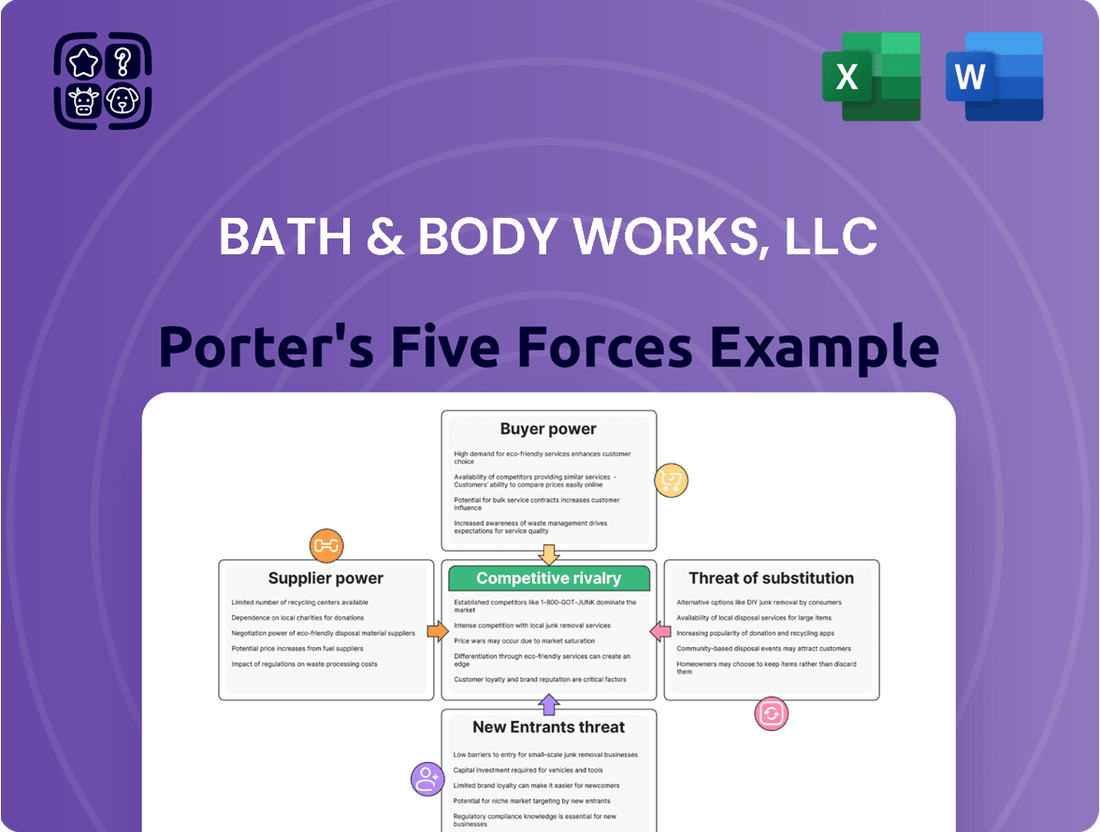

Bath & Body Works, LLC Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bath & Body Works, LLC Bundle

Bath & Body Works, LLC navigates a complex retail landscape where buyer power can significantly sway pricing, and the threat of new entrants, though moderate, requires constant vigilance. The intensity of rivalry among established players in the personal care and home fragrance market is substantial, demanding continuous innovation and customer loyalty programs. Supplier power, while present, is somewhat mitigated by the company's scale and diverse sourcing strategies. Furthermore, the threat of substitutes, ranging from DIY products to alternative gifting options, necessitates a strong brand presence and unique product offerings.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Bath & Body Works, LLC’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Bath & Body Works faces a significant challenge with its reliance on a small group of highly specialized suppliers for its core fragrance and cosmetic ingredients. This concentration means that a substantial portion of their needs, specifically around 87% of fragrance ingredients, comes from just three major global players: Givaudan SA, International Flavors & Fragrances (IFF), and Firmenich.

This limited supplier base grants these companies considerable leverage. When a company like Bath & Body Works needs critical components and has few other places to turn, those suppliers can often dictate terms, potentially leading to higher costs or less favorable supply agreements for Bath & Body Works.

The personal care ingredient supply chain is quite concentrated, with the top five suppliers holding a substantial share of the specialty fragrance ingredients market. This means Bath & Body Works has fewer options for sourcing these critical components.

