Banco Bilbao Vizcaya Argentaria Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banco Bilbao Vizcaya Argentaria Bundle

Discover the intricate workings of Banco Bilbao Vizcaya Argentaria's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, key resources, and revenue streams, offering a strategic roadmap for understanding their market dominance. Perfect for anyone seeking to dissect a leading financial institution's operational blueprint.

Unlock the complete strategic framework behind Banco Bilbao Vizcaya Argentaria's robust business model. Our Business Model Canvas provides a clear, section-by-section analysis of their value propositions, customer segments, and cost structures. Download the full document to gain actionable insights for your own strategic planning or competitive analysis.

Partnerships

BBVA actively collaborates with premier technology providers, notably Google Cloud and Cisco. These partnerships are crucial for bolstering its digital infrastructure and integrating cutting-edge solutions. These collaborations are strategically focused on advancing AI, cloud computing, cybersecurity, and networking capabilities, all aimed at accelerating digital transformation and optimizing operational efficiency.

A prime example of this strategic alignment is BBVA's expanded partnership with Google Cloud. This collaboration involves the deployment of Google Workspace with Gemini across the bank's worldwide operations. This initiative is designed to equip employees with advanced generative AI experiences, enhancing productivity and innovation.

BBVA strategically partners with fintech companies and startups to drive innovation and broaden its service portfolio. These alliances allow the bank to integrate cutting-edge solutions and reach new customer segments more effectively. For example, BBVA Spark actively cultivates relationships with tech startups, providing them with tailored financial support and resources to scale their businesses.

Collaborations with established fintech players also bolster BBVA's capabilities. A prime instance is the partnership with Olea, which focuses on enhancing specific financial solutions, demonstrating a commitment to targeted improvements through external expertise. This approach ensures BBVA remains competitive and responsive to evolving market demands.

BBVA is also deeply invested in leveraging open APIs and supporting the broader fintech ecosystem. This forward-thinking strategy positions the bank at the vanguard of financial technology, facilitating seamless integration of new services and fostering an environment of continuous advancement. By embracing these partnerships, BBVA aims to deliver superior digital banking experiences.

BBVA actively cultivates strategic alliances to bolster its sustainability objectives. A prime example is its collaboration with KKR, a global investment firm, aimed at facilitating the economy's decarbonization efforts by directing substantial capital towards green initiatives.

The bank's involvement in UN-backed programs, such as the International Year of Quantum Science and Technology, underscores its dedication to fostering sustainable development and embracing clean technologies.

These partnerships are crucial for mobilizing essential financing that fuels sustainable business ventures, demonstrating BBVA's commitment to a greener future.

Academic and Research Institutions

BBVA actively collaborates with academic and research institutions to foster talent and explore cutting-edge technologies. For instance, partnerships with universities like the University of Navarra are crucial for developing future banking professionals and staying ahead in areas like generative AI.

These collaborations are designed to enhance employee expertise in critical fields such as data science and artificial intelligence through specialized training programs and joint research initiatives. This strategic focus ensures BBVA maintains its technological leadership and consistently develops innovative financial solutions for its customers.

- Talent Pipeline: Access to a pool of highly skilled graduates in finance and technology.

- Research & Development: Joint projects exploring AI, blockchain, and sustainable finance.

- Skill Enhancement: Training programs for employees in advanced analytics and digital technologies.

- Innovation Hubs: Establishing centers for collaborative innovation with academic partners.

Payment System Providers

BBVA's strategic alliances with payment system providers are crucial for delivering efficient and instant payment experiences. Partnerships with platforms like Bizum are central to this effort, enabling customers to conduct transactions seamlessly within BBVA's digital ecosystem.

These collaborations directly bolster BBVA's digital transformation by embedding diverse payment functionalities into their mobile apps and online banking. This integration simplifies financial management for users, a core tenet of BBVA's customer-centric approach. For example, Bizum reported over 1 billion transactions in 2023, highlighting the scale and importance of such partnerships for user engagement and transaction volume.

- Bizum Integration: Facilitates instant P2P payments, enhancing customer convenience and transaction frequency.

- Expanded Payment Options: Partnerships allow BBVA to offer a wider array of payment methods, catering to diverse customer needs.

- Digital Channel Enhancement: Seamlessly integrates payment solutions into BBVA's digital platforms, improving user experience and adoption rates.

- Transaction Volume Growth: Collaborations with leading payment providers contribute to increased transaction volumes and customer stickiness.

BBVA's key partnerships extend to critical technology providers like Google Cloud and Cisco, underpinning its digital transformation and AI advancements. Strategic alliances with fintechs such as Olea and startups through BBVA Spark are vital for innovation and service expansion. Furthermore, collaborations with KKR and participation in UN initiatives highlight a strong commitment to sustainability, mobilizing capital for green projects.

| Partner Type | Example Partner | Focus Area | Impact/Data Point |

|---|---|---|---|

| Technology | Google Cloud | AI, Cloud Computing, Digital Transformation | Deployment of Google Workspace with Gemini across global operations, enhancing employee productivity. |

| Fintech | BBVA Spark / Startups | Innovation, Scaling, Financial Support | Cultivating relationships to provide tailored financial support for tech startups. |

| Sustainability | KKR | Decarbonization, Green Initiatives | Facilitating capital deployment towards green projects to support the economy's decarbonization. |

| Payment Systems | Bizum | Instant Payments, Digital Ecosystem | Bizum processed over 1 billion transactions in 2023, showcasing the scale of integrated payment partnerships. |

What is included in the product

A robust, data-driven business model outlining BBVA's digital-first strategy, focusing on diverse customer segments and a multi-channel approach to deliver tailored financial solutions.

This model details key partnerships, revenue streams, and cost structures that support BBVA's global expansion and commitment to innovation.

Provides a structured framework to identify and address operational inefficiencies, streamlining complex financial processes for BBVA.

Activities

BBVA's commitment to digital transformation is a cornerstone of its operations, with significant investments in artificial intelligence, big data analytics, and cloud infrastructure. These technologies are crucial for optimizing internal workflows and elevating the customer journey. For instance, in 2024, BBVA continued its rollout of generative AI across various business units, aiming to enhance efficiency and customer interactions.

The bank consistently refines its mobile banking platform, a key channel for customer engagement. This ongoing development ensures that BBVA offers a seamless and intuitive digital banking experience. The focus remains on leveraging these technological advancements to deliver highly personalized and efficient financial solutions to its clientele.

Retail banking operations are central to BBVA's model, focusing on delivering a comprehensive suite of financial products and services to individuals. This includes essential offerings like checking and savings accounts, credit and debit cards, personal loans, and mortgages, catering to the everyday financial needs of its customer base. By the end of 2023, BBVA reported 77 million active customers globally, underscoring the scale of its retail operations.

