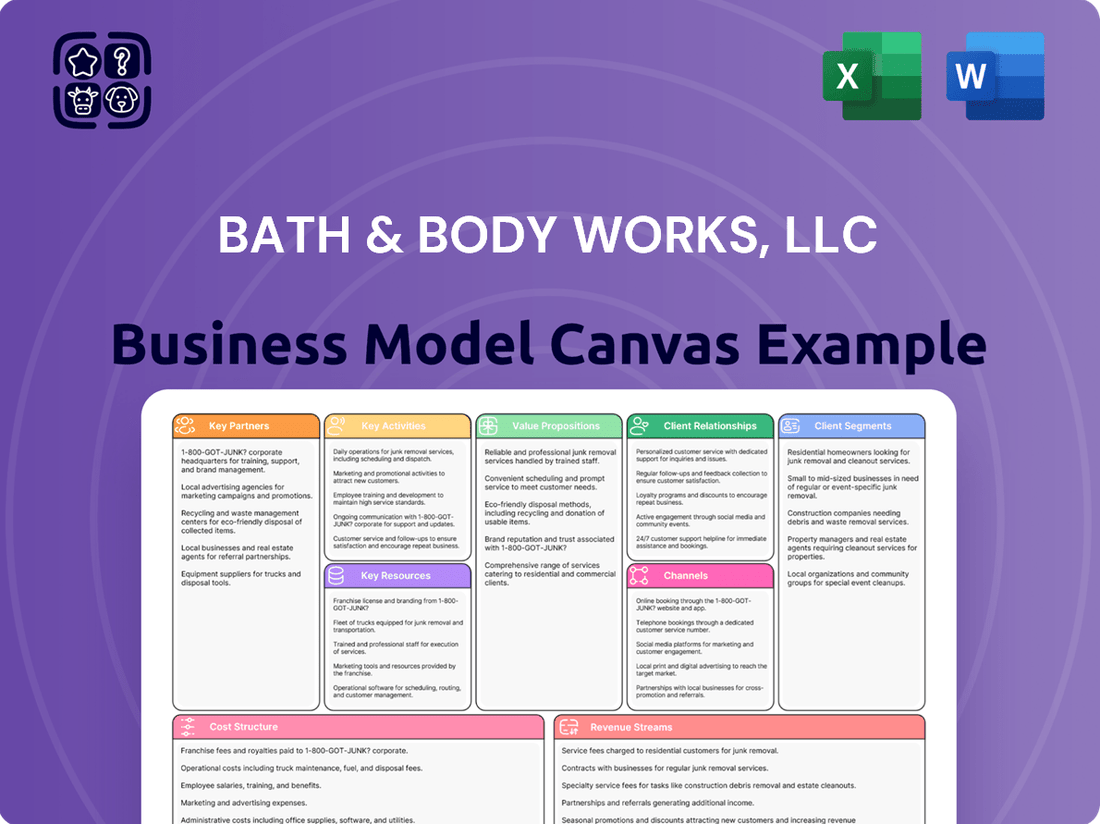

Bath & Body Works, LLC Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bath & Body Works, LLC Bundle

Unlock the strategic blueprint behind Bath & Body Works, LLC's success with our comprehensive Business Model Canvas. This in-depth analysis reveals how they effectively reach their diverse customer segments and deliver unique value through a wide range of personal care products. Discover their key partnerships and essential resources that fuel their operations.

Dive deeper into the core activities and revenue streams that drive Bath & Body Works, LLC's profitability. Understand their cost structure and how they maintain a competitive advantage in the dynamic retail landscape. This downloadable canvas provides actionable insights for entrepreneurs and business strategists.

Ready to emulate their market leadership? Get the full Business Model Canvas for Bath & Body Works, LLC to gain access to all nine building blocks, complete with company-specific insights and strategic analysis. Download it now to accelerate your own business thinking.

Partnerships

Bath & Body Works maintains crucial relationships with raw material suppliers, procuring essentials like fragrance oils, candle waxes, and personal care product ingredients. These partnerships directly impact product quality and the consistency of their wide product range. For instance, their collaboration with Givaudan highlights a commitment to ethical sourcing, specifically supporting vanilla farmers in Madagascar to secure a dependable and responsible supply chain.

Bath & Body Works relies heavily on strategic partnerships with packaging manufacturers to craft the distinctive and appealing containers for its extensive product range, from lotion bottles to candle jars. This collaboration is crucial for maintaining brand aesthetic and product integrity.

The company's commitment to a largely U.S.-based supply chain, with many suppliers located in proximity to its Ohio distribution centers, fosters remarkable speed and flexibility. This allows Bath & Body Works to swiftly adapt to evolving consumer preferences and efficiently roll out new product designs and packaging innovations.

For example, in 2024, Bath & Body Works continued to emphasize sustainable packaging initiatives, working with manufacturers to incorporate more recycled materials into their designs, a trend driven by increasing consumer demand for eco-conscious products.

Bath & Body Works relies heavily on logistics and shipping providers to move its diverse product range, from candles to personal care items, to its widespread customer base. These partnerships are vital for ensuring products reach over 1,700 retail stores in the U.S. and internationally, as well as fulfilling millions of online orders. In 2023, the company shipped millions of packages, highlighting the sheer volume and reliance on efficient transportation networks.

The company's vertically integrated supply chain, with significant manufacturing operations located in the United States, allows for greater control and potential cost efficiencies in its logistics. This integration means that raw materials and finished goods can move more smoothly between production and distribution centers, ultimately benefiting the speed and reliability of deliveries. This domestic focus can also mitigate some of the complexities associated with international shipping, though global distribution remains a key component of their strategy.

Technology and Digital Platform Partners

Bath & Body Works (BBWI) strategically partners with technology and digital platform providers to drive innovation and enhance customer engagement. For instance, collaborations with firms like Accenture are crucial for modernizing their IT infrastructure and e-commerce operations. These alliances enable the integration of advanced technologies, such as AI-driven personalization tools, to create more seamless and engaging online shopping experiences.

These technology partnerships are instrumental in supporting BBWI's digital transformation agenda. By leveraging external expertise, the company can accelerate the implementation of new digital features and improve the efficiency of its online platforms. This focus on digital capabilities is essential for meeting evolving customer expectations and maintaining a competitive edge in the retail landscape.