Furthermore, the possibility of suppliers integrating vertically could even reduce the number of available alternatives for Bath & Body Works, increasing supplier influence. The intricate nature of these specialized ingredients also contributes to the leverage suppliers hold over buyers like Bath & Body Works.

Bath & Body Works strategically employs long-term supplier contracts, typically spanning 3-5 years, to manage the bargaining power of its suppliers. These agreements often incorporate pre-negotiated pricing structures, offering a predictable cost environment for essential raw materials like fragrance oils and packaging components.

The necessity of these long-term arrangements highlights the significant leverage suppliers can exert, particularly for specialized or proprietary ingredients crucial to Bath & Body Works' product formulations. For instance, securing consistent supply of unique botanical extracts at favorable terms requires robust supplier relationships.

While these contracts help stabilize input costs, they also necessitate ongoing supplier relationship management to ensure quality and timely delivery. The company's reliance on a select group of key suppliers for many of its signature scents and product bases means maintaining these partnerships is paramount to operational continuity.

Proprietary Fragrance Development Investment

Bath & Body Works' significant investment in proprietary fragrance research and development, amounting to $42.3 million in 2023, highlights its strategy to carve out a unique market position. This investment, representing 4.7% of their total revenue, is geared towards developing exclusive scents that set their products apart. While this initiative aims to lessen dependence on generic fragrance formulas, thereby potentially increasing bargaining power, the company remains reliant on external suppliers for the fundamental raw materials and chemical compounds that constitute these proprietary scents.

- Proprietary Fragrance Investment: Bath & Body Works invested $42.3 million in R&D for fragrances in 2023.

- Revenue Share: This investment constituted 4.7% of their total revenue for the year.

- Differentiation Strategy: The goal is to create unique scents to differentiate products and reduce reliance on standard formulations.

- Supplier Dependence: Despite unique scent development, the company still depends on suppliers for the base fragrance ingredients.

Risk of Supply Chain Disruptions

Bath & Body Works' predominantly U.S.-based supply chain generally provides agility, but global events or issues within a concentrated supplier base can still trigger disruptions. For instance, in 2023, the company continued efforts to consolidate its supply chain. Their strategic relocation of its entire production system and ten key suppliers to Ohio was a significant move. This initiative aimed to drastically reduce shipping delays and lead times, thereby improving their capacity to meet fluctuating consumer demand effectively.

This concentration on domestic sourcing and supplier relationships is intended to mitigate risks associated with international logistics and geopolitical instability. However, reliance on a limited number of suppliers, even domestically, can amplify the impact of any single supplier's operational issues. The company's 2023 financial reports indicated ongoing investments in supply chain optimization, highlighting the continuous focus on resilience and efficiency in their sourcing and manufacturing processes.

- Domestic Focus: Primarily U.S.-based supply chain enhances agility and reduces international shipping risks.

- Supplier Concentration: Potential vulnerability exists if a concentrated supplier base experiences operational issues.

- Strategic Relocation: Moving production and ten suppliers to Ohio in 2023 aimed to shorten lead times and improve responsiveness.

- Investment in Optimization: Ongoing financial commitments in 2023 underscore the importance of supply chain resilience.

Bath & Body Works faces substantial bargaining power from its key suppliers, particularly for specialized fragrance and cosmetic ingredients. The company's reliance on a few major players, such as Givaudan SA, International Flavors & Fragrances (IFF), and Firmenich, who supply approximately 87% of its fragrance needs, allows these suppliers to dictate terms and potentially increase costs.

To mitigate this, Bath & Body Works employs long-term contracts, typically 3-5 years, which include pre-negotiated pricing for essential materials. This strategy helps stabilize input costs, but the company must still actively manage these supplier relationships due to the critical nature of proprietary ingredients.

The company's 2023 investment of $42.3 million in fragrance R&D, representing 4.7% of its revenue, aims to create unique scents. While this strategy enhances product differentiation, Bath & Body Works remains dependent on external suppliers for the fundamental raw materials used in these proprietary formulations.

