Banco Bilbao Vizcaya Argentaria Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banco Bilbao Vizcaya Argentaria Bundle

Unlock the strategic potential of Banco Bilbao Vizcaya Argentaria (BBVA) with a comprehensive understanding of its BCG Matrix. This powerful tool categorizes BBVA's business units into Stars, Cash Cows, Dogs, and Question Marks, offering a clear snapshot of their market share and growth potential. Are their digital banking services a rapidly growing Star, or are traditional loan portfolios mature Cash Cows?

This preview offers a glimpse into BBVA's strategic positioning. To truly grasp the nuances and actionable insights, you need the full BCG Matrix report. It provides detailed quadrant placements, allowing you to identify where BBVA excels and where it might be facing challenges.

Don't be left in the dark about BBVA's competitive landscape. Purchase the full BCG Matrix for a complete breakdown and strategic insights you can act on, empowering you to make informed decisions about resource allocation and future investments.

Stars

BBVA's digital banking and mobile services are a clear Star in its BCG Matrix. The bank has strategically poured resources into these channels to attract a substantial customer base digitally. In 2024, a significant portion of new customer acquisitions occurred through these digital avenues, reflecting both a rapidly expanding market and BBVA's dominant position within it. This strong performance is further bolstered by a notable surge in digital transactions, underscoring the segment's high growth trajectory and the bank's successful penetration.

BBVA's Corporate & Investment Banking (CIB) division is a clear Star in the BCG matrix. In 2024, CIB posted record revenues, driven by robust performance in Global Markets and Global Transaction Banking. This segment is experiencing significant growth, particularly in cross-border transactions and specialized financing solutions across Europe and the US.

The division's strategic expansion and strong client relationships in key markets like the UK highlight its dominant position in a high-growth sector. First-quarter 2025 results further reinforce this, showing continued revenue momentum and increased market share in investment banking and finance activities.

BBVA's sustainable finance solutions are a clear Star in its BCG Matrix. By the close of 2024, the bank had already surpassed its €300 billion sustainable business target set for 2018-2025, reaching an impressive €304 billion. This rapid expansion highlights the significant market demand and BBVA's strong capabilities in this area.

The bank's forward-looking strategy is further underscored by its new, ambitious target of €700 billion for sustainable business between 2025 and 2029. This substantial increase reflects not only the perceived high growth potential of sustainable finance but also BBVA's established leadership and commitment to driving green and social initiatives within the financial sector.

BBVA Mexico Operations

BBVA Mexico stands as a dominant force in the Mexican financial landscape. As of November 2024, it commanded the largest market share, demonstrating a substantial lead in both performing loans and deposits. This robust position is bolstered by the continued dynamism of the Mexican economy, fueled by healthy private consumption and a resilient labor market.

BBVA's strategic outlook for Mexico is exceptionally positive. The institution has committed to investing over MXN 100 billion in the country between 2025 and 2030. This significant capital injection signals strong confidence in the market's high growth potential and reinforces BBVA's already dominant position. Consequently, BBVA Mexico is classified as a Star within the BCG Matrix, indicative of its high market share in a high-growth industry.

- Market Dominance: Largest financial group in Mexico by market share.

- Key Financial Metrics: Significant lead in performing loans and deposits as of November 2024.

- Economic Tailwinds: Mexican market dynamism supported by private consumption and a strong labor market.

- Future Investment: Commitment to invest over MXN 100 billion in Mexico between 2025-2030.

Project Finance in Latin America

Project finance in Latin America represents a significant growth area, and BBVA is demonstrably a key player. In 2024, BBVA held a commanding 16.8% market share in syndicated loan bookrunner rankings across the region, underscoring its leadership. This growth is particularly evident in Mexico’s project finance sector, where BBVA has made substantial inroads.

The overall Latin American syndicated loan market saw robust year-on-year expansion in 2024. This expansion was largely fueled by substantial investments in energy and infrastructure projects throughout the region. BBVA’s strong position in this high-growth market, coupled with its significant market share, firmly places its project finance activities in Latin America within the Star quadrant of the BCG Matrix.

- Market Leadership: BBVA led syndicated loan bookrunner rankings in Latin America with a 16.8% market share in 2024.

