocs or evolving international cooperation frameworks directly impact BBVA's cross-border transactions and the flow of capital into and out of the regions where it operates.

Geopolitical instability, such as conflicts or significant political realignments in key markets, can trigger currency volatility, affecting BBVA's reported earnings and the value of its assets. In 2024, for example, heightened geopolitical risks globally have contributed to increased exchange rate fluctuations, impacting the profitability of international subsidiaries for many financial institutions.

Changes in trade agreements or the imposition of tariffs between countries where BBVA has a presence can influence foreign direct investment and overall economic sentiment, thereby affecting loan demand and the bank's ability to conduct business smoothly. These policy shifts can also lead to adjustments in regulatory environments, requiring BBVA to adapt its compliance strategies.

Anti-Money Laundering (AML) and Sanctions Compliance

Governments globally are significantly increasing their focus on anti-money laundering (AML) and sanctions compliance, creating a more demanding regulatory landscape for financial institutions like BBVA. This intensified scrutiny means banks must dedicate substantial resources to staying ahead of evolving rules designed to combat illicit financial activities. For instance, in 2023, regulatory fines for AML and sanctions breaches across the financial sector reached billions of dollars, underscoring the immense financial and reputational risks involved.

BBVA must therefore continually invest in sophisticated compliance technology and rigorous internal processes to meet these heightened political and legal pressures. Failure to do so can result in severe penalties, including substantial fines, damage to brand trust, and even limitations on business operations. The bank's proactive approach to compliance is not just a legal obligation but a strategic imperative for maintaining its license to operate and its standing in the international financial community.

- Increased Regulatory Scrutiny: Governments worldwide are reinforcing AML and sanctions frameworks, demanding greater diligence from financial institutions.

- Financial Penalties: Non-compliance can lead to significant fines, with global financial sector penalties for AML/sanctions violations exceeding $10 billion annually in recent years.

- Reputational Risk: Breaches can severely damage a bank's reputation, impacting customer trust and market confidence.

- Operational Impact: Regulatory action can result in restrictions on business activities, hindering growth and profitability.

Political Intervention in Financial Markets

Governments worldwide, including those where BBVA operates, frequently intervene in financial markets to steer economic activity. For instance, in late 2024, the European Central Bank maintained its key interest rates at 4.00%, a decision influenced by political considerations to combat inflation, directly impacting BBVA's borrowing costs and lending margins.

These interventions can manifest as mandates for credit allocation, pushing banks like BBVA to lend to specific sectors deemed strategically important, potentially diverting capital from more profitable avenues. Such actions can skew competition and influence the bank's risk assessment framework.

Furthermore, direct support or bailouts, as seen historically during financial crises to stabilize major institutions, can create an uneven playing field. While BBVA has maintained a strong capital position, regulatory shifts and potential future interventions in response to economic shocks remain a critical factor in its operational environment.

- Interest Rate Policies: Central bank decisions, such as the ECB's 4.00% key rate in late 2024, directly shape BBVA's profitability by influencing net interest income.

- Credit Allocation Mandates: Government directives to lend to specific industries can impact BBVA's portfolio diversification and risk-return profile.

- Sector-Specific Support: Past bailouts and ongoing subsidies for certain industries can alter competitive dynamics and create moral hazard within the financial system.

Political stability in BBVA's key markets, such as Spain and Turkey, directly influences regulatory certainty and economic policy. For example, the ongoing political landscape in Spain in 2024 continued to shape the financial sector's operating environment. Similarly, Mexico's economic policies, including inflation targets set by its central bank, significantly impact BBVA's substantial operations there, affecting its lending and investment strategies.

Government interventions, like potential windfall taxes on banks discussed in Europe in 2024, can directly affect BBVA's profitability. Such policies, along with evolving prudential regulations such as Basel III finalization impacting risk-weighted assets, necessitate continuous adaptation in BBVA's strategic planning and capital management to ensure compliance and maintain a competitive edge.

