BASF Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BASF Bundle

BASF's marketing success hinges on a meticulously crafted 4Ps strategy, from its innovative product portfolio to its strategic pricing and distribution. Understanding how these elements synergize is key to grasping their market dominance. Dive deeper into the specifics of BASF's Product, Price, Place, and Promotion with our comprehensive, ready-to-use analysis.

Uncover the intricate details of BASF's product innovation, pricing architecture, extensive distribution networks, and impactful promotional campaigns. This full analysis provides actionable insights and real-world examples, perfect for business professionals and students seeking strategic depth. Get instant access to an editable, presentation-ready report.

Product

BASF's diverse chemical portfolio is a cornerstone of its market leadership, encompassing a vast array of products from basic chemicals and intermediates to advanced materials and crop protection. This extensive offering, serving over 90% of the world's industries, highlights the company's ability to cater to a wide spectrum of customer needs. In 2023, BASF reported sales of €68.9 billion, underscoring the sheer scale and breadth of its product reach.

BASF's product strategy is deeply rooted in innovation and sustainability, a cornerstone of its 4P marketing mix. The company consistently invests heavily in research and development, a commitment evident in its 2024 R&D expenditure, which aims to foster groundbreaking solutions and enhance existing product lines. This focus ensures BASF remains at the forefront of developing advanced, environmentally conscious offerings that address evolving market needs and global challenges.

BASF's product strategy effectively balances foundational commodity chemicals with higher-value specialty chemicals. This diversification allows them to serve a broad market, from basic industrial needs to niche applications requiring tailored solutions. In 2024, their portfolio continued to reflect this, with significant contributions from both segments, supporting their overall market presence.

Agricultural Solutions

BASF's Agricultural Solutions segment is a cornerstone of its business, offering a wide array of products designed to boost farm productivity and sustainability. This includes advanced seeds and traits, alongside a comprehensive portfolio of crop protection chemicals such as fungicides, herbicides, and insecticides. The company's strategy focuses on delivering integrated solutions that address the complex needs of modern agriculture, from planting to harvest.

In 2023, BASF's Agricultural Solutions division reported sales of €8.3 billion, underscoring its significant market presence. The company is heavily invested in research and development, with a pipeline focused on innovative solutions to combat pests, diseases, and weeds while promoting resource efficiency. For instance, their Fungicides segment saw robust performance driven by key products like Revysol, which provides broad-spectrum disease control.

- Product Offering: Seeds, traits, fungicides, herbicides, insecticides, and biological crop protection solutions.

- Market Focus: Enhancing crop yields, improving crop quality, and promoting sustainable farming practices for global farmers.

- Financial Performance (2023): Sales of €8.3 billion, reflecting strong demand for innovative agricultural inputs.

- Strategic Direction: Continued investment in R&D for novel crop protection and seed technologies, with a growing emphasis on digital farming tools and biologicals.

Battery Materials and Performance Materials

BASF's Battery Materials and Performance Materials segment is a cornerstone of its innovation strategy, focusing on supplying essential components for the burgeoning electric vehicle market and advanced industrial applications. The company is a significant player in cathode active materials, crucial for lithium-ion battery performance, and also offers a range of high-performance plastics designed for durability and specific functional needs.

This product focus directly addresses key growth drivers, particularly electromobility, where demand for efficient and long-lasting batteries is paramount. BASF's commitment to these advanced materials positions it to capitalize on the global shift towards sustainable transportation and resource-efficient manufacturing. For instance, in 2023, the global battery materials market was valued at over $25 billion, with significant growth projected through 2030, driven by EV adoption.

- Cathode Active Materials: BASF is a leading supplier of these critical components for lithium-ion batteries, essential for EV range and charging speed.

- High-Performance Plastics: These materials offer enhanced properties like heat resistance and strength, finding applications in automotive lightweighting and demanding industrial sectors.

- Market Alignment: The product portfolio directly supports the growth of electromobility and sustainable packaging solutions, aligning with major global trends.