Furthermore, Bath & Body Works' strategic move in 2023 to consolidate its supply chain by relocating production and ten key suppliers to Ohio aims to reduce lead times and improve responsiveness. However, this reliance on a concentrated domestic supplier base still presents vulnerabilities if any single supplier experiences operational issues.

| Key Supplier Dependency | Percentage of Fragrance Ingredients Supplied | Impact on Bath & Body Works |

| Top 3 Global Fragrance Houses (Givaudan, IFF, Firmenich) | ~87% | High leverage for suppliers, potential for increased costs and less favorable terms. |

| Concentrated Specialty Ingredient Market | Significant market share held by top suppliers | Limited alternative sourcing options, amplifying supplier bargaining power. |

| Proprietary Ingredient Sourcing | Critical for unique product formulations | Necessitates strong supplier relationships, despite R&D investments in unique scents. |

What is included in the product

This analysis examines Bath & Body Works' competitive environment, detailing the intensity of rivalry, power of buyers and suppliers, threat of new entrants, and the impact of substitutes on its market position.

Instantly grasp Bath & Body Works' competitive landscape, identifying key pressures from rivals and suppliers to inform strategic decisions.

Clearly visualize threats from substitutes and new entrants, enabling proactive strategies to safeguard market share and profitability.

Customers Bargaining Power

Customers in the personal care and home fragrance sectors are often very concerned about price. This makes Bath & Body Works rely heavily on sales and discounts to attract and keep shoppers. For instance, the company saw a 5.2% drop in same-store sales during the third quarter of 2023, which points to customers being sensitive to pricing.

Because of this price sensitivity, customers can easily move to other brands if they find better deals elsewhere. This puts pressure on Bath & Body Works to constantly offer promotions to maintain its customer base and sales volume.

Consumers in the personal care and home fragrance market, including Bath & Body Works customers, face very low switching costs. This means it's simple for them to try a different brand of body lotion, candle, or soap without incurring extra expenses or hassle. For example, a customer can easily purchase a product from a competitor like Bath & Body Works' direct rival, Yankee Candle, or even a mass-market brand like Bath & Body Works' own parent company, L Brands (though L Brands is now known as Bath & Body Works Inc.), without needing to invest in new equipment or undergo extensive training.

This lack of barriers to switching significantly boosts the bargaining power of these customers. With so many options readily available, consumers can readily compare prices, scents, and product quality across numerous brands. In 2024, the beauty and personal care market alone was projected to reach over $500 billion globally, showcasing the vast array of choices available to consumers and further empowering their ability to switch.

Despite low switching costs in the broader beauty and personal care market, Bath & Body Works has cultivated significant brand loyalty. This is evident in its impressive loyalty program, which boasted 46.7 million active members as of 2023, encompassing a substantial 62% of its total customer base.

This robust loyalty program acts as a key defense against the inherent bargaining power of individual customers. The high participation rate fosters repeat purchases and enhances customer retention, creating a sticky customer relationship that mitigates the impact of easily accessible alternatives.

Multiple Purchasing Channels Available

Bath & Body Works customers benefit from a wide array of purchasing options, significantly influencing their bargaining power. The company operates a substantial physical retail presence, boasting over 1,895 company-operated stores across the U.S. and Canada as of February 2025. This extensive network ensures accessibility and convenience for many shoppers.

Complementing its brick-and-mortar stores, Bath & Body Works maintains a robust e-commerce platform. Online sales represented a considerable 27% of total company sales in 2022, highlighting the importance of digital channels for consumers. This omnichannel strategy offers customers flexibility in how and where they make their purchases.

- Extensive Retail Footprint: Over 1,895 company-operated stores in the U.S. and Canada (as of Feb 2025).

- Significant E-commerce Presence: 27% of total sales in 2022 were generated online.

- Omnichannel Convenience: Customers can choose between in-store or online shopping experiences.

- Enhanced Choice: Multiple purchasing channels empower customers with greater control over their buying decisions.

Evolving Consumer Preferences and Trends

Bath & Body Works is experiencing increased customer power due to rapidly changing consumer tastes. There's a strong and growing demand for products that are natural, organic, sustainable, and even personalized. This means customers who prioritize these values have more sway, compelling companies like Bath & Body Works to adjust their product lines and how they communicate with shoppers. For instance, the rise of 'skinification' in the fragrance sector, focusing on skincare benefits, and a broader emphasis on overall wellness are significant trends shaping consumer expectations.

