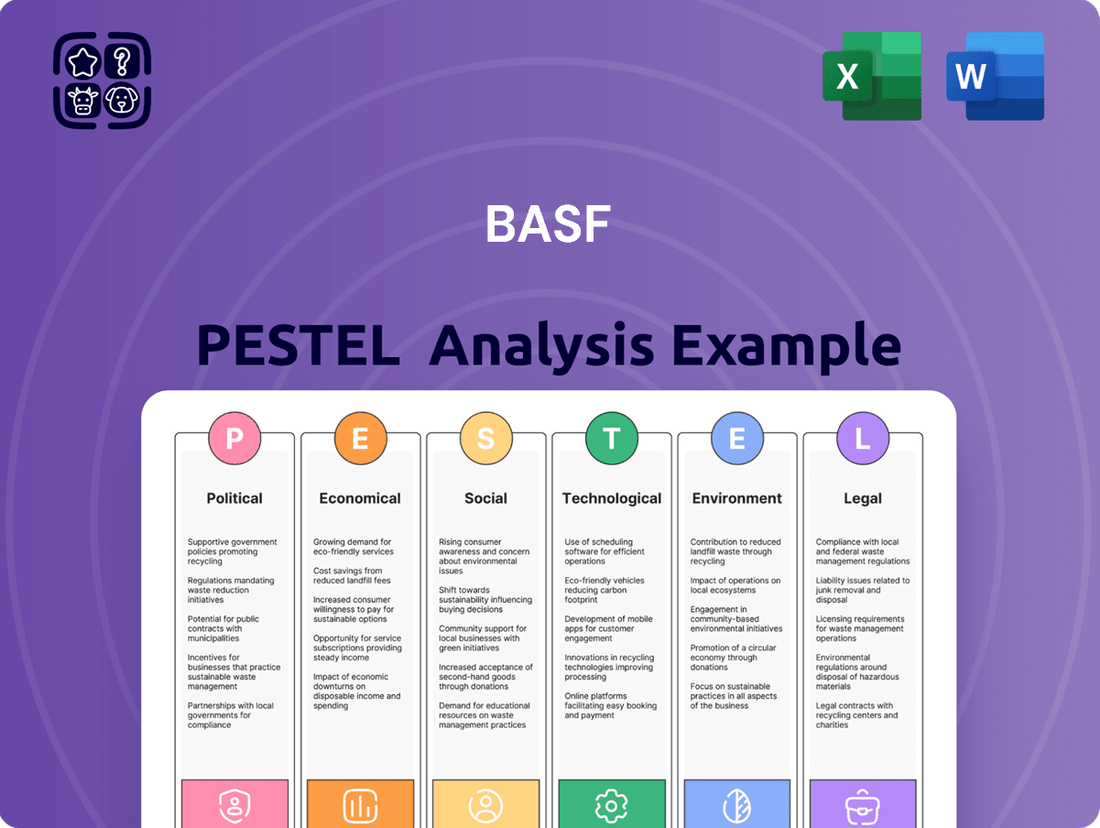

BASF PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BASF Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping BASF's trajectory. This comprehensive PESTLE analysis provides the essential external intelligence needed to anticipate challenges and capitalize on emerging opportunities. Download the full version to gain a strategic advantage and make informed decisions.

Political factors

BASF's global operations are significantly exposed to geopolitical uncertainties and ongoing trade conflicts, notably the trade friction between the United States and China. These tensions directly impact supply chain stability and can create volatile shifts in demand for essential chemical products. For instance, the automotive sector, a key customer for BASF, has experienced fluctuations due to these global trade dynamics.

Escalating trade disputes often result in unpredictable tariff policies, which can directly erode profitability and dampen overall business confidence. BASF has noted that such policies lead to increased costs and can force adjustments in pricing strategies. This environment also intensifies competitive pressures as companies navigate shifting market access and regulatory landscapes.

The indirect effects are also substantial, manifesting as reduced demand from crucial end-user segments such as automotive manufacturing and consumer goods production. Furthermore, these trade conflicts contribute to inflationary pressures, impacting BASF's operational costs and the affordability of its products in various markets. The company's 2024 outlook reflects ongoing vigilance regarding these geopolitical and trade-related risks.

Government regulations significantly shape BASF's operational landscape. For instance, the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation, continuously updated, mandates rigorous testing and documentation for chemical substances, directly impacting product development timelines and costs. In 2024, ongoing discussions around stricter emissions standards for industrial manufacturing in key markets like Germany could necessitate further capital expenditure for BASF to ensure compliance.