- Investment in Innovation: BASF continues to invest heavily in research and development for next-generation battery materials and advanced polymer solutions.

BASF's product strategy centers on a broad and innovative portfolio, ranging from essential chemicals to specialized solutions. This breadth allows them to serve diverse industries, a key strength highlighted by their €68.9 billion in sales for 2023. Their commitment to R&D, with significant investment planned for 2024, ensures a pipeline of advanced and sustainable offerings that meet evolving global demands.

The company balances high-volume basic chemicals with value-added specialty products, a dual approach that underpins their market presence. This diversification caters to a wide array of customer requirements, from fundamental industrial inputs to highly specific application needs. Their 2024 product mix continues to reflect this strategic equilibrium, contributing to their robust market position.

| Product Category | Key Offerings | 2023 Sales Contribution (Illustrative) | Strategic Focus |

| Agricultural Solutions | Seeds, traits, crop protection (fungicides, herbicides, insecticides), biologicals | €8.3 billion | Enhancing yields, sustainability, digital farming |

| Battery Materials | Cathode active materials | Significant growth driver | Electromobility, next-gen battery tech |

| Performance Materials | High-performance plastics, polyurethanes | Broad industrial applications | Lightweighting, industrial efficiency |

What is included in the product

This analysis provides a comprehensive breakdown of BASF's marketing strategies across Product, Price, Place, and Promotion, offering actionable insights into their market positioning and competitive advantages.

It is designed for professionals seeking to understand BASF's approach to marketing, enabling benchmarking and strategic planning with real-world examples and data.

Simplifies complex marketing strategies into a clear, actionable framework, alleviating the burden of deciphering intricate plans.

Place

BASF’s global production network is a cornerstone of its marketing strategy, featuring integrated Verbund sites and numerous other facilities worldwide. This expansive network spans Europe, Asia, Australia, the Americas, and Africa, enabling localized production to effectively serve diverse regional markets. For instance, in 2023, BASF continued to invest in optimizing its production capabilities, with capital expenditures of €3.9 billion globally, reflecting its commitment to maintaining and expanding this critical asset.

BASF primarily operates through direct sales channels, catering to a business-to-business (B2B) market. This strategy involves selling directly to other companies, from massive global players to mid-sized firms, ensuring a deep understanding of their specific chemical needs.

This direct engagement fosters strong customer relationships and allows for the development of customized solutions, a vital aspect in the complex chemical sector. For instance, in 2024, BASF's focus on these direct B2B relationships contributed to its robust performance across various industrial segments.

BASF's strategic Verbund sites are a cornerstone of its marketing mix, particularly in the context of production and place. These integrated production facilities, like the massive Ludwigshafen site in Germany, are designed for maximum efficiency, allowing for resource and energy sharing between different production units. This integration not only drives down operational costs but also significantly minimizes environmental impact, aligning with growing consumer and regulatory demands for sustainability.

The company's commitment to this strategy is evident in its ongoing investments, such as the new Verbund site in Zhanjiang, China, which is set to become BASF's third-largest Verbund site globally. This expansion highlights the critical role these sites play in BASF's global production and distribution network, ensuring reliable supply chains and market access for its diverse product portfolio. In 2023, BASF continued to invest heavily in these sites, with capital expenditures focused on enhancing efficiency and expanding capacity to meet future market needs.

Distribution Channels for Specific Segments

BASF tailors its distribution channels to specific customer segments. For its agricultural solutions, the company partners with agricultural cooperatives and specialized distributors to ensure products reach farmers effectively. This approach is crucial for delivering technical expertise alongside products, as seen in their 2024 initiatives to expand digital farming services directly to growers.

These targeted channels are vital for product adoption and customer support. For instance, in 2024, BASF reported a strong uptake of its new crop protection agents through these specialized agricultural networks, highlighting their efficiency in reaching the farming community.

- Agricultural Solutions: Direct sales to large farms and partnerships with agricultural cooperatives and retailers.

- Specialty Chemicals: Distribution through specialized chemical distributors and direct sales to industrial clients.