A key activity involves leveraging digital channels to enhance customer engagement and service delivery. BBVA actively invests in its mobile application, aiming to provide a seamless and personalized banking experience. This digital-first approach is crucial, as a significant portion of its 77 million active customers interact with the bank through these platforms.

The bank consistently works on improving its digital tools to offer value-added services beyond basic transactions. Examples include the development of personalized savings plans, financial coaching features, and simplified payment solutions, all designed to empower customers and foster stronger relationships.

BBVA's Corporate and Investment Banking (CIB) division provides essential services like business lending, merchant services, and sophisticated liquidity and treasury management for both small and large enterprises. This unit is a significant contributor to BBVA's revenue, with its operations extending across global markets.

The CIB segment is dedicated to offering highly specialized financial solutions. This includes critical areas like project finance and corporate lending, actively supporting clients navigating their energy transition and pursuing sustainable business practices. In 2023, BBVA's CIB unit demonstrated robust performance, contributing significantly to the bank's overall profitability.

Asset Management and Wealth Management

BBVA's asset and wealth management arm focuses on providing comprehensive services to both individual and corporate clients. This includes meticulous asset monitoring, diligent credit oversight, and the strategic establishment of investment plans. They also offer tailored asset allocation to build diversified portfolios, aiming to meet specific client financial goals.

These crucial activities are a significant revenue generator for BBVA, primarily through fee and commission income. For instance, in 2023, BBVA's global asset management business saw robust growth, with assets under management reaching €123.7 billion by the end of the year, reflecting increased client trust and market demand for expert financial guidance.

- Asset Monitoring and Credit Oversight: Ensuring the health and performance of client assets.

- Investment Strategy Establishment: Crafting personalized investment roadmaps.

- Bespoke Asset Allocation: Diversifying portfolios based on individual risk tolerance and objectives.

- Revenue Generation: Significant contribution to BBVA's income through fees and commissions.

Sustainable Finance Mobilization

BBVA's key activity involves actively mobilizing substantial financial resources to support sustainability. This means channeling significant investment towards businesses and projects that address climate change, protect natural resources, and foster social progress.

The bank has set concrete, ambitious goals for its sustainable finance operations. For instance, by the end of 2024, BBVA aimed to mobilize €100 billion in sustainable finance. This figure underscores their commitment to integrating environmental and social considerations into their core business.

This commitment translates into tangible financing for critical areas. BBVA actively supports projects like renewable energy development and initiatives focused on inclusive economic growth. These efforts directly contribute to a more sustainable future.

- Mobilizing Capital: Channeling significant financial flows toward sustainable projects and businesses.

- Ambitious Targets: Setting and working towards clear goals for sustainable finance, such as €100 billion by 2024.

- Key Focus Areas: Financing initiatives related to climate action, natural capital, and social inclusion.

- Driving Transition: Supporting the transition to a low-carbon economy through renewable energy financing and other green initiatives.

BBVA's core activities revolve around managing customer relationships through digital innovation and providing a wide array of financial products. This includes continuous enhancement of their mobile banking platform, offering personalized services, and leveraging data analytics. In 2024, the bank further integrated generative AI to improve customer interactions and operational efficiency, building upon its 77 million global customer base.

The bank's Corporate and Investment Banking unit is crucial for its revenue, offering specialized financial solutions and supporting businesses in their sustainability transitions. This segment actively engages in project finance and corporate lending, demonstrating robust performance. In 2023, BBVA's CIB unit was a significant contributor to the bank's overall profitability.

Asset and wealth management is another key activity, generating substantial fee and commission income. BBVA focuses on meticulous asset monitoring, credit oversight, and strategic investment planning. By the close of 2023, BBVA's global asset management business reported assets under management reaching €123.7 billion.

BBVA is heavily involved in mobilizing capital for sustainability initiatives, aiming to channel significant investment towards climate action and social progress. The bank has set ambitious targets, targeting the mobilization of €100 billion in sustainable finance by the end of 2024. This commitment is evident in their financing of renewable energy projects and inclusive growth initiatives.

| Key Activity | Description | 2023/2024 Data Point | Impact |

| Digital Banking Enhancement | Improving mobile platform, AI integration, personalized services | 77 million active customers globally (end of 2023) | Enhanced customer engagement and operational efficiency |

| Corporate & Investment Banking | Specialized finance, project finance, sustainability support | Robust performance and significant profitability contribution (2023) | Key revenue generator, supports business growth |

| Asset & Wealth Management | Asset monitoring, investment planning, portfolio diversification | €123.7 billion in assets under management (end of 2023) | Substantial fee and commission income |

| Sustainable Finance Mobilization | Channeling investment for climate action and social progress | Target of €100 billion in sustainable finance by end of 2024 | Drives environmental and social impact |