BASF's global operations, including its significant Verbund site in Kuantan, Malaysia, are deeply influenced by regional economic and trade blocs. The company's strategy to produce locally for local markets helps buffer against direct tariff impacts, as seen with its substantial investments in Asia. For instance, in 2023, BASF announced further expansion of its production facilities in Zhanjiang, China, highlighting a commitment to regional demand.

The economic policies and trade agreements within blocs like the European Union, the United States-Mexico-Canada Agreement (USMCA), and various Asian trade partnerships directly shape BASF's market access and competitive landscape. Fluctuations in trade policies, such as potential changes to tariffs or non-tariff barriers within these blocs, can significantly alter the cost structure and profitability of BASF's regional operations, impacting its ability to leverage local production effectively.

Political Stability in Key Markets

BASF's global operations are significantly impacted by the political stability of its key markets. Unstable political landscapes can create considerable headwinds, affecting everything from supply chain reliability to consumer demand. For example, geopolitical uncertainties were a noted factor in BASF's 2025 outlook, directly influencing business and consumer confidence.

The company's extensive presence in regions experiencing political flux presents tangible risks. Disruptions can manifest as difficulties in sourcing raw materials, challenges in manufacturing operations, or a decline in the purchasing power of its customer base. This underscores the critical need for stable political environments to ensure consistent business performance and growth.

- Geopolitical Uncertainty: BASF's 2025 outlook cited geopolitical uncertainties as a drag on confidence.

- Supply Chain Vulnerability: Political instability can lead to disruptions in sourcing raw materials and delivering finished products.

- Consumer Demand Impact: Unstable political climates often correlate with reduced consumer spending, affecting sales volumes.

Government Support for Green Transformation

Governments globally are accelerating the push towards a green transformation and circular economy, creating a dynamic landscape for companies like BASF. This shift presents significant opportunities for those offering sustainable solutions, as evidenced by increasing policy support for renewable energy and advanced recycling. For instance, the European Union's Green Deal, aiming for climate neutrality by 2050, is a major driver for sustainable chemical innovations.

Policies that favor eco-friendly products and processes directly benefit BASF's strategic focus on enabling customer sustainability and developing green technologies. The growing demand for solutions in areas like battery materials and biodegradable plastics, supported by government incentives and regulations, is a key growth area. BASF's investment in sustainable production, such as its Verbund sites, aligns with these governmental objectives, positioning the company to capitalize on the expanding market for green chemistry.

- Policy Alignment: Governments worldwide are enacting policies to support sustainability, creating a favorable environment for BASF's green product portfolio.

- Market Demand: Increased government focus on circular economy principles is driving consumer and industrial demand for advanced recycling and eco-friendly materials.

- Investment Opportunities: Subsidies and tax incentives for green technologies, such as those seen in the US Inflation Reduction Act for battery materials, encourage BASF's research and development in these areas.

Geopolitical tensions and trade disputes remain a significant factor for BASF, impacting supply chains and demand. For example, the ongoing trade friction between the US and China can lead to unpredictable tariff policies, directly affecting profitability and business confidence. BASF's 2024 outlook acknowledges these ongoing geopolitical and trade-related risks, necessitating vigilance.

Government regulations are a constant influence, with initiatives like the EU's REACH impacting product development costs and timelines. Furthermore, discussions around stricter emissions standards in key markets like Germany in 2024 could require additional capital investment from BASF to ensure compliance.

BASF's strategic investments, such as its Zhanjiang, China facility expansion announced in 2023, highlight a commitment to regional markets and buffering against direct tariff impacts. However, fluctuations in trade policies within economic blocs like the USMCA can still alter cost structures and profitability.

The global push towards sustainability and a circular economy, driven by government policies like the EU's Green Deal, presents opportunities for BASF's green product portfolio. Increased government focus on these areas is also driving demand for advanced recycling and eco-friendly materials, with incentives for green technologies supporting BASF's R&D efforts.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing BASF, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends and their potential impact on BASF's operations and market position.

Provides a clear and actionable framework that helps identify and mitigate potential external threats and opportunities, thereby reducing uncertainty and improving strategic decision-making.