- Performance Materials: Channels include direct sales to automotive and construction industries, as well as partnerships with converters and compounders.

Logistics and Supply Chain Optimization

BASF's logistics and supply chain are critical for its chemical operations, ensuring the safe and timely movement of materials. The company prioritizes efficiency and cost-effectiveness, a strategy that has become even more vital amidst global trade disruptions and fluctuating energy prices. For instance, in 2023, BASF continued to invest in its integrated Verbund sites, which inherently reduce transportation needs and associated costs by co-locating production facilities.

The company's approach to supply chain optimization involves:

- Leveraging Digitalization: BASF utilizes advanced digital tools for real-time tracking and predictive analytics to manage inventory and streamline transportation routes, aiming to mitigate risks and improve delivery reliability.

- Strategic Partnerships: Collaborating with logistics providers allows BASF to access specialized transport solutions for hazardous materials and optimize shipping networks, especially for bulk chemicals.

- Sustainability Focus: Efforts are underway to reduce the carbon footprint of logistics, including exploring alternative fuels and more efficient transport modes, aligning with their broader sustainability goals.

- Resilience Building: In response to geopolitical uncertainties and supply chain vulnerabilities highlighted in recent years, BASF has focused on diversifying sourcing and building greater flexibility into its distribution channels.

BASF's "Place" strategy revolves around its extensive global production network and tailored distribution channels. The company leverages its integrated Verbund sites and numerous facilities worldwide to ensure localized production and efficient market access across diverse regions. This physical presence is a key differentiator, allowing for responsiveness to regional demands and supply chain optimization.

Distribution is carefully segmented, with direct sales dominating the B2B landscape. For agricultural solutions, partnerships with cooperatives and specialized distributors are crucial, ensuring product reach and technical support. This multi-channel approach, from direct engagement with large industrial clients to specialized networks for agriculture, underscores BASF's commitment to meeting specific customer needs effectively.

| Key Distribution Channels & Segments | Primary Approach | Example Focus (2024/2025) |

|---|---|---|

| Industrial Chemicals (B2B) | Direct Sales | Supplying large global manufacturers and mid-sized firms with tailored chemical solutions. |

| Agricultural Solutions | Cooperatives & Retailers | Expanding digital farming services and direct support to growers through agricultural networks. |

| Performance Materials | Direct Sales & Partnerships | Serving automotive and construction industries directly, plus collaborating with converters. |