This shift is evident in market data. In 2024, the global market for natural and organic personal care products was valued at over $25 billion, demonstrating a clear consumer preference for these attributes. Furthermore, personalized beauty products are projected to reach $37.5 billion by 2027, highlighting the increasing influence of customization on purchasing decisions. Bath & Body Works' ability to respond to these evolving demands directly impacts its bargaining power with consumers.

- Evolving Preferences: Consumers increasingly seek natural, organic, sustainable, and personalized products.

- Increased Consumer Power: Brands aligning with these values gain leverage with customers.

- Key Trends: 'Skinification' of fragrance and a focus on wellness are impacting choices.

- Market Validation: The natural and organic personal care market exceeded $25 billion in 2024, with personalized beauty projected to reach $37.5 billion by 2027.

Customers hold considerable bargaining power with Bath & Body Works due to price sensitivity and low switching costs in the personal care market. The company's reliance on sales and discounts, exemplified by a 5.2% same-store sales drop in Q3 2023, underscores this. The vastness of the global beauty and personal care market, exceeding $500 billion in 2024, offers consumers ample alternatives, further amplifying their ability to choose based on price and preference.

| Factor | Impact on Bath & Body Works | Supporting Data (2023-2024) |

|---|---|---|

| Price Sensitivity | High; drives reliance on promotions | 5.2% same-store sales drop (Q3 2023) |

| Switching Costs | Low; easy to move to competitors | Global beauty & personal care market > $500 billion (2024) |

| Brand Loyalty Programs | Mitigates power; 46.7 million active members (2023) | 62% of customer base |

| Omnichannel Availability | Enhances customer choice and convenience | 1,895+ stores (Feb 2025); 27% online sales (2022) |

| Evolving Consumer Tastes | Increases power for brands meeting demand | Natural/organic market > $25 billion (2024) |

Full Version Awaits

Bath & Body Works, LLC Porter's Five Forces Analysis

This preview shows the exact Bath & Body Works, LLC Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the industry. This professionally prepared document offers deep insights into the strategic factors influencing Bath & Body Works' market position, providing actionable intelligence for informed decision-making.

Rivalry Among Competitors

Bath & Body Works faces fierce rivalry in the personal care and home fragrance markets. Direct competitors like Ulta Beauty and The Body Shop offer a wide array of similar products, while mass-market brands such as Dove and Yankee Candle also vie for consumer attention. The landscape is further complicated by a growing number of direct-to-consumer (DTC) brands, many of which leverage digital marketing to build loyal customer bases.

Bath & Body Works faces a broad spectrum of rivals, from established department stores to online-only sellers. This diverse competitive environment includes mass merchandisers like Target and Walmart, which offer a wide range of personal care products at accessible price points. Furthermore, the rise of direct-to-consumer (DTC) brands and specialty online retailers, many focusing on niche segments or subscription models, intensifies the pressure.

Bath & Body Works commands a substantial market presence, notably securing the second position in North America's mass bath and shower segment with a 12% market share in 2024. This strong foothold is further amplified by its dominant 33% share in the candle air freshener category during the same year.

Despite these impressive figures, the company operates in markets where it is not the outright leader, suggesting that fierce competition persists for the top market positions. This dynamic implies that rivals are actively vying for consumer attention and market dominance within these lucrative categories.

Emphasis on Product Innovation and Differentiation

Bath & Body Works places a significant emphasis on continuous product innovation to stay ahead. In 2023 alone, the company introduced approximately 87 new products, showcasing a commitment to refreshing its offerings. This strategy is vital for creating a distinct market position.

The company's approach involves launching a wide array of new scents, seasonal collections, and limited-edition items. Furthermore, Bath & Body Works is strategically expanding into new product categories, such as men's grooming and laundry care. This diversification helps capture a broader customer base and reinforces its competitive advantage.

- Constant Product Pipeline: Launching around 87 new products in 2023 demonstrates a robust innovation cycle.

- Scent Diversification: A broad range of scents caters to varied customer preferences, a key differentiator.

- Category Expansion: Entry into men's grooming and laundry lines broadens market reach and revenue streams.

- Limited Editions & Seasonal Offerings: These create urgency and drive repeat purchases, fostering customer engagement.