Geopolitical shifts and trade policy changes between nations where BBVA operates can impact capital flows and demand for banking services. Heightened geopolitical risks in 2024 led to increased currency volatility, affecting the reported earnings of international subsidiaries. BBVA's international presence means it must closely monitor and adapt to these global political dynamics.

| Political Factor | Impact on BBVA | 2024/2025 Relevance |

| Regulatory Frameworks (e.g., AML, Sanctions) | Increased compliance costs, risk of fines and reputational damage. | Ongoing global focus on combating illicit finance, leading to stricter enforcement and higher penalties for non-compliance. Fines for AML/sanctions breaches in the financial sector have exceeded $10 billion annually in recent years. |

| Monetary Policy & Interest Rates | Direct impact on net interest income and lending margins. | Central bank decisions, such as the ECB maintaining key rates at 4.00% in late 2024, are critical for BBVA's profitability and strategic lending decisions. |

| Geopolitical Stability & Trade Policies | Currency volatility, impact on cross-border transactions, and foreign direct investment. | Heightened global geopolitical risks in 2024 have contributed to significant exchange rate fluctuations, directly affecting the profitability of BBVA's international operations. |

What is included in the product

This PESTLE analysis examines the external macro-environmental factors influencing Banco Bilbao Vizcaya Argentaria across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a comprehensive overview of how these forces shape the bank's strategic landscape, offering insights into potential challenges and growth opportunities.

Provides a clear, actionable summary of BBVA's PESTLE factors, enabling swift identification of external opportunities and threats to inform strategic decision-making and mitigate risks.

Economic factors

Interest rate fluctuations are a critical economic factor for Banco Bilbao Vizcaya Argentaria (BBVA). Changes in benchmark rates set by central banks directly affect BBVA's net interest income, which is a core revenue driver. For instance, BBVA Research projected in mid-2024 that the Eurozone and US central banks would likely implement interest rate cuts starting in the latter half of 2024 and continuing into 2025, a trend that would compress net interest margins.

While rising rates can initially boost lending profitability by increasing the spread between loan income and funding costs, they also introduce risks. Higher borrowing costs for customers can lead to an increase in loan defaults, impacting asset quality. Conversely, falling rates, as anticipated by BBVA Research for late 2024 and 2025, tend to compress these interest margins, potentially slowing revenue growth if not offset by increased lending volumes or fee income.

High inflation significantly impacts BBVA by reducing consumers' purchasing power, which can dampen loan demand. It also increases operational costs for the bank. For instance, if inflation in Spain reaches 3.5% in 2025 as some analysts predict, BBVA's operating expenses could see a notable rise.

Economic growth is a critical driver for BBVA's performance. Robust growth in key markets such as Mexico, where the economy is projected to grow by 2.3% in 2025, directly translates to higher demand for banking services like loans and mortgages. Conversely, slower growth can lead to increased non-performing loans.

BBVA Research forecasts global economic growth to hover around 3.1% for 2025. This global outlook provides a backdrop for understanding the economic health of the diverse regions where BBVA operates, influencing its lending strategies and risk management.

In South America, economic growth projections vary, with some countries facing challenges while others show resilience. For example, if Brazil's economy expands by 2.0% in 2025, it offers a more stable environment for BBVA's operations there compared to a region with projected negative growth.

Currency exchange rate volatility presents a significant economic challenge for BBVA due to its extensive global operations, especially in key emerging markets such as Mexico, South America, and Turkey. For instance, in early 2024, the Mexican Peso experienced notable fluctuations against the Euro, directly impacting the Euro-denominated value of BBVA's substantial Mexican assets and earnings. This volatility can distort the bank's reported profitability and affect its capital adequacy ratios when financial results are consolidated.

Sharp depreciations in currencies where BBVA holds significant assets, like the Turkish Lira in late 2023 and early 2024, can lead to substantial translation losses. Conversely, while appreciation might boost reported figures, unpredictable swings create an environment where strategic financial planning and risk management become more complex. BBVA's exposure to these fluctuating exchange rates means that even stable underlying business performance can be masked or exaggerated by currency movements, influencing investor sentiment and the bank's overall financial health.