Same Document Delivered

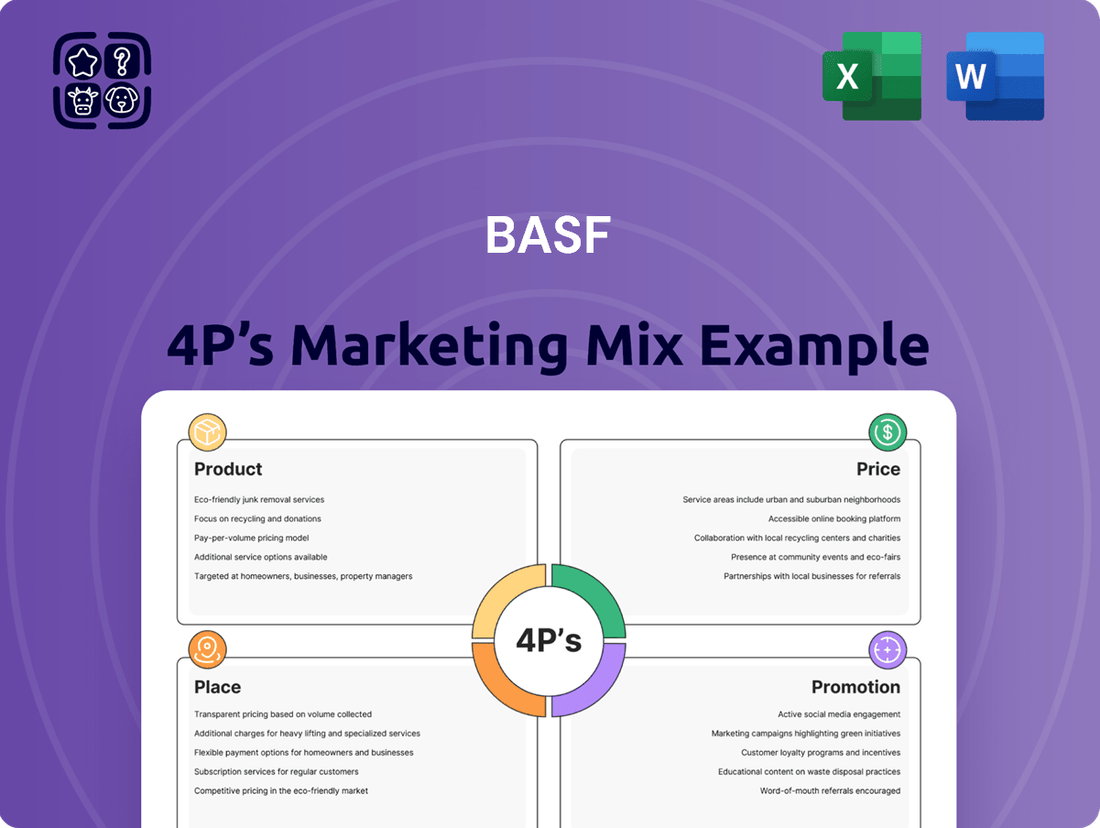

BASF 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of BASF's 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

BASF's promotional strategy centers on its customers, highlighting how its innovations support their transition to greener practices and market success. This approach fosters value co-creation by directly addressing the challenges faced by industrial clients, positioning BASF as a solutions partner.

BASF leverages industry fairs like the China Plant Protection Information Exchange and Sprayer Facilities Fair as key platforms for its 'Promotion' strategy. These events are crucial for showcasing new product innovations and fostering direct engagement with customers and industry partners. For instance, in 2024, BASF highlighted its advanced crop protection solutions, emphasizing their efficacy and sustainability benefits through live demonstrations, a critical element for building trust and driving adoption.

BASF actively communicates its sustainability commitment through its integrated reporting, showcasing progress in areas like carbon footprint reduction. For instance, in 2023, the company reported a significant reduction in its greenhouse gas emissions, demonstrating tangible progress towards its climate targets.

The company highlights its dedication to the circular economy and the development of sustainable product solutions, such as biodegradable plastics and resource-efficient manufacturing processes. This focus not only enhances its brand reputation but also appeals to investors and customers increasingly prioritizing environmental responsibility.

Digital Engagement and Information Resources

BASF actively leverages digital channels to communicate with its stakeholders. Their investor relations magazine and a suite of online resources serve as key platforms for sharing financial results, strategic updates, and details on their product portfolio. This digital-first approach ensures efficient dissemination of information to a global audience that is increasingly reliant on digital access for financial data.

In 2024, BASF continued to enhance its digital engagement, offering a wealth of information through its corporate website and dedicated investor portals. For instance, their annual reports and quarterly earnings releases are readily available online, often accompanied by supplementary digital content such as webinars and presentations. This focus on digital accessibility is crucial for reaching a diverse investor base, including individual investors and financial professionals who value immediate and comprehensive data.

- Digital Platforms: Investor relations magazine, corporate website, investor portals.

- Information Dissemination: Financial performance, strategic direction, product offerings.

- Audience Reach: Financially literate and technologically savvy global investors.

- 2024 Focus: Enhanced online resources, webinars, and digital presentations.

Public Relations and Media Outreach

BASF actively utilizes public relations and media outreach to broadcast key business milestones, collaborations, and financial performance. This strategic communication approach is crucial for shaping its corporate reputation and keeping stakeholders, including investors and the broader market, informed about its operational progress and strategic direction.