- E-commerce Enhancement: Collaborations with technology partners bolster Bath & Body Works' online sales channels, aiming to improve conversion rates and average order value.

- AI-Powered Customer Tools: Partnerships facilitate the development and deployment of AI tools, such as personalized product recommendations and digital scent finders, to enhance the customer journey.

- Digital Platform Modernization: Working with tech firms allows for upgrades to backend systems and customer-facing digital platforms, ensuring scalability and agility.

- Data Analytics and Insights: These partnerships often involve leveraging advanced data analytics to gain deeper customer insights, informing marketing strategies and product development.

Marketing and Influencer Collaborations

Bath & Body Works actively engages in marketing and influencer collaborations to amplify its reach and product appeal. This includes partnerships with specialized marketing agencies and a curated network of social media influencers. These collaborations are particularly crucial for generating buzz around new product introductions and seasonal collections, ensuring maximum visibility across diverse consumer segments.

A key objective of these partnerships is to connect with younger demographics, notably Gen Z, thereby enhancing brand relevance and fostering long-term customer loyalty. By leveraging the authentic voices of influencers, Bath & Body Works can build trust and drive engagement within these influential consumer groups. For instance, influencer campaigns in late 2023 and early 2024 consistently highlighted new fragrance launches and holiday gift sets, often resulting in significant social media mentions and direct traffic to the brand's e-commerce platform.

Furthermore, strategic collaborations with well-established brands significantly bolster Bath & Body Works' cultural resonance and consumer connection. These high-profile partnerships, such as those with Disney, have historically driven exceptional sales and brand enthusiasm. For example, a 2023 collaboration featuring characters from popular Disney franchises on limited-edition packaging saw a notable increase in sales for the participating product lines, demonstrating the power of co-branded marketing in capturing consumer imagination and driving purchase intent.

- Marketing Agencies: Partnering with agencies for broader campaign execution and targeted digital advertising.

- Influencer Marketing: Collaborating with micro and macro-influencers to showcase products authentically.

- Demographic Reach: Focusing on Gen Z and younger consumers to build future brand advocates.

- Brand Collaborations: Strategic alliances with brands like Disney to enhance cultural relevance and drive sales.

Bath & Body Works' key partnerships extend to fragrance houses and ingredient suppliers, vital for their product innovation and quality. In 2024, the company continued to focus on sourcing unique and sustainable fragrance components, ensuring a distinct scent profile across their extensive product lines. These relationships are foundational to their ability to consistently deliver new and appealing scents to consumers.

What is included in the product

This Business Model Canvas outlines Bath & Body Works' strategy focused on delivering indulgent personal care products through a multi-channel approach, emphasizing customer loyalty and brand experience.

It details their target customer segments, key value propositions like sensory experiences and gifting, and revenue streams driven by product sales across physical and digital platforms.

Bath & Body Works, LLC's Business Model Canvas acts as a pain point reliever by streamlining the customer's journey to self-care and gifting, offering a comprehensive solution for sensory indulgence and thoughtful presents.

This canvas efficiently addresses the pain point of fragmented shopping experiences by consolidating a wide range of personal care and home fragrance products into a single, accessible brand, simplifying consumer choice and satisfaction.

Activities

Bath & Body Works actively designs and develops a wide array of personal care and home fragrance items. This core activity focuses on creating distinctive scent combinations, innovating new product formats, and launching collections that align with seasonal themes and current market trends. The company's commitment to newness is evident in its introduction of over 400 new fragrances each year, a testament to its strategy for staying ahead in a dynamic market.

Bath & Body Works heavily relies on its manufacturing and production capabilities, largely centered within a vertically integrated U.S. supply chain. This allows them to directly produce a wide range of their popular items, including lotions, shower gels, hand soaps, and candles, ensuring quality control and responsiveness.

The company's significant investment in its 'Beauty Park' campus near Columbus, Ohio, is a testament to this focus. This facility acts as a hub, bringing together suppliers and streamlining various value chain activities, which is crucial for their agility in swiftly adapting to evolving consumer preferences and demand.

Managing and operating a widespread network of retail stores globally is a fundamental activity for Bath & Body Works. This encompasses crucial elements like optimizing store layouts and design, efficiently managing inventory levels, providing comprehensive staff training, and consistently delivering a cohesive brand experience to every customer.

The company is actively pursuing an off-mall expansion strategy and introducing innovative new store designs, such as the 'Gingham+' concept. These initiatives are specifically aimed at enhancing the overall in-store customer experience and successfully attracting and engaging new demographic segments.

In 2023, Bath & Body Works operated over 1,700 stores, a significant portion of which are in the United States. This vast physical footprint requires continuous investment in operational efficiency and brand consistency to maintain customer loyalty and drive sales.

E-commerce and Digital Platform Management

A core activity for Bath & Body Works is the continuous management and improvement of their e-commerce website and mobile app. This ensures a smooth and engaging online shopping journey for customers.

Key operational focuses include optimizing the digital user experience, executing targeted digital marketing efforts, and incorporating convenient services like Buy Online, Pick Up In-Store (BOPIS). These digital channels are vital for customer engagement and revenue generation.

Bath & Body Works strategically leverages its digital platforms to expand its reach and drive sales growth. The release of an enhanced mobile application in October 2024 underscores their commitment to a robust digital presence.

- E-commerce Platform Optimization: Ongoing refinement of the website and app for ease of navigation and purchase.

- Digital Marketing Campaigns: Strategic deployment of online advertising and social media to attract and retain customers.

- Omnichannel Integration: Seamless integration of online and physical store experiences, including BOPIS.

- Mobile App Enhancement: Continuous updates and feature additions to the mobile application, exemplified by the October 2024 release.

Marketing and Brand Building

Bath & Body Works consistently invests in marketing and brand building to maintain its strong recognition and attract a steady stream of new customers. This involves a multifaceted approach that includes engaging seasonal promotions, active social media engagement, strategic partnerships with influencers, and robust loyalty programs designed to foster repeat business.

- Seasonal Promotions: Bath & Body Works is renowned for its highly anticipated seasonal collections and sales events, such as the semi-annual sale, which significantly drive foot traffic and online sales.

- Digital Engagement: The company actively utilizes social media platforms to showcase new products, run contests, and interact with its customer base, often leveraging user-generated content.