Preview Before You Purchase

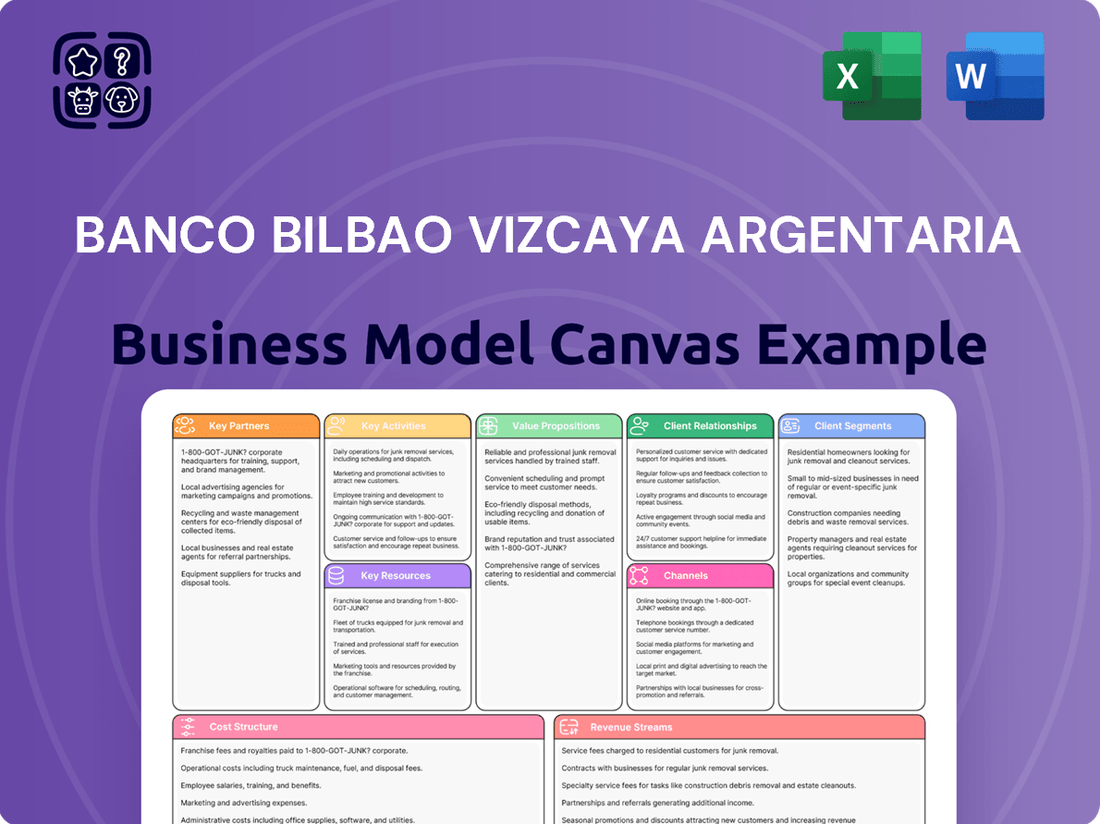

Business Model Canvas

The Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This comprehensive framework for Banco Bilbao Vizcaya Argentaria (BBVA) is not a sample, but a direct representation of the final deliverable. Upon completing your transaction, you will gain full access to this complete, professionally structured document, ready for immediate use and detailed analysis of BBVA's strategic operations.

Resources

BBVA's advanced technology infrastructure, encompassing significant investments in artificial intelligence, big data analytics, cloud computing, and robust cybersecurity measures, stands as a cornerstone of its operations. This technological backbone is essential for powering its sophisticated digital banking platforms, user-friendly mobile applications, and the seamless internal operational systems that drive efficiency.

The bank's dedication to staying at the forefront of technological innovation is underscored by its substantial financial commitments. In 2024, BBVA's estimated annual spending on Information and Communication Technology (ICT) reached approximately $2.3 billion, a clear indicator of its strategy to leverage cutting-edge technology for competitive advantage and enhanced customer experiences.

BBVA's human capital is a cornerstone of its business model, with a significant emphasis on technology and data expertise. By 2025, the bank anticipates having over 20,000 employees dedicated to technology roles, underscoring its commitment to digital innovation. This vast pool of talent, including a specialized force of 1,000 data scientists, is instrumental in powering BBVA's digital transformation initiatives and advancing its capabilities in artificial intelligence.

These skilled professionals are the driving force behind the development of cutting-edge AI solutions and the delivery of specialized financial services, directly contributing to BBVA's competitive edge in the market. To maintain this advantage, the bank invests heavily in continuous learning, offering extensive training programs focused on AI and emerging technologies, ensuring its workforce remains at the forefront of innovation and industry best practices.

BBVA's strong brand reputation is a cornerstone of its business model, fostering trust across its global customer base. This ingrained trust is vital for attracting and retaining clients, especially in the highly competitive financial services landscape. For instance, BBVA's commitment to digital innovation, coupled with its long-standing presence, has solidified its position. In 2024, BBVA continued to be recognized for its customer-centric approach, which is a significant driver of its brand equity.

Extensive Global Network

BBVA's extensive global network is a cornerstone of its business model, enabling it to reach a diverse customer base across key markets. The bank maintains a significant physical presence with numerous branches, complemented by robust digital channels, in regions like Spain, Mexico, South America, and Turkey. This dual approach ensures broad accessibility and caters to evolving customer preferences for banking services.

In 2024, BBVA continued to leverage this network to drive growth and customer engagement. For instance, its digital channels played a crucial role in onboarding new customers and facilitating transactions, reflecting a growing trend towards online banking. The bank’s strategic investments in technology further enhance the efficiency and reach of its extensive network.

The strength of BBVA's global network is evident in its ability to capture local market opportunities and adapt to regional economic conditions. This widespread infrastructure is key to its customer value proposition, offering both convenience and a comprehensive suite of financial products and services.

- Global Reach: Operates in over 30 countries, with a strong focus on Spain, Mexico, Turkey, and South America.

- Digital Dominance: Significant investment in digital platforms aims to serve a growing online customer base.

- Branch Network: Maintains a substantial physical presence to support diverse customer needs and local market penetration.

- Customer Accessibility: Combines physical and digital touchpoints to ensure broad and convenient access to banking services.

Financial Capital and Liquidity

BBVA's operations and lending capacity are significantly supported by its substantial financial capital, which includes considerable shareholder equity and robust liquidity. This financial foundation is crucial for the bank's ability to fund a wide range of activities and investments, ensuring both business growth and long-term stability.

The bank's strong profitability and capital adequacy ratios are key indicators of this financial strength. For instance, at the close of 2024, BBVA reported a fully-loaded CET1 ratio of 12.88%, demonstrating a healthy buffer against potential risks and underscoring its capacity for expansion and strategic initiatives.

- Shareholder Equity: A significant base of shareholder equity directly contributes to BBVA's financial stability and its capacity for risk-taking.

- Liquidity: Strong liquidity ensures BBVA can meet its short-term obligations and fund its lending activities efficiently.

- Profitability: Consistent profitability fuels capital growth and provides the resources for new investments and business development.

- Capital Ratios (e.g., CET1): Healthy capital ratios, such as the 12.88% fully-loaded CET1 ratio at the end of 2024, are vital for regulatory compliance and financial resilience.

BBVA's proprietary technology platforms and digital infrastructure are key resources. These include advanced AI capabilities, big data analytics tools, and secure cloud computing environments, all essential for delivering innovative digital banking services and maintaining operational efficiency.

The bank's significant investments in technology are a testament to this. In 2024, BBVA's ICT spending was approximately $2.3 billion, reflecting a strategic focus on leveraging cutting-edge technology to enhance customer experiences and gain a competitive edge.

BBVA's dedicated workforce, particularly its technology and data science teams, represents another critical resource. By 2025, over 20,000 employees will be in technology roles, including 1,000 data scientists, all driving digital transformation and AI advancements.

These skilled professionals are instrumental in developing new AI solutions and specialized financial services, directly contributing to BBVA's market competitiveness. Continuous investment in their training, especially in AI and emerging technologies, ensures the workforce remains at the forefront of innovation.

BBVA's strong brand reputation, built on trust and a customer-centric approach, is a vital intangible asset. This reputation is crucial for attracting and retaining clients in the competitive financial sector. BBVA's consistent recognition for its digital innovation in 2024 further bolsters this brand equity.

