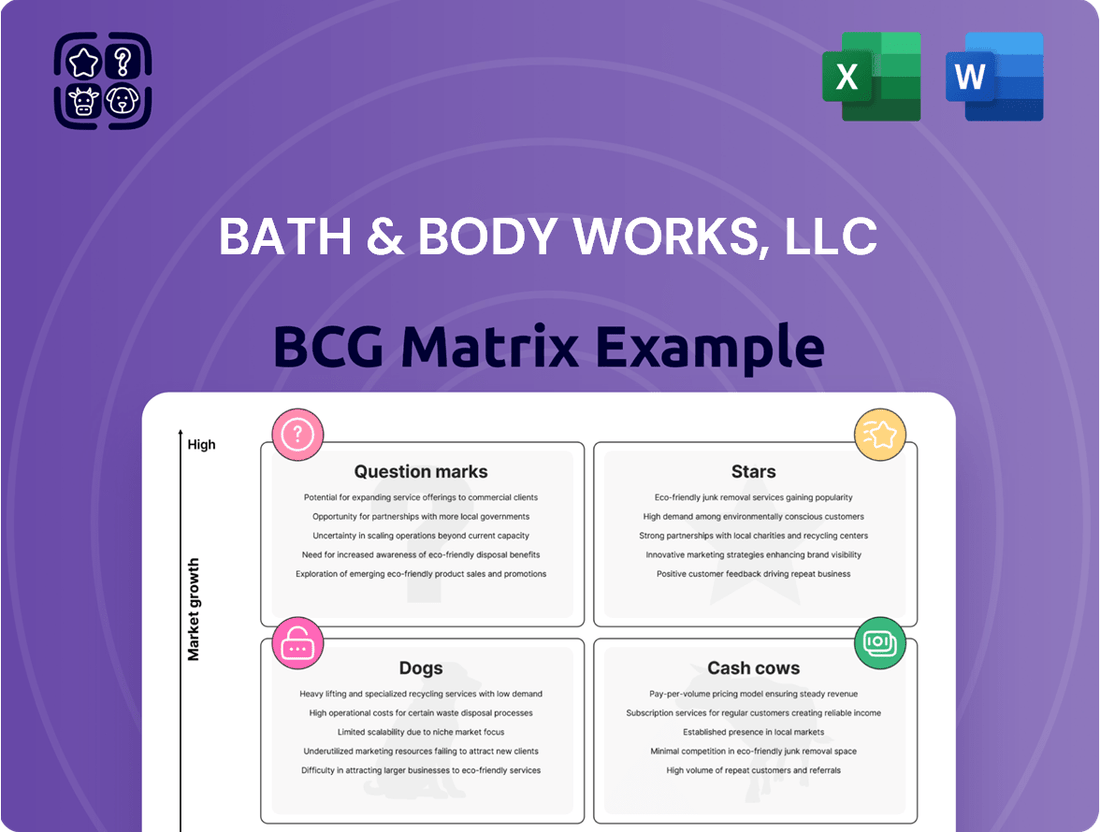

Bath & Body Works, LLC Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bath & Body Works, LLC Bundle

Bath & Body Works, LLC's product portfolio likely boasts strong Cash Cows in its core candle and body care lines, generating consistent revenue. However, newer ventures or seasonal collections might be positioned as Question Marks, requiring further investment to determine their market potential. Understanding the nuances of these placements is crucial for strategic growth and resource allocation.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Bath & Body Works.

Stars

Bath & Body Works' trending fragrance collections, like their seasonal releases and collaborations, act as Stars in their BCG Matrix. In 2024, the company continued to leverage these limited-time offerings, which often see rapid sell-outs and significant social media engagement, driving substantial revenue during their availability periods. For instance, their popular "Into the Night" collection, a perennial favorite, consistently performs well, demonstrating strong customer loyalty and a high market share in the premium body care segment.

Bath & Body Works' digital-exclusive product lines are a significant growth driver, fitting the profile of a Star in the BCG Matrix. These offerings are specifically crafted for and distributed through their e-commerce platform, tapping into the burgeoning online retail market.

This strategy allows Bath & Body Works to efficiently reach and engage with online shoppers, particularly younger demographics who are increasingly shifting their purchasing habits to digital channels. By 2024, e-commerce sales for apparel and general merchandise were projected to reach over $1.7 trillion in the U.S., demonstrating the immense potential of these digital-first initiatives.