- Influencer Marketing: Partnerships with lifestyle and beauty influencers amplify brand reach and credibility, introducing products to wider audiences.

- Loyalty Programs: Programs like their loyalty program encourage repeat purchases by offering rewards and exclusive early access to sales and new products, fostering a dedicated customer base.

Their marketing strategy is deeply rooted in captivating the senses, aiming to create an emotional connection with consumers by emphasizing the sensory experience of their products, from scent to packaging.

Bath & Body Works' strategic approach to sourcing, manufacturing, and distribution is a cornerstone of its business model. A significant aspect is their vertically integrated supply chain, with a strong emphasis on U.S.-based production. This allows for greater control over quality and faster adaptation to market demands.

| Key Activity | Description | Supporting Data/Facts |

|---|---|---|

| Product Design & Development | Creating new fragrances and product formats, aligning with seasonal trends. | Introduces over 400 new fragrances annually. |

| Manufacturing & Production | Vertically integrated U.S. supply chain for key product categories. | Owns and operates manufacturing facilities for lotions, soaps, candles, etc. |

| Retail Operations | Managing a global network of physical stores. | Operated over 1,700 stores globally in 2023. |

| E-commerce & Digital | Optimizing online platforms and mobile app for sales and engagement. | Released enhanced mobile app in October 2024; focuses on omnichannel services like BOPIS. |

| Marketing & Brand Building | Engaging promotions, digital marketing, influencer collaborations, and loyalty programs. | Leverages seasonal sales and a strong loyalty program to drive repeat purchases. |

Full Version Awaits

Business Model Canvas

This preview offers a direct glimpse into the comprehensive Business Model Canvas for Bath & Body Works, LLC. The document you see is not a mockup; it’s an authentic snapshot of the final deliverable, showcasing key elements of their operational strategy. Upon completing your purchase, you will receive this exact, fully detailed Business Model Canvas, providing you with actionable insights into their customer segments, value propositions, channels, and revenue streams.

Resources

Bath & Body Works’ brand intellectual property, including its vast collection of proprietary fragrance formulas and distinct product designs, is a cornerstone of its business model. This IP is the engine behind their ability to offer unique and sought-after products, directly supporting their value proposition.

These carefully crafted scents and innovative product concepts are not just appealing; they are the key differentiators that set Bath & Body Works apart in a crowded market. For instance, the introduction of the 'Everyday Luxuries' line in 2024 highlights their continuous innovation driven by this intellectual property.

The company's portfolio of brand names and registered trademarks further solidifies its market position. In 2023, Bath & Body Works reported approximately $4.0 billion in net sales, a significant portion of which is directly attributable to the consumer recognition and loyalty generated by its strong brand IP.

This intellectual property allows for the consistent creation of new and exciting collections, ensuring customers have fresh reasons to engage with the brand. It’s the foundation upon which their product variety and appeal are built, fostering repeat business and a strong customer base.

Bath & Body Works leverages an extensive retail store network, boasting over 1,700 locations primarily in the U.S. and Canada. This vast physical footprint is a cornerstone of their customer engagement strategy, offering a tactile and olfactory experience that drives sales.

The company's real estate strategy includes a significant push towards off-mall locations and updated store designs, aiming to enhance accessibility and customer convenience. This evolution in their physical presence is crucial for adapting to changing retail landscapes and optimizing the customer journey.

Bath & Body Works’ predominantly U.S.-based, vertically integrated supply chain is a critical resource. This includes their significant manufacturing presence, such as the 'Beauty Park' facility, which is central to their operational strategy.

This integration allows for remarkably rapid product development cycles and efficient, in-house production. For instance, the company has demonstrated the ability to bring new scents and product lines to market in a matter of months, a feat made possible by controlling much of the manufacturing process.

Furthermore, this model facilitates quick and agile distribution directly to their extensive store network. This operational speed is crucial for responding to fast-moving consumer trends and seasonal demands, a hallmark of their business.

This end-to-end control over production and distribution is a significant competitive advantage, enabling Bath & Body Works to maintain product availability and freshness while adapting swiftly to market shifts.

Skilled Workforce and Expertise

Bath & Body Works relies heavily on its diverse and skilled workforce. This includes highly specialized perfumers and product designers who are crucial for creating the unique fragrances and product assortments that define the brand. Their expertise directly fuels innovation and product appeal, ensuring the company stays competitive.

The company's retail associates are another key resource, providing the face-to-face customer interaction that is central to the brand's experience. Their ability to offer personalized service and product knowledge significantly enhances customer loyalty. In 2023, Bath & Body Works employed approximately 60,000 associates across its global operations, highlighting the scale of this human capital.

Furthermore, the operational backbone is supported by supply chain specialists. These individuals manage the complex logistics of sourcing ingredients, manufacturing, and distributing products efficiently. Their expertise ensures product availability and cost-effectiveness, impacting the company's profitability. Bath & Body Works also actively invests in its associates through various training and development programs, aiming to enhance their skills and career progression.

- Skilled Perfumers and Product Designers: Drive innovation and brand identity through unique fragrance and product creation.

- Expert Retail Associates: Deliver exceptional customer service, fostering brand loyalty and enhancing the in-store experience.

- Efficient Supply Chain Specialists: Ensure seamless operations from sourcing to delivery, optimizing costs and product availability.

- Investment in Associate Development: Ongoing training and professional growth programs to maintain and enhance workforce expertise.

Customer Data and Loyalty Program

The My Bath & Body Works Rewards program is a cornerstone of Bath & Body Works' customer strategy. As of the fourth quarter of 2024, this program boasted approximately 39 million active members, demonstrating its significant reach and engagement.

The data gleaned from these loyalty members offers critical insights into customer preferences and purchasing habits. This information is instrumental in crafting personalized marketing campaigns and recommending specific products, thereby enhancing the customer experience and driving sales.

The impact of the loyalty program on revenue is substantial. Loyalty members are responsible for nearly 80% of all U.S. sales, underscoring its vital role in the company's financial performance and customer retention efforts.

- Loyalty Program Membership: Approximately 39 million active members as of Q4 2024.

- Data Insights: Enables understanding of customer preferences and buying behavior for personalization.

- Sales Contribution: Loyalty members drive nearly 80% of U.S. sales.