Impact of Promotional Activities and Price Wars

The retail landscape for personal care and home fragrance is fiercely competitive, often compelling companies like Bath & Body Works to engage in frequent promotional activities. This can escalate into price wars, directly affecting profit margins. For instance, during the peak holiday season of 2023, many retailers, including those in similar sectors, heavily relied on discounts to drive traffic and sales, a trend likely to continue into 2024.

While Bath & Body Works has demonstrated resilience, achieving merchandise margin gains, this doesn't negate the underlying competitive pressure. The necessity for increased marketing spend to stimulate customer engagement in 2024 highlights that simply having desirable products isn't always enough. Companies must actively invest in promotions to stand out, influencing purchasing decisions in a crowded market.

- Promotional Intensity: Retailers frequently use promotions like BOGO (Buy One, Get One) or percentage-off sales to attract customers, a strategy likely to be a staple in 2024's competitive environment.

- Margin Sensitivity: Aggressive discounting can erode profit margins, making effective inventory management and targeted promotions crucial for maintaining profitability.

- Marketing Investment: Increased marketing spend, as observed in recent periods, indicates a need to cut through the noise and directly incentivize consumer purchases amidst intense rivalry.

- Pricing Power vs. Competition: While some brands can command higher prices, the overall market often forces a competitive pricing strategy to remain relevant and capture market share.

Bath & Body Works operates in a highly competitive arena, facing pressure from direct rivals like Ulta Beauty and mass-market players such as Dove and Yankee Candle. The company's 12% market share in North America's mass bath and shower segment in 2024, while significant, shows it's not the sole dominant force.

The fierce rivalry necessitates continuous product innovation, as evidenced by Bath & Body Works' introduction of approximately 87 new products in 2023, aiming to differentiate through scent variety and seasonal collections. This intense competition also drives frequent promotional activities, a trend expected to continue into 2024, impacting profit margins and requiring substantial marketing investments to capture consumer attention.

| Competitor Type | Examples | Market Share Impact |

| Direct Competitors | Ulta Beauty, The Body Shop | Varying product lines, price points |

| Mass Market Brands | Dove, Yankee Candle | Broad accessibility, established brand loyalty |

| Specialty & DTC Brands | Niche online retailers, subscription boxes | Targeted marketing, unique offerings |

| Mass Merchandisers | Target, Walmart | Price competition, wide product assortment |

SSubstitutes Threaten

The rise of DIY and natural alternatives presents a significant threat to Bath & Body Works. Consumers are increasingly drawn to products perceived as healthier or more sustainable, often creating their own personal care items or opting for simpler, less processed ingredients. This trend directly challenges the established product lines and market position of a company reliant on manufactured fragrances and formulations.

The market data underscores this shift. The global natural and organic personal care products market was valued at $22.35 billion in 2022, and its projected growth signals a substantial and expanding consumer base that may bypass traditional retailers like Bath & Body Works in favor of these alternatives.

The increasing availability of multi-functional products, such as skincare items with added fragrance or perfumes with embedded moisturizing properties, presents a significant threat of substitutes for Bath & Body Works. Consumers are increasingly seeking value and convenience, leading them to choose products that address multiple needs simultaneously.

The wellness trend further amplifies this threat. As consumers prioritize health, they may gravitate towards body care products that offer both scent and therapeutic benefits, like those infused with essential oils or antioxidants. For instance, the global market for skincare products, which often incorporate fragrance and wellness attributes, was projected to reach over $180 billion in 2024, indicating a substantial alternative spend for consumers.

The surging popularity of essential oils and diffusers presents a potent threat of substitution for Bath & Body Works' core home fragrance business. Consumers are increasingly turning to these natural alternatives for scenting their homes, viewing them as a healthier and more customizable option compared to traditional candles and sprays. This shift directly challenges the established market for products like Bath & Body Works' signature Wallflowers and candles.

The global essential oils market is experiencing robust expansion, with projections indicating continued growth. For instance, Grand View Research estimated the global essential oils market size at USD 12.8 billion in 2023, with expectations of a compound annual growth rate (CAGR) of 9.8% from 2024 to 2030. This growth is fueled by a heightened consumer awareness of aromatherapy benefits and a preference for natural ingredients, directly impacting demand for Bath & Body Works' existing fragrance portfolio.