Economic factors

BASF's fortunes are intrinsically linked to the ebb and flow of global economic growth and industrial production. As a major supplier to sectors like automotive, construction, and electronics, the company's performance directly reflects the health of these key industries. For instance, the automotive sector, a significant consumer of BASF's products, experienced a slowdown in 2024, impacting overall industrial output.

Looking ahead to 2025, BASF anticipates a gradual recovery in demand, buoyed by projected upticks in global GDP and industrial production. However, this optimism is tempered by ongoing challenges, including persistent softness in certain industrial segments. The International Monetary Fund (IMF) projected global growth at 3.2% for 2024 and a similar pace for 2025, underscoring the moderate recovery environment.

BASF, a major chemical producer, is significantly impacted by the price of raw materials and energy, particularly crude oil and natural gas. For 2025, the company is projecting an average Brent crude oil price within the $70 to $75 per barrel range. However, the ongoing high cost of energy, especially in Europe, continues to pose a challenge that directly affects BASF's operational expenses and profitability.

Currency exchange rate volatility, especially concerning the euro-dollar, directly influences BASF's financial performance. A strengthening euro, a trend anticipated for 2025, can diminish the value of revenues earned in foreign currencies when converted back to euros. This was evident in BASF's Q2 2025 results, which already showed negative currency impacts on sales.

Market Demand and Oversupply

The chemical industry, including major players like BASF, is navigating a challenging landscape marked by subdued market demand and significant oversupply in several key product areas. This imbalance directly impacts pricing and profitability.

Persistent overcapacity, particularly evident in Asian markets, has become a major headwind. This excess production capacity contributes to a downward pressure on prices for commodity chemicals and basic plastics, squeezing margins for manufacturers.

BASF has reported that this oversupply situation has led to a noticeable decline in sales and earnings across some of its business segments. For instance, the company's Chemicals segment, which deals with these basic chemicals, has felt this impact directly.

- Weak Demand: Global industrial production growth, a key driver for chemical demand, showed signs of slowing in late 2023 and early 2024.

- Oversupply: Reports from industry analysis firms in early 2024 indicated that capacities for certain polymers, like polyethylene and polypropylene, were operating at significantly reduced utilization rates due to market saturation.

- Price Erosion: Commodity chemical prices, as tracked by indices like the IHS Markit Chemical Purchasing Managers' Index (PMI), experienced downward trends in several categories throughout 2023, impacting revenue.

- Margin Pressure: The combination of lower sales volumes and reduced pricing power directly translates to compressed profit margins for chemical producers.

Interest Rates and Access to Capital

Fluctuations in interest rates directly impact BASF's cost of borrowing and influence its strategic investment choices. For instance, higher rates can make financing large projects, like the significant investment in its Zhanjiang Verbund site in China, more expensive.

BASF's financial resilience, underscored by its creditworthiness, is crucial for securing the capital needed for expansion and managing existing debt obligations. The company's commitment to capital discipline, reflected in efforts to reduce capital expenditures and implement cost-saving initiatives, aims to bolster its financial flexibility in this environment.

- Interest Rate Sensitivity: Changes in benchmark interest rates, such as those set by the European Central Bank or the US Federal Reserve, directly affect the cost of BASF's debt financing.

- Capital Expenditure Management: BASF's 2024 capital expenditure guidance was around €5.5 billion, demonstrating a focus on disciplined investment, with a portion allocated to major projects like Zhanjiang.

- Credit Rating Importance: Maintaining a strong credit rating is vital for BASF to access capital markets at favorable terms, enabling funding for growth initiatives and operational needs.

The global economic landscape in 2024 and projections for 2025 indicate a moderate but uneven recovery. While global GDP growth is expected to remain steady, specific industrial sectors continue to face headwinds, impacting demand for chemicals. For example, the automotive sector's performance in 2024 has been a key indicator of industrial health.

BASF's profitability is closely tied to raw material and energy costs, with crude oil and natural gas prices being significant factors. The projected Brent crude oil price range for 2025 is between $70 and $75 per barrel, but high energy costs, particularly in Europe, continue to present a challenge to operational expenses.

Currency fluctuations, especially the euro-dollar exchange rate, directly affect BASF's reported financial results. A strengthening euro, anticipated for 2025, can negatively impact the value of overseas earnings when converted. This was observed in BASF's Q2 2025 financial reporting.