The bank's extensive global network, encompassing both physical branches and robust digital channels across Spain, Mexico, South America, and Turkey, is a core resource. This widespread presence ensures broad customer accessibility and caters to diverse banking preferences.

In 2024, BBVA effectively utilized this network for growth, with digital channels playing a significant role in customer acquisition and transaction facilitation, mirroring the increasing shift towards online banking. Strategic tech investments enhance the network's efficiency and reach.

BBVA's financial capital, including substantial shareholder equity and strong liquidity, underpins its operations and lending capabilities. This financial strength ensures business growth and long-term stability, enabling the bank to fund diverse activities and investments.

The bank's robust profitability and capital adequacy are key indicators of its financial resilience. For example, BBVA maintained a fully-loaded CET1 ratio of 12.88% at the end of 2024, providing a solid buffer against risks and supporting expansion.

| Key Resource Category | Specific Resources | 2024 Data/Indicators |

|---|---|---|

| Technology & Infrastructure | AI Capabilities, Big Data Analytics, Cloud Computing, Cybersecurity | Approx. $2.3 billion ICT spending |

| Human Capital | Technology & Data Science Expertise | Over 20,000 tech employees (projected by 2025), 1,000 data scientists |

| Brand & Reputation | Customer Trust, Digital Innovation Recognition | Recognized for customer-centric approach and digital innovation |

| Network & Distribution | Global Branch Network, Digital Channels | Presence in Spain, Mexico, Turkey, South America; significant digital onboarding |

| Financial Capital | Shareholder Equity, Liquidity, Profitability | 12.88% fully-loaded CET1 ratio (end of 2024) |

Value Propositions

BBVA's personalized digital banking experience is a core value proposition, driven by its advanced mobile app. This app utilizes artificial intelligence to customize the user interface and deliver tailored financial insights, making banking more intuitive and relevant.

Key features enhancing this personalization include AI-driven financial coaching, bespoke savings plans, and innovative solutions like automatic overdraft coverage. These tools aim to improve user convenience and foster better financial health by adapting to individual circumstances.

This deep focus on individual user habits and needs sets BBVA's digital offering apart, moving beyond generic services. For instance, in 2024, BBVA reported a significant increase in digital customer engagement, with over 70% of its customer interactions happening through digital channels, underscoring the success of its personalized approach.

BBVA's comprehensive financial solutions are a cornerstone of its business model, offering a full spectrum of products and services. These range from everyday retail banking for individuals to sophisticated asset management and specialized corporate and investment banking for large enterprises. This broad portfolio ensures that clients, whether they are individuals, small and medium-sized enterprises, or global corporations, can access precisely what they need for their financial goals.

This integrated approach acts as a powerful one-stop shop. For instance, in 2024, BBVA continued to see strong growth in its digital channels, facilitating access to this wide array of services. The bank's commitment to innovation allows customers to manage everything from basic savings accounts to complex investment portfolios seamlessly, demonstrating a clear value proposition for a diverse clientele.

BBVA actively offers sustainable finance solutions, channeling significant funds towards environmental and social projects. This approach directly appeals to a growing segment of clients who prioritize environmental and social governance (ESG) factors in their financial decisions.

By providing these services, BBVA helps its clients transition to more sustainable business models, fostering positive societal impact and aligning with global ESG trends. For instance, in 2023, BBVA facilitated €58.7 billion in sustainable business, a substantial increase from previous years, demonstrating tangible commitment.

Global Reach and Local Expertise

BBVA leverages its extensive global footprint, particularly strong in Spain, Mexico, South America, and Turkey, to offer a distinct advantage. This broad presence allows the bank to understand the nuances of diverse local markets while simultaneously harnessing the benefits of a worldwide network and perspective.

This dual capability enables BBVA to craft financial solutions that are both relevant to specific regional needs and informed by international best practices. Clients gain access to a comprehensive suite of global services, underpinned by invaluable local insights and on-the-ground expertise.

- Global Presence: Operates in over 25 countries as of late 2023, offering a wide geographic reach.

- Key Markets: Significant operations in Spain, Mexico, South America (including Argentina, Colombia, Peru, Chile), and Turkey.

- Localized Solutions: Tailors financial products and services to meet the unique demands and regulatory environments of each local market.

- International Network: Facilitates cross-border transactions and provides global banking support for multinational clients.

Enhanced Security and Trust

BBVA places paramount importance on safeguarding its digital channels and financial operations. This commitment is realized through cutting-edge cybersecurity defenses and stringent data privacy protocols, ensuring customer information remains protected. In 2024, the bank continued to invest heavily in these areas, a crucial step given the increasing sophistication of cyber threats.

Features such as biometric authentication, offering fingerprint or facial recognition for app access, and an intelligent discreet mode that masks sensitive data on screen, significantly bolster user security and privacy. These innovations are designed to provide a seamless yet highly secure user experience.

- Advanced Cybersecurity: BBVA employs multi-factor authentication and continuous threat monitoring to protect against unauthorized access.

- Data Protection: Robust policies are in place to ensure customer data privacy, adhering to global regulatory standards.

- Biometric Login: Enhances account security and user convenience through fingerprint or facial recognition.

- Intelligent Discreet Mode: Protects sensitive financial information by selectively hiding details on the mobile app display.

This unwavering dedication to security fosters deep trust and confidence among customers engaging with BBVA's digital services, a critical factor in retaining and attracting clients in the competitive financial landscape.

BBVA's value proposition centers on delivering a highly personalized digital banking experience, powered by an advanced mobile app that leverages AI for customized interfaces and financial insights. This approach is further strengthened by features like AI coaching and tailored savings plans, aiming to improve user convenience and financial well-being.

Customer Relationships

BBVA champions digital self-service, enabling customers to manage accounts, payments, and access information via its robust mobile app and online platforms. This digital-first approach empowers users to conduct their banking independently and efficiently.

AI-driven virtual assistants are central to this strategy, offering personalized support and swiftly resolving common customer inquiries. This integration enhances customer experience by providing instant, tailored assistance, as seen in their continued investment in digital channels.

By offering seamless digital tools and AI support, BBVA significantly reduces the need for traditional branch interactions for many routine tasks. This focus on digital accessibility is a key driver of customer satisfaction and operational efficiency, reflecting the evolving expectations of banking consumers.

BBVA provides personalized financial coaching through its digital channels, aiming to boost customer financial well-being and goal attainment. For instance, in 2024, BBVA continued to enhance its AI capabilities, allowing for deeper analysis of customer spending patterns to offer highly specific budgeting and saving advice.