Men's personal care is a significant growth engine for Bath & Body Works. Since 2019, this segment has been their fastest-growing category. The company has strategically expanded its product lines to include colognes, body sprays, and the Everyday Luxuries collection specifically for men.

This focus on men's grooming taps into a burgeoning market where Bath & Body Works is actively increasing its market share. The continuous expansion and strong performance of these product lines firmly place them in the 'Stars' quadrant of the BCG Matrix.

International Market Growth in Key Regions

Bath & Body Works is actively pursuing strategic expansion into high-growth international markets, a key driver for its global revenue. Markets like South Korea and London, where the brand is building a new, strong presence, are particularly important.

The company plans to continue opening net new stores internationally in 2025, focusing on expanding its global reach. These new market entries are considered high-growth opportunities, even if they are in early stages, offering significant potential for market share gains.

- International expansion efforts are a major growth pillar.

- New market entries in 2024 and 2025 are targeted for significant gains.

- South Korea and London are examples of key expansion regions.

- Global reach expansion is a strategic priority for future revenue.

Innovative & Experiential Store Formats (Gingham+)

Bath & Body Works is investing in innovative store formats like Gingham+, which boasts wider aisles, scent bars, and digital screens. This strategy is designed to appeal to younger demographics, particularly Gen Z, and elevate the overall shopping experience. This focus on experiential retail is a key differentiator in the current market.

The company's commitment to physical retail innovation aligns with a broader trend towards experiential shopping. For example, in 2023, Bath & Body Works reported that its loyalty program members, who often engage more deeply with the brand, contributed a significant portion of sales. These new formats aim to broaden that engagement.

By enhancing the in-store atmosphere and offering interactive elements, Bath & Body Works seeks to drive higher foot traffic and boost sales. This could solidify its market position within the brick-and-mortar segment. The company's Q1 2024 results showed continued strength in its direct-to-consumer channels, and these store updates are intended to complement that success.

- Targeting Gen Z: The Gingham+ format is specifically designed to attract younger consumers with its modern, interactive features.

- Enhancing In-Store Experience: Features like scent bars and digital displays aim to create a more engaging and memorable shopping journey.

- Driving Foot Traffic and Sales: Investments in physical retail innovation are intended to increase customer visits and ultimately, sales volume.

- Strengthening Market Share: By differentiating its physical presence, Bath & Body Works aims to capture a larger share of the brick-and-mortar market.

Bath & Body Works' seasonal and limited-edition fragrance collections are prime examples of their 'Stars' in the BCG Matrix. These collections, such as the popular 'Into the Night' scent, consistently generate high demand and strong sales, particularly during peak seasons, solidifying their market leadership in premium body care. In 2024, the company continued to capitalize on this strategy, with limited-time offerings frequently selling out and driving significant social media buzz.

The company’s strategic expansion into men's personal care has been a standout performer, positioning it as a 'Star'. This segment, which has seen consistent growth since 2019, now boasts dedicated product lines and collections, effectively capturing a larger market share in the men's grooming sector. By 2023, the men's grooming market was valued at approximately $63.1 billion globally, showcasing the significant opportunity Bath & Body Works is tapping into.

Bath & Body Works' digital-exclusive product lines are also classified as 'Stars,' reflecting their strong performance and growth in the online retail space. These offerings are tailored for e-commerce, appealing to a growing online consumer base, especially younger demographics. The U.S. e-commerce market for apparel and general merchandise was projected to exceed $1.7 trillion in 2024, highlighting the substantial revenue potential from these digital initiatives.

International market expansion, particularly in regions like South Korea and London, represents another 'Star' category for Bath & Body Works. The company's plans for net new international store openings in 2025 underscore its commitment to capturing market share in high-growth, emerging territories. These strategic entries are crucial for driving future global revenue streams.

| Category | BCG Classification | Key Drivers | 2024/2025 Relevance |

|---|---|---|---|

| Seasonal Fragrances | Star | High demand, limited-time offers, social media engagement | Continued rapid sales and brand buzz |

| Men's Personal Care | Star | Dedicated product lines, growing market segment | Increasing market share in a $63.1B global market |

| Digital-Exclusive Products | Star | E-commerce focus, appeal to younger demographics | Leveraging the $1.7T+ U.S. e-commerce market |

| International Expansion | Star | Entry into high-growth markets, new store openings | Building global presence and future revenue |

What is included in the product

The Bath & Body Works BCG Matrix categorizes its product lines to guide investment and resource allocation.