- Sectoral Growth: The Latin American syndicated loan market grew significantly in 2024, driven by energy and infrastructure projects.

- Geographic Strength: BBVA shows notable growth in project finance specifically within Mexico.

- Strategic Positioning: BBVA's strong performance in a high-growth market qualifies its Latin American project finance as a Star.

BBVA's digital banking and mobile services are a clear Star in its BCG Matrix, showing high growth and market share. In 2024, a substantial portion of new customers were acquired digitally, reflecting the segment's expansion and BBVA's strong position. This is further supported by a notable increase in digital transactions, highlighting the segment's high growth trajectory and BBVA's successful market penetration.

BBVA's Corporate & Investment Banking (CIB) division is a Star, with record revenues in 2024 driven by Global Markets and Global Transaction Banking. The division is experiencing significant growth, particularly in cross-border transactions and specialized financing across Europe and the US, further cementing its dominant position in a high-growth sector.

Sustainable finance solutions are a Star for BBVA, having surpassed its €300 billion target for 2018-2025 by the end of 2024, reaching €304 billion. The bank has set an ambitious new target of €700 billion for sustainable business between 2025 and 2029, indicating strong perceived growth potential and BBVA's leadership in green and social initiatives.

BBVA Mexico is a Star, holding the largest market share in Mexico as of November 2024, with a significant lead in performing loans and deposits. This is supported by the dynamic Mexican economy and a commitment to invest over MXN 100 billion in the country between 2025 and 2030, signaling strong confidence in the market's high growth potential.

Project finance in Latin America is a Star for BBVA, evidenced by its 16.8% market share in syndicated loan bookrunner rankings in 2024. The region's syndicated loan market saw robust growth in 2024, fueled by energy and infrastructure investments, with BBVA showing notable strength in Mexico's project finance sector.

| BBVA BCG Stars (2024 Data) | Market Share | Market Growth | BBVA Performance Indicators |

|---|---|---|---|

| Digital Banking & Mobile Services | High | High | Strong new customer acquisition via digital channels, increased digital transactions. |

| Corporate & Investment Banking (CIB) | High | High | Record revenues in 2024, growth in Global Markets and Transaction Banking, expansion in Europe and US. |

| Sustainable Finance Solutions | High | High | Exceeded €300 billion target by end of 2024 (€304 billion), new €700 billion target for 2025-2029. |

| BBVA Mexico | Largest in market | High | Largest market share in loans & deposits (Nov 2024), over MXN 100 billion investment commitment (2025-2030). |

| Project Finance (Latin America) | 16.8% (syndicated loans) | High | Led regional bookrunner rankings in 2024, strong growth in Mexico's project finance. |