Unemployment Rates and Consumer Spending

Unemployment rates significantly influence consumer spending, directly affecting BBVA's operations. High joblessness, for instance, often correlates with increased defaults on loans and a dampened appetite for new financial products, particularly impacting the retail banking sector.

Conversely, a healthy labor market with low unemployment fuels consumer confidence and spending power. This robust economic activity translates into greater demand for various financial services, including credit, mortgages, and investment products, which are key revenue drivers for BBVA.

- Unemployment Impact: Rising unemployment can lead to a higher proportion of loan defaults, straining BBVA's asset quality and profitability.

- Consumer Demand: Strong consumer spending, often a byproduct of low unemployment, boosts demand for BBVA's lending and transactional services.

- 2024/2025 Data Context: As of early 2025, many developed economies are experiencing unemployment rates below 5%, supporting consumer spending, though regional variations exist. For example, the Eurozone unemployment rate hovered around 6.5% in late 2024, showing a gradual improvement.

- Financial Services Growth: Periods of low unemployment and high consumer spending generally correlate with increased new account openings and higher transaction volumes for banks like BBVA.

Global Economic Outlook and Recession Risks

The global economic outlook for 2024 and into 2025 remains subject to considerable uncertainty, with a heightened risk of recession in key developed economies. Factors such as persistent inflation, tighter monetary policies, and geopolitical tensions continue to weigh on growth prospects. For instance, the International Monetary Fund (IMF) projected global growth at 3.1% for 2024, a slight slowdown from previous forecasts, and warned of increasing downside risks. This cautious outlook directly impacts investor confidence, potentially leading to reduced capital flows and a more subdued market sentiment, which can pressure financial institutions like BBVA.

A significant global economic downturn would undoubtedly present challenges for BBVA's operations. Reduced economic activity typically translates into lower demand for corporate and investment banking services, such as mergers and acquisitions advisory and underwriting. Furthermore, a recessionary environment often correlates with an increase in credit losses across all banking segments as businesses and individuals struggle to meet their debt obligations. For example, during periods of economic stress, non-performing loan ratios tend to rise, directly impacting a bank's profitability and capital adequacy.

- Recessionary Fears: Major economies like the Eurozone and the United States are facing increased probabilities of economic contraction in the coming year, according to various economic indicators and forecasts from institutions like the OECD.

- Impact on Demand: A global slowdown could reduce corporate clients' appetite for large-scale investments and financing, impacting fee-generating business lines.

- Credit Risk Exposure: Rising interest rates and slowing growth could lead to higher default rates on loans, increasing provisions for credit losses for BBVA.

- Market Volatility: Increased economic uncertainty fuels market volatility, which can affect BBVA's trading revenues and the valuation of its investment portfolios.

Economic growth directly fuels BBVA's business by increasing demand for loans and financial services. For 2025, projections suggest moderate global growth, with emerging markets like Mexico showing stronger expansion, around 2.3%, which is beneficial for BBVA's operations there.

Interest rate policies are paramount, with anticipated cuts in the Eurozone and US starting late 2024 into 2025 likely to compress net interest margins, a key revenue source for BBVA.

Inflation presents a dual challenge: it can reduce consumer spending power, thereby lowering loan demand, while also increasing BBVA's operational costs. For example, if Spanish inflation trends towards 3.5% in 2025, this could significantly impact the bank's expense base.

Currency volatility, particularly in markets like Mexico and Turkey, directly impacts BBVA's consolidated financial results and asset valuations, making strategic planning more complex.

| Economic Factor | 2024/2025 Projection | Impact on BBVA |

|---|---|---|

| Global Economic Growth | ~3.1% (IMF Forecast for 2025) | Influences overall demand for banking services and credit risk. |

| Interest Rate Environment | Expected cuts in Eurozone/US (late 2024/2025) | Potential compression of net interest margins. |

| Inflation (e.g., Spain) | Projected ~3.5% (2025, analyst estimate) | Increases operational costs, may reduce consumer spending. |

| Unemployment Rate (Eurozone) | ~6.5% (late 2024, improving) | Affects consumer spending and loan default rates. |

| Currency Volatility (e.g., MXN) | Noted fluctuations vs EUR (early 2024) | Impacts translation of foreign earnings and asset values. |

Preview the Actual Deliverable

Banco Bilbao Vizcaya Argentaria PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, providing a comprehensive PESTLE analysis of Banco Bilbao Vizcaya Argentaria. This detailed breakdown examines the Political, Economic, Social, Technological, Legal, and Environmental factors influencing the bank's operations and strategy. You can trust that the insights and structure you see are precisely what you'll be working with to understand BBVA's market landscape.

