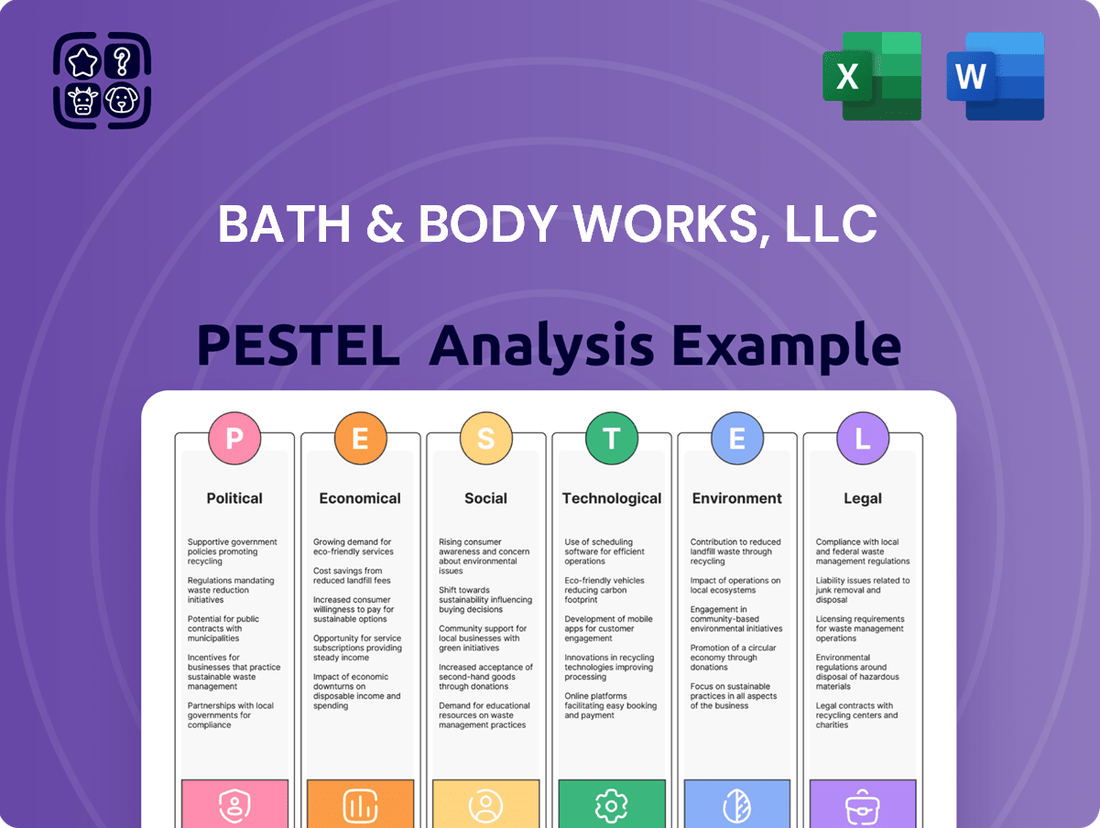

Bath & Body Works, LLC PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bath & Body Works, LLC Bundle

Bath & Body Works operates in a dynamic environment shaped by evolving consumer preferences, economic fluctuations, and technological advancements. Understanding these external forces is crucial for strategic planning and sustained growth. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors impacting the company.

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Bath & Body Works, LLC. Discover how external forces are shaping the company’s future, and use these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

Governments globally maintain rigorous oversight on personal care and home fragrance items, dictating standards for ingredients, production methods, and product information. Bath & Body Works navigates these diverse regulations, which influence how products are developed, sourced, and introduced into new markets. For instance, the European Union's Cosmetic Regulation (EC) No 1223/2009 requires extensive safety assessments for all cosmetic products sold within its borders, impacting formulation choices.

Adherence to these varied international rules is crucial for Bath & Body Works. Non-compliance, such as failing to meet the stringent labeling requirements set by the U.S. Food and Drug Administration (FDA) for cosmetics, can result in severe consequences. These include costly product recalls, substantial financial penalties, and damage to the brand's reputation, as seen with past industry-wide recalls affecting product safety claims.

Bath & Body Works, like many global retailers, is significantly impacted by international trade policies. For instance, ongoing shifts in trade agreements and the potential for new tariffs on goods imported from countries where Bath & Body Works sources ingredients or finished products can directly affect their cost of goods sold. In 2024, the global trade landscape continues to be shaped by geopolitical tensions, potentially leading to increased import duties on key components used in their product formulations or manufacturing processes.

Tariffs and import/export restrictions directly influence the cost and availability of raw materials, such as essential oils, fragrances, and packaging, as well as finished goods that may be manufactured overseas. For example, if the United States were to impose higher tariffs on products imported from Vietnam, a country known for its manufacturing capabilities, Bath & Body Works could see an increase in the cost of certain imported items, impacting their pricing and ultimately their profit margins.