What is included in the product

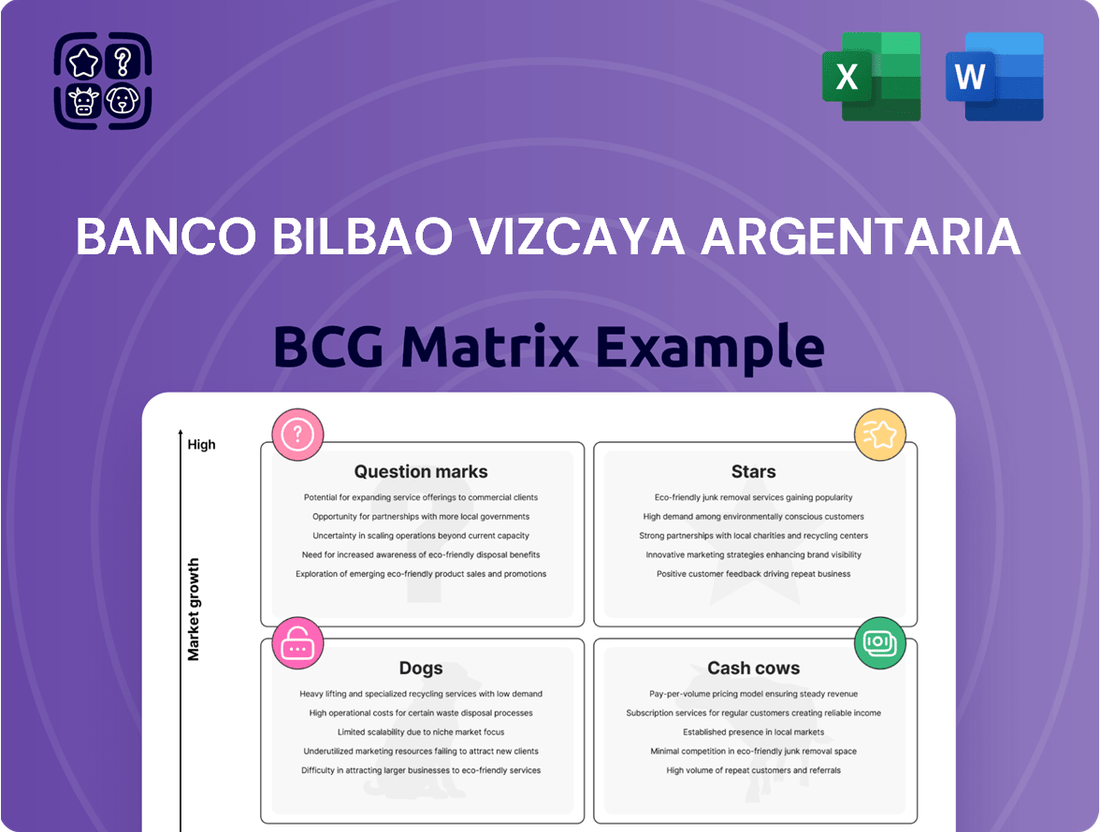

The BCG Matrix analyzes business units based on market share and growth, guiding investment decisions for Stars, Cash Cows, Question Marks, and Dogs.

A clear BCG Matrix visualization instantly clarifies portfolio complexity, relieving the pain of strategic indecision.

Cash Cows

Traditional retail banking in Spain represents a significant cash cow for BBVA. Despite the market's maturity and slower growth compared to emerging economies, BBVA commands a substantial and robust presence across the nation.

In the first quarter of 2024, this segment delivered strong results, with a notable net attributable profit fueled by consistent recurring revenues. This stability underpins its cash cow status.

Even with the impact of a temporary tax on credit institutions, the Spanish retail banking operations continue to be a reliable generator of cash. This is due to its well-established customer base and an extensive physical branch network.

BBVA's established asset management services are a prime example of a Cash Cow within its BCG Matrix. These operations typically cater to a mature and loyal client base, ensuring a predictable stream of fee-based income. This stability is further bolstered by relatively low capital expenditure needs, as the infrastructure is already in place.

As of the first quarter of 2024, BBVA's asset management division, along with its insurance and global wealth management units, contributed significantly to the group's fee and commission income. This segment consistently delivers strong profitability, underscoring its Cash Cow status by generating substantial earnings without requiring significant reinvestment for growth.

BBVA's Corporate Lending division in Spain, positioned as a Cash Cow in its BCG Matrix, demonstrated robust performance in 2024. The bank secured the second spot in Spain's syndicated loan market, capturing a significant 9.74% share.

This strong market position underscores the consistent and substantial revenue generation from Spanish corporate lending activities. The Spanish financing market's focus on investment and expansion in 2024 directly fuels this segment's stability.

Global Transaction Banking (GTB)

BBVA's Global Transaction Banking (GTB) is a prime example of a Cash Cow within its BCG Matrix. The division demonstrated exceptional strength throughout 2024, achieving a remarkable 32% revenue increase to €2.46 billion. This robust performance carried into the first quarter of 2025, signaling sustained momentum.

Despite prevailing trends of declining interest rates in key European and US markets, GTB's profitability remained high. This resilience is largely attributed to its substantial recurring fee income and highly efficient operational model. These factors underscore GTB's significant market share within a mature yet consistently profitable sector.

The consistent and substantial cash flow generated by GTB is a key characteristic of a Cash Cow. This division effectively supports other, less mature business units within BBVA, allowing for strategic reinvestment and growth initiatives across the broader organization.

- 2024 GTB Revenue: €2.46 billion (a 32% increase).

- Key Drivers: Recurring fees and operational efficiency.

- Market Position: High market share in a stable, profitable segment.