In 2024, BASF continued its commitment to transparent communication. For instance, its Q1 2024 earnings release, published in April 2024, detailed a revenue of €17.6 billion and an EBITDA of €2.7 billion, underscoring the importance of these announcements in conveying financial health and strategic execution to the public.

- News Releases: BASF issued numerous news releases throughout 2024, covering topics from new product launches to sustainability initiatives.

- Partnerships: The company highlighted significant partnerships, such as its ongoing collaboration with IBM on AI for chemical research, which was a focus of media outreach in early 2024.

- Financial Reporting: Regular dissemination of financial results, like the Q1 and Q2 2024 reports, served to manage market expectations and showcase performance metrics.

- Investor Relations: Proactive engagement with financial media and analysts is a cornerstone of BASF's PR strategy to ensure accurate reporting of its business developments.

BASF's promotional efforts are deeply integrated with its customer-centric approach, emphasizing how its innovations drive customer success, particularly in sustainability transitions. This strategy fosters value co-creation by directly addressing client challenges, positioning BASF as a vital solutions partner.

Key promotional activities include participation in industry fairs, such as the China Plant Protection Information Exchange and Sprayer Facilities Fair, where BASF showcases new product innovations and engages directly with customers. In 2024, the company highlighted advanced crop protection solutions, emphasizing efficacy and sustainability through live demonstrations to build trust and encourage adoption.

BASF also utilizes digital platforms extensively, including its investor relations magazine, corporate website, and investor portals, to share financial results, strategic updates, and product information. This digital-first strategy ensures efficient information dissemination to a global audience, with enhanced online resources, webinars, and digital presentations being a focus in 2024.

Public relations and media outreach are crucial for broadcasting business milestones, collaborations, and financial performance, thereby shaping corporate reputation. For example, the Q1 2024 earnings release in April 2024 reported revenue of €17.6 billion and EBITDA of €2.7 billion, demonstrating transparent communication of financial health.

| Key Promotional Channels | Focus Areas | Examples (2024) | Data Point |

| Industry Fairs | Product Innovation, Customer Engagement | China Plant Protection Information Exchange | Showcased advanced crop protection solutions |

| Digital Platforms | Financials, Strategy, Product Portfolio | Investor Relations Magazine, Corporate Website | Enhanced online resources, webinars |

| Public Relations/Media | Milestones, Collaborations, Financial Performance | Q1 2024 Earnings Release | Revenue: €17.6 billion, EBITDA: €2.7 billion |

Price

BASF's approach to pricing its specialty products, such as those in battery materials and advanced plastics, is likely rooted in value-based strategies. This means prices are set based on the perceived worth and unique advantages these offerings provide to customers, rather than just production costs.

For instance, BASF's high-performance battery materials, critical for electric vehicles, command premium pricing due to their contribution to longer range and faster charging. In 2024, the global battery materials market was projected to reach over $80 billion, with specialty chemicals playing a significant role in this growth.

This strategy acknowledges the substantial benefits, like enhanced sustainability and superior performance, that these innovative products deliver, justifying a higher price point and reflecting their critical role in customer success and market advancement.

In its more commoditized chemical segments, BASF navigates intense competition and readily available products, making price a critical factor. For instance, in the European cracker market during early 2024, spot prices for ethylene fluctuated significantly, impacting margins for downstream products.

BASF actively manages its pricing strategies to stay competitive in these sensitive markets. The company aims to balance market demands with its cost structures, a strategy evident in its approach to basic chemicals where price adjustments are frequent.

Operational excellence remains key for BASF to maintain profitability amidst price pressures. By optimizing production processes and supply chains, the company seeks to offset the impact of price volatility, a crucial element for its performance in 2024-2025.

BASF's pricing strategies are directly impacted by the volatile nature of raw material and energy costs, critical inputs in chemical manufacturing. For instance, in 2024, the company has navigated elevated natural gas prices in Europe, a key energy source for its production facilities, which naturally puts upward pressure on its product costs and, consequently, its pricing.