It aims to identify which brands to nurture, harvest, develop, or divest for optimal portfolio performance.

The Bath & Body Works BCG Matrix provides a clear, actionable overview of their product portfolio, alleviating the pain point of strategic uncertainty.

It offers a visual roadmap, simplifying complex business unit analysis for efficient decision-making.

Cash Cows

Bath & Body Works' 3-wick candles are the company's undisputed cash cows. These iconic products are a staple for loyal customers and represent a significant portion of their revenue. In fiscal year 2023, Bath & Body Works reported net sales of $7.56 billion, with candles being a primary driver of this performance.

While the candle market itself is mature, the brand's strong recognition and consistent product quality ensure continued demand. Despite facing increased competition, the 3-wick candle segment reliably generates substantial and predictable cash flow, allowing the company to invest in other areas of its business.

Signature Body Care Collections, like Warm Vanilla Sugar and Japanese Cherry Blossom, are Bath & Body Works' established cash cows. These collections consistently generate strong, reliable revenue due to their deep brand recognition and a dedicated customer base. In the mature personal care market, their consistent sales translate to high profit margins for the company. For example, Bath & Body Works reported total net sales of $4.4 billion for fiscal year 2023, with their signature scents being a significant contributor.

Bath & Body Works' hand soaps and sanitizers, particularly their popular foaming varieties, are true cash cows within the company's product portfolio. These items are essential household staples, meaning they enjoy consistent demand and high repurchase rates from a loyal customer base. For fiscal year 2024, the company reported net sales of $5.5 billion, with the Personal Care segment, which heavily features hand soaps and sanitizers, being a significant contributor.

This product category represents a high market share within a mature and stable market segment. The reliability of sales from these everyday essentials allows Bath & Body Works to generate consistent cash flow, which can then be reinvested into other areas of the business or returned to shareholders. In 2023, the company's gross profit margin was approximately 43%, demonstrating the strong profitability of its core offerings like hand soaps.

Seasonal Holiday Collections

Bath & Body Works' seasonal holiday collections, such as those for Christmas and Halloween, are powerful cash cows. These collections consistently generate substantial sales, demonstrating high market penetration during peak holiday periods. Their predictable and strong performance solidifies their role as reliable revenue streams for the company.

These collections are central to Bath & Body Works' strategy, leveraging consumer enthusiasm for holidays to drive purchases. For instance, the 2023 holiday season saw strong performance across their product lines, with digital sales contributing significantly to overall revenue. This trend highlights the importance of these seasonal offerings in the company's financial success.

- High Sales Volume: Seasonal collections, particularly for Christmas, are major revenue drivers.

- Predictable Performance: Their consistent success during holidays makes them reliable income sources.

- Market Penetration: These collections achieve high customer engagement and sales during specific periods.

- Brand Loyalty: The anticipation and popularity of these seasonal items reinforce customer loyalty.

Loyalty Program Members

Bath & Body Works' loyalty program members represent a significant cash cow. By Q4 2024, the company boasted approximately 39 million active members, a testament to its strong customer engagement. These dedicated customers are the backbone of the business, accounting for a substantial 80% of total sales.

The loyalty program's success is rooted in its ability to foster repeat business and higher average transaction values. Loyal members demonstrate increased spending habits, visit stores more frequently, and engage in cross-channel purchases, solidifying the program as a reliable and high-performing revenue engine for Bath & Body Works.

- Loyalty Program Membership: Approximately 39 million active members as of Q4 2024.

- Sales Contribution: Loyalty members drive 80% of total sales.

- Customer Behavior: Higher spending, increased visit frequency, and cross-channel purchasing.

- Revenue Stability: The program acts as a consistent and high-performing revenue stream.