Bath & Body Works' key resources are its strong intellectual property, extensive physical retail network, vertically integrated supply chain, skilled workforce, and robust customer loyalty program. These elements collectively enable the company to differentiate its products, reach customers effectively, maintain operational efficiency, foster innovation, and drive significant sales.

Value Propositions

Bath & Body Works boasts a vast array of fragrances, from signature body care lines like lotions and shower gels to popular home fragrances such as candles and wallflower refills. This extensive selection ensures customers can find scents that suit their personal tastes and lifestyle needs. In fiscal year 2024, the company reported a net sales figure of $5.18 billion, underscoring the broad appeal and purchasing power of its diverse product offerings.

The company’s commitment to offering a wide variety of scents across numerous product categories makes it a compelling destination for consumers seeking a personalized sensory experience. This approach fosters customer loyalty and encourages repeat purchases, as individuals can explore and discover new favorites. The sheer breadth of options, from seasonal specials to core collections, allows for continuous engagement with their customer base.

Bath & Body Works, LLC is dedicated to offering premium personal care and home fragrance items. They consistently launch new formulations and product advancements, like their 'Everyday Luxuries' fine fragrance mists, to adapt to changing consumer tastes and maintain market relevance. For instance, their Q1 2024 earnings report highlighted strong performance in their core categories, driven by new product introductions.

Bath & Body Works thrives on a strategy of frequent newness, particularly with its seasonal collections. This approach, evident throughout their business model, consistently injects fresh excitement into their product offerings. For instance, their 2023 holiday season saw a significant push of themed collections, driving customer engagement and anticipated sales spikes.

The introduction of limited-edition items and collaborations further fuels this constant refresh. This creates a sense of urgency and exclusivity, prompting customers to purchase before items disappear. This tactic is a cornerstone for encouraging repeat visits and purchases, keeping the brand top-of-mind and highly relevant to consumer desires.

This constant churn of newness is crucial for maintaining brand appeal, especially during peak gifting periods like the winter holidays. In 2023, their seasonal promotions and new product launches were instrumental in driving their revenue, demonstrating the direct impact of this value proposition on their financial performance.

Accessible Luxury and Affordable Indulgence

Bath & Body Works excels at making consumers feel like they are experiencing luxury without the high price tag. They offer a wide range of beautifully scented body care and home fragrance products that provide a moment of indulgence for everyday life. This strategy allows a broad spectrum of customers to enjoy premium-feeling items, fostering a sense of affordable pampering.

The company's commitment to accessible luxury is evident in its pricing strategy, making it a go-to for those seeking small, regular treats. For example, during their popular semi-annual sales, customers can often find items at significantly reduced prices, further reinforcing the value proposition of affordable indulgence. This approach builds customer loyalty by consistently delivering desirable products at attainable price points.

- Accessible Luxury: High-quality, sensorial products priced for everyday enjoyment.

- Affordable Indulgence: Enables a broad customer base to treat themselves regularly.

- Everyday Escapism: Provides moments of personal care and home ambiance without significant cost.

- Value Perception: Enhanced through frequent promotions and sales events, such as the Semi-Annual Sale, which can see discounts of up to 50% or more on select items.

Engaging Omnichannel Shopping Experience

Bath & Body Works excels at creating an engaging omnichannel shopping journey. They blend the sensory appeal of their physical stores, featuring scent bars and interactive displays, with the convenience of digital platforms. This strategy ensures customers can easily browse, purchase, and receive products whether online or in-person.

The brand's commitment to a seamless experience is evident in its robust digital offerings. Customers can enjoy convenient online shopping, utilize a user-friendly mobile app, and take advantage of buy-online-pickup-in-store (BOPIS) options. This caters directly to modern consumer preferences for flexibility and speed.

- Sensory In-Store Environments: Scent bars and interactive displays create a memorable physical shopping experience.

- Digital Convenience: Easy-to-navigate online store and mobile app enhance accessibility.

- Omnichannel Integration: BOPIS options bridge the gap between online browsing and in-store pickup.

- Customer Behavior Adaptation: The strategy aligns with contemporary shoppers' demand for choice and efficiency.

Bath & Body Works offers a wide variety of fragrances and products, making it a go-to for personal care and home scents. Their extensive selection appeals to a broad customer base seeking specific olfactory experiences. In fiscal year 2024, the company reported net sales of $5.18 billion, demonstrating the significant market demand for their diverse product lines.

The brand consistently introduces new products and seasonal collections, keeping their offerings fresh and exciting. This strategy of frequent newness, including limited-edition items and collaborations, drives customer engagement and encourages repeat purchases. This approach was particularly effective during the 2023 holiday season, contributing to their overall financial performance.

Bath & Body Works provides a sense of accessible luxury, allowing customers to enjoy premium-feeling products for everyday indulgence. Their pricing strategy, often supported by frequent promotions like the Semi-Annual Sale with discounts up to 50%, makes treating oneself attainable for many. This focus on value perception fosters strong customer loyalty.

The company excels at creating an integrated shopping experience across both physical and digital channels. Their stores feature engaging displays, while online platforms and mobile apps offer convenience and options like buy-online-pickup-in-store (BOPIS), catering to modern consumer preferences for flexibility and ease.

Customer Relationships

Bath & Body Works cultivates deep customer loyalty through its 'My Bath & Body Works Rewards' program. This initiative provides members with enticing perks such as early access to sales, personalized discounts, and complimentary items, fostering a sense of exclusivity and value.

The effectiveness of this loyalty program is substantial. In 2023, for instance, loyalty members represented a considerable percentage of the company's total U.S. sales, underscoring their significant contribution and higher level of engagement with the brand.

Bath & Body Works leverages customer data to provide personalized product recommendations and tailored offers, especially to its loyalty program members. This data-driven strategy aims to deepen customer engagement and boost sales by making shoppers feel recognized and catered to.

In 2024, Bath & Body Works continued to refine its digital platforms, with loyalty members often receiving early access to sales and exclusive discounts, directly tied to their purchase history and preferences. This focus on personalization is a key driver for increasing average order value and fostering long-term customer loyalty.

Bath & Body Works fosters customer loyalty through an immersive in-store experience, emphasizing personal interaction and product discovery. Knowledgeable associates guide shoppers, offering personalized recommendations and engaging product demonstrations that highlight the brand's sensory appeal.