General Household Cleaners and Air Purifiers

General household cleaners with strong scents and air purifiers present a significant threat of substitutes for Bath & Body Works' home fragrance products. Consumers seeking a pleasant home environment can opt for cleaning supplies that leave behind a fresh aroma, or invest in air purifiers that actively remove odors and allergens, thereby addressing the desire for a clean-smelling space without relying on dedicated home fragrance items. This is particularly relevant as consumer interest in health and wellness continues to grow, increasing the appeal of air quality solutions that focus on removing pollutants rather than masking them.

The market for air purifiers has seen robust growth, indicating a strong consumer preference for non-fragrance-based solutions for home air quality. For example, the global air purifier market was valued at approximately $11.5 billion in 2023 and is projected to reach $23.6 billion by 2030, growing at a compound annual growth rate of 10.7% during the forecast period. Similarly, the household cleaning products market, which includes fragranced options, is a massive industry, with the global market size estimated at over $250 billion in 2023. This indicates that a substantial portion of consumer spending on home ambiance can be diverted to these alternative product categories.

- Functional Equivalence: Many cleaning products are formulated with perfumes that offer a scent experience, directly competing with the primary benefit of home fragrances.

- Health and Wellness Trend: The increasing consumer focus on indoor air quality and the reduction of airborne irritants drives demand for air purifiers, positioning them as a health-oriented alternative to scented products.

- Cost-Effectiveness: For some consumers, purchasing a multi-purpose cleaner that also provides a pleasant scent might be perceived as more economical than buying separate home fragrance items.

- Market Size of Substitutes: The large and growing markets for both household cleaning products and air purifiers demonstrate the significant potential for these categories to capture consumer spending that might otherwise go towards home fragrances.

Cost-Conscious Consumer Behavior

In periods of economic strain, consumers often become more budget-aware. This can lead them to seek out personal care and home fragrance products that offer better value, potentially migrating towards mass-market retailers. This shift in consumer behavior, sometimes termed 'recession glam,' indicates a focus on affordability without a complete sacrifice of quality.

Bath & Body Works, like other specialty retailers, faces the threat of substitutes when consumers prioritize lower price points. For instance, in 2024, many consumers may opt for store brands or value-oriented alternatives found in supermarkets or discount chains rather than premium-priced specialty items.

- Increased price sensitivity: Consumers may reduce spending on discretionary items like specialty candles or lotions.

- Availability of private-label brands: Mass retailers often offer comparable products at significantly lower prices.

- Economic downturn impact: Studies in 2023 and projections for 2024 show a consumer focus on essential spending, impacting non-essential categories.

- Value-driven purchasing: Consumers seek to maximize their budget, making cheaper substitutes more attractive.

The threat of substitutes for Bath & Body Works is significant, as consumers increasingly turn to DIY, natural, and multi-functional alternatives for personal care and home fragrances. The growing markets for essential oils and air purifiers, valued at $12.8 billion in 2023 and $11.5 billion in 2023 respectively, highlight this trend. Furthermore, economic pressures in 2024 are driving consumers towards more budget-friendly options, including private-label brands found in mass retailers, directly challenging Bath & Body Works' premium positioning.

| Substitute Category | Market Size (Approx. 2023/2024 Data) | Growth Outlook (CAGR) | Key Consumer Driver |

|---|---|---|---|

| Natural & Organic Personal Care | $22.35 billion (2022) | Significant growth projected | Health and wellness consciousness |

| Essential Oils | $12.8 billion (2023) | 9.8% (2024-2030) | Natural fragrance, aromatherapy benefits |

| Air Purifiers | $11.5 billion (2023) | 10.7% (2024-2030) | Improved indoor air quality, odor removal |

| Mass Retailer Private Labels | N/A (Fragmented market) | Stable to growing | Price sensitivity, value for money |

Entrants Threaten

The growth of e-commerce and direct-to-consumer (DTC) strategies has significantly reduced traditional barriers to entry in the personal care and home fragrance sectors. New brands can now build a presence and connect with consumers more readily through digital channels, bypassing the substantial costs historically associated with brick-and-mortar retail expansion.

Leveraging social media and online advertising allows emerging brands to reach target demographics with a fraction of the capital previously required. For instance, in 2024, many successful DTC brands in the beauty and home goods space launched with minimal initial investment, relying on viral marketing and influencer collaborations to gain traction.

This accessibility means that online-only brands can compete effectively, posing a threat to established players like Bath & Body Works by offering niche products or unique brand narratives without the overhead of physical stores.