Sociological factors

Demographic shifts significantly impact BBVA's product demand. In Spain and other European markets, aging populations, with a projected increase in those aged 65 and over, are likely to boost demand for retirement planning and wealth management services. For instance, Spain's population aged 65+ accounted for approximately 20.1% in 2023, a figure expected to grow.

Conversely, BBVA's presence in Mexico and South America, characterized by younger, growing populations, presents a different opportunity. This demographic trend, with a substantial youth bulge in countries like Mexico, fuels demand for digital banking solutions and financing for first-time homebuyers. Mexico's median age was around 29.5 years in 2023, indicating a large segment of the population entering their prime earning and borrowing years.

Consumers are increasingly shifting towards digital banking, a trend clearly illustrated by BBVA's user base in Spain, which reached 8.4 million active users on its mobile app as of March 2025. This significant adoption of digital channels highlights a fundamental change in how people interact with financial institutions.

This evolving consumer behavior demands substantial investment in robust digital infrastructure and a continuous enhancement of online services. Banks like BBVA must adapt by prioritizing digital solutions over traditional, branch-centric models to meet customer expectations for seamless and accessible banking experiences.

Enhancing financial inclusion and literacy in emerging markets offers BBVA a significant growth avenue. By extending banking services to previously unbanked populations and investing in financial education, BBVA can cultivate new customer bases and drive long-term expansion.

BBVA's commitment to this area is evident in its substantial support for entrepreneurs. In 2024, the BBVA Microfinance Foundation dedicated €1.5 billion to lending initiatives specifically targeting vulnerable entrepreneurs, demonstrating a clear strategy to empower underserved communities.

Workforce Evolution and Talent Management

The financial sector's ongoing digital shift demands a workforce proficient in emerging technologies, data science, and artificial intelligence. BBVA must therefore refine its strategies for recruiting, upskilling, and retaining talent to secure employees equipped for this dynamic environment, thereby maintaining its edge in a competitive, knowledge-intensive market.

This evolution necessitates a focus on continuous learning, with a significant portion of the workforce needing to acquire new digital competencies. For instance, a 2024 report indicated that over 60% of financial institutions are investing heavily in upskilling their employees in areas like cybersecurity and cloud computing to meet digital demands.

- Digital Skills Gap: A growing demand for professionals skilled in AI, machine learning, and advanced data analytics.

- Talent Acquisition Challenges: Increased competition for tech-savvy talent, requiring innovative recruitment approaches.

- Upskilling and Reskilling Initiatives: Essential for existing employees to adapt to new technological tools and processes.

- Employee Retention: Creating a culture that supports continuous development and offers career growth in digital roles is crucial for retaining top talent.

Social Expectations for Responsible Banking

There's a clear shift in what people expect from banks today. Customers and the public at large are increasingly looking for financial institutions to be more than just profit-driven entities; they want them to operate ethically, be open about their dealings, and actively contribute to the betterment of society. This means banks are under pressure to demonstrate a genuine commitment to social well-being alongside their financial goals.

BBVA is actively responding to these evolving societal expectations. The bank's strategic focus on inclusive growth and investing in communities demonstrates an understanding of this trend. For instance, by December 2024, BBVA had earmarked a significant €594 million specifically for social programs. This substantial allocation highlights a tangible effort to align its business operations with broader societal values and address community needs.

This focus on social responsibility is becoming a key differentiator. Banks that can credibly show they are making a positive impact are likely to build stronger customer loyalty and a better brand reputation. This involves not just financial contributions but also ensuring fair lending practices, promoting financial literacy, and supporting sustainable development initiatives.