Changes in these policies, particularly concerning ingredients sourced globally or products manufactured abroad, can necessitate adjustments to pricing strategies. As of early 2025, continued volatility in global supply chains, partly driven by evolving trade regulations, means that companies like Bath & Body Works must remain agile in managing their inventory and sourcing to mitigate potential cost increases and maintain competitive pricing for consumers.

Monitoring and adapting to these trade policy shifts are crucial for maintaining a competitive advantage in the personal care and home fragrance market. Companies that can effectively navigate these changes by diversifying their supply chains or adjusting their manufacturing locations are better positioned to absorb potential cost increases and protect their profitability in a dynamic economic environment.

Consumer protection laws are a significant political factor for Bath & Body Works. These regulations, which are becoming increasingly stringent globally, demand transparency in product labeling, truthful advertising, and effective customer complaint resolution systems. For instance, the Federal Trade Commission (FTC) in the U.S. actively enforces rules against deceptive advertising, impacting how Bath & Body Works communicates product benefits and ingredients.

In 2024, the global regulatory landscape continues to evolve, with a growing emphasis on data privacy and product safety. Bath & Body Works must ensure its marketing strategies and customer data handling practices align with regulations like the California Consumer Privacy Act (CCPA) and the EU's General Data Protection Regulation (GDPR). Non-compliance can lead to substantial fines, with GDPR penalties potentially reaching 4% of global annual revenue.

The company's commitment to clear and accurate product information, including ingredient lists and potential allergens, is paramount. This not only satisfies legal mandates but also fosters consumer trust, a crucial asset in the competitive beauty and personal care market. A robust customer service framework is essential for addressing complaints and ensuring fair redress, thereby minimizing legal exposure and enhancing brand reputation.

Political Stability in Key Markets

Political stability in Bath & Body Works' key operating markets directly influences its ability to maintain consistent operations and supply chains. For instance, a country experiencing significant civil unrest or sudden government policy shifts, such as unexpected import tariff changes or retail regulations, can create immediate disruptions.

Geopolitical tensions in regions critical for sourcing raw materials, like certain agricultural areas for fragrance components, can lead to supply shortages or price volatility, impacting product availability and cost of goods sold. In 2024, global trade tensions and regional conflicts continued to be a concern for multinational retailers, with companies actively monitoring trade agreements and political developments in over 45 countries where they have a significant retail presence or sourcing relationships.

Bath & Body Works must therefore conduct ongoing risk assessments for markets like the United States, Canada, and the United Kingdom, which represent substantial portions of its revenue. Political instability can also affect consumer confidence and discretionary spending, a crucial factor for a lifestyle brand. For example, economic uncertainty stemming from political events in late 2024 and early 2025 could dampen consumer demand for non-essential goods.

- Impact on Supply Chains: Political instability can disrupt the logistics and availability of key ingredients and finished goods.

- Consumer Spending: Geopolitical events and domestic political uncertainty can negatively affect consumer confidence and purchasing power.

- Regulatory Changes: Sudden shifts in trade policies, labor laws, or retail operating regulations can impact profitability and operational flexibility.

- Market Access: Political tensions can lead to restrictions on market access or increased barriers to entry for international retailers.

Taxation Policies on Retail and Imports

Fluctuations in corporate tax rates, sales taxes, and import duties significantly impact Bath & Body Works' operational costs and profitability across its global markets. For instance, a rise in corporate tax rates, such as the potential consideration of adjustments to the U.S. federal corporate tax rate which stood at 21% as of early 2024, could directly reduce net income. Similarly, changes in sales tax structures in key markets like the United States, which features a complex state-by-state system, or shifts in value-added tax (VAT) rates in European countries, directly affect the final price to consumers and the company's revenue recognition.

Increased import duties, particularly on raw materials and finished goods sourced internationally, can substantially inflate the cost of goods sold. For example, if tariffs on fragrance oils or packaging materials imported into the U.S. from Asia were to increase, Bath & Body Works would face higher procurement costs. Conversely, favorable tax incentives, such as those offered to businesses for establishing operations or investing in specific regions, can encourage expansion and positively influence profitability. The company's ability to navigate and optimize its financial structure amidst these evolving tax landscapes is crucial for sustained growth and investment in new markets or product lines.

- Corporate Tax Rate Impact: A hypothetical 1% increase in the U.S. federal corporate tax rate from 21% could reduce Bath & Body Works' net income by millions, depending on its taxable income for the year.

- Sales Tax Complexity: Managing varying sales tax rates across the 50 U.S. states, which range from 0% to over 7%, adds significant administrative overhead and impacts revenue recognition.

- Import Duty Sensitivity: Tariffs on key components, like the 10% tariff historically applied to certain imported manufactured goods, can directly increase the cost of inventory.

- Incentive Opportunities: Tax credits for research and development or for creating jobs in underserved areas can provide a financial advantage for expansion initiatives.

Government regulations significantly shape Bath & Body Works' operations, from ingredient safety to marketing claims. Compliance with diverse international standards, like the EU's Cosmetic Regulation, is essential to avoid costly recalls and reputational damage. As of 2024, stricter enforcement of consumer protection laws, including those related to data privacy and truthful advertising, necessitates robust compliance frameworks.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors impacting Bath & Body Works, LLC, covering political, economic, social, technological, environmental, and legal influences.