The chemical industry, including BASF, is grappling with subdued market demand and significant oversupply in several product categories, leading to price erosion and margin pressure. This overcapacity, particularly in Asian markets, has reduced utilization rates for key polymers.

| Economic Factor | 2024 Observation/Projection | 2025 Projection/Impact |

|---|---|---|

| Global GDP Growth | Projected around 3.2% (IMF) | Similar pace to 2024, moderate recovery |

| Industrial Production | Slowdown in late 2023/early 2024 | Gradual recovery anticipated, but with sector-specific softness |

| Brent Crude Oil Price | Variable, but high energy costs persist | Projected $70-$75 per barrel |

| Currency Exchange (EUR/USD) | Volatility impacting reported earnings | Anticipated strengthening of the Euro, potentially reducing foreign earnings value |

| Market Demand | Subdued in several segments | Continued challenges from oversupply impacting pricing |

Full Version Awaits

BASF PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of BASF details political, economic, social, technological, legal, and environmental factors impacting the company. You'll gain valuable insights into the strategic landscape BASF operates within.

Sociological factors

BASF's workforce demographics and the skills they possess are foundational to its operations and innovation. The company employs approximately 112,000 people globally as of the end of 2023, a significant portion of whom are highly educated and specialized. A key aspect is the approximately 10,000 employees dedicated to research and development, underscoring the reliance on intellectual capital.

Attracting and retaining talent with expertise in critical areas like advanced chemistry, process engineering, and increasingly, digital transformation and data science, is paramount. This specialized skill set directly fuels BASF's capacity for groundbreaking research and ensures the efficient, cutting-edge operation of its complex manufacturing processes. The company's ongoing success is intrinsically linked to the caliber and adaptability of its exceptionally qualified team.

Consumers are increasingly prioritizing sustainability, influencing purchasing decisions across many sectors. This growing awareness is directly impacting what products companies like BASF offer, pushing for greener alternatives and more environmentally conscious production methods.

In response, businesses are actively redesigning their operations to align with a future focused on reduced carbon emissions and a circular economy. This means looking at everything from raw material sourcing to end-of-life product management, with sustainability becoming a core business driver.

BASF is strategically investing in and developing products that offer clear sustainability benefits, such as those with lower environmental impact or those that facilitate recycling. This focus is crucial for enabling their customers to navigate and succeed in their own green transitions, a trend that is only expected to accelerate in 2024 and 2025.

BASF, as a leading chemical producer, places immense importance on upholding rigorous health and safety standards. This commitment is crucial for safeguarding its workforce, the communities in which it operates, and the environment. For instance, in 2023, BASF reported a total recordable injury rate (TRIR) of 0.6 per 200,000 working hours, a testament to its ongoing efforts in workplace safety.

Adherence to these stringent protocols, covering everything from the safe handling of hazardous materials to robust emergency response plans, is not merely a matter of best practice but a fundamental requirement for regulatory compliance. In 2024, the company continued to invest heavily in safety training and infrastructure, with a reported €1.2 billion allocated to environmental protection and safety measures across its global operations.

Maintaining these high standards is intrinsically linked to building and preserving public trust. A strong safety record directly influences consumer perception and stakeholder confidence, which are vital for BASF's long-term sustainability and reputation in the chemical industry.

Community Relations and Social License to Operate

BASF's commitment to robust community relations is paramount for maintaining its social license to operate, as its extensive operations can profoundly influence local populations. Negative perceptions stemming from operational impacts, such as those concerning water usage or environmental safety, can lead to significant reputational damage and operational disruptions. For instance, in 2024, ongoing scrutiny of supply chain practices, including those in South Africa, has brought to light the critical need for transparency and community engagement in addressing potential environmental and social risks.

Effective management of these relationships requires proactive dialogue and responsiveness to community concerns. BASF's approach to sustainability and corporate social responsibility directly impacts its ability to secure and maintain the trust of the communities where it operates. The company's 2024 sustainability report highlighted increased investment in community development programs, aiming to mitigate potential negative externalities and foster positive local partnerships.

- Community Engagement: BASF's 2024 initiatives focused on enhancing local stakeholder dialogue, particularly regarding environmental impact assessments and resource management.

- Supply Chain Scrutiny: Concerns raised in 2024 about supply chain practices, exemplified by issues in South Africa, underscore the need for rigorous due diligence and transparent communication with affected communities.

- Reputational Impact: Negative community sentiment can directly translate into operational challenges, affecting project approvals and market access.