- Cash Flow Generation: Significant and consistent, supporting other business units.

Established Mortgage Lending

Established mortgage lending, particularly within mature markets such as Spain, serves as a reliable generator of interest income for BBVA. This segment, while not experiencing explosive growth, offers consistent cash flow due to BBVA's deep-rooted presence and efficient operational frameworks.

While the Spanish real estate market is projected for recovery by 2025, it remains a mature sector. BBVA's established mortgage lending operations, therefore, represent a stable, albeit slower-growing, revenue stream.

- Stable Interest Income: BBVA's mortgage portfolio in Spain provides a predictable stream of interest earnings.

- Mature Market Dynamics: Despite expected recovery in 2025, the Spanish mortgage market is characterized by established players and steady demand.

- Operational Efficiency: The bank's long-standing experience ensures streamlined processes, contributing to consistent cash generation.

- Cash Cow Status: This segment, while not a high-growth area, reliably contributes to BBVA's overall financial stability.

BBVA's established mortgage lending, especially in Spain, acts as a consistent cash generator. This segment provides steady interest income due to the bank's strong market position and efficient operations, even though the market is mature.

While the Spanish real estate market is expected to see a recovery by 2025, BBVA's mortgage operations are a stable, predictable revenue stream. This reliability solidifies its role as a cash cow, supporting the bank's overall financial health.

| Segment | Market Position | Revenue Driver | Growth Outlook | Cash Cow Indicator |

| Spanish Mortgage Lending | Established | Interest Income | Stable (Mature Market) | High, Consistent |

Preview = Final Product

Banco Bilbao Vizcaya Argentaria BCG Matrix

The preview you see is the precise Banco Bilbao Vizcaya Argentaria BCG Matrix document you will receive upon purchase, containing no watermarks or demo content. This comprehensive report is fully formatted and ready for immediate strategic application, offering a clear and professional analysis of your business portfolio. Upon purchase, you'll gain access to this exact version, enabling you to seamlessly integrate its insights into your business planning and decision-making processes.

Dogs

BBVA's legacy branch networks in declining or saturated markets represent potential Dogs in the BCG Matrix. These physical locations often carry significant operating expenses, including rent, utilities, and staffing, which may not be offset by their contribution to new customer acquisition or revenue generation. As digital banking channels gain traction, the foot traffic and transaction volumes in these older branches are likely to decline further.

In 2024, the banking sector continued to see a shift towards digital channels, with many institutions reporting a decrease in branch transactions. While BBVA is making substantial investments in its digital transformation, some of its older, less efficient physical branches may be struggling to adapt to these changing consumer preferences. These branches could be draining resources without delivering proportional returns, a classic characteristic of a Dog.

Certain traditional banking products, like physical passbook savings accounts, are increasingly being sidelined by more convenient digital options. These products often cater to a shrinking demographic and generate minimal revenue, placing them in the Dogs quadrant of the BCG Matrix. For instance, while specific figures for passbook accounts are not readily available, the broader trend shows a decline in physical branch transactions, with digital channels handling a significantly higher volume of customer interactions.

Small, Non-Strategic International Operations with Low Market Share, often referred to as Dogs in the BCG Matrix, represent segments where BBVA likely has a minimal presence and the market itself offers little growth potential. These might include operations in smaller, less developed economies or niche product lines in established markets where BBVA's market share is negligible. For instance, if BBVA has a less than 1% market share in a country with a projected GDP growth of only 2% annually, this would fit the description.

These ventures typically consume resources without generating significant returns or contributing meaningfully to the bank's overall strategic objectives. In 2024, BBVA's focus has been on strengthening its presence in key markets like Spain and Mexico, aiming for market leadership. Operations that don't align with this growth strategy or where BBVA isn't a dominant player are prime candidates for being classified as Dogs.

The challenge with these "Dog" segments is that they can tie up capital and management attention that could be better deployed in areas with higher growth prospects or where BBVA already holds a strong competitive advantage. For example, a small operation in a market with a stagnant banking sector and limited digital adoption would likely fall into this category, offering little strategic upside.