It provides actionable insights into emerging trends and potential challenges, enabling strategic decision-making and competitive advantage.

This PESTLE analysis for Bath & Body Works, LLC offers a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for efficient strategic planning and quick referencing.

Economic factors

Consumer disposable income is a crucial driver for Bath & Body Works, as its products, ranging from personal care to home fragrances, are largely discretionary purchases. When households have more money left after essential expenses, they are more likely to spend on these items. For example, in early 2024, the U.S. personal saving rate was around 3.1%, indicating consumers had some discretionary funds available, though it remained lower than the 2020-2022 period.

Economic downturns typically see a reduction in disposable income, forcing consumers to prioritize needs over wants. This directly impacts sales volumes for companies like Bath & Body Works. Conversely, periods of economic expansion, characterized by job growth and wage increases, tend to boost disposable income, leading to higher consumer spending on non-essential goods and services.

Market analysts anticipate that U.S. real disposable income is projected to grow by approximately 2.0% in 2024 and around 1.8% in 2025, suggesting a supportive environment for discretionary spending in the near term. This growth is important for Bath & Body Works' revenue streams, as consumers with increased disposable income are more inclined to indulge in self-care and home enhancement products.

Rising inflation significantly impacts Bath & Body Works by increasing the costs of key inputs. For instance, the Consumer Price Index (CPI) for goods saw a notable increase, with inflation rates averaging around 3.4% year-over-year in early 2024, impacting everything from fragrance oils to packaging materials. This upward pressure on raw materials, manufacturing, and logistics requires strategic adjustments.

To navigate these rising costs, Bath & Body Works must carefully consider its pricing strategies. Options include absorbing some of the increased expenses to maintain customer volume, passing the costs onto consumers through price hikes, or aggressively seeking more cost-effective sourcing and production methods. For example, if the cost of a key fragrance ingredient rises by 10%, the company needs to decide how much of that impact to absorb.

Effectively managing these inflationary pressures is paramount for sustaining healthy profit margins and ensuring competitive pricing in the retail landscape. In 2023, many consumer goods companies reported margin compression due to persistent inflation, highlighting the challenge. Bath & Body Works' ability to balance cost control with consumer price sensitivity will be a key determinant of its financial performance.

Exchange rate fluctuations pose a significant challenge for Bath & Body Works, given its global footprint and reliance on international sourcing and sales. For instance, if the U.S. dollar strengthens considerably against currencies in key markets like Europe or Asia, imported raw materials become cheaper, potentially boosting profit margins on goods manufactured domestically. However, this same stronger dollar makes Bath & Body Works' products more expensive for overseas customers, potentially dampening international sales volumes.

To navigate this, Bath & Body Works likely employs hedging strategies, such as forward contracts, to lock in exchange rates for future transactions, thereby reducing uncertainty. Furthermore, the company may implement localized pricing strategies, adjusting prices in foreign markets to account for currency shifts and maintain competitive positioning, even if it means accepting lower profit margins in U.S. dollar terms when the dollar is strong.

Considering the economic outlook for 2024 and into 2025, continued volatility in major currency pairs like EUR/USD and USD/JPY is anticipated, influenced by differing monetary policies and geopolitical events. For example, the Federal Reserve's interest rate decisions versus those of the European Central Bank will directly impact the EUR/USD exchange rate. This environment necessitates ongoing vigilance and strategic financial management for companies like Bath & Body Works to protect their international profitability.

Retail Market Competition

The personal care and home fragrance sectors are intensely competitive, featuring a wide array of brands from high-end luxury to everyday mass-market options. Bath & Body Works navigates this landscape against direct rivals, store-brand alternatives, and a growing number of direct-to-consumer online businesses.

This fierce rivalry directly impacts Bath & Body Works' ability to set prices and the significant marketing investments required to maintain customer loyalty and market position. The company must constantly introduce new products and fragrances to stay relevant and capture consumer interest.

Key competitive pressures include:

- Intense Rivalry: Established players like L'Occitane en Provence and smaller artisanal brands compete for consumer attention and spending.

- Private Label Growth: Retailers increasingly develop their own private label personal care and home fragrance lines, offering lower-priced alternatives.

- E-commerce Disruption: Online-only brands with agile supply chains and targeted digital marketing strategies are gaining traction, challenging traditional brick-and-mortar models. For instance, the global beauty and personal care market was valued at approximately $511 billion in 2023 and is projected to grow, indicating substantial room for new entrants and intensified competition.

E-commerce Growth and Digital Spending

The persistent shift to online shopping profoundly influences Bath & Body Works' sales strategies and necessitates ongoing investment in its digital infrastructure. In 2024, global e-commerce sales were projected to reach $7.7 trillion, underscoring the critical nature of a robust online presence. This trend demands continuous refinement of the digital user experience, targeted digital marketing campaigns, and streamlined last-mile delivery solutions to meet evolving consumer expectations.