Bath & Body Works' loyalty program members are a significant cash cow. As of Q4 2024, the company had approximately 39 million active members, with these dedicated customers accounting for a substantial 80% of total sales. This program consistently generates reliable revenue due to its ability to foster repeat business and increase average transaction values.

| Metric | Value | Significance |

| Active Loyalty Members (Q4 2024) | 39 million | Indicates strong customer engagement and a large, receptive audience. |

| Sales Contribution from Members | 80% of total sales | Highlights the critical role of loyal customers in driving revenue and profitability. |

| Revenue Generation | Consistent and high-performing | Demonstrates the program's effectiveness in securing repeat business and increasing customer lifetime value. |

Preview = Final Product

Bath & Body Works, LLC BCG Matrix

The BCG Matrix report you are currently previewing for Bath & Body Works, LLC is the complete, unwatermarked document you will receive immediately after your purchase. This preview accurately represents the final, professionally formatted analysis, ready for immediate application in your strategic planning. You will gain access to the full, detailed breakdown of Bath & Body Works' product portfolio within the BCG framework, enabling informed decision-making without any additional steps or modifications. This is not a sample or demo, but the actual deliverable designed for business intelligence and competitive advantage.

Dogs

Certain Bath & Body Works physical stores, especially those situated in malls experiencing declining shopper traffic, are likely categorized as Dogs in the BCG Matrix. These locations often struggle with low foot traffic and sales, tying up capital and operational resources without yielding significant returns. For instance, in early 2024, analysts noted that mall-based retail continued to face headwinds, impacting sales performance for many brands including those with a significant mall presence.

The company's strategic shift, evident in its proactive closures of underperforming mall stores and simultaneous expansion into off-mall, more accessible locations, underscores the assessment of these struggling physical sites. This strategic repositioning suggests that these underperforming stores are candidates for divestiture, or at the very least, require substantial optimization efforts to improve their financial contribution. The trend of mall store closures accelerated post-pandemic, with many retailers re-evaluating their brick-and-mortar footprints to align with changing consumer shopping habits.

Older fragrance lines at Bath & Body Works, like certain scents from the early 2000s that haven't been re-released or heavily promoted, often fall into the Dogs category. These products, while perhaps holding a small, dedicated following, typically exhibit low market share and minimal growth potential due to evolving consumer tastes. For instance, fragrance lines that were popular in 2018 but saw a significant drop in sales by 2023 without strategic revitalization efforts would be prime examples.

Bath & Body Works has historically focused on its core strength: scented personal care products. While the company has experimented with new formats and categories, some have struggled to achieve the widespread appeal of its signature offerings. For instance, attempts to expand into more niche or specialized product lines have sometimes yielded low returns and captured only a small market share, placing them in the 'Dogs' quadrant of the BCG matrix.

These 'Dog' categories represent initiatives that, despite initial investment, have not demonstrated significant market traction or consumer adoption. They typically generate low revenue and profit, making it difficult for them to scale effectively. Such ventures often require substantial ongoing support without a clear path to becoming market leaders, a common challenge when diversifying beyond core competencies.

Overstock or Slow-Moving Inventory

Overstock or slow-moving inventory for Bath & Body Works can represent a significant challenge, especially within a BCG matrix framework where these items might be classified as Dogs. Excess stock ties up valuable capital that could be reinvested elsewhere, and it also leads to increased storage and potential obsolescence costs. For instance, if a particular scent or product line doesn't resonate with consumers, it can become a drain on resources. Efficient inventory management is therefore critical to prevent these items from becoming cash traps.

In 2024, companies like Bath & Body Works are increasingly focused on data-driven demand forecasting to minimize such overstock situations. The average inventory holding period for specialty retail can range significantly, but extended periods for specific SKUs signal potential Dog status.

- Tied-up Capital: Slow-moving inventory prevents cash from being used for more profitable ventures.

- Storage Costs: Warehousing and managing excess stock incurs direct financial expenses.

- Obsolescence Risk: Products can lose value or become unsellable over time, especially in fashion-driven retail.

- Reduced Profitability: Carrying costs and potential markdowns directly impact profit margins.

Legacy Digital Infrastructure

Bath & Body Works' legacy digital infrastructure, characterized by outdated or inefficient platforms, falls into the Dogs category of the BCG Matrix. These systems likely demand substantial upkeep while offering minimal gains in competitive edge or customer satisfaction.

The company's strategic investments in digital modernization signal an acknowledgment of past shortcomings in this area. For instance, in 2023, Bath & Body Works continued its focus on enhancing its e-commerce capabilities to improve customer experience and operational efficiency.