While the digital landscape offers a lower barrier to entry for new players, the challenge of cultivating substantial brand recognition and deep customer loyalty is a formidable obstacle. Bath & Body Works, for instance, boasted a remarkable 39 million loyalty members in the fourth quarter of 2024, a testament to years of strategic marketing and fostered consumer trust. This established customer base makes it incredibly difficult for new entrants to swiftly gain meaningful traction and market share.

Establishing a widespread physical retail presence, akin to Bath & Body Works' network of over 1,700 stores globally as of early 2024, demands immense capital. This includes significant upfront investment in prime real estate acquisition or leasing, stocking thousands of individual locations with diverse product lines, and maintaining a substantial workforce. This considerable financial hurdle effectively deters many potential new competitors from attempting to replicate such an extensive footprint on a comparable scale.

Access to Specialized Sourcing and Supply Chains

New entrants into the personal care and home fragrance market may find it difficult to gain access to the same specialized suppliers and intricate supply chains that companies like Bath & Body Works have cultivated over time. For instance, securing unique fragrance oils or proprietary cosmetic ingredients often requires establishing strong relationships and demonstrating significant volume commitments, which can be prohibitive for newcomers.

The development of efficient and reliable supply chains for niche ingredients is a complex undertaking, demanding considerable investment in time and resources to identify, vet, and integrate suppliers. This process can create a substantial barrier to entry. In 2023, the global fragrance market was valued at approximately $50 billion, with a significant portion driven by proprietary formulations and specialized ingredient sourcing.

- Difficulty accessing proprietary fragrance oils and unique cosmetic ingredients.

- High cost and time investment required to build comparable supplier relationships.

- Established players benefit from economies of scale in sourcing, further disadvantaging new entrants.

- The need for specialized quality control and regulatory compliance for ingredients adds complexity.

Regulatory Hurdles and Product Development Expertise

New entrants in the personal care sector, like those aiming to compete with Bath & Body Works, face substantial regulatory complexities. Compliance with FDA regulations concerning product safety, ingredient disclosure, and manufacturing practices is non-negotiable. For instance, the FDA's oversight extends to labeling accuracy and claims made about product efficacy, adding layers of scrutiny that require specialized knowledge and resources. This regulatory landscape can significantly increase the cost and time to market for aspiring competitors.

Beyond regulatory hurdles, the development of a compelling product line demands considerable investment in research and development and specialized expertise. Creating a diverse range of fragrances and effective formulations, hallmarks of brands like Bath & Body Works, requires deep understanding of chemistry, perfumery, and consumer preferences. In 2024, the ongoing innovation in clean beauty and sustainable ingredient sourcing further elevates the R&D bar. Companies without established R&D capabilities or significant capital to invest in skilled personnel and testing facilities will find it exceptionally difficult to gain traction.

- Regulatory Compliance Costs: Navigating FDA regulations for personal care products can involve significant upfront investment in testing, documentation, and legal counsel.

- R&D Investment Requirement: Developing unique and appealing scents and effective formulations necessitates substantial expenditure on research, product development, and sensory analysis.

- Expertise in Formulation and Fragrance Development: Access to skilled chemists, perfumers, and product developers is crucial, representing a high-cost barrier for new entrants.

- Market Education and Consumer Trust: New brands must invest in educating consumers about their products and building trust, especially in a market with established players.

While e-commerce has lowered some initial barriers, the threat of new entrants remains moderate. Building brand recognition and customer loyalty comparable to Bath & Body Works, which boasted 39 million loyalty members in Q4 2024, is a significant challenge. Replicating their extensive global retail footprint of over 1,700 stores as of early 2024 also requires immense capital, deterring many potential competitors.

| Factor | Impact on New Entrants | B&BW Advantage |

|---|---|---|

| Brand Loyalty & Customer Base | Low initial customer base | 39 million loyalty members (Q4 2024) |

| Physical Retail Presence | High cost to establish | Over 1,700 global stores (early 2024) |

| Supply Chain & Ingredient Sourcing | Difficulty accessing proprietary ingredients | Established supplier relationships, economies of scale |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bath & Body Works, LLC is built upon a foundation of publicly available financial reports, SEC filings, and reputable industry market research from firms like IBISWorld. We also incorporate insights from competitor websites and news releases to capture the dynamic competitive landscape.