To counteract these pressures, BASF actively pursues cost-saving initiatives and production process optimization. In 2024, the company continued its focus on energy efficiency improvements across its Verbund sites, aiming to reduce consumption per ton of output, thereby buffering some of the raw material cost increases and stabilizing its pricing structure.

Regional and Currency Considerations

BASF's pricing strategy is significantly influenced by regional market dynamics and the constant fluctuations of currency exchange rates. These external forces directly impact sales volumes and profit margins across its diverse global operations. For instance, in 2024, a strengthening Euro against certain emerging market currencies could necessitate price adjustments to maintain competitiveness and profitability in those regions.

The company actively monitors and incorporates these regional and currency considerations when establishing its pricing for various markets. This granular approach ensures that pricing remains relevant and effective, even amidst global economic volatility.

- Regional Price Variations: In 2024, BASF's average selling prices in Europe might differ from those in Asia or North America due to local demand, competitive landscapes, and regulatory environments.

- Currency Impact on Profitability: A 1% unfavorable currency movement against the US Dollar in 2024 could directly reduce BASF's reported earnings by a quantifiable amount, influencing pricing decisions in dollar-denominated markets.

- Strategic Pricing Adjustments: The company may implement dynamic pricing models to offset currency risks, potentially increasing prices in markets with depreciating currencies to preserve the value of sales.

Strategic Adjustments and Portfolio Management

BASF's strategic shift, particularly its 'Winning Ways' initiative, signals a move towards more tailored pricing. This strategy emphasizes strengthening core businesses and potentially spinning off or partnering with standalone units, which naturally allows for distinct pricing strategies to be applied across its diverse product lines.

The company's portfolio adjustments, including potential divestments, will directly impact pricing. Businesses slated for divestment might see pricing strategies aimed at maximizing immediate value or attracting specific buyers, while those remaining as core operations will likely have pricing aligned with long-term strategic goals and market positioning. For example, in 2023, BASF announced the sale of its pigments business, which likely involved a pricing strategy focused on realizing its market value.

- Differentiated Pricing: 'Winning Ways' promotes distinct pricing based on business unit focus (core vs. standalone).

- Divestment Impact: Potential sales of certain business segments could lead to pricing adjustments to optimize transaction value.

- Partnership Influence: Strategic partnerships might necessitate collaborative pricing models or shared revenue structures.

- Market Responsiveness: Pricing will likely become more agile, reflecting the specific market dynamics of each adjusted business segment.

BASF's pricing strategy is multifaceted, balancing value-based approaches for specialty chemicals with cost-plus considerations for more commoditized products. This dynamic ensures competitiveness across its diverse portfolio, adapting to market realities and raw material cost fluctuations.

In 2024, elevated energy costs, particularly natural gas in Europe, pressured pricing upwards for basic chemicals. Conversely, premium pricing for battery materials reflects their critical role in the booming EV market, projected to exceed $80 billion globally in 2024.

Regional variations and currency movements also dictate pricing, with strategies adjusted to maintain profitability and market share in different economic zones. For instance, a stronger Euro in 2024 could prompt price increases in certain dollar-denominated markets.

BASF's 'Winning Ways' initiative further refines pricing by allowing for distinct strategies across its business units, especially concerning potential divestments or partnerships, aiming to optimize value for each segment.

| Product Segment | Pricing Strategy Focus | 2024/2025 Market Context | Key Influences |

|---|---|---|---|

| Battery Materials | Value-Based Premium | Global market > $80B (2024), high demand in EVs | Performance, sustainability, innovation |

| Advanced Plastics | Value-Based | Growing demand in automotive and construction | Unique properties, application-specific benefits |

| Basic Chemicals (e.g., Ethylene) | Cost-Plus / Competitive | Volatile spot prices, intense competition in Europe | Raw material costs, energy prices, supply/demand |

4P's Marketing Mix Analysis Data Sources

Our BASF 4P's Marketing Mix Analysis leverages a comprehensive blend of primary and secondary data sources. This includes official BASF corporate reports, investor relations materials, and product development announcements, alongside market research reports and industry publications detailing competitive landscapes and consumer trends.