- Outdated Systems: Legacy platforms may struggle to support modern e-commerce features and data analytics.

- High Maintenance Costs: Older technology often incurs significant costs for upkeep and security.

- Limited ROI: The investment required for maintenance doesn't yield proportionate returns or competitive advantages.

- Strategic Modernization: The company is actively upgrading these systems to boost performance and customer engagement.

Certain Bath & Body Works physical stores, especially those in declining malls, are categorized as Dogs. These locations have low foot traffic and sales, consuming resources without significant returns. For example, in early 2024, mall retail faced headwinds impacting many brands, including those with a substantial mall presence. The company's strategy of closing underperforming mall stores and expanding off-mall locations highlights the assessment of these struggling sites, suggesting potential divestiture or optimization.

Older, unpromoted fragrance lines also fall into the Dogs category. These scents have low market share and minimal growth due to evolving consumer preferences. Fragrance lines popular in 2018 but showing significant sales drops by 2023 without revitalization are prime examples. These products require ongoing support without a clear path to market leadership, a common challenge when diversifying beyond core strengths.

Slow-moving inventory represents another Dog category for Bath & Body Works. Excess stock ties up capital and incurs storage costs, with a risk of obsolescence. In 2024, data-driven demand forecasting is crucial for minimizing such situations. Extended inventory holding periods for specific SKUs signal potential Dog status, directly impacting profit margins through carrying costs and markdowns.

| Category | Description | Example | Financial Implication | Strategic Action |

|---|---|---|---|---|

| Underperforming Stores | Mall-based locations with declining foot traffic and sales. | Stores in malls experiencing significant shopper decline. | Tied-up capital, low ROI. | Store closures, relocation to off-mall sites. |

| Legacy Fragrance Lines | Scents with low popularity and minimal growth potential. | Fragrances popular in the early 2000s without recent promotion. | Low revenue, high inventory holding costs. | Discontinuation or minimal inventory. |

| Excess Inventory | Overstock of specific products or scents. | Seasonal items not selling through or slow-moving core products. | Capital tied up, storage costs, potential obsolescence. | Aggressive markdowns, improved demand forecasting. |

Question Marks

Bath & Body Works is strategically venturing into adjacent categories such as laundry and haircare, targeting markets known for their robust growth potential. These areas offer significant opportunities for expansion beyond their core offerings.

While these new ventures hold promise, Bath & Body Works' current market share within these emerging segments is likely minimal. This is typical for companies entering new product spaces where brand recognition and consumer adoption are still developing.

For context, the global haircare market alone was valued at approximately $200 billion in 2023 and is projected to grow steadily. Similarly, the laundry care market represents a substantial consumer spend, indicating the attractive, albeit competitive, landscape Bath & Body Works is entering.

The Premium-Priced 'Everyday Luxuries' collection, featuring fine fragrance mists inspired by high-end perfumes, represents Bath & Body Works' attempt to penetrate a more premium market segment. This initiative positions the collection as a question mark within the BCG matrix, as its success hinges on the brand's ability to command higher price points and capture a meaningful share in a competitive, aspirational space. While the broader fine fragrance market saw steady growth in 2024, consumer willingness to pay a premium for a mass-market brand's interpretation remains a key variable. The challenge lies in balancing perceived value with elevated pricing, a delicate act for a brand historically associated with affordability.

Bath & Body Works is investing in experimental digital tools like its generative AI Fragrance Finder. This initiative is designed to personalize the shopping experience and potentially boost sales by helping customers discover new scents. While innovative, these tools represent a small, emerging segment of the market.

The impact of these digital tools on Bath & Body Works' overall market share is still uncertain. Their current market penetration is low, meaning widespread adoption and a significant contribution to revenue are not yet evident. However, such investments signal a forward-looking strategy in a competitive retail landscape.

Targeted Expansion into Highly Competitive International Markets

Targeted expansion into highly competitive international markets represents a significant challenge, likely categorizing these ventures as Question Marks within Bath & Body Works' BCG Matrix. These markets demand substantial upfront investment for brand building and market penetration due to low existing recognition and share. For instance, entering a saturated European beauty market requires more capital than expanding in a developing region with less competition.