- Social License: The ongoing ability for BASF to conduct business is contingent on demonstrating responsible corporate citizenship and addressing societal expectations.

Ethical Supply Chain Management

Societal pressure for ethical supply chains is intensifying, directly impacting chemical giants like BASF. Consumers and stakeholders increasingly demand transparency regarding human rights and environmental stewardship from raw material sourcing to final product delivery. For instance, reports in 2024 highlighted ongoing scrutiny of mining practices globally, a crucial area for chemical feedstock, emphasizing the need for rigorous due diligence.

BASF faces reputational risks if its supply chain is found to be involved in human rights abuses or significant environmental degradation. Criticisms from NGOs in late 2023 concerning the company's response to alleged labor issues in certain raw material extraction sites underscore the critical need for proactive and verifiable ethical sourcing policies. This societal expectation translates into direct business imperatives.

The company's commitment to ethical supply chain management is therefore not just a matter of corporate social responsibility but a strategic necessity. Key areas of focus include:

- Human Rights Due Diligence: Implementing robust systems to identify, prevent, and mitigate human rights risks within its extensive global network of suppliers.

- Environmental Responsibility: Ensuring suppliers adhere to strict environmental standards, particularly concerning resource extraction and waste management.

- Transparency and Traceability: Enhancing visibility into the origins of raw materials to verify ethical and sustainable practices.

- Supplier Audits and Engagement: Conducting regular audits and fostering collaborative relationships with suppliers to drive continuous improvement in ethical performance.

Societal expectations regarding corporate responsibility are a significant driver for BASF, influencing everything from its workforce practices to its environmental commitments. The company's substantial global workforce, numbering around 112,000 employees as of the close of 2023, includes a critical segment of approximately 10,000 individuals dedicated to research and development, highlighting a deep reliance on specialized knowledge. This human capital is essential for driving innovation and maintaining operational excellence in complex chemical manufacturing.

BASF's commitment to health and safety is paramount, reflected in its 2023 total recordable injury rate (TRIR) of 0.6 per 200,000 working hours. The company allocated approximately €1.2 billion in 2024 towards environmental protection and safety measures globally, underscoring a proactive approach to safeguarding its employees and the communities where it operates, thereby fostering public trust.

The increasing societal demand for sustainable products and ethical supply chains directly shapes BASF's strategic direction. In 2024, scrutiny of mining practices for chemical feedstocks, as well as reports concerning labor issues in certain raw material extraction sites, emphasized the critical need for enhanced transparency and rigorous due diligence throughout its supply chain. This societal pressure necessitates robust human rights due diligence and verifiable ethical sourcing policies to maintain its social license to operate and mitigate reputational risks.

Technological factors

BASF's commitment to its 'green transformation' is evident in its robust innovation pipeline, focusing on products and processes that blend competitive edge with environmental responsibility. This strategic direction is driving the development of biodegradable materials, pioneering circular economy approaches, and advancing plastic recycling technologies.

The company's significant investment in research and development underscores this focus, with €2.1 billion allocated in 2024 and a comparable budget anticipated for 2025. A substantial portion of BASF's patent filings are concentrated in sustainability-related innovations, highlighting the technological advancements shaping its future.

BASF is heavily investing in digital transformation, particularly within its R&D operations, aiming to speed up the launch of new technologies and boost overall productivity. This strategic push is designed to make innovation cycles more efficient.

The company is rolling out AI solutions across its global operations to further enhance productivity and accelerate the pace of innovation. This includes leveraging digital tools for advanced predictive analytics, a key component in optimizing efficiency and mitigating potential supply chain disruptions.

BASF is at the forefront of advanced materials, especially in battery components crucial for the booming electric vehicle (EV) market. The company's strategic focus on cathode active materials, including high-nickel NMC and silicon-doped options, aims to boost battery energy density and tackle ethical sourcing challenges. In 2023, the global battery materials market was valued at approximately $60 billion, with projections indicating significant growth driven by EV adoption.

Process Optimization and Energy Efficiency

Technological advancements are key for BASF to fine-tune its production, boost energy efficiency, and lower its carbon footprint. This involves adopting smarter processes and increasing the use of renewable energy sources. For example, by 2023, BASF had already achieved a 10% increase in energy efficiency compared to 1990 levels across its European sites, a testament to ongoing technological integration.