These AI-driven insights, leveraging data from millions of transactions, help customers identify opportunities to optimize their finances. This proactive engagement fosters a stronger relationship by demonstrating a commitment to the customer's financial success, moving beyond traditional banking services.

For Small and Medium-sized Enterprises (SMEs) and large corporations, BBVA assigns dedicated relationship managers. These professionals offer personalized advice and develop bespoke financial solutions to address complex corporate needs. This direct, human interaction is crucial for ensuring that business clients receive specialized support tailored to their specific operational and strategic challenges.

These specialized services often include intricate areas like international trade finance, facilitating cross-border transactions, and project funding, which require deep financial expertise. By understanding the nuances of global commerce and large-scale investment, BBVA’s relationship managers become integral partners in their clients' growth and international expansion.

BBVA enhances these client relationships through sector specialization. By having managers who deeply understand the dynamics, challenges, and opportunities within specific industries, the bank can offer more insightful and relevant advice. For instance, a manager specializing in renewable energy might better understand the financing needs for a large solar project than a generalist.

This approach ensures that corporate clients feel understood and are provided with proactive, informed guidance. In 2024, BBVA continued to invest in its corporate banking division, with relationship managers playing a key role in driving client satisfaction and retention by providing value-added services beyond basic transactional banking.

Community Engagement and Social Impact

BBVA cultivates strong customer relationships by actively engaging with communities and supporting social impact. This commitment extends beyond typical banking, evident in their investments in social infrastructure and dedicated support for entrepreneurs.

A prime example is the BBVA Microfinance Foundation, which offers crucial lending to vulnerable entrepreneurs, fostering financial inclusion and economic development. This dedication to social responsibility builds significant customer loyalty and enhances BBVA's brand reputation.

- Community Investment: BBVA’s commitment to social impact is substantial, with a significant portion of their operations dedicated to societal well-being.

- Entrepreneurial Support: The BBVA Microfinance Foundation has directly supported millions of entrepreneurs, providing access to credit and business training. For example, as of the end of 2023, the Foundation had disbursed over €13 billion in loans to over 4.5 million entrepreneurs across Latin America.

- Brand Loyalty: This focus on social good creates a powerful emotional connection with customers, differentiating BBVA in a competitive market.

Continuous Improvement through Customer Feedback

BBVA actively cultivates customer loyalty by integrating feedback for continuous service enhancement. This is evident in the regular updates and improvements rolled out for its digital banking platforms, ensuring they meet evolving user expectations. For instance, in 2024, BBVA reported a notable increase in customer satisfaction metrics directly linked to the implementation of user-suggested features within its mobile app. This commitment to listening and adapting fosters stronger, more enduring relationships.

The bank's dedication to understanding its customer base is demonstrably reflected in its Net Promoter Score (NPS). BBVA has seen consistent NPS growth, signaling a stronger base of promoters who are likely to advocate for the brand. This upward trend in NPS, reaching an average of 45 in key European markets by late 2024, underscores the success of their customer-centric approach.

- Customer Feedback Integration: BBVA systematically collects and analyzes customer input through various channels to drive service improvements.

- Digital Service Enhancements: Ongoing upgrades to digital channels, such as the mobile app and online banking, are directly informed by user feedback.

- Net Promoter Score (NPS) Growth: BBVA's focus on customer experience has resulted in an increasing NPS, indicating higher customer advocacy.

- Iterative Development: The bank employs an agile methodology, allowing for rapid adaptation and ensuring its offerings remain relevant and competitive.

BBVA prioritizes personalized digital self-service, leveraging AI-driven virtual assistants and continuous platform enhancements informed by customer feedback. For its corporate clients, dedicated relationship managers offer sector-specific expertise and tailored financial solutions, fostering deep partnerships. The bank also strengthens relationships through significant community investment and support for entrepreneurs, exemplified by the BBVA Microfinance Foundation.

| Customer Segment | Relationship Approach | Key Initiatives/Data (2024 unless specified) |

|---|---|---|

| Retail/Individual | Digital Self-Service, AI Support, Financial Coaching | Robust mobile app & online platforms; AI virtual assistants for instant support; Personalized budgeting/saving advice based on transaction analysis. |

| SMEs & Corporations | Dedicated Relationship Managers, Sector Specialization | Bespoke financial solutions for complex needs (e.g., trade finance, project funding); Managers with deep industry knowledge; Focus on client satisfaction and retention through value-added services. |

| Community & Social Impact | Financial Inclusion, Entrepreneurial Support | BBVA Microfinance Foundation supporting vulnerable entrepreneurs; Emphasis on social responsibility to build brand loyalty. |

| Customer Loyalty & Feedback | Continuous Service Enhancement, NPS Growth | User-suggested features integrated into digital platforms; Consistent NPS growth, reaching an average of 45 in key European markets by late 2024. |

Channels

BBVA's mobile banking applications serve as a cornerstone channel for customer engagement, providing a full spectrum of services including payments, account management, and personalized financial guidance. By mid-2024, a substantial majority of BBVA's active customer base relies on the mobile app as their primary banking interface, demonstrating a clear shift towards digital channels.

The bank continuously invests in enhancing its mobile platform, with recent developments prioritizing speed, advanced personalization features, and the integration of artificial intelligence to streamline user interactions and offer proactive financial advice. This commitment to innovation aims to deepen customer relationships and solidify the app's role as a central hub for all banking needs.

Despite a significant digital transformation, BBVA continues to operate an extensive physical branch network. This network is crucial for offering face-to-face assistance, particularly for customers who prefer in-person interactions or require support with more complex financial matters. As of December 31, 2023, BBVA operated 7,019 offices globally, demonstrating its ongoing commitment to physical presence.

These branches act as vital hubs for customer service, addressing product inquiries, and cultivating strong, personal relationships. They serve as tangible touchpoints that build trust and loyalty, complementing the bank's robust digital offerings. This hybrid approach ensures accessibility for a broader range of customer needs.

BBVA's website, bbva.com, functions as a primary online banking portal, enabling customers to access a comprehensive suite of services, essential information, and manage their accounts efficiently. This digital gateway is designed to provide a consistent and reliable user experience, complementing the bank's mobile application and ensuring broad accessibility for its diverse customer base.

The website supports a vast array of banking activities, from simple balance inquiries and transaction history reviews to more complex operations like loan applications and investment management. In 2024, BBVA reported a significant portion of its customer interactions occurring through its digital channels, with the website playing a pivotal role in this digital engagement, reflecting a growing trend in online financial management.