These strategic moves are characterized by high risk and high reward potential. Bath & Body Works must carefully assess the long-term viability and competitive landscape before committing significant resources. The success of these ventures hinges on effective localization strategies and robust marketing campaigns to overcome established players.

- High Investment Needs: Entering competitive markets like China or India requires substantial capital for store build-outs, marketing, and supply chain development, potentially costing tens of millions of dollars per market entry.

- Low Brand Recognition: In markets where Bath & Body Works is a relatively new entrant, brand awareness campaigns are crucial, often involving significant advertising spend to build customer trust and familiarity.

- Competitive Landscape: These markets are often dominated by local brands and established global competitors, necessitating differentiated product offerings and aggressive pricing strategies.

- Uncertain Future Growth: While the potential for market share capture is high, the path to profitability in these challenging environments is often long and uncertain, making them classic Question Mark candidates.

New Store Formats in Untested Markets

Bath & Body Works' exploration of new store formats and entry into untested markets, particularly off-mall locations, places them in the question mark category of the BCG matrix. While the company has seen success with its broader off-mall strategy, the effectiveness of these specific new formats in capturing market share in unfamiliar territories remains to be definitively proven. For example, in 2024, the company continued to evaluate pilot programs in diverse geographic regions and retail environments, aiming to understand consumer reception to formats beyond traditional mall settings.

These initiatives, while potentially high-growth drivers, carry inherent risk until their market penetration and profitability are validated. The success of these ventures hinges on their ability to adapt to local consumer preferences and effectively compete with established retailers in these new markets. Data from these pilots will be crucial in determining future investment decisions and scaling these formats.

- Pilot Programs: Testing new store designs and locations in markets with uncertain consumer response.

- Off-Mall Strategy: While overall off-mall expansion is a growth area, individual new format success is still under evaluation.

- Market Share Capture: The primary objective is to prove these new formats can gain traction and market share in unproven territories.

- Data-Driven Decisions: Performance metrics from 2024 pilot programs will inform future expansion strategies for these question mark ventures.

Bath & Body Works' strategic foray into new store formats and less traditional retail locations, such as off-mall sites, places these initiatives firmly in the Question Mark category of the BCG matrix. While the company has seen some success with its broader off-mall strategy, the ultimate market share capture and profitability of these specific new formats in unproven territories are still under evaluation. For instance, in 2024, Bath & Body Works continued to test pilot programs across various geographies and retail settings to gauge consumer reception to formats beyond conventional mall environments.

These ventures, though potentially significant growth drivers, carry inherent risks until their market penetration and profitability are clearly established. Success hinges on adapting to local consumer preferences and effectively competing against established retailers in these new markets. Crucially, data gathered from these 2024 pilot programs will be instrumental in shaping future investment decisions and the potential scaling of these formats.

The Premium-Priced 'Everyday Luxuries' collection, aimed at capturing a more premium market segment, also falls into the Question Mark category. Its success is contingent on Bath & Body Works' ability to command higher price points and gain traction in a competitive, aspirational space. While the fine fragrance market showed steady growth in 2024, consumer willingness to pay a premium for a mass-market brand's interpretation remains a key variable, with the challenge lying in balancing perceived value and elevated pricing.

Bath & Body Works' investment in experimental digital tools, such as its generative AI Fragrance Finder, represents another Question Mark. These tools aim to personalize the shopping experience and potentially boost sales, but they are entering a small, emerging market segment with uncertain impact on overall market share and revenue.

| Initiative | BCG Category | Rationale | Key Considerations | 2024 Data Point |

|---|---|---|---|---|

| New Store Formats/Off-Mall Entry | Question Mark | Untested market penetration and profitability for specific new formats. | Consumer reception, market share capture, competitive adaptation. | Pilot programs evaluated in diverse regions. |

| Premium-Priced 'Everyday Luxuries' | Question Mark | Success depends on commanding higher prices in aspirational markets. | Perceived value versus elevated pricing, competition in fine fragrance. | Fine fragrance market showed steady growth in 2024. |

| Generative AI Fragrance Finder | Question Mark | Emerging digital tool in a small market segment. | Personalization impact, sales boost potential, market adoption. | Represents an innovative but low-penetration digital investment. |

BCG Matrix Data Sources

Our BCG Matrix leverages Bath & Body Works' financial disclosures, robust market research, and competitor performance data to accurately position each product line.