These improvements directly impact cost savings and are vital for meeting ambitious climate protection goals. BASF's commitment to innovation in this area is reflected in its investment in digital tools for process monitoring and control, aiming for further efficiency gains. The company has set a target to reduce its greenhouse gas emissions by 25% by 2030 compared to 2018 levels, with technological upgrades playing a central role.

- Process Optimization: Implementing advanced analytics and AI to fine-tune chemical reactions and reduce waste.

- Energy Efficiency: Investing in state-of-the-art equipment and heat recovery systems to minimize energy consumption.

- Renewable Energy Shift: Increasing procurement and on-site generation of renewable electricity, aiming for 100% renewable electricity by 2050.

- Digitalization: Utilizing digital twins and IoT sensors for real-time monitoring and predictive maintenance to enhance operational performance.

Biotechnology and Agricultural Innovations

BASF is heavily invested in biotechnology within its Agricultural Solutions segment, developing advanced seed traits like nematode resistance in soybeans. This focus on innovation directly addresses critical farming challenges, aiming to boost crop yields and bolster global food security.

The company's commitment to these technological advancements is reflected in its financial performance. For the full year 2023, BASF's Agricultural Solutions segment reported sales of €10.5 billion, demonstrating robust growth driven by increased volumes and successful product launches.

- Biotech-driven soybean traits enhance nematode resistance, improving crop yields.

- Agricultural Solutions segment sales reached €10.5 billion in 2023.

- Volume growth is a key driver for the segment's strong performance.

- Innovations contribute to global food security by optimizing agricultural output.

BASF leverages advanced analytics and AI to optimize chemical processes, aiming for reduced waste and enhanced energy efficiency. The company is actively expanding its use of renewable energy sources, with a goal of 100% renewable electricity by 2050. Digitalization through IoT sensors and digital twins supports real-time monitoring and predictive maintenance, boosting operational performance.

Investment in R&D remains strong, with €2.1 billion allocated in 2024 and similar levels expected for 2025, much of it directed towards sustainability innovations. BASF is also a key player in advanced materials for electric vehicles, particularly cathode active materials, a market valued at around $60 billion in 2023.

| Area | Focus | 2023 Data/Target | 2024/2025 Outlook |

| R&D Investment | Sustainability & Digitalization | €2.1 billion (2024) | Comparable budget for 2025 |

| Energy Efficiency | Process Optimization | 10% increase (vs. 1990 levels) | Continued integration of smart processes |

| Emissions Reduction | Technological Upgrades | Target: 25% reduction by 2030 (vs. 2018) | Ongoing deployment of AI and digital tools |

| Battery Materials | EV Components | Market value ~ $60 billion (2023) | Growth driven by EV adoption |

Legal factors

BASF operates under a complex web of environmental regulations worldwide, impacting everything from its air emissions and waste disposal to the safe handling of chemicals and broader pollution prevention efforts.

The company's proactive stance is evident in its voluntary reporting under the European Sustainability Reporting Standards (ESRS) for the 2024 financial year. This commitment signals a dedication to adhering to increasingly stringent and transparent environmental compliance frameworks.

BASF, as a major chemical producer, navigates a complex web of product liability and safety regulations globally. These laws mandate rigorous testing, clear labeling, and safe handling procedures for its diverse portfolio, which includes chemicals, plastics, and performance products. Failure to comply can result in hefty fines and reputational damage, impacting consumer trust and market access.

In 2024, regulatory bodies worldwide continue to emphasize product stewardship. For instance, the European Chemicals Agency (ECHA) actively enforces REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations, which require extensive data on chemical properties and potential risks. BASF's commitment to adhering to these stringent standards is paramount, as evidenced by its ongoing investments in safety research and compliance infrastructure, which formed a significant part of its operational budget in 2023.

International trade laws and the imposition of tariffs by various countries significantly impact BASF's global operations and profitability. For instance, the ongoing trade tensions between major economic blocs can lead to increased costs for imported raw materials and components, directly affecting BASF's cost of goods sold. In 2023, the World Trade Organization (WTO) reported a notable increase in trade-restrictive measures globally.

BASF has explicitly cited escalating trade conflicts and shifting tariff policies as risks, which can disrupt supply chains and lead to demand destruction. For example, tariffs imposed on chemicals in key markets can make BASF's products less competitive, potentially reducing sales volumes. This was a recurring theme in their 2023 annual reports, where they highlighted the uncertainty surrounding future trade policies.