Inefficient Back-Office Processes Not Yet Digitalized

Areas within Banco Bilbao Vizcaya Argentaria (BBVA) that still rely heavily on manual, paper-based, or legacy IT systems could be classified as Dogs in the BCG Matrix. These processes are characterized by low efficiency, high operational costs, and offer little competitive advantage in a rapidly digitalizing industry. They consume valuable resources without contributing to growth or profitability, thus hindering overall performance.

For instance, certain legacy mortgage processing systems or manual data entry for compliance checks might fall into this category. Despite being essential functions, their outdated nature makes them costly to maintain and slow to adapt to evolving market demands. In 2024, the banking sector continued to see significant investment in digital transformation, with many institutions aiming to automate at least 70% of their back-office operations to reduce costs and improve speed.

- Low Efficiency: Manual processes inherently lead to slower turnaround times and a higher chance of errors compared to automated systems.

- High Operational Costs: Maintaining legacy systems and employing staff for repetitive manual tasks incurs significant ongoing expenses.

- Lack of Competitive Advantage: In a digital-first environment, inefficient back-office operations can put a bank at a disadvantage against more agile competitors.

- Resource Drain: These processes divert capital and human resources away from innovation and customer-facing initiatives.

Specific Low-Yielding Investment Portfolios

Specific low-yielding investment portfolios, often found within a bank's overall asset allocation, can represent significant capital drains. These might include portfolios heavily concentrated in mature, slow-growth industries that have seen their prime or face intense competition, limiting their ability to generate substantial returns. For instance, as of mid-2025, certain legacy technology sectors or traditional retail segments might exhibit these characteristics.

These portfolios tie up valuable capital that could otherwise be deployed into more dynamic or profitable ventures. The limited growth prospects mean they contribute minimally to overall profit margins, acting as anchors rather than accelerators for the bank's financial performance. A prime example in 2024 was the continued underperformance of certain bond funds focused on very low-yield government debt, which offered minimal capital appreciation.

- Mature Industry Investments: Portfolios heavily weighted towards industries like print media or physical retail, which have experienced structural declines. In 2024, many such sectors saw revenue stagnation or decline.

- Low-Yielding Fixed Income: Allocations to government bonds or corporate bonds with very low credit ratings and minimal coupon payments, offering little in the way of capital growth. The average yield on 10-year US Treasury bonds hovered around 4.2% for much of 2024, a historically low figure.

- Non-Performing Assets: Historically, portfolios containing a high proportion of non-performing loans or assets that have been impaired due to economic downturns or mismanagement. These require active management with little hope of significant recovery.

- Market Saturation: Investments in sectors that are over-saturated with competitors, leading to price wars and razor-thin profit margins, such as certain segments of the fast-food industry.

Certain legacy IT systems and manual processes within BBVA can be classified as Dogs. These are characterized by low market share in terms of efficiency and high operational costs, offering little competitive advantage. For example, a 2024 report highlighted that many banks were still investing heavily in modernizing outdated core banking systems, which often consume significant resources without contributing to growth.

These "Dog" segments, such as underperforming international subsidiaries or niche, low-margin products, represent areas where BBVA's investment and operational focus may not yield substantial returns. In 2024, the banking industry saw a continued trend of consolidation and divestment of non-core assets, a strategy often employed to shed these low-performing units.

Examples include branches in declining urban areas or specific product lines that have been superseded by digital alternatives. These units may struggle to attract new customers or generate sufficient revenue to cover their operational expenses, making them prime candidates for the Dogs quadrant in a BCG analysis.

Low-yielding investment portfolios, particularly those concentrated in mature or saturated industries, can also be categorized as Dogs. These segments tie up capital without generating significant profits, potentially hindering the bank's overall return on equity. In 2024, many financial institutions re-evaluated their asset allocations, divesting from areas with limited growth potential.

Question Marks

BBVA's 2025 launch of a fully digital bank in Germany is a prime example of a Question Mark within its BCG Matrix. This venture targets the burgeoning digital banking sector, a segment projected for substantial expansion, yet BBVA's current presence is minimal, marking it as a low market share opportunity. The German digital banking market is highly competitive, with established players and a growing number of fintech challengers.