Bath & Body Works' commitment to optimizing its digital channels is crucial as digital spending continues its upward trajectory. For instance, by early 2025, mobile commerce is expected to account for a significant portion of online retail sales, requiring seamless mobile-first design and functionality. This digital focus also reshapes the strategic importance of physical retail locations, which increasingly serve as integrated touchpoints within a broader omnichannel customer journey.

- E-commerce Sales Growth: Global e-commerce sales are anticipated to surpass $7.7 trillion in 2024, highlighting the increasing reliance on online channels.

- Digital Spending Trends: Continued growth in digital consumer spending necessitates ongoing investment in online user experience and digital marketing.

- Omnichannel Integration: The strategic role of physical stores is evolving to complement and enhance the digital shopping experience.

- Last-Mile Delivery Efficiency: Optimizing delivery networks remains a key factor in customer satisfaction and retention within the e-commerce landscape.

Economic factors significantly influence Bath & Body Works' performance through consumer spending power and operational costs. Projected growth in U.S. real disposable income for 2024 and 2025, estimated around 2.0% and 1.8% respectively, suggests a favorable environment for discretionary purchases. However, persistent inflation, with CPI for goods averaging around 3.4% year-over-year in early 2024, increases input costs and necessitates careful pricing strategies to maintain margins.

Exchange rate volatility also presents a challenge for Bath & Body Works' global operations, impacting the cost of imported materials and the competitiveness of international sales. The company's ability to manage these economic headwinds through hedging and strategic pricing will be crucial for sustained profitability. For instance, the U.S. personal saving rate was around 3.1% in early 2024, indicating consumers have some discretionary funds but are potentially more cautious than in prior years.

Full Version Awaits

Bath & Body Works, LLC PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis for Bath & Body Works, LLC offers a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the brand's operations and strategic decisions. You'll gain valuable insights into market trends, competitive landscapes, and potential growth opportunities.

Sociological factors

Consumers are increasingly prioritizing wellness and self-care, a trend that directly benefits companies like Bath & Body Works. This shift is evident in the growing market for products promoting relaxation and mental well-being, with the global wellness market projected to reach $7 trillion by 2025, according to the Global Wellness Institute. This emphasis on personal indulgence and comfort creates significant opportunities for product innovation and marketing campaigns that resonate with these evolving consumer desires.

Consumers are increasingly scrutinizing the environmental and social footprint of their purchases, directly impacting brands like Bath & Body Works. This trend fuels a growing demand for products that are not only effective but also ethically produced, meaning they are sustainably sourced, cruelty-free, and utilize responsible packaging. For instance, a 2024 survey indicated that over 70% of consumers consider sustainability a key factor when making purchasing decisions, a notable increase from previous years.

Bath & Body Works needs to proactively adapt to this shift by integrating more eco-friendly practices throughout its operations. This includes carefully reviewing its supply chain for ethical sourcing, prioritizing ingredients that minimize environmental harm, and innovating with sustainable packaging solutions. Transparency regarding these efforts is paramount, as modern consumers value brands that openly share their commitment to these principles. Reports from late 2024 highlighted that brands with clear sustainability messaging saw an average of 15% higher customer engagement.

Social media platforms are powerful drivers of consumer trends and purchasing habits in the beauty and home fragrance markets. Bath & Body Works actively uses influencer partnerships and user-generated content, evident in their Q4 2023 earnings report which highlighted strong digital engagement contributing to net sales growth. These platforms allow for rapid dissemination of trends, requiring the brand to maintain agile marketing approaches to capitalize on emerging consumer preferences.

Changing Demographic Profiles and Lifestyles

Bath & Body Works must navigate evolving consumer demographics, particularly the growing influence of Gen Z and Millennials. These younger cohorts, representing significant purchasing power, often prioritize experiences and personalization, which can impact demand for traditional product offerings. For instance, a 2024 report indicated that 65% of Gen Z consumers are more likely to engage with brands that offer personalized product recommendations, a trend that could influence Bath & Body Works' product development and marketing strategies.

Shifts in household structures also play a role. With more single-person households and smaller family units, there may be a greater demand for travel-sized or multi-functional products. Conversely, changing living patterns, such as increased urbanization, can affect the viability of large retail store locations in suburban areas, necessitating a strategic review of the store portfolio and a potential focus on smaller, more convenient formats or a stronger e-commerce presence. By 2025, projections suggest that urban populations will continue to grow, potentially impacting foot traffic in traditional retail settings.

- Gen Z and Millennial Preferences: These groups increasingly favor experiential retail and personalized products, impacting traditional product demand.

- Household Structure Changes: The rise of single-person households may drive demand for smaller product sizes and multi-functional items.

- Urbanization Trends: Growing urban populations could necessitate adjustments to retail store locations and formats to align with changing living patterns.

- Personalization Demand: Data from 2024 suggests a strong consumer desire for personalized product recommendations, a key area for adaptation.

Health and Hygiene Consciousness

The post-pandemic era has cemented a heightened consumer focus on health and hygiene, directly fueling demand for products such as hand soaps, sanitizers, and germ-killing home fragrances. Bath & Body Works, a major player in hand care and scented products, stands to gain from this sustained trend. For instance, the global hand sanitizer market was valued at approximately $4.5 billion in 2023 and is projected to grow further.