The company’s strategic investment in store redesign, exemplified by the Gingham+ concept, creates vibrant environments with scent bars and dedicated testing zones. This direct engagement encourages customers to explore and connect with products, driving both immediate sales and long-term brand affinity.

For instance, in 2023, Bath & Body Works reported net sales of $4.0 billion, with a significant portion attributable to the strong in-store traffic and the enhanced customer experience. This focus on sensory engagement and service is a key differentiator in the competitive beauty and personal care market.

Digital Engagement and Community Building

Bath & Body Works actively engages customers digitally through its e-commerce platform, a dedicated mobile app, and popular social media channels like Instagram and TikTok. These digital touchpoints are crucial for showcasing new products, soliciting customer feedback, and cultivating a vibrant community centered on shared scent preferences and lifestyle aspirations. This consistent interaction significantly bolsters brand loyalty.

In 2024, Bath & Body Works continued to leverage these digital avenues to foster deeper connections. For instance, their mobile app offers personalized shopping experiences and exclusive early access to new collections, driving app engagement. Social media campaigns often feature user-generated content, encouraging customers to share their favorite products and experiences, thereby building authentic community connections.

- E-commerce & Mobile App: Bath & Body Works' digital sales channels provide a seamless shopping experience, allowing customers to browse, purchase, and track orders easily. The mobile app, in particular, offers personalized recommendations and loyalty program integration, enhancing customer retention.

- Social Media Presence: Active engagement on platforms like Instagram and TikTok allows for direct interaction with customers. This includes responding to comments, running interactive polls, and hosting live sessions to showcase products and build a sense of community.

- Community Building Initiatives: The brand encourages user-generated content, creating a space for customers to share their experiences and connect with like-minded individuals. This fosters a stronger sense of belonging and brand advocacy.

- Data-Driven Engagement: By analyzing customer interactions across digital platforms, Bath & Body Works gains insights into preferences and trends, enabling more targeted marketing and product development efforts.

Seasonal Promotions and Events

Bath & Body Works leverages seasonal promotions and events to foster strong customer relationships. Frequent promotions, like their highly anticipated semi-annual sales, along with themed product launches, are instrumental in keeping customers engaged and driving repeat purchases. These events generate a sense of urgency and novelty, which significantly boosts both in-store foot traffic and online sales.

This strategy reinforces Bath & Body Works' image as a dynamic brand. For instance, during the 2023 holiday season, the company saw a notable increase in sales driven by their festive promotions and limited-edition collections. The success of these events directly translates into higher customer lifetime value and a more robust brand loyalty.

- Seasonal Promotions: Frequent events like the semi-annual sale and themed product launches keep customers excited.

- Urgency and Newness: These initiatives create a sense of urgency, encouraging immediate purchases.

- Sales Impact: Promotions directly drive both in-store and online sales, contributing to revenue growth.

- Brand Dynamism: Seasonal activities reinforce the brand's ever-evolving and engaging nature.

Bath & Body Works builds strong customer relationships through its multifaceted approach, prioritizing loyalty programs, personalized digital experiences, and engaging in-store interactions. Their 'My Bath & Body Works Rewards' program is central, offering exclusive benefits that drive repeat business and foster a sense of community.

In 2024, the company continued to enhance its digital presence, making the mobile app a key channel for personalized offers and early access to new collections, which directly impacts customer engagement and sales.

The brand's success is further amplified by its strategic use of seasonal promotions and limited-edition product launches, creating excitement and encouraging frequent purchases, thereby increasing customer lifetime value.

| Customer Relationship Aspect | Description | Key Initiatives | Impact/Data Point |

|---|---|---|---|

| Loyalty Program | Fostering repeat purchases and brand advocacy | My Bath & Body Works Rewards program (early access, personalized discounts) | Loyalty members represent a significant portion of U.S. sales (2023 data indicates high engagement). |

| Personalization | Tailoring experiences to individual customer preferences | Data-driven recommendations, targeted offers via app and email | Refinement of digital platforms in 2024 to boost average order value. |

| In-Store Experience | Creating an immersive and sensory brand interaction | Store redesigns (e.g., Gingham+ concept), knowledgeable associates, scent bars | Contributed to $4.0 billion in net sales (2023) through enhanced customer engagement. |

| Digital Engagement | Building community and maintaining consistent brand interaction | E-commerce, mobile app, social media (Instagram, TikTok), user-generated content | App engagement driven by personalized experiences and early access in 2024. |

Channels

Bath & Body Works primarily distributes its products through a vast network of company-operated retail stores, primarily within the United States and Canada. These brick-and-mortar locations are key to their customer engagement strategy.

Strategically, these stores are often found in high-traffic shopping centers and malls, ensuring visibility. However, there's a noticeable shift towards off-mall locations, aiming to broaden accessibility and connect with a wider customer base beyond traditional mall shoppers.

As of early 2024, Bath & Body Works operates over 1,600 retail stores, underscoring the significant role these physical channels play in their go-to-market approach. This extensive footprint allows for direct customer interaction and brand experience.

The official e-commerce website, bathandbodyworks.com, is a cornerstone of Bath & Body Works' direct-to-consumer strategy. This digital storefront provides customers nationwide with access to the full product catalog, including many online-exclusive items and special promotions not found in physical stores. In fiscal year 2024, Bath & Body Works reported that its digital segment, largely driven by its website, experienced continued growth, contributing significantly to overall revenue.

The Bath & Body Works mobile application is a vital digital storefront, enhanced in October 2024 to simplify the shopping journey. It allows customers to browse products, manage their loyalty points, and access tailored promotions, reinforcing the company's integrated approach to reaching consumers across various platforms.

In 2024, mobile commerce continued its upward trend, with a significant portion of retail sales expected to originate from smartphone and tablet devices. Bath & Body Works' app capitalizes on this by offering a seamless experience for its extensive customer base, driving both engagement and conversion.

Social Media Platforms

Social media platforms are pivotal for Bath & Body Works' customer engagement and brand building. In 2024, the company is increasingly leveraging these channels to connect with its audience, particularly younger consumers. This focus is critical as social media trends often dictate consumer purchasing behavior.

Bath & Body Works is strategically expanding its presence on platforms like TikTok, recognizing its significant influence. The planned launch of a TikTok Shop is a key initiative for 2024, aiming to create a seamless purchasing journey directly within the app. This move is expected to attract and convert Gen Z consumers, a demographic that heavily relies on social media for product discovery and shopping.