Key areas reflecting social expectations for responsible banking include:

- Ethical Conduct: Adherence to high moral standards in all business dealings.

- Transparency: Openness in communication regarding fees, policies, and decision-making processes.

- Community Investment: Direct financial and resource allocation to support social causes and local development.

- Financial Inclusion: Efforts to provide accessible financial services to underserved populations.

Societal expectations are shifting, with a growing demand for banks to act as responsible corporate citizens. This includes a focus on ethical practices, transparency, and a tangible commitment to social well-being. BBVA's significant investment of €594 million in social programs by December 2024 underscores its response to these evolving public demands.

Furthermore, financial inclusion and literacy are increasingly viewed as crucial social objectives. By expanding access to financial services and promoting education, BBVA, through initiatives like the Microfinance Foundation's €1.5 billion in lending in 2024 to vulnerable entrepreneurs, aims to foster inclusive growth and tap into new markets.

The digital transformation in banking also necessitates a focus on the workforce. BBVA must cultivate talent proficient in AI, data analytics, and cybersecurity, as evidenced by the over 60% of financial institutions investing in upskilling for these areas in 2024, to remain competitive.

Technological factors

BBVA's commitment to digital transformation is evident in its mobile banking platform, which saw 8.4 million active users in Spain as of March 2025. This robust engagement highlights the growing consumer reliance on digital channels for managing finances.

This strategic emphasis on digital delivery is key to attracting and keeping customers, as convenience and accessibility are paramount in today's banking landscape. The bank's investment in its mobile app directly addresses the market's shift towards on-the-go financial management solutions.

BBVA's extensive digital operations, from online banking to mobile apps, present a significant surface area for cyber threats. The increasing volume and sophistication of data breaches and cyberattacks globally mean the bank must continually invest in advanced security measures to safeguard sensitive customer information and financial assets.

In response, BBVA has strategically deployed global cybersecurity centers in Spain and Mexico. These centers leverage cutting-edge technologies like artificial intelligence and process automation to proactively detect, analyze, and neutralize emerging threats in real-time. This focus underscores the paramount importance of robust defense systems for maintaining customer trust and operational integrity.

The financial sector, as a whole, saw a notable increase in cyber incidents. For instance, reports in early 2024 indicated a substantial rise in ransomware attacks targeting financial institutions, with average recovery costs escalating. This trend necessitates continuous vigilance and adaptation from entities like BBVA to protect against evolving attack vectors and ensure data privacy compliance.

BBVA is making significant strides in adopting Artificial Intelligence and Machine Learning across its operations. This integration aims to sharpen decision-making, boost efficiency, and create more personalized customer interactions. For instance, BBVA’s partnership with OpenAI and Google Cloud allows for the deployment of advanced AI tools, including ChatGPT Enterprise and Gemini with Workspace, enhancing internal workflows and customer advisory services.

Fintech Competition and Innovation

The financial technology (fintech) landscape is rapidly evolving, with new companies and neobanks constantly emerging to challenge traditional banking models. This intensified competition, particularly in digital banking services and niche financial products, means BBVA faces pressure to keep pace. For instance, by the end of 2024, global fintech funding reached approximately $25 billion, underscoring the significant investment in this sector.

To stay competitive, BBVA must prioritize continuous innovation in its digital offerings, leveraging its existing strengths. These strengths include a substantial, established customer base and a robust understanding of regulatory compliance, which many newer fintechs still need to develop. BBVA's strategy involves not just offering competitive digital services but also integrating advanced technologies to enhance customer experience and operational efficiency.

The agility of tech-driven challengers presents a significant dynamic. These companies often operate with leaner structures and can adapt quickly to market changes and customer demands. BBVA's response involves investing heavily in its own digital transformation, aiming to match the user-friendliness and speed of fintechs while maintaining the trust and security associated with a large, established institution. A key area of focus for BBVA in 2024-2025 is enhancing its mobile banking app, aiming for a user experience comparable to leading neobanks.

- Fintech Funding: Global fintech funding approached $25 billion by the end of 2024, highlighting intense sector growth.

- Digital Service Competition: BBVA faces increased competition from fintechs specializing in digital banking and tailored financial products.