To capitalize on this, Bath & Body Works needs to continuously innovate, ensuring its offerings not only meet but exceed evolving consumer expectations for efficacy and safety in cleanliness. Highlighting product benefits tied to well-being and germ protection is becoming increasingly crucial for consumer purchasing decisions.

- Increased Demand: Consumers are actively seeking products that promote cleanliness and personal health.

- Market Opportunity: Bath & Body Works' existing product lines in hand care and home fragrance align well with this trend.

- Innovation Imperative: The company must focus on product development that emphasizes proven efficacy and safety standards.

- Marketing Focus: Messaging should prominently feature the health and hygiene benefits of their products to resonate with conscious consumers.

Sociological factors significantly shape consumer behavior for Bath & Body Works, with a pronounced emphasis on wellness and self-care driving demand for relaxation-focused products. This trend is supported by the global wellness market's projected reach of $7 trillion by 2025, indicating a strong consumer appetite for products that enhance personal well-being. Furthermore, evolving demographics, particularly the purchasing power of Gen Z and Millennials, highlight a need for personalized experiences and product offerings, with a 2024 survey noting 65% of Gen Z consumers favoring brands that offer such personalization.

Consumers are increasingly prioritizing ethical consumption, demanding transparency in sourcing and production methods, with over 70% of consumers in a 2024 survey considering sustainability in their purchasing decisions. This societal shift necessitates that Bath & Body Works demonstrates a commitment to sustainable practices and ethical sourcing, as brands with clear sustainability messaging saw a 15% increase in customer engagement in late 2024 reports. Changes in household structures, such as the rise of single-person households, may also influence product demand towards smaller, more convenient sizes, aligning with shifting living patterns and urbanization trends projected to continue through 2025.

Technological factors

Bath & Body Works continues to invest heavily in its e-commerce platform, recognizing its critical role in driving online sales. For instance, in fiscal year 2023, the company reported that its digital channel represented approximately 25% of its total net sales, a figure that has steadily grown year over year, underscoring the importance of these technological upgrades.

Enhancements focus on improving the mobile shopping experience, a key driver of online engagement. This includes optimizing site speed and navigation for smartphones, as well as integrating features like buy online, pick up in-store. In 2024, early reports suggest a continued emphasis on AI-powered personalization, with advanced recommendation engines aiming to boost average order value.

The company is also refining its search functionality and checkout processes to ensure a frictionless customer journey. By reducing cart abandonment rates through simplified payment options and clear shipping information, Bath & Body Works aims to capture a larger share of the digital market. Their commitment to a superior online presence directly impacts customer loyalty and repeat purchases.

These technological advancements are vital for staying competitive in the rapidly evolving retail landscape. As of early 2025, the e-commerce sector continues to see robust growth, and Bath & Body Works' strategic investments in its digital infrastructure are designed to capitalize on this trend, further solidifying its position in the online marketplace.

Bath & Body Works is significantly leveraging big data analytics to gain a granular understanding of its customers. By analyzing purchasing patterns and preferences, they can tailor marketing efforts, like offering personalized product recommendations through their loyalty program. This approach helps drive sales and improve customer retention.

This data-driven strategy directly impacts operational efficiency. For instance, insights from analytics inform inventory management, reducing waste and ensuring popular items are well-stocked, especially during key sales periods. In 2023, Bath & Body Works reported a 2.3% increase in net sales, partly attributable to enhanced customer engagement through personalized strategies.

Bath & Body Works is increasingly leveraging automation in its warehouses and logistics to streamline operations. This includes implementing robotic process automation for tasks like order picking and sorting, aiming to boost efficiency and reduce labor costs. For example, investments in automated sortation systems can process a significantly higher volume of packages per hour compared to manual methods.

AI-driven demand forecasting is a critical technological factor, allowing Bath & Body Works to better predict customer needs. This enables more accurate inventory management, minimizing stockouts of popular items and reducing excess inventory of slower-moving products. In 2024, advancements in machine learning models for forecasting are expected to further refine these predictions, potentially leading to a 5-10% reduction in inventory holding costs.

Real-time tracking technologies, such as RFID and advanced GPS, provide enhanced visibility across the entire supply chain. This allows for better monitoring of goods from manufacturing to the customer's doorstep, improving delivery reliability and enabling quicker responses to any disruptions. Faster delivery times, especially for e-commerce orders, are a direct benefit, with many retailers aiming for same-day or next-day delivery options, a trend Bath & Body Works is likely to pursue.

Product Innovation and Manufacturing Technologies

Technological advancements are crucial for Bath & Body Works, particularly in areas like chemistry and material science. These fields enable the company to develop innovative product formulations, novel scents, and improved delivery systems for their wide range of items. For instance, advancements in encapsulation technology could lead to longer-lasting fragrance experiences in their popular candles and body care products.