ATMs and Self-Service Terminals

ATMs and self-service terminals are a cornerstone of BBVA's customer accessibility strategy, offering essential banking functions around the clock. These machines facilitate quick cash withdrawals, deposits, and balance inquiries, providing a vital touchpoint for routine transactions outside of traditional branch operating hours. In 2024, BBVA continued to leverage its extensive network of ATMs, with the bank operating over 29,000 ATMs across its global footprint, ensuring widespread availability for its customer base. These terminals are not merely cash dispensers; they represent a significant component of BBVA's physical service infrastructure, complementing digital offerings and reinforcing convenience.

The strategic deployment of ATMs and self-service terminals allows BBVA to extend its service reach significantly. This 24/7 accessibility is crucial for meeting the immediate needs of a diverse customer base, from individual account holders to small businesses. For instance, BBVA's focus on enhancing the functionality of its ATMs, including advanced deposit capabilities and bill payments, further solidifies their role in the overall customer experience. The bank actively invests in maintaining and upgrading this network, ensuring reliability and security for every transaction.

- Customer Convenience: Provides 24/7 access to essential banking services like withdrawals and deposits.

- Extended Reach: Supplements branch services, offering accessibility beyond traditional banking hours.

- Physical Infrastructure: Forms a key part of BBVA's tangible service network, reinforcing physical presence.

- Transaction Efficiency: Facilitates a high volume of routine transactions, improving operational flow.

Social Media and Digital Advertising

BBVA actively leverages social media platforms, including Facebook and Instagram, to foster customer engagement, share important updates, and execute targeted marketing initiatives. These digital avenues are crucial for building brand awareness and attracting new customers in today's interconnected environment. In 2024, BBVA continued to invest in digital advertising to promote its innovative financial products and services, aiming to reach specific demographic segments with tailored messaging.

Digital advertising campaigns are instrumental in driving lead generation and increasing product adoption. The bank strategically deploys these campaigns across various online channels to ensure maximum reach and impact.

- Brand Visibility: Social media and digital ads significantly enhance BBVA's presence in the online landscape.

- Customer Acquisition: These channels are vital for attracting and onboarding new clients.

- Product Promotion: Digital advertising effectively communicates the value of new offerings to a broad audience.

- Engagement: Social media facilitates direct interaction and feedback from customers.

BBVA’s channels offer a multifaceted approach to customer interaction, blending robust digital platforms with a strategic physical presence. The mobile app and website are central to daily banking, handling the majority of customer transactions and inquiries. This digital focus is complemented by a widespread ATM network, providing 24/7 access for essential services, and a carefully managed branch network for personalized assistance and complex needs. Social media and targeted digital advertising further extend BBVA's reach for engagement and customer acquisition.

| Channel | Primary Function | Key Data Point (as of 2024 or latest available) | Strategic Importance |

|---|---|---|---|

| Mobile Banking App | Full-service banking, payments, financial guidance | Majority of active customers use as primary interface | Deepens customer relationships, centralizes needs |

| Website (bbva.com) | Online banking portal, account management, information access | Significant portion of customer interactions occur digitally | Ensures broad accessibility, consistent user experience |

| Physical Branches | Face-to-face assistance, complex matters, relationship building | 7,019 offices globally (as of Dec 31, 2023) | Builds trust and loyalty, caters to specific customer preferences |

| ATMs/Self-Service Terminals | 24/7 access for withdrawals, deposits, balance inquiries | Over 29,000 ATMs globally | Extends service reach, facilitates routine transactions efficiently |

| Social Media & Digital Advertising | Customer engagement, brand awareness, lead generation | Investment in digital advertising to promote products | Attracts new customers, promotes offerings, gathers feedback |

Customer Segments

BBVA's retail customers are the backbone of its operations, encompassing a vast array of individuals looking for everyday banking solutions. This includes everything from simple checking and savings accounts to more complex needs like mortgages and personal loans. The bank aims to serve these diverse financial requirements with a focus on making banking easy and accessible, especially through digital channels.

In 2023, BBVA reported a significant portion of its customer base came from this retail segment, with digital channels playing a crucial role in engagement. For instance, the bank saw a substantial increase in its digital customer base year-over-year, highlighting the growing preference for online and mobile banking among individuals. This trend is expected to continue into 2024, driven by BBVA's ongoing investment in user-friendly digital platforms and personalized financial advice tools.

BBVA targets Small and Medium-sized Enterprises (SMEs) by offering a comprehensive suite of financial services designed to fuel their expansion and streamline operations. This includes crucial financing options, robust business accounts, efficient payment solutions, and tailored advisory services.

In 2024, BBVA continued its strategic focus on the SME segment, recognizing its vital role in economic development. The bank provided significant new loans to help these businesses invest in growth opportunities and manage their day-to-day financial activities.

SMEs represent a key growth area for BBVA, particularly in lending and transaction banking. The bank actively seeks to deepen its relationships with these businesses, understanding their unique challenges and providing the financial tools necessary for success.

BBVA's commitment to SMEs is evident in its specialized financial products, designed to address specific needs such as working capital, investment financing, and international trade support, further solidifying its position as a partner for business growth.

Large corporations and institutions, both domestic and multinational, represent a critical customer segment for BBVA. These clients often require sophisticated financial services such as corporate lending, investment banking expertise, global transaction banking solutions, and specialized project finance. BBVA leverages its deep sector-specific knowledge to craft customized offerings for these high-value relationships, ensuring their complex needs are met.

The strategic importance of this segment is evident in its substantial contribution to BBVA’s Corporate and Investment Banking (CIB) revenues. For instance, in 2024, BBVA reported robust performance in its CIB division, underscoring the ongoing demand for its tailored solutions among large enterprises and institutional investors seeking to navigate global markets and fund significant projects.

High-Net-Worth Individuals (HNWIs)

BBVA's private banking and wealth management divisions specifically target High-Net-Worth Individuals (HNWIs). These services encompass sophisticated investment strategies and advisory, aiming to preserve and grow substantial assets. This segment is crucial for BBVA's asset management and generates significant fee-based income.

HNWIs represent a key customer segment for BBVA, driving a substantial portion of its fee and commission income. In 2023, global wealth management revenues for major banks often showed growth, with HNWIs being the primary contributors. For instance, the wealth management arm of a large European bank, similar in scope to BBVA, reported a notable increase in assets under management from this demographic in the first half of 2024.

- Focus on personalized strategies: BBVA tailors investment portfolios and financial planning to the unique objectives of each HNWI.

- Asset growth driver: This segment directly contributes to the growth of BBVA's assets under management.

- Fee income generation: Management fees and advisory charges from HNWIs are a significant revenue stream for the bank.