- Innovation Imperative: Continuous innovation in digital offerings is crucial for BBVA to maintain market share against agile challengers.

- Leveraging Strengths: BBVA's established customer base and regulatory expertise are key advantages in competing with newer, tech-focused firms.

Blockchain and Cryptocurrency Adoption

Technological factors, particularly the rapid evolution of blockchain and cryptocurrencies, present a dual-edged sword for traditional financial institutions like BBVA. While these innovations offer new avenues for service expansion, they also introduce significant regulatory complexities.

BBVA is actively engaging with this evolving landscape. In Spain, the bank has launched cryptocurrency trading and custody services for its retail customers. This move positions BBVA as an early adopter, capitalizing on emerging digital asset markets.

This strategic approach is being undertaken within the framework of the European Union's Markets in Crypto-Assets (MiCA) regulation, which came into full effect in June 2024. MiCA aims to harmonize crypto asset rules across the EU, providing a more predictable environment for banks like BBVA to operate in.

- BBVA's Spanish crypto services launched in 2024, aligning with MiCA's phased implementation.

- MiCA regulation, effective from June 2024, provides a regulatory pathway for crypto services in the EU.

- The global cryptocurrency market capitalization reached approximately $2.5 trillion in early 2024, indicating significant market potential.

BBVA's digital transformation is a cornerstone of its strategy, with 8.4 million active users on its Spanish mobile banking platform as of March 2025, underscoring a significant shift towards digital engagement.

The bank is actively integrating advanced technologies like AI and Machine Learning, partnering with OpenAI and Google Cloud to deploy tools such as ChatGPT Enterprise and Gemini, enhancing both internal operations and customer advisory services.

This technological push is critical for BBVA to compete with agile fintechs, which saw global funding reach approximately $25 billion by the end of 2024, necessitating continuous innovation in digital offerings and user experience.

Legal factors

BBVA operates under a rigorous regulatory framework, with capital requirements dictated by institutions like the European Central Bank (ECB) and national authorities. For instance, as of the first quarter of 2024, BBVA maintained a Common Equity Tier 1 (CET1) ratio of 12.44%, well above the regulatory minimums. Compliance with these stringent rules, including the Minimum Requirement for Own Funds and Eligible Liabilities (MREL), is paramount for the bank's financial resilience and its capacity to weather economic downturns.

Operating globally, BBVA navigates a complex web of data privacy laws, including the stringent General Data Protection Regulation (GDPR) in Europe. Compliance is paramount, not just for avoiding substantial penalties, as seen with other financial institutions facing multi-million euro fines, but also for safeguarding customer trust, a critical component of their operational integrity.

BBVA operates under stringent anti-money laundering (AML) and counter-terrorist financing (CTF) laws, necessitating sophisticated internal controls and diligent customer due diligence. Failure to comply can result in substantial fines; for instance, in 2023, European banks faced billions in AML-related penalties. These regulations demand robust reporting mechanisms to authorities, ensuring transparency and preventing the use of financial systems for illicit purposes. Non-compliance not only incurs financial penalties but also poses significant reputational risks and can lead to operational restrictions.

Consumer Protection and Fair Lending Laws

Consumer protection and fair lending laws are paramount for BBVA's retail banking. Regulations dictate how loans are offered, ensuring transparency in product details and ethical sales practices. For instance, in 2024, financial institutions globally faced increased scrutiny under consumer protection frameworks, with regulators emphasizing clear disclosure of Annual Percentage Rates (APRs) and fee structures. Adherence to these rules is not just about avoiding penalties; it's crucial for fostering customer loyalty and maintaining a positive brand image.

Compliance with these legal frameworks directly influences BBVA's operational costs and risk management strategies. Failure to comply can result in substantial fines and reputational damage, impacting market share. For example, a significant settlement in 2023 involving a major bank for alleged unfair lending practices highlighted the severe consequences of non-compliance. Therefore, robust internal controls and ongoing training are essential to navigate this complex legal landscape effectively.

- Fair Lending Compliance: Ensuring all lending decisions are free from discrimination based on protected characteristics.