Furthermore, innovations in manufacturing processes offer significant opportunities. Bath & Body Works can leverage these to enhance production efficiency, reduce environmental impact through more sustainable methods, and potentially lower costs. This could involve adopting automated filling lines or exploring biodegradable packaging materials, aligning with growing consumer demand for eco-conscious products. In 2023, the company continued to invest in its supply chain and technology infrastructure, aiming for greater agility and efficiency in meeting market demands.

- Chemical Innovations: Development of new, hypoallergenic, or enhanced-performance ingredients for lotions, soaps, and fragrances.

- Material Science: Research into sustainable and advanced packaging solutions, including biodegradable plastics and recycled content.

- Fragrance Development: Utilizing advanced analytical techniques to create unique and long-lasting scent profiles.

- Manufacturing Automation: Implementing robotics and AI in production for increased speed, quality control, and cost reduction.

Digital Marketing and Customer Relationship Management (CRM)

Bath & Body Works leverages advanced digital marketing, including programmatic advertising and social media analytics, to precisely target consumer segments. This technological adoption is crucial for refining marketing spend and maximizing reach in a competitive landscape. Their investment in sophisticated CRM systems allows for personalized customer interactions and the management of loyalty programs.

These digital capabilities enable Bath & Body Works to foster stronger customer relationships through tailored communications across various touchpoints. For instance, in 2023, the company reported significant engagement through its digital channels, with email marketing and social media campaigns driving substantial traffic to their e-commerce platform. This focus on digital engagement is a key component of their strategy to enhance customer lifetime value.

- Targeted Advertising: Programmatic advertising allows for precise audience segmentation, ensuring marketing messages reach the most receptive consumers.

- Customer Data Utilization: Sophisticated CRM systems enable the collection and analysis of customer data to personalize offers and communication.

- Multi-Channel Engagement: Digital tools facilitate seamless customer interactions across social media, email, and the company website.

- Loyalty Program Enhancement: Technology supports the effective management and personalization of loyalty programs, driving repeat business.

Bath & Body Works is significantly enhancing its e-commerce capabilities, with digital sales comprising approximately 25% of total net sales in fiscal year 2023. Future investments in 2024 and 2025 are focused on AI-driven personalization to boost average order values and optimizing the mobile shopping experience, including features like buy online, pick up in-store.

The company leverages big data analytics to understand customer preferences, driving personalized marketing and improving inventory management, which contributed to a 2.3% net sales increase in 2023. Automation in warehouses and advanced AI for demand forecasting are also key, with the latter aiming to reduce inventory holding costs by 5-10% in 2024.

Technological advancements in chemistry and material science are crucial for developing innovative product formulations and sustainable packaging. Manufacturing automation, including robotics and AI, is being implemented to increase production efficiency, quality control, and reduce costs.

Digital marketing, including programmatic advertising and sophisticated CRM systems, allows for precise consumer targeting and personalized customer interactions, strengthening relationships and driving repeat business through enhanced loyalty programs.

Legal factors

Bath & Body Works operates under strict product safety and liability regulations, particularly concerning the ingredients and manufacturing processes of its personal care items. Compliance with these rules, often overseen by agencies like the Food and Drug Administration (FDA) in the United States, is crucial. For instance, in 2023, the FDA continued its focus on cosmetic ingredient safety, a trend expected to persist and potentially lead to new labeling requirements or ingredient restrictions impacting the industry.

Failure to meet these standards can lead to significant consequences. These include hefty fines, costly product recalls, and substantial litigation expenses if consumers are harmed. The company's commitment to rigorous testing and accurate labeling directly mitigates these legal and financial risks, ensuring consumer trust and brand reputation remain intact. The global nature of their business means adherence to varying international regulations is also a constant consideration.

Bath & Body Works must navigate a complex web of advertising and marketing laws. These regulations, covering truth in advertising, consumer privacy, and unfair competition, directly shape the company's promotional strategies.

Ensuring all marketing claims are substantiated is critical. For instance, claims about product efficacy or ingredients must be backed by reliable data to avoid accusations of misleading consumers. The Federal Trade Commission (FTC) in the U.S. actively enforces these standards, with significant penalties for violations.

Consumer privacy laws, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA), significantly impact how Bath & Body Works collects, uses, and protects customer data. Non-compliance can result in substantial fines; the CCPA, for example, allows for civil penalties up to $7,500 per intentional violation.

Avoiding unfair competition practices is also paramount. This includes refraining from deceptive comparative advertising or infringing on competitors' intellectual property. In 2023, the FTC reported a notable increase in enforcement actions related to deceptive marketing practices across various industries, highlighting the ongoing scrutiny companies face.

Bath & Body Works places significant emphasis on safeguarding its intellectual property, which includes its well-recognized brand name, distinctive logos, and unique fragrance formulations. These protections are vital for preventing the market from being flooded with counterfeit products and unauthorized use of their recognizable brand elements. The company's ability to maintain market differentiation and customer trust hinges on its diligent enforcement of these intellectual property rights.