The integration of e-commerce functionalities on social media aligns with broader retail trends. For instance, TikTok Shop has seen substantial growth, with projections indicating continued expansion in direct-to-consumer sales facilitated by these platforms. Bath & Body Works' entry into this space is a proactive step to capitalize on this evolving retail landscape.

The strategic importance of these platforms extends beyond direct sales. They serve as vital conduits for marketing campaigns, influencer collaborations, and gathering real-time customer feedback. This multi-faceted approach ensures that Bath & Body Works remains relevant and responsive to market demands in 2024.

- TikTok Shop Launch: Bath & Body Works is integrating direct sales capabilities on TikTok to streamline the customer purchase path.

- Demographic Targeting: This strategy specifically aims to engage and attract younger consumers, particularly Gen Z.

- Evolving Retail Landscape: The move reflects a broader industry shift towards social commerce, where platforms become direct sales channels.

- Marketing and Engagement: Social media continues to be a primary tool for brand building, customer interaction, and gathering market insights.

International Partner-Operated Stores

Bath & Body Works leverages international partner-operated stores to expand its global footprint beyond North America. These partnerships utilize franchise, license, and wholesale models, allowing for efficient market entry and adaptation to local consumer preferences. This strategy is a key component of their international growth, as evidenced by their nearly 500 international store count as of August 2024.

- Global Reach: Operates through franchise, license, and wholesale agreements in markets outside North America.

- Expansion Strategy: Indicates a deliberate focus on increasing international presence and brand awareness.

- Store Count: As of August 2024, Bath & Body Works managed close to 500 international stores.

- Partnership Model: Relies on external partners to manage store operations, reducing direct capital investment and operational complexity.

Bath & Body Works utilizes a multi-channel approach, with company-operated retail stores forming the backbone of its distribution. These physical locations, numbering over 1,600 as of early 2024, are strategically placed in high-traffic areas to maximize customer access and brand visibility.

The company’s robust e-commerce platform, bathandbodyworks.com, is a significant revenue driver and offers a comprehensive product selection, including online exclusives. This digital channel saw continued growth in fiscal year 2024, reinforcing its importance in the direct-to-consumer strategy.

Mobile commerce is increasingly vital, with the Bath & Body Works app enhancing the customer experience by integrating loyalty programs and personalized offers. This focus aligns with the 2024 trend where mobile devices are expected to originate a substantial portion of retail sales.

Social media, particularly platforms like TikTok, is a key engagement tool. The planned 2024 launch of a TikTok Shop aims to capture younger demographics by facilitating direct purchases within the app, reflecting a broader shift towards social commerce.

International expansion is achieved through partner-operated stores, utilizing franchise, license, and wholesale models. By August 2024, nearly 500 international stores were operating under these agreements, demonstrating strategic global reach without extensive direct investment.

| Channel | Key Features | 2024 Relevance | Store Count (as of Aug 2024) |

|---|---|---|---|

| Company-Operated Retail Stores | High-traffic locations, direct customer interaction | Primary physical presence, over 1,600 stores | ~1,600+ (primarily US/Canada) |

| E-commerce Website (bathandbodyworks.com) | Full product catalog, online exclusives, promotions | Significant revenue driver, continued growth | N/A (Digital) |

| Mobile App | Seamless shopping, loyalty management, personalized offers | Capitalizes on mobile commerce trend | N/A (Digital) |

| Social Media (e.g., TikTok) | Brand building, customer engagement, direct sales integration | Targeting younger consumers, TikTok Shop launch | N/A (Digital) |

| International Partner-Operated Stores | Franchise, license, wholesale models for global reach | Efficient market entry, brand expansion | ~500 |

Customer Segments

Bath & Body Works' primary customer base is the mass market, largely comprising women between 18 and 45 years old. These individuals seek out personal care items and home fragrances that offer both quality and an enjoyable sensory experience. The brand's extensive product selection and approachable pricing strategy are key to attracting this demographic.

The company's success in reaching a broad audience is evident in its significant market presence. In fiscal year 2023, Bath & Body Works reported net sales of $7.57 billion, demonstrating the vast reach and purchasing power of its mass-market consumer segment. This wide appeal is cultivated through a consistent focus on delivering appealing scents and well-formulated products.

Gift-givers represent a substantial customer segment for Bath & Body Works, with many purchases specifically intended for holidays, birthdays, and expressions of gratitude. The company's broad array of products, combined with appealing packaging and consistent promotional offers, positions it as a go-to for convenient and desirable gift options.

In 2024, Bath & Body Works continued to leverage this segment through curated gift sets and seasonal collections designed to capture the gifting market. Their strategy often involves creating visually appealing bundles that simplify the gift-selection process for consumers.

Loyalty Program Members represent a cornerstone of Bath & Body Works' customer base, with millions actively participating in the My Bath & Body Works Rewards program. These dedicated individuals are the engine of repeat business and higher average transaction values.

Data from late 2023 and early 2024 indicates that loyalty program members are significantly more valuable, exhibiting a higher purchase frequency and average spend compared to non-members. For instance, in Q3 2023, the company reported strong performance driven by its loyalty members, who were instrumental in boosting sales of new seasonal collections.

This segment’s receptiveness to personalized offers and early access to new product launches fosters a deeper connection with the brand. Their engagement translates directly into increased sales and a more predictable revenue stream, making them a critical focus for marketing and retention efforts.

Seasonal and Trend-Driven Shoppers

Bath & Body Works deeply engages customers who actively seek out new product releases and seasonal variations. This segment is particularly responsive to limited-edition collections and fragrances tied to specific times of the year. The company's strategy of frequent product innovation, including timely launches for holidays and trending scents, directly targets and cultivates this customer base. For example, their Q1 2024 earnings report highlighted strong performance driven by new product introductions and seasonal promotions, indicating the segment's significant contribution to revenue.

This customer group thrives on the anticipation and excitement of discovering fresh scents and product lines. Bath & Body Works effectively capitalizes on this by consistently refreshing its offerings, ensuring a sense of novelty throughout the year. Their ability to tap into current trends and translate them into popular fragrances, such as their summer collection launches, demonstrates a keen understanding of these shoppers' desires. This approach fosters repeat purchases and brand loyalty among those who value variety and timely releases.