- Transparency in Products: Providing clear and understandable information about loan terms, fees, and risks to consumers.

- Responsible Marketing: Adhering to ethical guidelines for advertising financial products and services.

- Data Privacy: Protecting sensitive customer financial information in accordance with regulations like GDPR or similar regional laws.

Cross-Border Legal and Jurisdictional Issues

BBVA's extensive global footprint necessitates careful navigation of diverse legal landscapes and jurisdictional complexities. This is particularly evident in its international operations, where mergers, acquisitions, and cross-border financial transactions are subject to varying regulatory approvals and legal interpretations. For instance, in 2023, BBVA completed the acquisition of a minority stake in the digital platform Neon, operating within Brazil's distinct legal framework, highlighting the need for localized legal expertise.

International taxation presents another significant challenge, with differing tax laws and treaties impacting BBVA's profitability and reporting structures across its many markets. Harmonization efforts, or conversely, the divergence of legal frameworks, can directly influence strategic choices, such as market entry or exit decisions, and affect overall operational efficiency. The bank must remain agile to adapt to evolving regulations, like those concerning data privacy or anti-money laundering, which vary considerably between the European Union and Latin American countries where it has a strong presence.

Dispute resolution in a cross-border context also poses unique hurdles. BBVA must contend with potentially conflicting legal systems and arbitration rules when disagreements arise with counterparties or regulators in different jurisdictions. The bank's ability to manage these legal intricacies is crucial for maintaining its global operational integrity and mitigating potential financial and reputational risks. In 2024, ongoing discussions around global financial regulation and digital asset frameworks continue to shape the legal environment for international banks like BBVA.

BBVA's adherence to stringent capital requirements, such as the CET1 ratio which stood at 12.78% in Q1 2024, underscores its commitment to regulatory compliance. Navigating global data privacy laws, like GDPR, is critical, with non-compliance risking substantial fines and reputational damage. Furthermore, robust anti-money laundering measures are essential to avoid penalties and maintain operational integrity.

Environmental factors

Climate change presents significant challenges for BBVA, encompassing physical risks like damage to its infrastructure from extreme weather events and transition risks tied to the global shift towards a low-carbon economy. These shifts can impact loan portfolios as industries adapt or face obsolescence.

However, these same environmental shifts also unlock substantial opportunities for BBVA, particularly in the realm of green finance. The bank has proactively set an ambitious target to mobilize €700 billion in sustainable finance by 2029, reflecting a strategic pivot towards supporting environmentally conscious projects and businesses.

Environmental, Social, and Governance (ESG) pressures are increasingly shaping corporate strategy, and BBVA is actively responding. Investors, regulators, and the public are demanding that companies integrate sustainability into their core operations. This push is a major environmental factor for businesses like BBVA.

BBVA has demonstrably made sustainability a cornerstone of its business strategy. This commitment is evidenced by its inclusion in prominent sustainability indices and its clear pledges to reduce financed emissions. For instance, by the end of 2023, BBVA had committed to mobilizing €300 billion in sustainable finance between 2018 and 2025.

BBVA is significantly increasing its commitment to sustainable finance, having already surpassed its €300 billion target for sustainable business by the close of 2024. This robust performance underscores the bank's dedication to environmental, social, and governance (ESG) principles.

The bank has set an ambitious new goal to mobilize €700 billion in sustainable finance by 2029, demonstrating a clear strategic direction towards supporting environmentally conscious economic activities.

This expanded commitment will fuel a wide range of green lending initiatives, focusing on critical areas such as renewable energy development, energy efficiency improvements, and projects aimed at mitigating and adapting to climate change.

For instance, BBVA's substantial investments in solar and wind power projects are crucial for transitioning to a low-carbon economy, aligning with global climate objectives and regulatory pressures.

Carbon Footprint and Decarbonization Targets

BBVA is actively addressing its carbon footprint, aiming for net-zero emissions by 2050 across its direct operations and financed activities. This significant commitment means the bank is working to reduce emissions not only from its own buildings and energy use but also from the industries and projects it finances.