Labor and Employment Laws

Bath & Body Works, as a significant employer with a vast retail and corporate footprint, navigates a complex landscape of labor and employment laws. These statutes govern everything from minimum wage and overtime pay to anti-discrimination policies, ensuring fair treatment and safe working conditions for its extensive workforce. For instance, in 2024, the U.S. Department of Labor continues to enforce the Fair Labor Standards Act (FLSA), impacting payroll practices across the company's thousands of employees.

Compliance is not merely a legal obligation but a strategic imperative for Bath & Body Works. Failure to adhere to these regulations can result in costly litigation, significant fines, and damage to the company's reputation, potentially impacting employee morale and customer perception. The company must stay abreast of evolving legislation, such as potential changes to overtime eligibility or new workplace safety standards being considered in 2025.

- Wage and Hour Laws: Ensuring compliance with federal and state minimum wage, overtime, and record-keeping requirements under laws like the FLSA.

- Anti-Discrimination Laws: Adhering to statutes such as Title VII of the Civil Rights Act of 1964, the Age Discrimination in Employment Act (ADEA), and the Americans with Disabilities Act (ADA) to prevent bias in hiring, promotion, and termination.

- Workplace Safety: Complying with the Occupational Safety and Health Act (OSHA) standards to provide a safe and healthy environment for all employees, particularly in retail settings.

- Unionization and Collective Bargaining: Understanding and respecting employees' rights to organize and engage in collective bargaining under the National Labor Relations Act (NLRA).

Data Privacy and Security Regulations

Bath & Body Works' significant e-commerce presence and customer loyalty programs necessitate careful handling of personal data. Global regulations like the EU's General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) impose strict requirements on data collection, storage, and usage. As of early 2024, the landscape of data privacy continues to evolve with new state-level regulations, such as those in Virginia and Colorado, requiring ongoing vigilance and adaptation. Failure to comply can result in substantial penalties, impacting the company's financial health and reputation.

Maintaining robust data security measures is paramount for Bath & Body Works to safeguard customer information and prevent breaches. This includes investing in secure IT infrastructure and regularly updating security protocols. Transparent privacy policies are also essential for building and retaining customer trust. Reports from 2023 highlighted increased consumer awareness regarding data privacy, making clear communication a competitive advantage. The potential financial impact of a data breach, including regulatory fines and loss of customer loyalty, underscores the importance of proactive compliance.

- GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher.

- CCPA provides consumers with rights to know, delete, and opt-out of the sale of their personal information.

- Data privacy breaches can lead to significant reputational damage, affecting customer acquisition and retention rates.

- Companies are increasingly investing in privacy-enhancing technologies to meet evolving regulatory demands.

Bath & Body Works must navigate a complex legal environment, particularly concerning product safety and ingredient regulations, with agencies like the FDA actively monitoring compliance. Failure to meet these standards can lead to substantial fines and recalls, as seen in the ongoing scrutiny of cosmetic ingredients throughout 2023 and anticipated for 2024-2025.

Environmental factors

Consumers and regulators are increasingly demanding that companies like Bath & Body Works source ingredients sustainably and ethically. This means ensuring raw materials, such as palm oil and essential oils, are obtained without causing deforestation or environmental harm. For instance, many major consumer goods companies have committed to 100% certified sustainable palm oil by 2020, a trend that continues to shape ingredient sourcing for the personal care industry.

Transparency in the supply chain is now a critical expectation. Customers want to know where their products come from and how those ingredients are produced. This pressure pushes companies to implement rigorous tracking and auditing processes for their suppliers, ensuring compliance with environmental and labor standards. By 2024, reports indicated a significant rise in consumer willingness to pay more for products with verified sustainable sourcing claims.

The environmental impact of product packaging, especially plastics, is a major concern for consumers and regulators alike. Bath & Body Works, like many in the retail sector, is under increasing pressure to minimize its packaging waste footprint.

This pressure translates into a need for Bath & Body Works to reduce its reliance on single-use plastics, boost the incorporation of recycled content into its packaging, and investigate innovative solutions like refillable product systems or compostable materials. For instance, the company's 2023 sustainability report highlighted efforts to increase the percentage of recycled content in its plastic packaging, aiming for a significant jump by 2025.

Engaging actively in circular economy initiatives offers a dual benefit for Bath & Body Works. It not only helps in building a stronger brand reputation by aligning with environmental consciousness but also directly addresses the growing consumer demand for more sustainable and eco-friendly product choices. This strategic shift can lead to increased customer loyalty and market differentiation.

Bath & Body Works is facing mounting pressure to actively manage and shrink its environmental impact. This includes meticulously tracking and reducing its carbon footprint throughout its entire business, from how products are made to how they reach customers and are sold in stores.

To address this, the company is exploring avenues like investing in cleaner energy sources, streamlining its supply chain and delivery routes for greater efficiency, and implementing energy-saving measures in its retail locations and corporate offices. For instance, many retailers are adopting LED lighting and smart thermostat systems in their stores.

Furthermore, there's a growing demand for companies to clearly state their goals for reducing emissions and to regularly report on their progress. This transparency is becoming a key factor in how consumers and investors perceive a company's commitment to sustainability.