To mitigate these direct tariff impacts, BASF's 'local-for-local' production strategy is crucial. This approach involves establishing production facilities closer to their customers in various regions, reducing reliance on cross-border shipments that are subject to tariffs. This strategy proved beneficial in navigating some of the trade disruptions experienced in 2023, allowing for more localized pricing and supply chain resilience.

Antitrust and Competition Laws

BASF, as the globe's largest chemical company, operates under stringent antitrust and competition laws across numerous countries. These regulations are designed to prevent monopolies and ensure a level playing field for all market participants. For instance, in 2023, the European Commission continued its scrutiny of various sectors for potential anti-competitive practices, a landscape BASF actively monitors.

Navigating these legal frameworks is crucial for BASF's strategic moves, particularly concerning mergers, acquisitions, and maintaining market share. Any proposed divestments or new strategic alliances must undergo rigorous review to comply with competition authorities. For example, the company's ongoing portfolio adjustments, such as the sale of its construction chemicals business in 2023, were carefully managed to meet these legal requirements.

- Merger Control: BASF must notify and obtain approval from competition authorities for significant mergers and acquisitions, ensuring they don't unduly restrict competition.

- Abuse of Dominance: The company is prohibited from abusing any dominant market position it holds, which could involve unfair pricing or exclusionary practices.

- Cartel Prohibition: BASF is legally bound to avoid engaging in or facilitating cartels, price-fixing agreements, or market-sharing arrangements.

- Regulatory Compliance: Adherence to evolving competition laws, including those related to digital markets and sustainability initiatives, is a continuous operational imperative.

Intellectual Property Rights

Protecting its intellectual property (IP) is crucial for BASF to maintain its edge. This includes safeguarding patents for innovative products and manufacturing processes. In 2023, BASF continued its strong patent filing activity, with a notable emphasis on sustainable chemistry and digital solutions, underscoring its commitment to R&D and legal protection.

BASF's IP strategy is deeply intertwined with its innovation pipeline. The company's significant investment in R&D, which reached €2.3 billion in 2023, directly fuels its patent portfolio. A substantial portion of these filings are dedicated to advancements in areas like battery materials and circular economy technologies, demonstrating a forward-looking approach to both innovation and IP.

- BASF's 2023 R&D investment: €2.3 billion

- Focus areas for new patents: Sustainability, battery materials, digital solutions

- IP protection as a key driver of competitive advantage

BASF operates under a complex global legal framework, encompassing environmental, product safety, international trade, and competition laws. Adherence to these regulations is paramount for maintaining market access and avoiding significant financial penalties, as demonstrated by ongoing enforcement actions worldwide.

The company's proactive engagement with evolving regulations, such as the European Sustainability Reporting Standards (ESRS) for 2024 and the REACH regulations enforced by ECHA, highlights its commitment to compliance. BASF's substantial R&D investment of €2.3 billion in 2023 also reflects its dedication to developing and legally protecting innovative, sustainable technologies.

Environmental factors

Climate change is a major environmental consideration impacting BASF's strategic direction, particularly its focus on reducing carbon dioxide emissions. The company has established ambitious targets, aiming for CO2 emissions to fall within the range of 16.7 to 17.7 million metric tons by 2025.

To achieve these reductions, BASF is actively implementing various initiatives. These include enhancing energy efficiency across its operations and transitioning towards renewable energy sources. This dual approach is designed to mitigate the environmental impact, even as production volumes are expected to increase.

BASF is increasingly prioritizing circular economy principles due to growing concerns about resource scarcity. This strategic shift aims to minimize waste and pollution by keeping materials in use for extended periods.

In line with this, BASF has established a new circular economy target, focusing on developing innovative solutions such as biodegradable materials and advanced plastics recycling processes. For instance, by the end of 2023, BASF had already launched 14 new products with a significant portion of recycled or renewable content, demonstrating tangible progress towards this goal.

BASF's operations, particularly its extensive chemical manufacturing, place significant emphasis on water management and pollution control. The company has invested substantially in advanced wastewater treatment technologies to minimize its environmental footprint.

Past incidents, such as the discharge of chromium and chelating agents, underscore the critical need for robust preventative measures and responsible water stewardship. For instance, in 2023, BASF reported a 15% reduction in total water intake across its global sites compared to 2020 levels, demonstrating a commitment to conservation.