- Seasonal Product Appeal: Customers are drawn to limited-edition items, especially around holidays and changing seasons.

- Trend Responsiveness: The brand's success hinges on its ability to quickly incorporate popular trends into its fragrance and product development.

- Newness as a Driver: Continuous product innovation and the introduction of new scents are key motivators for this segment.

- Revenue Impact: These seasonal and trend-driven purchases significantly contribute to the company's overall sales figures, as evidenced by strong performance during key promotional periods in 2024.

Omnichannel Shoppers

Omnichannel shoppers at Bath & Body Works are a key demographic, blending physical and digital interactions. These customers appreciate the flexibility of browsing online and then experiencing products in person, a trend that has become increasingly important. In 2024, retailers saw a significant surge in BOPIS (Buy Online, Pick Up In-Store) usage, with estimates suggesting over 50% of online orders for some sectors included this option, highlighting its convenience factor.

This segment values a fluid experience, moving effortlessly between the Bath & Body Works website, mobile app, and brick-and-mortar locations. They are likely to research products online before visiting a store to make a purchase, or conversely, browse in-store and complete their transaction digitally. This integrated approach caters to a desire for both immediate gratification and informed decision-making.

- Seamless Channel Integration: Customers expect to move between online and offline touchpoints without friction.

- Value Convenience: Services like BOPIS are highly valued for saving time and enhancing the shopping experience.

- Sensory vs. Digital Preference: This segment enjoys the tangible aspect of in-store shopping alongside the ease of digital platforms.

- Data-Driven Engagement: Retailers can leverage data from these interactions to personalize offers and improve service.

The core customer segment for Bath & Body Works is the mass market, primarily women aged 18-45 who seek enjoyable sensory experiences through personal care and home fragrances. This broad appeal is supported by a diverse product range and accessible pricing, contributing to the company's significant market presence. In fiscal year 2023, Bath & Body Works achieved net sales of $7.57 billion, reflecting the extensive reach and purchasing power of this demographic.

Cost Structure

The cost of goods sold (COGS) is the most significant expense for Bath & Body Works. This category encompasses the direct costs associated with creating their products, primarily the raw materials like fragrances, essential oils, waxes, and various botanical ingredients used in their lotions, candles, and soaps.

Beyond raw materials, COGS also includes the direct manufacturing and production expenses. This means the labor involved in making the products and the overhead directly tied to their production facilities are factored in here.

Bath & Body Works benefits from a vertically integrated supply chain, which is crucial for controlling these COGS. This integration allows them to have greater oversight and potentially negotiate better pricing on raw materials and manage production more efficiently, impacting their overall profitability.

For fiscal year 2023, Bath & Body Works reported Cost of Goods Sold as $2.88 billion, representing a substantial portion of their total operating expenses and highlighting the importance of managing these direct product costs effectively.

Bath & Body Works, LLC incurs significant operating expenses tied to its vast retail footprint. These costs primarily include rent for prime retail locations, essential utilities like electricity and water, ongoing store maintenance, and a considerable outlay for staff wages, encompassing sales associates and store managers. In 2024, retail store operating expenses remain a critical component of their cost structure, directly impacting profitability.

Bath & Body Works dedicates significant resources to marketing and advertising, a crucial element in promoting its vast product range, new arrivals, and seasonal offerings. These investments are essential for maintaining brand awareness and driving customer traffic.

In 2023, the company reported selling, general, and administrative expenses, which include marketing and advertising costs, of approximately $1.5 billion. This figure highlights the substantial commitment to reaching consumers through various channels.

Their strategy encompasses a mix of traditional advertising, a strong digital marketing presence, extensive social media campaigns, and collaborations with influencers. This multi-faceted approach aims to capture consumer attention and foster brand loyalty.

For instance, during their major holiday sales events, the marketing spend escalates considerably to ensure maximum visibility and drive seasonal sales, a pattern expected to continue in 2024.

Research and Development (R&D)

Bath & Body Works invests significantly in Research and Development to create new fragrance formulations and innovative products. This commitment is crucial for staying ahead in a dynamic market and catering to changing consumer tastes. For instance, in fiscal year 2023, the company reported R&D expenses of $175 million, a slight increase from the previous year, reflecting this ongoing dedication.

These R&D costs cover everything from sourcing new ingredients and testing unique scent combinations to developing advanced product technologies and packaging solutions. The goal is to continuously refresh their product lines and introduce exciting new offerings that resonate with their customer base. This strategic investment ensures their competitive edge.

- New Fragrance Development: Costs associated with creating and testing novel scent profiles.

- Product Innovation: Expenses for developing new product formats, such as lotions, soaps, and candles.

- Ingredient Sourcing and Testing: Investment in high-quality and unique ingredients, including safety and efficacy testing.

- Packaging Design: Costs related to designing attractive and functional packaging that aligns with brand aesthetics.

E-commerce and Technology Infrastructure

Bath & Body Works invests significantly in its e-commerce and technology infrastructure. This includes costs for maintaining and upgrading their website and mobile app, crucial for reaching a broad customer base. These enhancements are vital for a seamless digital shopping experience.

Key expenditures in this area cover platform development, ensuring the technology can support increased traffic and new features. Cybersecurity is paramount to protect customer data and prevent breaches. Furthermore, data analytics capabilities are funded to understand customer behavior and personalize offerings. For 2024, companies in the retail sector often allocate a substantial portion of their IT budget to these areas, with many seeing e-commerce as a primary growth driver.

- Platform Development: Continuous updates and feature additions to the e-commerce site and mobile app.

- Cybersecurity: Protecting customer data and transaction integrity.

- Data Analytics: Tools and personnel for analyzing online customer behavior.

- Technology Investments: Exploring and implementing new technologies like AI for enhanced customer experience and operational efficiency.

Bath & Body Works’ cost structure is heavily influenced by its direct product expenses, operational overheads for its retail stores, and substantial investments in marketing and technology. For fiscal year 2023, the company reported Cost of Goods Sold at $2.88 billion, underscoring the significance of raw materials and production. Selling, General, and Administrative expenses, including marketing, amounted to approximately $1.5 billion in the same period.