Significant capital infusion is anticipated to build brand awareness, acquire customers, and develop a robust digital infrastructure to rival existing offerings. For instance, in 2024, digital-only banks in Europe raised over €2 billion in funding, highlighting the investment needed for market penetration. BBVA's strategy hinges on leveraging its successful Italian digital model, but adapting it to the unique regulatory and consumer landscape of Germany will be critical.

BBVA's strategic focus on early-stage fintech collaborations, notably through BBVA Spark, positions it to tap into emerging technologies like AI and blockchain. This proactive approach aims to foster innovation and identify future growth drivers within the financial sector.

Partnerships, such as the one with OpenAI, underscore BBVA's commitment to leveraging cutting-edge advancements for disruptive financial solutions. These ventures, while promising, represent a significant investment in areas with currently uncertain market share and profitability, characteristic of 'Question Marks' in a BCG matrix.

For instance, BBVA's investment in AI-driven customer service or blockchain-based payment systems falls into this category. While the potential for high returns exists, the initial capital outlay and the need for further development and market adoption mean these initiatives are still building their market presence and cash flow generation.

Expanding into new, high-growth emerging markets beyond its core strongholds like Mexico and Turkey positions BBVA's smaller ventures as potential Stars or Question Marks in the BCG Matrix. These markets, characterized by nascent presence and low market share, represent significant growth opportunities but also carry elevated risks and demand considerable investment. For instance, BBVA’s strategic moves into markets like Colombia, where it has been actively seeking opportunities, illustrate this dynamic.

Development of Advanced AI and Data-Driven Financial Products

BBVA is significantly investing in generative AI and advanced data analytics to create entirely new financial products. This strategic push aims to revolutionize customer experience and streamline operations, positioning these innovative offerings as potential stars in the BCG matrix. While these AI-driven products are in their nascent stages, their high-growth potential is undeniable, promising substantial future market share.

The development of these advanced AI and data-driven financial products represents a key area of innovation for BBVA. The bank's commitment to leveraging generative AI, for instance, is evident in its ongoing projects to enhance customer interactions and internal efficiencies. The market adoption of these novel products is still in its early phases, reflecting the typical lifecycle of disruptive technologies.

- BBVA's generative AI initiatives target enhanced customer experience and operational efficiency.

- Development of entirely new AI-driven financial products is a high-growth area.

- Current market share for these new products is low due to early development and adoption stages.

- BBVA aims to capture significant future market share with these innovative offerings.

Specialized Greenfield Project Financing in Niche Sectors

Specialized greenfield project financing in niche sectors, while potentially Stars in a BCG Matrix due to high growth prospects, often fall into a Question Mark category initially. This is because these innovative clean tech ventures demand substantial initial investment and face considerable uncertainty regarding market acceptance and future profitability. For instance, financing for novel carbon capture technologies or advanced battery recycling facilities, while crucial for sustainability goals, carries elevated risk compared to established renewable energy projects.

These projects require tailored financing solutions that acknowledge their unique risk profiles. Traditional debt financing might be insufficient, necessitating a blend of equity, venture capital, and potentially government grants or subsidies. The Banco Bilbao Vizcaya Argentaria (BBVA) might view such niche greenfield projects as opportunities for significant future returns, but only if the initial hurdles of technological validation and market penetration can be successfully navigated.

- High Initial Capital Outlay: Projects in nascent clean tech sectors often require hundreds of millions, if not billions, of dollars in upfront investment for research, development, and infrastructure.

- Market Adoption Uncertainty: The long-term demand and competitive landscape for highly innovative technologies are often unclear, making revenue projections speculative.

- Technological Risk: Greenfield projects in niche sectors frequently involve unproven or early-stage technologies, increasing the risk of technical failures or performance shortfalls.

- Regulatory and Policy Dependence: The success of these ventures can be heavily influenced by evolving government regulations and incentives, adding another layer of complexity to financing.

Question Marks represent business ventures with low market share in high-growth industries. BBVA's foray into the German digital banking market exemplifies this, requiring substantial investment to gain traction against established competitors. Similarly, their investments in generative AI and novel financial products, while holding immense future potential, currently exhibit low market penetration. These initiatives demand significant capital for development and market acceptance, characteristic of Question Marks needing strategic evaluation for potential conversion into Stars.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including financial reports, sales figures, and industry growth rates, to accurately assess business unit performance.