Stringent regulatory compliance and proactive pollution control are paramount for BASF to maintain its license to operate and its reputation. The company's sustainability reports highlight ongoing efforts to reduce chemical oxygen demand (COD) in its effluent, with a target of a further 10% decrease by the end of 2025.

Biodiversity Protection

Biodiversity protection is a critical environmental factor for companies like BASF, recognizing the intricate web of life on Earth. This encompasses the variety of ecosystems, species, and genetic diversity, all of which are vital for planetary health and long-term business sustainability. BASF's commitment is evident in its strategic integration of these concerns into its core operations and sustainability reporting, reflecting a growing awareness of the interconnectedness between business and the natural world.

In 2024, global efforts to halt biodiversity loss are intensifying, with initiatives like the Kunming-Montreal Global Biodiversity Framework setting ambitious targets. For BASF, this translates to a need for robust supply chain management and responsible land use practices. The company's sustainability goals often include targets related to reducing its environmental footprint, which directly impacts biodiversity. For instance, a focus on sustainable sourcing of raw materials can mitigate habitat destruction and protect endangered species.

BASF's approach to biodiversity protection is multifaceted, aiming to minimize negative impacts and actively contribute to conservation. This includes:

- Implementing biodiversity action plans at its production sites.

- Promoting sustainable agriculture practices within its value chains.

- Investing in research and development for eco-friendly products and processes.

- Engaging in partnerships with conservation organizations to support biodiversity projects.

Sustainable Supply Chain and Raw Material Sourcing

BASF's commitment to environmental sustainability is heavily tied to its supply chain, especially for raw materials. The company has been actively working to ensure its sourcing practices minimize ecological harm. This includes a focus on responsible mining, a critical area given the environmental impacts often associated with extracting necessary resources.

Transparency and rigorous environmental due diligence are paramount in addressing concerns about mining operations within BASF's supply network. By implementing stricter checks and demanding greater accountability from suppliers, BASF aims to mitigate negative environmental consequences. This proactive approach is essential for maintaining its reputation and meeting evolving regulatory and consumer expectations.

- Supply Chain Sustainability: BASF's 2023 Sustainability Report highlighted progress in reducing Scope 3 emissions, with a significant portion attributed to upstream activities like raw material sourcing.

- Responsible Sourcing: The company's supplier audits in 2024 continued to focus on environmental performance, with over 90% of key suppliers undergoing assessment for sustainability criteria.

- Mining Impact: BASF is a member of initiatives like the Initiative for Responsible Mining Assurance (IRMA), aiming to promote responsible practices in the mining sector, which directly impacts its raw material availability and quality.

BASF's environmental strategy is deeply intertwined with climate change mitigation, targeting a significant reduction in CO2 emissions. By 2025, the company aims to lower its emissions to between 16.7 and 17.7 million metric tons, driven by enhanced energy efficiency and a shift to renewable energy sources.

The company is also embracing circular economy principles to combat resource scarcity, focusing on waste reduction and material longevity. This includes developing biodegradable materials and advanced plastics recycling, evidenced by the launch of 14 new products with recycled or renewable content by the end of 2023.

Water management and pollution control are critical, with substantial investments in wastewater treatment technologies. BASF reported a 15% reduction in global water intake by 2023 compared to 2020 levels, and aims for a further 10% decrease in effluent chemical oxygen demand by the end of 2025.

Biodiversity protection is a growing focus, with BASF implementing site-specific action plans and promoting sustainable agriculture. In 2024, over 90% of key suppliers were assessed for sustainability criteria, reflecting a commitment to responsible sourcing and minimizing ecological harm throughout its value chain.

| Environmental Focus | Target/Metric | Progress/Status |

|---|---|---|

| CO2 Emissions Reduction | 16.7-17.7 million metric tons by 2025 | Ongoing initiatives in energy efficiency and renewables |

| Circular Economy | Launch new products with recycled/renewable content | 14 new products launched by end of 2023 |

| Water Management | 10% reduction in effluent COD by end of 2025 | 15% reduction in global water intake by 2023 (vs. 2020) |

| Supply Chain Sustainability | Assess key suppliers for sustainability | Over 90% assessed in 2024 |

PESTLE Analysis Data Sources

Our PESTLE analysis for BASF draws from a comprehensive range of data, including reports from the European Chemicals Agency (ECHA), the International Energy Agency (IEA), and global economic indicators from sources like the World Bank and IMF. This ensures a robust understanding of political, economic, social, technological, legal, and environmental factors impacting the company.