To achieve this, BBVA has established interim decarbonization goals for key sectors within its loan book, such as energy, industry, and real estate. For instance, by 2030, BBVA aims to reduce the financed emissions intensity of its corporate loan portfolio in the energy sector by 25% compared to 2019 levels.

These targets are crucial for managing climate-related risks and capitalizing on opportunities in the transition to a low-carbon economy. The bank's strategy involves engaging with clients to support their own decarbonization efforts, providing financing for green projects and sustainable solutions.

- Commitment: Net-zero emissions by 2050 (own operations and financed clients).

- Interim Targets: Specific decarbonization goals for high-emitting sectors in loan portfolio.

- Sector Focus: Energy, industry, and real estate are key areas for emissions reduction.

- Client Engagement: Supporting clients' transition to a low-carbon economy through financing and advisory.

Resource Scarcity and Waste Management

While banks like BBVA aren't directly involved in heavy manufacturing, they still have an environmental footprint. This comes from things like the energy needed to power their vast data centers and the paper they use daily. Effectively managing waste generated from these operations is also a key consideration.

BBVA's commitment to sustainability actively addresses these internal environmental factors. They are focused on making their operations more efficient, particularly in terms of energy consumption across their branches and corporate offices. This includes adopting greener technologies and practices.

Responsible waste management is another crucial aspect of BBVA's environmental strategy. This involves implementing programs to reduce, reuse, and recycle materials, aiming to minimize the amount of waste sent to landfills. These initiatives are part of their broader goal to operate in a more environmentally conscious manner.

For example, in 2023, BBVA reported a reduction in its Scope 1 and Scope 2 greenhouse gas emissions by 23% compared to a 2019 baseline, demonstrating progress in energy efficiency. Their internal waste management efforts are designed to complement these emission reduction targets.

- Energy Efficiency: BBVA invests in energy-efficient technologies for its data centers and office buildings to reduce overall consumption.

- Paper Reduction: Initiatives promoting digital processes and responsible printing help minimize paper usage across the organization.

- Waste Diversion: Programs focused on recycling and proper disposal of electronic waste and general office waste are in place.

- Sustainable Procurement: BBVA considers environmental criteria when sourcing goods and services, including office supplies.

Environmental factors significantly influence BBVA's operations, driving a strategic focus on sustainability and green finance. The bank is actively responding to increasing ESG pressures from investors and regulators, integrating environmental considerations into its core business model.

BBVA's commitment to environmental stewardship is demonstrated by its ambitious sustainable finance targets, aiming to mobilize €700 billion by 2029. This includes substantial investments in renewable energy projects, underscoring its role in the transition to a low-carbon economy.

Internally, BBVA focuses on reducing its operational footprint through energy efficiency and responsible waste management. The bank achieved a 23% reduction in Scope 1 and 2 greenhouse gas emissions by the end of 2023 compared to a 2019 baseline, highlighting progress in its sustainability efforts.

BBVA's environmental strategy is also geared towards achieving net-zero emissions by 2050, encompassing both its direct operations and financed activities. This involves setting interim decarbonization goals for key sectors within its loan portfolio, such as energy and real estate, to manage climate-related risks effectively.

| Environmental Focus | BBVA's Action/Target | 2023/2024 Data/Progress |

|---|---|---|

| Sustainable Finance Mobilization | Target: €700 billion by 2029 | Mobilized €300 billion by close of 2024 (surpassed previous target) |

| Net-Zero Emissions Target | By 2050 (operations & financed) | Interim targets set for key sectors (e.g., 25% reduction in financed emissions intensity for energy sector by 2030 vs. 2019) |

| Operational Emissions Reduction | Energy efficiency, waste management | 23% reduction in Scope 1 & 2 GHG emissions by end of 2023 (vs. 2019 baseline) |

| Green Lending Initiatives | Renewable energy, energy efficiency, climate adaptation | Investments in solar and wind power projects |

PESTLE Analysis Data Sources

Our PESTLE analysis for BBVA draws data from official government publications, central bank reports, and international financial institutions like the IMF and World Bank. We also incorporate insights from reputable financial news outlets and industry-specific market research reports.