The company also allocates considerable funds to Research and Development, with $175 million spent in fiscal year 2023 to foster product innovation and new fragrance development. These costs are critical for maintaining a competitive edge in the dynamic beauty and home fragrance market.

| Cost Category | FY 2023 (in billions USD) | Significance |

|---|---|---|

| Cost of Goods Sold (COGS) | $2.88 | Direct costs of products (raw materials, manufacturing) |

| Selling, General & Administrative (SG&A) | $1.50 | Includes marketing, store operations, corporate overhead |

| Research & Development (R&D) | $0.175 | New product and fragrance innovation |

Revenue Streams

Bath & Body Works primarily generates revenue through direct sales at its own retail stores. This model leverages the physical shopping experience, allowing customers to engage with products through scent and touch. The company's vast network of over 1,700 stores across North America is a key driver of this revenue stream.

These in-store sales are significantly boosted by a strategy of frequent promotions and loyalty programs. For instance, during the fiscal year 2023, the company reported net sales of $8.5 billion, with a substantial portion directly attributable to these brick-and-mortar locations. The ability to offer a hands-on, engaging shopping experience remains a core strength.

Direct sales from e-commerce are a cornerstone of Bath & Body Works' revenue generation, primarily through their official website, bathandbodyworks.com. This digital storefront offers a comprehensive selection of their popular home fragrance, personal care, and other lifestyle products.

The e-commerce channel has seen significant growth, becoming an increasingly vital component of the company's overall sales strategy. It provides a convenient platform for customers nationwide to access their favorite items, often featuring exclusive online promotions and new product launches.

In fiscal year 2023, Bath & Body Works reported that their direct-to-consumer segment, which heavily includes e-commerce, represented a substantial portion of their net sales. This digital presence allows them to reach a broad customer base beyond their physical store footprint, driving significant revenue.

Sales from Bath & Body Works' mobile application represent a significant revenue stream, driven by direct customer purchases within the app. The platform offers a convenient and engaging shopping experience, encouraging repeat business.

Enhanced app features, such as personalized recommendations and exclusive offers, directly incentivize purchases, boosting sales. Furthermore, seamless integration with the company's loyalty program, My Bath & Body Works Rewards, fosters customer engagement and drives repeat transactions through this digital channel.

In the first quarter of 2024, Bath & Body Works reported a 2% increase in net sales, with digital channels playing a crucial role in this growth. While specific app-driven revenue figures aren't separately disclosed, the overall digital performance indicates the mobile application's substantial contribution to the company's top line.

International Franchise and Wholesale Sales

Bath & Body Works taps into international markets through various channels, generating significant revenue. These include franchise agreements, licensing deals, and wholesale partnerships with businesses abroad. This global reach is a key growth area.

In 2023, Bath & Body Works reported that its international segment, which includes franchise and wholesale, contributed to its overall financial performance. For instance, the company’s fiscal year 2023 results highlighted ongoing international expansion efforts, with a focus on optimizing these partnerships. While specific year-over-year growth figures for international franchise and wholesale are often embedded within broader segment reporting, the strategy indicates a deliberate push for global market penetration and revenue diversification.

- International Expansion: Bath & Body Works leverages franchise, license, and wholesale models to extend its brand reach globally.

- Revenue Generation: These international operations serve as a crucial source of revenue diversification for the company.

- Strategic Growth: The company actively pursues global market penetration through these collaborative arrangements.

- Partnership Focus: Success in international markets relies on strong relationships with franchise and wholesale partners.

Seasonal and Promotional Sales

Bath & Body Works heavily relies on seasonal and promotional sales to drive revenue. Their Semi-Annual Sale, a cornerstone event, consistently generates significant sales figures. For instance, the July 2023 Semi-Annual Sale saw a strong performance, contributing to the company's overall financial results.

Holiday collections, such as those for Christmas and Halloween, are also critical revenue drivers. These themed product launches create excitement and encourage impulse purchases, particularly during peak shopping seasons. The company strategically plans these releases to maximize customer engagement and spending.

- Seasonal Sales: Events like the Semi-Annual Sale are major revenue catalysts.

- Holiday Collections: Themed product launches, especially around major holidays, boost sales significantly.

- Promotional Impact: Special offers and discounts during these periods attract a high volume of customers.

- Customer Engagement: These events foster anticipation and encourage repeat visits.

Bath & Body Works capitalizes on its expansive retail footprint, with over 1,700 stores, to drive direct sales through a compelling in-store experience. This physical presence is augmented by frequent promotions and a robust loyalty program, which were instrumental in achieving $8.5 billion in net sales for fiscal year 2023.

The company's e-commerce platform, bathandbodyworks.com, is a vital revenue stream, offering a broad selection of products and exclusive online promotions. This digital channel, a key component of their direct-to-consumer segment, significantly expands their reach beyond physical store locations.

Bath & Body Works' mobile application also serves as a significant revenue generator, providing customers with a convenient shopping experience and personalized offers. The seamless integration with their loyalty program further encourages repeat purchases, contributing to overall digital sales growth.

International revenue streams are cultivated through franchise, licensing, and wholesale agreements, allowing for global brand expansion. These partnerships are crucial for market penetration and revenue diversification, as evidenced by the company's ongoing international strategic initiatives.

Seasonal and promotional sales, particularly the highly successful Semi-Annual Sale and holiday collections, are critical revenue drivers. These events create significant customer engagement and spur impulse purchases, especially during peak shopping periods.

| Revenue Stream | Description | Fiscal Year 2023 Relevance |

|---|---|---|

| Direct Retail Sales | In-store purchases at company-owned locations. | Core revenue driver, leveraging over 1,700 North American stores. |

| E-commerce Sales | Online purchases via bathandbodyworks.com. | Significant contributor to direct-to-consumer segment, expanding reach. |

| Mobile App Sales | Purchases made through the company's mobile application. | Drives repeat business via personalized offers and loyalty program integration. |

| International Sales | Revenue from franchise, license, and wholesale partners abroad. | Key for global expansion and revenue diversification. |

| Seasonal & Promotional Sales | Revenue generated from events like Semi-Annual Sale and holiday collections. | Major catalysts for sales spikes and customer engagement. |

Business Model Canvas Data Sources

The Bath & Body Works Business Model Canvas is informed by a blend of internal financial data, extensive market research on consumer preferences and retail trends, and insights from competitive analysis within the beauty and personal care sector.