Water Usage and Waste Management

Manufacturing personal care items, like those produced by Bath & Body Works, often requires significant water usage. Effective waste management is therefore paramount to prevent environmental contamination. The company needs robust strategies to cut down water consumption during production and to manage manufacturing by-products responsibly.

Adherence to environmental mandates regarding waste and water discharge is not just a legal necessity but a core operational consideration. For instance, during 2023, companies in the consumer goods sector faced increasing scrutiny over their water footprints. Bath & Body Works' commitment to sustainability, as demonstrated in its 2024 environmental, social, and governance (ESG) reports, highlights ongoing efforts to improve water efficiency and waste reduction across its supply chain. These initiatives are crucial for maintaining brand reputation and meeting evolving consumer expectations for environmentally conscious practices.

- Water Intensity: The production of soaps, lotions, and other personal care products can be water-intensive, impacting operational costs and environmental footprint.

- Waste Management Challenges: Proper disposal of manufacturing by-products, including packaging materials and chemical residues, is critical to avoid pollution.

- Regulatory Compliance: Meeting stringent environmental regulations concerning water discharge quality and waste disposal is essential for legal operation and avoiding penalties.

- Sustainability Initiatives: Bath & Body Works, like many in the retail sector, is investing in technologies and processes to reduce water usage and improve waste recycling rates, aiming for a more circular economy model by 2025.

Climate Change Impact on Supply Chain

Climate change presents significant challenges for Bath & Body Works' supply chain, particularly concerning the availability and pricing of natural ingredients. Extreme weather events like droughts or floods can disrupt agricultural yields of botanicals and essential oils crucial for their product formulations. For instance, a prolonged drought in a key sourcing region could impact the supply of lavender or shea butter, driving up costs.

The company must proactively evaluate these climate-related vulnerabilities. Developing diversified sourcing strategies and exploring alternative suppliers are essential to mitigate disruptions. This includes assessing the long-term viability of current sourcing locations and investing in more resilient agricultural practices among their partners. Ensuring supply chain continuity is paramount to maintaining product availability and customer satisfaction.

- Impact on Raw Materials: Climate change risks to natural ingredients like essential oils and botanicals could lead to price volatility and supply shortages.

- Sourcing Resilience: Bath & Body Works needs to build a more robust supply chain by diversifying suppliers and exploring alternative ingredient sources.

- Extreme Weather Disruptions: Events such as floods, droughts, and heatwaves directly threaten the cultivation and harvesting of key natural components.

- Cost Implications: Supply disruptions and increased agricultural challenges will likely translate to higher raw material costs, impacting profit margins.

Bath & Body Works, like many companies, faces increasing scrutiny over its environmental footprint, driving a need for sustainable ingredient sourcing and transparent supply chains. Consumers expect ethically produced raw materials, pushing for commitments like 100% certified sustainable palm oil, a trend that saw significant consumer willingness to pay more for verified sustainable products by 2024.

The company is also pressured to minimize packaging waste, particularly single-use plastics, and increase recycled content, with efforts to boost recycled content in plastic packaging highlighted in their 2023 reports, aiming for substantial increases by 2025.

Reducing its overall carbon footprint is a priority, involving investments in cleaner energy, supply chain efficiency, and energy-saving measures in stores. Transparency in emission reduction goals and progress reporting is key to consumer and investor perception.

Water intensity and waste management are critical operational concerns. The company must manage water usage during production and responsibly handle manufacturing by-products. Adherence to environmental mandates regarding waste and water discharge is essential, with ongoing efforts to improve water efficiency and waste reduction noted in their 2024 ESG reports.

Climate change poses risks to ingredient availability and pricing due to extreme weather events, necessitating diversified sourcing strategies and exploration of alternative suppliers to ensure supply chain resilience.

| Environmental Factor | Impact on Bath & Body Works | Industry Trend/Data (2024-2025) |

|---|---|---|

| Sustainable Sourcing | Pressure to use ethically sourced raw materials (e.g., palm oil, essential oils). | Increased consumer willingness to pay a premium for products with verified sustainable sourcing claims (reported rise by 2024). |

| Packaging Waste | Need to reduce reliance on single-use plastics and increase recycled content. | Focus on refillable systems and compostable materials; company reports efforts to increase recycled content in plastic packaging by 2025. |

| Carbon Footprint Reduction | Mandate to track and reduce emissions across operations and supply chain. | Adoption of LED lighting and smart thermostats in retail locations; growing demand for transparent emission reduction goal reporting. |

| Water Usage & Waste Management | Requirement for efficient water use in production and responsible disposal of manufacturing by-products. | Increased scrutiny on water footprints in the consumer goods sector (during 2023); focus on improving water efficiency and waste recycling rates by 2025. |

| Climate Change Impact | Risk of supply chain disruptions and price volatility for natural ingredients due to extreme weather. | Need for diversified sourcing and exploration of alternative suppliers to mitigate risks like droughts or floods impacting botanical yields. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Bath & Body Works, LLC is grounded in comprehensive data from reputable sources. We incorporate insights from industry-specific market research reports, financial news outlets, and official company filings.