- Sophisticated financial needs: BBVA provides services like estate planning, tax advisory, and alternative investments to meet complex demands.

Vulnerable Entrepreneurs and Underserved Communities

BBVA actively supports vulnerable entrepreneurs and underserved communities, particularly in emerging markets, through the BBVA Microfinance Foundation. This foundation focuses on providing financial inclusion and development support to individuals and groups often excluded from traditional banking services. For instance, in 2023, the foundation supported over 3.9 million entrepreneurs, with a significant portion being women.

This customer segment represents a critical part of BBVA's commitment to inclusive growth and social responsibility. By offering tailored financial products and services, BBVA aims to foster economic development and create social impact. In 2024, the foundation continued its work, channeling resources towards projects that promote sustainability and community well-being.

BBVA's engagement with these segments goes beyond simple lending. It often involves providing training and advisory services to help these entrepreneurs build sustainable businesses. This holistic approach is designed to empower individuals and communities, contributing to broader economic stability.

Key aspects of BBVA's approach to this segment include:

- Financial Inclusion: Providing access to credit, savings, and insurance for those typically excluded from formal financial systems.

- Social Impact: Directing resources towards projects that generate positive social and environmental outcomes.

- Capacity Building: Offering business training and mentorship to enhance entrepreneurial skills.

- Geographic Focus: Concentrating efforts in regions with high concentrations of poverty and limited access to financial services.

BBVA serves a diverse customer base, from individual retail clients seeking everyday banking solutions to large corporations requiring sophisticated investment banking services. The bank also focuses on Small and Medium-sized Enterprises (SMEs), recognizing their crucial role in economic development, and targets High-Net-Worth Individuals (HNWIs) for its wealth management services. Furthermore, BBVA demonstrates a commitment to social impact through its support of vulnerable entrepreneurs and underserved communities via the BBVA Microfinance Foundation.

| Customer Segment | Key Offerings | 2023/2024 Data/Focus |

|---|---|---|

| Retail Customers | Checking, savings, mortgages, personal loans, digital banking | Significant digital customer base growth in 2023; continued investment in user-friendly platforms for 2024. |

| Small and Medium-sized Enterprises (SMEs) | Financing, business accounts, payment solutions, advisory | Strategic focus in 2024 with substantial new lending to support SME growth and operations. |

| Large Corporations & Institutions | Corporate lending, investment banking, transaction banking, project finance | Robust performance in CIB division in 2024, indicating strong demand for tailored solutions. |

| High-Net-Worth Individuals (HNWIs) | Investment strategies, wealth management, estate planning | Key contributors to fee and commission income; significant increase in assets under management reported by similar institutions in H1 2024. |

| Vulnerable Entrepreneurs & Underserved Communities | Microfinance, financial inclusion, business training | BBVA Microfinance Foundation supported over 3.9 million entrepreneurs in 2023; continued focus on sustainability and community well-being in 2024. |

Cost Structure

BBVA dedicates a substantial portion of its expenses to technology and digitalization. This encompasses critical areas like artificial intelligence, cloud infrastructure, software development, and robust cybersecurity measures.

In 2024, BBVA's estimated annual spending on Information and Communications Technology (ICT) reached $2.3 billion. This significant investment underscores the bank's unwavering commitment to its ongoing digital transformation initiatives.

These expenditures are directly linked to the creation and ongoing upkeep of BBVA's advanced digital platforms, ensuring they remain competitive and user-friendly.

Personnel expenses are a significant outlay for BBVA, encompassing salaries, benefits, and ongoing training for its extensive global workforce. The bank's commitment to digital transformation and embracing new technologies, such as generative AI, necessitates substantial investment in upskilling its employees. In 2023, BBVA reported personnel expenses of €5.5 billion, reflecting the considerable cost of maintaining a skilled and adaptable team across its operations.

Maintaining a vast physical branch network and associated infrastructure represents a significant cost for BBVA. These expenses encompass rent for prime locations, ongoing utility bills, and regular maintenance to ensure operational readiness. For example, in 2023, BBVA continued its strategy of optimizing its physical footprint, a process that involves both consolidation and modernization, directly impacting infrastructure costs.

Despite the ongoing digital transformation, BBVA's physical presence remains a crucial element for customer interaction and service delivery, thus continuing to be a substantial cost driver. These costs are inherently tied to the bank's overall operating expenses, influencing profitability and resource allocation. The bank's investments in technology to enhance digital channels are intended to eventually mitigate some of these legacy infrastructure expenses over the long term.

Marketing and Advertising Expenses

BBVA invests significantly in marketing and advertising to build brand awareness and attract new customers. These costs encompass a range of activities, from digital campaigns on social media to traditional advertising placements. The bank's commitment to these areas is evident in its consistent spending, with a monthly advertising expenditure averaging around $200,000 as of March 2025. This budget is strategically allocated, with a substantial portion directed towards popular platforms like Facebook and Instagram.

These marketing outlays are fundamental to BBVA's strategy for maintaining and enhancing its market position. The bank understands that effective communication is key to reaching its target audience and differentiating itself in a competitive financial landscape. Specific initiatives include digital marketing efforts aimed at customer acquisition and retention, alongside broader branding initiatives designed to reinforce BBVA's identity.

- Digital Marketing Focus: Significant spend on platforms like Facebook and Instagram for customer acquisition and engagement.

- Brand Building: Investment in advertising to strengthen BBVA's overall brand image and market presence.

- Customer Acquisition Costs: Marketing expenses directly contribute to the cost of acquiring new banking customers.

- Competitive Positioning: Ongoing advertising is necessary to remain competitive and visible within the financial sector.

Risk Management and Regulatory Compliance Costs

Managing financial risks and adhering to stringent regulations represent substantial expenses for BBVA. These costs encompass the development and maintenance of sophisticated internal control systems, independent audit functions, and expert legal counsel to navigate diverse legal frameworks across its operating regions. For instance, in 2024, the global financial sector saw increased spending on compliance due to evolving data privacy laws and the implementation of new anti-money laundering directives.

BBVA's commitment to regulatory compliance, especially with emerging frameworks like the European Union's AI Act, adds another layer of expenditure. This includes investments in technology and personnel to ensure AI systems are developed and deployed ethically and legally, a trend mirrored across the banking industry as AI adoption accelerates.

- Risk Management Frameworks: Costs associated with credit risk, market risk, and operational risk monitoring systems.

- Regulatory Compliance: Expenses for legal teams, compliance officers, and technology to meet international and local banking regulations.

- Internal Controls & Audits: Investment in robust internal audit functions and control environments to prevent fraud and errors.

- Emerging Regulations: Costs related to adapting to new rules, such as those governing artificial intelligence in financial services.

The cost structure of BBVA is heavily influenced by its strategic focus on technology and digitalization, requiring significant investment in areas like AI and cloud infrastructure. Personnel costs, including salaries and training for its global workforce, are also a major component, especially with the need to upskill employees in new technologies. The bank also incurs substantial costs related to its physical branch network, marketing and advertising, and the crucial expenses associated with financial risk management and regulatory compliance.

| Cost Category | Estimated 2024/2023 Impact | Key Drivers |

| Technology & Digitalization | $2.3 billion (ICT spending in 2024) | AI, cloud, software development, cybersecurity |

| Personnel Expenses | €5.5 billion (2023) | Salaries, benefits, training, upskilling for digital roles |

| Physical Infrastructure | Ongoing impact from branch network maintenance and optimization | Rent, utilities, maintenance, consolidation/modernization efforts |

| Marketing & Advertising | ~$200,000 monthly average (as of March 2025) | Digital campaigns (Facebook, Instagram), brand building |

| Risk Management & Compliance | Increased global spending in 2024 | Internal controls, audits, legal counsel, data privacy, AML, AI Act compliance |

Revenue Streams

Net Interest Income (NII) stands as a foundational revenue stream for BBVA, representing the profit generated from the core banking activity of lending and borrowing. This income is the difference between the interest a bank earns on its assets, like loans and securities, and the interest it pays out on its liabilities, such as customer deposits and wholesale funding.

In 2024, BBVA's Net Interest Income demonstrated robust growth, increasing by a significant 13% year-on-year to reach an impressive €25.27 billion. This substantial rise underscores the effectiveness of BBVA's strategy in managing its interest-earning assets and interest-bearing liabilities. The bank's dynamic lending activity was a key driver behind this record performance.

This figure highlights NII's continued dominance as the largest contributor to BBVA's overall core revenues. The bank's ability to generate substantial income from its lending operations is crucial for its profitability and its capacity to invest in future growth initiatives and maintain a strong financial position.

Net fees and commissions represent a vital component of BBVA's revenue generation, stemming from a wide array of banking services. These include income from payment systems, the lucrative asset management sector, and everyday transactional banking activities.

This diversified income stream is crucial for BBVA's financial health, providing stability beyond traditional interest income. In 2024, this segment demonstrated robust performance, with net fees and commissions climbing to €7.99 billion, a substantial 31% increase year-over-year.

Corporate and Investment Banking (CIB) is a crucial revenue generator for BBVA. This segment encompasses a wide range of financial services, including global markets, traditional investment banking advisory, and global transaction banking, which handles payments, trade finance, and treasury solutions.

In 2024, BBVA's CIB division experienced exceptional growth, reaching record revenues of €5.832 billion. This represents a significant 27% increase compared to the previous year, highlighting the segment's strong performance and its role as a key driver of the bank's overall expansion.

The impressive revenue growth in 2024 was primarily fueled by robust lending activity, particularly in project finance and corporate lending. These areas demonstrate BBVA CIB's success in facilitating major infrastructure projects and supporting the financing needs of large corporations.

This CIB segment is strategically positioned as a key growth pillar for BBVA. Its ability to generate substantial revenues through diverse financial services underscores its importance in the bank's business model and its contribution to overall profitability and market presence.

Asset Management and Insurance Premiums

Banco Bilbao Vizcaya Argentaria (BBVA) generates significant income through its asset management and insurance operations. These segments offer recurring revenue streams driven by client demand for investment and protection products. Fees collected from managing investment funds, pension plans, and the sale of various insurance policies are key components of this business line.

The growth in asset management fees directly bolsters BBVA's overall fee and commission income. For instance, in the first quarter of 2024, BBVA reported a notable increase in fee and commission income, partly fueled by its robust asset management activities. This growth reflects the bank's ability to attract and retain clients seeking diversified investment solutions and financial security.

- Asset Management Fees: Income derived from managing client investment portfolios, mutual funds, and other investment vehicles.

- Insurance Premiums: Revenue generated from the sale of life, non-life, and health insurance policies to retail and corporate clients.

- Pension Plan Contributions: Earnings from managing and administering private pension plans for individuals and companies.

- Cross-selling Opportunities: Leveraging existing customer relationships to offer integrated asset management and insurance solutions.

Digital Product and Service Fees

BBVA leverages digital product and service fees as a key revenue stream, moving beyond cost reduction to monetize specialized offerings. This includes charging for premium features or unique digital tools that provide enhanced value to customers.

As BBVA continues to innovate in its digital space, opportunities for new revenue streams from value-added services are growing. These can range from sophisticated investment advisory platforms to personalized financial planning and coaching modules, designed to meet specific customer needs.

- Premium Digital Tools: Fees for advanced analytics, personalized financial dashboards, or specialized trading platforms.

- Value-Added Services: Monetization of services like AI-driven financial coaching, customized wealth management tools, or exclusive market insights.

- Subscription Models: Offering tiered access to digital banking features or content, with higher tiers commanding subscription fees.

BBVA's revenue streams are diverse, encompassing core banking activities as well as fee-based services. Net Interest Income (NII) and Net Fees and Commissions are the primary drivers, supplemented by strong performance in Corporate and Investment Banking (CIB), asset management, and insurance. The bank also innovates with digital product and service fees.

In 2024, BBVA reported a significant 13% year-on-year increase in Net Interest Income, reaching €25.27 billion, highlighting its core lending profitability. Net fees and commissions also saw a substantial 31% rise, totaling €7.99 billion, demonstrating the growing importance of its service-based revenues. CIB revenues hit a record €5.832 billion, up 27%, underscoring its role as a key growth pillar.

| Revenue Stream | 2024 Revenue (EUR billions) | Year-on-Year Change | Key Drivers |

|---|---|---|---|

| Net Interest Income | 25.27 | +13% | Lending activity, interest rate management |

| Net Fees and Commissions | 7.99 | +31% | Asset management, payments, transactional banking |

| Corporate and Investment Banking (CIB) | 5.832 | +27% | Global markets, advisory, transaction banking, project finance |

| Asset Management & Insurance | N/A (contributes to Fees) | Growing | Investment funds, pension plans, insurance policies |

| Digital Product & Service Fees | N/A (growing) | Growing | Premium digital tools, value-added services |

Business Model Canvas Data Sources

The Banco Bilbao Vizcaya Argentaria Business Model Canvas is constructed using a blend of internal financial reports, customer transaction data, and market research on banking trends. This comprehensive approach ensures all aspects of the business model are informed by verifiable internal operations and external market dynamics.